patrick.net

An Antidote to Corporate Media

1,365,174 comments by 15,735 users - clambo, WookieMan online now

Ron Paul explains why the Banking Committee didn't see the bubble

2012 Aug 8, 3:24pm 10,842 views 30 comments

Comments 1 - 30 of 30 Search these comments

Greed trumps logic. Ho Hum. What I wanna know is, when & what the inevitable collapse will mean to the average citizen and how to better protect my family.

TOO BIG to FAIL BANKS have grown even BIGGER under gubmint bailout rules.

The DOW has doubled only under gubmint QE programs. Of course Big investors are begging for MORE QEs.

Any bank that is too big too fail is too big to exist and should be broken apart by anti-trust laws.

Any bank that is too big too fail is too big to exist and should be broken apart by anti-trust laws.

It's either that, or regulate the hell out of them, which seems unlikely, given the stranglehold those hugely overgrown banks have on our government.

I've been banking at my local credit union for over 20 years and all of my business accounts are there as well. A small protest, but it's something...

Ron Paul and his Austrians wouldn't have seen it coming either. They deny that bubbles are possible under a "true" free market. That such bubbles did in fact occur in the USA during periods when there was no central bank, is a fact they avoid. If they got their way and ran amok and reformed it to Paulista standards, there'd still be a collapse. And then they'd blame it on imperfect implementation and how we needed to keep trying.

Any bank that is too big too fail is too big to exist and should be broken apart by anti-trust laws.

The term "Too big To Fail" is a bullshit term really. No one is too big to fail. But they want us Americans to believe in that lie so they can justify taking our and our childrens money and giving it to their crony friends on wall street in the gambling/investment banking sector.

It really is sickening. It's one reason I'm voting for Ron Paul this election. Don't care for Romney, don't care for Obama. It's Ron Paul even if I know he won't win.

The term "Too big To Fail" is a bullshit term really. No one is too big to fail.

People think that anti-trust laws exist solely to protect users from being charged too much. But there are many other reasons anti-trust laws exist such as

1. They prevent a company from bringing down an entire industry.

2. They prevent a company from causing a depression.

3. They prevent a company from unduly influencing the government to give themselves unjust advantages and to stifle competition and the interests of society at large.

Of course, we have to actually enforce anti-trust laws for them to work, and anti-trust laws were in effect nullified by the Reagan administrations. We need to bring them back. Bring back the ghost of Teddy Roosevelt!

Housing wasn't really in a bubble if you matched it against the real rate of inflation. It only looked like one because government proclaimed inflation was 3% a year. The problem was that peoples wages were not increasing at the same rate. That made everything unaffordable, and it is getting worse as we print more money.

Much of our current problems are from falsely thinking we killed the inflation monster in the early 1980's. It was all a lie. Government said inflation was gone, but they themselves had to keep borrowing as prices to build new roads and infrastructure were soaring. It was a great way to defund the social security burden, but other set costs could not be calculated away so easily.

Bubbles do happen in free markets. But those who risk their capital take the loss. We don't stick it on taxpayers who didn't participate. It's like the beanie baby craze. People paying $20k for one beanie baby. That bubble bursted. We didn't bail them out, and the losers were cautious to jump in another bubble. General Motors is another example. Many of their brand names were just bought up from companies that went bankrupt. GM would buy up the losers, strip their workers, and keep the good parts. GM was very much like what Bain Capital became. If we had allowed GM to go bankrupt in 2008, other investors would have done what GM did before and bought them out....

Too bad the media didn't give Ron Paul coverage like this during the campaign. Instead, the only time they talked about him was when some amatuer youtube video mentioned Huntsman adopted child was from China, and claimed it was all Ron Pauls fault....

Housing wasn't really in a bubble if you matched it against the real rate of inflation.

