patrick.net

An Antidote to Corporate Media

1,261,052 comments by 15,056 users - gabbar, The_Deplorable online now

Triple dip in prices starts now.Followed by boomlet with 2% mortgages from Fed.

2012 Aug 22, 8:46am 17,009 views 26 comments

« First « Previous Comments 4 - 26 of 26 Search these comments

around election time, inevitably you are going to hear the old saying "are you better off now then you were four years ago"?

well, take a deep breath, think slowly about all the government aiding and abetting that has been done in the last four years, parlayed with ever lowering interest rates

here's a bit of nostalgia to remind you where it all began, and what you were doing four years ago

http://www.usatoday.com/news/washington/2008-07-30-bush-housing_N.htm

As an FHA borrower myself, that is going to close on a 3.5% refi tomm, i ran the numbers down with lower rates, and it really won't make sense for me to refi again in the future, especially not if i were to use FHA what with their jacked up fees seeing as how they are an insurance company and that which they insure is getting riskier and they are self funding

The losses on 3% mortgages must be huge. Delinquency rate is still an order of magnitude larger than when we had 7% mortgages (and federal reserve rate was 4%). So the spread the banks get it at is about the same (3% spread from getting a zero percent loan from feds, then they lend it at 3%, charge fees and then the stick the loans with 10% fail rates with the FHA/VA/phoney/Fraudie).

absolute rubbish

The losses on 3% mortgages must be huge. Delinquency rate is still an order of magnitude larger than when we had 7% mortgages (and federal reserve rate was 4%). So the spread the banks get it at is about the same (3% spread from getting a zero percent loan from feds, then they lend it at 3%, charge fees and then the stick the loans with 10% fail rates with the FHA/VA/phoney/Fraudie).

absolute rubbish

Statistics without informed context are usually worthless, easily manipulated and often misleading.

Maybe. But then explain WHY fannie,freddie went BK, are still run by the feds at a loss and wall street has NO PLANS to take them public again like GM? Probably because the 'permanently high foreclosures/loan mod/bailout mess' makes lending at low interest rates a baked in loss.

Private lenders get 8-12% on thier hard money loans. Because they dont run a loss. Also they demand 30% down not 3.5% like FHA. (although they gouge fees and MI out of people I could see how FHA is not a basket case like fannie,freddie)

As an FHA borrower myself, that is going to close on a 3.5% refi tomm, i ran the numbers down with lower rates, and it really won't make sense for me to refi again in the future, especially not if i were to use FHA what with their jacked up fees seeing as how they are an insurance company and that which they insure is getting riskier and they are self funding

I know your closing tomorrow... But might I ask why you chose an FHA and not a traditional refinance? I did a traditional refinance last fall and paid ZERO in fees and they cut my PMI insurance nearly in half because the appraisal came in at the 15% equity mark.. (when i'd purchased 6months prior I'd only put 10% down).

FHA has so many fees... once I hit 20% equity I can have PMI removed entirely. With FHA loans your stuck paying fees for life of the loan.

You have one nice advantage though with an FHA loan.. If in say 10 years interest rates SKY ROCKET... you can sell your 3.5% mortgage rate along with the loan balance. It's called an assumable mortgage rate... and you can only do it with FHA and maybe VA loans as far as I know.

I'd imagine if some crazy shit happens.. and rates skyrocket... You could find more buyers at the price you want because you could sell the buyer your low rate with the home.

I dont buy into the line 'you can let people assume and fha loan if rates skyrocket' because they have changed virtually ALL the rules. They now let you refi no matter how underwater you are. (this was unthinkable 6 years ago).

So if rates sky, then they will pass a law letting EVERYONE assume todays low rate loans. Its bailouts 4eva.

(however if rates only go up a little, you would be right probably)

2% mortgages would be an equivalent of paying someone to borrow money. There isn't enough room to price in risk.

I don't think it will happen, but who knows this government is nuts when it comes to posturing / pretending and postponing dealing with their pyramid schemes.

Heres the google ad I saw when reading your comment. Suupoosedly its for a 2.5% refi.

http://showrates.com/landing/plus-pro-25-refi2.html?rlid=Gog901

so its gonna happen! almost there now.

boom and bust, i am using FHA to refi, because i used FHA to buy originally with very little DP, and used them when i refinanced from 7.125 down to 5%. I'm eligible for some streamline program where they didn't need an appraisal or much of any income documentation, and there was barely any fees.

