Comments 1 - 40 of 46 Next » Last » Search these comments

Another horrible article/video that misinforms people on how to do a relatively simple calculation of the value of owning a house.

Long term return on housing is absolutely NOT zero before or after expenses. Capital gains may be zero after adjusting for inflation, but the real returns in housing are the monthly payments--either the difference between market rent and mortgage payment (if occupied) or the rent payment (if landlord).

Just remember this very simple statement--rents rise with inflation, while mortgage payments don't.

The biggest (by far) factor in the rent vs. buy decision is the expected length of ownership. If greater than 10 years, it's almost always better to buy. If less than 5, it's usually better to rent.

Long term return on housing is absolutely NOT zero before or after expenses.

Feel free to provide evidence to back up this statement. Adam backs up his statements with citations displayed on the show.

Here's some other citations regarding the real return rate of housing.

Recent research from Wenli Li and Fang Yang (via Harvard Business Review) shows that the real rate of return on housing from 1975-2009 was actually negative.

For the period 1890-2005, inflation-adjusted home prices rose just 103 percent, or less than 1 percent a year. One can only imagine how many fewer investors would have piled into the residential home market if they were aware of the historical evidence. As Spanish philosopher George Santayana famously remarked: "Those who cannot remember the past are condemned to repeat it."

For the majority of U.S. history – or at least as far back as reliable information goes – housing prices have increased only slightly more than the level of inflation in the economy. Only during the period between 1990 and 2006, known as the Great Moderation, did housing returns rival those of the stock market. The stock market has consistently produced more booms and busts than the housing market, but it has also had better overall returns as well.

Any results derived from comparing the relative performance of stocks and real estate prices depends on the time period examined. Examining the returns from just the 21st century looks very different than returns that include most or all of the 20th century.

Take a different time period: the 38 years between 1975 and 2013. A $100 investment in the average home (as tracked by the Home Price Index from the Federal Housing Finance Agency (FHFA)) in 1975 would have grown to about $500 by 2013. A similar $100 investment in the S&P 500 over that time frame would have grown to approximately $1,600.

The real long-term return on housing: Zero!

If you can find any counter-evidence that shows the long term real return of housing to be higher than even a single percentage point, please show it. All the evidence I've encountered states otherwise.

Feel free to provide evidence to back up this statement. Adam backs up his statements with citations displayed on the show.

I told you why he is wrong and what he ignored. That was the evidence. That he is looking only at capital returns and ignoring where the money is actually made--on the rent/mortgage payment.

All of your citations do the same thing. It's faulty analysis. I'm not sure how to make it more clear.

That he is looking only at capital returns and ignoring where the money is actually made--on the rent/mortgage payment.

OK, so you are implying that rents have been rising faster than inflation (we are talking over a long term period). Show us the data that proved this. To me it makes no sense.

OK, so you are implying that rents have been rising faster than inflation (we are talking over a long term period). Show us the data that proved this. To me it makes no sense.

Nope--that's not what I'm saying at all. I'm saying rents rise with inflation and mortgage payments don't. If you were alive in the late 70s/early 80s, you'd understand this quite well.

I told you why he is wrong and what he ignored. That was the evidence.

No, it's not. It's conjecture. Evidence is data showing that you are correct in your assertion that he is wrong.

All of your citations do the same thing. It's faulty analysis. I'm not sure how to make it more clear.

The citations I have given do take into account rent payments, deduction of mortgage interest, and housing appreciation. Robert Shiller literally wrote the book on this.

It's not that your assertions are unclear. It is that they are unsupported by evidence. One could easily assert that George Washington never existed and all evidence that he did is misinterpreted and faulty. One could argue with absolute certainty that Washington is just a fictional folklore character, but one would be wrong. Evidence, not certainty in your convictions, is what matters.

If I presented a thousand independent lines of evidence all reaching the same conclusion, you could simply dismiss them if you didn't like them, but then your arguments carry no weight. So here's a second chance. Find evidence to support your argument that the return of housing is close or better than the return on stocks. If you could actually find such evidence, I'd gladly change my position. I'm married to no position but the truth.

