patrick.net

An Antidote to Corporate Media

1,265,369 comments by 15,133 users - desertguy, mell, Tenpoundbass online now

Comments 1 - 13 of 13 Search these comments

OK, I actually did some original research and overlaid real home prices (thick line) over interest rates (thin line)

Using Shiller’s data set from 1890 until the end of 2007

I think it's a BIG mistake to try to use dynamics from the 1970s, 80s, or even 90s to predict what's going to happen this decade and next. Using numbers from the 1910s is downright retarded.

In the Greesnpan era, interest rates were used to combat "inflation expectations" ie wage inflation by throwing people out of work via credit restriction.

This happened in 1995, 1999, and 2006.

But in the Bernanke era, we have already seen a willingness to try new and unusual measures to provide liquidity to the current system. I see no reason why this won't continue, and I think mortgage interest rates will go to 3% before we see 7.0% again.

This implies that buying now is NOT a bad strategy. Let's take an example:

$375,000 price 30 year @ 4.5% : $1700 carrying cost, $2300 actual cash outgo (includes principal repayment)

Refi $330,000 balance to 3% 15 year in 2015: $1300 carrying cost, $2800/mo cash outgo

If the above chart is any guide, rates aren't going to go up without concomitant wage inflation, which will be a wash for home prices, and also making the decision to buy now a win.

The only disaster would be rates going up but wages not. This would destroy the economy and giving the house to the bank would be advisable.

By game theory terms, the decision matrix is flashing BUY.

I agree somewhat but there's a big honking obvious singularity in that chart and I think it's a big mistake to look at any history previous to it.

IOW, the system reset itself in 1982 and until we get another Volcker at the helm of the Fed I think it's deceiving to look at the 1970s. Even if Volcker himself returned now, EVERYTHING is different between the 2010s and the 1970s. I've rattled off the differences dozens of times here so I won't do it again.

The main takeaway is that since 1982 the dominant interest rate regime has been DOWN. People say it can't continue but I disagree, 3% is still lower than 4.5%. $2600/mo buys a $415K house at 4.5% and a $450k house at 3%.

I'd LOVE to see a wage-price spiral this decade, but I just fail to see in which sector such a thing would take off. Wages are still 4X or more higher here than most everywhere else we're trading with.

Wages are still 4X or more higher here than most everywhere else we’re trading with.

Wages aren't everything though. You incur a lot of other costs doing business overseas. I just saw an article where a US company is moving jobs back from China to the US because the wage difference is shrinking and the transportation, communication, and quality costs are more than the wage difference. In their opinion at least.

Here's a better graph:

The light blue line is 30 year interest rates per the Fed.

This implies that buying now is NOT a bad strategy. Let’s take an example:

$375,000 price 30 year @ 4.5% : $1700 carrying cost, $2300 actual cash outgo (includes principal repayment)

Refi $330,000 balance to 3% 15 year in 2015: $1300 carrying cost, $2800/mo cash outgo

If the above chart is any guide, rates aren’t going to go up without concomitant wage inflation, which will be a wash for home prices, and also making the decision to buy now a win.

The only disaster would be rates going up but wages not. This would destroy the economy and giving the house to the bank would be advisable.

By game theory terms, the decision matrix is flashing BUY.

And what would one expect for 330K? I would agree with your analysis.

Wages aren’t everything though. You incur a lot of other costs doing business overseas. I just saw an article where a US company is moving jobs back from China to the US because the wage difference is shrinking and the transportation, communication, and quality costs are more than the wage difference. In their opinion at least.

LOL! they are moving back because housing costs are down as are employee costs. Dont expect them to be coming back around these parts. They are being moved back to lower costing states, not California certainly.

LOL! they are moving back because housing costs are down as are employee costs. Dont expect them to be coming back around these parts. They are being moved back to lower costing states, not California certainly

Nope-- This particular company wasn't moving back to CA. CA is not a good state for manufacturing, no doubt about it.

At the end of the day, the "average" American only cares about one thing - how much will this cost me? That cost is measured in two ways. The cost today (e.g. how much do I need to put down) and the cost per month.

So as much there may be a loose correlation between interest rates and prices, we should all bear in mind how much the lending landscape has changed. Heck we all agree that loose lending helped get us into this mess, and even today, you still only need to put 3.5% down --- a far cry from the 10% or 20% that "historically" was required.

As far as predicting rates, what rate are you predicing, and what time frame are you using. My personal prediction is that morgate rates wil bounce around between just under 4.5% and just over 5.25% over the next six to twelve months.

Then again, I also expect that sometime between labor day and Halloween, the stock market will have a one day drop of 1000+ points. I guess I'll have to check back around Thanksgiving to see how right (or more probably, how wrong) I was.

For the record my opinion is that as much as I want to believe that house are still overpriced, the low interest rates do help push prices up since once can "buy more house". As much as I am reluctant to admit it, prices in my area are probably closer to the bottom than I care to admit to. Expecting prices to revert to 1999 levels is not realistic, at least not in my area.

Then again, I also expect that sometime between labor day and Halloween, the stock market will have a one day drop of 1000+ points. I guess I’ll have to check back around Thanksgiving to see how right (or more probably, how wrong) I was.

ECBB, that's quite bold prediction. Do you mind tell us what made you think that way? It will be interesting if this really happens in this year.

For the record my opinion is that as much as I want to believe that house are still overpriced, the low interest rates do help push prices up since once can “buy more houseâ€. As much as I am reluctant to admit it, prices in my area are probably closer to the bottom than I care to admit to. Expecting prices to revert to 1999 levels is not realistic, at least not in my area.

So, what price level your local housing market is at now, and what price level do you think is fair in your area to compare with the peak?

