patrick.net

An Antidote to Corporate Media

1,257,332 comments by 15,004 users - keeprubbersidedown, Patrick, RandalRay, SunnyvaleCA online now

« First « Previous Comments 28 - 67 of 89 Next » Last » Search these comments

but Freddie and Fannie still have to be done away with. The institution is waste of time and money.

I disagree. We need a 'public option' for housing finance, too, where life necessities like housing don't get sucked into the 1%'s maw.

I'd rather the interest I'm paying on a mortgage go to DC than some hedge fund in the Caymans.

+1. That's the whole point, the money will inevitable flow somewhere.

And only people who can afford to live in desirable areas. The riff raff cannot get in.

Prop 13 is a beautiful thing. My BIL is an extremely hard-core libertarian/conservative. They're renting a $900,000 place in a very nice part of LA that was inherited and has a Prop 13 value of $500,000.

We don't get into politics much, well I don't, but I like picking around the edges of this reality he's stuck in, paying sky-high rent to someone who's doing absolutely nothing to earn this money. . .

The contradictions are heightening. . .

And only people who can afford to live in desirable areas. The riff raff cannot get in.

Prop 13 is a beautiful thing. My BIL is an extremely hard-core libertarian/conservative. They're renting an $900,000 place in a very nice part of LA that was inherited and has a Prop 13 value of $500,000.

We don't get into politics much, well I don't, but I like picking around the edges of this reality he's stuck in, paying sky-high rent to someone who's doing absolutely nothing to earn this money other . . .

The contradictions are heightening. . .

My neighbor once responded. I have been paying property tax for 40 years (in inflation adjusted amount), how long have you?

Well you know, If you hold 900K worth of Edison Electric stocks, you have done nothing to earn the 40K in dividends too.

My neighbor once responded. I have been paying property tax for 40 years (in inflation adjusted amount), how long have you?

Well, if the property is being rented, then the renter is paying the property tax to the property owner. That's sort of how the system works. People who are not renting their properties are paying their own property taxes.

In any case, property taxes in CA are a joke. Local governments are largely supported by state income tax proceeds kicked to them by the state government and sky-high sales taxes, so who cares what your uninformed neighbor says?

The purpose of Fannie/Freddy is to push debt, make people debt slaves, artificially inflate housing, and maybe use the increased debt as a short term stimulus of the economy.

When Democrat politicians say "affordable housing" they really mean "unaffordable housing".

What are Fannie/Freddie doing that makes rents go up? Unless you can answer that, you can't make an argument that they are increasing house prices.

Yeah, declining prices is just what will encourage homebuilders to increase the supply of houses.

That's a BS argument: Homebuilders can build new homes for $250K. That's about the average price of a NEW house in the US.

That's way below the median price of *any* house in CA.

I do not believe in blaming the democrats, but I do believe what you wrote above is correct.

Democrats are hypocrites. Republicans are irrational. I hate republicans even more on that account.

But I won't vote for politicians that do everything possible to inflate housing prices.

I do not believe in blaming the democrats, but I do believe what you wrote above is correct.

Democrats are hypocrites. Republicans are irrational. I hate republicans even more on that account.

But I won't vote for politicians that do everything possible to inflate housing prices.

Agreed. Here is what I purposed on Patrick's latest thread:

How about both conservatives and liberals joining together and demanding to end all campaign financing and setting all elected officials pay to the minimum wage? Wouldn't that automatically guarantee a better caliber of elected officials?

The internet could then be used for its original hope: direct democracy. A web page could be created were anyone could sign in as a candidate. Each candidate would be asked 100 important questions, plus have to state how important each issue is to them in percentages. The sign-up to run for office would not be complete until all questions were answered. That would be each candidate's "payment." There would be a place on each candidate's sight for Q&A and a bio. The website could have a test to see who your views are in alignment with to help narrow down different candidates to explore. The test could be the same 100 questions and same percent scale.

The fact Realtors are lobbying heavily for housing market subsidies tells you everything you need to know above such subsidies.

The fact Realtors are lobbying heavily for housing market subsidies tells you everything you need to know above such subsidies.

Figures.

http://research.stlouisfed.org/fred2/graph/?g=toT&dbeta=1

Housing affordability is significantly higher than it has ever been.

Didn't NAR change their formula to make it so more people found housing "affordable"?

That's a BS argument: Homebuilders can build new homes for $250K. That's about the average price of a NEW house in the US.

