patrick.net

An Antidote to Corporate Media

1,198,716 comments by 14,141 users - brazil66, RayAmerica, tomtomtom online now

« First « Previous Comments 81 - 120 of 241 Next » Last » Search these comments

Apple is worth more than google+microsoft.

Apple's phone business alone is bigger than microsoft.

There is a momentum from a monstrous successful business that is like a giant snowball rolling down a hill.

Businesses are going to iPads. They are also going to Macs (OS=UNIX), dropping Crackberries for iPhones.

After a couple new products come out, AAPL will probably go up another $50/share.

My crystal ball which is from the same dollar store as some clown at Merrill says that AAPL is $600 by December.

Businesses are going to iPads. They are also going to Macs (OS=UNIX),

Sorry, modern day ERP software (Oracle, SAP, etc ) that run the backbone of business like Apple, GE, HP, Adobe, IBM, Banks or any other small, middle, larger size companies dont run on Mac OsX or iTabs or iPhones.

PE looks good.

Yep, Imagine using SAP on a Tablet. Most people who do serious work in SAP and other ERP tools have multiple widescreens, not a single 10" screen. Tablets are consumption, not creation, tools.

Apple is a Smartphone company now. Macs pale in comparison to iPhones in the Apple Revenue Stream. More than 2/3rds of Apple revenue comes from iPhones and Tablets.

Samsung makes the A4/5 Chip. Motorola just won a patent fight. Both manufacture their own Smartphones.

You got patent risk, margin compression risk, and shrinking Market Share right now with no end in sight. Apple's revenue is based on selling a phone made with the same components it's competitors use (and Design and Manufacture!), made in the same facility that makes many of their competitors products, at a very high premium, thanks to fantastic marketing.

They are buying these for business. Whether you believe all and any business model requires Oracle or SAP is your bias.

The marketing by Apple follows the old saw by the guy running Procter and Gamble: "The key to marketing is superior product performance".

The Apple products are moving from consumers to businesses and soon will be everywhere.

Of course people will buy a few of the "other" brands. I have an Andriod phone because my data/text/voice plan is about 1/3 what verizon or att cost.

iPads and similar will also be getting into education bigtime.

They are buying these for business. Whether you believe all and any business model requires Oracle or SAP is your bias.

Not every business needs SAP or Oracle - not Daddy Green's Pizzeria - but many medium and even small cap businesses need it, depending on how much logistics they engage in.

And Macs are not just rare for Business in the US, they are like the Loch Ness Monster outside of North America.

"The key to marketing is superior product performance".

Evidence?

Many electronics components - a wide array of brands from a variety of manufacturers, of which the iPhone is just one, are made at Foxconn.

The same 80+ hour overworked 14-year old girl that made the generic MP3 players last week was put on the iPad line today.

The Apple products are moving from consumers to businesses and soon will be everywhere.

Do you have evidence of this adoption?

Of course people will buy a few of the "other" brands. I have an Andriod phone

Yes, you own the market dominant phone.

The vast majority of modern servers run linux. Nothing else is even close, despite what Microsoft might want people to believe.

Sorry, modern day ERP software (Oracle, SAP, etc ) that run the backbone of business like Apple, GE, HP, Adobe, IBM or any other small, middle, larger size companies dont run on LINUX.

...and ERP software represents a tiny fraction of servers in use. And the assertion that ERP solutions don't run on LInux is simply false. There's a reason why Oracle and SAP are getting into the linux market so aggressively.

Yep, Imagine using SAP on a Tablet. Most people who do serious work in SAP and other ERP tools have multiple widescreens, not a single 10" screen. Tablets are consumption, not creation, tools.

Screens are not computers, they're screens. I can connect a tablet to a screen, a keyboard, and a mouse. I can do that with a smartphone, too.

Screens are not computers, they're screens. I can connect a tablet to a screen, a keyboard, and a mouse. I can do that with a smartphone, too.

Of course not. But not convenient to schlep two 19" monitors, keyboard, and mouse and all to a coffee shop or anywhere else you go. Tiny devices will never wholly replace the need to have large screens and ergonomic input devices to do substantial amounts of work.

