patrick.net

An Antidote to Corporate Media

1,257,435 comments by 15,004 users - HeadSet, Patrick, socal2, stereotomy, theoakman online now

« First « Previous Comments 103 - 142 of 219 Next » Last » Search these comments

It's much better to buy when interest rates are higher and housing prices are lower - esp in CA

Unfortunately, history shows that doesn't happen.

tatupu - what do you think will happen when interest rates inevitably go up to 5 - 6 - 7% or higher? I'll tell you - affordability goes down and so does the price of housing. The artificially low interest rates fueled the bubble and continue keep prices inflated. The best time to buy is when rates are high, prices are low and the market is dead. It's happened more than once in my lifetime (I'm in my early 50s) and I believe it will happen again. There is also the advantage of locking in a low property tax rate, which in CA can last a lifetime.

russell,

If you say so.

But Hipsters and wealthy immigrants will tell you no

It's different this time.

It's different here.

Purchase Price in PARAMOUNT!!!

Interest rate is not that important. I also have experience in previous cycle and market indeed will come to dead zone very soon. Recently we have very low inventory due to the following facts:

1. Houses for sale are mostly represented by short sales and foreclosure with extremely low number of regular sales. Apparently many should be regular sellers hold they breath, thinking we are in the bottom and rebound is just other the corner. That will not happen unfortunately, so seller will have no choice and list house on market to various reasons: kid’s outgrown, new kinds, divorces, job transfers, to name a few.

2. Facebook and other IPO’s is just another propaganda spread by realtors to create fear (yes, our nation is so good with it)

3. Low interest rate create another fear (can go only up!). Didn’t happen in Japan.

4. OMG multiple offers! Look bellow (Santa Clara county), yes we have multiple offers but not above asking price. January statistics: Sale vs. List Price - 99.0%!

Indeed, every cycle is different, but has same stages. If you found great deal – go for it. If not, don’t PANIC. Real Estate does not behave like stock market.

Trends At a Glance Jan 2012 Previous Month Year-over Year

Median Price $485,000 $532,000 (-8.8%) $524,000 (-7.4%)

Average Price $642,128 $716,061 (-10.3%) $649,476 (-1.1%)

No. of Sales 649 899 (-27.8%) 682 (-4.8%)

Pending Properties 1,678 1,528 (+9.8%) 1,329 (+26.3%)

Active 1,466 1,386 (+5.8%) 1,757 (-16.6%)

Sale vs. List Price 99.0% 98.7% (+0.3%) 98.9% (+0.1%)

Days on Market 66 63 (+4.7%) 67 (-1.0%)

tatupu - what do you think will happen when interest rates inevitably go up to 5 - 6 - 7% or higher? I'll tell you - affordability goes down and so does the price of housing. The artificially low interest rates fueled the bubble and continue keep prices inflated. The best time to buy is when rates are high, prices are low and the market is dead. It's happened more than once in my lifetime (I'm in my early 50s) and I believe it will happen again. There is also the advantage of locking in a low property tax rate, which in CA can last a lifetime.

The only problem with that is that it isn't supported by the facts. Look at historical housing data - house prices very often continue to rise even as interest rates go up. You are waiting for something that may very well never happen.

tatupu - what do you think will happen when interest rates inevitably go up to 5 - 6 - 7% or higher? I'll tell you - affordability goes down and so does the price of housing. The artificially low interest rates fueled the bubble and continue keep prices inflated. The best time to buy is when rates are high, prices are low and the market is dead. It's happened more than once in my lifetime (I'm in my early 50s) and I believe it will happen again. There is also the advantage of locking in a low property tax rate, which in CA can last a lifetime.

The only problem with that is that it isn't supported by the facts. Look at historical housing data - house prices very often continue to rise even as interest rates go up. You are waiting for something that may very well never happen.

Please reference the data you are referring to here. I would love to be enlightened here.

