patrick.net

An Antidote to Corporate Media

1,260,295 comments by 15,050 users - Al_Sharpton_for_President, DOGEWontAmountToShit, Patrick, Undoctored online now

So... Mr. Bernanke, what would you say ya do here?

2006 Jun 27, 2:31pm 19,996 views 277 comments

« First « Previous Comments 211 - 250 of 277 Next » Last » Search these comments

Sushi is a magical thing.

Sushi is just a tiny part of Japanese cuisine. My mind is now filled with the mental picture of Japanese food, all kinds of Japanese food, whole room filled with Japanese food. So colorful!

Of course, limiting outside growth might encourage that. Right?

If we take away all NIMBYist restricts, one natural consequence is that urban centers will start to build up and far-away suburbs will disappear. People do want to live closer to urban centers if NIMBYism is not denying the right kind of urban-renewal.

As to Japanese food, I only know SukiYaki

I can cook Sukiyaki. Good beef is the key. Vary the portion of sake, mirin, soy sauce, sugar, and water as you please.

Very important: use beef lard to caramelize leek or white onion

Peter P,

I was in the bookstore the other day and they had "Building the Traditional Japanese House Today". The level of craftsmanship that goes into making a simple wood joint is just amazing (especially considering one in an area that will likely never be seen!) It gives us some insight as to their level of dedication and attention to detail that seems at odds with today's construction techniques. Evidently this dedication transfers to their cooking skills as well.

*No Black and Decker tools were harmed in the making of this book!

>>I’m at a loss to explain this as well. So had the Fed raised 50 bps we would have had twice the rally?

Hehe. Funny. :->

No, I think the way it worked was that fear of a 50 was keeping the market down. When it was 25, relief swept in.

Regardless, I am just against suburbs as far as the eye can see. If I am not doing a good job describing a method that would prevent that, then I apologize. I think it is nice to have urban, suburban, and rural environments. I grew up in an area where the city center was about 20 minutes across, then the suburbs on each side were about 20 minutes across, then the farmland began. I always thought those were nice ratios and worthy of maintaining.

I understand where you're coming from and, as a life-long CA native, can even sympathize. However, I'm hoping you can keep an open mind and see where I'm coming from.

You may feel that having X% urban/high-density, Y% suburban-exurban/medium density and Z% rural/low-density and a 20-minute "radius" per band as an optimum allocation of housing resources and population density. However, this is a purely subjective and personal value judgment. Others probably feel differently, and for various reasons (not all of them entirely selfish). Some may prefer to live in Manhattan-style urban-only environments, while some prefer to live far away from any urban areas.

My point is, we all have our own varying (and equally valid) idea of what constitutes "ideal" housing and population distribution. I would much rather empower individual consumers the power to choose what type of housing they want than have this decision forced upon them by supposedly more "enlightened" politicians and bureaucrats. In the end, consumer choices will be constrained by practical realities and trade-offs anyhow (short commute time vs. bigger yard, lower land costs vs. close to shopping, etc.), so the end result is always a compromise among people's competing priorites.

"Ideal" is always in the eye of the beholder, regardless of the education level or intelligence of the person doing the choosing.

Daggnabit with those italics. Re-posted. (Moderator, if you would like, please delete the previous post)...

DinOR Says:

June 29th, 2006 at 12:25 pm

I’m at a loss to explain this as well. So had the Fed raised 50 bps we would have had twice the rally?

This is making me very disappointed in the Fed. If you read the statement:

it’s wishy-washy and sets themselves up for moving up, down, or staying put at the next round in August. Now I’m convinced they are only TRYING to appear hard on inflation, but they want to keep the liquidity flowing along as long as possible. Maybe through the elections in November??? Of course the market rallied. It wasn’t a 50bp hike, and the statement leaves room for a pause or worse next time around. What a bunch of asswipes.

“Recent indicators suggest that economic growth is moderating from its quite strong pace earlier this year, partly reflecting a gradual cooling of the housing market and the lagged effects of increases in interest rates and energy prices.â€

I couldn't resist that Tucson thread. I posted as Subcranium.

As far as city planners doing better? Well, city planners would consider the benefit of everyone (including future participants). Consumers, on the other hand, don’t even know what is in their own best interest. They are not educated on most matters.

