patrick.net

An Antidote to Corporate Media

1,290,611 comments by 15,416 users - AD, AmericanKulak, Blue online now

« First « Previous Comments 78 - 117 of 219 Next » Last » Search these comments

1 or 2 million in retirement plus massive inflation or huge economic upheaval and still renting as an old person sounds like a bad plan.

A lot of money in retirement AND a stable place to live (paid off house) is the best plan, obviously.

I, for one, do not want to be renting when I am 75 or 80 years old.

Oh- but you will. We all will because in the end we all wind up in a retirement home, paying "rent" to the company that owns it.

But putting that aside, we're going to buy and do so probably in the next year or so. We're just doing the opposite of what most people do: we're taking care of our retirement investments first.

(paid off house) is the best plan, obviously.

Obviously? Really? REALLY?

Hows that working out for millions of elderly bailing out of their oversized, depreciating houses and going to live with kids because they can't take care of themselves anymore?

Well, personal testimony, FWIW

I watched my elderly father bounce around from sublet to sublet after losing his Manhattan apartment when it went co-op. Not fun when your health is failing. He ended up dying in a nursing home, which I guess would have happened whether he was a renter or a home owner, but I do think that in old age that kind of instability (moving every year) can't be fun.

My mother, on the other hand, owns her place outright now, and even though her pension is small and her retirement fairly meager, she loves her home and has a sense of "place" and safety that she would not have if she were a 76 year old renter.

Ultimately, some people are happier nesting than others, and owning a home is not purely a financial decision.

I have a good friend who is by nature a wanderer. She has lived in 5 different RVs and twice as many places in the last 10 years. I wouldn't want to live like that, but she's happy.

Some of us want to have kids and dogs and cats and plant trees and fix a place up so we can make it ours. Some don't.

Some of us want to have kids and dogs and cats and plant trees and fix a place up so we can make it ours. Some don't.

But again- those are sort of generalizing. We don't have kids but we have done everything else on that list. We landscaped our yard, have a garage to work on things, and generally take care of the house. We also have pets. As mentioned, we've been there for 9 years. Who's to say you couldn't raise kids and have dogs and cats if you rent? A LOT of people do exactly that.

I could also make a generalized claim that people who buy move around a lot also because I've seen it. They bounce from not only house to house, but often times from city to city or even state to state, packing up a huge amount of possessions each time.

Basically, the assertion that buying a home means you are suddenly in a more stable and more permanent situation isn't anymore accurate than making the claim that all renters do is move and move and bounce from one place to another all the time.

Basically, the assertion that buying a home means you are suddenly in a more stable and more permanent situation isn't anymore accurate than making the claim that all renters do is move and move and bounce from one place to another all the time.

I think we are both right in this case, honestly.

I also think it would be dumb for anyone to buy right now if they think they are going to make a pile of money or if they don't plan on staying where they are for at least 8-10 years.

We have rented the same place for 13 years. But the landlady is getting old and since she retired she has nothing else to do than bug us. Made us clean our garage and cut down a tree (a tree that she gushed over 5 years ago, go figure). Raised our rent $300 month (SFH are not rent-controlled here). And I hate the electric stove but even if I pay for a new gas one and the hook-up she still says no.

I have yet to meet a landlord that isn't imperious. Even the nice ones.

My wife and I started feeling the pressure to buy lately. We still think San Diego is overpriced, but it's coming down and with interest rates we can get into some decent homes now for an affordable mortgage. We were worried that interest rates might go up before (or faster than) house prices declined.

But then Bernanke promised low interest rates til late 2014. We have no doubts now, we're waiting.

It is suggested that one needs to have 1 million dollars worth of retirement savings by the time you retire. 2 million if you live in an expensive metro ( like the Bay Area).

1 or 2 million in retirement plus massive inflation or huge economic upheaval and still renting as an old person sounds like a bad plan.

A lot of money in retirement AND a stable place to live (paid off house) is the best plan, obviously.

I, for one, do not want to be renting when I am 75 or 80 years old.

You always rent unless you live under a bridge. The question is just what you are renting.

1) house

2) money from a bank to pay off house

3) your own investment money to pay off a house

People think owning a home means you are free and clear. Owning a home means less mobility, more maintenance, loss investment growth, etc. A house is not an investment. It is a functional asset that keeps our body protected from the outside elements. You own it just as much as you own the water that flows in your toilet. We are renting everything, don't be fooled.

