patrick.net

An Antidote to Corporate Media

1,260,416 comments by 15,050 users - DOGEWontAmountToShit, ForcedTQ, Misc, RandalRay, WookieMan online now

Gold housing ratio falls to historic low

2012 Mar 3, 12:07pm 32,972 views 77 comments

« First « Previous Comments 24 - 63 of 77 Next » Last » Search these comments

If they qualify to buy a sh**box in The Fortress, either with cash or qualify to borrow, then whether or not they call themselves wealthy or whether or not you consider them wealthy, it doesn't matter: by any reasonable comparison to most of the residents of the USA, California, and even the Bay Area, they are wealthy.

And yes, the apartments they lived in at places like Hong Kong, Shanghai, Mumbai, Bangalore, Taipei etc. besides being in multi-unit housing, are quite small. Your SFD sh**box in The Fortress is a palace by comparison.

The whole point is, these people, are not really, wealthy, because, if they were truly wealthy, they wouldn't be living in sh*t-boxes, no matter how good the schools are. All those places where all those people which you mentioned come from, come from cities, not culture-less waste zones without public transportation, like the so-called cities in the bay area are, so, your comparison doesn't really apply. If you want to compare prices between Los Altos and China for example, you shouldn't pick Shanghai or Bejing which are both cities of 20 million people. Instead, you should pick a place like Quamdo China, where prices are much cheaper than Los Altos.

Why do the prices of housing and gold have to be in some sort of ratio lockstep? There are things that will affect the prices of each that have nothing to do with each other. Am I missing something here? This chart is just pointing out arbitrary numbers in time, who cares?

Yes, you are missing something. It is the price of a house in US$ which nobody cares about, because, it is the US$ which is an arbitrary piece of paper with ink on it, and which has already lost 99% of it's purchasing power, since it came into existence (incidently, coincidental with the birthday of the federal reserve in 1913). The gold currency is the true currency of the world, and, since the Babylonian War, it has never lost it's purchasing power.

no matter how good the schools are

You mean, how high the standardized test scores are?

Why do the prices of housing and gold have to be in some sort of ratio lockstep? There are things that will affect the prices of each that have nothing to do with each other. Am I missing something here? This chart is just pointing out arbitrary numbers in time, who cares?

Yes, you are missing something. It is the price of a house in US$ which nobody cares about, because, it is the US$ which is an arbitrary piece of paper with ink on it, and which has already lost 99% of it's purchasing power, since it came into existence (incidently, coincidental with the birthday of the federal reserve in 1913). The gold currency is the true currency of the world, and, since the Babylonian War, it has never lost it's purchasing power.

Never lost its purchasing power? What on earth do you mean by that?

The gold currency is the true currency of the world, and, since the Babylonian War, it has never lost it's purchasing power.

From point “A†to point “B†gold lost purchasing power by 5.5 times (house cost).

Gold is just a commodity today. Let’s build a chart: barrel of oil vs. house prices or bushel of corn vs. house prices.

The gold currency is the true currency of the world, and, since the Babylonian War, it has never lost it's purchasing power.

Never lost purchasing power since the Babylonian War, ha! I guess the Babylonian War happened in the 1980s over a dispute about whether the following video rocked or sucked. I believe the forces of suck prevailed.

Of course, that was the second Babylonian War. The first was won by these guys.

bubblesitter says

toothfairy says

this means house prices will need to triple to get bck to the historic ratio.

Hahahaha. I haven't laughed that hard in a while.

I know it sounds kind of funny right now but that's a fact not an opinion.

It's a bit of a stretch to call that a "fact." You could also say that it was a fact that gold would have to fall by 2 thirds to get back to the historic ratio.

Gold is just a commodity today. Let’s build a chart: barrel of oil vs. house prices or bushel of corn vs. house prices.

Yep. If the sheeple flock to gold, gold can be "overpriced" too. There's nothing inherently special about gold.

People are madly running around exchanging one asset class for another, imagining that they're smarter than everyone else. Dollars for gold, gold for stocks, stocks for bonds, bonds for Euros, Euros for silver, silver for oil, and on and on it goes. And nobody has any better information about the future than anyone else. If they do have "insider" information, that's generally considered illegal.

There's nothing inherently special about gold.

But it's shinny! That means it can't fall in purchasing power because shinny things rule!

