patrick.net

An Antidote to Corporate Media

1,197,396 comments by 14,108 users - Ceffer, GNL, RC2006, WookieMan online now

Comments 1 - 31 of 31 Search these comments

So, a few big issues with this:

#1 The supposed income taxes that US companies aren't paying SHOULD NOT GO TO THE US GOVERNMENT. These are taxes on international income, and the proper place that they should be paid to (if the countries involved actually cared to be honest about it) is the countries where the profits are made. This would be the case REGARDLESS of tax rates in the US. Note that if the US tried to make US companies pay US taxes on foreign income, you'd effectively have double taxation, and US companies would not be globally competitive.

#2 Most of these corporations DO still pay the 35% flat tax assessed on US-based profits. Google's effective tax rate was over 20%, for instance.

#3 The vast majority of taxes in the united states are paid by individuals, not corporations. Corporate taxes are less than 10% of federal revenue for 2010.

National income taxes rather than income taxes is an interesting idea, but I think it all falls apart on enforcement. The UK has a 20% VAT (lower than proposed in fairtax) and a top marginal income tax bracket of 50% -- but VAT makes up only 15% of total revenue. Now, granted, VAT has lots of exceptions, but even then I think 30% is grossly optimistic. Keep in mind that taxes in the UK are about 38% of GDP, whereas in the US it's 28% of GDP. That's a big difference, yeah, but I think it still shows that a 30% tax rate is never going to match income tax revenue.

So, a few big issues with this:

#1 The supposed income taxes that US companies aren’t paying SHOULD NOT GO TO THE US GOVERNMENT. These are taxes on international income, and the proper place that they should be paid to (if the countries involved actually cared to be honest about it) is the countries where the profits are made. This would be the case REGARDLESS of tax rates in the US. Note that if the US tried to make US companies pay US taxes on foreign income, you’d effectively have double taxation, and US companies would not be globally competitive.

#2 Most of these corporations DO still pay the 35% flat tax assessed on US-based profits. Google’s effective tax rate was over 20%, for instance.

#3 The vast majority of taxes in the united states are paid by individuals, not corporations. Corporate taxes are less than 10% of federal revenue for 2010.

National income taxes rather than income taxes is an interesting idea, but I think it all falls apart on enforcement. The UK has a 20% VAT (lower than proposed in fairtax) and a top marginal income tax bracket of 50% — but VAT makes up only 15% of total revenue. Now, granted, VAT has lots of exceptions, but even then I think 30% is grossly optimistic. Keep in mind that taxes in the UK are about 38% of GDP, whereas in the US it’s 28% of GDP. That’s a big difference, yeah, but I think it still shows that a 30% tax rate is never going to match income tax revenue.

If corporate income taxes represent only 10% of government tax revenue that is even better reason to abolish income tax. This would be the best way to stimulate creation of new jobs in the USA. There would be no reason to play hide and seek with foreign profits. Think also about billions of hours wasted on figuring out income taxes. It is a stupid way to collect revenue.

Paying no income tax in the USA would offset at least part of the difference in wages between USA and countries where our jobs are being outsourced. This would also be one less incentive to move headquarters to a foreign country.

The enforcement of an incomprehensible income tax code is for sure more difficult than enforcing the sales tax. The tax base would increase - those who cheat on income tax would pay their share of taxes.

A drug dealer buying a new car would not be able to avoid paying tax. Guess how much income tax do such people pay today? Large number of illegals would also pay increased taxes compared to the present situation.

Companies would have one less reason to hire lobbyists in Washington DC.

GROAN!

Any Country out there, have room for an Idiosyncratic Refugee? I'm not like "THEM" I promise!

Converting to sales taxes will only accelerate the wealth transfer.

Then we just have to find a warlord to swear fealty to, and settle down into our straw hovels.

The US will not be able to collect 3T annually on any single tax system alone. Then there are another 1T in state income tax that piggyback off the federal system that have to follow suit. To replace the current system, we are talking about taxing 50% of the GDP performed domestically.

People go the extreme route to not pay 8% sales tax, imagine what people will do to avoid 30% (23% margin = 30% markup) federal consumption another 10% state to replace state income tax and another 8% state sales tax already in place.

There's no such thing as fairtax anyway, some wil pay more and some will pay less. Because the IRS try to make the tax code fair, is the very same reason why the IRC code is so thick and complicated. We have different standard deduction for the old and the blind just to start.

This would be the best way to stimulate creation of new jobs in the USA. There would be no reason to play hide and seek with foreign profits.

Taxation of foreign income has zero impact on hiring. Companies will hire exactly as many workers as they need to fulfill demand for their products. Companies do not hire out of the kindness of their hearts.

This would be the best way to stimulate creation of new jobs in the USA. There would be no reason to play hide and seek with foreign profits.