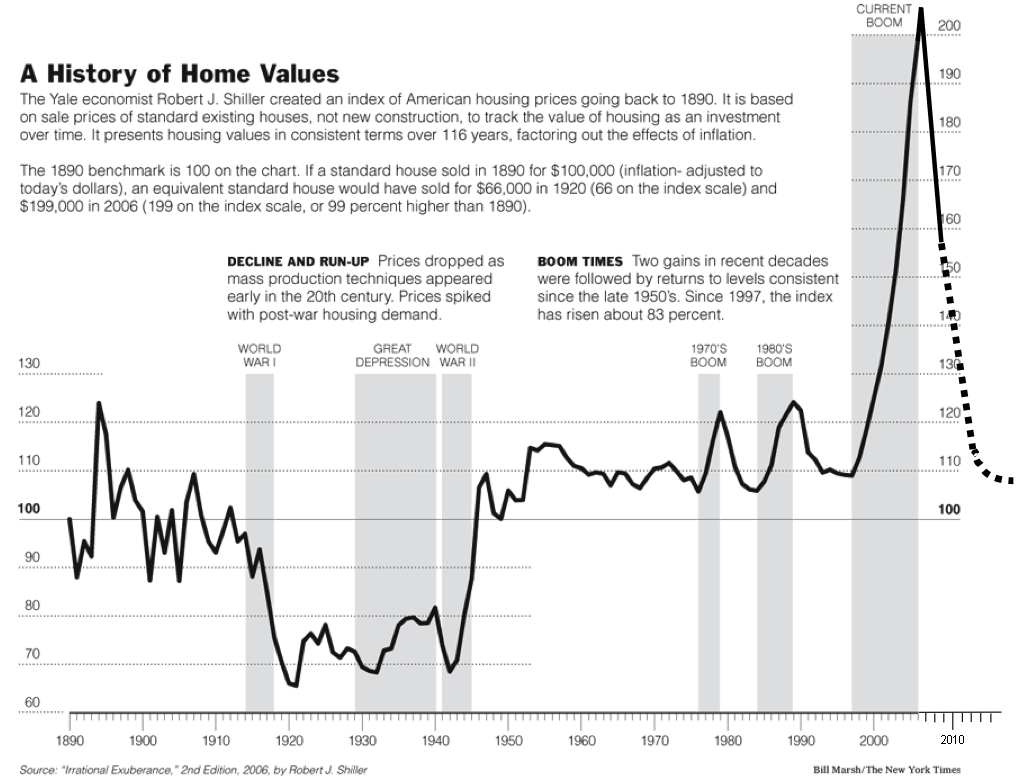

That graph doesn't indicate a bubble to you?

Well technically speaking, an oligopoly does satisfy the current anti-trust laws out there.

Realize, having Citgroup, JP Morgan Chase, Bank of America, Well Fargo, HSBC, & BoNY-Mellon control all of America's commercial banking sector, is still more than 2 companies.

Of course many of the Austrians called it, here is just a quick sample :

2006 - Nov 2006 Peter Schiff Mortgage Bankers Speech

http://www.6G3Qefbt0n4

2002- 2009 Peter Schiff

August 2005 "Housing Market is a Weak Foundation...it will not last much longer",

2006 "Recession will be very bad...American Consumer will stop consuming...it will last for years"

etc. etc.

http://www.A0Uk3hKnQQ8

Ron Paul Predictions 2002, so many are spot on:

http://www.zGDisyWkIBM

Ron Paul, 2001 - "Rapidly Expanding Real Estate bubble, which will eventually collapse"

http://www.MGgle-nXJl0

Well technically speaking, an oligopoly does satisfy the current anti-trust laws out there.

They had oligopolies in the 19th century that were busted, as well as into the 20th century.

If you put that chart next to one of the official inflation rate, then yes, it looks like a bubble. Then pull up charts for most of you daily basics. Gas, food, utilities, insurance, etc. Most of our costs have tripled since the late 1990's. Back then I could get a 15oz bag of Dorittos for $1.69. Today I get a 10oz bag for $4.29. Gas was $1, now almost $4. etc....

That chart and our other skyrocketing prices is just proof that the government has lied about inflation. They don't even report M3 money supply anymore....

