patrick.net

An Antidote to Corporate Media

1,351,277 comments by 15,725 users - Al_Sharpton_for_President, SharkyP online now

15 Day Timeline of the Dollar Collapse and the HOUSING NIGHTMARE

2010 Nov 7, 3:41am 16,503 views 49 comments

« First « Previous Comments 41 - 49 of 49 Search these comments

The only reason we are a net importer is because foreigners invest here. In fact it's not possible to avoid being a net importer, as calculated in the value of goods traded, as long as people invest here. If there were not a flow of capital from China, etc. to the united states, the trade deficit would be exactly zero. Our currencies would have to balance out in the flow of trade such that the net valuation of goods traded was equal.

WTF are you talking about. What foreign bank is transacting in dollars? Who are they loaning dollars to? None of this makes any sense at all.

Plenty of foreign banks, governments, companies and individuals transact in USD. Just google "dollar denominated loans"

Take for example the first link, about dollar loans in Vietnam:

....Interest rates for US dollar-denominated loans, however, are hovering between 5.5 and 8 percent, with some experts predicting that it will be more advantageous to take out US dollar loans rather than Vietnamese dong loans.....

Anticipating the related decline in deposits, SBV lowered the required foreign currency reserve rates to 4 percent from 7 percent for loans of less than 12 months, and to 2 percent from 3 percent for loans exceeding 12 months in duration. As a result of this move, capital sources for loans have increased by US$500 million (VND9 trillion).

http://www.vfr.vn/index.php?option=com_content&task=view&id=1037&Itemid=3

This is exactly what I'm talking about. Vietnamese banks keep a billion USD cash in their vaults (and deposits in the US), and make many times that amount in loans.

WTF are you talking about. What foreign bank is transacting in dollars? Who are they loaning dollars to? None of this makes any sense at all.

As an example...Mexicans who live anywhere in Baja California, or who live within 20 km of the U.S. border elsewhere are allowed to open U.S. Dollar bank accounts in Mexican Banks, such as: http://www.bancomer.com/persona/perso_cuech_maedo_main.html

That 20 kilometer restriction is actually new, I remember a few years back there was no domicile restriction to open dollar-denominated bank accounts in Mexico.

WTF are you talking about. What foreign bank is transacting in dollars? Who are they loaning dollars to? None of this makes any sense at all.

As an example…Mexicans who live anywhere in Baja California, or who live within 20 km of the U.S. border elsewhere are allowed to open U.S. Dollar bank accounts in Mexican Banks, such as: http://www.bancomer.com/persona/perso_cuech_maedo_main.html

That 20 kilometer restriction is actually new, I remember a few years back there was no domicile restriction to open dollar-denominated bank accounts in Mexico.

Anywhere in Canada, you can open a USD checking or savings account (I had one when I lived there), just like any US person can open an account in EUR, AUD, Yen, and assorted other currencies in the US Everbank. But Can. banks do NOT give loans in USD, nor US Everbank gives loans in EUR, AUD, or Yen, hence the original argument has little merit.

But Can. banks do NOT give loans in USD, nor US Everbank gives loans in EUR, AUD, or Yen, hence the original argument has little merit.

You can get loans in Vietnam. See my post above.

Russia...

The biggest jump in Russian demand for dollar-denominated loans since the collapse of Lehman Brothers Holdings Inc......is contributing to the weakest ruble in more than two months

...The amount of foreign-currency corporate lending is the highest since before the credit crisis froze markets in October 2008 and led New York-based Lehman to fail, said Anton Nikitin, an analyst at Renaissance.

Philippines....

MORE Philippine residents took out dollar loans last year....By borrower, FCDU loans went mostly to the private sector, consisting of public utilities and exporters at $3.851 billion

http://www.manilatimes.net/national/2009/april/04/yehey/business/20090404bus6.html

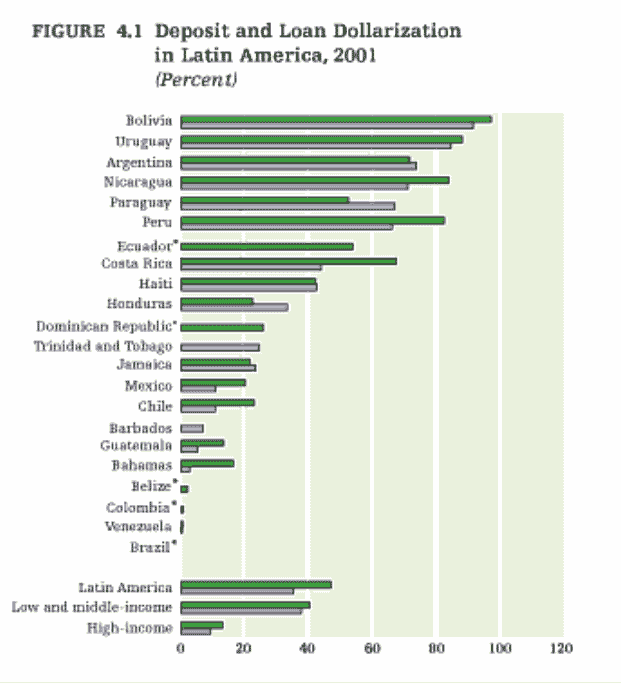

Latin America of course has loans out in USD in the biggest amounts. (Argentina currency collapse was directly related to loans in USD)

I really don't care that some people on a forum don't know this stuff, but assholes like Glen Beck are ACTIVELY SPREADING FEAR AND IGNORANCE. And it has political consequences.

See the thing is, Beck BENEFITS from the anxiety about a world seemingly out of control.

What is he selling? Fear.

Fear of collapse and degeneration and KEEP WATCHING or you'll miss something important! Ultimately the only thing that keeps his viewers glued to their seats is his mastery of spinning fears into an almost believable narrative.

No thanky sir!

See the thing is, Beck BENEFITS from the anxiety about a world seemingly out of control.

What is he selling? Fear.

He's not only selling fear, he's selling grossly overpriced Gold coins:

http://www.ritholtz.com/blog/2010/07/glenn-beck-goldline/

« First « Previous Comments 41 - 49 of 49 Search these comments

I believe anyone that bought a home in the last 5 years should hope the dollar does not collapse. If rates are hiked up to over 5-6% due to the run on the dollar, home prices will take an enormous hit across the board.

http://www.youtube.com/watch?v=hoOh08KmGvU

#housing