patrick.net

An Antidote to Corporate Media

1,262,254 comments by 15,074 users - GNL, RWSGFY, TheDonald online now

John Williams of Shadowstats.com Interview: The Next Crash Will Be A Lot Worse!

2013 Jan 28, 7:31am 70,572 views 174 comments

« First « Previous Comments 121 - 160 of 174 Next » Last » Search these comments

Home prices are not overpriced anymore.

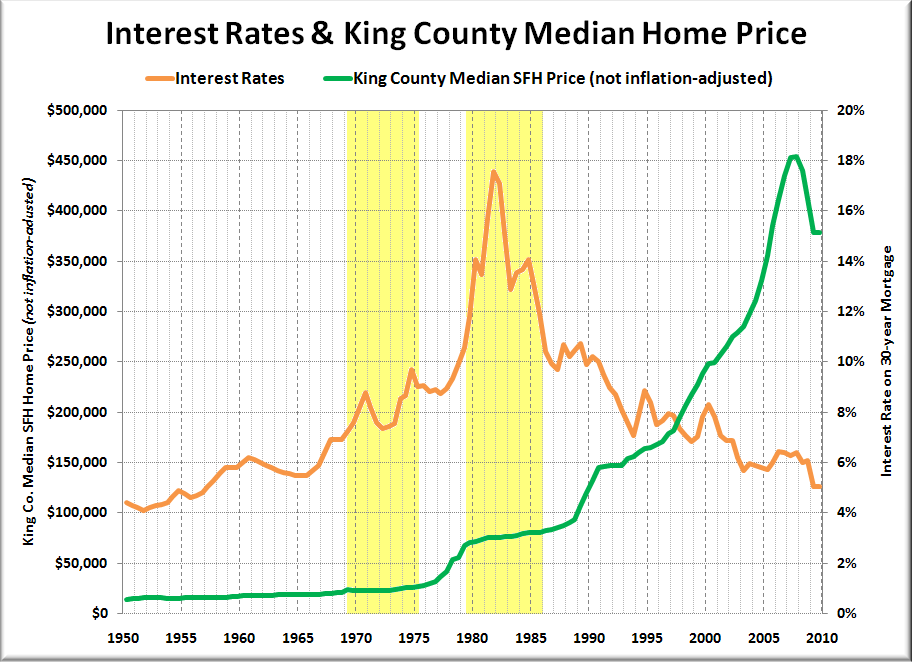

So says those that own, those that rent believe the opposite, some of those that own (me) still believe the opposite. Home prices are being supported by low interest rates. What happens if rates rise?

Lots of reasons why 2008 can't be repeated anytime soon:

You saying it can't be repeated shows your ignorance. Lehman, Bear, Wachovia, WAMU, Countrywide, Merril, have been absorbed by the remaining big 5 banks. They are now much bigger than before the last crisis when Lehman ALONE destroyed the credit markets. You keep smoking that it can't happen again crack pipe.

Home prices are not overpriced anymore.

So says those that own, those that rent believe the opposite, some of those that own (me) still believe the opposite. Home prices are being supported by low interest rates. What happens if rates rise?

If rates rise, that means unemployment will certainly have fallen and incomes will be up. So house prices will probably be rising as well.

If rates rise, that means unemployment will certainly have fallen and incomes

will be up. So house prices will probably be rising as well.

The last housing bubble was caused by what? Artificially low payments with crazy subprime loans. Interest only, pick a pay, you name it. Rising rates do not lead to higher home prices.

For the last 3 years, despite you continuing to call for a "collapse", it has

been the soft landing as each crisis turns into nothingburger after

nothingburger. So again, is there any point in the next 0-50 where you decide to

re-evaluate your conclusion? Is there any point in the next 0-50 years when you

say, "gee, I guess there is not going to be a second collapse after all"?

I guess I would ask why do you believe that 2008 cannot be repeated?

No absolutely, it can be repeated. I continue to look for risk pricing in the bond market, or in the a1/p2. As they both sit there, while we print with wild abandon, I dont think twice about it. If they start to rise, like we saw in 2007 - absolutely I will be changing my tune - and fast.

