patrick.net

An Antidote to Corporate Media

1,189,962 comments by 13,850 users - stereotomy online now

Comments 1 - 40 of 48 Next » Last » Search these comments

Yah know, it's not my kids NOT moving out that bothers me, it's all of the mooching friends they attract, that haven't moved out either.

"Now who's that?"

"Oh that's Jeremy..."

"Ah cool, what does he do?"

"Nothing..."

I don't think I knew one person that didn't work if they wanted to when I was their age, or the age of their oldest friends at least.

And that was during the Reagan years.

Yah know, it's not my kids NOT moving out that bothers me, it's all of the mooching friends they attract, that haven't moved out either.

"Now who's that?"

"Oh that's Jeremy..."

"Ah cool, what does he do?"

"Nothing..."

I don't think I knew one person that didn't work if they wanted to when I was their age, or the age of their oldest friends at least.

And that was during the Reagan years.

Yes, there's hardly anything more annoying than a parasite living under the roof. One reason to stay DINK!

"Who knocked you up this time?"

"I don't know, I was leaning out the window at the party throwing up and I couldn't tell who they were."

Good for them that millions of properties have just been bought up with the intent to rent them out. Once they leave the nest they will be able to take advantage of falling rents, as the rental bubble bursts....

Good for them that millions of properties have just been bought up with the

intent to rent them out. Once they leave the nest they will be able to take

advantage of falling rents, as the rental bubble bursts....

The only way they leave the nest is when they realize that free rent, housekeeping, cooking services and errand services have been terminated......

I don't think I knew one person that didn't work if they wanted to when I was their age, or the age of their oldest friends at least.

And that was during the Reagan years.

you also didn't grow up in a time when working might actually make you LOSE money. It's very common when adding up all the costs of transportation, health issues, food, etc. that working actually puts you in the hole.

yes, this is what we have come to.

keep putting down the young people asshole, pretty soon when things turn over you'll be begging us to support your medical costs.

I don't think I knew one person that didn't work if they wanted to when I was their age, or the age of their oldest friends at least.

And that was during the Reagan years.

you also didn't grow up in a time when working might actually make you LOSE money. It's very common when adding up all the costs of transportation, health issues, food, etc. that working actually puts you in the hole.

yes, this is what we have come to.

keep putting down the young people asshole, pretty soon when things turn over you'll be begging us to support your medical costs.

Could you please provide the example of how working could cause someone to "lose money?" Are you saying that if someone is single with a kid that public assistance is more profitable than working when accounting for childcare expenses? Also, how can someone develop "health issues" due to working unless someone works in a factory with dangerous chemicals?

Once they leave the nest they will be able to take advantage of falling rents, as the rental bubble bursts....

rents nationwide are up a couple percent since last year. Do you ever actually not just make stuff up?

