Thread for orphaned comments

2005 Apr 11, 5:00pm 234,329 views 117,730 comments

by Patrick ➕follow (59) 💰tip ignore

« First « Previous Comments 2,112 - 2,151 of 117,730 Next » Last » Search these comments

Oh, and don't forget, almost total government support of the mortgage market via FHA (which just so happens to amount to a free down payment with the tax credit...)

Of course it's not all inclusive...but you also need to look at your demographic. The statistics show that the majority of sales are on the lower end (which means the credit has an even bigger impact). Interest rates were also at a historic low coinciding with the last months of the tax credit. And the biggest sales increases are in the cheaper areas (22% in the mid-west, compared to a FALL of 5% in the West...).

My point stands. I am not calling the bottom nor saying we are in the midst of a recovery until all the government funny business stops, and interest rates are at a normal level.

FWIW the 8K tax credit had no bearing on my purchase decision. I still have to send my taxes off. I had it *almost* perfect this year, was going to get $89 back. I did do FHA and the 8K doesn't come close to covering what we had to put out (~20K or so)

I also think interest-rate increases will put downward pressure on the market for awhile. So many buyers are "monthly payment" borrowers that a rise in interest rates will have a direct negative impact on the amount they can buy.

Still looks like the 1930 dead cat bounce only extended through unprecedented govt intervention. Lot of people were wiped out when the real crash happened.

Stronger jobs, services reports send stocks higher

Pending home sales rise 8.2 percent in February

Oil Surges to 17-Month High on Signs of U.S. Economic Growth

TREASURIES-10Y yield hits 4 pct on signs economy picking up

I also think interest-rate increases will put downward pressure on the market for awhile. So many buyers are “monthly payment†borrowers that a rise in interest rates will have a direct negative impact on the amount they can buy.

For a home I am a "monthly payment" borrower. I have the credit and income to get in to a more expensive place but there was a "comfort zone" of my monthy outlay. If interest rates rise what you can get at the same price changes. If the higher rate drives the housing market down at the same pace it's all good.

If things are "picking-up" why are 400,000 more people on federal exetnded unemployment?

Why has U6 gone up to 16.9 percent? How does that indicate "stronger jobs"?

Stock market is having it's strongest rally since 1930... what could possibly go wrong?

Stock is definitely recovering, not the housing market though as the government intervention causing the delay of the inevitable

Going up!

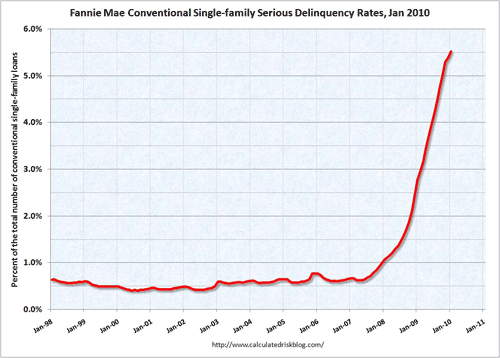

Indeed. Subprime is old news. Yet delinquencies of prime and jumbo loans continue to explode unabated.

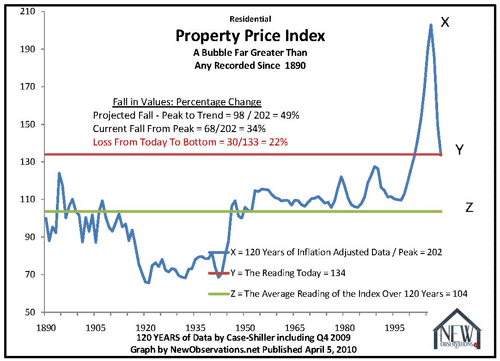

And, speaking of Case-Shiller....

No guarantee the drawn baseline is correct, but nationwide things still look pricey.

There is NOTHING that screams 'recovery.' Foreclosures are steady and loan delinquencies are up, according to Fannie/Freddie. Employment is still way down there in the toilet - particularly for those making less than 100K a year; indeed, long-term unemployment increased by 414,000 over the month to 6.5 million. Over 40% of Americans fall into the long-term unemployed category. HOLY SHIT! Personally speaking, at least three people I know (high and mid-level professionals) have had their salaries either frozen or reduced starting last year.

Personal bankruptcies are up sharply and personal savings rates are back down again, too. It likely only flourished last year thanks to all the squatters/defaulters who were socking away the money they would otherwise have been using to pay their mortgages.

Perhaps there's a takeaway from this; if house prices weren't being gigged, the American consumer might actually have a little more money in his jeans, which necessarily translates to a better personal savings rate and better cash flow in local economies. Now THAT would be good news. Instead, we have a government devoted to throwing as many future generations under the bus to keep the cost of housing as high as possible for the benefit of...whom? Maybe for speculators, but speculators are the natural enemy of anyone who isn't a born taker. So, the takers, the fraudsters and swindlers are all doing well. Huzzah.

