patrick.net

An Antidote to Corporate Media

1,188,977 comments by 13,846 users - Morris, Skygoddess, zzyzzx online now

The bill for house-equity lines is coming due

2014 Mar 26, 2:40am 12,693 views 63 comments

Comments 1 - 40 of 63 Next » Last » Search these comments

http://www.marketwatch.com/story/what-to-do-if-your-home-equity-line-is-about-to-end-2014-03-26

NEW YORK (MarketWatch) — If you vaguely remember signing up for a home-equity line some time in George W. Bush’s second term, then brace yourself. That credit line is probably about to shut down — the sort of gut-punch equivalent to getting a credit card revoked — and your monthly payments are about to go up.

If you’re worried that you won’t be able to make the higher payments, then don’t sit idly by. Talk to your bank and see if there’s anything they can do to change the terms of your home-equity line.

“If you have an interest-only, you should be reaching out to your lender right now, saying, ‘I see the train coming down the tracks, what can we do?’†said Keith Gumbinger, vice president of the mortgage-data provider HSH.com ,

So, what can you do? We’ll walk you through some common options.

• First, if you can afford the higher payments when your home-equity line resets, and don’t mind losing access to that line of credit, then just stay put. You should be aware of when your monthly bill will go up, and budget for it ahead of time, but otherwise you don’t need to change anything.

• If you still want access to a home-equity line, then ask the bank if you qualify for a new one. If you do, then you can open a new home-equity line, pay off the old one with the proceeds, and continue tapping the new line when you need extra cash.

• Otherwise, see if the bank will soften the terms of your repayment.

You could also ask the bank to extend the “draw†period on your home-equity line, perhaps giving you another few years before you have to start paying down the principal. Or the bank might be willing to lengthen the amount of time you have to pay back the money you borrowed, which would also cut down on your monthly payments.

The bank might be willing to give you a lower-than-average interest rate. Or it might be willing to wrap your home-equity bill into your first-mortgage bill, which should have a lower rate. The average rate for a 30-year fixed-rate mortgage is about 4.3%, according to Freddie Mac. The average rate for a home-equity line of credit is about 5.1%, according to HSH. Don’t wait too long to ask for a lower interest rate, though: Rates are expected to creep up as the Federal Reserve slowly gets out of the business of propping up the economy.

Christina Rexrode covers banking for MarketWatch. Follow her on Twitter @chris_rexrode.

For borrowers who tapped into their home equity in the heady days before the crisis, odds are good that their bill is about to jump by several hundred dollars a month. Regulators are worried that this will throw the neediest borrowers into default. And banks are concerned about what this means for their bottom line.

The consequences of such home-equity largesse have been percolating, but not yet exploding. That’s because most of these lines let borrowers pay very little — usually interest only — for the first 10 years.

Those years, though, are coming to an end.

The OCC estimates that $171 billion in home equity lines held by the biggest banks will reset from 2014 through the start of 2018, compared to just $28 billion in the previous four years. The reset, or “end of draw,†means borrowers won’t be able to tap those lines any more - basically the equivalent of getting one's credit card canceled - and they’ll have to start paying down the loan rather than just paying the interest.

The ride could crash....

Our nation's finances and capitalist consumer culture is a house of cards. It relies on ever-increasing consumption...financed by make-believe money. It spirals bigger, bigger, bigger...now even global to the poorest regions....which are now considered the markets with the biggest potential. Population growth is encouraged...more consumers! GROWTH is the universal mantra.

Look at the charts for practically any metric....population, air quality, foodstocks, water....and even a fool can see where this is going at geometrically increasing rates. The human desire for more, more, more will be our demise.

"So what do we do when we don't have enough money?"

"Aha, good question. Click on 'Available Balance'. Now click 'Edit'. Click just to the left of the period and add a couple of zeros."

"How many?"

"Uh, how about three. Good. All set for another couple more years."

"Is that it? That's all we have to do?"

"Yeah. We figured this trick out a few years ago."