If they do have "insider" information, that's generally considered illegal.

Unless they are Senators. And, no, I'm not being facetious about that.

Then Gold is over inflated that's no secret.

Is gold over inflated or is the dollar's credibility inflated ?

Efficient market theory says the "Peter Schiff Factor" is already priced into the gold market. The herd has already bid up the price of gold. It's too late to buy gold.

To beat the markets, you have to know the future. I don't know the future.

The Fed holds the cards in this "sucker's game." It could just as easily adopt a deflation policy just to fake everyone out. I can't predict the Fed.

Is gold over inflated or is the dollar's credibility inflated ?

Is paper currency a shitty asset class right now? Absolutely. But stocks and bonds are overvalued. Commodities are too volitile. Gold and silver are bid up.

Cash is the worst asset class right now except for all of the others.

s paper currency a shitty asset class right now? Absolutely

I wouldn't take an absolute position either way. I'm ambivalent towards all assets right now :)

. But stocks and bonds are overvalued.

Yes. Bonds have always been overvalued and can stay like that for a long time. Stocks are overvalued in the sense that liquidity is sloshing around and keeping the equity markets appear stable, but the hidden volatility usually comes to the fore with a vengeance.

Gold and silver are bid up.

Yes I think once we have liquidity concerns again, I expect the metal markets to correct significantly. Buying is a good decision then, because everyone would be selling to scramble for cash.

Cash is the worst asset class right now except for all of the others.

Cash is a fine asset to have, as we're waiting for mass selling to get things at a discount, whatever the thing is.

What about Silver? I set aside 500 ounces to buy a House with some day!

Then Gold is over inflated that's no secret.

Is gold over inflated or is the dollar's credibility inflated ?

I don't know, we're still the only game in town. A new impending calamity befalls the Euro almost on an ongoing daily basis. The same forces working to debase our dollar and make it worthless is the same forces working to inflate Gold. So you tell me.

Seems like the Aussie and Canadian dollars are stable. Canada is less vulnerable to a China clusterf*ck.

Is gold over inflated or is the dollar's credibility inflated ?

I don't see why these are mutually exclusive.

Is paper currency a shitty asset class right now? Absolutely. But stocks and bonds are overvalued. Commodities are too volitile. Gold and silver are bid up.

Cash is the worst asset class right now except for all of the others.

In essence, today all stores of wealth are either extremely volatile, precarious, or devaluing because our government decided to socialize the losses of the largest banks, and the socialization of these losses have hit pretty much everything. We're all paying to keep the big banks afloat.

Oh, and we're also paying to keep these numb-nuts in their mansion:

http://patrick.net/?p=1209701

What about Silver? I set aside 500 ounces to buy a House with some day!

Jesus. With that much silver you will be able to buy two houses!

A new impending calamity befalls the Euro almost on an ongoing daily basis.

I think Euro has problems, but it'll survive.

I don't know, we're still the only game in town.

I don't think so. For several reasons, but check this chart.

The same forces working to debase our dollar and make it worthless is the same forces working to inflate Gold.

Gold is getting upthrust from all fiat currencies, not just the dollar.

What about Silver? I set aside 500 ounces to buy a House with some day!

Silver is notoriously volatile.

Please check this paper .

It's a two-function metal (industrial and monetary), and industrial use dominates its price more than the monetary usually, which leads to more volatility relative to gold.

I don't see why these are mutually exclusive.

They're not mutually exclusive. It's one and the same thing, it just depends on your perspective ;)

What about Silver? I set aside 500 ounces to buy a House with some day!

Great Move! With that much silver, you'll be able to buy a house in the fortress, and have enough money left for a gardner.

Never lost purchasing power since the Babylonian War, ha! I guess the Babylonian War happened in the 1980s over a dispute about whether the following video rocked or sucked. I believe the forces of suck prevailed.

Back in Babylon, you could buy a house with 100 gold coins. Now you can still buy one with about the same number of gold coins. Now, if you had saved $2,000 in green-backs, which was enough to buy a nice house back in 1913 when the FED began to print these, now, you could buy yourself a decent Barbie house, but that's about it.

Gold is just a commodity today. Let’s build a chart: barrel of oil vs. house prices or bushel of corn vs. house prices.

If gold is just a commodity, then why are all the world central banks hoarding it? Why aren't they hoarding pork bellies or coffee beans?

