patrick.net

An Antidote to Corporate Media

1,355,122 comments by 15,731 users - ForcedTQ, Patrick, Tenpoundbass online now

Comments 1 - 30 of 30 Search these comments

Crazy, but... if you did this wait until the baby boomers are gone to even start, because we need the inflows from everyone to cover the huge number of boomers. Even then, the ratio of people paying in to the recipients gets way too low.

We need to find a way to disentrench ourselves from an inherently unstable system - SS for all practical purposes has become a ponzi scheme

No it's not. This assertion is unfounded bullshit.

SS is just income redirection from workers to retirees.

It is a sublimely elegant system to ensure that all workers have a sufficient, zero-risk pension income to fall back on.

As long as the working wage base is large enough to cover retirees collecting their pensions, there is no "ponzi" aspect.

FICA payers from 1990 to 2009 overpaid their FICA by $1.5T or so -- the overpayment was 20% of FICA taxes for much of the 2000s -- and this was done to make sure the baby boom retirement (starting NOW) doesn't overwhelm Generation X and Y.

and has morphed beyond its original intent.

SS was a pension plan when it started.

http://www.youtube.com/watch?v=aVZijG4WSOw

"we have tried to frame a law which will give some measure of protection to the average citizen and to his family against the loss of a job and against poverty-ridden old age."

The average social security benefit is $1200/month. $7 bucks an hour.

As more people were added to SS, contributions were raised to keep the system in long-run balance.

Even then, the ratio of people paying in to the recipients gets way too low.

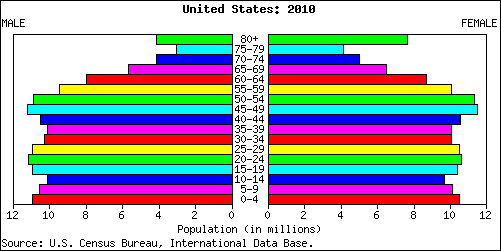

Not really. Generation Y is the nearly the same size as the baby boom:

As long as productivity continues to increase, we'll be able to support social security payouts to retirees.

Once the trust fund starts getting drawn down towards its statutory minimum (1 year's worth of expenses) we can look at starting to raise FICA on workers.

Ah, who the hell am I kidding. This nation is in fact stupid enough to kill the one thing that is working in this place.

"a) they don't expect the monies to be there anyway"

that's not how social security works. It is pay as you go. As long as the working population is monotonically increasing, and per-worker productivity is also monotonically increasing, income can meet expenses.

The baby boom required $1.5T of FICA overtaxation 1990-2009, but that actually needs to be redeemed over the 20 years -- that money SHOULD NOT be there 20 years from now.

Every dollar over a trillion in the SSTF is money taken from FICA payers that should be paid back *to* FICA payers.

"As a result of the above can ultimately downsize (or perhaps close all together) an entire governmental department."

LOL. Your ideology is showing.

We need to find a way to disentrench ourselves from an inherently unstable system - SS for all practical purposes has become a ponzi scheme - only an ever growing number of people at the bottom (new workers) will support the top (retirees) and has morphed beyond its original intent.

You've been talking to too many politicians or something. Social Security is working fine thus far. As Bellingham Bill said, if we get to a point where the reserves in Social Security are below what's required to be paid, we can fix it then. But there's nothing particularly wrong with it now. Politicians are just creating a fake crisis because projections are suggesting one thing, even though those projections probably aren't particularly accurate.

Politicians are just creating a fake crisis because projections are suggesting one thing, even though those projections probably aren't particularly accurate.

I think their projections are inaccurate -- but too optimistic about future wage growth.

I think the core problem with SS -- to whatever degree a payout mismatch exists -- is pretty much the labor vs. capital problem in general -- the capitalists have walked off with all the productivity gains since 1990 or whenever.

If wages were 20% higher there wouldn't be any long-run SS problem.

"Bottom 90%" is the same as "FICA payers".

Until St Raygun, FICA payers were making 60%+ of the national income.

Now we're at 50%.

4) continue to pay disability benefits as normal - but more narrowly define what constitutes a disability AND have annual checkups to ensure said disability is still valid.

It's very hard to qualify for disability. Allow me to climb up on my soapbox for a moment:

You are injured in a tragic Christmas accident in December 2010 – can’t return to work. You have saved 6 months worth of expenses, which you intend to live on (although your spouse gets a job which extends the length of time you can live on that savings account). You realize that you’re possibly permanently disabled and apply for SSD in January of 2011. Mind you – you’re not applying because you can’t do the same job – you’re applying because you can’t do any job.

