patrick.net

An Antidote to Corporate Media

1,355,401 comments by 15,730 users - Ceffer, FortWayneHatesRealtors, ohomen171, socal2, The_Deplorable online now

Comments 1 - 30 of 30 Search these comments

Yeah. And the dumb realtors in the BA, are still pushing the "Housing always going up" crap. When will they ever learn, that they can make more money scaring sellers into selling that scaring buyers into buying.

In 2006, I remember we had something like 12,000 houses on MLS. Now we only have 400. What a joke!

With such a low volume on MLS, anything can move this market. You get one ghetto guy, to buy a house in a place like Palo Alto, and there will be mass discounts all over the place.

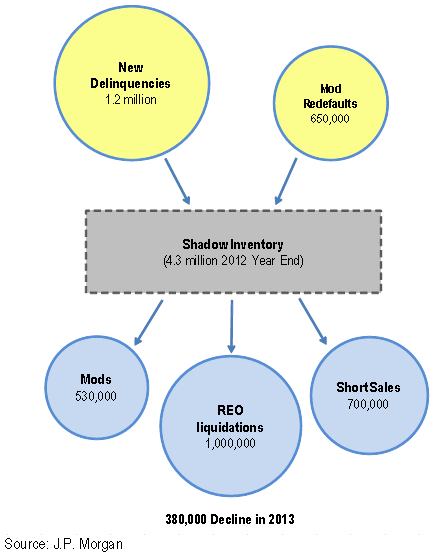

JP Morgan Chase is expecting 1.2 million new foreclosures and 650,000 loan modifications that will re-default in 2013.

In 2012, 1 out of every 3 purchases was to an investor.

so your premise is that Low Inventory leads to low prices???

so your premise is that Low Inventory leads to low prices???

surething! Econ 101 wants the book back, you clearly didn't make it past chapter 1!

And, you can't claim there isn't demand, otherwise how did the inventory become low?

Wow, what a leap of faith you took there. Ever heard of the old straw-man argument? 5th grade debate class definitely wants their book back from you, my friend. Did you hear me say anything about low inventory leading to low prices? All I said was that in low volume environment, one can move prices very easily. Right now, the FED and the banks have the strangle-hold on the market, and that's why prices are moving up. But, all it takes is a little spark, like a ghetto man moving into a Fortress neighborhood, to bring the prices right back down. That, by the way, is also in the Econ 101 book, which you obviously didn't even get past the cover (or maybe, you've never even seen that book).

And, you can't claim there isn't demand, otherwise how did the inventory become low?

Sure, I can. If the banks withhold all the inventory, you don't need any strength in demand, to drive the inventory down. That, by the way, was in the Econ 101 syllabus, which the TA gave out to people interested in taking the course.

And, you can't claim there isn't demand, otherwise how did the inventory become low?

And it doesn't take a math genius to figure out that if the inventory goes down from 12K to 400, even if you had 1/5 the demand of what you had when inventory was at 12K, the 400 houses on the market would not even be there.

One counterfeiter buying a trillion dollars worth of housing per year under the table makes a market.

"In a low volume enviroment, one can move prices easily" Ok, go move those prices!!! Housing isn't a thinly traded penny stock!!!

400 houses on the market in a city with a population over 1 Million. And you don't think that's thinly traded market? Maybe, you should go back to your Econ 101 class.

EVERY factor effecting house prices is better today than it was a year ago:

1. Foreclosures? Down.

Wrong: http://www.bloomberg.com/news/2012-12-13/home-seizures-rise-as-banks-adjust-to-foreclosure-flow.html

2. Inventory? Way down.

Yes, but this is market manipulation, and is not sustainable.

3. Loans 60 days late or in foreclosure? down.

Wrong: see article above.

4. Employment? 2 million or so more jobs than one year ago.

Yes, 2 million more lower paying jobs replacing higher paying jobs, with most of that attributable to population growth.

5. Interest rates? lower.

Yes, manipulation again. Not sustainable.

6. Future sentiment about housing? better than a year ago.

Sentiment was highest back in 2006, right before the crash.

Even you can't see that is negative...

Depends if you consider 4 million properties in the "shadow" negative or not. :)

Also consider the extremely high amount of "new" delinquencies. I think it tells us a bit about the real economic recovery that is going on here.

sustainable, per FED announced policy, through the next several years..

I see you really failed your Econ 101 class. FED doesn't control long-term rates. They only control short-term rates. 30 year mortgages are based on long term rates, which FED cannot directly control, but they can try to manipulate, by printing money and buying long-term treasuries. However, this strategy is becoming less and less affective with time, and the FED will find that they would need to print more just to move interest rates a little. Eventually, just the interest rate on the huge debt, will use up all the taxable income, and the FED will not be able to manipulate the rates any more.

Today, however, in many if not most markets, mortgages are actually less than rent on tons of homes,

Total BS. Most coastal areas, where most people in this country live, rents are still much lower than mortgages. Where I live, in the Silly.con valley, rent is still less than 50% of a PITI payment for a comparable house.

I teach those university classes you don't understand!

College education is total crap, these days, because of professors like you, who don't know their short-term interest rates from long-term interest rates. Colleges, these days, are not about good education, but all about bankers making more money on getting students in debt. Here is an example of how much students know about Israel in the top 25 institutions in America:

I link your past 100% wrong predictions,

You didn't prove anything which I said was wrong. Just because, there was a short-term dead cat bounce, doesn't make you right. I was able to disprove most of the BS points you made, and I am sure that most people here would agree with me. In my mind, you don't qualify to teach any subject in any higher institution, and, I certainly hope that your next job will be a dog trainer.

who said two years ago, that prices would crash, and when presented with that thread, and the very obvious evidence (which you disputed 100's of times on here) that prices were in fact rising.... ?

