patrick.net

An Antidote to Corporate Media

1,261,787 comments by 15,068 users - B.A.C.A.H., Booger online now

« First « Previous Comments 4 - 43 of 63 Next » Last » Search these comments

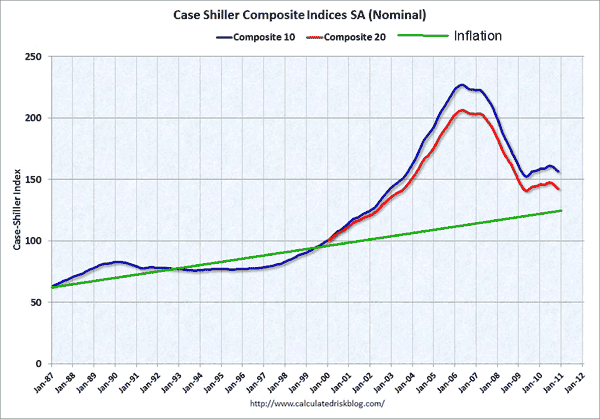

Looks awfully familar…

Except the degree to which many bay area cities are above the inflation "trend line" is much more exaggerated than it is in the C/S index.

Since I do not accept inflation as a valid trend line, preferring household income instead, I look at C/S and think maybe it doesn't have a whole lot further to fall (though it could take many years), unless it overshoots.

I do not accept inflation as a valid trend line, preferring household income

The more household income falls off, the more wealthy foreign investors will buy up all the haute real estate and keep prime prices high and mighty.

The more household income falls off, the more wealthy foreign investors will buy up all the haute real estate and keep prime prices high and mighty.

No doubt the top 1% of real estate that is owned by the uber-wealthy who have multiple residences operates by different rules, but be real. It's 1%, if that. That market is more like the art market than the housing market.

The more household income falls off, the more wealthy foreign investors will buy up all the haute real estate and keep prime prices high and mighty.

LOL! I guess there will be plenty of Rich Egyptians rushing to buy in Fortress Palo Alto soon.

No doubt the top 1% of real estate that is owned by the uber-wealthy who have multiple residences operates by different rules, but be real..

Do you even realize what prices were in SF, Palo Alto and my town of Los Gatos before the bubble? Hardly the ubber rich many think... more myth than fact.

I do not accept inflation as a valid trend line, preferring household income

The more household income falls off, the more wealthy foreign investors will buy up all the haute real estate and keep prime prices high and mighty.

I have to say it again. We need hatians(sorry no offense) and asians and now middle easterners to relocate to our wonderful land of opportunities and put their misery to end and happily live here. LOL. I mean LOL.

I remember when I did my PhD in the Bay Area in the 90s, when did Palo Alto become such a coveted area? I remember there being a bad side of the city back then, and an empty side of the city.

I guess it is just a west-bay thing. There still is a bad side aka East Palo Alto. Very high crime per capita. One of the worst in the country at one time. There is a good side too - possibly used to be the empty side you describe until the dotcom of the late 90s promoted it to a "good" side

Yes but it's the 100-year chart that really has impact to people.

Only a few decades doesn't carry the same weight, found one

which at least incorporated date up through 2009.

From here:

http://www.ritholtz.com/blog/2009/07/update-case-shiller-100-year-chart/

Eyeballing this chart

I'd say we're at equilibrium now, "ceteris paribus".

I mean, if all positive trends continue and no negative surprises appear, we're at the (nominal) bottom now.

Said positive trends we need through ~2020:

1) employment recovering to at least 2002-2003 levels. http://research.stlouisfed.org/fred2/series/UNEMPLOY (only 5 million more jobs needed!)

2) government interest rates remain low -- 10 year well under 5%

(not looking so good on that front http://finance.yahoo.com/q/bc?s=%5ETNX+Basic+Chart&t=1y )

3) feds allowed to deficit spend $1.5T/yr (per the CBO)

4) mortgage rates in the 3-4% range.

5) oil under $200, preferably under $100

6) state budget is fixed without massive tax increases or massive spending cuts

Just one of these things doesn't happen, and hello world of pain.