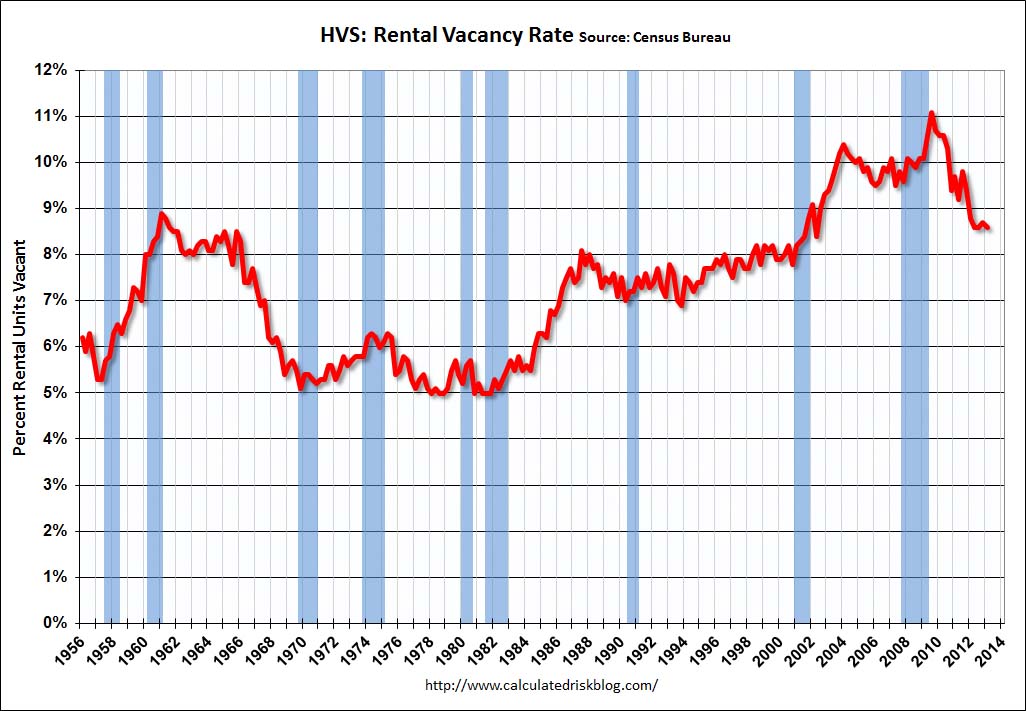

Many hedgefunds who bought in bulk to rent are at 50% occupancy rates. Let's see what rents do when all of the rentals hit the market. Millions have been bought to rent. We will not have enough renters. Landlords are gonna have to drop their rents to compete with each other.... Let's see how renters handle the rise in credit rates and increases in daily essentials like food and gas, and if they will still have enough left over to pay higher rents...

THE 'Y' CHROMOSOME

People born before 1946 are called -

The Greatest Generation.

People born between 1946 and 1964 are calledThe Baby Boomers.

People born between 1965 and 1979 are called

Generation X.

And people born between 1980 and 2010 are called -Generation Y.

Why do we call the last group -Generation Y ?

Y should I get a job?

Y should I leave home and find my own place?

Y should I get a car when I can borrow yours?

Y should I clean my room?

Y should I wash and iron my own clothes?

Y should I buy any food?

Y me?

Y bother to do anything?

Y not text me?

But perhaps a cartoonist explained it most eloquently below...

Just thought you might want to know "Y"

I REST MY CASE!!!

Problem is that wherever the jobs are the rents rise and wherever the jobs are not the rents fall.

Real Estate is still local.

The comments on here are extremely telling of the generational disconnect. I am not Generation Y, but I have compassion for them for living in a time when education costs are sky-high and housing inaccessible to even those like me, age 37, who have saved rabidly since age 15.

I'm pretty fed up with the age 50+ population that believes that it's mere laziness causing the unemployment. We are picking up the tab for your health costs, pensions, and social security, and in my case I wonder for what.

The entitlement of the boomers is incredible--their only concern being the recovery of their stock holdings, house equity, and medicare payments. Disheartening. So much for solidarity between generations.

It's damned hard for kids to make it work in urban life these days. You need a high income job to just make rent (if you're not in the ghetto or the barrio). Then there's student loans to pay, transportation costs keep rising, and the tax man comes for the rest. Having kids in that environment is hard, especially once you have more than one. Being a sole breadwinner for a family of five is a damned heroic achievement where I live, especially since I got here after the housing bubble ruined the market and rents have only gone up. Dual income would take a load off, but it's not practical for us at this point.

The comments on here are extremely telling of the generational disconnect. I am not Generation Y, but I have compassion for them for living in a time when education costs are sky-high and housing inaccessible to even those like me, age 37, who have saved rabidly since age 15.

I'm pretty fed up with the age 50+ population that believes that it's mere laziness causing the unemployment. We are picking up the tab for your health costs, pensions, and social security, and in my case I wonder for what.

The entitlement of the boomers is incredible--their only concern being the recovery of their stock holdings, house equity, and medicare payments. Disheartening. So much for solidarity between generations.

Yes, millenials born in 1985 - 1990 are likely experiencing the double whammy of crushing student debts with lack of available decent full time work in aggregate. But what about those millenials born from 1994 to 2000, how do you explain their almost narcissistc sense of entitlement and lack of work ethic in aggregate?

Yes, millenials born in 1985 - 1990 are likely experiencing the double whammy of crushing student debts with lack of available decent full time work in aggregate. But what about those millenials born from 1994 to 2000, how do you explain their almost narcissistc sense of entitlement and lack of work ethic in aggregate?

It may be the emphasis on self esteem and not keeping score in sporting competitions and participation trophies and that sort of rot...