It's much better to buy when interest rates are higher and housing prices are lower - esp in CA

Unfortunately, history shows that doesn't happen.

Can you reference the history of the relationship between real house prices and interest rates? It would be helpful.

Yes, when you own with a mortgage, you owe the bank payments on your loan. The bank, however, doesn't own the home. You do. You have put up the house as collateral on the loan.

Please tell the jury who holds the title to the home during this process. "uh uh uh, The banks holds the title but but but...."

So, if the current person living in the house decided to not make the agreed upon payments then does the bank have any ownership rights to the house? "Um yah, but but you are being misleading here, house prices always rise, history shows that, so there is no worry about a mortgage holder missing payments".

Uh um, please answer the question. It is a Yes or No. "well um uh I guess if you had to say the answer and it really". Please please just answer the question for the jury. "I guess it would be yes then".

So, the person living in the house really only has an obligation to use the house while the bank is owning the title. If that fore mentioned person completes the required payments on time like outlined in the mortgage agreement then they will receive title and be the new owners. Would that be a fair assessment? "Um uh um uh, Look a Puppy!" as tatupu runs out of the court room never to be seen as a real estate expert again.

Executive summary: Bank owns the house. You rent money or a house. If you think otherwise then you don't understand the real estate ponzi scheme disease that is killing this country and you must really be confused each year we drop further and further into the abyss. Real estate is dead. Deal with it.

I say don't buy yet b/c prices are still dropping. Interest rates are artificially low which is propping up the housing market. It's much better to buy when interest rates are higher and housing prices are lower - esp in CA. If you buy when prices are lower you are locked in to lower property taxes and lower level of indebtedness. Eventually interest rates will revert to historical mean and housing will take another hit. Of course it also depends on your circumstances. 500 sq ft is pretty tight for a family of four. If you don't plan on moving for at least 10 years and can ignore the headlines when the value of your house drops then maybe you should buy. It would be a bummer to buy with a 3% loan and have the value of the property go down 20% when interest rates go up to 6% or higher - it doesn't matter unless you want to sell but still, it's a bummer.

Finally some forward thinking on this site that actually makes sense. I don't understand why everyone can't see this logic. What is said here I also believe to my core. I wish it wasn't, but the greed and manipulation of the last 10 years is on the road to recovery. On that road will be a lot of hurt people. Some good, some still greedy. Such for the good, so I hope others hear this stuff and get out of dodge to avoid the crap that will hit the fan. 685K debt per family! Come on, how the hell are we going to dig out of that hole? We are not.

The only problem with that is that it isn't supported by the facts. Look at historical housing data - house prices very often continue to rise even as interest rates go up. You are waiting for something that may very well never happen.

Does the par value of a bond fall when interest rates rise? Yes. ALL the time, EVERY time.

Stop lying to the public.

Realtors Are Liars.

That's just another daft post from you. A house is not a bond, and it's price isn't as directly dependent on mortgage rates as people seem to think. I mean for crying out loud, interest rates were going up in 2006. What happened to house prices? That's one, very recent, example that shows other factors play an important role in determining prices. That's why it's wishful thinking for people to just say "I'm waiting for interest rates to rise because house prices will fall." Well no, not necessarily. What about correlations between house prices and income and population growth. If the interest rate was the be all and end all, then house prices/sales would be doing very well right now.

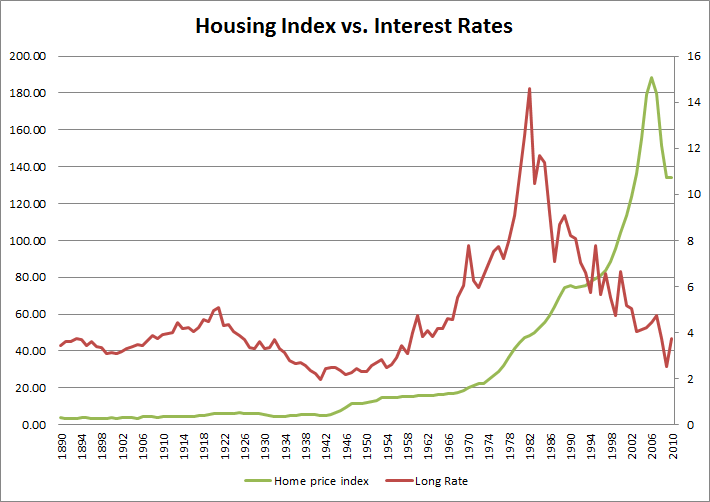

And here you go:

So, if the current person living in the house decided to not make the agreed upon payments then does the bank have any ownership rights to the house?

Sure-it's a condition of the loan agreement. So what?

So, the person living in the house really only has an obligation to use the house while the bank is owning the title. If that fore mentioned person completes the required payments on time like outlined in the mortgage agreement then they will receive title and be the new owners. Would that be a fair assessment?

No--they have repaid their loan agreement. And the collateral is returned to them.

Executive summary: Bank owns the house. You rent money or a house. If you think otherwise then you don't understand the real estate ponzi scheme disease that is killing this country and you must really be confused each year we drop further and further into the abyss. Real estate is dead. Deal with it.

Wrong again. I'm sorry you have such a poor understanding of property law. Read up and then you can try again.

tatupu - what do you think will happen when interest rates inevitably go up to 5 - 6 - 7% or higher?

I think the economy will be recovered, inflation will be higher and incomes will be growing. And house prices will be rising as well. Historically, that's what has happened.

Can you reference the history of the relationship between real house prices and interest rates? It would be helpful.

#1--we're talking about nominal home prices, not real.

#2--Historically, there is no correlation between nominal home prices and interest rates. And it's easy to explain why. Home prices are most dependent on income and incomes rise during good times. And guess what--interest rates are higher during good times.

Yeah, houses are exactly like bonds, except where they aren't. And we aren't talking about inflation - you and others have been saying that higher interest rates = lower prices. The graph shows that that is a massive over simplification. If all things held equal, then you could argue your case about interest rates, but they don't.

And I was under the impression that house prices were relatively flat during much of 2006 whilst interest rates were rising. The subsequent collapse in house prices wasn't driven by that relatively small rise, or are you seriously trying to argue that they were?

Wrong again. I'm sorry you have such a poor understanding of property law. Read up and then you can try again.

Hence why we are in such a mess. If I sold a piece of property to someone that was unable to make full payment, I consider that property (or collateral as you call it) mine, until full payment has been paid. If you damage, burn down, misuse, etc. my property then I am the one losing. Hence, why the mortgage issuer requires you to get the proper insurance. Try to get a mortgage and tell them that you don't require insurance on your home (you know, the one you own). You will quickly realize who has the vested interest, and who the rightful owner is.

You are obviously stuck in a rut and not until the ponzi scheme collapses completely will you see things properly. Good luck the next 5 years, you will need it.

Can you reference the history of the relationship between real house prices and interest rates? It would be helpful.

#1--we're talking about nominal home prices, not real.

#2--Historically, there is no correlation between nominal home prices and interest rates. And it's easy to explain why. Home prices are most dependent on income and incomes rise during good times. And guess what--interest rates are higher during good times.

Perfect, thanks for the data and graph. Wow, I see it now. ;)

And here you go:

From you own graph, the people that benefited the most from housing were the ones who bought in 1984 when interest rates were the highest and the housing index was just start to rise. Then as the rates started to collapse in order to support and even futher increase in the house index (adding greed by many to the equation) the owners would just refi. Now they have the benefit of a low payment and an increasing house price. Perfect! Fast forward to today and we have a completely different story with nothing pointing in a positive direction for the buyer. The benefit is gone, and will only return when interest rates rise again. You need to buy when they are high and refi as they are going down. That is how money is made in housing, not the other way around.