The citations I have given do take into account rent payments, deduction of mortgage interest, and housing appreciation. Robert Shiller literally wrote the book on this.

No, they actually don't. The cbs article touches on it, but the others ignore it completely.

Calculators like the nytimes or Patrick's show it pretty clearly. Put in a sample rent vs. buy on any house near you with a 20 year horizon, rents and appreciation at inflation and I bet you it will be better to buy.

No, they actually don't. The cbs article touches on it, but the others ignore it completely.

Did you watch the video? Adam shows that the mortgage interest deduction benefits mostly the rich.

The NY Times agrees,

If the mortgage interest deduction is designed to encourage middle-income Americans to buy moderately priced homes, then it wins the award for the most useless and counterproductive tax expenditure. It does not achieve its aim.

The mortgage interest deduction is not used by most taxpayers. Nearly two-thirds of all U.S. households take the standard deduction instead of itemizing their deductions and only a quarter of all taxpayers deduct mortgage interest. It's for good reason: Most middle- and lower-income homeowners take the standard deduction because it usually exceeds the amount of interest they pay on their mortgage loans.

While the mortgage interest deduction is largely useless to ordinary Americans, it is very useful to the more than 70 percent of higher-income taxpayers who are itemizers.

The evidence does show that housing is a lousy investment compared to stocks or even bonds. And what counter-evidence have you provided? You have all of the Internet and can't find anything to show that housing is a better investment than stocks?

Then you make no sense.

What don't you understand? The part about rents rising with inflation? Or the part about mortgages not rising with inflation?

The part about rents rising with inflation? Or the part about mortgages not rising with inflation?

Rents go up with salaries, not necessarily with currency debasement, CPI increases, or cost of living increases (whichever you mean by inflation) because they are based on what the market can and will bear.

Mortgage interest is compound interest with a rate greater than any of the above. Hence the compound interest on mortgage grows faster than any of the meanings of inflation.

So no, you don't make out like a bandit as a debtor even with inflation.

The citations I have given do take into account rent payments, deduction of mortgage interest, and housing appreciation

They don't take out into account the amount you save on rent.

If you are in this forum, probably you think a house is not always the best investment. But this doesn't mean that the math in the video is good.

After you acount for rent and everything else, probably stocks are still better investment than housing in the long term, but also more volatile

Rents go up with salaries, not necessarily with currency debasement, CPI increases, or cost of living increases (whichever you mean by inflation) because they are based on what the market can and will bear.

Mortgage interest is compound interest with a rate greater than any of the above. Hence the compound interest on mortgage grows faster than any of the meanings of inflation.

So no, you don't make out like a bandit as a debtor even with inflation.

I can't believe this is controversial and/or confusing.

Yes, rents go up with salaries so they actually should track higher than inflation. Inflation plus productivity is probably a better gauge, but I was trying to simplify it to illustrate a point.

Mortgage interest rate is higher than inflation, but that is not the proper way to look at the return. If you own, the return is the difference between equivalent rent and your payment (and that difference gets larger and larger over time) or if you are a landlord, the return is the rent you collect. (minus your payment if you have a loan)

I can't believe this is controversial and/or confusing.

Tamajoe, when you find yourself in disagreement with people who are smarter than you, your first assumption should be that you are the confused one. Think harder and you may be able to figure out the fault in your logic. Good luck.

Tamajoe, when you find yourself in disagreement with people who are smarter than you, your first assumption should be that you are the confused one. Think harder and you may be able to figure out the fault in your logic. Good luck.

Funny-if I ever find myself in that situation I will do as you say. There is no fault in my logic in this case, however. The fact that you make a statement like this rather than point out the supposed error is telling.

Hello friends!

I pretty much dropped off of Patrick.net, based on increasing nimrod dominance.

I see this has only gotten worse, had to go back 3 pages to find this post with sane content.

Anyhow, good to see there are still a few old-timers tilting at the windmills.

Til next time.

They don't take out into account the amount you save on rent.

