patrick.net

An Antidote to Corporate Media

1,354,844 comments by 15,730 users - Maga_Chaos_Monkey online now

« First « Previous Comments 21 - 59 of 59 Search these comments

Id say buy a bunch of rope, fasten a noose, and climb a tree and hang yourself. I mean, what better thing could one do with money then to leverage themselvges into uber awesome coastal calif real estate. Its like so effin cool!

Do you really want to buy a house to live in one, or is it something you want to do because you've heard that's a good place to put money?

I was in a similar boat as you, sitting on a bunch of cash, half invested and half earning almost nothing, but my wife and I are in need of a nicer place to live, so we decided to buy right now, despite the horrible prices, because we need a home. Renting in the areas we like is very expensive, so purchasing isn't too bad compared to that (though still, the numbers favor renting, it's just that the rental market for SFH is very tight). So, I spent $250k+ on a down payment, and bought a house at a time I think is a really dumb time to buy, and I fully expect to lose money if I have to sell in the next decade, and even after that, I expect that while I may not be underwater in dollar terms, that money will have done worse than investments.

We are in a real estate bubble, but it's really hard to time when it will pop. The stock market is just as overvalued as housing for the same reasons. Banks have a lot of exposure to these assets, and the Fed exists only to help banks, its dual mandate is bullshit. This environment makes it impossible for us unconnected people to protect ourselves from the inflation, so I just figured, screw it, I need to live my life like I want and not wait for stuff to get cheaper, since i don't know how long to wait and I'm not immortal.

Take it out in bundles of ones and build a cash fort in your living room.

APOCALYPSEFUCK is Shostakovich says

Yams.

Fresh water.

Dynamite.

This is where you want to put your money.

Add a Gatling gun and lots of ammo.

And a barrel of whiskey.

APOCALYPSEFUCK is Shostakovich says

Yes, of course. Why dig out a sniper's nest at your siege if you're not going to arm it appropriately?

Do you have a philosophical disposition against can goods?

Do brass caseings count as cans?

Since May I'm sitting in about 50% cash as well. Even if it's earning next to nothing, it's doing better than PMs or the stock market.

inflation is going to make cash worthless.

This is precisely why I despise inflation. A person should not have to gamble with his savings in order to prevent those savings from losing value while he saves up for a reasonably priced house. This is simply not socially just.

Keep piling the cash, their is no right time, the key is to live where you REALLY want to live, if you have to rent until then, so be it. If your able to stack that much cash, just keep going!, and invest conservatively, your doing well and many will never be able to amass wealth like you are doing.

A person should not have to gamble with his savings in order to prevent those savings from losing

This is an idea especially supported by those with the most money. Way better not to even think about working while massive income arrives at the door. Of course the love making money hand over fist when the opportunity arises but don't want to lose any.

This is an idea especially supported by those with the most money. Way better not to even think about working while massive income arrives at the door. Of course the love making money hand over fist when the opportunity arises but don't want to lose any.

Money devaluation hurts all savers, especially on the poorer end who saved for retirement and now live on fixed income.

Keep piling the cash, their is no right time, the key is to live where you REALLY want to live, if you have to rent until then, so be it. If your able to stack that much cash, just keep going!, and invest conservatively, your doing well and many will never be able to amass wealth like you are doing.

I would like to buy now, but can't see myself paying alot of money for a fixer, even if I could find one in the limited inventory available. If the bubble doesn't pop in the next 2 years, I won't buy and will continue renting and saving.

In 10 years I will be retired and move out of state, buying with cash.

California is not the best place to retire, unless you bought 30 years ago.

I was in a similar boat as you, sitting on a bunch of cash, half invested and half earning almost nothing,

Agree with you 100% . its almost like you are describing my personal situation.

I also waited along sidelines for 9 years (reading patrick.net) resisting the urge to buy. I finally bought house in Mountain View in Feb.

time will tell if this was a right decision.

A person should not have to gamble with his savings in order to prevent those savings from losing

This is an idea especially supported by those with the most money. Way better not to even think about working while massive income arrives at the door. Of course the love making money hand over fist when the opportunity arises but don't want to lose any.

1. I've worked for every dollar I have.

2. I'm working right now.

3. The rich are not nearly as affected by inflation as the middle class. The rich can avoid inflation with preferred stocks, art, farmland, etc. The middle class has little recourse except gambling in common stocks.

4. If you want to prevent a growing rich-poor gap, you should be against inflation and for a progressive wealth tax.

Keep the cash until:

1) The fed starts getting really frustrated about the lack of efficacy of it's QEternity. At this point, put 50% of your money in.