Taxation of foreign income has zero impact on hiring. Companies will hire exactly as many workers as they need to fulfill demand for their products. Companies do not hire out of the kindness of their hearts.

http://www.fairtax.org/site/PageServer?pagename=about_faq_answers#31

"...Because the FairTax is automatically border adjustable, the 17 percent competitive advantage, on average, of foreign producers is eliminated, immediately boosting U.S. competitiveness overseas. American companies doing business internationally are able to sell their goods at lower prices but at similar margins, and this brings jobs to America.

In addition, U.S. companies with investments or plants abroad bring home overseas profits without the penalty of paying income taxes, thus resulting in more U.S. capital investment.

And at last, imports and domestic production are on a level playing field. Exported goods are not subject to the FairTax, since they are not consumed in the U.S.; but imported goods sold in the U.S. are subject to the FairTax because these products are consumed domestically..."

American companies doing business internationally are able to sell their goods at lower prices but at similar margins, and this brings jobs to America.

A bullshit leap of logic if ever there was one. (I'm going to ignore the bullshit claim of "17% competitive advantage" of foreign companies because it just makes this even more absurd).

I already said it once, I'll repeat it again:

"Companies will hire exactly as many workers as they need to fulfill demand for their products."

Companies will not hire more people just because they have better margins, they hire more people because they need more workers to fulfill demand. Companies do not lay people off because of profitability issues, they lay them off because of revenue shortfalls.

This is the sort of thing written by people who are either lying, or have never run a company.

In addition, U.S. companies with investments or plants abroad bring home overseas profits without the penalty of paying income taxes, thus resulting in more U.S. capital investment.

Another huge leap of logic. Why would they invest more? Just because they have more to invest? Why aren't they investing now? Why are Apple, Microsoft, Google, and others sitting on more than $30B each?

Furthermore, why would companies that are making half of their profits overseas be reinvesting that money in the US rather than in the foreign markets where they're making so much money?

And at last, imports and domestic production are on a level playing field. Exported goods are not subject to the FairTax, since they are not consumed in the U.S.; but imported goods sold in the U.S. are subject to the FairTax because these products are consumed domestically…

This one doesn't make any sense at all. How is this any different from the situation today? How will this be "more level" than what happens with foreign and domestic goods right now?

A married couple makeing a combined $80,000 per year will soon be paying about $450 per month MORE in taxes. Thats courtesy of our compassionate, benevolent President. Yup, that ought to help our struggling economy.

Gee, I guess "End the tax breaks for the rich" is simply a great way to pander for votes by pitting the "rich" against the "poor". In the end, tax increases targeting "the rich" always seem to drift down and affect everyone..."rich" and "poor" alike.

I don't think tax INCREASES were what democratic voters had in mind when they voted for Hope and Change. Obummer.

I'm in favor of abolishing the income tax and replacing it with the Fat Tax. It's time for Democrats to start carrying their load.

Yes because clearly the Tea Party & President Palin nutters are LEAN MEAN FIGHTING MACHINES:

Repeat - I don't think TAX INCREASES, for themselves, were what democratic voters had in mind when they voted for "Hope and Change". They wanted to "stick it to the man", "soak the rich", "spread the wealth", "punish those greedy capitalists" - hahaha. Well, it didn't quite work out that way, did it? It backfired when the democrats voted for hope and change. And now its going to cost everyone, in the form of LESS take home pay.

Ah, spreading the misery amongst all, and all for the common good, comrade.

Repeat - I don’t think TAX INCREASES, for themselves, were what democratic voters had in mind when they voted for “Hope and Changeâ€.

Except, according to my tax return, I paid less in taxes this year. Doubtless you made some mistake if you think yours went up, but we thank you for the extra donation!

What are all those liberals doing at a Tea Party event?

According to I think it was PolishKnight, liberal Welfare Queens spend all their free time going around to Tea Party rallies and trying to look crazed & racist to embarrass the Tea Party. You're right, it's obvious these people are plants.

Vincente - the tax breaks for millions of middle class, working Americans is over at the end of the year. The tax punishment begins Jan 1, 2011. Haven't you been paying attention to current events?

A married couple making a combined income of $80,000 will soon be paying about $450 MORE IN TAXES, per month. If our economy is based on consumption, what effect will that have on the economy? If people earn LESS, are they likely to spend MORE? Why can't you lib's figure this stuff out for yourselves? Shoot, I'm not even a Harvard trained economist and I understand it.

Vincente - the tax breaks for millions of middle class, working Americans is over at the end of the year. The tax punishment begins Jan 1, 2011. Haven’t you been paying attention to current events?

A married couple making a combined income of $80,000 will soon be paying about $450 MORE IN TAXES, per month. If our economy is based on consumption, what effect will that have on the economy? If people earn LESS, are they likely to spend MORE? Why can’t you lib’s figure this stuff out for yourselves? Shoot, I’m not even a Harvard trained economist and I understand it.

Liar. Liar. Liar.

