patrick.net

An Antidote to Corporate Media

1,362,450 comments by 15,738 users - brazil66, HeadSet, KgK one, stereotomy online now

Comments 1 - 40 of 77 Next » Last » Search these comments

If my math is right if gold prices hold at current level this means house prices will need to triple to get bck to the historic ratio.

this means house prices will need to triple to get bck to the historic ratio.

Hahahaha. I haven't laughed that hard in a while.

Dont worry, last time prices were this low it took 10 years to get back to the average so youve still got time.

I would be curious to see this chart for the Bay Area. I'll bet, we are nowhere near the trough in housing, here. Also, as far as how much money has been printed by the FED, we are are living in unprecedented times, so gold has a lot more to go on the up-side, while housing has a lot more to fall.

Also, S&P is still about 5-6 times overpriced relative to gold, and BA housing will not see any real price discovery until this ratio is below 1:

I think the trick is to buy a gold house! Right in the middle of Cupertino next to a great school. You can't lose then! Genius

this means house prices will need to triple to get bck to the historic ratio.

Hahahaha. I haven't laughed that hard in a while.

I know it sounds kind of funny right now but that's a fact not an opinion.

Now I see why Warren Buffet likes housing. If I were a betting man I'd probably go out and buy the biggest most expensive house I could find. Finance with a 4% 30 yr mortgage with as little down as possible and just live there for 10 years.

Put something like 100k down on a million dollar house in Palo Alto.

900k mortgage would only be around 4k per month.

Man this is actually kind of temping.

Put something like 100k down on a million dollar house in Palo Alto.

900k mortgage would only be around 4k per month.Man this is actually kind of temping.

Don't forget the extra $1,000 for property tax each month. And maintenance costs. And insurance. And PMI. And the $60,000 the realtor cartel will take if you want to sell.

And the potential $100,000 to $200,000 loss from depreciation in the next few years.

Maybe not so tempting.

But as a primary residence the deduction from the interest should just about wipe out the tax and insurance cost.

But you are assuming that prices will increase in that time frame - very bad idea. Even if it remains flat you are forgetting to consider lost opportunity to invest the principle part of mortgage payment. Remember - the principal is your money,that the banks keep for free - until you sell your house - if there is no appreciation,then when you sell it bank gives that principal back to you - as is - without a penny over the principal you paid. You would have to assume big price appreciation by the time to sell it,just to cover the costs that Patrick mentioned.I know,I know, this math is really fuzzy.

But as a primary residence the deduction from the interest should just about wipe out the tax and insurance cost.

You clearly haven't met up with AMT wiping out most of your deductions.

You would have to be in AMT territory to even begin to think about paying the mortgage and carrying costs of a million dollar home.

Put something like 100k down on a million dollar house in Palo Alto.

There are basically no homes that are practical (not shoeboxes) in Palo Alto under 1.5 million.

But you are assuming that prices will increase in that time frame - very bad idea.

I'm basing the whole idea on the assumptions that prices will go up as demonstrated by the OP.

You clearly haven't met up with AMT wiping out most of your deductions.

Actually last time I came close to getting hit with AMT my mortgage interest deduction knocked me under the threshold.

http://patrick.net/housing/calculator.php?uaddr=%2C+&rent=4%2C000&price=100%2C0000

What are the 70k in maintenance costs? Are you replacing the foundation?

There are basically no homes that are practical (not shoeboxes) in Palo Alto

Mick, Americans are so spoiled. Your shoebox is the size of a palace to most people in the world. And many of those who're bidding up the prices of homes in The Fortress are from other parts of the world. It is different here, and it is different this time.

http://patrick.net/housing/calculator.php?uaddr=%2C+&rent=4%2C000&price=100%2C0000

More realistic assumptions with appreciation at 0%. I even left in the 70k maintenance cost.

whoops just noticed the link doesn't update preferences.

anway with 3% appreciation and my realistic assumptions is says the house is worth $1.5 million.

Now I see why Warren Buffet likes housing.

Couldn't at all be that he has 5 billion riding on Bank of America. The biggest pansy bank in this whole mess. Remember Countrywide? Well, that pig is still around and as much as Bank of America is trying to dress it up, the smell is still getting worse every day. Buffett is not God. He makes mistakes and he has already admitted that he was wrong on housing last year. "I was dead wrong" was his quote. He would be the first to say that housing has its risk right now.

Mick, Americans are so spoiled. Your shoebox is the size of a palace to most people in the world. And many of those who're bidding up the prices of homes in The Fortress are from other parts of the world. It is different here, and it is different this time.