Of these sins what would you have me do differently?

You should have voted to pay more taxes, and well, made more children.

Being a sole breadwinner for a family of five is a damned heroic achievement where I live, especially since I got here after the housing bubble ruined the market and rents have only gone up. Dual income would take a load off, but it's not practical for us at this point.

Being a sole breadwinner in a family of whatever is a luxury. Lotsa working class families had both parents working full time on different shifts. Including my family. It's a grind but it beats the heck out of having all the paycheck in a single job-basket.

As far as that goes, the nuclear family construct is a luxury too. Living with or next to or very near extended family provided more flexibility (and a whole lot less stress) on childcare when both parents had work outside the home. The whole "American Dream / nuclear family" construct was an anomalous and relatively short part of the American Experience for only about 3 decades after WW2. Now we're just back to normal, but at least nowadays BOTH parents have nearly the same opportunities in the workplace. So it's better now in that regard.

@sbh

I am 37, bought a portfolio of stocks with tax-advantaged money, bought 2 apartments outright, and have self-insured with health care as well! I have money in the bank and will be fine--just positing that I would be more fine if I lived in a different generation since now I must be worried about SS, rising health care, and SHAKY employment.

I just think that if you were playing your cards the SAME way in the current business environment as a young person by the time you were 55-56 you would be less advantaged than you are now.

You were prudent. Good for you. The deck is stacked differently now in a way that doesn't reward prudence nearly as much.

I'm pretty fed up with the age 50+ population that believes that it's mere laziness causing the unemployment. We are picking up the tab for your health costs, pensions, and social security, and in my case I wonder for what.

I don't think so.... but nice try anyway...

The 50+ population has been working since they were 16, or younger, and have been paying INTO the system longer than you!!

They also have been paying the tab for 65+ crowd... so stop your crying....

You'll be paying the tab soon enough for the 50+ crowd, just not yet!!

No need to direct blame here as this will continue as long as the Fed and the Keynesians voodoo crony capitalists are at the helm. 17 trillion and counting.. ;)

They also have been paying the tab for 65+ crowd... so stop your crying....

People 50+ grew older in a environment of increasing asset prices due to Fed policies / falling rates. They bought houses cheap 25+ years ago, which have increase in prices faster than inflation and much faster than wages.

Now some baby boomers will try to sell their houses at inflated prices to young people who can't get good jobs, already have a big student debt loans on their backs. They (boomers) expect to get ss and medicare paid by the same relatively less numerous young people, who clearly shouldn't hope to get any ss and medicare themselves, because that will be long gone by the time they get there.

All the problems that happened during the lifetime of boomers were pushed to the next generations as debts.

I think it's obvious that boomers have a big advantage over the following generations. It's not to blame anyone in particular. All policies were made to advantage them.

The first arrivals to any assets will be helped by inflation boomers or crony's.

You guys seem optimistic about the future, I'm not sure there will be country a at all. Simply because debt service is 200 billion at 1.5% it will be at a trillion overnight when rates return to normal, at that point there will be some BIG changes.

The biggest change for boomers was when women entered the workforce and you had two income households, that increased BUYING power, which caused the rise in prices....

Just out of curiosity it would seem that the introduction of credit cards had some effect on the economy as well as that increased the money supply also?

Just out of curiosity it would seem that the introduction of credit cards had some effect on the economy as well as that increased the money supply also?

We should just do what Japan did the other week, and double the YEN in circulation.

Even the fed only prints a fraction less than 2% of the money it CREATES out of thin air.(

It's a race to the bottom with the FED PRAYING it's is the last one standing.

, I'm not sure there will be country a at all. Simply because debt service is 200 billion at 1.5% it will be at a trillion overnight when rates return to normal, at that point there will be some BIG changes.

You Americans are so callow. Countries don't disappear just because it goes bankrupt or the currency becomes worthless. Otherwise most European countries wouldn't exist today.

These debts problems are relatively benign: it just means that there is a crisis, maybe the currency changes, in any case money gets redistributed. There will be losers and winners. Big deal. Life will go on.

It's not like if there was only food for half the population.

To be fair some of every "boom" was organic (the initial tech boom certainly was), but every time it started naturally correcting they threw more money and cheaper rates at it to keep it "going".

