patrick.net

An Antidote to Corporate Media

1,257,240 comments by 15,002 users - stereotomy online now

« First « Previous Comments 11 - 50 of 61 Next » Last » Search these comments

The true value of a house is whether or not it puts people where they need to be useful to their own future. Individually and collectively, this is the rub. Whether inflation occurs or not is based on the economics of the culture, because the economy is just data that reflects what people are doing. If everyone is using oil to drive to a job to buy a car to drive to a job, and they plop houses anywhere they have a hankerin' to do so, then basing your assumptions on the value of A: the economy figures and B: the price of the house is simply deluding yourself that the culture itself will continue to function as the consuming beast that it is, and that the availability of resources for it to do so will remain stable.

Hyperinflation will only help you with mortgage or other debts IF your income keeps up with inflation - which is a BIG if!

I know what you mean, but I don't agree entirely.

I think too big a mortgage is an unwise risk. And we can't know about inflation. But having said that, debt is a hedge in inflationary times.

Say you buy a 600K house with a 500K mortgage, and an household income of 190K. If 20 years later your household income has gone up to only gone up 350K, but the house is up to 2.4 million then it's a win. You're now paying back dollars on your mortgage that are worth much much less than the ones your borrowed.

The thing is, it's impossible to predict. What if we have a 20 years like japan has had?

Also, if inflation kicks in and prices go down in the short term because of higher interest rates, then you are locked in to a deal that's losing in the short term (although you might be able to rent it out - do the analysis on that).

I think you need to be confident in your long term ability to pay the mortgage and stay in that home (or rent it out), but even then an oversize house commitment is a risk because of the possible japan effect - and resulting opportunity cost of other investments (savings) you haven't done.

Always better to buy than to rent. After renting for 30 years your Landlord gives you not even one Penny when you move out. After paying mortgage for 30 years you get every single penny back since prices triple every 30 years. Just make sure you buy with a 3,5% down FHA loan in case house prices drop or things go bad in anything so you can walk away and let Obama eat the loss. And if you're married buy only in one spouses name so that the minute the bank takes your old house the other spouse can get a new 3.5% down FHA mortgage. Remember, mortgages are free at the moment, meaning you only pay around 3-4% just like inflation, that's the same as a free zero percent loan if you include inflation in your financial planning. And if for any reason we should fall into deflation just hand the keys back to the bank, Obama got your back! Most important to remember: never put more than 3,5% down!!!

that's the same as a free zero percent loan if you include inflation in your financial planning. And if for any reason we should fall into deflation just hand the keys back to the bank, Obama got your back!

This advice represents some serious things that are wrong in this country.

uomo_senza_nome: You're absolutely right! And from what I hear from my friends in Europe/Canada/Caribbean: the US seems to be the only country where you can walk from your financial obligations (mortgage) without any consequences even if you got a million bucks cash in your bank account!

How severely would inflation have to rise for it to make sense to burden oneself with a huge mortgage. Many people believe that there is a good chance of hyperinflation in the future.

Hyperinflation did occur in the 70s. As a result many workers (unionized) demanded higher wages or had wide strikes shuting down their employers business. So the employers accepted higher wages which in turn increased inflation, and the cycle kept repeating. We barely had global competition to worry about.

Today, you have higher level of global competition and decline in collective bargaining. In places/industries of SV deflation is much much higher due to global competition and unheard of Unions.

Hyperinflation in the future, if that is even possible, will not lead to increase in wages/salaries.

Concur. Employers will move jobs to Right To Work states.

That's what the Boeing thing in South Carolina was all about.

Always better to buy than to rent. After renting for 30 years your Landlord gives you not even one Penny when you move out. After paying mortgage for 30 years you get every single penny back since prices triple every 30 years. Just make sure you buy with a 3,5% down FHA loan in case house prices drop or things go bad in anything so you can walk away and let Obama eat the loss. And if you're married buy only in one spouses name so that the minute the bank takes your old house the other spouse can get a new 3.5% down FHA mortgage. Remember, mortgages are free at the moment, meaning you only pay around 3-4% just like inflation, that's the same as a free zero percent loan if you include inflation in your financial planning. And if for any reason we should fall into deflation just hand the keys back to the bank, Obama got your back! Most important to remember: never put more than 3,5% down!!!