I thought the prices have only been rising since last year? So, even if you didn't buy 2 years ago, you would still be just about breaking even. Also, I told everyone to buy gold, on this very blog, and if you had bought gold, instead of your stupid houses, 2 years ago, you would still be way ahead, than you are today. So, please, don't lie about what I said, here, on the record. Just go back to your vulgarian life in the desert, and try not to talk about subjects you know absolutely nothing about.

I will post a pic with me having an afternoon drink on the beach

Oh yeah! A pic on the beach with a cheap $2 soda is supposed to prove something to us, over here!

I'm surprised that the banks are not releasing more inventory. Even if they start to release more inventory right now, it would take a while to get back to the neutral 4-6 months of inventory. We live in an interesting period of history indeed.

It's the same situation is Orange County. Inventory is right around 1 month, and sales dropped 20% m-o-m in October, and 12% m-o-m in November. So there is some demand destruction.

I do agree it's an interesting period of history for the housing market, and I dare say this might be one of the worst times to buy that I can ever remember.

That's where we differ. I can see another 20%-30% appreciation from today's price in the next 3-5 years. That's a lot of money. A $500k home today selling for $600k-$650k in the next few years at 3.5% interest rate is not expensive. Run the numbers.

That's assuming we get appreciation. Like I said in the other thread, if home prices rise too high, investors will get smoked out of the market (Roberto already claims to be out), and right now they represent 1 in 3 purchases across the country.

Unless rents also rise in tandem with this supposed appreciation, I don't see it. Incomes are way too stagnant. Also consider FHA is about to be bailed out, that part of the market is going to get hit with some massive insurance premiums further decreasing purchasing power.

Also since 2009, the market has been flat. Even in OC, we're only back to 2010 prices and things are flattening out. 30% appreciation seems like a pipe dream not heard of since 2005-2006.

Had I listened to you 2 years ago, i would have nearly a million dollars less in net worth than I have today! AND I would not have my $5000 a month in net income from my rentals!!!

I'm out because: 1. I'm out of money for now, and 2. I'm making more than I will likely ever need in my life, I want to concentrate on something else now: yoga and pilates, mountain biking and hiking...

Good for you. You supposedly have over a million dollars in net worth but are out of cash.

You may be gloating now but your over-leveraged ass (thanks to my tax money) is going to be in for a nasty surprise in the not-too-distant future.

College education is total crap, these days, because of professors like you

as always, you have to resort to taking personal attacks on me. that is because you are jealous of me... (and since you are such an f*ing idiot that, even when I link your past 100% wrong predictions, you don't back down, we'll just leave it at this: You sir, are always wrong. About everything. Thus, your insults at me as a professor are actually compliments! If someone as wrong and clueless as you thought I was a good professor, that would be scary!)

Enjoy your lifelong wongness sir! In six months or a year, i will resurrect this post, just like I did your other ones, and you will once again make excuses!!!!!

The word you are looking for is "envious".

I'm neither poor or jealous. The problem with you and your ilk is that you're too near-sighted to realize that you're gonna be the ones getting fucked by the system when this house of cards collapses. You think a rube such as yourself can compete with big-boy hedge funds?

I'm not sure how many times you have to see that there has never been a meaningful "recovery" with net job growth (not just shitty part time jobs that barely keep up with population growth. Who do you think is gonna rent your hovels when jobless families keep piling into the same house, freeing up even more rental inventory?

AND I would not have my $5000 a month in net income from my rentals!!!

Rentier income. Money stolen from the working man from loans the working mans taxes pay for. The sick thing is you bankster thief types think you are "doing something" for the economy being slumlord landlords.

We arent going to put up with you rentier rats forever, you know.

AND I would not have my $5000 a month in net income from my rentals!!!

Rentier income. Money stolen from the working man from loans the working mans taxes pay for.

Half stolen. The rent on the land is pure theft from the public, yes. But the rent on the building is justified by the original construction costs and the maintenance costs. That part is a legitimate service.

This board is over run with perma bears. I though in 1999 that RE prices 'had to got back to 97 levels' but man was i wrong. The fed makes the game, the rules, picks winners and losers. Money doesnt exist people - its fiction. Its not like there is a natural law dictating prices like gravity- they just lower rates, print money, buy mbs bonds with printed money it takes like 10 minutes of 'work' to turn aournd RE (but of course politically it took 5 years to rig the system at every level to turn it around, but its still just zeros and ones.)

20% of $650,000 is $130,000. Mortgage purchase applications are at historical lows, and not for nothing. Right now the market is investors, FHA'ers, and a small percentage of foreigners. That's going to blow the market 30% in 3 years?

Also, who will be providing those interest only loans? Certainly not Chase, BofA, and Wells. FHA? Who?

I'm not attacking your point, but I'd like the full story, not just a theory.

Who's going to blow it up 30%? Buyers. The people that lost their house through foreclosures and short sales in recent years. They couldn't refinance their $800k at 6%-7% because they make too much money. Now they can buy that same house for $650k to $700k at 3.25% to 3.5%. What's the reason to wait? After all, they're gambling with other people's money.

So you're betting on the "strategic defaulters" from the last bubble to come in and blow things up higher. Interesting theory, even if I'm not completely convinced.

Wouldn't surprise me though. That's how dysfunctional the housing market has become.

It's now becoming too obvious that the banks are trying to offload their inventory to the unsuspecting fools, for the top dollar. This is the biggest fraud perpetrated upon the sheeple, in centuries. When the music stops playing, 2008 will seem like a child's play...