My daughter can live with me as long as she likes. Then again, my kid isn't shitty like other peoples kids.

Lahossain, are you in California?

Indeed, I am in the Bay Area. Hence, the inaccessible housing.

As to all the 50+ yr olds on here defending their brilliance and prudence for securing their future, I'm only suggesting that you step back and consider the new context for those starting out in an environment of fed-easing to the benefit of only 10% of the population and shrinking wages.

@SBH, I am a young ma'am about to have have a first child in the SFBA and frankly very concerned about the US prospects with the elite in Congress and the Senate (in both parties) are tone-deaf to anyone except their most prized constituency, the boomer crowd supporting their elections. So, if we can call that the "context," I would very much like to change it.

But thanks, in the meantime, I'm doing the best I can which is working 2 professional jobs to break the 6 figure mark which is all too essential in the SFBA.

Cheers.

You Americans are so callow

Ok Mr Maturity, would you say that Argentina or the USSR even resemble what they were before? or Great Britain for that matter. Argentina had the 2nd largest GDP 100 yr ago, China was the leading power many years ago and Great Britain 150 yr ago. Nope they don't even resemble their former selves at the risk of being callow gotsta disagree with you there.

People 50+ grew older in a environment of increasing asset prices due to Fed policies / falling rates. They bought houses cheap 25+ years ago, which have increase in prices faster than inflation and much faster than wages.

Oh, you mean back when mortgage rates were 12+%..... O.K.

And I also guess 25+ years ago they were making buckets of money and didn't need to qualify for a mortgage based on monthly income, right??

The biggest change for boomers was when women entered the workforce and you had two income households, that increased BUYING power, which caused the rise in prices....

Women entering the workforce to create rise in prices. I think it was the other way around, that women entered the workforce to compensate for lost wages by their husbands and thus the inability to face costs of living (housing included).

If you like Robert Reich, he explains it well in his book "Aftershock."

A blurb taken from Amazon:

"Reich points out that income for American middle class families has been essentially stagnant or declining for over three decades. The middle class has coped with this in three basic ways: (1) Women have entered the workforce, (2) People worked longer hours, and, of course, (3) We all relied on debt (credit cards and home equity loans) rather than income to support our consumption. Those coping methods are now exhausted, and we are left in a position where average Americans simply do not have sufficient discretionary income to support a sustainable recovery. The great American consumer class -- which was the driving force behind our prosperity in the 1950s and 1960s -- has been largely decimated."

would you say that Argentina or the USSR even resemble what they were before? or Great Britain for that matter. Argentina had the 2nd largest GDP 100 yr ago

I'm saying Argentina, GB, and Russia are still there. (In spite of pretty putrid decision making).

Change is inevitable, debts or not. Empires come and go.

But what causes a country to disappear is almost certainly not just a change of financial system.

A blurb taken from Amazon:

"Reich points out that income for American middle class families has been essentially stagnant or declining for over three decades. The middle class has coped with this in three basic ways: (1) Women have entered the workforce, (2) People worked longer hours, and, of course, (3) We all relied on debt (credit cards and home equity loans) rather than income to support our consumption. Those coping methods are now exhausted, and we are left in a position where average Americans simply do not have sufficient discretionary income to support a sustainable recovery. The great American consumer class -- which was the driving force behind our prosperity in the 1950s and 1960s -- has been largely decimated."

The subject is more nuanced that he would have you believe.

Household income is a straw man tool. used by propagandists like Elizabeth Warren.

Until recent years spending by consumers was still quite high.

But what causes a country to disappear is almost certainly not just a change of financial system.

Ok so you are saying the land does not disappear, that is tautology, very astute.

The subject is more nuanced that he would have you believe.

Household income is a straw man tool. used by propagandists like Elizabeth Warren.

Until recent years spending by consumers was still quite high

Spending may have been high--but what about savings? Nothing but downwards.

Riddle me the nuances then. "Propagandists"--is that what we call all of our politicians then, despite their academic record? Ok.

I just don't see how you can refute wage erosion.

Riddle me the nuances then. "Propagandists"--is that what we call all of our politicians then, despite their academic record? Ok.

I just don't see how you can refute wage erosion.

What do you use as a metric for wage erosion?

Here is quote from a friend of mine:

With regard to consumption, how about just the last 15 years, when terrible things were supposed to be happening to everyone not part of the upper few percent?