In 1920 a 2bdr bungalow in Green Bay, WI was about $3000. 1920 dollar is 1/11 of what it is today. So, if houses were as cheap now as they were in 1920, the price would be $33,000 today. But a 1920's bungalow in Green Bay, WI is about $70-80K today which is about 2-2.5 times of the $33K which is what it should cost if prices were as cheap as 1920. Now, based on the Case-Shiller index, the index is approximately 2 times now of the 1920's level (140/65 = 2.15). Conclusion: The 100 year Case-Shiller chart is incredibly accurate.

In 1920 a 2bdr bungalow in Green Bay, WI was about $3000.

I'm curious where you got that figure.

I found this:

1920 Green Bay Wisconsin

Four-room Bungalow w/one acre land

$3,100

Thats 4 bedrooms, not 2, and with a full acre of land. How much land does your $70K 2br bungalow have today?

1921 Green Bay Wisconsin

Eight Room two-family Home, Partly Modernized ,

$2900

Eight room / 2 family for less that your 2rb? Hmmmm....

The plot that Vicente posted is not supposed to work for the Bay area. It is a national average. There are separate plots for particular cities, for the composite 10, and the composite 20. This is because the authors recognize that price swings have been more dramatic in some areas.

True, but the point is there are are almost no examples of of 50’s homes in the bay area that are priced what C/S says they should be. If you go to most blighted areas of Richmond of Oakland you might find a few, but that’s it.

I'm looking forward to seeing the exhaustive study of all Bay Area homes from which you drew that conclusion.

Actually, I take that back. You would need to do an exhaustive study of homes NATIONWIDE, since the Shiller chart is for the whole country, not just the Bay Area.

I look at C/S and think maybe it doesn’t have a whole lot further to fall (though it could take many years), unless it overshoots.

http://www.thetruthaboutmortgage.com/wells-fargo-calls-for-30-percent-down-payments-on-mortgages/

1947 3 bedroom house in Elyria, Ohio $9,900 Shiller chart at 105

1990 3 bedroom house in Elyria, Ohio $49,900 Shiller chart at 122

$9900 for a 1947 house in 1990 dollars is $58,039, which is MORE than the 1990 example.

Also, there should have been a 16% increase according to the Shiller chart, so a comparable house should have sold for $67,325 in 1990. That's how you're calculating it, right?

Hmmm...came in way under that.

Let's see, I could jump to the wild conclusion that the Shiller Chart OVERSTATES home price inflation, or I could come to the more likely conclusion that since it's a nationwide average, that anecdotal examples are not enough to make a blanket statement about the index.

True, but the point is there are are almost no examples of of 50’s homes in the bay area that are priced what C/S says they should be. If you go to most blighted areas of Richmond of Oakland you might find a few, but that’s it.

I’m looking forward to seeing the exhaustive study of all Bay Area homes from which you drew that conclusion.

Actually, I take that back. You would need to do an exhaustive study of homes NATIONWIDE, since the Shiller chart is for the whole country, not just the Bay Area.

Obviously I do not have the resources to do this. I am merely pointing out why the long term Shiller index may not at all represent what it porports to: the price of in identical home over time over the long run.

I'm not the only one questioning it, and some people have put lots of effort into studying the question, including Mr. Case, the OTHER guy who's name is on the Case-Shiller brand. The long term chart is exclusively the product of Mr. Shiller and his graduate students, Case-Shiller refers to data after 1987 under a similar methodology.

Mr. Case points out that all pre-1970 housing statistics are suspect......

...Likewise, Mr. Case has dug up sales records for houses in the Boston area that were built in the late 19th century and are still around. The records show prices rising 2.5 percentage points a year faster than inflation, which is just about what income has done.

Perhaps most persuasive is a statistic that Mr. Shiller sent me when I asked him about this debate. It shows that the share of consumer spending — and, by extension, of income — devoted to housing has not fallen over time. It has hovered around 14 or 15 percent for the last 60 years. The share of spending devoted to food, by contrast, has dropped to 13 percent, from 25 percent.

These numbers make a pretty strong argument that the post-1970 period is not one long aberration. As societies get richer, they do spend more and more on housing.