If you live in Dallas or Atlanta? Probably.

If you live in an expensive coastal area? No...because there comes a point at which buying in safe or even desirable area isn't worth the financial risk or even possible. That's the situation we found ourselves in during the last eight years. Finally, we found an area we liked and a deal we could afford and that made sense. That's the only reason we did this.

As I've said before, a friend of mine in Cleveland bought a home recently and the bank wanted three years of financial statements. The bank wanted three months of pay stubs, an employment certification letter from each of our employers plus our credit reports. That's it. Why? Obviously they know something positive about the area in which we bought that no one here seems to.

Isn't that right?

uomo_senza_nome: You're absolutely right! And from what I hear from my friends in Europe/Canada/Caribbean: the US seems to be the only country where you can walk from your financial obligations (mortgage) without any consequences even if you got a million bucks cash in your bank account!

I think it depends upon the state. Texas and California (as far as I know) are non recourse states. You can walk away from a house as long as there's no second mortgage attached to it.

Ohio is a very different situation. It's a different economy and culture altogether...and if you pull that shit up there, the bank will chase your ass to the end of the earth and until your dying day for that money. You'll be very lucky if you don't end up in jail.

They make markets fall and rise at their whim. You have to remember. The "Debt" people or "Credit" people are the ones that can print at a whim. Nothing to stop them. No president or anything else. They can make "inflation" disappear. Take the Carter years gas went up to only 1 dollar. That screwed the CPI and sent rates to 19% on a home loan. Gas is now at 4 dollars a gallon. Car prices have gone from 5k to almost 15k and nothing has happened. In those days it was more or less a United States positioning itself against an "Oil Cartel". That very much ment business.

The Auto industry and the Home industry have always been the "drivers" of the economy. Anyone with a Series 7 license that watch CNBC knows that. Deal is the Con Market is at 13k it means absolutly nothing. Because well the "drivers" of the economy that have failed have actually made it go up. Which dosen't defy gravity. It just tells you the Stock Market is Bullshit with a Button.

When you finally realize they could give a crap about 1% overnight lending rates leading to inflation and the CPI and PPI. Then you will realize they pretty do much what they want. When they want.

So for you its a crap shoot. If you know a guy thats a real bigshot with the "paper" then you might have an idea. Barring that (you seem like most people). Next time you put cash in the stock market don't ever, ever take it out till someone tells you to. Or put it in anything till someone says what. That someone better know something or you really had have better have been a "good boy" for somebody. Or they may "forget" to tell you. Theres a lot of bullshit artists (selling stock) that don't know anyone in that game. Some that "kind" of know. Then there are people that, well know the people with the "button". Watching the stock market for most people now means nothing. I don't think they have figured that one out yet. They are way to consumed in their own delusion that we are all that "gullible". In fact many people in here were laughing hysterically pointing at the Google stock figures the other day. I don't know why.

As for gold what they are selling in the United States is more than likely stolen from someone. Just like a lot of the other things they take that does not belong to them. Like oh oil. Stuff like that.

Even if it's true, you're not gonna do anything about it.

Once you understand that you can accept that it's an imperfect world, do your best to take care of those you love, move on and live your life.

Or, you can be a martyr...if you live in the Bay Area and have a guilt complex. I have more than one flaw in my character but this isn't one of them.

If I was a Russian "Shipping" maven. I guess I would stand a chance. I'll never be that "great" of course.

Some people have their flaws. I believe the future can be really nice without all of the steeling. I mean how much is enough?

Hyperinflation did occur in the 70s. As a result many workers (unionized) demanded higher wages or had wide strikes shuting down their employers business. So the employers accepted higher wages which in turn increased inflation, and the cycle kept repeating. We barely had global competition to worry about.

Hyperinflation did not occur in the 70s. Hyperinflation occurred in Germany in the 1920s. It occurred in Chile in the 1970s. Hyperinflation occurred in Zimbabwe in the 2000's. But it has never occurred in the USA (yet).

In Hyperinflation you do not worry about your house. You don't care about investments. You need two things more than anything else, food and safety. You will trade anything for these. Everything is reduced to what do I need to do today to survive.