Yup1 says..."Do you think that the Fed can bailout everything if everyone decides to sell? When will you get concerned with the Fed balance sheet 5 Trillion, 10 Trillion, 50 Trillion?"

Yes. Unequivocably. Again, I am operating on the assumption that they realize how serious this is - and if push comes to shove, they would much rather risk a global conflict with our creditors than they would see rioting, tanks in the streets, and the risk they could be dragged thru the streets, mogadishu style.

And therein lies the risk with changing course. There is so so so much debt out there - if called simultaneously, like we almost had in 2008, some very very very powerful players on the worlds stage will be very very screwed. And everyone knows this. Hence, no one is willing to pull the trigger - instead they wail, and shout, and then readily gobble down more of our debt.

So in that regard, honestly, there is no notational limit that we cannot exceed. Its kinda like the 500 billion dollar bill (zimbabwe dollars) I got as a gift. The guy got it for $4USD on ebay. Mugabe would rather destroy his country's ability to be a member of the worlds stage than risk dying at the hands of his countrymen. When push comes to shove, I am pretty sure which way our PTB will decide too.

Rising rates do not lead to higher home prices.

Of course not. It's not cause and effect. But rates also don't rise and fall randomly. They rise when there is an expectation of inflation and fall when there is an expectation of deflation.

So, if you are saying that rates are rising, that means there is an expectation of inflation, which implies higher incomes and lower unemployment.

Its kinda like the 500 billion dollar bill (zimbabwe dollars) I got as a gift.

The guy got it for $4USD on ebay.

Dude whoever bought that got robbed my buddy got me a 100 Trillion dollar one for 4 bucks, ROFLMFAO!

Hence, no one is willing to pull the trigger - instead they wail, and shout,

and then readily gobble down more of our debt.

So in that regard, honestly, there is no notational limit that we cannot

exceed.

At some point mathematics takes over and the amounts of debt cannot even be serviced, then what? If you are just printing money to make fake reserves you are doing nothing. If that money does not get into the real economy the increased debts will eventually default. I guess you could go with a 0 interest rate, all of that money is fake anyway.

I guess that is the point, do we all not understand at this point that it is all fake. A large group of people being "poor" while an individual person is "rich" when ALL of the credit money ever created is fake is pretty rediculous.

If the population in general ever comes to truely understand the nature of credit money, no one will ever pay back another debt again, EVER!

But rates also don't rise and fall randomly. They rise when there is an

expectation of inflation and fall when there is an expectation of deflation.

That is what they used to mean, I agree. If you think that is what rates mean in todays ZIRP environment I believe you are wrong.

Of course not. It's not cause and effect. But rates also don't rise and fall

randomly. They rise when there is an expectation of inflation and fall when

there is an expectation of deflation.

So, if you are saying that rates are rising, that means there is an

expectation of inflation, which implies higher incomes and lower

unemployment.

Bill Gross from PIMCO said in 2010 that without Uncle Sam backing mortgages rates would climb by 3 to 4 %. I wonder what home prices would be with 7-9% mortgages?

You guys understand that Zimbabwe was never a stable global superpower with reserve currency status right?

Dude whoever bought that got robbed my buddy got me a 100 Trillion dollar one

for 4 bucks, ROFLMFAO!

LOL - I stand corrected it was actually a 500 trillion note. Is yours the one with the 2010 redemption date?

I guess that is the point, do we all not understand at this point that it is all

fake.

Yeah , pretty much. If there was any doubt, the world realizes it is all a big ponzi scheme right now. But like all ponzis, once you recognze its a ponzi and all of you will lose, it behooves you to pawn it off on someone else - in this case the next generation (who will then have their own 2008 minute whereupon [unless someone calls their bluff] they will pawn that ponzi on to the next generation.

A large group of people being "poor" while an individual person is "rich" when

ALL of the credit money ever created is fake is pretty rediculous.

