« First « Previous Comments 20 - 40 of 40 Search these comments

@swebb,

AGNC has collapsed since early May. Buying now is bottom fishing. The price action is saying that dividend cuts are coming. Its book value is at $29/share, but looks like the book value is going down in the coming quarters.

I'll let the dust settle before jumping back in although it looks very attractive now.

Why is this dropping so fast?

I think the drop today was related to this news item / sentiment:

I don't claim to know how it all works (maybe someone else can chime in?) but my understanding is that AGNC makes money by buying and re-selling mortgages (I don't think they hold anything for very long). In order to do this and make good returns, they use leverage (around 6:1, I think)...the spread between the interest rates they are borrowing at and the interest rates of the loans they are buying is a critical factor in how much money they make....The Bernanke QE / liquidity party keeps the borrowing rates lower, maintaining a bigger spread....if that cheap money gets throttled back, rates will rise, spreads will shrink and along with it profits. Since they use leverage, even small changes can have a big impact.

Also I would think that the lower interest rates for mortgages would eventually impact the spread since recently originated mortgages will be at lower rates on average...So the AGNC business model works in a declining rate market, but not so well in an increasing rate environment...

I'm out of my depth, here, so I will stop speculating and let someone else explain it.

As SFace said,

Going forward, the spread will improve on the new MBS purchases as the higher rate will improve the spread everything else being equal. I noticed AGNC cut its dividend to $1.05 this last round. Looks like more dividend cuts are coming.

Is this a double bottom for AGNC? It went sideways for a month and a half. It's currently selling about 20% below book value although we know its book value will keep on deteriorating in the near future. Dividend was recently cut from $1.25 to $1.05/quarter, which is about a 19% yield.

Gotta keep on eye on this one, but I don't think it's time to jump in yet. Let the dust settle a bit more.

I keep watching it -- I have an itch to get back in. Today was interesting, but it feels more like a gamble right now than an informed / smart investment (for me, at least). If I invested for entertainment, I'd probably buy some and hold on for the ride...I'm chicken shit, though.

swebb, can you handle this assignment?

Homework? I can't give it much time right now, but here is what I found:

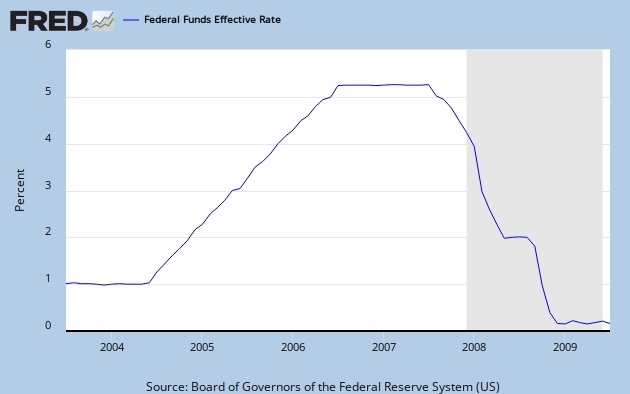

Fed funds rate started moving up in mid 2004 from 1% steadily climbing to 6% in mid 2006 where it plateaued for another year bfore the precipitous drop to near zero by the end of 2008.

For comparison here is what the "10 year treasury constant maturity" graph looks like:

Pretty flat during the fed rate ramp up, but experienced the same drop starting in mid 2007.

NLY started reducing the dividend in Q3 2004, dropping from $0.50 in Q2 2004 to $0.10 Q2 2005 (the price dropping at the same time from the mid $18 range to the mid $11 range). After the initial hit, the price and dividend stabilized and recovered modestly through the fed funds rate ramp up. During the plateau at 5%, NLY steadily increased the dividend and the share price (mostly) followed. By early 2008 the dividend was fully recovered but the share price was pretty volatile.

@E-man Any thoughts on this?

@swebb,

I believe we have just missed the bottom on AGNC and NLY. :)

I'll get back to you later when I get a chance to look at their balance and projected earnings for next year.