Taxes for a couple with $80k taxable income in 2010: $12,364

Taxes for a couple with $80k taxable income in 2011: $14,899

Monthly increase: $211.25

Under Obama's proposal, the couple would pay the same in 2011 as they pay in 2010. Why don't you support Obama's proposal?

Also, $80k in TAXABLE income is a *LOT*. You're looking at gross income in the $100-120k range, which is more than 90% of American families make.

In other words, even if the bush tax cuts expire (calling it a "tax increase" is a lie), the average american family will be impacted by less than the cost of their monthly cable bill.

Realistically, the most likely outcome next year is going to be that you pay exactly the same as you pay this year. The only people who might have their rates go back to what they were in 2001 are those with taxable income over $250k. The only "real" debate on the floor right now is whether the cut off is going to be $250k or $500k.

What are all those liberals doing at a Tea Party event?

According to I think it was PolishKnight, liberal Welfare Queens spend all their free time going around to Tea Party rallies and trying to look crazed & racist to embarrass the Tea Party. You’re right, it’s obvious these people are plants.

Mind if I ask what's wrong with those people, if anything?

Mind if I ask what’s wrong with those people, if anything?

That they are commie pinko socialist nazis, try to keep up!

Real Americans look like this:

Vincente, I stand corrected. Your math is correct, but so is my overall premise. People earning less, will not be spending more.

Vincente, I stand corrected. Your math is correct, but so is my overall premise. People earning less, will not be spending more.

So why not just reduce taxes to zero? After all, there are clearly no other things to consider aside from the volume of money in people's pockets. I'm sure the military and social programs will get paid for somehow.

As for the wealthy, they will get slammed with it whenever they buy a new Rolls.

The majority of "wealth" of Richy Rich is not held in cash and used for buying Rolls Royces.

Convert dividend and interest taxes to the highest bracket instead of the criminally low 15% and you might sell me on it.

But in the meantime, that means a lot of jobs in the private sector won’t be created that otherwise would have.

The underlying assumption in all of these sorts of schemes, always seems to be "trickle down" doesn't it? Let's jigger the tax code and hopefully it will rain jobs? The fact is rich people have negative interest in generating jobs for Americans and fight it at every turn. Make it CONDITIONAL and then you might convince a lot of people. You create X new American jobs or we apply retroactive penalty taxes.

It's always funny to me that people decry liberals for NAIVELY trusting that if they help people via something like welfare or job training, that they will better themselves and Utopia will result. FOOLS, they say, all is you need to make it CONDITIONAL. Make 'em WORK for it smashing rocks or picking up trash, otherwise they will just take advantage and never live up to their end. Set limits of 5 years, oh wait we did that one under Clinton. Yet the same concept applied to a different class as "let's set free the capitalists, without strings, and they will deliver good-paying jobs for Americans" hasn't delivered in 30 years either and it doesn't seem to be subject to the same criticisms by the same people.

Whenever we taxed the rich more, I have never seen a direct benefit come my way. But when we taxed them less, a lot more jobs got created. And I definitely benefited from that.

Wait are we talking about YOU, or about Americans?

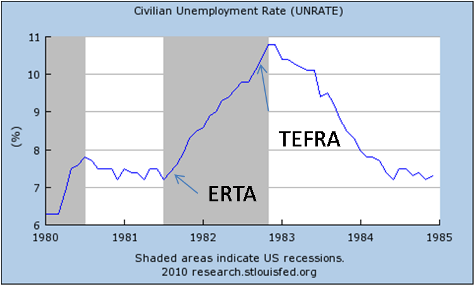

Reagan had to backtrack a bit on tax cuts after unemployment went up:

More recently Bush Jr. tax cuts, did that decrease unemployment? Nope.

The US will not be able to collect 3T annually on any single tax system alone

The UK has a 20% VAT (lower than proposed in fairtax) and a top marginal income tax bracket of 50% — but VAT makes up only 15% of total revenue. Now, granted, VAT has lots of exceptions,

Isn't the exceptions to the VAT the real problem. Just make no execptions. The rate should be the same on all goods AND services.

Tell me more about WalMart in France! Did the French surrender to WalMart there, or something?

I wish they fixed the off-shoring loopholes. I frankly don't want to keep on paying taxes anymore, it seems hardly fair.

http://www.bloomberg.com/news/2010-10-21/google-2-4-rate-shows-how-60-billion-u-s-revenue-lost-to-tax-loopholes.html

Since big corporations are already paying next to nothing in income tax - let's just scrape it. It would be much better for US economy if profits made by big corporations are freely reinvested in the USA rather than kept in offshore accounts.

A national retail sales tax implemented as described at www.fairtax.org is much better solution:

"...The FairTax Act (HR 25, S 296) is nonpartisan legislation. It abolishes all federal personal and corporate income taxes, gift, estate, capital gains, alternative minimum, Social Security, Medicare, and self-employment taxes and replaces them with one simple, visible, federal retail sales tax administered primarily by existing state sales tax authorities...."