We are entering the "fear" phase of the housing bubble.

2012 Jan 21, 7:27pm 18,935 views 35 comments

Comments 1 - 35 of 35 Search these comments

We are entering the "fear" phase of the housing bubble.

I agree. But If Big Brother runs us out of money. That red line won't see a bottom.

I'll bet Tony is long FAVA BEANS.

speakin of bottoms,

I am bakin cookies !

I thought we were entering the capitulation phase.

Or more precisely, I still think we're on track by the following graph.

fear was when prices were falling 30% YOY

capitulation was when people were walking away in droves.

ear was when prices were falling 30% YOY

capitulation was when people were walking away in droves.

So, when was the return-to-normal bull trap?

that was very early on before anyone would admit there was a housing crash.

that was very early on before anyone would admit there was a housing crash.

Show me a price graph, which shows me a bull trap early one, then.

I dont have one. but that doesn't mean that people walking away in droves and houses losing up to 70% in value was the "denial" phase.

In the bay area the bubble ran for 7 years beginning in 2000 and ending in 2007 - and it's taking another 7 years to completely pop - 2014. So, I'm thinking the bottom will be around 2014 - but there's no telling when it will go up from there. It may reach bottom and then flat line for a few years until most buyers are convinced the bottom is real. I also don't think it matter much who is elected this time around - this is a sine wave - 7 yrs up and 7 yrs down and then who knows? Other markets may differ depending on when the bubble started and when it popped - so some areas may recover faster than the BA:

I dont have one. but that doesn't mean that people walking away in droves and houses losing up to 70% in value was the "denial" phase.

Only very few areas lost 70% of the value, even today, and the prices are down only that much in ghetto areas of worst cities. Even today, the prices are down only 30-40%, after the biggest bubble run-up in history of mankind. When the C-S index is down 70% across the board, then we'll talk about any kind of capitulation. For now, it's still fear.

You graph clearly shows the bull trap from 2009 till now. But, notice that the prediction which you graph showed with dashed-lines didn't pan out. Instead, prices turned around and started falling again, confirming the bull-trap curve.

That's not my prediction by th way that's the futures market. People who are actually putting money where their mouth is.

The actual Case shiller looks like the prediction has been pretty close

The actual Case shiller looks like the prediction has been pretty close

Nice try. The prediction is showing prices way above 150, almost hitting the 175 level. In reality, prices never even breached above 150. The bottom third is showing prices retracing all the way back to 2009, and that's what the composite graph C-S graphs are showing as well. How, much longer do think SF is going to remain above 100?

Also, do you see prices retracing all the way back to the pre-bubble levels, like they do in the bubble graph? Look at where the bear trap was, back in early 90's. The price action of bubble deflation, should take the price way below that level. Instead, it is wavering way above that level.

I think people who try to apply patterns of investment and bubbles to housing in particular are looking in the wrong direction.

It's very hard to make a logical, emotionless decision about the thing that you live inside of.

Housing needs its own investment model.

You need to know where the trend line is. We went below the trend line in the 94 housing crash so its actually much steeper upward trend than in that bubble graph.

I don't think it's any steeper. And, in the bay area, and other bubble cities, we didn't go below the trend-line. Also, the bubble graph is a graph of human psychology. Aren't these humans buying all these houses?

You need to know where the trend line is.

Also, I said prices need to go below the low of the bear trap. This has nothing to do with the trend-line.

I think people who try to apply patterns of investment and bubbles to housing in particular are looking in the wrong direction.

It's very hard to make a logical, emotionless decision about the thing that you live inside of.

Housing needs its own investment model.

actually it comes down to indivisual houses. Anyone trying to paint a broad brush is asking to be wrong.

I bought in 2008 and sold in 2010 and made money but according to the chart that should've beensomewhere in between denial and desperation.

I bought again in 2011 and could probably sell for more than I paid then too.

here comes the bull trap!

http://abclocal.go.com/kgo/story?section=news/business&id=8422604

UCLA Anderson Forecast is a pure joke. They've been predicting the bottom in housing for 5 years now, ever since the bubble burst, because they get their money from the RE criminals. Nobody treats their predictions seriously, any more.

So you dont like the cme futures market. You dont lik UCLA school of business. So who's forecast do you go by?

LOL I think I hear somebody on my ignore list trying to say something. Patrick needs to make it not show up on the topic listing page.

So you dont like the cme futures market. You dont lik UCLA school of business. So who's forecast do you go by?

Forecasts are just that, forecasts. But when facts (like the C-S price index) tell you that prices are falling and the futures market prediction is already wrong, there is nothing you can dispute here. Besides, the UCLA Anderson Forecast never predicted the housing crash, in the first place. What they did predict was a soft landing, without a recession, back in 2006. Also, they said that California house prices will not have a significant decline. And this is when, sales fell through the floor, and it was pretty obvious to most honest economists, that prices are ready to crash:

http://uclaforecast.com/contents/archive/media_9_06_1.asp

So, ABC News, takes a group of corrupt economists, which never predicted the extent of the recession and the housing market, and they spin their forecast to say that they predicted the crash, and then, use their new forecast of an impending recovery as a gospel.

I think we're in the "New Normal" phase. The Fear phase has passed.

People either have jingle mailed or accepted the jingle mail option as a solution to their problems, or resolved to pay their mortgages no matter what happens to the value of their property.

(Edited for clarity.)