Not true. The analysis of stocks vs real estate takes into account many things including:

- down payments

- mortgage interest

- re-investing dividends and capital gains of stocks

- carrying costs of mutual funds

- maintenance costs of real estate

- taxes and tax deductions

If anything, the case against real estate is understated because you don't get the diversity and resulting lower risk when you buy a single asset, a house.

After you acount for rent and everything else, probably stocks are still better investment than housing in the long term, but also more volatile

A ridiculous statement. A single house purchase is far more volatile then the S&P 500 index.

And not probably, but definitely. With few exceptions people are better off buying stocks for wealth building. Companies produce goods and services. They create wealth. Houses do not. Houses consume wealth.

There are damn good reasons to buy a house when the price is right. Having a place to live that you can greatly customize to your desire is one of those reasons. Building wealth is typically not so.

Yes, rents go up with salaries so they actually should track higher than inflation.

You think that wage inflation is greater than price inflation or currency debasement? Not so.

And that's just comparing to the CPI, which understates both currency debasement and price inflation.

Tamajoe, when you find yourself in disagreement with people who are smarter than you, your first assumption should be that you are the confused one.

The problem isn't that Tamajoe is being outsmarted. It's that he refuses to accept evidence that contradicts his assumptions. This is a problem very common in humans.

www.youtube.com/embed/vKA4w2O61Xo

I'm hoping Tamajoe is wise enough to understand the problem of confirmation bias and adjust his world view.

I pretty much dropped off of Patrick.net, based on increasing nimrod dominance.

I hear you brother. Been tempted to do so a few times myself, but they keep pulling me back.

Most of the old timers have left.

Not true. The analysis of stocks vs real estate takes into account many things including:

- down payments

- mortgage interest

- re-investing dividends and capital gains of stocks

- carrying costs of mutual funds

- maintenance costs of real estate

- taxes and tax deductions

Which analysis is that? None of your previously posted charts or links appear to do so.

And not probably, but definitely. With few exceptions people are better off buying stocks for wealth building. Companies produce goods and services. They create wealth. Houses do not. Houses consume wealth.

Again you are making a false comparison. You continue to simply ignore the facts that don't agree with you.

You think that wage inflation is greater than price inflation or currency debasement? Not so.

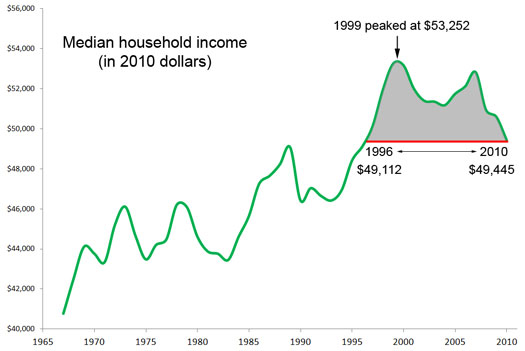

Yes, for the last 7 years you are correct. How about you look over a slightly larger timeframe? Nevermind, I'll do it for you.

That's real income. So, clearly wages have grown faster than inflation when you look at a larger time period.

The problem isn't that Tamajoe is being outsmarted. It's that he refuses to accept evidence that contradicts his assumptions

I'll be happy to accept it as soon as either of you two yahoos present any evidence! It's amusing that fp posts that I'm being outsmarted but conveniently forgets to make any reference to how or why. Sounds awful trollish to me.

Yes, for the last 7 years you are correct. How about you look over a slightly larger timeframe? Nevermind, I'll do it for you.

That's real income. So, clearly wages have grown faster than inflation when you look at a larger time period.

You are cherry picking the time frame. Let's look at the whole picture like you requested.

http://keepthemiddleclassalive.com/where-do-you-stand-is-this-system-fair/

After rising steadily during the three decades following World War II, wages have stagnated since the early 1970s. Between 1947 and 1972, the average hourly wage, adjusted for inflation, rose 76 percent. Since 1972, by contrast, the average hourly wage has risen only 4 percent.

That's 4% total increase over the past 40-years. Sure, before that real wages use to rise, but for two generations it has risen basically by 0.1% per year in real terms. That's the big picture.