That's way below the median price of *any* house in CA.

Except that in certain parts of CA, it costs significantly more to build due to fees and permitting and other government requirements.

What are Fannie/Freddie doing that makes rents go up? Unless you can answer that, you can't make an argument that they are increasing house prices.

What are Fannie/Freddie doing to make rents go down?

Unless you can answer that you can't make an argument we need them.

What are Fannie/Freddie doing that makes rents go up? Unless you can answer that, you can't make an argument that they are increasing house prices.

The market does not operate in a vacuum. If owning housing is subsidized, causing prices to go up, then renting prices will usually go up too, whether it's to pay off those more expensive housing or just to fill the gap.

Take away the subsidies, and the price of housing should go down, and theoretically rental prices should go down too, but none of this operates in a vacuum, and it doesn't happen immediately.

The price of a rental is theoretically the cost of owning plus a profit (a penalty for liquidity or whatever you want to call it), but market distortions can change the formula and it may shift around a bit sometimes based on various conditions, but should apply over the long-run if there aren't distortions.

Didn't NAR change their formula to make it so more people found housing

"affordable"?

Right... Go look at the source for that graph: NAR!!! Yep, totally unbiased

data....

You guys are such douches..

http://research.stlouisfed.org/fred2/graph/?g=tqP&dbeta=1

Interest carry cost of median home compared to median income. 20% down.

Historical numbers, not NAR numbers. I just used math.

The market does not operate in a vacuum. If owning housing is subsidized, causing prices to go up, then renting prices will usually go up too, whether it's to pay off those more expensive housing or just to fill the gap.

Take away the subsidies, and the price of housing should go down, and theoretically rental prices should go down too, but none of this operates in a vacuum, and it doesn't happen immediately.

The price of a rental is theoretically the cost of owning plus a profit (a penalty for liquidity or whatever you want to call it), but market distortions can change the formula and it may shift around a bit sometimes based on various conditions, but should apply over the long-run if there aren't distortions.

A very good answer to a good question. Thank you.

YOU posted the graph with the NAR as the source of the data...

The new graph tells the same story as the NAR graph. Ergo, the NAR graph is at worst, directionally correct. At best, it is absolutely correct.

Either way, your ad hominem to the point is inaccurate.

Now, do you want to actually debate something here with facts of your own, or are you going to continue with logical fallacies that don't even stand up to 5 seconds of scrutiny?

The market does not operate in a vacuum. If owning housing is subsidized, causing prices to go up, then renting prices will usually go up too, whether it's to pay off those more expensive housing or just to fill the gap.

I disagree. If owning is subsidized, causing more people to own, it will necessarily cause less people to rent and drive rental costs down. Renters don't care what your house payment is. It's supply and demand.

Take away the subsidies, and the price of housing should go down, and theoretically rental prices should go down too, but none of this operates in a vacuum, and it doesn't happen immediately.

See answer above--I completely disagree.

The price of a rental is theoretically the cost of owning plus a profit

The price of a rental is supply and demand. I guess in the infinite long run it is cost of owning plus a profit, but that never occurs. Because everyone's cost of owning is different.

What are Fannie/Freddie doing to make rents go down?

Unless you can answer that you can't make an argument we need them

They are reducing the number of renters. That should reduce rental prices.

Why can't we go back to housing prices being about twice the median income? Normal markets price adjust all the time. What would happen if Freddie and Fannie were eliminated? What if at the same time we tightened regulations for foreign investors, or better yet, made it a law that only tax paying citizens can purchase property? We could tax the 1% their share and force everyone the government bailed out to pay back the government at 14% interest. How about more afforadable housing? How about a tax on anyone owning more than one home? How about eliminating prop 13 while on this roll? If all that happened, and it could (and we the people could push for all of the above) then where would housing prices be?

Businesses and governments rise and fall. Is it impossible to imagine that housing prices could go back to former healthy numbers? Is the American housing market the most infinite institution in all of history? Is the American housing market and our government immune to change in a way no government or business has ever been before?

It takes some nerve to be so dishonest as to argue that houses are at their most affordable, while at the same time most expensive when you consider the price tag.

Yea, we all know that rates have never been lower, so the fuck what? What kind of asshole wants to finance a house with a 30 year mortgage? Anchored to 30 yrs worth of exhorbitant PMI?

I want to buy a house with cash, hence, an honest person would not dare to muddy the conversation with such bullshit as "housing is more affordable now, than ever.