Dan8267 says

Any bank that is too big too fail is too big to exist and should be broken apart by anti-trust laws.

It's either that, or regulate the hell out of them

Much simpler: do not believe in this "too big to fail" mantra and let them fail.

Ron Paul and his Austrians wouldn't have seen it coming either. They deny that bubbles are possible under a "true" free market. That such bubbles did in fact occur in the USA during periods when there was no central bank, is a fact they avoid.

There are bubbles naturally built by human stupidity. Normally they pop up quickly with very little economic hangover.

On the other hand there are bubbles fully designed and exploited by those in power to control human stupidity, bankers in our case. The main problem with such bubbles is that they artificially redirect resources to serve non-productive activities.

One did not need to be "Austrian" to understand that

1. already in 2002 housing prices hit the "bubble" territory;

2. they were artificially fueled by the lenders, which could be only explained by lenders confidence in further bailouts;

3. it caused a huge damage to the economy by sucking resources from productive activities and dumping them into the housing market;

4. the situation is unsustainable and the further it goes the more damage it will cause.

The main difference between "keynesians" and "austrian" is that "keynesians" believe in higher than 1 economy multipliers of money dumped into economy, while "austrian" point out that the multipier is often less than 1, because such "stimulus" money distort the market and cause many people to do economically unjustified work. Therefore, for "austrian" any stimulus, any subsidy, and any injection of money (credit) damages the economy.

Personally, from what I've seen I think the truth is in the middle. Definitely, subsidising producers is destructive. This includes subsidising lenders. However, subsidising consumers may have economic multiplier higher than 1, therefore actually stimulating the economy. In this sense subsidies like unemployment benefits, foodstamps, SSI may be good for economy. (those are tiny expenses anyway).

But subsidies like tax deductible mortgage interest are purely destructive. The same with all recent stimulus packages, same with the resources dumped into the "health" insurance reform, and with the Bush military expenses (they indeed worked like stimulus packages).

But worst of all were banking and mortgage industry bailouts. The business of FMA and FMC is like terrorist attacks on real economy. Any mortgage they help creating is a powerful bomb planted in American economy. By bailing them out American government has opened unlimited supply of exposives for them and the lenders who actually create the bombs.

If you put that chart next to one of the official inflation rate, then yes, it looks like a bubble. Then pull up charts for most of you daily basics. Gas, food, utilities, insurance, etc.

OK, lets have a longer term comparison. I would look at food prices vs. housing prices, but I guess you would get similar results with utilities etc. (Gas and insurance markets are very distorted, it's hard to adjust for these).

First thing about food is that producing it envolves even more land use than with producing housing. Second is that while food production has been severily industrialised in the last 100 years, housing production has industrialised even more.

Now take a look at historic restaurant prices:

http://restaurant-ingthroughhistory.com/restaurant-prices/

You may easily find out that (in nominal price) the dinner prices from 1890th-1930th went up about 80-150 times. (Low end -- about 80 times, high end -- 150 times).

However, if you look at the food and grocery prices of 1920th :

http://www.thepeoplehistory.com/20sfood.html

the multiplier is just 10-20 times, sometimes even less than 10 like:

Milk ½ Gal. 33¢ 1920

Milk ½ Gal. 28¢ 1925

Eggs 1 Doz. 47¢ 1920 WI

Eggs 1 doz. 25¢ 1924 WI

Eggs 1 doz. 68¢ 1925

Eggs 1 doz. 55¢ 1925

Eggs 1 doz. 59¢ 1929 New York

There change between 1890th and 1930th was small (less than twice) mostly because supressed prices during the Great Depression. Likewise with the housing prices.

However, if you compare housing prices then and today you'll find they went up 400-600 times. For example look at:

http://answers.yahoo.com/question/index?qid=20080719193937AA6lSHf

or from 1920th (and remember 1920th was a real estate boom time)

http://www.thepeoplehistory.com/20s-homes.html

Re the chart in post #17

We know this has happened, but do we know why?