>> I challenged everyone to show me this house

Could the problem be that Case-Schiller deals with real houses, and not some imaginary house that you cooked up as a fake and singular counter-example?

"Home sales WAY up."

No they are not, mortgage apps were up in February. I was one of those statistics, and guess what?

I got out of the market, and houses are already 30K cheaper than when I was looking 2 to 3 months ago.

"Roughly 700 million square feet, or 17.2%, of the more than 4 billion of available office space nationwide was unoccupied as of the end of March, according to the real estate research firm Reis. The last time office vacancies were this high was in 1994."

So nobody is renting office space, and nobody is working in those office spaces, then Who's buying houses?

I don't know the ins and outs of the case shiller index, but the main issues I see:

1) Housing in the bay area went up because demand pushed it higher, not inflation. The population has exploded here, so obviously demand will go up. I'm sure a house out in the middle of now where palo alto in 1947 vs no where idaho, with the same price, didn't track identically. I'm guessing one of those homes would be worth significantly more than the other.

2) Housing will go up, if there is access to money. Eg a 30 year loan vs a 5 year loan, greatly increases how much a person could spend. We've got dual incomes now, easier ability to leverage ourselves, etc.

3) Houses from 1947 would be retrofitted with plumbing, electricity etc. But really it would be the land that was worth 99% of the real estate value today. The house would probably pull down the value of the real estate because it would have tear down costs associated with it.

Actually, people are leaving the Bay Area and California in droves. Immigration has slowed way down. I'll look for the actual figures, but I heard it on CBS radio while driving in the car. (I wish I had more time to find the actual numbers, sorry, maybe someone else will.) And I heard on the same program that the Bay Area job market will take 5-10 years to recover. We simply don't have any new industries to support enough job support.

So, where's that demand coming from?

A home selling for $6000 in 1946 does NOT in fact sell for $42,836 today. Depending on what area of the country it’s in, it sells for anywhere between $125,000 and $600,000.

Perhaps -- but the point is that they aren't worth that much, and that they should NOT be selling for so much, and WOULD NOT were it not for either a) cheap credit or b) a nationalized mortgage market.

Your points are interesting. Some hard data that tracks the actual sales histories on a decent cross-section of properties for the last 70-80 years would be nice to add to the dialogue.

Personally speaking, the Case-Shiller index is not the main indicator in gauging how much further housing has to fall -- because it is really a question of that, not whether it will. I prefer the coalface to theory, and based on what I am witnessing at street level, nothing makes me ready to sympathize with the sunny scenarios from your original post. The consumer mindset hasn't really changed - I'll grant you that - but there will continue to be less of the easy credit underpinnings to facilitate discretionary spending/zero savings, and eventually less government intervention to assuage the contractions and inevitable austerity long due the American public. The free-money economy is over for main street, and eventually, even the comedy in housing must come to an end; a too-long fade out to black, it seems, but an end.

Still waiting for the address of the 3 houses from 1930s-50s that are still standing and supposedly prove that Case-Schiller is "wrong".

the case-shiller index shows aggregate prices, not specific homes, and only a nitwit would ask for a specific data point to validate an index number; AND, major metros have likely exceeded the US/State/City indexes for multiple decades.

I'm not as expert as many of the others here, but I thought Case-Shiller was specific homes.

He gave us a link, with 1930's pricing. Come on, at least read his messages before replying with your "This is what will happen! I have no data! and I'm ignoring your data! I'm right!" attitudes.

As far as old housing needing updates, electrical or sewer, we're talking about 75,000 vs 300,000. 225,000 in upgrades to bring a house up to code? We aren't talking about bringing the house up to full code, only none egregious upgrades need to be done. Most houses haven't had all their piping pulled, and wiring pulled from the walls. I've lived in too many of these houses around here to see no ground outlets on any of these houses. They aren't cutting edge upgrades on any of these houses. The case shiller index is including all these homes. Not to mention many of these upgrades would go under the "repair" category. Pulling every wall out of a house to replace electrical and piping isn't common. Once a house gets to that point, it's a tear down.

Housing trading at a premium means nothing. A premium of 50% in the 1930's is added on in the 1930's and now. The premium has been increasing over time, which the case shiller index isn't showing. In fact it's stating that there has been no increase and that is ewogs entire argument.

The comment on earth quakes:

http://www.cnn.com/2010/TECH/science/04/07/earthquake.frequency/index.html?hpt=C1

"Quake frequency normal, scientists say."

In essence: More earthquakes around populated areas this year, nothing else.

Case shiller probably works in areas where demand does not increase. Which is essentially the only areas where people want to live these days.

Otherwise, demand is going to push housing up in an uneven fashion, and will be held there. There will always be a buyer for a property that is in high demand.