Is it just coincidence that these lyijg ASSHOLES! All cheerlead the democrap party while blaming all societies ills on republicans. The same people that blindly support the affordable care (republican) act.

How can anyone take these people seriously if they are willing to be so dishonest on this particular issue,,,,the entire point of this website and its forums existence

Yea, we all know that rates have never been lower, so the fuck what? What kind of asshole wants to finance a house with a 30 year mortgage? Anchored to 30 yrs worth of exhorbitant PMI?

Why is renting for 30 years OK, but paying a mortgage for 30 years is being a debt slave?

If you don't want to pay PMI, then save some damn money and put 20% down.

Why can't we go back to housing prices being about twice the median income?

get the specuvestors out of the market would have to be the first step.

How about more afforadable housing?

Housing is housing, the price level is largely set by the need for it and how much we are able to pay vs. the mix of available homes. Price is the sorting mechanism for who gets what from the mix, not what you get per se.

If by "affordable" you mean subpar quality aka "shitty", then that's not the place we need to save money on, all that will result is us paying more for shittier places to live.

What is actually needed is more QUALITY housing supply. Not gold-bricked $500/foot that developers prefer building, but decent stuff that ticks everyone's checklist for "reasonable" build finish and amenities and won't fall apart in 10-15 years.

How about a tax on anyone owning more than one home?

That would be good. We can imagine a lot better ways to penalize, er, de-incentivize, land-hoarding. Parcel taxes, rent taxes, land value tax. . .

then where would housing prices be?

absent more supply than the demand, whatever we are able to borrow, or whatever cash buyers want their cash-on-cash yield to pencil out at.

So if landlords can rent out a place for $1100 -- call it $12,000/yr gross -- $120,000 would give them 10% gross yield, $240,000 would be 5%.

With 4.25% interest rates, a family who can handle a PITI etc of $1200/mo can buy a $220,000 place (with 20% down).

The thing about real estate is this:

https://research.stlouisfed.org/fred2/series/CUUR0000SEHA

wages go up, rents go up.

it's a brutal cycle. breaking it is tough; even the nordic socialist paradises have screwed themselves with housing borrowing debt, and the periphery -- Spain, Greece, Ireland -- doubly so. Only Germany and maybe France is doing OK here, and I guess the former communist bloc, since they started with zero mortgage debt in 1990 at least.

India is horrific for housing, as is China. Maybe Mexico is OK but consumer credit doesn't exist there basically. UK, home of "buy to let", is screwed.

Japan blew themselves up with housing in the late 80s, but at least their ongoing depopulation should result in continued collapse of real estate -- when one out of four houses are empty, prices simply HAVE to go down.

http://www.japantimes.co.jp/news/2014/01/07/national/abandoned-homes-a-growing-menace/

Housing is a really peculiar sector of the economy, since land cannot be manufactured or shipped, yet it is considered capital anyway.

Obscuring this peculiarity is partially how the rich stay that way. It's really quite something.

We're so immersed in land economics that we cannot really see them for what they are. Just like fish in water, or worms in soil, do not think about the reality of the medium they're living in.

You guys are such douches..

http://research.stlouisfed.org/fred2/graph/?g=tqP&dbeta=1

Interest carry cost of median home compared to median income. 20% down.

Historical numbers, not NAR numbers. I just used math.

Well, you're the one who used NAR data, not me.

I don't know if medians are fully accurate for housing prices, but it'll do. I would include principal + interest + tax + insurance, although ideally it'd include maintenance too.

Even if principal comes back to you, you will eventually have to pay it. That's why I'd much rather pay 8% on a $300K loan vs. 3% on an $800K loan. The interest cost in the first year is roughly the same, but I can pay off the former much quicker and if the interest rate drops, I'm golden.

I disagree. If owning is subsidized, causing more people to own, it will necessarily cause less people to rent and drive rental costs down. Renters don't care what your house payment is. It's supply and demand.

That assumes that all of the housing being purchased are being newly occupied and not part of existing occupied housing stock, right? The reality is that assumption is false -- if renting is no longer a viable enterprise, landlords will sell houses to these new owners, so in the long-run. What you're saying shouldn't happen or else there would be a lot of vacants.

If you are a proper investor, if you're not getting the right percentage return on your rental, you should sell and deploy your money elsewhere. Why take the risk if the return sucks?