I'll be happy to accept it as soon as either of you two yahoos present any evidence

Look, it's obvious you don't want to be convinced and you'll make up any rationalization to avoid that happening. Fine. You go out and buy the most expensive houses you can find in recourse states. According to your beliefs, this is the way to maximize your future wealth. So go put your money where your mouth is. Buy now. I don't care what you've bought in the past. If you think housing is going to rise and is a great investment, put your cash on the line in states where you can't wipe away mortgage debt and start buying to flip in two or three years. Please do this. You'll make a lot of money if you are right, and you are right, right?

I have on problem with you inflicting financial devastation on yourself because of your pride. Just don't sucker other people into it. I offered you wisdom. If you want to ignore it, go right ahead.

You are cherry picking the time frame. Let's look at the whole picture like you requested.

Nope.. Actually the difference is likely that you are using hourly wages and I'm using income (includes salary). My chart was since 1967 which isn't cherry picking at all if you look at your latest chart. (and using 2009 as an endpoint is cherry picking in itself)

That's 4% total increase over the past 40-years. Sure, before that real wages use to rise, but for two generations it has risen basically by 0.1% per year in real terms. That's the big picture.

OK--then why did you make such a big fuss about using inflation as a general rule about future rent increases. According to your data, inflation and wage growth are the same. So, I was right all along. Again.

Look, it's obvious you don't want to be convinced and you'll make up any rationalization to avoid that happening. Fine. You go out and buy the most expensive houses you can find in recourse states. According to your beliefs, this is the way to maximize your future wealth. So go put your money where your mouth is. Buy now. I don't care what you've bought in the past. If you think housing is going to rise and is a great investment, put your cash on the line in states where you can't wipe away mortgage debt and start buying to flip in two or three years. Please do this. You'll make a lot of money if you are right, and you are right, right?

Cop out. Nowhere did I ever state that the best way to become rich was to buy expensive houses. All I did was point out the flaw in your reasoning that owning a house produces zero or negative return. And I showed you why you and your sources are wrong.

Honestly, you are the one who is close-minded and incapable of accepting that in many cases buying a house is the better investment. Not always for sure. But, if the price/rent ratio is good, you plan on staying for many years, etc. then it usually makes financial sense to buy.

To put a finer point on it-here's one of your sources (business insider discussing Harvard Business Review article):

"From Li and Yang:

Assuming an annual depreciation rate of 2.5 percent, a property tax rate of 1.5 percent, a mortgage interest rate of 7 percent, and a marginal income tax rate of 25 percent for a typical taxpayer, the adjusted real rate of return on housing actually falls below zero (1.3-2.5-1.5+0.25(7+1.5))=-0.575 percent! Remember that 1.3 percent is the real rate of return of the national house-price index between 1975 and 2009. Meantime, under the 25 percent marginal income tax rate for a typical taxpayer, the rate of return on stocks during the same period falls only to 4.5*(1-0.25)=3.375 percent."

They've calculated return assuming the house sits empty. Just like all of your sources. Sure, they've included the MID, which is nice. But a house is a money generating asset-to ignore the rents generated as a landlord or equivalent rent as a homeowner is laughable. The analysis is flawed to be kind.

and using 2009 as an endpoint is cherry picking in itself

If you think I was cherry picking, you're delusional.

Actually the difference is likely that you are using hourly wages and I'm using income (includes salary).

There are more part-time workers who want to be full-time workers today then there was in the 1960s. But hey, if you want the income data, here it is. Source data from the U.S. Census Department.

The net median house income growth from 1996 to 2010 was essentially zero. More importantly during the housing bubble 1999-2007 the household income growth was negative. In fact during more of the time period were real estate prices were rising, household incomes were falling.

Here's the Shiller Price Index for that period.

Housing prices were not driven by household income, but rather by rampant speculation and leveraging, and thus are not sustainable. Hence the first housing crash, which is over, and the second housing crash, which is just starting.

OK--then why did you make such a big fuss about using inflation as a general rule about future rent increases. According to your data, inflation and wage growth are the same. So, I was right all along. Again.