You go to doctors, and but without insurance you dutifully followed the system which is to attempt to become eligible for Medicaid and have the bills held until you are approved for disability. This means trips to the Medicaid office and jumping thru whatever hoops they want you to. This is a bitch because you don’t feel well.

You’re denied. You appeal. You’re denied again, you appeal again – and so on. The denials are automatic – and it doesn’t matter that you have MD statements to support your inability to perform any work. Finally, it goes to a judicial review – and they tell you that you can be represented by an attorney if you want. You want.

Finally in November of 2012 you are deemed disabled – but the adjudicator decides you were actually disabled effective June of 2011. The first five months that you’re disabled, you aren’t eligible for Disability, you would have been eligible for SSI but you have too much in savings.

You’ll get a retro check for 11 months of disability payments – of which you’ll pay 25% to the attorney. That’s cool – he helped you and all.

But you also owe the doctors and/or hospitals for the medical bills – because if you were over $2,000 in assets, you don’t qualify for Medicaid either. Oh – and it gets better. Since the SSA decided you weren’t disabled until June 2011, you won’t get Medicare until 24 months later. If you need health insurance before then, you’re out of luck (unless you still have COBRA or are covered by a spouse’s insurance policy).

Qualifying for disability is not a walk in the park - most states don't offer disability payments (Calif is one of the few that does).

I actually love the idea of a private account, a 401K type government account that has direct relationship with what you put in.

401(k)Social Security (sorry, typo fix) has a direct relationship to what you put in. If you don't think so, then you haven't read the formula and are misinformed.

Agree with you that removing the cap on SS taxable income is probably the wrong way to go -- that changes it from insurance to an entitlement.

Agree with you that removing the cap on SS taxable income is probably the wrong way to go -- that changes it from insurance to an entitlement.

Me too, though if rich people are living longer than wage slaves, raising the cap without raising monthly benefits accounts for this.

It's getting harder for the average tech worker bee to stay above the cap, LOL.

When I joined the dotcom economy in 2000 the cap was $76,200, for 2012 it's $110,100.

4% pa cap inflation, ouch. Gotta run to stand still.

One thing the pro private account people forget is that when you divert money away from the Social Security trust fund and instead into private accounts, the system collapses. There is no money being brought in to fund current retireees or those who are soon going to retire. As a result, the checks have to stop going out and Social Security is immediately bankrupt. And yes, it would be immediate. Not twenty years from now. Not ten years. But immediate.

Your post presumes we want to phase it out.

It is an insurance plan, and all insurance plans have a balance that make them workable. Remove the cap and take more from higher earners. Limit the COLA increase to tighten up payouts over time.

All you have to do is a little bit here and there to make it through the Boomer Bulge and then it will be fine again.

One thing the pro private account people forget is that when you divert money away from the Social Security trust fund and instead into private accounts, the system collapses. There is no money being brought in to fund current retireees or those who are soon going to retire. As a result, the checks have to stop going out and Social Security is immediately bankrupt. And yes, it would be immediate. Not twenty years from now. Not ten years. But immediate.

Fist off, I think their proposal is usually more that people under a certain age don't won't receive SS or as much, and they pay in to a

private account. (but it would destroy SS a ways out anyway).

Secondly, I don't think those behind the idea are forgetting anything (if you know what I mean).

I would do it differently. Every year raise the age by 6 months until the minimum age to get anything is 72 and for full benefits 75. None of this grandfathering in stuff and taking forever to get the age increase implemented.

SS is just income redirection from workers to retirees.

It's welfare for old people.

Question:

How come nobody applies the SS/MC payroll taxes to the savings rate?

Isn't having 6%+ of your income (the employee side at least) deducted from your paycheck each period, that you will supposedly get back, savings?

I laugh every time someone mentions the Social Security Surplus. There is no surplus. The government used all of the surplus to spend on there over extended budget in previous years and gave Social Security Government Bonds. When income from Social Security doesn't cover expenditures, your going to see how worthless those government bonds really are. They can't even balance the budget today, despite 100's of billions of dollars in cuts (usually over a 10 year period) how exactly are they going to come up with hundreds of billions of dollars of additional dollars, when Social Security needs to cash in those Government Bonds?

I predict either a default or hyperinflation. They may stave off default for a few years, but in the end, it's pretty much a guaranteed outcome. Sooner or later people will realize the government will never be able to pay back it's government bonds and it's a default or a mad printing press to cover the bills.

APOCALYPSEFUCK is Tony Manero says

Just give a tax break to neocon psychopaths who stuff Sears overunders into their parents' mouths and pull the trigger. That will fix SS. How long before this appears as a GOP plank?