Some of this spending, Mr. Shiller notes, comes in the form of bigger, more expensive houses. These houses don’t do anything to lift the value of a smaller, older house — which is what matters to individual homeowners. But McMansions are not the only factor.

To see this, you can look at the share of consumer spending devoted to things inside houses, like furniture. As with houses, they have become fancier. But they haven’t become so much fancier that they make up anywhere near as large a share of consumer spending today as in the past. That’s a strong clue that the upgrading of houses themselves isn’t enough to explain the increased spending on housing.

What is? The value of the underlying land. Those Boston-area houses that Mr. Case studied did not change much over time. Yet their value did.

For a house whose location has any value — in a major city or a nearby suburb, where a builder can’t simply put up a similar house down the street — the land is a big part of the equation. Over time, Mr. Zandi says, the value of that land should grow almost as fast as the local area’s economic output or, in other words, with incomes.

I actually wasn't aware of this article today, but it looks like Case and Leonhardt are thinking along the same lines I am.

http://www.nytimes.com/2010/09/08/business/economy/08leonhardt.html?ref=us

I am merely pointing out why the long term Shiller index may not at all represent what it porports to: the price of in identical home over time over the long run.

It may not for any given geographical region, because it is a nationwide average. That I will grant you.

I’m not the only one questioning it, and some people have put lots of effort into studying the question, including Mr. Case, the OTHER guy who’s name is on the Case-Shiller brand. The long term chart is exclusively the product of Mr. Shiller and his graduate students, Case-Shiller refers to data after 1987 under a similar methodology.

My reading of the article is not that they are questioning the accuracy of the chart, but rather where they think it will go in the future.

I am merely pointing out why the long term Shiller index may not at all represent what it porports to: the price of in identical home over time over the long run.

It may not for any given geographical region, because it is a nationwide average. That I will grant you.

Obviously neither us is going be able to do such a study of actual homes 1900 to now that are in similar condition, but I firmly believe that if such a study were to be done nationally, it would show that the Shiller index does not in fact reflect the average price change of those homes - not by a longshot. And I also firmly believe it is the land value factor that the Shiller methodology underweights that is the reason.

My reading of the article is not that they are questioning the accuracy of the chart, but rather where they think it will go in the future.

The chart is probabaly accurate. The question is what is it actually measuring.

Obviously neither us is going be able to do such a study of actual homes 1900 to now that are in similar condition,

I don't need to. You are the one making an assertion here.

but I firmly believe that if such a study were to be done nationally, it would show that the Shiller index does not in fact reflect the average price change of those homes - not by a longshot. And I also firmly believe it is the land value factor that the Shiller methodology underweights that is the reason.

The only evidence I have seen you present here is your statement that you personally believe "there are almost no examples of of 50’s homes in the bay area that are priced what C/S says they should be."

You're basing this sweeping statement about the Shiller national index on that? I'm not sure that you're understanding what "average" means. The index doesn't SAY what Bay Area prices "should be". It's an average of the whole country. Bay Area prices may in fact be more inflated than other areas. You don't think that prices appreciate by the exact same percentage in all cities, do you?

I just don't think you guys are getting it. It's like saying: "The average age in the United States can't be 36, because everyone who lives at the local retirement home is older than that." You can't examine only one subset of the data and draw any kind of meaningful conclusion. You can't look at just Bay Area homes and say that a chart of the national average is wrong.

In addition, as I said before, your data is anecdotal. You can state all the supposed "reasons" the chart is wrong, but until you actually establish that it IS wrong, that doesn't mean anything.

I'm not saying you're wrong; I'm just saying you haven't provided any solid reasoning as to why you might be right. Your unsubstantiated "belief" doesn't cut it.

MarkInSF says

Obviously neither us is going be able to do such a study of actual homes 1900 to now that are in similar condition,

I don’t need to. You are the one making an assertion here.

No, Mr. Shiller is making the assertion. I'm just pointing out absurdities of his conclusions.

I’m not sure that you’re understanding what “average†means.