Hyperinflation did occur in the 70s. As a result many workers (unionized) demanded higher wages or had wide strikes shuting down their employers business. So the employers accepted higher wages which in turn increased inflation, and the cycle kept repeating. We barely had global competition to worry about.

Hyperinflation did not occur in the 70s. Hyperinflation occurred in Germany in the 1920s. It occurred in Chile in the 1970s. Hyperinflation occurred in Zimbabwe in the 2000's. But it has never occurred in the USA (yet).

In Hyperinflation you do not worry about your house. You don't care about investments. You need two things more than anything else, food and safety. You will trade anything for these. Everything is reduced to what do I need to do today to survive.

Did you know there's been a shortage of forty five caliber pistol ammunition in California for over two years? Go out and try to buy some tomorrow. Wal-Marts on this side of the hill have stopped carrying it, last box I found was in a sporting goods store and it's not cheap.

You are correct and people are paying attention. The word's out.

In any decision problem it is important to clarify exactly what are the alternatives under consideration.

If they are "mortgage + house" vs "rent" then yes the case for mortgage is stronger under inflation. Note that the case for buying is stronger if house prices go up, and it is also stronger as rents go up (assuming fixed rate mortgage). If you want to confirm with numbers plug into NY times buy vs rent calculator. Maybe it is true as some have pointed out that wages won't keep up with inflation, but it is difficult to see a kind of inflation where rents not go up as the money supply increases. In fact owners equivalent rent is a key part of the standard inflation definition.

If the alternatives are "buy house with cash" vs "invest same cash in something else" then maybe if you are a very good stock picker you could do better in the market. But it is difficult to see why market index in general should do better than a house generating (or saving) rent. Why would people make more money selling iPhones, cars, or soda than they would from renting out a house?

I would also mention that taxes play a *huge* role when inflation is big. Suppose you have 10% inflation and you have found a good asset that also goes up by 10%, just keeping your real value constant. But then, depending on how well you manage your taxes you may have to pay income tax, capital gains tax, or no tax at all on the 10% "gain". Owning a house is very good from this perspective.

Hyperinflation did not occur in the 70s

Thanks for the correction.. it was Stagflation...

Hyperinflation did occur in the 70s. As a result many workers (unionized) demanded higher wages or had wide strikes shuting down their employers business. So the employers accepted higher wages which in turn increased inflation, and the cycle kept repeating. We barely had global competition to worry about.

Hyperinflation did not occur in the 70s. Hyperinflation occurred in Germany in the 1920s. It occurred in Chile in the 1970s. Hyperinflation occurred in Zimbabwe in the 2000's. But it has never occurred in the USA (yet).

You need to read up on your early American currency history. google "not worth and continental"

If you really want to understand hyperinflation with the background understanding that we have an ongoing credit deflation, consider this link.

I have read the links you have linked me to and in addition alot of the links that they link to in those blogs. It is all very intriguing and I have to say it seems very likely, if not inevitable. It sounds crazy, but I think everyone also will concede that is is definitley not impossible. So If this is the case, if the dollar is going to be worthless sooner or later, then isn't the entire point of this site and many others, how house prices are outrageously inflated, a moot point? Buy however much you can afford now, make the minimum payment, stock up on food, guns and ammo, and wait for the dollar to collapse? Maybe that is the way to go.

Hey Dummy! Take 2 classes: Cost Accounting & IRR math!

If your too lazy to do these 2 classes, then do this:

1=Buy a HP10B2 $35 and do the manual 5 times

2=Buy the book: Real Estate Market Timing by Robert Campbell of San Diego, 4th Edition, and read that 3 times then ever 3 months.

Then: make 27.12% IRR Net Net Net per month from 1999 to 2008, on 198 sold Escrows, about 8000 acres in California.

Now buying land at 2.7 cents on the dollar (5000acres so far).

Aka3600% profit if returns to 2007 value=(720%/year/5years)

Aka7322% profit if doubles 2007 value=(720%/yr/10 yrs)

Irr will exceed 27%/month Net net net!

This is what 4 semesters of Calculus does to a brain with 2 majors in Business (Finance & Real Estate).

Good luck everyone! Obama is crushing the 99% and moving their assets to the top 1%.

IRR/MATH GENIUS!

Are you okay?