Eventually, tablets might be comparable in speed and power to a desktop, but that day is probably many years away, because of the cooling and battery life issues relative to small size have to be conquered.

Then there are the speed and security problems of running off a public wireless instead of a wired connection at a place of business/home office.

And then human ergonomic issues are still there.

Today I helped my wife sell stuff at an event outside. We used Square and her smartphone to take CC's. It took a damn long time to process cards because of the tiny screen and keyboard, which was fine since most people paid cash, but a bear if they didn't. It would have been alot easier had I taken the netbook or laptop along. But then where could I have plugged it in?

Maybe that's where a tablet shines.

The US Air Force just ordered 18,000 iPads. It seems they want to put those aircraft manuals into something slimmer than a Manhattan phone book.

Superior product performance=runs UNIX, is more stable and less prone to viruses and spyware than Windows.

The iPhone is not plastic, etc. Macbook air is selling like hotcakes, it's a super product. Etc.

Anyway, what difference does anything we say make? The truth is that Apple is going to be $500/share.

Superior product performance=runs UNIX, is more stable and less prone to viruses and spyware than Windows.

The iPhone is not plastic, etc. Macbook air is selling like hotcakes, it's a super product. Etc.

Ipads = Toys... your talking nickels and dimes.

Talk to me when NORAD system, all our communications, nuke missiles and space defense is put on OSX.

...and ERP software represents a tiny fraction of servers in use. And the assertion that ERP solutions don't run on LInux is simply false. There's a reason why Oracle and SAP are getting into the linux market so aggressively.

Sad fact back in the 80s Apple was running their McCormick and Dodge on an IBM, they run their SAP ERP on WinTel.. Thats about the only servers SAP runs on. All the Apple desktops, laptops they use to run their main system are mear dumb terminals ...

How much to implement a vast SAP ERP system globaly.. about $10M .. with 18% a annual support costs.

Sure Apple makes a great consumer product.. but that is all. The commercial/industrial market is very large and very complicated.. not something Apple can tackle easily overnight.

I'm sort of baffled by thomas.

The Apple personal computers, laptops, phones, ipods and tablets are the best products in consumer electronics. They sell them by the million.

Apple makes money in other ways, such as distributing music via iTunes.

Apple is branching into government and education markets and this trend will continue.

I also remember that Microsoft produced their shareholder annual report years ago on a Mac.

This thread is stupid. I'm sending this so I can stop following it.

Oh, and the forum's software is also a terrible piece of software.

Apple crossed the $500 threshold today. I don't buy Apple products myself, can't afford it, but know many others who are sold on the simplicity of them. Apples GUI is always one step ahead, and far as features go, most people don't need or care about them.

...and ERP software represents a tiny fraction of servers in use. And the assertion that ERP solutions don't run on LInux is simply false. There's a reason why Oracle and SAP are getting into the linux market so aggressively.

Sad fact back in the 80s Apple was running their McCormick and Dodge on an IBM, they run their SAP ERP on WinTel.. Thats about the only servers SAP runs on. All the Apple desktops, laptops they use to run their main system are mear dumb terminals ...

How much to implement a vast SAP ERP system globaly.. about $10M .. with 18% a annual support costs.

Sure Apple makes a great consumer product.. but that is all. The commercial/industrial market is very large and very complicated.. not something Apple can tackle easily overnight.

I have no idea what you're talking about now. Nobody with two brain cells to rub together thinks apple gives a shit about these markets. They care about the consumer device market because that's where the money is.

I have no idea what you're talking about now. Nobody with two brain cells to rub together thinks apple gives a shit about these markets. They care about the consumer device market because that's where the money is.

No apple isnt interested in the Business market, so some here should stop saying they are.

No the business market, mission critical systems (including PC and servers) are more expensive and carry post contract support at 15-18% additional costs yearly. So by 5 years, a end user would be paying 75-100% on top of list price purchase. Commerical products are very very profitable...

You should know this if you work in places like Silicon Valley.

I have no idea what you're talking about now. Nobody with two brain cells to rub together thinks apple gives a shit about these markets. They care about the consumer device market because that's where the money is.

No apple isnt interested in the Business market, so some here should stop saying they are.

