« First « Previous Comments 6 - 30 of 30 Search these comments

Millennials are often blamed for the drop in homebuying, but Generation X isn't jumping on the homeowner bandwagon either.

Both generations are making rational financial decisions based on the price to value ratio of real estate. Both generations realize that in many markets they have far more to lose than to gain and that stocks and other equities make for far better investments than houses. Neither generation is as ignorant as the Boomers. Both generations are more educated, more rational, and are more capable of using technology to research. The Millennials even more so than Gen X.

Put simply, there are no more greater fools. Information technology decreases the fools per capita, and both generations are smaller than the Boomers to boot.

Both generations are making rational financial decisions based on the price to value ratio of real estate. Both generations realize that in many markets they have far more to lose than to gain and that stocks and other equities make for far better investments than houses. Neither generation is as ignorant as the Boomers. Both generations are more educated, more rational, and are more capable of using technology to research. The Millennials even more so than Gen X.

Put simply, there are no more greater fools. Information technology decreases the fools per capita, and both generations are smaller than the Boomers to boot.

Great post. I hate how the Boomers give advice to their kids and others..."Buy a house...it'll make you rich like I am and all my Boomer buddies." They think they're so smart when in fact they were extremely gullible and stupid and just got lucky on the massive herd phenomenon of all other Boomers buying houses and driving up prices for decades. It became such a cult idea that "you have to own a home", that it snowballed into huge capital gains for everyone participating. Now that the newer (and much smarter) generations are calling bullshit on the "greater fool" theory that Boomers have been bathing in for so long, the Ponzi scheme has to collapse at some point.

I guess we'll classify you too into the "greater fool" category. You make sure you enjoy that renting for the next 10 years and have NOTHING to show for it! We'll see how much smarter you are....

Ok

All they have to do is go upstairs from the basement and poison their BoomFuck parents. Problem solved.

They can even hide the bodies and collect the social security checks.

All they have to do is go upstairs from the basement and poison their BoomFuck parents. Problem solved.

They can even hide the bodies and collect the social security checks.

Yes

I guess we'll classify you too into the "greater fool" category. You make sure you enjoy that renting for the next 10 years and have NOTHING to show for it! We'll see how much smarter you are....

That's some funny stuff..... Young people have better things to spend their credit on....

The old man play is gone just like the 1's who think they are smarter then the market

and don't see they are much to late, the crash was here and gone. Greed's a funny

thing, a real monster. The ignorance people in general approach RE as a whole

10 years won't make a bit diff. for most. Same ole shit a diff. yr....

The old man play is gone just like the 1's who think they are smarter then the market

and don't see they are much to late, the crash was here and gone. Greed's a funny

thing, a real monster. The ignorance people in general approach RE as a whole

10 years won't make a bit diff. for most. Same ole shit a diff. yr....

Como?

Millennials are often blamed for the drop in homebuying, but Generation X isn't jumping on the homeowner bandwagon either.

They jumped in and got bit during the bubble. They fueled it with their Banker and Baller jobs.

You know when I was in my 20's I dated women in their late 30's and early 40's, and all of my friends have always been at least 10 years older than me.

I always thought they were too risky and quick to do stupid shit or jumped in things without considering the risks. They started the downward slope that the Melinials are spiraling out of control on.

I just couldn't connect with my generation then I still can't connect with them today.

I was running my own Flooring business with enough contacts that kept me busy without having to work for a shop full time, by time I was 18.

They jumped in the houses that you guys say the Boomers were selling for 200% and 300%, but that's my point. While I was saying... "Don't DO IT JIM!" and renting the same house for 11 years.

Those idiots were all flipping houses and parlaying every dime they made into the next ever bigger super duper huge deal. Just greedy stupid shits, everyone of them. They wouldn't listen to reason about how there's no possitive endgame to the game they were playing. Unless they just didn't give a shit about their kids or really expected them to make 3mil a year when they were in their late 20's and ready to buy a house.

Now they are too stupid to buy a house, beause if they buy it for $170 to $225K they know the value isn't projected to double or tripple over the next three years. So they think the market is broken. THEY the champions of broken markets are worried stable RE markets are broken.

Let them rent for life fuck 'em!

