patrick.net

An Antidote to Corporate Media

1,248,715 comments by 14,891 users - Ceffer, KgK one online now

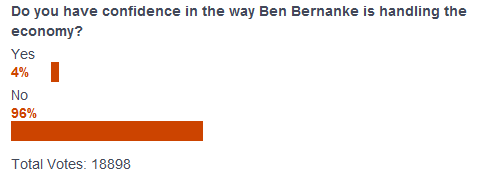

Trying to understand how QE creates the wealth effect

2011 Jun 21, 9:55am 2,707 views 19 comments

Comments 1 - 19 of 19 Search these comments

Yes, its the Fed that's causing the ruin by price fixing interest rates. Price fixing gives false signals as to whats happening in the economy which CAUSES malinvestment on a massive scale, aka "Bubbles".

Price fixing for the little guy is illegal. Government and businesses with affiliated arrangement's with the government, have immunity, I guess, from the law - "some animals are more equal than others".

Out with Bernanke and in with Austrian man !

Yes, its the Fed that’s causing the ruin by price fixing interest rates.

Exactly. I have never understood how one small closed group of men (FOMC) can decide what the market interest rates should be... Are they really THAT better than the collective consciousness of the market?

I get e-mails from these real estate agents saying that "interest rates are low, now is a great time to lock in these low rates"....That cracks me up...I mean why shouldn't the interest rates go higher?

A better question would be...what will happen if interest rates go higher?

People cannot borrow already as lots of them are unemployed and most people are saturated with debt up to their eyeballs...if credit becomes hard to get due to higher interest rates, housing prices will just collapse...Who doesn't want that..? well lots of powerful people...banks, Fed etc.

The other ramification is that - how on earth will the government continue to borrow to perpetuity (which is their plan btw), if interest rates go up? I think the Government will go broke just to pay interest on the debt, so it has to borrow to even pay the interest.. debt piling on more debt...

The house of cards is fragile at the moment.

Bernanke said he has no idea why the slow growth

of economy persists. He does not want to admit

that he is causing inflation with QE while middle

income earners continue to earn less. With the QE,

the average middle income must also increase

in adjacent to inflation. It is not. Do your

own diligence. Bernanke is an idiot and a

coward.

We don't need to devalue our dollars against all

currency. Only against Chinese currency,

and it will bring back the jobs.

QE2, almost all 600 billion, was used to buy US treasury notes from Banks whose primary operations are outside of the United States.

In short, QE2 is yet another attempt to recapitalize European banks that should file for bankruptcy because they are insolvent.

But the game continues. The Fed will continue inflating until the Chinese allow the Yuan to float in foreign exchange markets.

The Fed will simply bail out banks around the world that continue to finance the Chinese economic expansion with imports of cheap crap. The Chinese will blink because they have no other choice unless they're angling for a fight.

We don’t need to devalue our dollars against all

currency. Only against Chinese currency,

and it will bring back the jobs.

Can't. The Chinese peg their currency to the US Dollar. If Bernanke devalues the US dollar the Yuan merely trails the leader.

This is also why the bailout of global banks will continue for infinity until the Chinese allow their currency to float.

The house of cards is fragile at the moment.

What you see as fragile is in fact incredible strength. The US is nothing close to a house of cards. Any country that can feed its own people and a few billion more on top of that is not weak.

Can you eat an Iphone?

China is the house of cards. Traders just have minimal ability to punish the Chinese for it because of the peg to the US dollar.

But the game continues. The Fed will continue inflating until the Chinese allow the Yuan to float in foreign exchange markets.

Let me see who is at fault here. One country outsources all its jobs to the other country, where companies have started establishing manufacturing plants due to the low cost overhead. In this age of fiat currency standard, pegging the currency allows the country to get more capital and jobs. The country that outsourced the jobs went on a debt binge, wants the other to float its currency so that it can pay off its debts through inflation. Who's problem is the debt?

The Chinese will blink because they have no other choice unless they’re angling for a fight.

They're making their moves. It would not be prudent to think they're fools.

What you see as fragile is in fact incredible strength. The US is nothing close to a house of cards. Any country that can feed its own people and a few billion more on top of that is not weak.