The difference between 1968-71 and 2010 is about three trillion in market cap of various tech companies in the South Bay.

The South Bay *invented*, and greatly profited from, the personal computer, the most wealth-creating advance of the 20th century.

The South Bay was a sleepy cowtown and orchards before tech hit.

I thought it was big budget features like The Milpitas Monster that kicked things off for the South Bay.

Tatapu70,

Case-Shiller is based on comparing multiple sales (over time) of the same house. It then aggregates the statistics of such same-house sales. In other words, C-S looks at specific houses, namely those with multiple resales, but then naturally also aggregates many such houses to get a more accurate statistical estimate of price increases.

C-S is also uses the concept of CONSTANT QUALITY houses. If someone puts money into changing the size of the house, say doubling the size. C-S does not count that as a constant quality house. And it shouldn't. If the price went up because you increased the size or standard of the house, that changes both the baseline cost and the new value. If you doubled the house size with an addition or re-build, and the new price went up, some of that must be attributed to the size doubling. Just as an example. Other types of upgrades also matter.

I quote from Wikipedia:

The Case–Shiller Home Price Indices are constant-quality house price indices for the United States. There are multiple Case-Shiller home price indices: A national home price index, a 20-city composite index, a 10-city composite index, and twenty individual metro area indices.

Forget about defaulting, how many countries owe us billions or trillions for saving their bacon when no one else would or could? How about most of Europe, certain Middle Eastern kingdoms? One could go on and on. Maybe it is time to call in those markers!

I also posted an entire page full of homes for sale in the 1930s from all over the country. Instead of acknowledging it, you ignored it.

What would be much more interesting is a sampling of such properties with sales histories or even just tax assessments from over the last seven decades.

CPI in 1925 = 17.5

CPI today = 216

average salary 1925 $1300 a year. [not sure if this is per worker, or per capita]

Home prices in metros 5000 to 10,000.

yes, major California cities have seen higher than inflation price increases. This stands to reason, as they basically grew from nothing to modern cities over this time frame, and the nature of supply and demand have not grown the same in major cities over this time. Salaries have also apparently grown faster than inflation as well, but then again, standards of living have increased. homes today are a bit bigger than 600 square feet of 1926, have more than one small bathroom, have electricity and running water...

These people are probably responsible for the rise in consumer confidence.

Bap33,

Houseprice/income has increased over a number of years from a historical typical value of about 3/1 to over 7/1 in some areas. I think that is well established.

pkennedy--

But, don't you agree that using a countrywide Case-Shiller and applying it to the BA isn't appropriate? I doubt Case or Shiller would try to use the index in that way. Does anyone have a BA index?

I think you all are getting too wrapped up in trying to rationalize absolute/nominal valuations when all you really need to worry about are relative comparisons. Clearly, sometime in the very late 90's house prices became unhinged from their historical levels. In the Bay Area one could argue that it was tons of highly paid high-tech people bidding up prices. And I'm fine with that. However, when the bottom fell out o fthe tech market, wages dropped and people were unemployed; the pace of house price appreciate accelerated. This was clearly a speculative anomaly/bubble. House prices should track people's ability to pay, ie: wages. However for reasons that have been beaten to death house prices continued to climb.

So as I see it, we need to get back to 2000 prices in order to come back to wage-supported valuations. And even that baseline may be too high as employment was higher in 2000 than it is now.

So as I see it, we need to get back to 2000 prices in order to come back to wage-supported valuations. And even that baseline may be too high as employment was higher in 2000 than it is now.

Yes, but there has been 10 years of inflation since then.

@justme

Did you EVER go to the site he referenced?

He pointed out bay area priced housing from the 30's (that is on the site btw if you go there...)

He pointed out their cost

He plotted in onto their data, pulled their value that they should be today

There should be *MANY* houses in around that area. We don't need to be as diligent as case shiller and plot one for one. We simply need to know average costs, and we should find some outliers that fit their methods.There aren't.

Here is one from the site. Now we just need to find a 5 bedroom place in oakland for roughly $80,000.

1934 Oakland California

5 room stucco bungalow , breakfast room , separate garage, delightful location

$3,750

April 6th, 2010 at 1:33 pm | top | q

I have noticed this as well, not Cali, but Oregon, prices dropped a good 20% since the New Year. At least on Craigslist!

What hasn’t been changing in price are the McMansions - they are still in the 400k plus range, laying like snakes on a Southern rural road.

Oregon was late to the sub prime game aka more alt-a type loans and foreclosures aren't going down here but on the rise. The starter homes are moving but they've never really slowed down that much and those are still high priced IMHO.

Going up sure, right into the fryer.

« First « Previous Comments 2,112 - 2,151 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,267,114 comments by 15,153 users - HANrongli, rocketjoe79 online now