I assume it is because wages are tied to time, rather then to what said labour actually produces. Time is the constant unit of measurement. People get paid for putting in x hours. Productivity rises immensely with technology, however, people are still working 40 hours. The disconnect grows further over time. Productivity continues to increase yet hours worked remain the same. yes, every once in a blue moon, your labour union fights tooth and nail to get you a .35 cents raise. Meanwhile, thanks to technology, your output per hour has increased ten fold. The system is designed to BURY the hourly worker. The unions should be fighting for a ten hour work week, rather then miniscule penny raises that get sucked up by rising prices of all other goods

The unions should be fighting for a ten hour work week, rather then miniscule penny raises that get sucked up by rising prices of all other goods

My union got our employer to provide us good benefits payed hourly for up to a 40 hour week. The employer required us to work 62 hours in 5 days. If we didn't we had to show up for a sixth day. The senior workers all got disabled, the young guys screwed up, the company went bankrupt. The corporate officers payed themselves royally, and thanks to low tax rates, retired after a couple years to Jackson Hole, Wy.

Normally they pop up quickly with very little economic hangover.

Therefore the Panic of 1837 never happened? Even though that was during a "free banking" era? How about the Great Depression? I mean the one in 1873 which was the ORIGINAL Great Depression. Later they recycled that name, then later still decided to clean up the confusion by renaming 1873-1879 the "Long Depression".

The myth that Paulistas operate under, is that the "business cycle" will fix everything if we are abolish government controls entirely and let banks run rampant. Do you see Ron Paul agitating for breaking up TBTF or enacting Glass Steagall 2.0? I don't. Libertopians would be happy for banking monopolies and trusts to boom again like in the Robber Baron eras.

US history has numerous economic collapses, not all of them coincided with the hated Federal Reserve. Paulistas are only good students of history where it is recent and suits their purposes.

One mistake that Paulistas make I think, is that they think abolishing the "Federal Reserve" would end bank cartel behaviour. I guarantee you they would still meet in smoke-filled rooms and fix rates and rig bids just as they have done throughout history. However there would no longer be minutes and public records of their actions. Paulistas don't recognize they face a Hydra, lop off one head and two more sprout.

"Do you see Ron Paul agitating for breaking up TBTF or enacting Glass Steagall 2.0? I don't."

So your saying Paul voted for the repeal of Glass-Steagall?

So your saying Paul voted for the repeal of Glass-Steagall?

No. I said he hasn't proposed a new bill to break up TBTF. Instead he proposes some magic bullshit whereby if we deregulate even further the rainbow-farting unicorn will shower us all with gold and FIRE cartels will cease to exist. He prefers to spend his time on The Hill poking hornets nests with a stick and endlessly proposing bills to outlaw abortion.

Therefore the Panic of 1837 never happened?

Panic is just a panic.

How about the Great Depression? I mean the one in 1873 which was the ORIGINAL Great Depression, since overlaid by "journalists" who recycled the name and obscured it from casual view.

Depression of 1873-1879 with the following recession of 1882-1885 was 12 years long. Though there was a very slow growth till 1996.

The "Great Depression" of 1929-1942 was 13 years long with the New Deal and all Keynessian stimulus. It ended only because of the WW2, not because of the Government interventions. Also, I never told that welfare kind of intervention is unjustified or bad for economy.

The myth that Paulistas operate under, is that the "business cycle" will fix everything if we are abolish government controls entirely and let banks run rampant.

The government has proved without doubt it can't control banks, rather banks control the government. What we've seen is that the government supports and protects banks running rampant. It steals money from the people and transfers it to the banks. Without guaranteed bailouts banks would never even try their reckless runs. Those who would try it would go out of business. (BTW, maybe it's better to avoid calling names and sticking labels like "Paulistas". Without them your arguments would sound much more serious.)

Do you see Ron Paul agitating for breaking up TBTF or enacting Glass Steagall 2.0? I don't. Libertopians would be happy for banking monopolies and trusts to boom again like in the Robber Baron eras.

TBTF is just a myth. Just allow them TF and they will be gone or break up by themselves. "Libertopians ..." -- again label and a bit of libel -- not a serious argument.