Great post. I hate how the Boomers give advice to their kids and others..."Buy a house...it'll make you rich like I am and all my Boomer buddies." They think they're so smart when in fact they were extremely gullible and stupid and just got lucky on the massive herd phenomenon of all other Boomers buying houses and driving up prices for decades.

Precisely. Boomer were extremely lucky in their birth dates. They lived during a time when the population doubled driving up hard assets like real estate and investments like the stock market. Simply buying anything was a guarantee path to riches. But such asset appreciation requires a constantly increasing population, and that's not happening anymore.

Now that the newer (and much smarter) generations are calling bullshit on the "greater fool" theory that Boomers have been bathing in for so long, the Ponzi scheme has to collapse at some point.

Ponzi schemes always start to collapse when the population of prospective new buyers becomes less than the population of old buyers. At that point, demand is insufficient to generate higher prices and old buyers all start trying to cash out. The longer one waits to cash out, the less money one gets if one gets any.

I guess we'll classify you too into the "greater fool" category. You make sure you enjoy that renting for the next 10 years and have NOTHING to show for it! We'll see how much smarter you are....

Ok

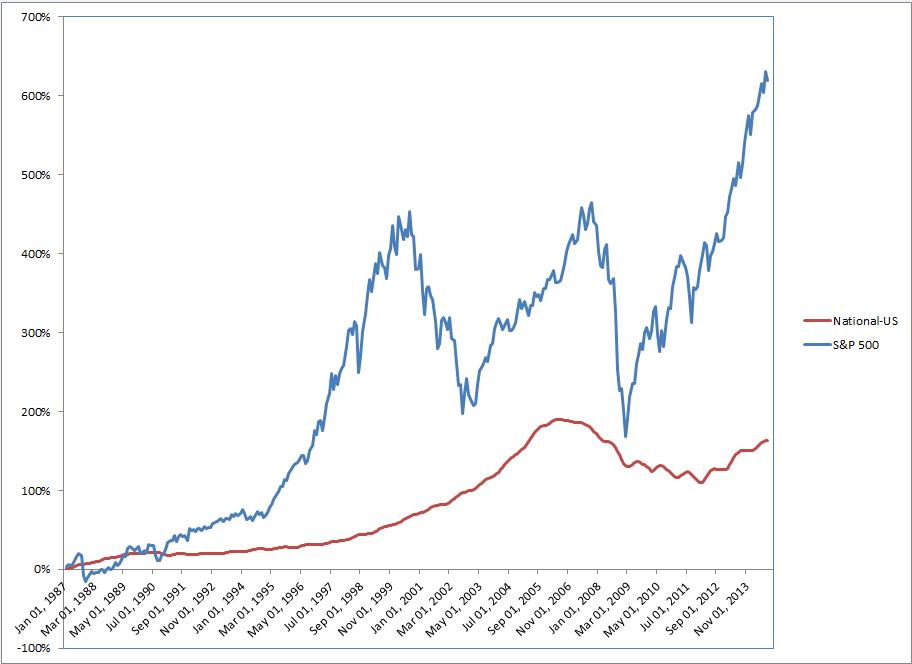

CIC is a dumb ass who still hasn't realized that even with the housing bubble, stocks outperform real estate over any long period.

For the majority of U.S. history – or at least as far back as reliable information goes – housing prices have increased only slightly more than the level of inflation in the economy. Only during the period between 1990 and 2006, known as the Great Moderation, did housing returns rival those of the stock market. The stock market has consistently produced more booms and busts than the housing market, but it has also had better overall returns as well.

So what do we have to show for not buying overpriced houses? The answer is wealth, and lots of it.

Both generations are making rational financial decisions based on the price to value ratio of real estate. Both generations realize that in many markets they have far more to lose than to gain and that stocks and other equities make for far better investments than houses. Neither generation is as ignorant as the Boomers. Both generations are more educated, more rational, and are more capable of using technology to research. The Millennials even more so than Gen X.

Put simply, there are no more greater fools. Information technology decreases the fools per capita, and both generations are smaller than the Boomers to boot.