+1

in cuts (usually over a 10 year period) how exactly are they going to come up with hundreds of billions of dollars of additional dollars, when Social Security needs to cash in those Government Bonds?

Indeed, changing the indexing of benefits to inflation is a subtle way to renege on the Greenspan Commission deal from the 1980s.

If the SSTF isn't at its statutory minumum by the time I start collecting I'm going to be PLENTY pissed.

But not 1 person in 50 can follow the pea with this.

The right wants to not pay back the $2.6T they owe the SSTF, the center understands how difficult it's going to be to raise taxes to do so, and the left is too clueless to understand what's going down, and too powerless to stop it anyway.

As long as the working wage base is large enough to cover retirees collecting their pensions, there is no "ponzi" aspect.

What a vile lie.

As long as the working wage base is large enough to cover retirees collecting their pensions, there is no "ponzi" aspect.

What a vile lie.

If the homeowner isn't insulted by your offer...you didn't bid low enough!!!

Do you understand what a Ponzi scheme is? For Social Security to qualify as a Ponzi scheme it would have to guarantee contributors a complete payout of their principle plus interest. That is not the way SS is setup. Do you understand how SS actually works? Or are you just telling a vile lie?

That is like calling your car insurance a Ponzi scheme. Now, what kind of idiot would think SS is a Ponzi scheme?

Hmmm... Oh, yeah this kind:

Coincidentally, this is also the same kind of idiot that thinks an optional 20% tax rate that still gets deductions and exemptions is a "flat tax" and also a good idea.

For Social Security to qualify as a Ponzi scheme it would have to guarantee contributors a complete payout of their principle plus interest.

No, if the economy is growing interest can be paid too.

Part of the problem is the non-FICA-paying part of the economy has captured an increasing amount of the productivity gains since 1980.

There are ways SS can become a ponzi, since like Krugman said back in the 1990s it has a ponzi aspect -- payers become payees after some number of years.

But that alone doesn't make it a ponzi. Should total wages collapse later this decade, or people start collecting benefits for decades longer than they used to, then the system will collapse.

We are far from that and I'm really tired of arguing with liars like zzyzzx about it.

We are far from that and I'm really tired of arguing with liars like zzyzzx about it.

Agree -- there are many people who don't understand a whit about how Social Security actually works and have no interest in learning. Unfortunately, most of these people are the ones who spew nonsense about it.

The whole point of the liars is to just throw bullshit out so we talk about bullshit instead of what the actual problems are.

This is because their team is the one creating these problems, and they don't want them fixed.

I think that there is a way in which Social Security could be responsibly phased out.

Rough outline is as follows

1) Lift the cap.

Have all wages (not just the first $106,800 [soon to be raised to $110,100] be subject to SS tax.

2) Index retirement age to average life expectancy.

3) Tier benefits

50 or older - no change - current system remains in place

35 to 50 - keep paying in as normal. Can collect SS benefits upon retirement UP to a maximum

amount, where said maximum is equal to the amount paid into the system by the individual over the

course of their working career.

25 to 35 - stop paying into the system in in five years time. Can collect SS benefits upon retirement, as with the preceding their, maximum benefit will be equal to what the person has paid into the system

25 or younger - stop paying into the system BUT will receive no benefit upon retirement.

4) continue to pay disability benefits as normal - but more narrowly define what constitutes a disability AND have annual checkups to ensure said disability is still valid. At some point disability befits needs to be decoupled from the retirement benefit aspect of SS. They serve different purposes, and have different cost basis, and the arguments (pro and con) and rationals for existence are very different.

5) As a result of the above can ultimately downsize (or perhaps close all together) an entire governmental department.

My general philosophy is 1) we need to keep the promises we made to those for who retirement is imminent, but for those for whom retirement is 20+ years away a) they don't expect the monies to be there anyway and 2) they have sufficient time to make alternate retirement plans if they so choose.

2) SS was never meant to be enough for retirees to live on - it was implemented after the great depression to save the working poor from destitution in the event of a financial collapse in or around their retirement years.

3) Disability payments (part of SS system currently) are a different argument- how we support the truly downtrodden who cannot work is separate from how much we pay retirees who have worked all their lives.

I'm not saying the above is perfect solution-but it represents the overall goal. We need to find a way to disentrench ourselves from an inherently unstable system - SS for all practical purposes has become a ponzi scheme - only an ever growing number of people at the bottom (new workers) will support the top (retirees) and has morphed beyond its original intent.

Comments, pro and con, and alternatives or additions are welcome!