At the end of the day, money is just a representation of resources, (be them natural, political, or otherwise). In 2008, the worlds pool of bullshit was drained, and we were all exposed as swimming naked. Still, we, here in the US were still recognized as being the biggest, strongest, pack of grenades across its chest... So when we said "why dont we re-fill this pool, and lets all pretend it didnt happen" everyone else, recognized how powerless they were they nodded in agreement.

It wont always be this way. Eventually China or someone else will be big enough to call the shots. Im just not so sure that is going to happen while I happen to be on this planet.

Rising rates do not lead to higher home prices.

Real or nominal? In nominal terms, the record is not as clear as you think it is.

I dont have a graph for the US, but I do have tabular data, if you want to confirm it for the whole US. Either way, Im sure the people back in the 80s who decided to wait as interest rates hit 14-15-16 percent, watched in horror as nominal prices continued to slowly lurch upward.

I wonder what home prices would be with 7-9% mortgages?

The market would collapse. Removing govt supporting 90% of all new mortgages underwriting or increasing interest rates or dumping shadow inventory at once will dramatically impact the housing market to the downside. We saw how quickly it dried up once the home buyer credit expired. It needs govt support to survive at all.

Yup! Watch the bond market. It's in the largest bubble in over 200 years and WILL burst because ALL economic bubbles bursts. The sheep won't know what hit them. Bonds have an inverse relationship with rates so you know what that means

Contrarian conjecture aside -- you're right, YUP1.

There will be no middle class income growth in America in the next decade. (Why would there be?)

Home prices are not overpriced anymore.

So says those that own, those that rent believe the opposite, some of those that own (me) still believe the opposite. Home prices are being supported by low interest rates. What happens if rates rise?

If rates rise, that means unemployment will certainly have fallen and incomes will be up. So house prices will probably be rising as well.

The only way house prices can rise with rising interest rates is if wages rise

accordingly.... and we know where wages have been all these past years.

Yep, and we know where interest rates have been all these past years. That's the point.

If you are betting that interest rates will rise sifnificantly while wages stay stagnant, then you are betting on a very unusual event occurring.

Just so you understand that you are the one predicting against history.

There will be no middle class income growth in America in the next decade.

(Why would there be?)

lol. US productivity continues to rise. The only reason there is no median income growth is because it's all going to the 1%. If Obama continues to make taxes more progressive, median income growth will return.

The FED has pretty much admitted that they will keep rates low until things/unemployment gets better. The current QE, they didn't even set a time limit-they can buy junk for all of eternity. There is no risk in the market for the big players.

The only thing that can happen, is if the dam breaks and the flood is large enough to bury even the FED. While unlikely, it may happen-but chances are slim. I think we are stuck at these low rates for a long time.

The only thing that can happen, is if the dam breaks and the flood is large enough to bury even the FED. While unlikely, it may happen-but chances are slim. I think we are stuck at these low rates for a long time.

The Fed is the king of creating bubbles. The dam will break sooner or later.

There will be no middle class income growth in America in the next decade.

(Why would there be?)

lol. US productivity continues to rise. The only reason there is no median income growth is because it's all going to the 1%. If Obama continues to make taxes more progressive, median income growth will return.

I think this will be one vital solution to the problem--more money definitely needs to trickle down. That is crucial.

And, more dumb ass anecdotal evidence ignoring the effect a 7.5% interest rate would have on leverage mortgage payments. Just more of the same BS miss roberta

Everyone understands the effect that higher interest rates has on mortgage payments. Believe me, we get it.

But we also understand the historical relationship between interest rates and wage inflation. Like I said earlier, interest rates don't rise and fall randomly--they move in response to macroeconomic factors. And those factors historically have also had an effect on wage inflation.

So, for you to completely ignore the historical relationship shows your ignorance.

It's another high jacked real estate thread by underwaterman. underwaterman says

Another ad hominem personal attack via my profitable investment.

I've yet to hear about your profitable investments, yet you want us all to tell you ours in great detail. So far all I've ever read you say is Real Estate bad, gold good, because Glenn Beck tells me all these other people have made fortunes from gold.