There are a couple of stocks I'm looking at buying/trading, RIG and DO. These have been my bread and butter trading stocks. Looking to add WFC and JPM to my position right here. I'll get back to this thread this weekend. Have a great one.

@swebb,

Here's my take on AGNC after reviewing its balance sheet. AGNC got a huge hit in loss last quarter. Looks like AGNC has reduced its leverage from 8 to 1 to 6 to 1. This reduces the yield as well as the yield spread has been compressed in the recent quarters. Its book value dropped the low $30 to $25.50. At this point, AGNC is selling for about 10% below its current book value, but the book value might deteriorate a little more in the coming quarters, but my guess is that it won't be more than 10%.

With all that said, AGNC still brings in over $7/share from its operation, which means the dividend is sustainable at this rate. The reason I asked for NLY's history is because NLY has been around the longest, and history tends to repeat itself. Based on NLY's chart since 1997, the worse case scenario for AGNC is $18/share, but I believe it will hold above $20/share. I see interest rate will hover around 4.5% for the rest of the year, which means the spread will get a little better for mREITs in the coming quarters. Therefore, buying AGNC at this price will have a 10% downside potential, which is about 2 quarters of dividend. I'd be a buyer at 1/2 position here.

@SFace,

Love to hear your take on this. :)

Nice call on FB. I'm up nicely. Still regret for not getting into TSLA. I was waiting for a pullback to $97, but that never happened and TSLA just took off from there.

@swebb,

Just bought 400 shares of RIG. At this price, the downside potential is $43.75. The upside potential is high $50. In the meantime, wait and collect 5% dividend.

Thanks for your analysis/input -- always appreciated. I may put in for a 1/2 position on AGNC as you mention.

You put a bug in my ear regarding RIG. I have been watching it, but not very closely -- maybe time for a closer look.

FWIW my Lending Club portfolio continues to do well. 17.25% returns over the past ~year. I do have a few delinquent notes -- about 2.5% are > 15 days late, so my returns will be going down. My problem lately has been finding enough notes to invest in...they seem to get gobbled up before I can put my eyes on them.

Also, I used to own CYS and got out on its first dividend cut over a year ago. It's interesting that CYS increased its dividend last quarter while all other mREITs cut their dividends. Could this be nearing the end of the dividend cuts for other mREITs? I'd like to think so.

As the mortgage market becomes stable in the coming months or quarters, mREITs will benefit from a higher spread. I believe that's when these mREITs will increase their leverage again to increase yield even more. Increase dividend will increase the stock price and vice versa. I like the odds here.

With respect to the Lending Club, I know someone that borrowed from there in the 7-8% to buy low-end real estate, $20k -$40k properties in the mid-west. I don't like to be a lender because it's unsecured.

That's a fantastic return you got there. Who are your borrowers?

Lending club: Agreed on the unsecured part, but at least it's diversified over hundreds of borrowers.

I actually hand pick the notes that I invest in -- it is a bit time consuming (especially if you want to invest a big chunk at once), but maintenance is pretty painless assuming there are enough notes to choose from. Just 15 minutes once a week, maybe.

I did some "analysis" when I first got in -- Lending club makes historical data available as a CSV, and at least a few sites have plugged this into a basic database front end so you can filter based on the various fields. The one sentence takeaway is this:

Credit card refinancing is the "loan purpose" that gives the best net returns.

Business loans (risk), green energy loans (ROI way overstated), education/training (too prospective, probably not realistic) all do poorly and I don't touch them. Vacation and wedding loans offend my sensibilities, so I tend to avoid them, but they actually do pretty well. There wasn't nearly as much data for theses loan purposes, another reason I avoid them.

Debt refinancing is a mixed bag -- if it's someone refinancing their payday loan or other personal loans, could be a bad sign...if it's someone refinancing credit cards and they just called it debt refinancing, maybe not so bad. I fund these a lot if the amount they are borrowing lines up with the revolving credit pretty well, but it's a red flag when someone wants to borrow $20k for credit card refinancing and only shows $6k in revolving debt.