My wife and I started feeling the pressure to buy lately. We still think San Diego is overpriced, but it's coming down and with interest rates we can get into some decent homes now for an affordable mortgage. We were worried that interest rates might go up before (or faster than) house prices declined.

But then Bernanke promised low interest rates til late 2014. We have no doubts now, we're waiting.

affordable mortgage is an oxymoron. If you mean the monthly looks good, then that is fine. But look around at the house and think about how many hours of work it will require before you are able to pay back the bank. That is anything but affordable to me. Interest rates are a scam.

May I ask what you are fishing for? You registered on this site yesterday, and four of you live in a 500 square foot house?

I too started thinking of buying a house here, but only in the last year or so. Mainly only because in our area I started seeing some houses with prices that were not insanely expensive. As in 350-400k. These had been 600k+ during the boom. That said, I fully realize they seem cheap only because I am comparing them to bubble pricing. I don't really feel any pressure to buy because our rent situation is fairly comfortable and gives us basically the same thing as buying a house since it is a house we're renting. I'd wager to bet that prices will probably not boom anytime soon. The new reality will probably be somewhere in the middle with prices more closely tied to actual real economics and not the unrealistic scenarios during the boom.

My mother, on the other hand, owns her place outright now, and even though her pension is small and her retirement fairly meager, she loves her home and has a sense of "place" and safety that she would not have if she were a 76 year old renter.

Buying actually made sense when your Mother purchased. It just doesn't make sense now that we are going through a cleansing process. Will it make sense again? Yup. When? Who the hell knows. My best guess is 3 years from now. I was wrong over 10 times today already, though, if you ask my wife. ;)

My oldest is five and my baby just turned one. My business is totally client and word of mouth based - I teach children and adults to dance. It's not a lucrative business, in the slightest, but because of my solid reputation I do alright. It was a lot of work to get to this point in my career. The other thing holding us here is our family lives in the Bay Area. You are all right, I don't like this area, but I established myself here. I went to school on scholarship here in the Bay Area and started working very young. We are invested, we do have a retirement, but we have always wanted a home, one where we could do as we please, in a quiet neighborhood. We don't want a home to flip, we want a home to plant fruit trees, a place where memories are made. Thank you for all your good advice and honest opinions. After further study of the market we are sure that the Bay Area will come down like everything else, not as low, but back to what it was: a little higher than everything else. We didn't put the offer in, and we plan to let our stocks mature and wait out the market until things settle. I can't say how much a appreciate all of you jumping in with your knowledge and time to help me work this out. As you can see, I had good reasons to do both choices. I just needed to chew on it a little more. I feel good about our choice to wait. We live in a 500 square foot house, for very little rent so we can save, but it has room to run and garden, and is close to our family and our work. For now that is enough. Thank you everyone. (:

We live in a 500 square foot house, for very little rent so we can save, but it has room to run

In my opinion, you are just the type of person the financial sharks would like to exploit. I live in Los Angeles and prices are still dropping here. Hope you found valuable information from your post

David9 - I wasn't fishing for anything, just wanted advice. I had good reasons to stay, and good reasons to bid. I didn't want to regret not bidding and I didn't want to regret the house. I posted the day we were set to bid. I wanted advice from people who were not emotionally invested in me, and not financially invested in me. I wanted a dialogue I could chew on, nothing more. The house is pending. I don't know the bid that won, and for now I'm okay with that. I'm glad I didn't jump in. I just needed to clear my head a little.

hrjhuliet, not my blog, just follow it, this blog has helped me with making good real estate decisions. Sometimes Realtors post here, that's what I was fishing for. ;-)

You always rent unless you live under a bridge. The question is just what you are renting.

1) house

2) money from a bank to pay off house

3) your own investment money to pay off a house

People think owning a home means you are free and clear. Owning a home means less mobility, more maintenance, loss investment growth, etc. A house is not an investment. It is a functional asset that keeps our body protected from the outside elements. You own it just as much as you own the water that flows in your toilet. We are renting everything, don't be fooled.

Ding Ding Ding. We have a winner! Vanna, tell him what he's won...

Vanna: you win 24/7 access to Benjamin Bernanke. Call him anytime you need some money. Fuck up your finances? No problem. Uncle Ben is there to bail you out.

APOCALYPSEFUCK is Tony Manero says

Plant potatoes and teach the family hand to hand combat skills.

Actully I did that, HAGANAH!

Who sets prices ? (supply & demand

Not for housing unfortunately

Especially for housing.

BUYERS MAKE VALUE ! No one else.

Fat people are still eating too much and home buyers are still paying too much. LOTS of denial out there.