I priced it up against using a conventional re-fi, and it made sense for me. Now, if i wasn't eligible for the streamline program with the special mortgage insurance rates, it wouldn't have been an easy decision.

2% mortgages would be an equivalent of paying someone to borrow money. There isn't enough room to price in risk.

I don't think it will happen, but who knows this government is nuts when it comes to posturing / pretending and postponing dealing with their pyramid schemes.

Anything is possible if it's subsidized with taxpayer money!

hmmm, as an investor, I care why? Good, refinanced every loan to ultra low levels, cashflowing like crazy...

Let it crash again in a year or two, that gives me time to stockpile a bunch more money and start picking deals again!

Alway assuming you can rent at a level that generates good cash flow. One side effect of a depreciating asset is that people can again afford to buy. You just lost your renting market. It is just a pile of junk wood btw.

hmmm, as an investor, I care why? Good, refinanced every loan to ultra low levels, cashflowing like crazy...

Let it crash again in a year or two, that gives me time to stockpile a bunch more money and start picking deals again!

That's because you know how to invest and what to buy. Good investors are rare commodity in this country.

I have a client who bought rental properties, couldn't rent them out for 6 month, not without losing money every month, and are now trying to remodel and sell them just not to lose his t-shirt. A total winner there. He can't even afford repairs on his car, I took an IOU from him for now.

I have a client who bought rental properties, couldn't rent them out for 6 month, not without losing money every month, and are now trying to remodel and sell them just not to lose his t-shirt. A total winner there. He can't even afford repairs on his car, I took an IOU from him for now.

So what do you call the person who extended an IOU to a "total winner"? Just saying... ;)

Heres the google ad I saw when reading your comment. Suupoosedly its for a 2.5% refi.

http://showrates.com/landing/plus-pro-25-refi2.html?rlid=Gog901

so its gonna happen! almost there now.

Just requested 500K equity loan. It said it should be in the mail in 2 weeks. Living the dream!

Since you only have a half a brain, I'll explain this slowly to you, in small words:

My half still works better than most peoples full, especially the people with 110 degree brain burn. ;)

Hey, if things are as you say and you can get houses at 50% of market over and over and never be wrong, you should start a REI fund. You are clearly an oracle and should help others as well. I know many real estate investors and none would make claims like you have. You are just that good I guess. Amazing.

Hey, if things are as you say and you can get houses at 50% of market over and over and never be wrong, you should start a REI fund. You are clearly an oracle and should help others as well. I know many real estate investors and none would make claims like you have. You are just that good I guess. Amazing.

Sorry, you can't invest with me. It was a once in a lifetime opportunity, and you snoozed... you losed!

Nope, didn't lose. Stayed away from Real Estate as an investment in the US. Instead, bought in Canada and benefited and also invested in the latest bull rally in the S&P. I still wouldn't invest in US housing, even after the 1/3 haircut. To each his own.

Nope, didn't lose. Stayed away from Real Estate as an investment in the US. Instead, bought in Canada and benefited and also invested in the latest bull rally in the S&P. I still wouldn't invest in US housing, even after the 1/3 haircut. To each his own.

I find it kind of funny that real estate investors like Roberto believe that those who didn't "invest" into houses "lost" something by not doing so. That misconception is sort of annoying to me.

I would be willing to put up my ROI/ROA/ROIC rates of my portfolio against any housing REITs, and I am confident I would wipe the floor with most of them. Housing as an "investment" has been horrible for over a decade.

Nope, didn't lose. Stayed away from Real Estate as an investment in the US. Instead, bought in Canada and benefited and also invested in the latest bull rally in the S&P. I still wouldn't invest in US housing, even after the 1/3 haircut. To each his own.

I find it kind of funny that real estate investors like Roberto believe that those who didn't "invest" into houses "lost" something by not doing so. That misconception is sort of annoying to me.

I would be willing to put up my ROI/ROA/ROIC rates of my portfolio against any housing REITs, and I am confident I would wipe the floor with most of them. Housing as an "investment" has been horrible for over a decade.

I think you mean RE for 'buy and holders' has been bad for a decade. You could say the same for stocks. Buy and holders in stock market get their lunches eaten daily by the successful traders (until they blow up and get bailed out or BK).

I cashed in my RE in 05/06 and stayed away from stocks. I should have 'gotten back in water' last year in RE as that was most recent nominal bottom, but we are probably on a meteoric rise in RE prices due to ZIRP 4eva- thus lots of room to profit from renters whose numbers are increasing now.

meteoric rise

That requires demand and housing demand is at 15 year lows and falling.