You must have not been traveling to too many places around the world. Those pseudo-palaces in cupertino and palo alto and other so-called "elite" places throughout the bay area (which don't even have a proper down-town), are nothing but stinking chicken coops, to most citizens throughout the civilized world. Yes, if you are from New Guinea, yourself, please accept my sympathy, but most people, who call themselves wealthy, anywhere, else in the world, do not live in such pithy conditions.

Here is an example of some houses from Russia:

http://www.home-designing.com/2011/06/rublevka-where-russias-super-elite-live

I'm basing the whole idea on the assumptions that prices will go up as demonstrated by the OP.

Hell, I'll by any property in USA,right now if it is guaranteed to increase 3 times in what 10 years? Only problem? your assumption is just hilarious. :)

dunross,

If they qualify to buy a sh**box in The Fortress, either with cash or qualify to borrow, then whether or not they call themselves wealthy or whether or not you consider them wealthy, it doesn't matter: by any reasonable comparison to most of the residents of the USA, California, and even the Bay Area, they are wealthy.

And yes, the apartments they lived in at places like Hong Kong, Shanghai, Mumbai, Bangalore, Taipei etc. besides being in multi-unit housing, are quite small. Your SFD sh**box in The Fortress is a palace by comparison.

Why do the prices of housing and gold have to be in some sort of ratio lockstep? There are things that will affect the prices of each that have nothing to do with each other. Am I missing something here? This chart is just pointing out arbitrary numbers in time, who cares?

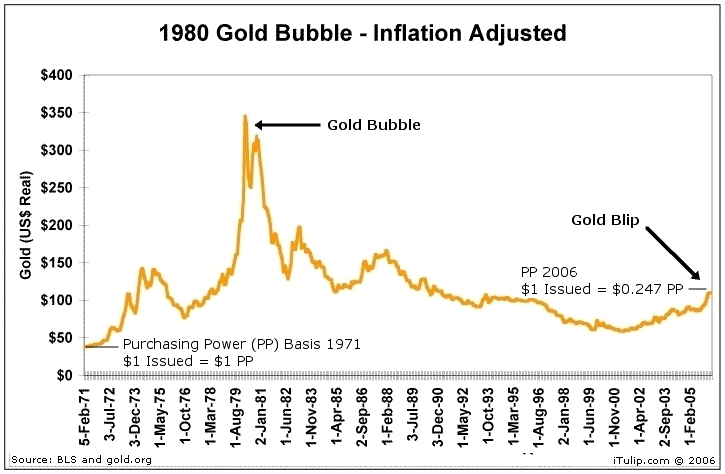

This is simply because gold is in a bubble. Please realize that gold prices can and someday will plummet, and don't bet your life savings on gold forever going up. I'm waiting for David Lereah's new book:

If they qualify to buy a sh**box in The Fortress, either with cash or qualify to borrow, then whether or not they call themselves wealthy or whether or not you consider them wealthy, it doesn't matter: by any reasonable comparison to most of the residents of the USA, California, and even the Bay Area, they are wealthy.

And yes, the apartments they lived in at places like Hong Kong, Shanghai, Mumbai, Bangalore, Taipei etc. besides being in multi-unit housing, are quite small. Your SFD sh**box in The Fortress is a palace by comparison.

The whole point is, these people, are not really, wealthy, because, if they were truly wealthy, they wouldn't be living in sh*t-boxes, no matter how good the schools are. All those places where all those people which you mentioned come from, come from cities, not culture-less waste zones without public transportation, like the so-called cities in the bay area are, so, your comparison doesn't really apply. If you want to compare prices between Los Altos and China for example, you shouldn't pick Shanghai or Bejing which are both cities of 20 million people. Instead, you should pick a place like Quamdo China, where prices are much cheaper than Los Altos.

Why do the prices of housing and gold have to be in some sort of ratio lockstep? There are things that will affect the prices of each that have nothing to do with each other. Am I missing something here? This chart is just pointing out arbitrary numbers in time, who cares?

Yes, you are missing something. It is the price of a house in US$ which nobody cares about, because, it is the US$ which is an arbitrary piece of paper with ink on it, and which has already lost 99% of it's purchasing power, since it came into existence (incidently, coincidental with the birthday of the federal reserve in 1913). The gold currency is the true currency of the world, and, since the Babylonian War, it has never lost it's purchasing power.

no matter how good the schools are

You mean, how high the standardized test scores are?

Why do the prices of housing and gold have to be in some sort of ratio lockstep? There are things that will affect the prices of each that have nothing to do with each other. Am I missing something here? This chart is just pointing out arbitrary numbers in time, who cares?