Right about what? You central point seems to be -- and if I'm wrong on this it's your fault for not being clear -- that real estate is almost as good if not better a long-term investment as stocks. This is clearly not supported by historical evidence. Your arguments to support this faulty assertion are

1. Ignore evidence to the contrary because it's wrong.

This is not actually the case though. You seem to be misreading everything, so there's no point in trying to further explain the text.

2. Rents and housing prices track wage increases therefore it is always profitable to buy and then rent out to other people and/or buy and flip.

This is clearly not the case and even if it were the conclusion does not follow the premise.

More importantly, the premise is false. In the long run, rents and housing do track income. However, since 1999 housing prices have greatly outpaced income growth and, in fact, have completely ignore income changes as real estate prices rose while income plummetted! The fact that in the long-run housing prices have to track income means that it is mathematically necessary for housing prices to plummet or for incomes to skyrocket, and the later sure as hell isn't going to happen. Everything in our economy is pushing greater income and wealth gaps.

The mathematical and inescapable principle that will cause real estate prices to collapse in order to fall in line with household income is called reversion to the mean. It is perhaps the most important mathematical principle in investing. I strongly recommend that you read Common Sense on Mutual Funds by John Boggle, founder and retired CEO of the Vanguard Group.

3. The savings on rent and the tax deduction for mortgage interest makes leveraging to buy a house lucrative.

This is absolutely wrong. Read Patrick's analysis in the thread 37 Bogus Arguments About Housing. "You don't get rich spending a dollar to save 30 cents!"

Cop out.

It's hardly a cop out to point out the hypocrisy of someone advocating an investment they themselves are unwilling to make. For example, Goldman Sachs recommended that their clients purchase vast amounts of "safe" mortgage back security derivatives while Goldman was aggressively shorting these same assets, that is betting that the assets would catastrophically fail.

All I did was point out the flaw in your reasoning that owning a house produces zero or negative return.

I would never make a statement that is so vague. My point is that in the long-run, the average real appreciation of real estate is zero. That does not mean, in any way, that owing a house never produces a return in the short-term or the long-term. However, the risk:reward ratio is much worse than for stocks which is why anyone who plays the real estate game does so with other people's money and simply default and take the hit to their credit rating if they guess wrong. Heads I win, tails the pension plans of other people lose.

And I showed you why you and your sources are wrong.

In order to demonstrate that my sources are wrong, you must produce counter-evidence. You have not.

Empirical evidence matters. Speculation does not.

But a house is a money generating asset-to ignore the rents generated as a landlord or equivalent rent as a homeowner is laughable.

If you are in a market where rental income is significant enough to make being a landlord more profitable than being a stock owner, then you are in a market where landlords who bought long ago have driven up the real estate costs so much that buying to become a new landlord does not make sense. Landlords will use their existing revenue to buy more real estate and get more revenue. This means that in order to be a success landlord in a place like New York or San Fransisco, you have to get in before it's more profitable than stock buying. The older, bigger players pull up the ladder after them. They also get political connections to maintain their power and crush competition.

But again, if you really think I'm wrong, buy like crazy and start renting them out. Put your money where your mouth is. I'm doing that right now and I'm quite happy with my investment profiles, which are as unsexy and boring as can be: Vanguard index funds.

I follow my own advice which is to buy stocks for the long-term returns and reinvest the dividends and capital gains. More specifically, I recommend passively managed index funds. Even more specifically, I recommend low-cost, low-fee funds of this type. Most specifically, I recommend using Vanguard as they are the largest, most experience, most stable, and least costly company that does this. Their founder literally wrote the book on passively managed index funds and invented the industry back in the 1970s.

I haven't bothered to watch the entire video, but it sounds from the comments like the Robert Schiller argument: In the long run, houses barely go up faster than inflation... as if that is a bad thing???

Seeing all the comments above, "who cares about rent" I really start to see how it was so easy for me to make several million dollars... simply put, my analysis and thinking is better.