No the business market, mission critical systems (including PC and servers) are more expensive and carry post contract support at 15-18% additional costs yearly. So by 5 years, a end user would be paying 75-100% on top of list price purchase. Commerical products are very very profitable...

You should know this if you work in places like Silicon Valley.

"The business market" and "servers" are not even close to the same thing.

Apple is going to do just fine selling macs, ipads and iphones to businesses.

I've worked on plenty of the types of projects you're referring to, and they're not nearly as profitable as you think. The reason they're so expensive is because they tend to be a whole lot of labor that does not replicate for free. There are no benefits from economies of scale, which is really the reason why Apple, Google, and Microsoft are able to make so much money.

1. Stocks prices have little to do with the underlying business.

2. Fundamentals are affect by stock prices as much as the other way around

Pure price action, man. :-)

As mostly a long-term investor, I couldn't see myself investing in AAPL back in April '12. At the time, i felt I missed the boat at the beginning of 2012. I'm glad I didn't chase this stock.

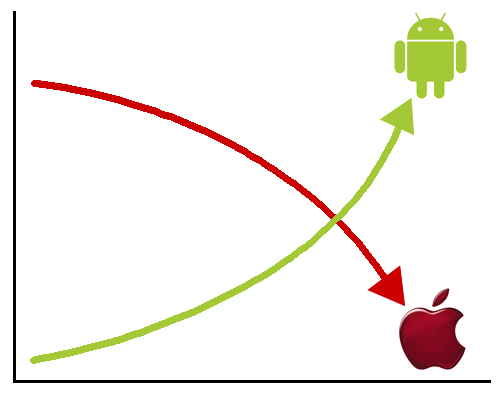

I understand the immense success of Apple the last 5 years. I understand the innovation this company has brought to mobile phones and tablets. It's a great company for consumers, but not a great company (long term) for investors. Why? They busted out in the early 80's w/ the MAC, a game-changer that was quickly copied by Microsoft, and eventually commoditized....Apple busted out again recently w/ the iPhone/iPod/iPad and the ecosystem that's ringing the cash register w/ IMMENSE profits. But both product and ecosystem are being copied as we speak. Talk all you want about 'quality product/customer experience', high-end fit/finish, the 'must have/'IN crowd item' appeal. At the end of the day, it's consumer experience can, and is being copied, just like the MAC back in the early 80's. Apple is a great innovator, but it's missing a "dominate trait" for the long haul. It can't seem to dominate like the Wintel juggernaut (SP?) has the past 25 years.

Am I over-simplifying this? Absolutely. Am I interested in what Apple will do w/ his HUGE pile of cash? Yes. Am I going to invest in Apple and wait to see what happens when they put that pile of cash to use? NO..... Just too much risk for me.....My tech investment dollars are going to Intel at these great prices, because nobody (as of now) can copy their product. it's a 'best of breed' company w/ a real moat that Apple doesn't have. Yes, they are late to the mobile party, but I think we're in the 2nd inning, so to speak. I'll get growing dividend payments (think yield on cost) while I wait... I'm not an Apple hater. I love my iPhone 4s. For me, I just can't invest in this company. I wish those that do, all the best....

Apple is basically a consumer products company in a market segment with the most fickle of tastes. One miss-step or even if they just get a little lazy or behind and Samsung or some other competitor takes 50% of their market share in 90 days. I've already seen Apple rise and fall once in my lifetime. I've seen Nokia and Motorola rise and fall. Apple is not a solid investment iMHO. There are sharks constantly circling it.

One miss-step or even if they just get a little lazy or behind

In this case it was more like "the brains behind the operation died".

Samsung is the new Dell and Sony wrapped in one. This is purely Dell and Sony's fault. The last 5 years both of their products have gotten crappier and shittier. I don't think I've been to a best buy since Windows 7 came out, that didn't have a Sony Lap top that didn't have several keys missing.

Sony used to be the Moniker of quality electronics. And Dells used to be solid dependable Laptops. Their offerings for the last several years have been crap. Made from plastic so cheap and flimsy the case flexes and gives when you grab the laptop and place it on your lap.

Samsung makes a solid dependable product, and their touch pad is more innovative than anything on Sony or Dell.

And their smart phones seem to get better mileage than HTC or LG.