FYI, my local area home price is not much differ from the peak. I consider 2003 level is fair though, I don't think I can see it happening any time soon.

Do you mind tell us what made you think that way?

http://dshort.com/charts/bear-recoveries.html?four-bears

If this were the 1973 bear market we'd be a month from semi-recovery that was created by raging stagflation and restructuring during the Carter malaise years.

If this were the 2001 bear market we'd be a month past the low as interest rates going from 8% to 5% and nifty outfits like WaMu, Countrywide, and hundreds of other subprime lenders were let loose with no adult supervision to drive the biggest debt boom this country has seen.

http://research.stlouisfed.org/fred2/series/CMDEBT?cid=97

Such a pretty graph.

Our recovery's been bullshit-driven so far. The 70s and early 80s problems were finally put in the past by Reagan's deficit spending, Volcker dropping interest rates, gas prices falling 50% in real terms, the rise of PCs, etc.

Government spending has already blown its wad and Congress is all but saying "no mas" to that. States are in even worse shape than the Feds if that is possible. The 99 week unemployment extensions are hanging by a thread in the Senate right now, if they don't pass it this month then millions of the funemployed are going to be pushed into the labor market ready or not.

Is there any good news on the horizon to appear this year or next? More emergency government spending? Even California's train thing is up in the air now. How about lower taxes? That going to happen?

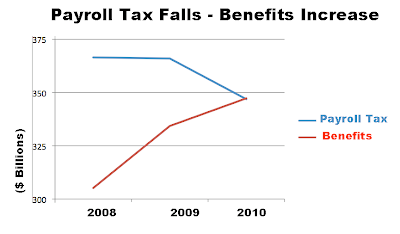

Then we've got the Social Security system needing to start dipping into the General Fund years before expected, ~$50B this year alone.

Surprise!

Medicare is screwed now and is only going to get worse. Congress can't pass the ~$30B Medicaid handouts either. The Annual Report of the Social Security Board of Trustees is two months MIA and no doubt has no cheery news for the market.

How about the GSEs and FHA? Good news coming for these guys?

Looking at that chart above, the market is in a zone of No Support. You may remember that we passed through this level very quickly in 2008, with the Dow going from 10300 to 8500 in a week, then we had the continued fun through the following March to finally find the 6600 bottom. Any shift into negative mode now and traders will be looking to test THAT low, not the October 2008 lows.

Cheer me up. Where's the good news coming from? Show me the money.

For whatever resson, some of the biggest stock market one day drops (in terms of %) have historicly occurd in the fall (12 of the top 20). I could go as far as postulate the reason why this is the case but that's a whole different topic.

http://en.wikipedia.org/wiki/List_of_largest_daily_changes_in_the_Dow_Jones_Industrial_Average

I don't have solid statistical reasons, so much as I have a general sense of things. I feel that we are not out of the woods, given the "on the ground" sings that I see (vacant storefronts, less trafic around the malls, few people hiring, etc.) are more or less where they were a year or two ago. People will start to "pay attention" again as summer winds down, only to realize that the fundamental problems are still there; the economy isn't appreciably better, despite the government throwing good money after bad trying to fix it. With that kind of a mindset, it doesn't take much to trigger a massive sell off. And the down going from say 11k to 10k in one day is not unrealistic.

@Troy.

Wow, that's big chart and tiny graph. I need bigger monitor. :)

Yes. This economy after 2008 so far has been driven by bullshit.

You said "never underestimate the power of bullshit" in the other thread, and I do agree with it. Add "too big to fail" and "too spoiled to get real" on top of it too. Someone may call recovery is recovery whatever bullshit is there. Some place like DC area looks like everything went back to pre 2008 era. You know full of gangs in starbucks etc. yeah, these people is trying their best to cut some costs... by skipping a dessert or something.

But I can not be sure about recovery yet. Because to me, our ecomony looks just like BP oil spill. They add a cap on it and said it's under control. But those problems that cause the spill haven't been fixed, and it is spilling all over at this very moment... just like our national debt.

Ok, let's leave it right there, think it is ok for a while.

But what worries me is this. What do we have in economy to lead next decade?

@ECCB

What I asked was your reasoning, not a solid evidence. So I heard you. The part I have a doubt is "pay attention" part. This country is largely driven by capital hill, wall street and sillicon valley. Don't know about sillicon valley though, other two places are never good at paying attention. So, we will see what's gonna happen. :)

By "pay attention" I am referring to my expectation that the mainstream media will start up with stories about "where we are now" (economically speaking) as the anniversary of the Lehman / Bear Sterns / panic of 2008 approaches.

Once the news cycle focus back on the economy, everyone will be talking about where things really are, good, bad or otherwise.

Are housing prices and interest rates related? I am getting conflicting answers:Â

Here is a quote from Shiller's book, Irrational Exuberance, "Obviously, there is no hope of explaining home prices in the United States solely in terms of building costs, population, or interest rates."Â

Here is one reason Patrick offers why it is a terrible time to buy: "Because it's a terrible time to buy when interest rates are low, like now. Realtors just lie without shame about this fundamental fact. House prices fall as interest rates rise, because a fixed monthly payment covers a smaller mortgage at a higher interest rate."Â

Using Shiller's data set from 1890 until the end of 2007, I calculate the correlation of house prices and long term interest rates to be 0.20, which does not seem too strong. Even if the correlation were strong, this would tell us nothing about the direction of causation (i.e. do high house prices cause high interest rates or do high interest rates cause high house prices?). Note the correlation is not negative as Patrick suggests.   Â

Can anyone accurately predict interest rates? I think you can make a fortune in the bond market if you can forecast interest rates. Maybe those of us who have not made money speculating in the bond market should ignore the current level and forecasts of interest rates when considering real estate investments.

#housing