That's it, and yet you keep mucking up Real Estate threads with your psycho babble.

Yeah, silly me. Wages causes interest rates to go up and down is what your stating. Seems to me the FED is having some kind of causal effect thru their ZIRP policies. Yes, wage inflation accounts for housing interest rates going from 6.5% in 2008 to 3.5% today. Yeah, right.

In a sense, it does. You are the one who keeps saying that wages are flat or falling for the last decade. Interest rates and wages move together, so it's not surprising that interest rates are falling.

personal attacks via my investment,

What investment?

You have no information here about an investment strategy.

Gold isn't an investment strategy.

Are you buying, and selling by market timing, because that is the only way to make gold work for you.

It's like taking your jewelry in, and out of pawn.

You haven't presented a strategy, and yet you are here killing another Real Estate thread with your Glenn Beck gold stories.

Then you throw in some insults, and psycho babble, and off you go again.

I've outlined some of my investments, but you have only told tales about losses.

There not causal oh dumb one.

Of course not, oh reading comprehension deficient one. I never claimed they were.

your an expert whose to clue me in on economics

Boy, I hope I used the words "you're and your" correctly here professor because we all know how important that is now.

Unfortunately...

I think I'll keep my info private thank you.

Here come the clowns into the thread derailing it making their usual attacks on the person, never the argument.

I would suggest the one below. It gives a good overview of how the fed was formed secretely in 1910 by rich bankers

So, now you admit you have no strategy, just the same old, tired conspiracy of the Fed with the Gold Standard, but you can't get the Glenn Beck connection.

You should get a white board and put all the conspiracy theories up there to prove your point, it's what Glenn Beck does.

Now, you have nothing here that indicates you have any working knowledge about politics, or the economy, so there is nothing there to address.

You're making random comments about wages, or unemployment, maybe the federal deficit, that's always a good one, but nothing that ties it to the Gold Standard.

We have been over this before, repeatedly, on other threads you have high jacked.

So, this is another Real Estate thread; for you Real Estate is bad, gold is good. OK, we got that, and the personal attacks that you make against everybody, but you ultimately have nothing to say.

Nope. It is literally 0%!

Most of those guys and gals had previous funding from the FED, and aspire to be on the FED Board of Governors some day just like Bernanke the ex-and-future Princeton Professor. Interesting to note, one of them had the balls not to answer the question.

Congrats on your purchases. However, a 10% or so rental yield is not especially high. I'd think a couple years ago when everyone's crystal balls were cloudy, 20% rental yield should have been do-able. Is the current investments that you are making simply due to inertia and cash flow stream from the houses having to have a place to go?

You know you just keep repeating things right?

That is exactly what you do.

You don't have any discussions, input, or information, it's just the same stalking, and insults.

I don't see why Roberto wastes his time responding to you, because you never have a come back, response, or clarity of thought.

I noticed your quite obsessed with your investment and have an excessive need to let everyone know about it with practically each and every post whether it has anything to do with the topic or not. You are overcompensating because your insecure. Buying in a bubble of 2012 and sinking all your networth into houses in one market with the level of systemic risk in the economy and competing against all the other investors driving the bubble in phoenix should leave you give your pause for concern.

Presumably not remotely similar to you constantly talking about precious metals and how you went all in in 2012 using all that money you made selling your 5 houses in 2012, houses you bought in 2003, 2005 and 2006. It's also amusing how you think his 2012 purchases in Phoenix are buying in a bubble. What exactly were you thinking in 03/05/06?

gold numeraire (which is real money)

Gold is a commodity. There is no gold money on the market today.'

That is what I mean by you repeating conspiracy theories.

We don't have hyper inflation which is just a fact of life.

Our government has printed tons of money, but there is no hyper inflation.

Hyper inflation isn't coming, deflation is.

This is a Real estate thread that you chose to high jack. It's boring, and without merit.

You have no point so there is nothing to address.

It's boring, and without merit.

Yeah, 12 minutes of 33 is all I can take on a Sunday, started watching a couple times before too.