From BLS's Table 2.3.6. "Real Personal Consumption Expenditures by Major Type of Product, Chained Dollars" with population data from the Census Bureau:

Total Personal Consumption Expenditures (goods and services):

'95: 6.076 trillion

Population: 262.8 million

Real per capita spending: 23,121

'10: 9.221 trillion

Population: 309.0 million

Real per capita spending: 29,841

That's an average REAL (inflation-adjusted) increase in per capita PCE spending per year of about 1.75% over the last 15 years, which includes 2 recessions. Total REAL increase: 51%.

Services are about 2/3rds of PCE. Housing, utilities, health care, restaurants, airfare, movie theaters, etc.

The largest increase in services? Health care. The 2nd largest? "Recreation services."

Same numbers for goods only:

'95: 1.896 trillion

Population: 262.8 million

Real per capita spending: 7,215

'10: 3.231 trillion

Population: 309.0 million

Real per capita spending: 10,455

That's an average real increase in per capita spending on goods per year of about 2.6% over the last 15 years. Total REAL increase: 70%.

The biggest increase? "Recreational goods and vehicles."

We now spend 460 billion on recreational equipment (like RVs and personal watercraft and snowmobiles and motorcycles and off-road vehicles and tennis rackets and baseball gloves and running shoes and exercise machines, etc.,) up over 500% in just 15 years, and considerably more than the 330 billion we spend on cars and trucks.

Spending on furniture, appliances and other durable household equipment like flat-screen TVs and personal computers has about doubled to 260 billion in 15 years.

The few percent who are the reviled "rich" certainly bought more than their share of all of this stuff, but the numbers reflect what's been going on in the population at large, that is, the 95+% who aren't "rich," but are a lot richer than the class-warriors would have everyone believe.

http://www.bea.gov/iTable/iTable.cfm?ReqID=9&step=1

http://www.census.gov/

With regard to earnings, there's total employee compensation, as reflected in the BLS's National Compensation Survey Table 4. "Employment Cost Index for total compensation for all civilian workers (Dec. 2005 = 100)" over the last 28 years:

Yr/Index/% change

'82 41.5 6.4

'83 43.9 5.8

'84 46.2 5.2

'85 48.2 4.3

'86 49.9 3.5

'87 51.7 3.6

'88 54.2 4.8

'89 56.9 5.0

'90 59.7 4.9

'91 62.3 4.4

'92 64.4 3.4

'93 66.7 3.6

'94 68.7 3.0

'95 70.6 2.8

'96 72.6 2.8

'97 75.0 3.3

'98 77.6 3.5

'99 80.2 3.4

'00 83.6 4.2

'01 87.0 4.1

'02 90.0 3.4

'03 93.5 3.9

'04 96.9 3.6

'05 100.0 3.2

'06 103.3 3.3

'07 106.7 3.3

'08 109.5 2.6

'09 111.0 1.4

'10 113.2 2.0

ftp://ftp.bls.gov/pub/suppl/eci.ecicois.txt

That's an average REAL (inflation-adjusted) increase in employee compensation of about 3.65% per year over the last 28 years, which includes 4 recessions.

And an average REAL increase of about 3.3% per year over the last 15 years. Including 2 recessions.

The BLS's National Compensation Survey includes all civilian workers, EXCEPT for those in Federal agencies, the military, agriculture, the self-employed, AND ANYONE WHO SETS THEIR OWN PAY such as owners, major stockholders and partners in unincorporated firms.

In other words, it excludes most of the "rich."

As BLS says, wages and salaries are only about 70% of total compensation. BLS explains what the Employment Cost Index includes, in addition to wages and salaries:

paid leave - vacations, holidays, sick leave, and personal leave

supplemental pay - premium pay for overtime, weekends, holidays and shift differentials

nonproduction bonuses - year-end, referral, and attendance bonuses

insurance benefits - life, health, dental, vision, short and long-term disability

retirement and savings benefits - defined benefit and defined contribution plans

legally required benefits - Social Security, Medicare, Federal and State unemployment insurance, and workers’ compensation.

A detailed description of the NCS survey and how it is used to calculate the BLS Employment Cost Index is here:

http://bls.gov/opub/hom/pdf/homch8.pdf

Now, as everyone knows, not all compensation is cash compensation, so not all of it can be used to consume "stuff." But, cash or not, ALL of it IS compensation.