If gold is just a commodity, then why are all the world central banks hoarding it? Why aren't they hoarding pork bellies or coffee beans?

Imperishable, don’t need refrigerator or ventilation, nice block shape, easy to handle, pleasant to look.

Imperishable, don’t need refrigerator or ventilation, nice block shape, easy to handle, pleasant to look.

how about the real reason that it is universally accepted as the wealth reserve?

how about the real reason that it is universally accepted as the wealth reserve?

Good point indeed. With the same reason every woman prefers a ring with a diamond in the center instead of soy bean.

ow, if you had saved $2,000 in green-backs, which was enough to buy a nice house back in 1913 when the FED began to print these, now, you could buy yourself a decent Barbie house, but that's about it.

Just because greenbacks lose purchasing power doesn't mean the market price of gold doesn't fluctuate wildly. I have yet to see any offer in writing that guarantees that I will not lose money if I purchase gold today.

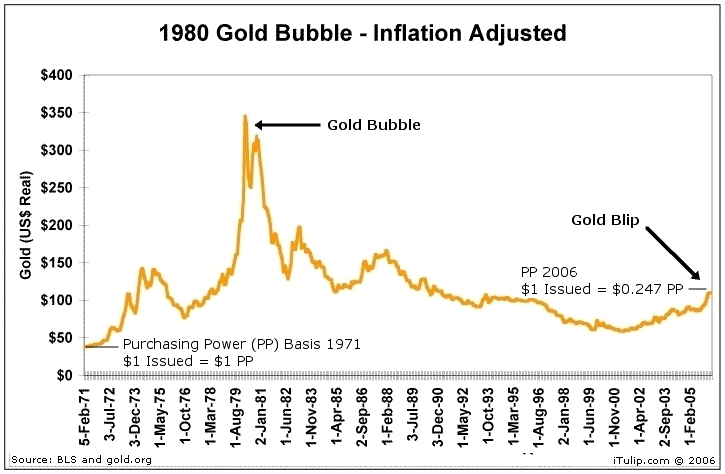

Had a person bought gold in 1979, he would have been financially wrecked. Today's gold bubble is far greater.

Just because over very long periods (100 years+) the market price of gold relative to say housing is a constant, doesn't mean you can't incur massive losses during periods of rampant speculation. For every fortune made, two are lost.

Had a person bought gold in 1979, he would have been financially wrecked. Today's gold bubble is far greater.

No he wouldn't. Today's pricer is more than double that of 1979. With gold, you just hold it, and you will break even, eventually. With the dollar, you are guaranteed to lose. Also, when you sell your gold, you are actually, buying back your dollars. Why would anybody want to sell the only true store of value, and buy worthless piece of paper, with ink printed on it, backed by nothing but debt and the lying politicians who rule our untrustworthy gov't.

doesn't mean the market price of gold doesn't fluctuate wildly.

By market price, you should be meaning the paper price of gold.

Sure of course it fluctuates, because gold truly does not float. Gold futures (a lot more than available physical), gold backed derivatives, metal leasing/lending -- all of these lead to price fluctuations on the physical. Nevertheless, I think because of all this paper trading (a lot more volume than the actual physical), time to time-- there's significant discount on spot price.

Consider: http://jessescrossroadscafe.blogspot.com/2012/02/what-is-spot-price-of-gold-and-silver.html

I have yet to see any offer in writing that guarantees that I will not lose money if I purchase gold today.

I think the capital gains tax of 28% is extremely punitive and I agree it doesn't make it worthwhile when measured in dollar terms . But the reality that you should consider is that the tail risk for bad outcomes are quite high now.

doesn't mean you can't incur massive losses during periods of rampant speculation.

I agree average investors cannot make a ten bagger with gold. But that's not the point of gold though. If you think of it like that, you are losing the plot ....

With the same reason every woman prefers a ring with a diamond in the center instead of soy bean.

Of course!

After all, value does not exist outside mankind's consciousness.

Mpgph! Just being reminded of that author and his series of books makes me sick.

Today's pricer is more than double that of 1979. With gold, you just hold it, and you will break even, eventually. With the dollar, you are guaranteed to lose.

Where have I heard that before. Oh yeah:

Today's price is more than double that of 1979. With housing, you just hold it, and you will break even, eventually. With the dollar, you are guaranteed to lose.

