patrick.net

An Antidote to Corporate Media

1,355,178 comments by 15,730 users - Maga_Chaos_Monkey online now

« First « Previous Comments 41 - 59 of 59 Search these comments

The wealthy invest in stocks because it offers the most growth potential in the long term, beating inflation is not necessarily their #1 objective.

The wealthy also have access to information you do not.

I have to agree here. With stocks, as a retail investor, you have a high chance of losing the principle as well. Look at apple

$300K is 2-4 weeks worth of money for a reasonable sized startup which can expect to spend $20,000,000-$200,000,000 before a liquidity event with a 50% chance the investors won't get all their money back (the last two craters I experienced saw the investors get $4M out of $20 back and $13M out of $35). Smaller endeavors with less experienced investors and principals are far less likely to succeed. Also note that while over-night successes get a lot of press a 7-10 year period in which investors are illiquid is more common.

What kind of business are you starting with $300,000 to spend in 2-4 weeks? Most businesses you see in America today were started with nothing by $5 and a great idea and a whole lot of free time.

What kind of business are you starting with $300,000 to spend in 2-4 weeks?

You have to provide cappuccino machines, cafeterias and swimming pools for the hipster douchebags you hire to create your useless video games.

Why not 1 in 25??

I would second the business, but only if it's something you've been mulling over for a long time, and have some idea what it takes to make such a business a success.

I'm never surprised when dart board entrepreneurs fail.

The odds are 4 in 100 after 5 years. No not the business idea.

Then why not 40,000,000 in 1,000,000,000??

Why not 1 in 25??

I think the way I said it makes a better point.

Then why not 40,000,000 in 1,000,000,000??

Why not 1 in 25??

I think the way I said it makes a better point.

I don't want to be pretentious like O

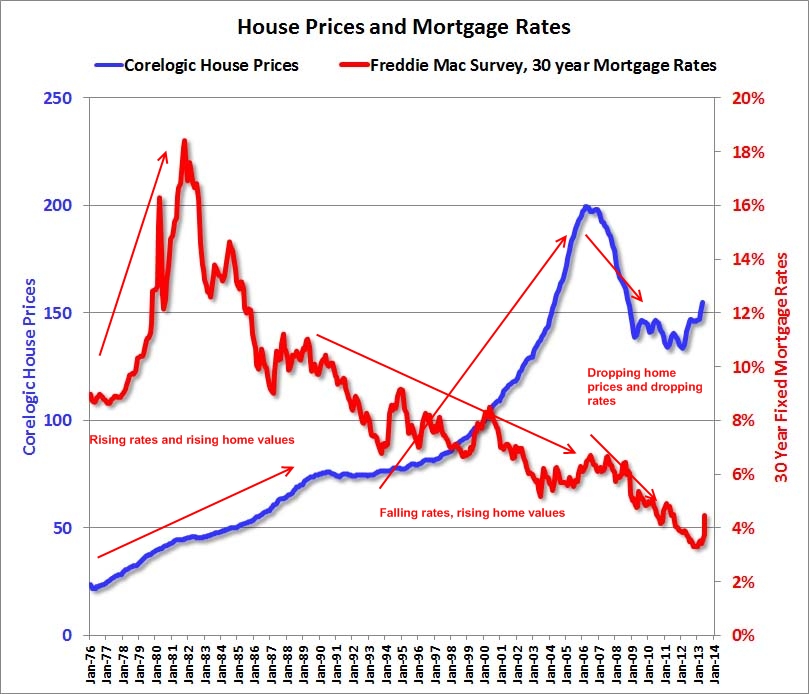

I'm buying when these two lines cross again.

They have a way to go, don't they.

Man, an $800,000 mortgage is a huge leap forward from a $400,000 mortgage. Have you done the numbers? Just from my cursory glance, the monthly nest egg would be drastically different especially since you would be over the conforming limit, so it really depends on what amount of money you are willing to spend on housing per month.

If I decide to buy, is it right time to buy in sf bay area? Or should I wait couple of months until interest rate hike is digested by markets (i.e sellers and hence lower their expectations)

I think it would be wise to purchase a few quality rental properties preferably at the court house.

Smart money is spent opposing the herd...

When the herd sells, smart money buys.

When the herd buys, smart money is selling

So the big question is, what is the herd doing?

I'll tell you, they are stuffing their faces with subway sandwiches, nonfat yogurt, and lettuce wraps......

this health fad shit won't last...go against the herd...

and invest in this.

http://www.franchisesolutions.com/franchise/French-Fry-Heaven.cfm

Inflation is a(the) price of our modern capitalism. Insidious as it is, it demands an important lesson that capital (stored labor) must be expected to suit up and further do labor. The only response we have to inflation is to make our capital make capital at least at a rate equal to inflation in order to make it real.

The problem is we don't operate under a capitalist system anymore. It's devolved into fascism/corporatocracy.

I am reading these articles, when interest rates go up, dollar value actually will go up. When dollar goes up, should I be able to buy more housing, more services for the same money. Or it does not apply to SF bay area?

It might not take long.

Do you really see interest rates going up to 10% by next year. Then I am definitely sitting tight on cash.

Inflation is a(the) price of our modern capitalism. Insidious as it is, it demands an important lesson that capital (stored labor) must be expected to suit up and further do labor. The only response we have to inflation is to make our capital make capital at least at a rate equal to inflation in order to make it real.

Pure Kool Aid

I think it would be wise to purchase a few quality rental properties preferably at the court house.

@drudometkin,

Have you done this? Can you show us step-by-step on how to do it?

« First « Previous Comments 41 - 59 of 59 Search these comments

As I said in my previous post, I did not buy a house when it was the right time. Now I have about 300k sitting in my bank earning about 50 bucks a month. I dont want to invest in stocks because I am worried I might lose it and left with nothing if I want to buy a house. I feel this is not the right time to buy a house as well because interest rates are just going up, its going to take few months to have any effect on real estate.

Please let me know what would you do. Thanks.

#housing