. It sounds crazy, but I think everyone also will concede that is is definitley not impossible. So If this is the case, if the dollar is going to be worthless sooner or later, then isn't the entire point of this site and many others, how house prices are outrageously inflated, a moot point?

Of course it is a moot point if the dollar goes toast.

I mean dollar is the unit of measurement for not just houses, practically everything in the world. If that collapses, sure we are staring at a true financial armageddon. 2008 would be a child's play compared to that.

Buy however much you can afford now, make the minimum payment, stock up on food, guns and ammo, and wait for the dollar to collapse? Maybe that is the way to go.

Well, it depends. The problem with a confidence collapse is you can never tell when it's gonna happen. It can happen a year from now, or may be even a decade from now. It can even be avoided through disciplined fiscal and monetary policy, but is that politically and economically feasible?

Complex dynamic systems are not easy to model, they are totally non-linear. I would say, preparation is critical for general peace of mind.

Taking on debt is not bad if the income stream can support it and the debt is at a reasonable level when compared to disposable income.

The other prepping part you refer to -- some people here will think that's totally crazy. And sure there are tons of places and websites that try to sell their stuff using this whole apocalypse concept.

http://dailycapitalist.com/2012/01/08/the-end-is-nigh/

Applying reason and logic to decision making will help a long way.

Those are my .02.

Canada not a bad idea.

Nice place, very stable, highly educated population...and COLD as hell.

They also know how to have a good time.

Those guys don't look Canadian.

Yeah, I don't see any back bacon, beer, sock hats or heavy coats there.

Those guys don't look Canadian.

It's the trailer Trailer Park Boys, a popular Canadian television series...

I really love the TP boys. Seen every single episode. Sure "many" here have. Nice guys to. Sometimes unreasonable but not often. Dunsworth is hysterical in that. Really good worth watching show. Quiet hit for those that don't know.

Artemis,

Whatever drugs you're on, they must be pretty sweet. Know where I can score some of it?

Heres a guy that buys my really "Good shit" Hes a good customer. Smokes about a LB a week. He just gets out in public and starts saying all kinds of shit. No one can make any sense out of it. "I'm trying to some of the people that get "Shit" from him. Hes getting them something. They look like they huff paint or something.

You can tell when he's smoking dope. He starts snearing and acting like a pirate.

non recourse is a huge advantage to buying in cali.

Even though FHA demands 3.5% and fairly high MI payment - they also allow the seller to contribute up to 6% toward closing costs (meaning they cover your down payment and bank underwriting fees and maybe new carpet).

I might buy this year for a primary residence, if prices crash much further give house back to Obama after squatting 3 years in it, selling off all the applicances, and moving fence line over 10 feet to give land to the neighbor if he pays me enough $. haha. (that happens)

You have to think like a sociopath to just not lose your shirt in todays america. Much like getting ahead in the old CCCP I suppose....

It's the trailer Trailer Park Boys, a popular Canadian television series...

Are they as popular as these guys?

Wow, people love talking about anything instead of MATH. Here goes...

Assumptions:

Fixed Interest rate of 4.0%

$500,000 loan

20% down

vs.

Renting the same place for $2000/mo

lets look at living in the place for seven years and include Interest, tax, ins, water (something you generally don't have to pay as a renter) and extra maintenance. I assumed int and tax will be fixed (prop 13...) and ins, water and maint are subject to the same inflation as rent.

At what inflation point do these break even?... With these assumptions it takes around 26% inflation to make owning break even in seven years.

Of course I'm using the typical numbers from the little beach community where I live (Summerland, CA).

If you go to someplace like Vegas where you can either rent a nice house for $1750, or buy it for $200,000... With all the same assumptions you can have NEGATIVE 8% inflation and come out ahead by owning.

You're asking the wrong question. Salary inflation is what inflates house prices, not just plain old inflation. Salary inflation is a response to inflation and is therefore lagging. They're not even 1-to-1. If your salary has barely crept up during a state of hyperinflation, you're screwed!

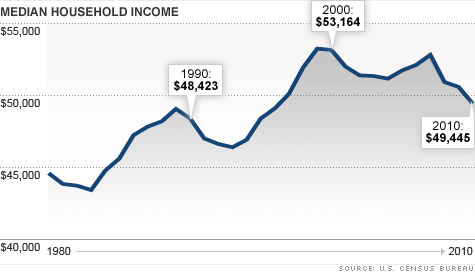

Chart already presented by uomo:

The average salary is down to $49,445. Inflation wasn't negative, was it?

