patrick.net

An Antidote to Corporate Media

1,349,885 comments by 15,721 users - Al_Sharpton_for_President, FortWayneHatesRealtors, Robert Sproul online now

« First « Previous Comments 80 - 119 of 119 Search these comments

Those articles are hilarious, because like so many others penned by elites who focus too much on the palace potentiates they're ignoring the big picture.

Demographics is the big picture, not the economic tides.

You don't think so? Just ask Native Americans who faced the demographic changes in their continent during various and sundry nineteenth century USA economic crises.

John Mauldin wrote last week in his economics web site that while, ahem, Europeans are no longer a religious people, he reckons that they are finding a new secular religion, a religion of some kind of federated/integrated European entity.

In the context of the trends and changes that are much larger than "Euro-this, sovereign debt - that", I suppose he is partly right, though missing the main point. There is a vibrant and growing demographic in Europe which in time will allow "the Europeans" to grow out of their problems, and they are religious Europeans, too. But the religion is not the "secular" religion for a united Europe, unless you mean for a "united" European Islamic Republic. No telling what may come of those sovereign debt notes in the decades to come under sharia law.

But the religion is not the "secular" religion for a united Europe, unless you mean for a "united" European Islamic Republic. No telling what may come of those sovereign debt notes in the decades to come under sharia law.

True.

And you thought the hated Christians were your worst enemy...

Part of me says there is entirely too much pessimism about Europe. The Germans won't let the EU fail, it's crucial, absolutely vital, to the German economy. Europe can get by without Germany and just default - but the Germans can't lose BOTH loan payments and the Common Market without destroying Germany's way of life.

Merkel's footdragging is only giving Germany a Cheap Charlie Rep, instead of establishing itself as the Hero and Savior.

Demographics is the big picture, not the economic tides.

Yes for the long term; about 2 decades or more. But for the next 15 years, this won't matter.

In terms of the economy, they just keep kicking the can down the road, and I think they can only keep this up for a few more years (maybe 5?). The dam will break much sooner than most people think, and that is a big concern.

Part of me says there is entirely too much pessimism about Europe. The Germans won't let the EU fail, it's crucial, absolutely vital, to the German economy. Europe can get by without Germany and just default - but the Germans can't lose BOTH loan payments and the Common Market without destroying Germany's way of life.

Merkel's footdragging is only giving Germany a Cheap Charlie Rep, instead of establishing itself as the Hero and Savior.

Homo Economicus. A Legendary Creature, like Bigfoot, claimed to exist by Pseudoscientists.

I couldn't disagree more. Germany does not need most of Europe at all. Germany lives in a permanent state of austerity, suffers from a strong Euro as they're an export-driven economy, and is most at risk from an entitlements cliff that dwarves that of the US. They won't receive any relief from their neighbors, all of which have even worse demographically-driven entitlement cliffs.

Germany has been facing a declining "global share" of value-weighted exports while Japan has been mostly holding steady and the US has been increasing (against what current common wisdom and pop hype has told you, the US continues to increase global share of value weighted trade -- the only non Asian country still growing). Germany has huge problems, and those problems are only further complicated by carrying Europe on their backs.

The ONLY reason Germany would keep supporting the EMU is for geopolitical reasons. I listen to Deutsche Welle in German quite a bit, and I'd say 90% of the discussions are purely political in nature and center around whether Germany is better off trying to make Europe into Germany, something which many believe is folly (myself included), or whether they're better off reclaiming Germany as its sovereign self.

Germany has been facing a declining "global share" of value-weighted exports

Let's put that in context. The total value of German exports has doubled over the past decade:

http://www.tradingeconomics.com/germany/exports

Germany does not need most of Europe at all. Germany lives in a permanent state of austerity, suffers from a strong Euro as they're an export-driven economy, and is most at risk from an entitlements cliff that dwarves that of the US.

Germany is certainly not in a permanent state of Austerity. It is not Ireland. The German economy is very healthy, from unemployment to exports, it has all the marks of a bustling economy, despite the Great Recession. The Germans may want Austerity for Europe but certainly not for themselves, as recent election results illustrated with Merkel's party being handed several key defeats.

Where do the bulk of German exports go to? Europe.

http://2.bp.blogspot.com/_1V7wnZxPqok/S4d4imEOwhI/AAAAAAAAMpI/fOJlny_yXG8/s400/germany+trading+partners.jpg

The weaker Euro means that German Goods are actually more competitive now that they were a few years ago. Germany is not running an Austerity program.

Germany has a $150B Trade Surplus, contrasted with America's ~$600B Trade Deficit that only grows worse over time. We should kill to have those numbers.

The EU provides a host of benefits to Germany: A common currency and reduced trade barriers, both of which benefit Germany's exports (and banks). Leaving the EU will have severe effects on German exports; trade barriers will return, And if Austerity, which almost never works, becomes widespread in Europe, that will also have a negative effect on Germany's economy.

Germany has:

* Lower unemployment than the US

* More productivity per worker

* A massive Trade Surplus

* Less Debt than the US

Boj policymaker warns of uncertainty over recovery amid Europe woes

What? I thought it was said that all is well now!

Ah yes, words are important

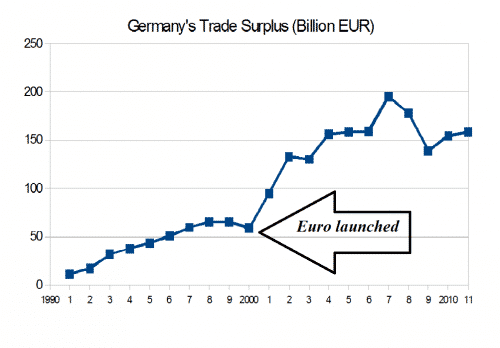

The Euro was the best thing that ever happened to Germany.