And again, the government should make absolutely clear that it will never bailout any financial speculation. Making thsi message unambiguos, clear, and sticking to it will end any TBTF bubbles.

Edited.

Vicente - Panic of 1837 was caused by that day's Federal Reserve - Second Bank of the United States printing money aka causing inflation.

The "Great Depression" of 1929-1942 was 13 years long with the New Deal and all Keynessian stimulus.

Slight correction - Great Depression was 1929-1947.

WWII didn't end it - only exacerbated it - things were pretty crappy for Americans until War stopped, soldiers returned into productive sector and taxes were slashed.

The "Great Depression" of 1929-1942 was 13 years long with the New Deal and all Keynessian stimulus.

Slight correction - Great Depression was 1929-1947.

WWII didn't end it - only exacerbated it - things were pretty crappy for Americans until War stopped, soldiers returned into productive sector and taxes were slashed.

Thanks. Well, at least the unemployment ended in 1943.

Thanks. Well, at least the unemployment ended in 1943.

Yes, unemployment ended - because everyone was on war footing - either dying, or destructing, or making weapons for destruction.

War employment is the worst thing for real economy - where normal purpose of the economy is to enrich people, build, create stuff, war employment produces poverty and destruction for everyone invovled, except of course weapon manufacturers and their government cronies.

So yes, US unemployment went down, but there was a food shortage, and you had quotas for sugar and butter, and had to stand in line. Only idiot government-paid pseudo-economists call it an "economic recovery".

AlexS, you are preaching to the choir about how bad a thing war is.

But the war related production included building ships, tracks, jeeps etc. Those not only for US military but for our allies and also a lot of cargo ships.

Beside this, a major development of the WW2 was British opening of their colonies for free trade (basically for American trade) and eventually the complete collapse of British Empire. As the result, by the end of the war the production in other industrialised nations was all but destroyed, while all markets turned open for America.

So, the WW2 was a horrible thing, but it greatly benefited American economy.

AlexS, you are preaching to the choir about how bad a thing war is

Hence I said "slight correction" :)

But no, War wasn't good for American economy either. It's like saying that if you bombed your business partners and clients, you become better of. You don't.

Everyone's lifestyle suffered tremendously during WWII, both on the receiving end of bombs (Europeans), but also on the giving end (American capital was squandered on producing destruction).

Metal and rubber and oil went on producing worthless (to the consumer) goods such as tanks and military trucks and bombs. Digging and filling holes is even better for the economy than that - less capital is squandered.

The term "Too big To Fail" is a bullshit term really. No one is too big to fail.

People think that anti-trust laws exist solely to protect users from being charged too much. But there are many other reasons anti-trust laws exist such as

1. They prevent a company from bringing down an entire industry.

2. They prevent a company from causing a depression.

3. They prevent a company from unduly influencing the government to give themselves unjust advantages and to stifle competition and the interests of society at large.

Of course, we have to actually enforce anti-trust laws for them to work, and anti-trust laws were in effect nullified by the Reagan administrations. We need to bring them back. Bring back the ghost of Teddy Roosevelt!

If you look at these 3 things from a military logistics standpoint, then you see how the military-industrial complex works to protect itself, more than to protect citizens.

Distributed logistics.

Any bank that is too big too fail is too big to exist and should be broken apart by anti-trust laws.

David Stockman agrees with you:

The greatest regulatory problem — far more urgent that the environmental marginalia Mitt Romney has fumed about — is that the giant Wall Street banks remain dangerous quasi-wards of the state and are inexorably prone to speculative abuse of taxpayer-insured deposits and the Fed’s cheap money. Forget about “too big to fail.†These banks are too big to exist — too big to manage internally and to regulate externally.

Libertopians would be happy for banking monopolies and trusts to boom again like in the Robber Baron eras.

I think they miserably fail to recognize that human nature is prone to entropy and deterioration.

Comments 1 - 30 of 30 Search these comments

http://www.INvKPYdTs3E

#bubbles