If you had the most magnificent palace in all de land. But there were NO buyers. What is de value ? That's right, NADA F-ckin thing.

If you are selling a quanset hut , and there are 20 people in line wanting to buy and 19 people are offering $500k and the 20th guy offers you $600K. What is the value ?

Gubmint is trying to buffalo the masses because that is what we want them to do. We want gubmint to prove to us that "all is well". They will generate false hope only to be reelected or til the money runs out.

Inflation is coiled like a snake and about to spring forth, crushing everything gubmint has been offering. We will look back and see tarp, & hemp & harp in their true colors. B.S.BROWN.

What we need to do is boycott real estate for one year, That should finish off the banks and send most realtors back to school.

Especially for housing.

BUYERS MAKE VALUE ! No one else.

Think about it like this. If people were forced to use real money (not the future money they hope to make) to pay for a house, then you have a supply/demand market. When there is a free money train that comes through town and writes note for basically free money that people can use to buy homes, then the market gets distorted.

People are not really weighing the amount their paying against the value in the asset they are getting. Not their fault, they are victims in this ponzi scheme as well. Like every ponzi scheme though, you either run out of friends or run out of money. We have already run out of money, we just are in denial.

You watch this a minute and then predict how this will end. Hint: in a world of hurt for Americans. (of which I am one)

HEY TAZ,

That clock reminds me of a friends advise for watching a train wreck in progress. Wait til it's over and pick up the pieces. I hate that advise. That is like saying "let the drug addict (gubmint) hit bottom" while they are destroying our economy.

People are not really weighing the amount their paying against the value in the asset they are getting. Not their fault, they are victims in this ponzi scheme as well

Do you mean ? Take a bare piece of land add $65 to $100 per square foot for building costs and you have the actual value ? If Bill Gates & Gary Coleman both bid on that property, who ya gonna call ?

Not a ponzi scheme so much as a marketing scheme. DeBeers forces competition & high pricing by distorting supply. OIL is valued according to our addiction. If you can't pay $7 bucks a gallon, step aside till the more affluent makes up the margin. Land developers realized they overbuilt and won't build today.

Our mentality is manipulated by all types of sales people. In real estate,

At the mere suggestion to a sales rep that you would like to buy a home, the FIRST question is "WHAT IS THE MAXIMUM YOU CAN AFFORD TO PAY"? The second question is "how much MORE can be SQUEEZED out of you. Buyers are pussies. They should be telling the sellers what it is worth, NOT the other way around ! BUYERS have fluidity and inventory on their side.

The insane justification for buying homes from the mid 70s till the bubble popped was, "pay anything, it will be worth 20% more next year". There are still buyers anticipating a "RECOVERY". That is just more marketing.... Negotiating tomorrows prices should include yesterdays insanity. Prices will crash till demand (jobs) increase.

Gubmint has spent trillions using the word "RECOVERY". While sacrificing the old (zero interest rates) and the young (your grandchildren will probably not enjoy appreciation or pensions). Mayan cultures performed similar rituals during droughts. They sacrificed the Old & the Young because they could not fight back.

You always rent unless you live under a bridge. The question is just what you are renting.

I can't believe how many smart people perpepuate this nonsense. Renting and owning are different.

Yes, when you own with a mortgage, you owe the bank payments on your loan. The bank, however, doesn't own the home. You do. You have put up the house as collateral on the loan.

Yes, when you own, you have to pay property taxes. The locality doesn't own the property, however. You do.

There are valid reasons to rent, but being afraid of debt slavery shouldn't be one of them.

Two guys I know asked me to lend them money to pay off their mortgages. They heard that interest rates are low. So, they both said to me: "Led me $150K, I would pay you much higher interest than you are making today."

I said "I'll pass. Thank you for your interest in helping me find higher interest on my capital."

Everyone who thought they were "rich" buying a property now see it as an expensive albatross unless they work for the government, are doctor/lawyer, etc.

Your results may vary.

hrhjuliet : I know you've got the info you needed - personally I think you made the right decision - for now.

It's interesting to see someone hash out their thinking and personal situation in a public forum - to see how their thought processes work.

Personally, we are in a somewhat similar situation - we have money saved, are looking for a house, two kids etc. However, I personally would be scared spitless to have money in the markets right now (any markets). They are all a disaster just waiting to happen IMO - things like high frequency trading (HFT), MF Global and the like would make it impossible for me to sleep at night. A 100+ percent gain in 2+ years is NOT healthy functioning marketplace. But it's your money to lose. I sleep very well with all our money in cash, spread in several credit unions in non-money market funds. It's the safest and most liquid thing I can think of - return OF capital versus return ON capital. And you're talking to guy who has done a lot of high risk trading in the past - the kind where you lose 400k in 45 minutes LOL

No more. The stakes right now are too high.

