patrick.net

An Antidote to Corporate Media

1,257,268 comments by 15,004 users - askmeaboutthesaltporkcure, Blue, mell, socal2 online now

Comments 1 - 40 of 72 Next » Last » Search these comments

If they go lower I'll put more into these tomorrow

You don't have to wait until tomorrow....lower has arrived today...a day early!

In 2009 , many of my friends bought BAC under 5 and made money.

BAC would always get bailed out......

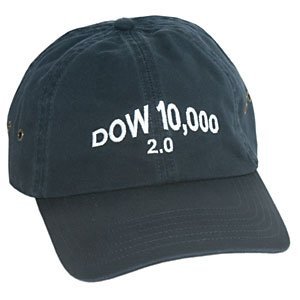

Some guy on here was extolling the virtues of buy & hold, the market always goes up long term. Right now I'm looking at Dow 10K looming for what is it, the 3rd or 4th time? First time was 1999. I wonder if my kid will still be watching this thing yoyo when he's in college.

Okaay Just bought BAC

Sincereley, the best of luck.

It's like I'm at a casino standing behind a guy at the high limits blackjack table. I'm rooting for him, but I don't have the balls to make that kind of bet.

I hope it triples for you.

Hey only 900 points to go now.

And I'm glad I didn't buy that hat, the 2.0 ruins it.

Berkshire Hathaway? They seem beat down too. I'm actually tempted by the idea of buying an A share, perhaps it's just because this is one of the few times it's in my reach.

What about Abbott Labs? It's ABT, I was looking at other medical stocks after recent good experience with Sanofi (SNY).

Stocks bought today will be the best stock for others few days/weeks later. Don't catch the falling knife.

Berkshire Hathaway? They seem beat down too. I'm actually tempted by the idea of buying an A share, perhaps it's just because this is one of the few times it's in my reach.

“Eagles are dandified vultures†- Teddy Roosevelt

I bought more today (and got creamed at the bell). BRK/B, I can't touch BRK/A.

What made you bought AAPL yesterday heading into the close?

It was a gamble that we were going to hit some resistance a little below 11,000. I like AAPL. I think TPTB will fight here. although it may still slide lower soon.

Avoid BAC /Bank of America like the plague, Citi also is dangerously radioactive. They have too much exposure to bad debt. Bank of America is in particular a badly run enterprise.

If I had to pick anything to buy *when you first posted* I would have suggested a Swiss stock ETF, iShares has EWL for example.

If I found a big bunch of money I would buy Swiss EWL, Swiss Francs, Apple, but also Vanguard Wellington, Equity Income, Total Bond market index.

In reality I just buy some Apple in addition to feeding my mutual funds when I have new money to buy them.

cloud13,

helluva pick and run with BAC. Hats off to you for having the balls to stick your money in there and make some money. Did you take some profits or are you waiting for it to go back to $15+ per/share?

Thanks E-MAN for giving tips about NLY and AGNC ( I'll research about them tonight )

I'm waiting for BAC to cross $10 atleast...... BAC and C have seen so many bad news that nothing effects them anymore.

we bought BAC yesterday and PFE. Transaction costs were well worth it, it's rare to buy and be positive the next day. Day trading is a wild ride at times.

It's never a "gamble" to buy Apple these days, they grew PROFIT 124% last year. There's no risk until 5 billion people have an Apple product.

It's never a "gamble" to buy Apple these days, they grew PROFIT 124% last year. There's no risk until 5 billion people have an Apple product.

If 5 billion people could afford apple products, nobody would be worried about the economy.

The biggest risk with apple is that Steve jobs isn't immortal.

I'm waiting for BAC to cross $10 atleast...... BAC and C have seen so many bad news that nothing effects them anymore.

Yea. Sure.

I just don't buy BAC or C or any other big bank. To my mind they were prime players in this whole housing bubble nonsense. No doubt my insignificant cash on this point means nothing, but it's an ethical issue.

Plus as Whitney says they are zombie banks. So playing them right now seems to me like people playing GM during the bankruptcy, just financial casino games nothing to do with the long-term.

I just don't buy BAC or C or any other big bank. To my mind they were prime players in this whole housing bubble nonsense. No doubt my insignificant cash on this point means nothing, but it's an ethical issue.

Plus as Whitney says they are zombie banks. So playing them right now seems to me like people playing GM during the bankruptcy, just financial casino games nothing to do with the long-term.

I pretty much stick to day trading on those too.

I'm with e-man on this, BAC and C are dangerous. Go for WFC if you're going to buy a bank right now.

I hate WFC as a bank, and I've found every company I hate, Warren Buffet owns. They have fee's and manipulate their products to maximize their profits. I walk about of a WFC bank feeling like I've been had every time. They're smart weasels.

Every time I walk out of BAC, I feel like I've been cheated, but had to give up because it just wasn't worth my time trying to fix the problems they've created. They're just complete incompetents, trying to mimic WFC but fail.

Kevin, whether or not people can afford something never stopped them from trying to buy it. I lived in Mexico, and I was astounded by stuff sold in a store Elektra. They allowed people to buy stuff like TVs on credit. They sent guys around on motorcycles to collect the $10-15 per week the various people owed the store. I see this happening in many poor countries. My friend told me about how some people in China would save up for several months to buy an Apple product.