"Cool."

Fitch Warns Of Housing Bubble, Says "Unsustainable" Jump Leaves Home Prices 17% Overvalued

Looking at investment properties in Arizona and California

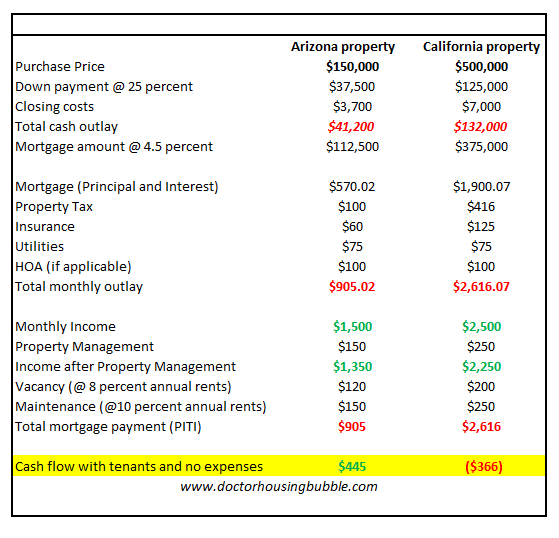

In SoCal $500,000 gets you very little especially in L.A. and Orange Counties. It might get you a nice condo in a sought after market. As an investor, you are looking at cash flow on a variety of fronts. Tax benefits are overplayed in many cases and most long-time investors understand this. In fact, most seasoned investors will tell you to allocate close to 50 percent of your gross rents to costs outside of the regular mortgage payment. Many investors that I know are not your Blackstone’s. They are folks that buy properties with at least 25 percent down and finance the rest through conventional banks or through other lenders. They do put a large amount of skin in the game so the numbers absolutely matter.

So let us take an example of two markets right now with Arizona and California. It is very doable to find a $150,000 property in Arizona that will rent for $1,500 and a $500,000 condo in California will get you close to $2,500. This is very common. For some $500,000 in SoCal seems like a great deal so we’ll run with that. I think people assume that this unlimited investor buying spree is going to continue deep into the future. We are already seeing near record low sales volume even though prices went crazy in 2013.

http://www.doctorhousingbubble.com/investor-exhaustion-with-investment-rental-properties-blackstone/

Sure, some will tell you to close your eyes and simply pick a place and buy since real estate always goes up in certain markets. But for investors, numbers absolutely matter and if Blackstone was optimistic on the future they would be buying up these high priced properties but they are not. I think the above numbers highlight why investors are balking big time. Novice investors will throw out figures like “that $2,500 a month in rent on that $500,000 home is great!†$30,000 in gross rents seems great when you don’t crunch the numbers. They fail to mention that you will fork out $132,000 of cold hard cash and still have a $375,000 mortgage as well. I was very optimistic on the low HOAs above because in some areas in Orange County HOAs of $300 and higher per month are routinely common especially with condos.

You’ll notice that even in Arizona that $150,000 investment property with 25 percent down is going to bring in something like $445 per month assuming no vacancies, maintenance, or other unforeseen costs after your outlays are factored in. Your tax benefits will absolutely depend on your tax bracket but if you are shelling out this kind of money, you are probably already at a very high tax bracket so any rental income you get is going to get taxed nicely. Something tells me Blackstone is not a poor organization.

But look at the figures for California. You are running in the red with a 25 percent down payment here. This also assumes you are fully rented, no monthly expenses, and you don’t need to do any major repairs. People are waiving contingencies on these crap shacks and fail to realize that a roof or slab work will likely eat up a few years of profits. Plumbing work? Flooring? Labor is not cheap in SoCal.

What about appreciation? This is where speculation dives in and this is why a correction is very likely to occur. You pay rents from net monthly income! Investors are 30 percent of the market in SoCal. If they are seeing these crude numbers is it any shock that they are slowly pulling back? So when the year-over-year gains go stale and even negative (which is very likely) do you think they will ramp back up? The current pace makes no sense for investors already. The only reason to purchase would be to flip and this is practically the definition of a mania if we are not seeing underlying incomes increase. It is also why California is largely becoming a part of the new renter nation.