Yes, you are missing something. It is the price of a house in US$ which nobody cares about, because, it is the US$ which is an arbitrary piece of paper with ink on it, and which has already lost 99% of it's purchasing power, since it came into existence (incidently, coincidental with the birthday of the federal reserve in 1913). The gold currency is the true currency of the world, and, since the Babylonian War, it has never lost it's purchasing power.

Never lost its purchasing power? What on earth do you mean by that?

The gold currency is the true currency of the world, and, since the Babylonian War, it has never lost it's purchasing power.

From point “A†to point “B†gold lost purchasing power by 5.5 times (house cost).

Gold is just a commodity today. Let’s build a chart: barrel of oil vs. house prices or bushel of corn vs. house prices.

The gold currency is the true currency of the world, and, since the Babylonian War, it has never lost it's purchasing power.

Never lost purchasing power since the Babylonian War, ha! I guess the Babylonian War happened in the 1980s over a dispute about whether the following video rocked or sucked. I believe the forces of suck prevailed.

Of course, that was the second Babylonian War. The first was won by these guys.

bubblesitter says

toothfairy says

this means house prices will need to triple to get bck to the historic ratio.

Hahahaha. I haven't laughed that hard in a while.

I know it sounds kind of funny right now but that's a fact not an opinion.

It's a bit of a stretch to call that a "fact." You could also say that it was a fact that gold would have to fall by 2 thirds to get back to the historic ratio.

Gold is just a commodity today. Let’s build a chart: barrel of oil vs. house prices or bushel of corn vs. house prices.

Yep. If the sheeple flock to gold, gold can be "overpriced" too. There's nothing inherently special about gold.

People are madly running around exchanging one asset class for another, imagining that they're smarter than everyone else. Dollars for gold, gold for stocks, stocks for bonds, bonds for Euros, Euros for silver, silver for oil, and on and on it goes. And nobody has any better information about the future than anyone else. If they do have "insider" information, that's generally considered illegal.

There's nothing inherently special about gold.

But it's shinny! That means it can't fall in purchasing power because shinny things rule!

If they do have "insider" information, that's generally considered illegal.

Unless they are Senators. And, no, I'm not being facetious about that.

Then Gold is over inflated that's no secret.

Is gold over inflated or is the dollar's credibility inflated ?

Efficient market theory says the "Peter Schiff Factor" is already priced into the gold market. The herd has already bid up the price of gold. It's too late to buy gold.

To beat the markets, you have to know the future. I don't know the future.

The Fed holds the cards in this "sucker's game." It could just as easily adopt a deflation policy just to fake everyone out. I can't predict the Fed.

Is gold over inflated or is the dollar's credibility inflated ?

Is paper currency a shitty asset class right now? Absolutely. But stocks and bonds are overvalued. Commodities are too volitile. Gold and silver are bid up.

Cash is the worst asset class right now except for all of the others.

s paper currency a shitty asset class right now? Absolutely

I wouldn't take an absolute position either way. I'm ambivalent towards all assets right now :)

. But stocks and bonds are overvalued.

Yes. Bonds have always been overvalued and can stay like that for a long time. Stocks are overvalued in the sense that liquidity is sloshing around and keeping the equity markets appear stable, but the hidden volatility usually comes to the fore with a vengeance.

Gold and silver are bid up.

Yes I think once we have liquidity concerns again, I expect the metal markets to correct significantly. Buying is a good decision then, because everyone would be selling to scramble for cash.

Cash is the worst asset class right now except for all of the others.

Cash is a fine asset to have, as we're waiting for mass selling to get things at a discount, whatever the thing is.

What about Silver? I set aside 500 ounces to buy a House with some day!

Comments 1 - 40 of 77 Next » Last » Search these comments

http://www.financialsense.com/contributors/daniel-amerman/2011/11/18/gold-housing-ratio-falls-to-historic-low

This must mean something to the gold bugs doesnt it?

As shown at "Point A", on an average annual basis, there was a previous modern ratio low of 99 ounces of gold to buy a house when gold reached its financial crisis peak valuation in 1980. Real estate was remarkably cheap relative to gold - and real estate investment would outperform gold by a huge margin over the 21 years to come.

"Point B" occurred in 2001, with the Gold / Housing ratio reaching a high of 543 ounces of gold being needed to buy a single family home. Gold was remarkably cheap relative to real estate - and gold asset prices would outperform real estate asset prices by a huge margin over the 10 years to come.

The current price of gold (as of November 15, 2011) is reflected in "Point C", which shows a Gold / Housing ratio of 96 ounces of gold being needed to buy the average single family home. This is only 18% of the 543 ounces required in 2001. Real estate is once again remarkably cheap, when compared to gold.

#housing