Oh, but I do. It means that if there are 100,000 homes in the Bay Area that are the same as they were in 1950, but they are 3X the price of what the Shiller chart says they should be worth, that means you have to have 200,000 homes somewhere else that are worth $0 to make the average work. Or 400,000 homes worth 50% what the Shiller chart says. Where are these homes?

dunnross

4 rm in 1920's is exactly 2 bdrm now. Back then, they counted living room & dining room as rooms too. Also, land in Green Bay isn't worth much, so 1 acre doesn't really add that much to value of the house. Besides, many houses in the suburbs of Green Bay have 1 acre lots, even now.

Someone posted a Case-Shiller graph normalized to 1987. But someone else is comparing current prices to the 1920's or whatever.

There is some demographic data from a gov't website, I think it was the census, that I used a few years ago to see how our standard of living has declined. I think it was around 1988 when the number of workers per household plateaued at around 1.8 or something like that after steadily rising for decades.

Comparing present prices to 1987 or so is probably not misleading, but comparing to the 1920's certainly is. Because in the post-WWII years that our number of workers per household steadily increased , their contribution just as steadily masked the decline in our standard of living. Because, more labor / work / effort was needed to maintain an apparent standard of living. No doubt, part of the slippage was an increase in house prices, with concomitant extra "ability" to pay the higher prices.

Note: Quality of Life is not the same thing as standard of living. While there are tradeoffs having two parents in the household both working fulltime with young children at home, there is nothing wrong with both parents sharing equally in the efforts of working outside the home and also housekeeping and parenting. What IS wrong with it is when those parents fall into the TWO INCOME TRAP that Dr. Elizabeth Warren wrote about in her book with the same title, where the couple uses the sum of their two incomes to borrow the absolute most that the combined income would theoretically permit. And that sum became even higher with the creative loan terms that were offered when the two income trap had shown signs of exhausting itself.

1) The Case Shiller plot that Vicente posted starting in 1890 is adjusted for inflation. It says as much right on the graph. The graph is based on cost ($). It is normalized to a value of 100 in order to make calculation of percent change easy to spot on the graph. Scientists typically report normalized numbers (typically ratios), because they are more intuitive than values with units. The normalized C-S type plots can be made with nominal prices or inflation adjusted prices.

2) The census data reports median house price in 1946 & median price in 1997. The median house in 1946 is very different than the median house in 1997. In order to better show appreciation of a particular house, Case-Shiller tracks changes on single houses. If you bought a particular house in 1940 that was 900 SF, and you sold it in 2000 it would still be 900 SF. So, the price of a median house in 2000 (2100 SF) does not accurately represent your house. CS can show the expected appreciation of a particular house that you invest in.

So what are the specific the differences between the Shiller-100 and the Case-Shiller 10 or 20 composite city models? I assumed the geographic locations for the data points were different, but don't both account for inflation?

Also, I checked Calculatedriskblog for this figure, and could only find ones WITHOUT an added inflation line. I'm guessing MarkInSF added this feature to the original graph. Kind of confusing for evaluating current house price levels if the Composite 10 and 20 curves are in fact adjusted for inflation.

BTW, here is the same chart with inflation

Here is an update with the latest blip.

http://www.ritholtz.com/blog/2010/07/updating-the-case-shiller-100-chart-forecast/

I showed above that the median house in the US from 1940 was about 900 SF and should cost $50,000 in 2000. The median house in the US in 2000 was 2100 SF and cost $120,000. The ratio 120,000 / 50,000 is 2.4. That is about the ratio of the square foot increase (2100 / 900 = 2.3). So, CS predicts an increase from 30,000 to 50,000, and the rest of the price increase is due to houses increasing in size.

I lived in a house in SoCal for the last 3 years that was built in 1938. It was fairly upscale relative to the other houses nearby that lasted that long. It sold for $88,000 in the late 90s, went up to $400,000 and back down to around $200,000 since then. It is 1370 SF, so maybe 1.5 times the average size from that time. And, in 2000, it sold for about 1.5 times the $50,000 value.

What you have to think about is that many of the houses from 1940 have been replaced. The ones that are still standing represent the better portion. They are the Darwinian survivors of the wrecking ball, and are probably not accurate representations of the median house from 1940.

CS does not try to predict the price of the median of the 1940s house still standing.