Total REAL compensation was up about 60% over the last 15 years, a little over half of that being in the form of cash, the rest in benefits. As demonstrated by the 3.3% annual increase in total real compensation that resulted in a 1.75% real increase in consumption, with no significant change in the savings rate (no, I won't bore you with those details.)

If people want even more cash, they should work to stop government from requiring that employers provide ever-more and increasing expensive non-cash benefits like health insurance and leave and unemployment benefits. After all, employers have a budget for labor, and every dime of mandatory benefits comes out of it, leaving less for actual cash pay.

My estimates of REAL earnings and consumption being up about 50% over the last 30 years were very conservative, they're actually up considerably more than that. Both real consumption and real earnings are both up that much just in the last 15 years.

The fantasy that the compensation of U.S. workers has stagnated or that the "rich" are suddenly getting more than the large share they have always gotten isn't just a statistical hoax, it's a statistical fraud.

From BLS's Table 2.3.6.

I'd be interested to see the trend in these numbers for years 2011-present (yes, I know, BLS lags by 2 years).

Also consider that inflation calculations are increasingly manipulated, or at least increasingly neglect the rising costs of necessities that are ignored by gov't inflation numbers. So that will naturally overstate the comparison of YoY inflation-adjusted numbers.

The entitlement of the boomers is incredible--their only concern being the recovery of their stock holdings, house equity, and medicare payments. Disheartening. So much for solidarity between generations.

OK, I'll bite. What can I do for you? I'm 55-56. Bought my portfolio of stocks with tax-advantaged money. Own my house outright. I currently self-insure my health care. Created my own employment for 35 years. Of these sins what would you have me do differently?

Since you asked...

...Rant On...

Burned far less fossil fuel.

Blown less chloroflurocarbons into the atmosphere.

Dumped far less toxic waste into the environment.

Saved more more for retirement.

Embraced nuclear energy (but dumped nuclear weapons).

Had fewer children (really? SEVEN billion and counting?)

Never smoked tobacco (you knew damn well it caused cancer)

Decriminalize and legalize marijuana at all levels (you knew damn well it did NOT cause cancer OR brain damage)

Reject fundamentalist religion as dangerous nonsense.

Reject the creation of the prison industrial complex

Required basements in the California's residential building codes (more efficient use of land)

Reject California's Prop 13

Kept up the nation's infrastructure (bridges especially)

Voted against politicians who pushed for lower taxes for the "job creators"'.

NOT push abstinence on US after your generation had its fill of hedonism.

.../Rant Off...

education costs are sky-high and housing inaccessible to even those like me, age 37, who have saved rabidly since age 15.

lahossain,

education costs are not sky-high for Californians, or at least they don't have to be: almost all Californians live within reasonable commute distance of a heavily taxpayer subsidized community college. Students can transfer to a UC or CSU for the last two years. The portion that students pay for classes at UC/CSU has gone up quite a bit, but it's still heavily subsidized: by California taxpayers and also by foreign and out of state students from rich families.

About the housing, if you are willing to be an urban pioneer (like my partner and me) it's not so much, even in the Cool and Hip Bay Area. One can buy/borrow one's way away from social ills or dive in. Those neighborhoods that hipsters and wealthy immigrants sneer at are chock full of well intentioned hardworking families with an ethic. Just learn how to steer your kids in the right direction, be a presence at their schools, and spend your time with other like minded families and it won't be so bad. I'd recommend trading in the lexus for a camry, though, and shake off any Sense of Entitlement.

It's the path my partner and I took decades ago because we didn't have the means to buy/borrow into (Cool and) Hip zip codes and it worked out just fine. My kids got accepted to UC's and CSU's and attending debt free. We don't subsidize county government so much with Fortress-Sized property tax payments and we've never stressed about the rent.

They are priced out and will remain so jobs or not.

No, I'm quite certain JOBS are a big piece of the missing puzzle here.

Comments 1 - 40 of 48 Next » Last » Search these comments

http://www.forbes.com/sites/trulia/2013/07/23/kids-arent-moving-out-yet/

>

It will take lower housing prices or lower rents. They are priced out and will remain so jobs or not.

#housing