Price action is 100% psychology in the short term.

In the long run, asset pricing and fundamentals are reflexive.

Why would anyone invests uding fundamental data alone?

The title of this thread should be how soon Apple is $1000/share.

The only limit to Apple's profits is the growth of the working population of the world. Presently, I think it's about 20 million new working people per year.

It's pretty amazing. Their success is they do not make any crappy junk, Jobs would not tolerate it.

Their website is great, their stores are great, their customer service is great, their products are great, their brand is great, even their various software is great. Their ads are great also come to think of it.

The market knows this at yhe current price. What is new?

Who cares about the company? It is a time series.

Down to $529.69/sh

Anyone remember what it was the day this thread started? Wasn't it $422/sh?

52 week high is 705.07

http://finance.yahoo.com/video/apple-shares-could-dip-below-170100918.html

Apple Shares Could Dip Below $500

This is either the buying opportunity of a lifetime, or a major paradigm shift for Apple.

$480B market cap.

$200B in assets at the close of this quarter.

2% dividend yield currently.

wish I hadn't sold at $12.50, sigh.

Another thing to consider, the knowledge of Apple's future growth has been baked into the price. What new information will cause the stock price to go up? A smaller iPhone? A bigger iPhone? A smaller AND bigger iPhone?

Other than that, it is all psychological.

In my view, Apple's only competitive moat was steve jobs because you cannot just buy Vision in the market.

And I remember him as a sushi eater.

I saw him several times in different sushi restaurants. That we have in common.

Vision is reflexive. Did Steve Jobs create the vision? Or did people call something a vision because it came from Steve Jobs? Or was it a feedback loop?

When will people start associate missteps to the beginning of the downfall? It is a nonlinear system.

It has nothing to do with technology or vision.

The ability to visualize a product as being important and valuable for customers is the "vision" i am talking about.Even customers didn't agree that they will like Ipad until they started using them..now thats called vision.

Yes, but then how many more customers "like" the product only because other people like it? A trend is a feedback loop.

The Apple Newton was even more "visionary." Yet it was a flop.

Try using Ipad for some time and see if serves a purpose for certain people and get back to me.

We have had several. We got two soon after the original launch.

Don't get me wrong, it is nice. But "vision" is really a crowd psychology thing.

apple newton was visionary but the end product didn't meet the vision.

But whether is was visionary could only be determined after the fact. If it were successful it would have been called a "vision."

Another thing...

Can one count on having new visions time after time?

Good companies sell good products. Great companies sell crap.

A person who "consistently" comes with new products which sell like hot cakes and are way ahead of the competition is visionary...period.

It was a self-reinforcing trend. And that person is no longer with us. What is the future of that trend?

Thats the whole point. since that person is no longer there, the future is bleak.

We will see. I am NOT an Apple fan, yet we have pretty much iEverything. ;-)

http://finance.yahoo.com/news/stock-index-futures-signal-lower-100247769.html

Apple (AAPL) fell for the third day in a row as the biggest drag on both the S&P 500 and Nasdaq 100 after reports on Monday of cuts to orders for iPhone parts. Apple was down nearly 3 percent at $487.50 after hitting a session low of $485.60, its lowest level since February.

It is always cyclical. The Apple stock goes up after the new product is announced. And it takes a dive after. I am always on the short sale after the new product announcement. And buy back later. I have never lost on this position yet. My gain this time is more than 20% in 4 months. I sold it at $700. I bought it back at $500. If it goes down even more, that's unrealized gain. I don't care.

Waiting for a bounce to put on a short. Am I too late?

Just wait til Apple announces a new exciting product like low cost iPhone. I am so sure that market is going to go wild bucking bull. After they blow their wad, you know what happens. Or are you going to buy now and take a chance that Apple is going to announce a new exciting product. Nah, I wait til they do. And I see how the market reacts and short sale.

Apple needs to make a real impressionable product this time. Unfortunately, no amount of investment can develop a talent like Steve Jobs and his visions. The talent is indeed scarce.

« First « Previous Comments 81 - 120 of 241 Next » Last » Search these comments

Starting my New Year with a nice bump on the AAPL I picked up last year.

Consensus on AAPL to $500? It's testing 52-week high.