No. Demand only needs to be one home more than the available supply then you have a sellers market/rising prices.

Clearly in AZ metro areas now there is WAY MORE DEMAND THAN SUPPLY. It doesnt matter that its all fake CCCP soviet central planning that caused it. The government/humans have caused ALL bubbles and ALL crashes in the past.

If they are 'empty' then drive down the street and see 'how many are for sale'.

Empty doesnt matter in CCCP system. Only what 'they will let you buy with a government loan' matters.

Roberto, I would think some real estate related organization pays you to be a cheerleader. If this is the case please provide some details. (I recall you once admitted to being on the payroll of the NAR)

I think you mean RE for 'buy and holders' has been bad for a decade. You could say the same for stocks. Buy and holders in stock market get their lunches eaten daily by the successful traders (until they blow up and get bailed out or BK).

It depends. Someone who bought 5,000 shares of Apple in 2000, and sells today, would they get "their lunches" eaten? No they would buy a Cupertino sh*t box all-cash.

I myself buy and hold, and sometimes I buy and sell. It's about the management, just like it is for people who invest in housing. Investors who looked at the fundamentals in housing, and said "Man, Vegas is going to crash hard in 2 years!" and then sold in 2006-2007, they made out like gangsters. Those who ignored the fundamentals of job growth, employment, hiring forecast, etc, they got slaughtered like pigs by trying to hold past 2007.

But when I say "bad", I'm talking strip out all the personal heroism, and skill.

A broker managed portfolio by Northwestern Mutual from 2000 to 2010 that was 50/50 in bonds and stocks, rebalanced annually earned over 6% per year over that time period.

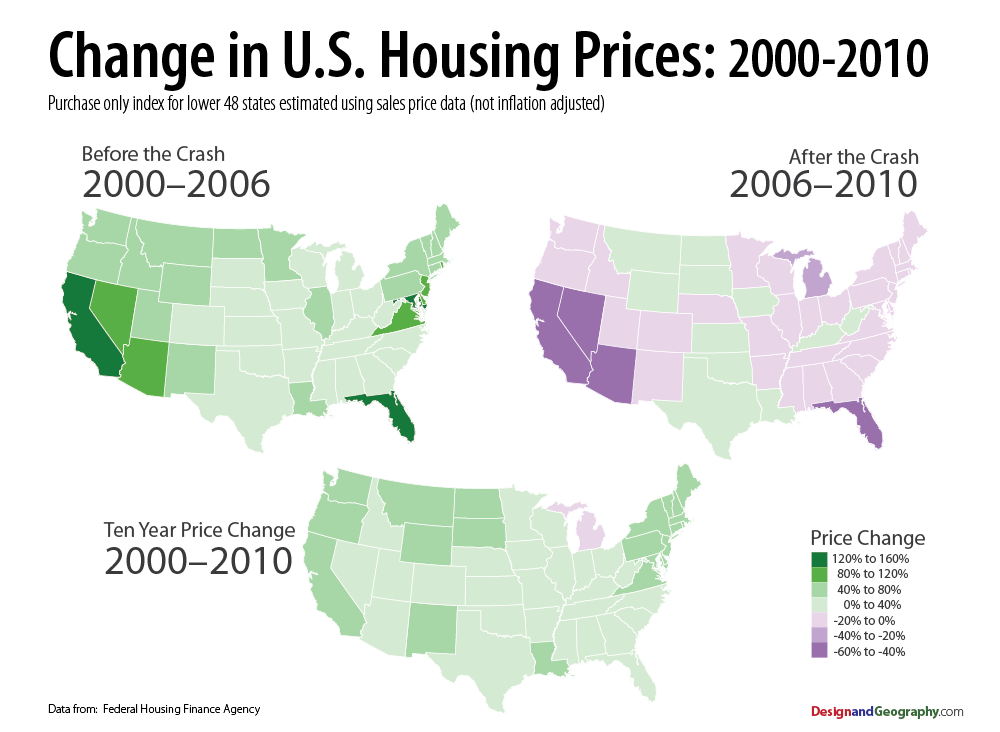

Look at the slaughter in U.S RE from 2000 to 2010, 90% of the country is back to where it was in 2000 (or even a bit under once inflation is factored in):

If you weren't one of the lucky one who bought in West L.A, or Manhattan, or other equally prime RE markets, you got slaughtered.

http://mhanson.com/archives/1013?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+MarkHansonAdvisers+%28Mark+Hanson+Advisors%29

#housing