You can select any small periods of time and argue what you like, but the general trends show that there's a lot more going on than simply stating that higher interest rates will mean lower prices. And housing started rising from a low in '81, didn't it? And yes, interest rates played a major role in the 80s, but then again they did reach up to 16% or so, and as you follow the real house prices and interest rates, there are periods where yes the correlation holds and when it doesn't (interest rates rose 83-84 as did house prices for example, and then there was a long period from 86 or so to 91 where rates were flat and house prices declined substantially).

Anyway, my point isn't that interest rates don't have a role in house prices as they obviously do, but that it is by no means the only factor in determining what house prices will be at any given time.

Don't waste your money buying something you will not be happy with. These insanely high prices can't and wont' sustain themselves forever.

I wouldn't compromise if I were you, it's a lot of money to buy something you won't love and will probably grow to hate.

It's a price repeat of DotCom. During DotCom people were buying very expensive houses because those involved were making money hand over fist. And as soon as that ended, all those insane IPO's came to the end it crashed. If I were you, I'd expect the same repeat. It's no different today.

One of my old clients used to make a lot of money during DotCom, due to IPO's and overvalued stocks. When that ended, they ended up foreclosing, and prices dropped a lot too. Amount of money went away, and prices went down.

Perfect, thanks for the data and graph. Wow, I see it now. ;)

since another poster pasted it already, I didn't see the need to duplicate his work.

Did you not see it?

I rest my case your honor.

Thanks for proving that the only way you can make your case is by deception.

Perfect, thanks for the data and graph. Wow, I see it now. ;)

since another poster pasted it already, I didn't see the need to duplicate his work.

Did you not see it?

And it was debunked already. It doesn't show what you both are saying. Not even close. The best time to buy real estate is when interest rates are at the peak or heading towards the peak, not the other way around.

Perfect, thanks for the data and graph. Wow, I see it now. ;)

since another poster pasted it already, I didn't see the need to duplicate his work.

Did you not see it?

Correlation factor is not at all obvious like you say. Here is what I see in the graph.

1902-1920: Int up, Houses flat

1922-1942: Int down, Houses flat to up

1954-1962: Int up, Houses flat

1970-1982: Int up, Houses up

1982-1988: Int down, Houses up

1988-1991: Int down, Houses flat

1991-2006: Int down, Houses up

2006-now : Int down Houses down

The only correlation I see is that when there is a runup in prices like now there will be a correction in prices no matter what happens to the interest rate. The rates are normally adjusted down in an attempt to stop the drop, but at best it keeps prices flat or the drop continues (like now). The correlation that low interest rates are the best time to buy, I just don't see. It actually looks like the worse time to buy to me in terms of future price appreciation potential.

I think both sides are correct here. It is not a good time to buy now because of low interest rates. But as rates start to rise then that might turn out to be the best time to buy. That is normally when prices of housing starts to appreciate the best. Probably because it means we have come out of the woods are things are on fire for the economy to justify the raise in interest rates. Remember, they are raised to cool the economy. So, if we start seeing interest rates rise we all should really cheer.

Anyway, my take on the graph. I'm sure others will see it differently.

RentingForHalfTheCost says

So, if the current person living in the house decided to not make the agreed upon payments then does the bank have any ownership rights to the house?

Sure-it's a condition of the loan agreement. So what?

Lets try again. I'll answer the "so what?" This means the bank owns the property until you satisfy the mortgage. That is why they hold the title. If you are the rightful owner then ask the bank for the title. Shouldn't you own the title if you are the house owner? Damn right you should. I have 4 titles on my properties in my safe and am the owner in a sense. I can still lose the homes to the city if I don't keep up on the property tax payments. So, there is a bit of pseudo ownership going on. I'll take the pseudo over the owning a mortgage any day though. Mortgages are an easy way to put and keep yourself in debt for life. Did you see the bonuses given to bank executives, Freddie and Fanny Mae executives. Guess who is paying for all these bonuses?