Observation #1. Houses, "only go up at the inflation rate..." SO? how much do bonds go up? Today if you but a AAA company 30 year bond, you will get precisely ZERO inflation, and only the monthly interest. Does that make the bond worthless?? No, of course not. Bonds pay an income stream, and the face value never increases, yet the have value. Houses pay an income stream of either rental income, or rent you aren't paying... As a bonus, they increase in value, and you can finance them at rates I wouldn't take as an investor, currently under 4% for 30 years. Would you take that low of a return?

Observation #2. Consider a home that rents for $1500 a month, and 3 possible scenarios:

A. the home costs $450K.

B. the home costs $150K.

C. the home costs $75K.

Today, you can get 4% 30 year fixed quite easily. So the interest component monthly is:

A. $1500

B. $500

C. $250

Assume $50 a month in insurance, $150 a month in tax and $100 a month in maintenance.

and total cost is

A. $1800

B. $800

C. $550

Now, if the argument "homes are a bad investment, because they only go up at the rate of inflation" was legitimate, it would apply to all 3. Of, course it does not. In example C, you are looking at nearly $1000 in income a month.

Example A is not a terribly well priced purchase, but even in that case, with only nominal inflation to rent, the home is a reasonable investment over the longterm.

If you don't understand why C. is a stellar investment, you are too stupid to handle your own money. If you don't understand how B. is also very damn good, ditto.

A. could go either way, and would depend on your longterm plans, stability of your job, desire to live in the same house for a decade etc.

And before smartasses start talking about what they don't know:

I own 16 homes. I collect $22,000+ in rent, and my mortgages are $10,500 a month. I could still raise several of my rents, the local market has been going up and I haven't always kept up. I did all of this, with $400K I had from seeing the bubble coming, and selling 3 investment homes before the crash. If I sold out, I would walk out with over $2.5 million today. Every month, my mortgage debt drops by $2500, which is a hidden plus, I don't even really think about much.

So, saying "housing is a bad investment" is just moronic. Saying rent doesn't count, or inflation doesn't favor an owner is utterly stupid.

In the long run, houses barely go up faster than inflation... as if that is a bad thing???

It's not. It's actually a very good thing. If houses outpaced income increases or currency debasement, then the younger generations would never be able to buy and houses would simply become the property of an increasingly small percentage of the population.

if the argument "homes are a bad investment, because they only go up at the rate of inflation" was legitimate

That's not the argument. The arguments are

1. Stocks outperform housing consistently in the long run, and they outperform by a typical 7% real rate.

2. Houses historically are about break-even investments. Owning your house has a lot of nice advantages, but return on investment is not typically one of them. So buy to live not to fund your retirement. There are far better mechanisms for that.

3. Housing right now is a terrible buy. It's way overprice and due for a painful correction. This is because of the principle of reversion to the mean.

4. Buying one or two houses or condos is a terribly greater risk then buying stocks and bonds because you aren't diversify. All your eggs are in one or two baskets. This is a foolish investment strategy.

I will make two additional arguments.

5. Houses have huge carrying costs and transactions costs. The carrying costs and transaction costs of stocks and bonds are close to zero.

6. Real estate appreciation depends heavily on increasing population and fixed supply of land. America's population doubled in the 20th century. It is currently flat-lining and many experts believe it may decline as immigration slows due to the rest of the world becoming more developed and the fertility rate continuing to plummet. A population crash would not be unprecedented. Japan is experiencing one right now.

So, saying "housing is a bad investment" is just moronic.

Correction. Saying "housing is always a bad investment" is just moronic. Saying "housing is never a bad investment" is even more moronic. Saying that "housing is a bad investment right now almost everywhere in the United States" is a judgement well-supported by evidence.

Saying rent doesn't count, or inflation doesn't favor an owner is utterly stupid.

Which is why no one has said anything remotely like that.

Done right, there is NO INVESTMENT as good as real estate.

Time stocks right and you'll do far better with far less cost in time.

Ok, dan, then no doubt from 2010 till today, you've increased your investments 500%???

did you retire because you'll never need to work again? I did!!

Ok, dan, then no doubt from 2010 till today, you've increased your investments 500%???

did you retire because you'll never need to work again? I did!!