Great post. I hate how the Boomers give advice to their kids and others..."Buy a house...it'll make you rich like I am and all my Boomer buddies." They think they're so smart when in fact they were extremely gullible and stupid and just got lucky on the massive herd phenomenon of all other Boomers buying houses and driving up prices for decades. It became such a cult idea that "you have to own a home", that it snowballed into huge capital gains for everyone participating. Now that the newer (and much smarter) generations are calling bullshit on the "greater fool" theory that Boomers have been bathing in for so long, the Ponzi scheme has to collapse at some point.

That's what I had expected to happen in 2008-2010, but the boomers bailed themselves out at the expense of renters and savers and younger generations. Political power enabled the Ponzi schemers to get the benefit while the people who hadn't fallen for the scheme paid the price. Instead of letting overpriced house prices fall, the political pressure seems to be to raise the price of everything else. In our empire of debt, the merchants of debt control policy, and they don't let LTV ratios rise above 100%.

Except, assholes like you forget one thing, you can't compare housing and stocks in a vacuum, because you're still cutting a check each month to pay for your shelter, and getting zero equity in return for it.

You can't. Financial professionals can and have. Their conclusion is shown in the graph above. There have been countless articles written on this subject matter. All of the conclude the same thing. Real estate is a pitiful investment and stocks pay orders of magnitude better even after the mortgage interest deduction.

If you weren't a dumb shit, you'd read and learn. But you're too much of a stubborn ass to correct your mistakes. That's why you cannot believe how much richer I am than you. You simply have no idea how bad your financial decisions are because you are incapable of learning. And that's why you deserve to be poor.

Political power enabled the Ponzi schemers to get the benefit while the people who hadn't fallen for the scheme paid the price. Instead of letting overpriced house prices fall, the political pressure seems to be to raise the price of everything else

That's only a partial bail out. Eventually the cost of food, health insurance, medication, etc. causes the real price of houses to fall. It just becomes a slow death march.

The government can delay the inevitable; it cannot stop it.

That's only a partial bail out. Eventually the cost of food, health insurance, medication, etc. causes the real price of houses to fall.

True, but that is basically the borrow&buy argument, i.e. buy now and pay later when dollars will have lower real value. It's the bait that lures people into the Ponzi scheme.

BTW, Gen-X and Millenials are more likely to live in cities where most jobs are, and where Islam seems most likely to attack. Terror attacks jeopardize property values. If the number of terror attacks continues to grow, then the prospect of a $300k mortgage to buy a condo in a city that people might soon feel terrified to live in might also cause Gen-X and Millenials to prefer renting.

Too bad you're completely clueless to my financial situation

I know exactly what your financial situation is.

BTW, Gen-X and Millenials are more likely to live in cities where most jobs are

It goes even further than that. Millennials have experienced a cultural shift as well. They prefer to have a small apartment in the city than a big house in the suburbs. Some of that is do to being single even into their 30s, but it's also a cultural attitude that's different from Boomers.

Millennials are also a lot more active. Almost every Boomer I know spends his or her free time watching TV on the couch. Most Millennials I know spend little time on TV, and when they do it's Internet-based like Net Flicks or YouTube, and are a lot more active. They don't care that their apartments are small because the only time they spend there is when they are sleeping or showering. Otherwise, they are at a park, on the beach, at a Starbucks, or doing some other social activity. And with smartphones and social media, when they are online they are also outside.

Boomers like to surround themselves with stuff. Millennials like to spend their time doing stuff. Millennials spend more of their money on experiences rather than things in contrast to their Boomer parents. It's more about the here and now.

Here is the link to the original article, which seems to have gone missing: http://money.cnn.com/2015/06/25/real_estate/generation-x-homeownership/

Here is another interesting, article about gen x from January 2015:

http://www.marketwatch.com/story/10-things-generation-x-wont-tell-you-2014-06-27?page=10

Ironman/CIC: Who made you the Thread Police? If people want to bring up older threads, then obviously they are still relevant. Why do you belittle people for this?

Millennials have experienced a cultural shift as well. They prefer to have a small apartment in the city than a big house in the suburbs. Some of that is do to being single even into their 30s, but it's also a cultural attitude that's different from Boomers.

Millennials are also a lot more active. Almost every Boomer I know spends his or her free time watching TV on the couch. Most Millennials I know spend little time on TV, and when they do it's Internet-based like Net Flicks or YouTube, and are a lot more active. They don't care that their apartments are small because the only time they spend there is when they are sleeping or showering. Otherwise, they are at a park, on the beach, at a Starbucks, or doing some other social activity. And with smartphones and social media, when they are online they are also outside.