Actually, if you look at housing, it has risen more than gold from the 1979 peak. And we all know what a bad deal housing can be.

Why would anybody want to sell the only true store of value, and buy worthless piece of paper, with ink printed on it, backed by nothing but debt and the lying politicians who rule our untrustworthy gov't.

The point is, gold isn't a constant store of value. If only it were. No one here is arguing that our fiat currency doesn't suck the sweat off a dead man's balls or that our fiat currency doesn't lose damn significant value over a decade. That's NOT the point.

The point is that gold does fluctuate wildly in its purchasing power, a point well proven back in the 19th century, again in the 1970s, and yet again today. Compare the number of gallons of milk you could buy in 2000 with an ounce of gold to the number of gallons of milk you could buy today with the same ounce of gold. You get a lot more milk today. Sounds like buying gold is a good idea, right? WRONG!

It is exactly because you get more milk per gold ounce today that makes buying gold today risky and makes gold a lousy store of value. A good store of value neither goes up nor down in its aggregated purchasing power. Gold has gone way, way up in its purchasing power. Getting in on the gold rush today is like being a peak housing buyer. Anything that can as quickly and as dramatically increase in purchasing power can also as quickly and dramatically decrease in purchasing power. What goes up, can and does come down.

Gold has been an excellent financial move in the past ten years, but that doesn't mean it is an excellent move now. Furthermore, if we're talking about wealth preservation rather than speculation, gold is bad, bad, bad. As I wealth preserver, I don't give a rat's bottom if I have a 70% chance of doubling my purchasing power, but I do care deeply about the 30% chance of losing 50% of my purchasing power. And no one will ever give a written guarantee, backed with insurance, that a portfolio of gold won't decrease in purchasing power. And for good reason: we all know that someday the gold bubble will pop. We have no idea when, but it is a matter of when not if.

Cash, as crappy as it is, at least is a far less risky short-term store of value. Yeah, I get hit hard with the inflation tax, but I'm not going to risk my life savings trying to time the gold market. All it would take is one major player to sell off all its gold and short the gold market to cause a massive stampede out of gold. It makes no sense for me to risk being caught by this stampede when I plan to spend my savings within the next few years.

Dan8267 says

doesn't mean the market price of gold doesn't fluctuate wildly.By market price, you should be meaning the paper price of gold.

Nope, I don't care about the price of gold in U.S. dollars. I care about the price of gold in milk, wheat, Ferraris, Caribbean cruises, hours of maid service, and other relatively stable commodities/services. And gold has increased greatly priced in these measurements, which means it can also decrease greatly priced in these measurements.

Nevertheless, I think because of all this paper trading (a lot more volume than the actual physical), time to time-- there's significant discount on spot price.

Maybe there is, but I'm not a speculator and I don't want to try to time the gold market. There be sharks in those waters who knowledge of the gold market and players far exceeds my own and that get information far quicker than I do. Gold: good for speculators and day traders, bad for savers.

Of course!

After all, value does not exist outside mankind's consciousness.

Beauty may be in the eye of the beholder, but we all have the same eyes.

You can say beauty (value of appearance) does not exist outside of mankind's consciousness, but that appraisal is based on things that most certainly do exist outside of mankind's consciousness and can be objectively measured.

« First « Previous Comments 24 - 63 of 77 Next » Last » Search these comments

http://www.financialsense.com/contributors/daniel-amerman/2011/11/18/gold-housing-ratio-falls-to-historic-low

This must mean something to the gold bugs doesnt it?

As shown at "Point A", on an average annual basis, there was a previous modern ratio low of 99 ounces of gold to buy a house when gold reached its financial crisis peak valuation in 1980. Real estate was remarkably cheap relative to gold - and real estate investment would outperform gold by a huge margin over the 21 years to come.

"Point B" occurred in 2001, with the Gold / Housing ratio reaching a high of 543 ounces of gold being needed to buy a single family home. Gold was remarkably cheap relative to real estate - and gold asset prices would outperform real estate asset prices by a huge margin over the 10 years to come.

The current price of gold (as of November 15, 2011) is reflected in "Point C", which shows a Gold / Housing ratio of 96 ounces of gold being needed to buy the average single family home. This is only 18% of the 543 ounces required in 2001. Real estate is once again remarkably cheap, when compared to gold.

#housing