Yeah, stupid people get lucky too. But despite this, being stupid is very unlucky, because it is hereditary.

Yeah, stupid people get lucky too.

So, predicting the housing bubble, selling my homes, getting out, buying like crazy a the bottom and making millions is stupid in your world?

Well, I'm sure someone smart like you has done much better than a spanish speaking immigrant like me, who grew up in a single mother home, while she worked as a janitor, no doubt you've done much better!

did you retire because you'll never need to work again? I did!!

And yet you choose to spend your time on PatNet like all of the opulent rich. Hey you said it on the Internet, therefore it must be true, just like that guy with the 147-inch dick.

Those who chase get-rich-quick schemes usually end up poor. Steady solid returns may not be sexy, but they work.

Right about what?

You have a hard time following the discussion? Here, I'll refresh you about my original statement that you seemed to take umbrage with:

Rents go up with salaries, not necessarily with currency debasement, CPI increases, or cost of living increases (whichever you mean by inflation) because they are based on what the market can and will bear.

I just showed you that approximating rents with inflation is a good 1st approximation--if anything, it understates rent increases.

You central point seems to be -- and if I'm wrong on this it's your fault for not being clear -- that real estate is almost as good if not better a long-term investment as stocks. This is clearly not supported by historical evidence.

No--that is not at all what I'm saying, and it's absolutely your fault for not paying attention to the discussion. Let me state it again, and I'll try not to use big words this time.

1. Your initial thesis was that housing returns are zero or negative. That is what you said on you OP directly below the video.

2. I posted that you are wrong (and houses most definitely have a positive return), and I included a detailed explanation for why the video and links you posted are incorrect showing that they ignored a very important part of return from housing.

OK--hopefully you now understand my very simple point. I've never said anything about stocks or whether housing is a better investment--it's not a very good comparison really because stocks are a passive investment while housing requires work.

1. Ignore evidence to the contrary because it's wrong.

Not sure why you keep saying this. I'm not ignoring anything. On the contrary, I've posted multiple time showing exactly why your "evidence" is incorrect.

2. Rents and housing prices track wage increases therefore it is always profitable to buy and then rent out to other people and/or buy and flip.

This is clearly not the case and even if it were the conclusion does not follow the premise.

More importantly, the premise is false. In the long run, rents and housing do track income. However, since 1999 housing prices have greatly outpaced income growth and, in fact, have completely ignore income changes as real estate prices rose while income plummetted! The fact that in the long-run housing prices have to track income means that it is mathematically necessary for housing prices to plummet or for incomes to skyrocket, and the later sure as hell isn't going to happen. Everything in our economy is pushing greater income and wealth gaps.

The mathematical and inescapable principle that will cause real estate prices to collapse in order to fall in line with household income is called

You make an assumption in there that you probably don't even realize. You assume that housing prices in 1999, households were spending as much as they could in rent/mortgage and it was impossible for them to cut back in other areas and pay a higher percentage on housing. We can argue whether that is the case (look at the percentage of income that is spent on housing in other countries), but it doesn't matter. Your tendency to state in absolutes is usually wrong and is certainly so in this case.

The savings on rent and the tax deduction for mortgage interest makes leveraging to buy a house lucrative.

This is absolutely wrong. Read Patrick's analysis in the thread 37 Bogus Arguments About Housing. "You don't get rich spending a dollar to save 30 cents!"

I've never said anything about the MID. I'm assuming you are trying to make a strawman argument here. My point is, and always has been, that your sources ignored the fact that a house is a money generating asset. They all run their analyses as if the house was sitting empty for the entire time.

All I did was point out the flaw in your reasoning that owning a house produces zero or negative return.

I would never make a statement that is so vague

Really? Here's your statement directly under the video:

"Long-term return on housing before expenses: zero. Long-term return after expenses: negative." Sure seems like you said it.

In order to demonstrate that my sources are wrong, you must produce counter-evidence. You have not.

Empirical evidence matters. Speculation does not.

It's not speculation. It's explaining a factual error in the calculation.