This is a rather insulting and paternalistic (and might I say, un-democratic) thing to say. Government does not always know "what's best for us" nor always act in ways that are beneficial to the general public. Obviously, some planning is needed (to ensure that adequate public infrastructure is built --schools, roads, sewer/power, etc.-- but I'll take the end result of competing "dumb" consumer choices any day over Central Planning.

No, I think the way it worked was that fear of a 50 was keeping the market down. When it was 25, relief swept in.

You may be onto something here.

Michael Anderson/skibum,

Best explanations I've heard yet! I think this is where so much of the (my) bitterness comes from. During the whole "dog and pony" show of the last 16 hikes is that they were coming UP from 1% and was like beating DL and cartel with a WET NOODLE! Was there ever any real fear that the hikes would be meaningful? That they would actually have an impact on mortgage rates? Noooooooo. So here we are stuck again in limbo with another "pity rally". Great..........

HARM,

No worries. I'm still here; just very busy lately.

I'll agree that in theory what you describe -- a world without modern Central Banks, but instead just functioning Treasuries -- could well be more efficient and fair.

Instead of arguing about the relative merits of the Fed (or the BoJ, ECB, etc), perhaps looking at it like this will clarify my position. Note, I don't take Fed criticism personally; I wish Feldberg had gotten the job:

We must have a Central Bank because everyone else has one. It's basic game theory. We have to actively manage our nominal rates because everyone else does. Even if we could get everyone to agree to get rid of their Central Banks, someone would cheat and everyone would have to bring them back or mimic the functions somewhere else.

Someone theorized that if we eliminated the Fed then the USD would just be set at "market", and "what's wrong with that?" Here's what's wrong with that. The "market" wouldn't be a free market, but a market manipulated by Korea, Japan, China, etc. to maximize their economic benefit even where to the detriment of other, "Fed Free" countries. So yes, a market would set your interest rates and the value of the dollar, but it wouldn't be a free market, just a much worse market than we have today.

Someone theorized that if we eliminated the Fed then the USD would just be set at “marketâ€, and “what’s wrong with that?†Here’s what’s wrong with that. The “market†wouldn’t be a free market, but a market manipulated by Korea, Japan, China, etc. to maximize their economic benefit even where to the detriment of other, “Fed Free†countries. So yes, a market would set your interest rates and the value of the dollar, but it wouldn’t be a free market, just a much worse market than we have today.

Not only that, but what this theory fails to account for is that the USD enjoys the status of world standard for all things financial. Despite the gradual decline over the past several decades, we as a country still get a ton of benefit from that advantage. Lose that, and we're REALLY screwed.

Randy H,

I DO hear your arguments. I understand as well as appreciate your position that if it wasn't the FED it would be something very much "like" the FED but today is another case in point to "de-politicize" that office. By FURTHER delaying a much needed correction in housing prices we can all go to the polls feeling warm and fuzzy. This should be about what the economy needs, not what the administration needs?

DinOR,

I agree 100% on the need to keep politics and Monetary Policy separate. The recent politicization of the Fed is just part of a wider politicization of everything, from Courts to Schools to Central Banks. All this perversion of every system in existence for short-term political gain won't end well, I'm afraid.

Randy H,

True enough. I've heard it said that it will be difficult to get "the genie back in the bottle" where the FED is concerned but try we must.

Further thoughts on the reason we must have a "Fed Function" (that is Central Bank).

Keep in mind that nominal rates are linked directly and unbreakably from currency exchange rates. This is called interest-rate-parity. Covered IRP must always be true or else the currency will be arbitraged. And foreign exchange is the one area where there is certainly enough arbitrage power to force an efficient market pricing.

It works like this (simplified and stylized): If 1USD = 1EUR, and each country had a 5% nominal rate, then everything is great. Let's pretend that's the natural, no-fed equilibrium. But then the EU cheats and somehow forces all their banks to pay 6%. The EUR must appreciate or else everyone will just take loans in USDs and buy EURs because they can get more EURs for their USD by taking a loan at 5% and opening a savings account at 6%.

The result of a world where the US had no CB but China did would be a world where China dictated US interest rates, which would be extraordinarily high. To the US consumer then, they would be in a situation where the only products they could afford would come from China and other similar countries. Basically, the same may be true today buy only if China, Korea, etc. all "agree" to keep buying our dollars to manipulate their currency rate.