So you dont like the cme futures market. You dont lik UCLA school of business. So who's forecast do you go by?

Who's forecast do I go by? People who are not corrupt, like Dean Baker of the CEPR:

and Peter Shiff:

http://www.youtube.com/embed/A2_Hmt-MKLA

and Dr. Housing Bubble:

http://www.doctorhousingbubble.com/

All these people did predict the housing collapse back before it happened, but ABC News doesn't like their current forecast, because they are predicting continuing deterioration in prices, and they are not getting paid by the RE Criminal Cartel to say that prices will continue to fall.

one of the biggest things keeping prices up in the central valley is the welfare system that is handing taxpayer money to investors through Section 8, and other welfare systems. The highest rents paid for SFH in the 209 are by Section 8 getters. If the friggin GOV would stop supporting privately owned SFH's with Section 8, and only allow Section 8 in government housing, then the rental prices would drop and the knife catching investors would be stuck with either dropping the rent price or selling the house .. and THAT will push the prices down to reality.

RE pukes suck dirty canal water

Agreed. And not that much different from the first home assistance in "wealthy" neighborhoods for luxury apartments beyond the million dollar mark as happened in NYC. Ridiculous and criminal to incentivise one form of debt over others. Also I wonder how much inflation these graphs factor in - likely the lies by the govt which puts plenty of electronics into your shopping basket, as real inflation is surely 5% or more - adjusted for that the prices do not look at all that rosy. Got gas?

Ca will drop like a rock.

Freedom 1789-2012

I hope so. CA was special even before and I know plenty of people who bought their houses for 30-40 and 50 k. Granted it was a few decades ago, but still-nothing justifies the current mad prices.

Ca will drop like a rock.

Freedom 1789-2012

I hope so. CA was special even before and I know plenty of people who bought their houses for 30-40 and 50 k. Granted it was a few decades ago, but still-nothing justifies the current mad prices.

I think government is trying to step in, but they are going to be slow.

Right now they will be making shortsales/foreclosures faster. So in a year or two market might return to normal. Prices should drop significantly, especially on housing that is priced way above rent. It just takes time.

It may be that we'll face a long depreciation in home prices, but it'll be variable according to where and what kind of property is in question.

Cities will do well, and even continue to gentrify.

Suburbs, esp. the more distant suburbs, will continue to lose value.

We'll never see $1/gal or even $2/gal gas ever again. Demographics are changing; and both of the adult prime working age generations - X and Y - have less children and prefer urban living, be that in a large metropolis like SF or a small college town like Ann Arbor, MI - with 'real downtowns'.

The decline of the Shopping Mall is a major facet of all this. Wasn't Tom the Mustache's wife's 2nd biggest mall company in big trouble?

Actually, the bubble is mostly deflated, at least nationally:

http://www.multpl.com/case-shiller-home-price-index-inflation-adjusted/

Looks like there may be another small leg down to get to the post-WW2 average.

Locally, anything can happen. What happens if they discover oil in Your Town, USA? And waterfront property is always desirable.

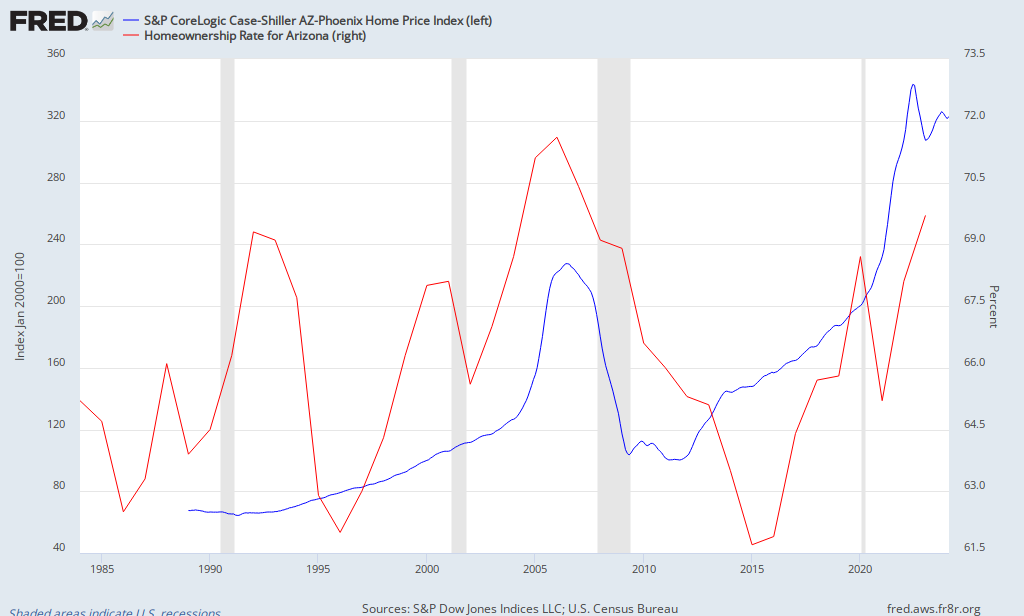

If "prophet" means completely wrong, then yes it was! prices in Phoenix have been flying up since this time!

The data supports Roberto, at least for now. I don't know if you can say "flying up", looking at it long term.

I'm not sure what to make of the correlation between vacancy rate or home ownership rate to home prices though.

Are any of you house owners out there getting "fearful" now, or are you still in denial?

#housing