Someone on PatNet recently suggested that 3% would be an appropriate return on a house in Palo Alto, but that only works if you're speculating. When you're getting 2.7% on 10-year government bonds, 5% in intermediate bond funds, and some crazy number in the stock market, it's stupid to risk your money for 3% on speculation.

Why can't we go back to housing prices being about twice the median income?

Normal markets price adjust all the time. What would happen if Freddie and

Fannie were eliminated? What if at the same time we tightened regulations for

foreign investors, or better yet, made it a law that only tax paying citizens

can purchase property? We could tax the 1% their share and force everyone the

government bailed out to pay back the government at 14% interest. How about more

afforadable housing? How about a tax on anyone owning more than one home? How

about eliminating prop 13 while on this roll? If all that happened, and it could

(and we the people could push for all of the above) then where would housing

prices be?

Politics in a nutshell. 50% wants something and the other 50% doesn't. It is a waste of time. The reason you are for somemthing is also something many are against for the same reasons.

In a capitalistic society, resources are scarce and things people like are coveted and competed for. Things will always get more competitive, not less competitive in the future.

That assumes that all of the housing being purchased are being newly occupied and not part of existing occupied housing stock, right?

Nope--just that people have to have a place to live. So, they either buy or rent. Those are your two options. corntrollio says

If you are a proper investor, if you're not getting the right percentage return on your rental, you should sell and deploy your money elsewhere. Why take the risk if the return sucks?

Yes--I agree.

Nope--just that people have to have a place to live. So, they either buy or rent.

Right, but what you're saying can't really happen easily in the long-term.

I disagree. If owning is subsidized, causing more people to own, it will necessarily cause less people to rent and drive rental costs down. Renters don't care what your house payment is. It's supply and demand.

Let's go back to the quote above -- you can't say it's supply and demand and then say that the rental market will act completely independently of the purchase market. Those markets are intertwined, as you apparently agree now. If there are fewer renters, then fewer people will be landlords because it won't be as lucrative, so rents can't go down independently in the long term.

Why can't we go back to housing prices being about twice the median income? Normal markets price adjust all the time. What would happen if Freddie and Fannie were eliminated? What if at the same time we tightened regulations for foreign investors, or better yet, made it a law that only tax paying citizens can purchase property? We could tax the 1% their share and force everyone the government bailed out to pay back the government at 14% interest. How about more afforadable housing? How about a tax on anyone owning more than one home? How about eliminating prop 13 while on this roll? If all that happened, and it could (and we the people could push for all of the above) then where would housing prices be?

Name one thing from above we shouldn't push for, and if we shouldn't, why?

Except that in certain parts of CA, it costs significantly more to build due to fees and permitting and other government requirements.

That's exactly the point: subsidize demand, penalize supply.

That's the game they play to raise prices, and this is plain evil.

Let's go back to the quote above -- you can't say it's supply and demand and then say that the rental market will act completely independently of the purchase market. Those markets are intertwined, as you apparently agree now. If there are fewer renters, then fewer people will be landlords because it won't be as lucrative, so rents can't go down independently in the long term.

I've always agreed that they are intertwined. In the long run, the only thing that can lower house prices is more supply. Freddie and Fannie have no effect. But they do allow people who would be renters for life the opportunity to buy. Which takes money from the landlord's pockets and puts it in the back in the pockets of the new homeowner. IMO, that is a good thing.

Name one thing from above we shouldn't push for, and if we shouldn't, why?

Eliminating Freddie and Fannie won't lower housing prices and will make lifelong renters out of people that would like to own. Which would make inequality even worse.

Name one thing from above we shouldn't push for, and if we shouldn't, why?

Eliminating Freddie and Fannie won't lower housing prices and will make lifelong renters out of people that would like to own. Which would make inequality even worse.