Wall Street closes at three-month high on hopes for Europe

"Sentiment in Spanish and Italian bond markets - the forefront of the three-year debt crisis - improved, with two-year Spanish yields falling to 3.42 percent on Monday, less than half of a late July high of over 7 percent."

Whatever, I'm still not convinced.

How bad is Greece? Worse than you think--Ross

But I thought...

A personal account of Greece:

Life in Greece since the recession began (Peakprosperity.com)

How bad are things in Greece?

About as bad as they are in Japan:

from

http://www.indexmundi.com/greece/total_fertility_rate.html Total fertility rate: 1.39 children born/woman (2011 est.)

from

http://www.indexmundi.com/japan/total_fertility_rate.html 1.39 children born/woman (2011 est.)

for comparison from

http://www.indexmundi.com/united_states/total_fertility_rate.html Total fertility rate: 2.06 children born/woman (2011 est.)

American,

Europe is not American and Europe is not Japan. What is going on there is kinda fascinating, I agree. Kinda like a slow motion crash.

Just asking: being as how you are an American (not European) in Japan (not Europe) why the obsession with Europe?

I may live their in the future. What's more it seems like world markets hinge on the precedents being set in Europe are affecting world markets...but what do I know...

Another one funny or not :

IMF's Lagarde says talks with Greece "very productive" ml

I hope so for your sake Lagarde...the emperor isn't as forgiving as...

I posted on a different thread before, based on their identical birth rates, things are just about as bad in Greece as in Japan.

But things are also just about as good in Greece as in Japan,

American in Japan says

I hope so for your sake

sake as you point out that you hope, is very much different than ouzo, but also very much as good as ouzo.

It was a line from *Return of the Jedi* except it goes."I hope so for your sake commander, the Emperor isn' t as forgiving as I am."

Sake might taste good like ouzo, but like the guy in Star Wars, The Emperor of Japan was also a bad dude, didn't take responsibility for what was done in his name in places like Nanking and Bataan.

I'm not a fan of the Japan emperor, but I was only referring to a movie here.

And this:

http://finance.yahoo.com/news/another-extension-greece-now-seems-095247909.html

When will Spain pop the question? (US News)

What question?

The question is the request for the bailout. The Spaniards should compare Iceland to Greece before they decide.

Greece-austerity-strike-hurt-gdp (Yahoo.com)

Wait, i thought...

Hilarious. The STRIKE will hurt GDP?

But not the non-reality based Austerity measures?

Gotta love a one-sided article like this one.

Interestingly, the euro has gained ground solidly the last month.

Despite all of the calls for the destruction of the EU, the euro so far has held up well against the US dollar at about $1.30 / euro.

Negative new on Europe is less the last few months.

http://www.economist.com/blogs/graphicdetail/2013/02/european-economy-guide

Despite these improvements, government debt levels are now worryingly high in the periphery, with debt burdens (ie, as a share of GDP) above 100% in Greece, Italy, Ireland and Portugal. Greece’s remains exceptionally high, at 178% of GDP, despite a bond buyback late last year and the writedown of over half of privately held debt in March 2012. But other European governments, to whom Greece now owes over half of its debt, have eased the effective burden by lowering interest rates and extending the maturities of their loans.

3-Month Performance Leaders

http://www.barchart.com/commodityfutures/leaders?type=pl&cat=65d&view=chart

relative performance

http://finviz.com/forex_performance.ashx?v=26&o=-perfdaypct

Now Cyprus is all better too!

http://finance.yahoo.com/news/stock-futures-signal-rise-cyprus

Euro still above $1.28.

Despite all of the calls for the destruction of the EU, the euro so far has held up well against the US dollar at about $1.30 / euro.

That says a lot about what people around the world think of the dollar. The euro should be dropping like a rock against the dollar. Zerohedge likes to point out how well the dollar is doing, but only against the yen, pound, and euro. As we used to say in Texas, it's the best of a (really) bad lot. How's the dollar doing against the rest of the world's currencies? Not nearly as well.

People are getting antsy about the dollar. Lots of direct currency exchange deals popping up around the world lately, especially in China. Going to get interesting the next 5-10 years. Sooner or later the piper must be paid. The only question is who runs out of cans to kick down the road first. It's the ultimate game of chicken going on out there. If the situation wasn't so deadly serious and dire it would actually be funny.

« First « Previous Comments 80 - 119 of 119 Search these comments

Stories like this seem to imply that all is well:

Stock futures rise Greek debt hopes

Asia stocks following surge wall

However, something is rotten in the state of....

Greek debt talks to stretch into weekend (profit.ndtv.com)

Faber-Greece is a write-off (The Mess that Greenspan Made)

Market Bulls Rely on...Greece? (Zacks)

Greece tearing-Europe apart politically socially economically-William (Yahoo Tech Ticker)

Why the Euro-zone could unravel very fast. (Time)

Europe bailout of Spain could cost 125 billion (Japan Today.com)

Spain unveil's austerity steps soon (Yahoo Finance)

Boj policymaker warns of uncertainty over recovery amid Europe woes (Japantoday.com)

Euro-crisis-revving-again-fasten (yahoo.com)

Greek-protest-turns-violent-during-general-strike (Yahoo.com)

Spain-default-debt-just-greece-john-mauldin-162554593.html

http://finance.yahoo.com/news/spain-time-greece-does-not-110143314.html

Could it be?