2) The fed makes an official statement that, no matter what, they will target inflation higher, without a specific number to target. Then go 100% in.

Oh, i forgot. If you have so much cash, and do not know what to do with it: Donate 0.1% of it to the poor. This will make you a better person, something that the best investment in the world will never be able to do for you.

1) If your 300k is in one account, you're FDIC insurance may not be enough to cover you should your bank ever fail. [not likely, but just thought I'd point that out]

2) A high yield checking should pay you more than $50/month

3) Don't buy based on trying to time the market. Your post makes it sounds like that's what your doing.

4) Interest rates going up historically (and I wish I had the data - it was in a different thread a few years back) cause prices to RISE, not fall.

5) With $300,000 you can probably buy a home in 90% of the country, for cash. Most people don't like uprooting - particularly if they have familial ties to an area - but it never hurts to look at all potential options.

6) don't buy into your comfortable with the idea. Buy because A) you can afford it B) you get "fair value" for your money C) you're going to live there for a while. [Unless your buying a portfolio of investment properties - but my guess is that ship has already sailed]

Remember Singe Family Homes are (rarely) an investment.

Thanks a lot friends for your valuable suggestions. Now, if I decide to buy a home - I am confused for couple of things.

1. When I look at houses worth 700k in the areas I am interested in, basically I am getting value for money. Houses are really small and in fact I might have to move again after 5 years or so (I have 2 small kids).

2. Other options is going for 1M range in which case I put down 200 and keep the remaining 100 as backup.

My question to you is, is it work going for such a big house and paying higher property taxes? Should there be a down town, will that difference (between million dollar house and 700k house) remain same?

Man, an $800,000 mortgage is a huge leap forward from a $400,000 mortgage. Have you done the numbers? Just from my cursory glance, the monthly nest egg would be drastically different especially since you would be over the conforming limit, so it really depends on what amount of money you are willing to spend on housing per month.

A person should not have to gamble with his savings in order to prevent those savings from losing

This is an idea especially supported by those with the most money. Way better not to even think about working while massive income arrives at the door. Of course the love making money hand over fist when the opportunity arises but don't want to lose any.

The wealthy invest in stocks because it offers the most growth potential in the long term, beating inflation is not necessarily their #1 objective.

Thanks a lot friends for your valuable suggestions. Now, if I decide to buy a home - I am confused for couple of things.

1. When I look at houses worth 700k in the areas I am interested in, basically I am getting value for money. Houses are really small and in fact I might have to move again after 5 years or so (I have 2 small kids).

2. Other options is going for 1M range in which case I put down 200 and keep the remaining 100 as backup.

My question to you is, is it work going for such a big house and paying higher property taxes? Should there be a down town, will that difference (between million dollar house and 700k house) remain same?

Use bubble to your advantage. The rich invest ahead of bubbles and get out when the "retail" investor gets in.

I read where Buffet has 47 billion in cash. That might mean something?

The wealthy invest in stocks because it offers the most growth potential in the long term, beating inflation is not necessarily their #1 objective.

The wealthy also have access to information you do not.

The wealthy invest in stocks because it offers the most growth potential in the long term, beating inflation is not necessarily their #1 objective.

The wealthy also have access to information you do not.

I have to agree here. With stocks, as a retail investor, you have a high chance of losing the principle as well. Look at apple

$300K is 2-4 weeks worth of money for a reasonable sized startup which can expect to spend $20,000,000-$200,000,000 before a liquidity event with a 50% chance the investors won't get all their money back (the last two craters I experienced saw the investors get $4M out of $20 back and $13M out of $35). Smaller endeavors with less experienced investors and principals are far less likely to succeed. Also note that while over-night successes get a lot of press a 7-10 year period in which investors are illiquid is more common.

What kind of business are you starting with $300,000 to spend in 2-4 weeks? Most businesses you see in America today were started with nothing by $5 and a great idea and a whole lot of free time.

What kind of business are you starting with $300,000 to spend in 2-4 weeks?

You have to provide cappuccino machines, cafeterias and swimming pools for the hipster douchebags you hire to create your useless video games.

Why not 1 in 25??

I would second the business, but only if it's something you've been mulling over for a long time, and have some idea what it takes to make such a business a success.

I'm never surprised when dart board entrepreneurs fail.

The odds are 4 in 100 after 5 years. No not the business idea.

Then why not 40,000,000 in 1,000,000,000??