The two party congress will just bail them out. That's the only thing you need to brace yourself for.

http://www.dqnews.com/Articles/2014/News/California/Southern-CA/RRSCA140312.aspx

Interesting tidbits from the dqnews article:

- Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 6.8 percent of the Southland resale market in February.

- Absentee buyers – mostly investors and some second-home purchasers – bought 29.0 percent of the Southland homes sold last month, up slightly from 28.2 percent in January and down from 32.3 percent a year earlier. The monthly average since 2000, when the absentee data begin, is 18.6 percent. Last month’s absentee buyers paid a median $320,000, up 25.5 percent year-over-year.

- In February 6.2 percent of all Southland homes sold on the open market were flipped, meaning they had previously sold in the prior six months. That’s the same flipping rate as the month before and it’s down from a record 7.0 percent a year earlier. (The figures exclude homes resold after being purchased at public foreclosure auctions on the courthouse steps).

- Buyers paying cash last month accounted for 30.9 percent of home sales, up from 29.1 percent the month before and down from a record 36.9 percent in February last year. Since 1988 the monthly average for cash buyers is 16.4 percent of all sales. Cash buyers paid a median $340,000 last month, up 28.3 percent from a year earlier.

-Last month 12.9 percent of Southland home purchase loans were adjustable-rate mortgages (ARMs) – more than double the ARM level of a year earlier. Last month’s figure was down a bit from 13.5 percent in January and up from 5.6 percent in February 2013. The January ARM level was the highest since April 2008, when it was 16.4 percent. Since 2000, a monthly average of about 31 percent of Southland purchase loans have been ARMs.

- Jumbo loans, mortgages above the old conforming limit of $417,000, accounted for 27.2 percent of last month’s Southland purchase lending. That was up from 26.7 percent the prior month and up from 21.1 percent a year earlier. In the months leading up to the credit crunch that struck in August 2007, jumbos accounted for around 40 percent of the home loan market.

http://www.marketwatch.com/story/existing-home-sales-slowest-since-july-2012-2014-03-20

?uuid=49de1b18-b046-11e3-9d47-00212803fad6

?uuid=49de1b18-b046-11e3-9d47-00212803fad6

WASHINGTON (MarketWatch) — Hurt by rising mortgage rates and prices, the sales pace of existing homes continued to slide last month, hitting the slowest rate since July 2012, according to data released Thursday.

Sales of existing homes ticked down 0.4% in February to a seasonally adjusted annual rate of 4.6 million, the National Association of Realtors reported Thursday. Sales rates have trended down since the summer as rising mortgage rates and home prices cut affordability. Constrained inventory and unusually poor weather may have also played a role in weak buying, the trade group said.

Enlarge Image A sale pending sign is seen in front of a home on April 29, 2013 in Miami, Florida.

“It’s possible that adverse winter weather, which continued in the Northeast and Midwest in February, depressed buying traffic in those regions. The broader trend is still one of weak underlying demand, as existing home sales have been declining across the country ever since last summer’s interest rate shock,†said Laura Rosner, an economist at BNP Paribas.

Economists had expected the pace of existing-home sales to decline to 4.58 million in February from a rate of 4.62 million in January.

In addition to dropping affordability, home sales face headwinds from new mortgage rules for would-be buyers and lenders, and stringent lending standards.

The bad weather conditions make it tough to clearly identify recent underlying trends in home sales, as well as other economic ports. But regional data show that February’s pace of existing-home sales rose in the South and West, and dropped in the Northeast and Midwest.

The silver lining to winter’s cloudy weather is that residential projects and purchases delayed during a particularly tough winter could show up in the spring.