Boomers like to surround themselves with stuff. Millennials like to spend their time doing stuff. Millennials spend more of their money on experiences rather than things in contrast to their Boomer parents. It's more about the here and now.

Another great post, man. So true.

The Boomers did all those activities 30 years ago asshole!!

No, they didn't, dumb ass. Millennials are a lot more active even in their 30s then Boomers were in their 20s. And you don't have to be active to sit on a bench in a park, yet most Boomers prefer the couch and the t.v. Millennials didn't grow up channel surfing like Boomers. It's a different culture.

Of course an old fart like you couldn't possibly realize that. The last time you spent time with a young woman it was in court listening to the judge issue the restraining order.

The only outside activity you get is going to the petting zoo to pick up interspecies STDs.

It goes even further than that. Millennials have experienced a cultural shift as well. They prefer to have a small apartment in the city than a big house in the suburbs.

this is patently false - and is why the democrats/greens/de-growth crowd may lose all political power for many years to come.

you can't raise kids in the city. period. millennials do favor mixed-use eco-friendly spaces, but those are in the suburbs, not downtown.

this is patently false - and is why the democrats/greens/de-growth crowd may lose all political power for many years to come.

you can't raise kids in the city. period.

Most Millennials I know aren't even thinking about having kids until their 40s. Half of them don't ever want to get married or have kids.

http://www.realtor.com/news/real-estate-news/generational-home-buying-trends/

+ Just 17% of buyers under the age of 35 closed on urban residences, down from 21% a year earlier

+ About 51% of millennial home buyers scooped up residences in the suburbs or a subdivision

+ Millennials make up the largest share of home buyers at 35%, according to the report. That should come as no surprise, given the unprecedented size of their generation (83 million) and the life changes that are motivations for buying a home (nearly two-thirds of millennial buyers are married, while almost half have children living with them—and are therefore probably desperate for more space).

Millennials are often blamed for the drop in homebuying, but Generation X isn't jumping on the homeowner bandwagon either.

The U.S. homeownership rate has been falling since 2005, and Gen-Xers are a big part of the decline.

Homeownership among those aged 35-54 has dropped the most of any other age group since 1993, according to Harvard's State of the Nation's Housing 2015 report -- especially those under age 44.

"The market peaked right when they were at peak first-time buying age," said Daniel McCue, senior research associate at The Joint Center for Housing Study of Harvard University.

And the older members of the generation were at the age when people normally trade up to bigger homes, just when the housing crisis struck.

"They were subject to the decline in home prices, which made [some homes] subject to distress, underwater and delinquency," McCue said.

The homeownership rate, which currently sits at 63.7%, has been propped up by Baby Boomers, the report found, a trend Gen X might not be able to support given its smaller size.

"When we look at Millennials, their homeownership rates are low ... they have a much higher chance of building careers and catching up, but for those aged 35-44 it's more of a question," said McCue.

Generation X, which the study defined as those born from 1965-1984, play an important role in the housing market. Their trading-up activity frees up inventory for new first-time buyers.

But this isn't happening: The number of homeowners aged 35-39 has dropped 23% from 10 years ago, according to the report.

Instead of buying, Gen Xers are staying in the rental market longer. "The normal cycle of renting and moving onto homeownership and making room for younger renters to follow isn't happening as quickly," said McCue.

And they might not become homebuyers any time soon. More demand in the rental market has led to higher rents, which makes it harder to save for a down payment.

Stagnant wages also make owning a home a financial hardship: For households aged 35-44, incomes are at mid-1980s levels, the report found. The situation is more grim for those aged 45-54, whose incomes are the lowest since the end of the 1960s.

Memories from the housing crisis can make potential buyers hesitant to commit to homeownership.

But we could see more Gen Xers become homeowners soon with the return of those who lost their homes during the crisis.

About 11 million people were foreclosed on during and in the wake of the housing crash, according to Lawrence Yun, chief economist at the National Association of Realtors. Only about 2 million have returned to the market since.

"The remaining percent, we will see a steady conversion from renting into ownership," he said. "It won't be sudden, it will take some time."

#housing