Why not 1 in 25??

I think the way I said it makes a better point.

Then why not 40,000,000 in 1,000,000,000??

Why not 1 in 25??

I think the way I said it makes a better point.

I don't want to be pretentious like O

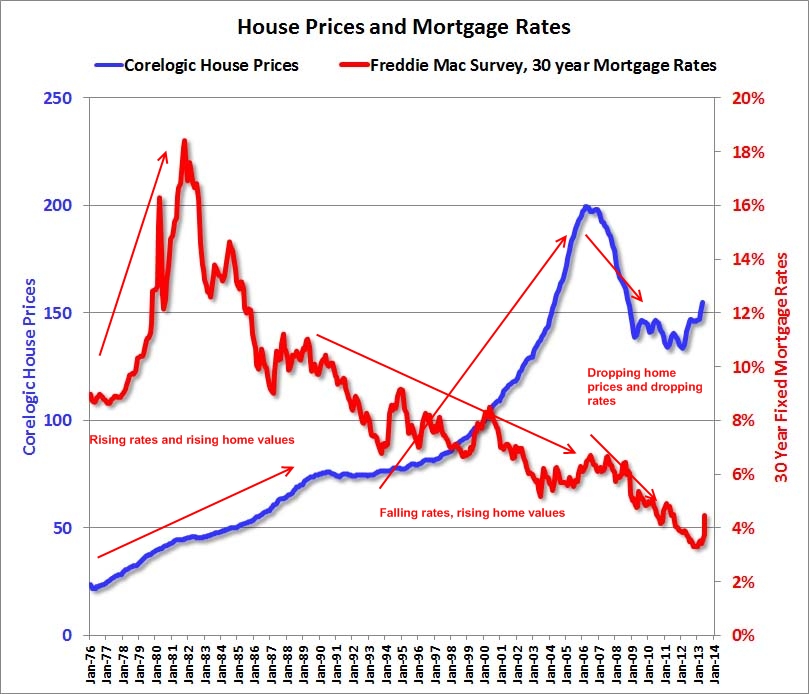

I'm buying when these two lines cross again.

They have a way to go, don't they.

Man, an $800,000 mortgage is a huge leap forward from a $400,000 mortgage. Have you done the numbers? Just from my cursory glance, the monthly nest egg would be drastically different especially since you would be over the conforming limit, so it really depends on what amount of money you are willing to spend on housing per month.

If I decide to buy, is it right time to buy in sf bay area? Or should I wait couple of months until interest rate hike is digested by markets (i.e sellers and hence lower their expectations)

I think it would be wise to purchase a few quality rental properties preferably at the court house.

Smart money is spent opposing the herd...

When the herd sells, smart money buys.

When the herd buys, smart money is selling

So the big question is, what is the herd doing?

I'll tell you, they are stuffing their faces with subway sandwiches, nonfat yogurt, and lettuce wraps......

this health fad shit won't last...go against the herd...

and invest in this.

http://www.franchisesolutions.com/franchise/French-Fry-Heaven.cfm

Inflation is a(the) price of our modern capitalism. Insidious as it is, it demands an important lesson that capital (stored labor) must be expected to suit up and further do labor. The only response we have to inflation is to make our capital make capital at least at a rate equal to inflation in order to make it real.

The problem is we don't operate under a capitalist system anymore. It's devolved into fascism/corporatocracy.

I am reading these articles, when interest rates go up, dollar value actually will go up. When dollar goes up, should I be able to buy more housing, more services for the same money. Or it does not apply to SF bay area?

It might not take long.

Do you really see interest rates going up to 10% by next year. Then I am definitely sitting tight on cash.

Inflation is a(the) price of our modern capitalism. Insidious as it is, it demands an important lesson that capital (stored labor) must be expected to suit up and further do labor. The only response we have to inflation is to make our capital make capital at least at a rate equal to inflation in order to make it real.

Pure Kool Aid

I think it would be wise to purchase a few quality rental properties preferably at the court house.

@drudometkin,

Have you done this? Can you show us step-by-step on how to do it?

« First « Previous Comments 21 - 59 of 59 Search these comments

As I said in my previous post, I did not buy a house when it was the right time. Now I have about 300k sitting in my bank earning about 50 bucks a month. I dont want to invest in stocks because I am worried I might lose it and left with nothing if I want to buy a house. I feel this is not the right time to buy a house as well because interest rates are just going up, its going to take few months to have any effect on real estate.

Please let me know what would you do. Thanks.

#housing