Ok, Randy,

Glad there are no hard feelings --sorry, if I got a tad personal.

I see your point on the game theory/foreign currency manipulation angle. We can all agree that the increasing politicization of monetary policy, science, etc. is a bad thing for society overall, and us plebians in particular. How to go about de-politicizing it is another question.

How to go about de-politicizing it is another question.

Or, more importantly, how to exploit the situation when we know that nothing can be done.

HARM,

How to go about de-politicizing it is another question.

That's easy: space colonization. The only politics of the new-world colonies for at least the first couple hundred years would be ridding themselves of Earth's unfair taxation without representation.

Of course, all of this could end up moot. If energy prices keep rising and urban communities keep flourishing, then eventually this suburban sprawl will stop as people can’t afford the commute. Will it take $10 gas? Maybe. Of course, all bets are off if some replacement comes along and makes travel cheap. I think at that point, the inevitable suburban expansion will continue. Well, unless population starts to drop. I think the US is near joining the list of nations where each woman has less than 2 children.

Exactly. There are so many exogenous forces constantly at work on influencing consumer choice and individual priorities, there's no way to precisely predict what people will choose tomorrow. This is also why central planning will never completely replace open markets as a more efficient resource allocation mechanism. Too many unknown interrelated variables, too many complicated feedback loops, too much change.

>>We can all agree that the increasing politicization of monetary policy, science, etc. is a bad thing for society overall, and us plebians in particular.

I agree with everything but the word "increasing." Are you sure it's increasing? I can't tell that from reading accounts of previous eras.

@Michael Anderson,

Point taken. Well, I haven't been alive (or at least as an adult tuned into housing/politics/finance) long enough to qualify as an "expert", but my relatively short span, I've observed subjects that used to be (somewhat) sheilded from the election cycle becoming MUCH more politicized --especially in the last 15 years. Of course, this is merely my subjective opinion, but... remember Paul Volcker? The guy who raised the Fed funds rate above 18% in the early '80s and triggered the worst recession since the Great Depression. And did it to break the back of out-of-control inflation.

Can you imagine the current fed chief doing that today?

I can also recall a time when the CPI reflected something close to "true" inflation. Before the magical "improvements" of hedonics, substitution and plain-old leaving shit out. Oh well...

Can't just blame the Repugnican pols, either (though they do happen to be in charge of all 3 branches of government at the moment). Those big, wonderful speculative-inducing tax breaks occurred under Clinton's watch. Ditto for starting the trend of blatantly gaming the CPI and blowing asset bubbles. Plus, I see the level of shrillness rising on both sides, to the detriment of useful discourse.

Btw, I'm sure you've all seen this by now, but Bernanke pussied out and raised FFR a paltry .25%. And indicated they are probably done raising them:

http://www.federalreserve.gov/boarddocs/press/monetary/2006/20060629/default.htm

Should still be enough to help break the HB's back, though more slowly than we would have liked.

I remember a time when political wars were waged in the Middle. That was the way Reagan got elected by landslides. Political battles are now waged on the margins, not in the middle. We now distill everything, from social issues to economic issues to military issues to simple, black and white, you're either with us or them choices. Such choices are deceptively satisfying, but generally fail to address the real root of the issues. Such politics disillusions the majority in the middle who simply tune out, turn on reality TV, and ignore it all as long as they can. It's not as simple as sheeple morons wasting time watching American Idol. A lot of it is that American Idol is immeasurably more pleasurable to many folk than watching/listening to engineered personalities scream over one another in crude, staged, demonization fest, non-debates.

>>but… remember Paul Volcker?

Well, that's a good point. But I like to look at that as one guy just being incredibly great.

I always thought that the most political time for these jobs was 1940-1980 when Democrats were so powerful they held an iron grip. But I guess because they were so dominant, it was all just understood. Maybe the shrillness comes from some level of parity.

>>Such choices are deceptively satisfying, but generally fail to address the real root of the issues.

That's true. And nothing really gets solved so these battles become touchstones.

The only thing about American Idol that appeals to me is that it's the first public entertainment in decades that reaches across the generations. Everything else is so niche focused that a grandma doesn't know what a granddaughter is talking about.

American idol is stupid rehash of Star Search.

We should have American Chef instead.