I have some reasons behind my picks, but a lot is based on gut feeling. Easy "don't fund" decisions come from (borrower entered) titles such as "help me stop drowning". Loan applications where people have their shit together and can articulate why the loan is a good financial decision get my money (for example, something as simple as: "Current minimum payments $450, this loan will cost $380 per month")

Things I like to see:

payment $3k/month income

Long employment history

"Stable" employer, public school system, police department etc.

minimum 12 months since last delinquency, 24+ is better

No mention of medical bills in their loan app.

Borrowing amount that matches up with their revolving credit balance

I pick D grade loans as the majority of my portfolio, but do some Cs and Es and Fs as well.

I'm happy with it, assuming I can keep finding notes to invest in. I don't know what (if any) edge I gain from hand picking, but I often see C grade notes that wouldn't get my $$ even at a D or E, and also D grade notes that appear much better qualified than the others. Now that I am past my evaluation of it, I'm ready to put some more in..not sure how deep I will go, though. It's hard to unroll, so that's one concern. $25k is probably my limit at this point in my life.

Is lending club, one of the peer to peer lending website outfits (I think prosper.com is the one id checked out in the past, but wouldn't allow PA residents on the credit side of the trade, only debt :(

@swebb,

Just bought 400 shares of RIG. At this price, the downside potential is

$43.75. The upside potential is high $50. In the meantime, wait and collect 5%

dividend.

Agree with RIG, one of the safest play out there at low 40's. It's highly likely to hit 50's before $43.

No opinion on AGNC which hinges on interest rates and have some uncertainty. who willl be the next fed chief (Summers?)

Yes, LC and Prosper are the same animal. State laws are what prevent you from being a lender -- to protect the "little guy" some states require you to be an "accredited investor" to invest in the P2P lending...Some states have a "back door" -- you can buy notes on the secondary market. (Kentucky is like this, I know). The thing is, the secondary market is probably not as good as getting access to the full pool. Some people dump their notes on the first hint of a problem, so you have to make sure you are getting a good discount (not sure what "good" is, though)...

@swebb,

Sounds like you target government employees. :)

Lending Club is definitely not for me.

Yeah, government employees with 10 years under their belt are really hard to fire and unlikely to quit...but it's the credit card refinancing loan purpose that attracts me the most.

To be fair to Lending Club, there are "hands off" options that let you pick your portfolio mix (and filters) and they will automatically re-invest for you...I'm not sure how well you fare on the shotgun approach, though...LC says I should expect about 11% from my mix which is nominally 17.25%.....that's a lot of defaults. Maybe I am dodging a few here and there by picking by hand?

Yeah, government employees with 10 years under their belt are really hard to fire and unlikely to quit...but it's the credit card refinancing loan purpose that attracts me the most.

To be fair to Lending Club, there are "hands off" options that let you pick your portfolio mix (and filters) and they will automatically re-invest for you...I'm not sure how well you fare on the shotgun approach, though...LC says I should expect about 11% from my mix which is nominally 17.25%.....that's a lot of defaults. Maybe I am dodging a few here and there by picking by hand?

Seems like you did your homework and it has paid off so far. Congrats. Like everything else, you have to find your niche. Now, if you can find your niche in real estate, you will not have time to screw around with stocks and Lending Club. :)

Now, if you can find your niche in real estate, you will not have time to screw around with stocks and Lending Club. :)

Heh. I suppose so. The nice thing about stocks and LC is that you can do it while keeping a normal job. Real estate takes more capital and time. You are right, though, it can be a lucrative business. I watched as my parents methodically acquired, renovated and managed one property after another...I'll probably acquire my rentals more organically...buy a new house to live in, keep the current one as a rental. Rinse and repeat a few times.

I was in and out of AGNC for a while, and then have been out for good since the beginning of 2012 (?), so I missed most of the climb up and dividends in the mean time..

It has taken a big hit lately...I'm starting to watch it more closely again, anyone with thoughts on this?

I know there has been a lot of press about how QE is going to hurt the spreads, etc...Also they have announced a buyback program, which might be a reaction to fewer good opportunities to invest..

Thoughts, anyone?