“The inclement weather will prove only a temporary constraint on home sales. As the weather returns to seasonal norms, still-favorable affordability, steady job creation and a gradual loosening in credit conditions will see existing home sales pick up again,†Paul Diggle, property economist at Capital Economics, wrote in a research note.

Just this week, two of the country’s largest builders, Lennar LEN -0.49% and KB Home KBH -0.84% , reported jumping revenue for the fiscal first quarter, and one analyst remarked that the all-important spring selling season for the building industry might get off to a “reasonable start.â€

Hope for the housing market

Despite choppy data reports, there’s hope for the housing market in 2014. Some large banks are making it easier to obtain a mortgage , hungry for the revenue lost when refinancing applications plunged last year. Also, pent-up demand remains high, and the pipeline of foreclosures is dropping.

Also, even though rates have climbed, they remain relatively low, and “should serve as a stimulus to people coming back into the housing market,†Federal Reserve Chairwoman Janet Yellen said at a Wednesday press conference. Rates for fixed-rate mortgages, which started rising in 2013 on speculation about the timing of the Fed tapering its bond-buying program, have climbed about one point over the past year, making loans more expensive for borrowers.

Cutting affordability even further, buyers also face rapidly rising prices. The median sales price of used homes hit $189,000 in February, up 9.1% from the year-earlier period, as inventory remained tight, the trade group said. February’s inventory was 2 million existing homes for sale, a 5.2-month supply at the current sales pace. That 5.2-month supply is up from 4.9 months for January — a plus for the market.

“The increased supply of homes for sale could be a positive down the road for activity,†according to a research note from Andrew Grantham at CIBC World Markets.

First-time buyers have had a particularly tough time in this housing market, making up just 28% of existing-home sales last month, compared with a long-term average of 40%.

However, if jobs growth is strong enough, chunks of pent-up demand could be unleashed. With many young would-be buyers stuck living with their parents, the pace of household formation remains slow, and there’s potential for home builders to ramp up construction.

“I do expect housing activity to begin to expand more rapidly,†Yellen said Wednesday in response to a reporter’s question about whether keeping rates low is an effective strategy.

Yellen’s remarks came after Fed officials announced a shift in factors that could prompt a rate hike. After the announcement, shares in major home builders lost ground, with investors concerned about rising rates hurting housing demand. Even before the Fed’s Wednesday announcement, a report this week showed that home builders remain pessimistic this month about sales trends.

Investors, who have been an important chunk of the housing market’s recovery, are shrinking as a share of existing-home sales.

With spiking home prices (one gauge says they rose 13.4% in 2013), it’s harder to get an attractive deal.

“Not only are fewer deals available, but once found, the deals are not as sweet: as supplies of distressed homes contract, the discount has narrowed,†economists at IHS Global Insight wrote in a Thursday research note.

Single-family homes became an institutional asset class with the collapse of the housing bubble. Previously, it was too difficult to acquire a large number of single-family homes at prices that provided attractive returns. Typically, owner-occupants bid up prices far too high, and the increased management costs make returns far less than multi-family projects. Since the housing bust concentrated foreclosures in certain markets, and since prices were so low that cash yields greatly exceeded multi-family, private equity groups plunged into these markets and acquired large portfolios of homes.

http://ochousingnews.com/blog/institutional-home-buying-abruptly-tapers/

Most economists predict home sales and prices will rise in 2014. The consensus retreats to safe predictions with a high probability of success, particularly given the momentum from 2013. I believe the consensus will be wrong, and sales volumes will decline, house prices may rise, but sales volumes in 2014 will be lower than 2013.

Sales volumes will decline from 2013 levels

Though, don't you think they will just bail them out and use the incedious lie that they are helping poor struggling families out?

Our government has done it before.

... NEW YORK (MarketWatch) — The consequences of the financial crisis just keep popping up. Next on the horizon: home-equity lines of credit.

For borrowers who tapped into their home equity in the heady days before the crisis, odds are good that their bill is about to jump by several hundred dollars a month. Regulators are worried that this will throw the neediest borrowers into default. And banks are concerned about what this means for their bottom line.