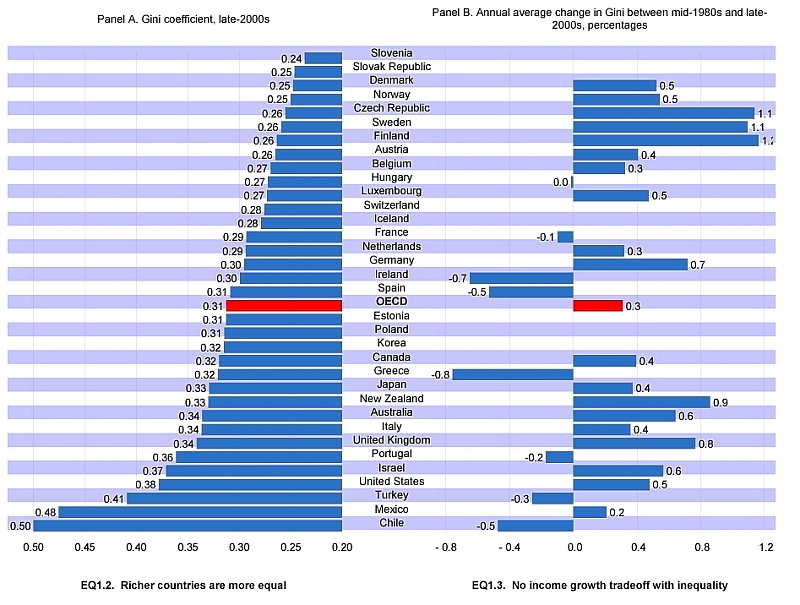

Bullshit - plenty of countries with far lower house-ownership and less inequality. If there is a correlation, than it's the opposite: the more debt-serfs a country produces, the bigger the inequality. Debt is slavery.

the more debt-serfs a country produces, the bigger the inequality.

. . .

Gini vs. private DTI levels in the nordic states runs counter to that assertion.

http://runningofthebulls.typepad.com/.a/6a00d83451986b69e20134828024c4970c-450wi

Switzerland has 200% debt to income, LOL.

Furthermore, Mexico has negligible consumer debt and very high Gini, which rather destroys that assertion outright.

and if we shouldn't, why?

mainly

http://research.stlouisfed.org/fred2/series/HHMSDODNS

there's still $9.4T of TBTF assets tied to mortgages. Lowering the asset value by half or whatever would destroy the financial system we have.

It'd be a replay of 2008-2009 all over again.

Plus homeowners aka voters don't want to see their property values decline like that and will always vote to defend their property valuations.

it's stupid to risk your money for 3% on speculation

the only speculation on 3% in PA is on continued wage and income growth in PA.

http://research.stlouisfed.org/fred2/graph/?g=ttK&dbeta=1

SF to SJ employment

Nominal wages for the top 10% have tripled in 20 years, maybe quadrupled -- average high-level salary has gone from $30,000 ~ $40,000 to $120,000 ~ $150,000.

And this is aside from the fortress nature of PA itself, with all the non worker-bee residents.

Plus a lot of successful worker-bees become ex-worker bees and retire in-place, too. Most of my Gen X peers who beat me to the SV gold rush, sigh.

Plus that's just tech, and not health care and other high-end professional residential demand.

Name one thing from above we shouldn't push for, and if we shouldn't, why?

"Why can't we go back to housing prices being about twice the median income? "

That presumes much lower prices which will benefit some but will devastate others. I don't think 2009 was all that great.

"What would happen if Freddie and Fannie were eliminated?"

Nothing really, private market will pick up the void. The US financial system is too dynamic to not pick up an extremely profitable segment.

"What if at the same time we tightened regulations for foreign investors, or better yet, made it a law that only tax paying citizens can purchase property?"

That implies that low price is a good thing. Good for some, not good for some. Almost everyone was a foreignor at one time anyway so not sure why natives are all that special. We want to attract bright foreignors not alienate them. nothings wrong with recruiting elites, that makes the country stronger.

"We could tax the 1% their share and force everyone the government bailed out to pay back the government at 14% interest. "

Taxing “everyone†but yourself is popular. Unless it effects you, it must be good. I support all taxes I don't have to pay as well and get government subsidized affordable housing.

"How about more afforadable housing? "

Who will pay for it and who will get it? Let's use the 1% money.

"How about a tax on anyone owning more than one home?"

Where in American law that says one home for all? Taxing “everyone†but yourself is popular. Unless it effects you, it must be good.

"How about eliminating prop 13 while on this roll?"

Taxing “everyone†but yourself is popular. Unless it effects you, it must be good.

All the questions amount to is socalism. I get that. but the US is competing against the world in a capitalistic driven society in a smaller planet. Better to compete than to give up.

Bullshit - plenty of countries with far lower house-ownership and less inequality

Of course. Your logic is flawed. There are many, many factors leading to inequality--home ownership is only one small one. That doesn't mean I'm not right.

If there is a correlation, than it's the opposite: the more debt-serfs a country produces, the bigger the inequality. Debt is slavery.

Now that is BS. Again I'll ask. What is the difference between paying $2000/mo. in rent and $2000/mo. in a mortgage? Why is one "debt slavery" and the other not??