Feed its own people with debt beyond limits, feed the entire world also with its debt. US is quite vulnerable to the confidence game. It is not weak though, because of its military might.

China is the house of cards.

Agree that China has its own share of problems with malinvestment in real estate/ghost towns...but it has one advantage...trade surplus, and it can use those dollars to make wise moves.

Exactly. I have never understood how one small closed group of men (FOMC) can decide what the market interest rates should be… Are they really THAT better than the collective consciousness of the market?

That's because they don't. The market sets LIBOR, the market sets US Treasuries, etc. The FED sets the discount window rate. True, it has an effect on short term rates, but they are not "setting" market rates.

True, it has an effect on short term rates, but they are not “setting†market rates.

It is my understanding that they don't directly do that. But by being a marginal buyer of the US Treasuries, they have a strong influence up to the 10 year T-note market. If the Fed is the marginal buyer, there is no limit on how much it can buy, as it can just create money out of thin air.

True, it has an effect on short term rates, but they are not “setting†market rates.

This would be news to the Fed. They do set the rate by buying and selling Treasuries from primary dealers.

This would be news to the Fed. They do set the rate by buying and selling Treasuries from primary dealers.

Again--they can influence the rate through their purchases and sales. They don't set them.

Again–they can influence the rate through their purchases and sales. They don’t set them.

The Fed doesn't come in to the market and say this should be the rate. nobody is saying that. The Fed has no limit on how much it can buy (unlike you and me) so they can tweak this 'influence' from 'no influence at all' to 'weak influence' to 'strong influence' to 'completely dominating and setting the interest rate'. It is up to them to decide how far they want to push the knob. But the fact is, they can dominate enough to set it, if they want to. The power is there.

Again–they can influence the rate through their purchases and sales. They don’t set them.

The Fed doesn’t come in to the market and say this should be the rate. nobody is saying that. The Fed has no limit on how much it can buy (unlike you and me) so they can tweak this ‘influence’ from ‘no influence at all’ to ‘weak influence’ to ’strong influence’ to ‘completely dominating and setting the interest rate’. It is up to them to decide how far they want to push the knob. But the fact is, they can dominate enough to set it, if they want to. The power is there.

OK--I agree. I just think their power isn't as strong as indicated here. There have been times where they clearly wanted the 10 year or 30 year rate to be low but were not able to budge it much.

How will the Chinese currency floating stop the bailouts? The banks will still be in the trouble they were before.

I didn't say they would.

I saw an interesting interview this morning: http://www.charlierose.com/view/interview/11738

It is worth watching fully, even though you may hate Greenspan for obvious reasons.

He makes an important point about excess reserves. This is how I understand the point he's making.

So when the Fed is conducting Quantitative Easing, it is essentially purchasing assets from Primary Dealers ( http://www.newyorkfed.org/markets/pridealers_current.html ) with freshly created electronic money. This electronic money then sits with the Primary Dealers who can choose to do a few things (correct me if I'm wrong here):

1. Short-term deposit in a commercial bank, thereby increasing the bank reserves -- this allows the said deposited bank to lend more money to local institutions, small businesses thereby creating jobs/helping recovery. The banks are not doing this though, because they are afraid they may lose capital, so they are just sitting on the reserves. They can in turn deposit these reserves with the Fed for a short term interest (yeah that's right, the Fed will pay interest on the excess reserves!!!!)

2. PD's can choose to speculate in the open market (stocks/bonds/commodities/precious metals..whatever) and thereby bidding up the prices of these. In reality this is what is happening, creating the wealth effect. This is actually also causing indirect price inflation, in the sense that by bidding up the price of a barrel of crude, they have effectively contributed towards increasing the gasoline bill of an average American. But at any time, when all this liquidity gets drained out of the market there will be a crash.

Direct monetary inflation hasn't really begun yet, but if the banks pull the plug on these excess reserves to be lent out, we will see dramatic price inflation.

Greenspan also warns of a US bond market crisis within the next 2 years, if Congress does not engage in fiscal consolidation (another fancy name for austerity measures I guess?) ...is he hinting that there will be lack of buyers in the Treasury market if the Govt. continues to engage in reckless spending?

So how does the Fed genuinely believe that the private financial enterprises will help the overall economy? Were they not the ones responsible for causing the ruin in first place?