The banks may be able to manage this if they start addressing the issue now and accommodate HELOC borrowers before they default.

The two party congress will just bail them out. That's the only thing you need to brace yourself for.

http://www.counterpunch.org/2014/03/21/housing-one-chart-says-it-all/?source=Patrick.net

“Blackstone Group LP is slowing its purchases of houses to rent amid soaring prices after a buying binge made it the biggest U.S. single-family home landlord. Blackstone’s acquisition pace has declined 70 percent from its peak last year, when the private equity firm was spending more than $100 million a week on properties, said Jonathan Gray, global head of real estate for the New York-based firm…

“The institutional wave has passed,†Gray, who oversees almost $80 billion in property investments, said in a telephone interview. ‘It’s at a much lower level than it was 12 or 24 months ago.’

Private-equity firms, hedge funds, real estate investment trusts and other institutional investors have spent more than $20 billion to buy as many as 200,000 rental homes in the last two years. They snapped up properties after prices fell as much as 35 percent from the 2006 peak…

American Homes 4 Rent and Colony American Homes, the second- and third-largest single-family landlords, also have been scaling back as bargains dry up…

“We’re going to have to probably slow down a little bit on our acquisition pace until we have a better view or actual certainty of the capital being available,†(Chief Executive Officer David ) Singelyn said.

Colony Financial Inc. (CLNY), a REIT that invests in Colony American Homes, slowed its funding for acquisitions last year to focus on improving operations, CEO Richard Saltzman said in a November conference call…

American Residential Properties Inc. (ARPI), a landlord with 6,000 homes, slowed acquisitions by almost half in its latest quarter ending Dec. 31. It invested $104 million in 633 homes compared with $204 million on 1,251 homes in the previous quarter, the Scottsdale, Arizona-based company said in a statement.†(Blackstone’s Home Buying Binge Ends as Prices Surge, Bloomberg)

They absolutely cannot let housing crash, or even correct. It's political and real-life suicide. Americans gauge their health and happiness on their home values. Keep equity positive and there will be no riots. Let it go negative and the pitchforks and torches will come out.

So stop whining and buy a house... ANY house. You should know by now that resistance is futile.

On the chart the green line shows median incomes and the other metric is the mortgage purchase applications index. I believe it speaks clearly for itself . Hope springs eternal. To be sure , there is yet time for the mortgage purchase applications to make their seasonal rise for the spring selling season. However, the clock is ticking . If we don't see a pick up with in the next 5 weeks, then the 2014 existing home sales numbers will need to be revised a little lower.

So what must be in place for housing to attract more mortgage buying interest with these higher level rates?

It's simple. We Need:

Wage Growth: One of the economic metrics I follow just showed a first level red flag. It's the national saving rate falling and consumer debt being leveraged up again. For me, that is a bad sign in a low wage growth economic cycle.

Better Paying Jobs: The housing market can't have a strong recovery on the backs of service sector jobs going to people 50 and over.

They absolutely cannot let housing crash, or even correct. It's political and real-life suicide. Americans gauge their health and happiness on their home values. Keep equity positive and there will be no riots. Let it go negative and the pitchforks and torches will come out.

So stop whining and buy a house... ANY house. You should know by now that resistance is futile.

Already have 2. Just waiting for the next opportunity. A crash would be another investment opportunity.

http://www.leadingtrader.com/03/alessio-rastani-on-tip-tv-money-is-made-in-a-bear-market/

Looking for the next purchasing opportunity. Been following Alessio Rastani. Learned a lot and makes sense to me... Even in Real estate.

Inventory is pretty crappy right now. There are a lot of homes that appreciated too fast.

Ceffer:

"Detroit is the epicenter of the New American Order: i.e. the Somali-ization and third world-ization of the USA."

-Agree

Your numbers are pretty convincing.