We should have American Chef instead.

First contestant: Peter P

food theme: toro

I am actually on topic this time !

Interesting little article on Fed :

http://www.twincities.com/mld/twincities/news/columnists/14924782.htm

The author is quite optimistic about BB being the man. They actually did omit the line today "further policy blah blah may be needed" etc. Stock markets took that as a sign of a pause that will happen very very soon.

Given the language, that might very well be true. I am not as confident about BB as the author of this editorial. There is too much political pressure to pause.

If the Fed does pause, I would not be so confident about crash/correction. The long term and mortgage rates show no sign of correcting. They are higher than a year ago, but still historically very low. And apart from increasing rates, I don't see what can cause this bubble to burst quickly.

There will be high inventory, low sales, no appreciation or even a small decrease in prices which remain flat for decades. But 10-15% drop does not help me.

First contestant: Peter P

food theme: toro

How about..

Fresh Toro Tartar

White truffle oil, quail egg, chives, white pepper

And apart from increasing rates, I don’t see what can cause this bubble to burst quickly.

There will be high inventory, low sales, no appreciation or even a small decrease in prices which remain flat for decades. But 10-15% drop does not help me.

I for one have never predicted a sharp or fast decline (you can scan the archives for my posts/predictions from a year ago and see this is true), though I highly doubt FBs can hold onto their negative cash-flow properties for "decades". I always expected the Fed would stop short of doing what was necessary to really "pop" this thing in a big way, as they have become little more than cheap political hacks, seeking to please/ensure re-election for the current crop of lying shitbags who appoint & confirm them.

This does not mean the bubble cannot/will not deflate, however. Though, yes, it will probably be slow & very sticky on the way down. The last one took some 6-7 years from peak to trough (using either sales or median price as a barometer) and I see no reason to be certain it will proceed more quickly this time around. Recall there are two ways for prices and rents/incomes to "revert to the mean": (1) prices holding relatively flat while inflation raises the price of everything else + wages, (2) nominal price cuts.

The correction/pop will most likely come as a combination of both (as it also did last time). We are already seeing nominal price drops in many CA locations (see recent CAR/Dataquick numbers). And we are at the very beginning of the down cycle. Have patience.

And why did the Japanese leader with the cool hairdo seem way smarter than Bush today?

they always do... why isn't the leadership of the free world subject to the rules of merit like everywhere else?

substitute any other govt as required:

And why did the ________ leader with the ________ seem way smarter than Bush today?

Why does he seem smarter than Bush? ... Because he is smarter than Bush.

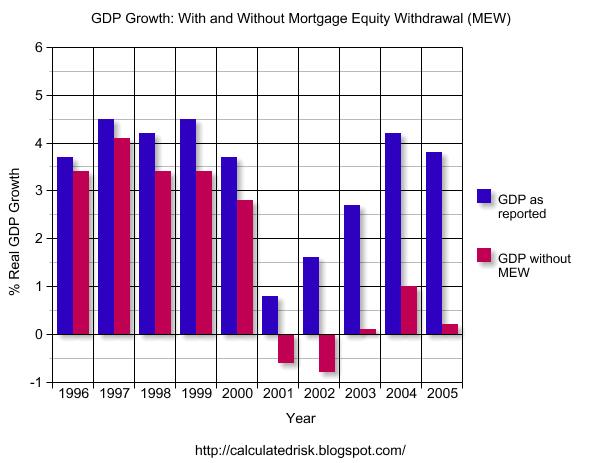

Just to give you a nice graphical representation about just HOW dependent the economy is on MEW right now, here's a lovely chart from Calculated Risk:

MEW = Mortgage Equity Withdrawal: cash-out refinancing, HELOCs, etc.

Oh, and this doesn't even take into account the impact on HH incomes/employment when RE-related employment falls off a cliff. Remember, approx. 40% of all jobs created in the last 5 years have been RE related.

Randy says:

Half the time I hear “let the market decide†the commentor probably couldn’t even define the relevant market and explain the mechanism by which it “decidesâ€, let alone tell me “what’s wrong or right with letting it decideâ€. Invoking free-market doctrine when convenient is nothing more than ideology, and does a disservice to those who truly favor free market solutions.

didn't you know? markets are benign, super-intelligent organisms that always produce the best result for everybody involved and for the environment.