All I can say is that if there is any 'systemic collapse' that we are still in danger of, it's going to kept a secret.

6 years is a long time to deal with anything.

All I can say is that if there is any 'systemic collapse' that we are still in danger of, it's going to kept a secret.

Don't think it is going to play out in secret.

Here, take a look at a simulation by james rickards, he's the guy that designed the first financial warfare simulations for the pentagon. It is 8 minutes and gives you some sense of how currency wars can play out:

This whole scenario is absurd. There is nothing to prevent COMEX declare Force Major and refuse delivery if anyone tries to corner the market like Hunts Brothers did. Better yet, 2000tons can be delivered over many years, just like what the USFED is doing to Germany's 300tons of their "own" gold. Even more importantly, there's nothing the Chinese leader would do when getting stiffed, just like the Germans government officials are not doing jack when getting "gently" stiffed. Even more than Angela Merkle, Chinese leaders actually have their kids in the US attending colleges. What? Bomb their own kids? It's ridiculous.

The trade deficit itself will reverse shortly as the US becomes the top oil and gas producer in the world, and manufacturing comes back to the US due to automation.

hyperinflation is coming (read the article of the post your in dummy)

You should read the post. Hyperinflation had a chance, but it never materialized.

That is the problem. Hyperinflation isn't coming, but deflation is.

The global economy is contracting, we are past peak energy, and there is a real need for resource distribution.

The Deriviatives market stands a $1 Quadrillion, and that is another meaningless number.

You have nothing here.

The video itself has something to offer in terms of discussion, but you have only conspiracy theory hysteria to quote.

Move along back to your silver thread fantasies, and leave Real Estate alone, it obviously eludes you.

The trade deficit itself will reverse shortly as the US becomes the top oil and gas producer in the world, and manufacturing comes back to the US due to automation.

These are valid points. What I think most conspiracy theory hysteria misses is that we are a global economy, with more transparency than there has been ever before.

The world is changing.

For the comment about the COMEX James is explaining that if the chinese buy contracts on the COMEX and attempt to call them all in at once they will simply settle in cash because they have the ability to do so in the contract. Normally if a client has a futures contract and wants to take delivery the COMEX does this.

So in other words, it's a big Nothingburger. James Rickards is a book seller. If he is really as important to the Pentagon as he implies, the Pentagon wouldn't be allowing him to make all those noises.

Here's the bottom line:

1. If the Chinese really want to maximize the gold they can buy from the international market, they would be buying it quietly with minimal impact to price as possible. The idea of demanding delivery on 150,000 contracts (2000tons) all at once is more than absurd. And as I mentioned in my previous post, and Rickards admit, even if they did, it would be a Nothingburger as the rules of Comex is set up precisely to prevent such attempt at cornering the market. The Comex is a price discovery place for the industry, not a price manipulation place (although there are arguments for PTB manipulating it the other way; if you believe so, go pick up more gold for yourself, quietly)

2. The scenario that he presents goes off on a non-starter. The next assumption that the Chinese government would somehow resort to war of any sort for denied delivery is even more absurd. Frankly, even if the Chinese have its military watch all its gold, it can not guarantee some of it does not flow back to the US or some of the officials knowingly accept tungsten bars! That's how hopelessly corrupt the Chinese bureaucracy is. Ours are not much better, but given a choice, corrupt bureaucrats in either country would still prefer parking the rest of their lives and their personal wealth in the US than in China. We are not talking about US vs. Switzerland or vs.Cayman Island or even Canada here.

3. The Syrian response to Israeli bombing so far should give you a hint how those international hissy fits work. Big Nothingburger when one party is way too occupied with domestic issues. Just like the Syrian leader's top priority is ensuring he and his family would spend the rest of their lives abroad after their regime is toppled (therefore extremely unlikely to respond to Israeli attack), the Chinese leaders already have their family members in the US and other western countries as citizens of the newly adopted countries. What do you think they will do when their creeky regime is under international pressure? Big Nothingburger.