I never said that low interest rates were the best time to buy. I said that there wasn't an automatic correlation between high interest rates and low prices, so I'm not quite sure what you think you've debunked. Your own list above doesn't even match what you've been arguing. Trying to predict when the best time to buy is is a pretty futile exercise. There are far too many unknowns for people to truly know what is going to happen. To me, it looks a pretty good time for a lot of Americans to buy a house - prices are pretty low (in terms of multiples of salary) in many parts of the country and interest rates are at historically low levels. Now that doesn't mean everywhere makes good sense. This place seems heavily focused on the BA and prices seem quite a bit more out of whack there compared to many places. Fine, wait it out if that's what you want to do, but then people shouldn't generalize it out to the rest of the US by pretending the situation is the same everywhere. It clearly isn't.

I never said that low interest rates were the best time to buy. I said that there wasn't an automatic correlation between high interest rates and low prices, so I'm not quite sure what you think you've debunked.

I was caught up in two conversation, so sorry it wasn't perfectly clear my points. I am in more agreement with you than tatu. Your reasoning is spot on to me and you are correct about over-generalizing a complicated problem (timing the market). In places undergoing intense distressed housing, now might be not a bad time to get your feet wet. However, in most areas like the BA, New York, etc. the local housing market is still in need of adjustments to match the economy.

Tatu's reasoning on the other hand lacks the data and is more about emotion and hope.

Sorry I confused the two threads

This means the bank owns the property until you satisfy the mortgage.

No, it really doesn't. It means you are using the house as collateral until you pay off your loan. If you can't see the difference in those two scenarios, then I'm afraid I can't help you.

Tatu's reasoning on the other hand lacks the data and is more about emotion and hope

What is my reasoning? All I said was that history disputes the false premise that there is a negative correlation between interest rates are prices.

but I'm not willing to spend 20 to 40 years sitting in a cube

Dont worry, nobody will work for the same company for 20 years ever again. The rate of change is so high today, its impossible to see a future.

worth financing and keeping the rest of your money in stocks.

You mean the computer generated casino?

Took me awhile to clean out my email inbox from all of this. I too have lived through several real estate marktets, and I have never seen one quite like this. Take for example this listing which also came in my email today, it's a short sale. Someone slashed the price $40,000. Regardless of the details, I'm not interested in such a volatile market. And I don't think this property will appreciate much beyond 149K anytime soon.

http://www.redfin.com/CA/Woodland-Hills/22100-Burbank-Blvd-91367/unit-265G/home/4003440

This means the bank owns the property until you satisfy the mortgage.

No, it really doesn't. It means you are using the house as collateral until you pay off your loan. If you can't see the difference in those two scenarios, then I'm afraid I can't help you.

I don't need help. I'm doing fine already. You see it through rose realtor glasses, whereas I see it for what it actually is. Owner of the title (legal document showing ownership) owns the home. No real debate only with people that don't understand what the word title means.

"It may also refer to a formal document that serves as evidence of ownership."

Taken from Wikipedia's definition of "title"

http://en.wikipedia.org/wiki/Title_%28property%29

Again, don't try to help if you can't really understand the definition yourself. Title=ownership. That is not open for debate with me. Go argue with your wallpaper if it makes you feel better. ;)

Owner of the title (legal document showing ownership) owns the home

Exactly--the bank doesn't own the title, you do.

The bank is holding it until you pay off the loan. Then they give it back to you.

I can't tell if you're just trolling or if you really believe that there is no difference...

OK--I'm growing tired of this. How about this. What new rights do you have as an owner once you have paid off the mortgage? Or what additional rights do you have when you buy with cash vs. with financing?

You should be able to name some, right?

Like you're entitled to any appreciation in the asset. Oh wait, you get that when you have a mortgage.

Or you have the right to make any changes to the asset as you see fit. Nope--you get that either way too.