The BA is a very odd place in that, as long as there is some tech presence there prices will always be skewed upwards. For someone like you, with your business you really have very little freedom to live elsewhere.

For my family, we are going the route discussed above - saving our money to buy a house outright in a decent weather area (very very important to me) and going into semi-retirement. That's a big lifestyle change, but I'm not willing to spend 20 to 40 years sitting in a cube, dreaming of being elsewhere.

It's my considered opinion that we as a society have been balanced on the edge of a cliff for years now, just waiting for a push into the abyss economically. Even when that happens, it almost certainly won't be an overnight thing. But when it does happen, those who are going to be hurt the least (and that is the best you can hope for at this point - to minimize the pain) are going to be those who have invested the least (emotionally and financially) in the religious belief called 'faith in the system / status quo'.

IMO Things are going to change (for the worse) in the next 5 to 10 years more than you could ever believe and a person's best efforts right now should be oriented towards mitigating the damage. Buying a house in one of the last true bubble RE markets in the USA is probably not the best way to accomplish that.

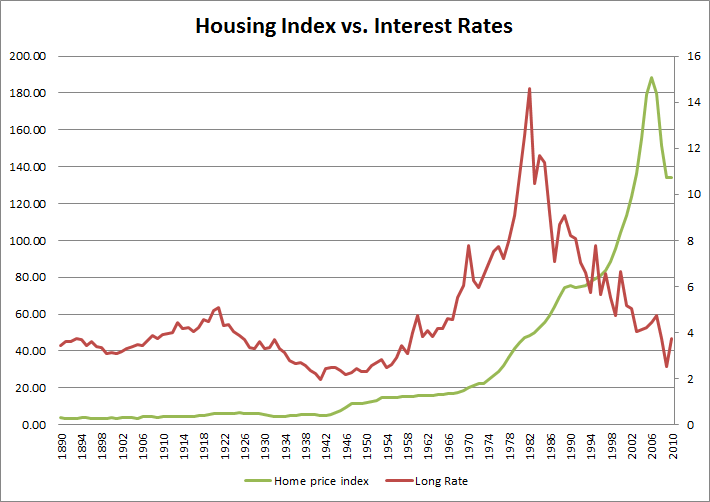

I say don't buy yet b/c prices are still dropping. Interest rates are artificially low which is propping up the housing market. It's much better to buy when interest rates are higher and housing prices are lower - esp in CA. If you buy when prices are lower you are locked in to lower property taxes and lower level of indebtedness. Eventually interest rates will revert to historical mean and housing will take another hit. Of course it also depends on your circumstances. 500 sq ft is pretty tight for a family of four. If you don't plan on moving for at least 10 years and can ignore the headlines when the value of your house drops then maybe you should buy. It would be a bummer to buy with a 3% loan and have the value of the property go down 20% when interest rates go up to 6% or higher - it doesn't matter unless you want to sell but still, it's a bummer.

I didn't want to regret not bidding and I didn't want to regret

hrhjuliet saysI'm afraid of regrets, but I'm also afraid of making the wrong choic

but don't want to rush in if this is a bad time.

Not to mention I would be afraid

It sounds like you need to confront then resolve your fear factors first. People who are important in your life are not going to hold you accountable if your decision turned out not to be the Most Excellent Choice. Only time would tell on that one. And if people do hold it against you, then by definition they are not persons who are important to you, even if you think that they are.

Imagine if young Americans on the beaches of Normandy, or the victims on United flight 93, or Caption Sullenbreger were motivated by fear of regret or fear of not timing things perfectly.

It's much better to buy when interest rates are higher and housing prices are lower - esp in CA

Unfortunately, history shows that doesn't happen.

tatupu - what do you think will happen when interest rates inevitably go up to 5 - 6 - 7% or higher? I'll tell you - affordability goes down and so does the price of housing. The artificially low interest rates fueled the bubble and continue keep prices inflated. The best time to buy is when rates are high, prices are low and the market is dead. It's happened more than once in my lifetime (I'm in my early 50s) and I believe it will happen again. There is also the advantage of locking in a low property tax rate, which in CA can last a lifetime.

russell,

If you say so.

But Hipsters and wealthy immigrants will tell you no

It's different this time.