The coming "collapse" is not some kind of international war, but a financial collapse that will transfer even more of the damage to the creditors of the US government. There's nothing the creditors can do about it. That includes domestic and international bond holders, and cash holders, as well as holders of all sorts of promises by the governments of the world. A real war of any kind is however highly unlikely.

They are already doing this and also buying gold mines. The scenarios are for the escalation of the currency wars and possibilities.

"This" meaning they are trying to get gold without driving up price. The so-called scenario is the exact opposite: presenting 150,000 contracts for delivery all at once would only drive up price without getting them any gold.]

n fact, it seems to be following the beginning of the scenario with Isreal bombing Syria another middle eastern country similar to Iran.

And the Syrian response has been? The Syrian president doesn't even dare to call Israeli action as an act of war, for crying out loud. There is no WWIII if one side has no intention of fighting.

The Chinese are already engaging in currency wars and executing computer attacks already against US companies like google and the US govt.

"Currency war" is no more a war than a "junkyard war." It's just a term that the government uses to cover up for its irresponsible debasement of local currency. The Chinese government hasn't even engaged in deliberate debasement of its own Yen lately. If anything, the Chinese Yen is artificially trading at a level much higher than what a free float would land it: millions of Chinese probably would prefer converting their savings to the US dollar. Computer network penentrations are the sort of things all governments waste their time on. The Chinese government is quite divided internally regarding relationship to Google, due to one faction's financial/censorship interest in a domestic competitor in China.

History shows this is exactly how world wars get started by some small first attack that seems unimportant but escalates.

Also, there is Russia and China backing Syria not insignificant military powers.

History shows that there have been far more forecasts of world wars than actual world wars. You have to have two sides both think themselves can win before any major war can take place. In the current world, nobody is interested in engaging the US in a global war, aside from the infamous patsy "toilet" organization.

I suggest you read the book or read up on what the end result is of currency wars and start listening to the people paid to predict them for the military.

The military has dozens and dozens of war scenarios at any given time. That's what the military is paid to do, and how they get funding.

Those countries holding the gold at the end of musical chairs wins.

King Darius of Persia must be wondering how he lost his empire to Alexander. Heck, how did Croesus lose his?

Countries are also going to need all those commodities to survive and is why China is spending it's time buying commodity companies all over the world and stockpile them

There is no real shortage of commodities in the world. The Chinese have been buying much in the last few years simply because they do not have better investment ideas. IMHO, in the long run, they will lose money on those hoards.

while the US is wasting away printing fake dollars trying to pump up the stock and housing markets. When the US needs those rare earth materials and can't have them how do you think they will get them?

Mine them and buy them. Rare earth material is not rare. It's all over the world, just takes time and effort to mine. The Chinese accounted for much of the world's production only because their labor used to be cheap and they didn't give a rat's ass about polluting their environment mining the stuff.

Do you see countries in the middle east at peace like Egypt or Syria because the currency wars are making food prices in those countries too expensive so the population implodes into civil war?

"Currency War" has no real meaning. Competitive devaluation between neighbors took place numerous times: Britain in the early 1990's, Agentina and Brazil every decade.

Civil war in some parts of the world is a possibility. The far more severe ones might be those in Russia (when commodity price collapses) and in China (when their communist party collapses). If those giant countries break up into smaller pieces, hopefully peacefully, it will be good thing for the rest of the world.

You could have said this about Iraq. Look at the war we initiated on this "nothingburger" country with no nuclear weapons and how many years, lives, and money it costs to end up with just another corrupt govt there. The middle east is a hornets nest and is critical to US national interest of oil so it is anything but a "nothingburger" concern.

Nobody is talking about ground invading and occupying Syria. The so-called "scenario" talks about Russia and China coming to the aid of Iran and Syria in a massive stand-off. Well, guess what, they are not. Syria is bending over backwards to avoid a war.

As the US becomes the world's top oil and gas producer, the importance of middleast recedes into the background.

« First « Previous Comments 121 - 160 of 174 Next » Last » Search these comments

http://www.youtube.com/embed/seBWlOMt2Tk