If you are in a market where rental income is significant enough to make being a landlord more profitable than being a stock owner

I have never compared housing to stocks because, as I said, it's apples and oranges. One is a passive investment, one is not.

I'm not trying to tell you or anyone how to invest. I tend to be a passive investor that believes in market efficiency theory so I just buy Vanguard index funds or similar. My only point was to show you that the "evidence" you posted is flawed and makes a very poor assumption (that houses sit empty).

At this point TamponJoe is just contradicting and flinging poo. All that there is to be said had been said. Those who think Joe's right, go out and buy overpriced houses now. There are a multitude on the market. Those that think I'm right, invest slow and steadily in the stock market using low-cost index funds.

Just remember, Joe isn't buying houses right now. Hey Joe, if you really think you're right, I'll hook you up with one of those houses for a mere 1% commission. That's way lower than what real estate agents charge. Better yet, the commission will be paid by the seller, so it won't cost you anything. All you have to do is buy.

Those who chase get-rich-quick schemes usually end up poor. Steady solid returns may not be sexy, but they work.

steady solid returns is what buying real estate that is well priced relative to rent gives you.

Rents increase over time, mortgages mostly stay the same, and what starts as a good investment turns into a fantastic one.

And yet you choose to spend your time on PatNet like all of the opulent rich. Hey you said it on the Internet, therefore it must be true, just like that guy with the 147-inch dick.

your here too, it amuses me.

So anyone who has done fantastically well with housing as an investment is either "lucky" as you said above, or a "liar" in your world? are you always this pathetic a human being, to avoid admitting you are completely wrong?

At this point TamponJoe is just contradicting and flinging poo. All that there is to be said had been said. Those who think Joe's right, go out and buy overpriced houses now. There are a multitude on the market. Those that think I'm right, invest slow and steadily in the stock market using low-cost index funds.

Just remember, Joe isn't buying houses right now. Hey Joe, if you really think you're right, I'll hook you up with one of those houses for a mere 1% commission. That's way lower than what real estate agents charge. Better yet, the commission will be paid by the seller, so it won't cost you anything. All you have to do is buy.

lol--all you're doing now is creating more strawman arguments. I am right but it has nothing to do with me buying houses. My point continues to be only that houses do NOT have a zero or negative return. It's mind boggling to me that you persist in arguing this point.

You are a very stubborn person Dan. Is it really that hard to admit when you're wrong?

I assume you'll go the way of FP and just stop posting now--I'm still waiting for him to point out "the fault in my logic". I'm guessing that I'll be waiting a long time.

Those who think Joe's right, go out and buy overpriced houses now. T

overpriced based on what? I'm moving to las vegas, where I can buy homes for $180K that rent for $1300+... tax in Nevada is real low, about $1100 a year, insurance about $500 a year.

SHOW ME any analysis that shows that type of home is overpriced!!! I get payments of $900 verus rent of $1300... Not homeruns like right after the crash, but still good investments.

Inflation increases the rent, but not much of the mortgage, so it just gets better over time.

Why is this so hard for you to understand?

Those that think I'm right, invest slow and steadily in the stock market using low-cost index funds.

And, fyi, I'm the one who said in my previous post that I invest slowly and steadily in the stock market using low cost index funds. Why do you create a false choice? Your posts are a diarrhea of bad logic. It's obviously possible for housing to produce a nice positive return AND for stocks to also produce a nice positive return. One is a passive investment while one is an active investment. Depending on ones preferences (free time, risk tolerance, skills), they can choose which makes more sense for them.

So, predicting the housing bubble, selling my homes, getting out, buying like crazy a the bottom and making millions is stupid in your world?

I go with the evidence. Your comments are stupid.

Your comments are stupid translation equals I'm too dumb to understand your math.

You are trying to "math not understand" insult me?? Bwahahaha.

Comments 1 - 40 of 46 Next » Last » Search these comments

www.youtube.com/embed/j02zRb0B42s

Long-term return on housing before expenses: zero. Long-term return after expenses: negative.

Stocks, not housing, if you want to be wealthy.

#housing