And yet that is precisely what it claims to predict. Read the chart"

"...to track the value of housing as an investment over time"

If it doesn't predict the value of an unaltered home purchased in 1950 or whenever, then what exactly is it's use?

Also, I checked Calculatedriskblog for this figure, and could only find ones WITHOUT an added inflation line. I’m guessing MarkInSF added this feature to the original graph. Kind of confusing for evaluating current house price levels if the Composite 10 and 20 curves are in fact adjusted for inflation.

The composite 10 and 20 are not adjusted for inflation. That's why I added the inflation line. I also just drew the line straight from 1987 to today, based on CPI. Obviously it's not a straight line like that.

Wow, astounding to see this thread has generated so much concentration. And here I thought it was a simple matter of chart updating.....

If I were to take Ritholz updates as reasonable though, looks like 2015 before things are "normal".

LOL. Reading further, this is looking a little like a flame war over an pretty niche topic. If I am wrong on this, thanks to those of you that are putting in the effort to try to set me straight.

So the Case-Shiller index measures exactly what?, and this measurement is applicable to my real life how? In as few words as possible. . . .

Case-Shiller tries to show how your investment will appreciate over time if you buy a house. It measures how an individual purchase in the past would have appreciated over time (if it is typical of the region being measured, national or one of the cities). Obviously, a landlord would have to take into account rent and upkeep. The chart is showing how the appreciation part has changed over the years.

That 1100 ft2 is not from the census. Also, it is an estimate of houses build in the 1940s and 1950s, so call it representative of new houses in 1950 (smack in the middle of the 40s and 50s). Yet, you insist that it is exactly what the average house was in 1940, and that 900 SF is too small.

If you want to be so nit-picky and insistent, then you ought to be more precise.

1. coastal california prices have of course outpaced inflation for a generation. that is sort of a natural fact, as these cities increased in density in far more drastic manners than probably anywhere else in the US save New York.

See, but here's the thing: It would seem to me the average property from 1940 is in an area that has increased in density, for the simple reason that density as a whole has increased. People haven't just spread out - though clearly there is a lot of that, they've gotten more dense within the original habitation limits from 70 years ago, and that's where all the homes from 70 years ago are (by virtue of being in the original habitation limits before sprawl). Sure coastal CA and NY are extreme examples, but density overall is up in the areas where 1940's homes were.

I have acknowledged that it is POSSIBLE that different areas appreciate at different rates, but that is a far cry from you showing any quantifiable, non-anecdotal evidence.

Wow. You are one tough customer if you won't even concede that. I give up.

10. What housing sales are excluded from the index calculation?

The indices measure changes in housing market prices given a constant level of

quality. The repeat sales method limits the effect that changes in the types and

sizes of houses sold or changes in the physical characteristics of houses have on

the indices. Filters are used to maintain the integrity of the index as an indicator

of market trend. These filters identify and exclude: non-arms length transactions

(e.g., property transfers between family members); transactions immediately

preceding or subsequent to substantial physical changes to a property;

http://www2.standardandpoors.com/spf/pdf/index/SP_Case_Shiller_Home_Price_Indices_FAQ.pdf

The "transactions immediately preceeding" bit has always bugged me. Why should it be excluded just because a developer bought the property? Not to mention, if a developer buys a property to develop it, it's likely because the land value has gone way up, and the existing structures are no longed a best economic use.

I have acknowledged that it is POSSIBLE that different areas appreciate at different rates, but that is a far cry from you showing any quantifiable, non-anecdotal evidence.

Wow. You are one tough customer if you won’t even concede that. I give up.

Huh? I said different areas can appreciate at different rates. I conceded it, then you said I won't concede it and you give up?

Whatever, dude...

Shiller went out on a limb and correctly predicted the crash at a time when every other mainstream media source was saying "real estate always goes up", "it's a new economy", "it's different this time", "not here", and even after the impending crash was obvious, still saying "soft landing". If one is claiming the chart that did this is nonsense, I think it's contingent on THAT person to prove it.

« First « Previous Comments 4 - 43 of 63 Next » Last » Search these comments

Say, has anyone updated the Shiller graph recently?

All I find when I web search is this old one with projected lines, where's the actual?

http://patrick.net/housing/contrib/housing_projection.html

#housing