It's different here.

Purchase Price in PARAMOUNT!!!

Interest rate is not that important. I also have experience in previous cycle and market indeed will come to dead zone very soon. Recently we have very low inventory due to the following facts:

1. Houses for sale are mostly represented by short sales and foreclosure with extremely low number of regular sales. Apparently many should be regular sellers hold they breath, thinking we are in the bottom and rebound is just other the corner. That will not happen unfortunately, so seller will have no choice and list house on market to various reasons: kid’s outgrown, new kinds, divorces, job transfers, to name a few.

2. Facebook and other IPO’s is just another propaganda spread by realtors to create fear (yes, our nation is so good with it)

3. Low interest rate create another fear (can go only up!). Didn’t happen in Japan.

4. OMG multiple offers! Look bellow (Santa Clara county), yes we have multiple offers but not above asking price. January statistics: Sale vs. List Price - 99.0%!

Indeed, every cycle is different, but has same stages. If you found great deal – go for it. If not, don’t PANIC. Real Estate does not behave like stock market.

Trends At a Glance Jan 2012 Previous Month Year-over Year

Median Price $485,000 $532,000 (-8.8%) $524,000 (-7.4%)

Average Price $642,128 $716,061 (-10.3%) $649,476 (-1.1%)

No. of Sales 649 899 (-27.8%) 682 (-4.8%)

Pending Properties 1,678 1,528 (+9.8%) 1,329 (+26.3%)

Active 1,466 1,386 (+5.8%) 1,757 (-16.6%)

Sale vs. List Price 99.0% 98.7% (+0.3%) 98.9% (+0.1%)

Days on Market 66 63 (+4.7%) 67 (-1.0%)

tatupu - what do you think will happen when interest rates inevitably go up to 5 - 6 - 7% or higher? I'll tell you - affordability goes down and so does the price of housing. The artificially low interest rates fueled the bubble and continue keep prices inflated. The best time to buy is when rates are high, prices are low and the market is dead. It's happened more than once in my lifetime (I'm in my early 50s) and I believe it will happen again. There is also the advantage of locking in a low property tax rate, which in CA can last a lifetime.

The only problem with that is that it isn't supported by the facts. Look at historical housing data - house prices very often continue to rise even as interest rates go up. You are waiting for something that may very well never happen.

tatupu - what do you think will happen when interest rates inevitably go up to 5 - 6 - 7% or higher? I'll tell you - affordability goes down and so does the price of housing. The artificially low interest rates fueled the bubble and continue keep prices inflated. The best time to buy is when rates are high, prices are low and the market is dead. It's happened more than once in my lifetime (I'm in my early 50s) and I believe it will happen again. There is also the advantage of locking in a low property tax rate, which in CA can last a lifetime.

The only problem with that is that it isn't supported by the facts. Look at historical housing data - house prices very often continue to rise even as interest rates go up. You are waiting for something that may very well never happen.

Please reference the data you are referring to here. I would love to be enlightened here.

It's much better to buy when interest rates are higher and housing prices are lower - esp in CA

Unfortunately, history shows that doesn't happen.

Can you reference the history of the relationship between real house prices and interest rates? It would be helpful.

Yes, when you own with a mortgage, you owe the bank payments on your loan. The bank, however, doesn't own the home. You do. You have put up the house as collateral on the loan.

Please tell the jury who holds the title to the home during this process. "uh uh uh, The banks holds the title but but but...."

So, if the current person living in the house decided to not make the agreed upon payments then does the bank have any ownership rights to the house? "Um yah, but but you are being misleading here, house prices always rise, history shows that, so there is no worry about a mortgage holder missing payments".

Uh um, please answer the question. It is a Yes or No. "well um uh I guess if you had to say the answer and it really". Please please just answer the question for the jury. "I guess it would be yes then".

So, the person living in the house really only has an obligation to use the house while the bank is owning the title. If that fore mentioned person completes the required payments on time like outlined in the mortgage agreement then they will receive title and be the new owners. Would that be a fair assessment? "Um uh um uh, Look a Puppy!" as tatupu runs out of the court room never to be seen as a real estate expert again.

Executive summary: Bank owns the house. You rent money or a house. If you think otherwise then you don't understand the real estate ponzi scheme disease that is killing this country and you must really be confused each year we drop further and further into the abyss. Real estate is dead. Deal with it.