It would be ridiculous for a nation trillions in debt to even consider a bail out, not to mention that it would undermine the values of free enterprise this country prides itself on. ...but of course, that's me having a lapse where my mind thought for a moment that we were not a plutocracy run by criminals and sociopaths.

Of course, your numbers point to the banks gaining if left to honestly correct, so it might happen without government interference.

Our government has done it before

Don't loose your head....

Government interference just pisses me off!

Of course, your numbers point to the banks gaining if left to honestly correct, so it might happen without government interference

They should let the market correct itself... In this case the banks have an opportunity to correct it before it becomes a serious problem.

Win-win.

https://www.youtube.com/watch?v=oNdUF7PP9Ho&feature=player_embedded

People need to learn to live within their means.... Kudos Jim!

not l spending or creating so much debt they cannot afford

MC Hammer learned the hard way.

https://www.youtube.com/watch?v=oNdUF7PP9Ho&feature=player_embedded#t=0

http://abcnews.go.com/Business/wireStory/levis-strauss-eliminate-800-positions-23066305

Levi Strauss & Co. will eliminate about 800 jobs, almost 20 percent of its non-retail and non-manufacturing employees, over the next 12 to 18 months.

Hope that investment pays-off for Levi's.

In fact, most seasoned investors will tell you to allocate close to 50 percent of your gross rents to costs outside of the regular mortgage payment.

Really? What do you mean by "regular mortgage payment"? (only P&I, or does it include T&I also)

Do you have sources to back up this assertion - it seems really high and is counter to my experience.

Also, the zerohedge charts are a bit misleading. The cashflow number is presented as being "with tenants, and no expenses", but 8% vacancy is baked in to the numbers, as well as plenty of expenses, including utilities, property management, HOA and maintenance...

http://www.doctorhousingbubble.com/investor-exhaustion-with-investment-rental-properties-blackstone/swebb says

Do you have sources to back up this assertion - it seems really

high and is counter to my experience.

You're welcome.

You can do your own independent research as well. Just because I do mine, doesn't mean it is intended to change anyone's mind or start a debate.

http://www.cnbc.com/id/101487642

.

Play VideoRobert Shiller: Housing could weaken more

Robert Shiller, Case-Shiller Index co-founder and Yale University professor of economics, breaks down today's key housing data and explains how investors can dictate housing momentum.

http://video.cnbc.com/gallery/?video=3000259649

Despite prices still being up year–over–year, this week's Standard & Poor's/Case-Shiller 20-city home price index showed a dip in January—the third month in a row. This was mainly due to a perfect storm of a brutal winter, low inventory and rising interest rates. Despite the fact that the index dropped just .01 percent for the last 3 months, Yale economics professor and co–founder of the index Robert Shiller did say on this week's "Squawk on the Street" that the market is "gradually slowing...according to the data we have".

Also, this week's U.S. Department of Commerce report showed that new home sales in February were down both 3.3 percent from January and 1.1 percent from a year ago .

Blodget declared that both stocks and bonds are priced to have "the worst-long performance in history," in a Business Insider column published Tuesday. He tells The Daily Ticker's Aaron Task that stocks could go higher -- even double -- from current trading levels but "at some point we're going to revert to long-term means."

"I'm not selling anything," Blodget notes. "I am expecting to"earn only 2% a year for the next 10 years."

ChapulinColorado - 2% is lower than 10-year Treasury and AAPL? Buy these two asset class?

Your Captain Kirk and Cosby jpg.s add much needed humor to the grim topic of our manipulated and sick housing industry. Nice.

Comments 1 - 40 of 63 Next » Last » Search these comments

?uuid=0b439b58-b456-11e3-9a49-00212803fad6ming-due-2014-03-26

http://www.marketwatch.com/story/the-bill-for-home-equity-lines-is-coming-due-2014-03-26

For borrowers who tapped into their home equity in the heady days before the crisis, odds are good that their bill is about to jump by several hundred dollars a month. Regulators are worried that this will throw the neediest borrowers into default. And banks are concerned about what this means for their bottom line.