Or you are responsible for any liabilities. Sorry, that applies both ways too.

So, what are the differences again?

OK--I'm growing tired of this. How about this. What new rights do you have as an owner once you have paid off the mortgage? Or what additional rights do you have when you buy with cash vs. with financing?

You should be able to name some, right?

Sure. You now have full rights to your property that you finally own. Not just the possession rights. You cannot lose it to the previous owner (mortgage holder) because of an inability to pay the mortgage. You are not forced to carry insurance on your house to cover the mortgage in the case of theft, damage, fire, etc. Do you know that if insurance carriers refuse to issue you insurance then this will break the mortgage contract and you will have to pay in full to keep your home? Many people forget this, but it is right there in writing. I had one house that had a fire close to it in the Sierras in 2004 and I was close to having this happen to me. After contacting nearly close to 10 insurance companies I finally found one that saved me. True story and I thought I was screwed.

You can sell your home without having to involve the previous owner. If you wanted to pass it to a family member it is as simple as hiring a lawyer and change the name on the title (which you now have in your possession). If you have a gambling problem and want to throw you home into a pot that you feel you can not lose, then you can do it. It is your home now, not the banks.

I take huge pride in the fact that I have titles to property. Until I got the titles I was always aware that if I lost my job, no matter how much equity I had built into the place I could actually be at risk of losing it. Just like many people in this country are right now as I type this. It doesn't matter that you paid down your mortgage for 5 years (never missed a payment) and now all of a sudden cannot make the payment. Add to it that no one will buy your home for the cost of the remaining mortgage and that put you in a very dangerous position. The bank then exercises its right to take possession rights away from you and do what it is necessary to recoup the skin it has in the game.

Even after you have title and ownership rights you still have the obligation to the city. You still have to pay taxes and if you don't you still risk losing your home. However, that is the closest you can get in this country to actually being in the free and clear. You like mortgages, then you must also like gambling. I have a huge distaste for both. Maybe because math is my specialty as opposed to luck.

Lastly, when you buy with cash, you actually focus on the value of the asset when you negotiate. Not the monthly payment. In my experience this is a much better bargaining position. Seller hate it though, but they also realize that any form of financing these days is very risky and can fall through at a minutes notice. If we were all forced to only deal in cash this country would be in such a better place financially and I would feel so much better about what we are leaving behind to our children. Currently, I feel like I need to apologize to my children for our stupidity.

Owner of the title (legal document showing ownership) owns the home

Exactly--the bank doesn't own the title, you do.

The bank is holding it until you pay off the loan. Then they give it back to you.

I can't tell if you're just trolling or if you really believe that there is no difference...

Lord have mercy... (I'm not even religious).

Hey, can I hold onto your retirement money? I won't own it, I'll just hold it for you. Jesus - I'm done here.

A mortgage is a loan procured by a buyer to pay off the seller of a piece of property in full. The buyer then owes the mortgage lender the total amount borrowed, plus interest and fees. As collateral or guarantee of payment, the lender of the mortgage holds the deed or ownership of said property, until the buyer pays the mortgage off. However, the buyer occupies the property as if it were already his or her own.

above paragraph was from this site

Once upon a time, what you could afford matched the money in hand. That proved to be an insufficient means for growing the amount of money some people wanted. So a system was devised to redefine what you could afford so that people would spend almost all of their lifetime net earnings in an instant by agreeing to occupy a house and pay that money in monthly payments.

So a system was devised to redefine what you could afford so that people would spend

And not to mention every 10 or so years along comes an economic downturn and these 'some people' get to reclaim their rentals.

« First « Previous Comments 103 - 142 of 219 Next » Last » Search these comments

What do you all think? Wait out the Bay Area market a few more years? We have two kids, jobs here and we are renting a 500 square foot home. Should we buy some crap hole under $400,000 in the area, or move to a place where we could have a nice home for $200,000? Should we invest? Please add your reasons why, and any solid data or links you have to help.