patrick.net

An Antidote to Corporate Media

1,260,170 comments by 15,050 users - FortwayeAsFuckJoeBiden, GNL, Tenpoundbass online now

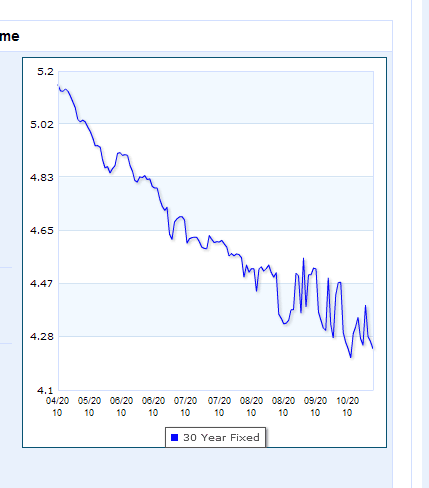

Good news for Patrickans mortgage rates going higher

2010 Oct 21, 1:13am 2,326 views 6 comments

Comments 1 - 6 of 6 Search these comments

There's a flawed logic here. Mortgage rates go lower because nobody is buying. Rates go higher when everybody is buying (hence prices going up).

The exception was the past 6 or 7 years when rates were artificially low due to teasers and option arms.

No need to worry, QE2 is coming, 3.75% 30 year mortgage rates will be here in 3-6 months:

No need to worry, QE2 is coming

That’s too bad because I wish to see conditions that prove that Tatu and his ‘when interest rates rise, home prices rise’ theory come to pass.

My theory? I was just stating the fact that in the past interest rates have shown very little correlation with house prices. And, if anything, rising house prices have tended to occur in time periods with high interest rates. I've explained why it's the case on many, many occasions--you just choose to ignore the reasons. Or perhaps it's over your head....

It can go either way.

I think previous examples of inflation can be analyzed as wage, demographic, and productivity growth fueling both higher prices overall and higher debt service capacities.

The PTB had to raise interest rates while the economy was in this mode to brake runaway debt-money creation and "inflation inflation".

Well, that was the 1970s at least: http://research.stlouisfed.org/fred2/series/MORTG/

I don't think the 1970s has anything to do with now, as I've detailed dozens of times.

I became a Japanophile around 1988 so I got to see a bit of their bubble period "in realtime" as they say. It was quite a happy time, and people now look back on it generally fondly -- life was "as good as it gets" for them back then.

But by the time I actually moved to Tokyo in 1992, things were beginning to be a bit different.

Anyhoo, their central bank was able to push mortgage rates to the floor and keep them there:

If 2004-2006 is as "good as it gets" for us (or at least the middle class), then I expect a similar slow grind in store for us for the remainder of the decade and beyond.

No wage inflation, no price inflation, just redistribution. And actual deflation, due to the http://en.wikipedia.org/wiki/Paradox_of_thrift and the necessity for the middle class to start paying back all that money they borrowed the previous decade.

We won't even get into the state of governmental finances, though "parlous" comes to mind.

This is no longer that contentious of an argument. Obama firing his original batch of advisors can tell us that they are now aware that there is something rotten in the State of Denmark.

http://www.cnbc.com/id/39777342

wont be long before economy has fully recovered and rates are back at 6%

Then It will be a great time to buy?

#housing