Salary inflation simply devalues your debt, as you get a better income-to-debt ratio. Let's just take the numbers presented by California Equity & Loan. Here's what I got.

Additional assumptions:

- Starting salary is $50,000

- Salary inflation is approx 7% (roughly doubles your salary in 10 years)

After 10 years:

- Starting income-to-debt is $50,000 to $400,000

- Ending income-to-debt is $100,000 to $315,000

Patrick, that is an interesting question. I have been writing some finance programs in Javascript for a class I am teaching. If free time crops up, then I will look at your question.

By the way, the U.S. has never experienced hyperinflation. Using Cagan's definition, hyperinflation is inflation exceeding 50% per month.

Hyperinflation causes many problems, so I restrict myself to five.

(1) Interest rates will also with inflation. If the inflation rate is 600% per year (12*50%), then the interest rates will be slightly higher than this rate. If you have a fixed interest rate loan, then loan balance is reduced to nothing. If you have an adjustable rate loan, then this could be dangerous.

(2) Savers are severely penalized if they keep their savings in that currency. Furthermore, the financial sector would not survive a hyperinflation episode.

(3) People stop using the currency as a medium of exchange. Barter would make a come back. The key is you do not have to buy gold or precious metals. Anything of value becomes a medium of exchange, like bullets, seeds, medicines, cigarettes, bottles of gasoline, etc. Foreign currencies could also become valuable.

(4) Hyperinflation would destroy the U.S. government's budget along with the state's and local governments. (Would people still pay their taxes?) Government will put its survival before its people. I would not be surprised if government would start confiscating the precious metals.

(5) Wages are not likely to keep pace with hyperinflation, so most people will literally be shoved into poverty overnight. The good question would policemen, firemen, soldiers, and medical personnel still report to work? When the Soviet Union collapsed, people still reported to work, even when they were not paid in months. I do not think Americans would do the same.

Vladimir Lenin has a great quote, "The best way to destroy the capitalist system is to debauch the currency."

Professor, that's precisely why we will have another (intentional) recession as we did from 1980-1982.

We have to. Either that, or we destroy the country.

Wouldn't one need to calculate compound interest...

No need to try to determinte the outcome of hyperinflation -- things usually get really nasty.TravellingProfessor says

(1) Interest rates will also with inflation. If the inflation rate is 600% per year (12*50%), then the interest rates will be slightly higher than this rate.

the U.S. has never experienced hyperinflation

We banned our citizens from owning gold in April 1933. Soon after that, we defaulted in October 1933. The result was monetary illiquidity that prolonged the depression that lasted until the end of WWII.

TravellingProfessor says

I would not be surprised if government would start confiscating the precious metals.

That should happen BEFORE the event. Also, it was not confiscation per se. People got dollars for their precious metals. In 1933, if you had a safe deposit box, an agent would have to be present before you could open your box. He would then take your metals (if any) and write you a check. Don't fall for any of the intentional misinformation out there.

Now, what have we learned from Weimar, Argentina, etc, etc? Hyperinflation is intense short-term pain, but both countries were back on track immediately after the event.

to burden yourself with a 30yr mortgage would require a growth rate of nearly 8%

assuming maintenance costs are moderate to low.

I don't see inflation "helping" the housing market since I expect in a domestic inflationary environment to see wages not indexed to inflation. Housing prises aren't likely to rise at all just because there is inflation unless wages rise as well.

« First « Previous Comments 11 - 50 of 61 Next » Last » Search these comments

How severely would inflation have to rise for it to make sense to burden oneself with a huge mortgage. Many people believe that there is a good chance of hyperinflation in the future. Lets say someone decides to take out a 500,000 dollar mortgage at 5% 30 year fixed right before interest rates start to rise and house prices fall. How much would inflation have to up and over how long a time period for that person to have made a wise choice, compared to renting for ten years after rates go up and prices drop, and buying with cash at a lower price. Not sure how low the price would be though and of course that is a key variable. I am just toying with the idea of housing vs gold. Stash your money in real estate, stash your money in gold? A little bit of both?

#housing