Now that is BS. Again I'll ask. What is the difference between paying $2000/mo. in rent and $2000/mo. in a mortgage? Why is one "debt slavery" and the other not??

The difference is that you can downsize any point in time according to your wallet. You cannot do this in the mortgage case without losing a lot of equity by abandoning or short selling it. Of course it works better if house prices only go up which apparently they do! ;)

the only speculation on 3% in PA is on continued wage and income growth in PA.

You quoted me without context:

Someone on PatNet recently suggested that 3% would be an appropriate return on a house in Palo Alto, but that only works if you're speculating. When you're getting 2.7% on 10-year government bonds, 5% in intermediate bond funds, and some crazy number in the stock market, it's stupid to risk your money for 3% on speculation.

There's a difference between investment and speculation in my book. Investors try to get returns based on fundamentals. Warren Buffett has talked about this, when he says that the income something is throwing off is much more important to him than the actual share price, assuming the latter is within reason. Thinking too much about the share price is really more about speculation:

http://www.usatoday.com/story/money/markets/2014/03/10/must-read-quotes-from-buffett/6259941/

On investing in stocks as you would in a farm:

"If 'investors' frenetically bought and sold farmland to each other, neither the yields nor prices of their crops would be increased. The only consequence of such behavior would be decreases in the overall earnings realized by the farm-owning population because of the substantial costs it would incur as it sought advice and switched properties. Nevertheless, both individuals and institutions will constantly be urged to be active by those who profit from giving advice or effecting transactions. The resulting frictional costs can be huge and, for investors in aggregate, devoid of benefit. So ignore the chatter, keep your costs minimal, and invest in stocks as you would in a farm."

And this is aside from the fortress nature of PA itself

Any time someone starts thinking things can never change...

Nominal wages for the top 10% have tripled in 20 years, maybe quadrupled -- average high-level salary has gone from $30,000 ~ $40,000 to $120,000 ~ $150,000.

You're saying that the top 10% got paid $30-40K in San Jose/Palo Alto in 1994? I call bullshit.

That number seems extremely low, even for 1984. Here's a cite -- AGI *nationally* in 1984 was more than $40K for the top 10%, so income was even higher:

http://taxfoundation.org/article/summary-latest-federal-individual-income-tax-data-0

The real data says that in 1994, the *national* number for top 20% was around $60K and the top 5% was around $110K, and the link above says that AGI in 1994 for top 10% was $68K:

http://www2.census.gov/prod2/popscan/p60-191.pdf

In addition, I suspect top 10% in SJ is actually higher than you're saying currently too. According to this, 16% of people in the SJ metro area (separate from SF) during 2007-2011 are in the top 5% nationally:

https://www.census.gov/prod/2013pubs/acsbr11-23.pdf

Top 5% is about $180K during the period in that study -- probably around $170K or so in 2007 and something north of $185K in 2011. If 16% are at that mark or higher, logically the top 10% in SJ is higher than that mark.

Nationally the top 10% number for 2012 was about $146K, and the top 5% number was about $191K:

http://www.usatoday.com/story/money/business/2013/09/17/census-median-household-income/2825129/

Your figures are highly suspect, and inflation accounts for a lot too. $40K in 1984 would be $90K today.

You're saying that the top 10% got paid $30-40K in San Jose/Palo Alto in 1994? I call bullshit.

I was thinking about starting salaries in 1990 (what I am familiar with) around $30,000 or so for worker-bee jobs in SV. I guess the outer range for experienced worker-bees was 2X that in 1990, but certainly $60,000 was very low for anyone once the dotcom boom got going in the late 90s.

http://research.stlouisfed.org/fred2/series/SANJ906INFO

shows the employment trend in part of SV.

t'd be a replay of 2008-2009 all over again.

Really? What was so bad about those years? Prices going down certainly will not hurt any working family under 45 that I know of.

« First « Previous Comments 28 - 67 of 89 Next » Last » Search these comments

http://www.huffingtonpost.com/harlan-green/losing-fannie-and-freddie_b_4975985.html

Comment/post from Michael S.: "If you increase "affordability" you will increase demand. When demand increases then prices rise. When prices rise, affordability falls.

Government backed loans don't help homebuyers, they line the pockets of bankers and the real estate industry. Rising prices help increase tax revenue too, so the industy lobbyists get what they want.

17 MAR 2:47 PM"

#housing