'Capitalism is the astounding belief that the most wickedest of men will do the most wickedest of things for the greatest good of everyone.'

John Maynard Keynes

more keynesian quotes:

The decadent international but individualistic capitalism in the hands of which we found ourselves after the war is not a success. It is not intelligent. It is not beautiful. It is not just. It is not virtuous. And it doesn't deliver the goods.

Successful investing is anticipating the anticipations of others.

Americans are apt to be unduly interested in discovering what average opinion believes average opinion to be.

Education: the inculcation of the incomprehensible into the indifferent by the incompetent.

For at least another hundred years we must pretend to ourselves and to every one that fair is foul and foul is fair; for foul is useful and fair is not. Avarice and usury and precaution must be our gods for a little longer still.

I work for a Government I despise for ends I think criminal.

Like Odysseus, the President looked wiser when he was seated.

Most men love money and security more, and creation and construction less, as they get older.

The day is not far off when the economic problem will take the back seat where it belongs, and the arena of the heart and the head will be occupied or reoccupied, by our real problems - the problems of life and of human relations, of creation and behavior and religion.

In the long run, we're all dead.

RIP JK Galbraith, by the way (that's me, not keynes)

‘Capitalism is the astounding belief that the most wickedest of men will do the most wickedest of things for the greatest good of everyone.’

No doubt JMK said that with great irony, while more or less agreeing with the basic premise. Sort of similar to this one:

"It has been said that democracy is the worst form of government except all the others that have been tried."

--Sir Winston Churchill

Throw that in with greed. We have become a nation of greedy, ego-centric, selfish jerks. How did we get here?

hmmm, you split off from the noble, moderating influence of great britain...

Water vapor is some 70% of the atmospheric greehose gases but it wouldn’t do to drain the Chinese rice paddies or pull the plug on their hydro projects now would it?

surely there is a lot more water vapour coming off the earth's oceans than the rice paddies.

methane is more destructive than CO2, but less of it is produced.

which glaciers are growing?

Peter P Says:

Glad I didn’t do any shorting. The market roaring today.

Same. I have almost finished entering the ticket. Glad I did not execute the trade.

Will this rally peter out to give us some shorting opportunities or is this the start of a new upward trend?

Something does not smell right. Expect a surprise soon.

I assume it's held to be OK to invest and speculate in stocks, because they are intangibles and discretionary items, but not OK for investors to turn their attention to property as a wealth creation vehicle because it is human shelter, i.e. that the concept of owner-occupied property should trump the concept of residential property as an investment class?

No doubt JMK said that with great irony, while more or less agreeing with the basic premise.

I don't think he did.

« First « Previous Comments 211 - 250 of 277 Next » Last » Search these comments

Randy H Said:

HARM Replied:

Federal Reserve System from Wikipedia

Roles and responsibilities

The main tasks of the Federal Reserve are to:

–Supervise and regulate banks

Not doing so well on that score lately from my POV.

–Implement monetary policy by open market operations, setting the discount rate, and setting the reserve ratio

Yes, they’ve done a “mah-velous†job of flooding capital markets with unlimited liquidity, blowing asset bubbles and destroying the value of the USD –kudos to them!

–Maintain a strong payments system

No argument here –creditors/lenders of all kinds have enjoyed limitless cash-flow under the Fed. Debtors on the other hand…

–Control the amount of currency that is made and destroyed on a day to day basis (in conjunction with the Mint and Bureau of Engraving and Printing)

Kind of depends on what you mean by “controlâ€, doesn’t it? If you mean “set the money-creation spigot permanently to ‘ON’ and flood asset/capital markets until you have one speculative bubble after anotherâ€, then they’ve done a bang-up job!

In short, I believe the Fed has failed miserably at serving the public’s interests (assuming that it ever really had anything to do with this –I doubt it) and has only succeeded in making the business cycle even more volatile/extreme than it already was. Let’s not forget that the 1930s Great Depression, 1970s Stagflation and several severe recessions occurred on the Fed’s watch (founded in 1913), as has the consistent destruction of the purchasing power of the USD, in the interests of fake nominal “growth†through inflation.

The Treasury handles the production of paper money and coinage just fine. What exactly do we (the public) need a Federal Reserve System for?

Discuss, enjoy...

HARM