I say don't buy yet b/c prices are still dropping. Interest rates are artificially low which is propping up the housing market. It's much better to buy when interest rates are higher and housing prices are lower - esp in CA. If you buy when prices are lower you are locked in to lower property taxes and lower level of indebtedness. Eventually interest rates will revert to historical mean and housing will take another hit. Of course it also depends on your circumstances. 500 sq ft is pretty tight for a family of four. If you don't plan on moving for at least 10 years and can ignore the headlines when the value of your house drops then maybe you should buy. It would be a bummer to buy with a 3% loan and have the value of the property go down 20% when interest rates go up to 6% or higher - it doesn't matter unless you want to sell but still, it's a bummer.

Finally some forward thinking on this site that actually makes sense. I don't understand why everyone can't see this logic. What is said here I also believe to my core. I wish it wasn't, but the greed and manipulation of the last 10 years is on the road to recovery. On that road will be a lot of hurt people. Some good, some still greedy. Such for the good, so I hope others hear this stuff and get out of dodge to avoid the crap that will hit the fan. 685K debt per family! Come on, how the hell are we going to dig out of that hole? We are not.

The only problem with that is that it isn't supported by the facts. Look at historical housing data - house prices very often continue to rise even as interest rates go up. You are waiting for something that may very well never happen.

Does the par value of a bond fall when interest rates rise? Yes. ALL the time, EVERY time.

Stop lying to the public.

Realtors Are Liars.

That's just another daft post from you. A house is not a bond, and it's price isn't as directly dependent on mortgage rates as people seem to think. I mean for crying out loud, interest rates were going up in 2006. What happened to house prices? That's one, very recent, example that shows other factors play an important role in determining prices. That's why it's wishful thinking for people to just say "I'm waiting for interest rates to rise because house prices will fall." Well no, not necessarily. What about correlations between house prices and income and population growth. If the interest rate was the be all and end all, then house prices/sales would be doing very well right now.

And here you go:

So, if the current person living in the house decided to not make the agreed upon payments then does the bank have any ownership rights to the house?

Sure-it's a condition of the loan agreement. So what?

So, the person living in the house really only has an obligation to use the house while the bank is owning the title. If that fore mentioned person completes the required payments on time like outlined in the mortgage agreement then they will receive title and be the new owners. Would that be a fair assessment?

No--they have repaid their loan agreement. And the collateral is returned to them.

Executive summary: Bank owns the house. You rent money or a house. If you think otherwise then you don't understand the real estate ponzi scheme disease that is killing this country and you must really be confused each year we drop further and further into the abyss. Real estate is dead. Deal with it.

Wrong again. I'm sorry you have such a poor understanding of property law. Read up and then you can try again.

tatupu - what do you think will happen when interest rates inevitably go up to 5 - 6 - 7% or higher?

I think the economy will be recovered, inflation will be higher and incomes will be growing. And house prices will be rising as well. Historically, that's what has happened.

Can you reference the history of the relationship between real house prices and interest rates? It would be helpful.

#1--we're talking about nominal home prices, not real.

#2--Historically, there is no correlation between nominal home prices and interest rates. And it's easy to explain why. Home prices are most dependent on income and incomes rise during good times. And guess what--interest rates are higher during good times.

Yeah, houses are exactly like bonds, except where they aren't. And we aren't talking about inflation - you and others have been saying that higher interest rates = lower prices. The graph shows that that is a massive over simplification. If all things held equal, then you could argue your case about interest rates, but they don't.

And I was under the impression that house prices were relatively flat during much of 2006 whilst interest rates were rising. The subsequent collapse in house prices wasn't driven by that relatively small rise, or are you seriously trying to argue that they were?

Wrong again. I'm sorry you have such a poor understanding of property law. Read up and then you can try again.

Hence why we are in such a mess. If I sold a piece of property to someone that was unable to make full payment, I consider that property (or collateral as you call it) mine, until full payment has been paid. If you damage, burn down, misuse, etc. my property then I am the one losing. Hence, why the mortgage issuer requires you to get the proper insurance. Try to get a mortgage and tell them that you don't require insurance on your home (you know, the one you own). You will quickly realize who has the vested interest, and who the rightful owner is.

You are obviously stuck in a rut and not until the ponzi scheme collapses completely will you see things properly. Good luck the next 5 years, you will need it.

« First « Previous Comments 78 - 117 of 219 Next » Last » Search these comments

What do you all think? Wait out the Bay Area market a few more years? We have two kids, jobs here and we are renting a 500 square foot home. Should we buy some crap hole under $400,000 in the area, or move to a place where we could have a nice home for $200,000? Should we invest? Please add your reasons why, and any solid data or links you have to help.