Looks like Bank of America still sucks, but hope springs eternal for some people I guess.

Profitable companies that are selling crap that people must buy or crave badly will still be OK in my opinion.

I hate WFC as a bank, and I've found every company I hate, Warren Buffet owns. They have fee's and manipulate their products to maximize their profits. I walk about of a WFC bank feeling like I've been had every time. They're smart weasels.

The other interesting thing about Wells Fargo is how they picked up Wachovia. Shitty gave Wachovia a shitty offer that was partly backed by the FDIC -- Shitty was to buy Wachovia (including the Golden West assets) for something slightly north of $2B, excluding AG Edwards and Evergreen, and the FDIC would have picked up any losses above $42B on a $312B portfolio in exchange for $12B in preferred stock and warrants in Shitty.

Wells Fargo went balls out and picked up all of Wachovia for a whopping $15B without FDIC assistance. It was a shrewd move when no one else really had the cash, and appears to have paid off. They've been settling lawsuits for what seem like token amounts and the write-downs seem to have slowed. Part of it is that even if a lot of the Golden West portfolio performs badly, that bad performance will be spread out over the next several years.

Pkennedy, Loved your description of Wells. They are actually my bank as well -- they haven't done anything to piss me off lately so I've stuck with them. Heck, they even sent me an ATM only card this past month when my old one expired (instead of foisting a check card on me). But you're right, they are weasels. I bought some Berkshire B shares today for some more Wells exposure and went in on JPM as well. I've had cash on the sidelines for a while and ended up buying indexes on Friday and Monday. Also bought some dividend stocks -- GE and MRK without doing much research. Getting old and tired I guess.

And some more PBR yesterday. SFace, how you feeling about this one these days.

Keep an eye out for companies shares which are trading at or near book value and some near cash. LVS traded $2 at near cash. This was an extreme example back in early 2009.

Hmmm..well here's some

1) PG - they've paid a dividend I think for the past 130 years..they aren't flashy but everyone consumes. Right now it's the cheapest its been in two years...colgate might seem good but it's still a bit high..if it gets to 65 then maybe

2) I'd avoid social media but I'd say if google reaches 450-500 that might be good

3) retail can be iffy...tractor supply has been a solid 45 degree angle for the past few years but the PE still looks good..maybe 45-50 for a price range. HH Gregg might be a good one too but you'd be playing with fire. They bounced back years ago and some made a killing but that might not happen again. It might sound bad but discounters aren't doing that bad..bottom end ones. Dollar Tree is not even down 10%..it's had a significant run up, dollar general seems stable but that doesn't mean it is moving up either, family dollar if you get 30-35 then I don't think it will get lower

vf corp looks good. If people are trading down for clothing it hasn't phazed them...they also rent uniforms under their red cap division.

Their EPS looks really low though. SF Ace, whats your strategy and position on these types of companies? Low EPS, low Marketshare, pretty good divident....

ill scoop up some stocks if the price is right on an individual basis, i will buy stocks that have the potential to grab market share,, an example AMD, growth is dead, market share is king, and options are the single best tool to use, but you have to be very very careful when you pull the trigger, never ever ever buy something just because you have the money, wait as long as you need too 1 year 5 years, 10 years, buying something at the right time will make you money, always being invested will get you squat, patience is king, you need to be like a sniper behind VC lines living off snakes for subsistence watching your target through a scope, finger resting on the trigger, waiting for weeks at a time for the perfect shot

picture related its my investment strategy

WHEEE!

It's like a rollercoaster ride.

Took AAPL profits off the table, I am back in all cash, I lack conviction about this rally.

Buy stocks of can food or you'll be cannibalizing your neighbors!

Sorry, I've been reading too many of Apock's posts.

There are a lot of traders who make money from the ups and downs, that is what is going on lately. It's almost irresitible.

But, many countries are growing quickly, and these are going to be consumers of: 1. gadgets (Apple 2. health care (Novartis, Pfizer, Merck) 3. entertainment (Discovery, Disney, Universal) 4. Energy (Exxon) 5. food (Potash, Monsanto, Deere) 6. government construction (Caterpillar). 7. communication (Telmex, Chinamobile, Verizon). 8. shampoo, toothpaste, butt wipe (Kimberly Clark, Procter and Gamble). 9. luxury goods/fashion (LVMH, Ralph Lauren) Some large companies are paying nice dividends today.

If you think this is all going to stop because USA has slow growth, I would not bet on it. I lived in a third world country for a few years and there was a tremendous pent up desire for junk and comfort and they are trying their hardest to have everything we have here. They'll kill themselves trying to get it, and to please some woman and her kids in the process.

Of course, governments are still inept enough to ruin this too, there is always that possibility.

My friend yells at me to get out of my mutual funds but I am investing for the year 2025 or so.

Comments 1 - 40 of 72 Next » Last » Search these comments

I'm going to put into BAC and C, If they go lower I'll put more into these tomorrow.

But WHAT ELSE ??

#investing