« First « Previous Comments 43 - 61 of 61 Search these comments

Wow, people love talking about anything instead of MATH. Here goes...

Assumptions:

Fixed Interest rate of 4.0%

$500,000 loan

20% down

vs.

Renting the same place for $2000/mo

lets look at living in the place for seven years and include Interest, tax, ins, water (something you generally don't have to pay as a renter) and extra maintenance. I assumed int and tax will be fixed (prop 13...) and ins, water and maint are subject to the same inflation as rent.

At what inflation point do these break even?... With these assumptions it takes around 26% inflation to make owning break even in seven years.

Of course I'm using the typical numbers from the little beach community where I live (Summerland, CA).

If you go to someplace like Vegas where you can either rent a nice house for $1750, or buy it for $200,000... With all the same assumptions you can have NEGATIVE 8% inflation and come out ahead by owning.

You're asking the wrong question. Salary inflation is what inflates house prices, not just plain old inflation. Salary inflation is a response to inflation and is therefore lagging. They're not even 1-to-1. If your salary has barely crept up during a state of hyperinflation, you're screwed!

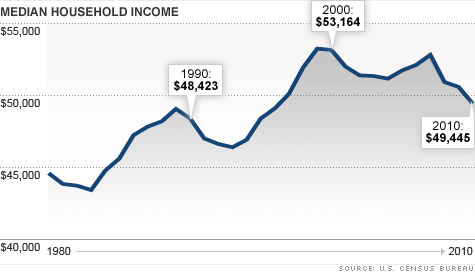

Chart already presented by uomo:

The average salary is down to $49,445. Inflation wasn't negative, was it?

Salary inflation simply devalues your debt, as you get a better income-to-debt ratio. Let's just take the numbers presented by California Equity & Loan. Here's what I got.

Additional assumptions:

- Starting salary is $50,000

- Salary inflation is approx 7% (roughly doubles your salary in 10 years)

After 10 years:

- Starting income-to-debt is $50,000 to $400,000

- Ending income-to-debt is $100,000 to $315,000

Patrick, that is an interesting question. I have been writing some finance programs in Javascript for a class I am teaching. If free time crops up, then I will look at your question.

By the way, the U.S. has never experienced hyperinflation. Using Cagan's definition, hyperinflation is inflation exceeding 50% per month.

Hyperinflation causes many problems, so I restrict myself to five.

(1) Interest rates will also with inflation. If the inflation rate is 600% per year (12*50%), then the interest rates will be slightly higher than this rate. If you have a fixed interest rate loan, then loan balance is reduced to nothing. If you have an adjustable rate loan, then this could be dangerous.

(2) Savers are severely penalized if they keep their savings in that currency. Furthermore, the financial sector would not survive a hyperinflation episode.

(3) People stop using the currency as a medium of exchange. Barter would make a come back. The key is you do not have to buy gold or precious metals. Anything of value becomes a medium of exchange, like bullets, seeds, medicines, cigarettes, bottles of gasoline, etc. Foreign currencies could also become valuable.

(4) Hyperinflation would destroy the U.S. government's budget along with the state's and local governments. (Would people still pay their taxes?) Government will put its survival before its people. I would not be surprised if government would start confiscating the precious metals.

(5) Wages are not likely to keep pace with hyperinflation, so most people will literally be shoved into poverty overnight. The good question would policemen, firemen, soldiers, and medical personnel still report to work? When the Soviet Union collapsed, people still reported to work, even when they were not paid in months. I do not think Americans would do the same.

Vladimir Lenin has a great quote, "The best way to destroy the capitalist system is to debauch the currency."

Professor, that's precisely why we will have another (intentional) recession as we did from 1980-1982.

We have to. Either that, or we destroy the country.

Wouldn't one need to calculate compound interest...

No need to try to determinte the outcome of hyperinflation -- things usually get really nasty.TravellingProfessor says

(1) Interest rates will also with inflation. If the inflation rate is 600% per year (12*50%), then the interest rates will be slightly higher than this rate.

the U.S. has never experienced hyperinflation

We banned our citizens from owning gold in April 1933. Soon after that, we defaulted in October 1933. The result was monetary illiquidity that prolonged the depression that lasted until the end of WWII.

TravellingProfessor says

I would not be surprised if government would start confiscating the precious metals.

That should happen BEFORE the event. Also, it was not confiscation per se. People got dollars for their precious metals. In 1933, if you had a safe deposit box, an agent would have to be present before you could open your box. He would then take your metals (if any) and write you a check. Don't fall for any of the intentional misinformation out there.

Now, what have we learned from Weimar, Argentina, etc, etc? Hyperinflation is intense short-term pain, but both countries were back on track immediately after the event.

to burden yourself with a 30yr mortgage would require a growth rate of nearly 8%

assuming maintenance costs are moderate to low.

I don't see inflation "helping" the housing market since I expect in a domestic inflationary environment to see wages not indexed to inflation. Housing prises aren't likely to rise at all just because there is inflation unless wages rise as well.

The fed has held basic inflation to 2% and will maintain this for the foreseeable future.

Also stated the fed will devalue the dollar 33% over 20 years.

Wage inflation ! it's stagnant for 30yrs+.

Interest rates are only going to fall.

Once interest rates are allowed to rise (unlikely) property prices will fall and create more starts.

However, even 1/4 percent raise in rates is equal to $1 Trillion of added cost to the governments own debt.

And if for any reason we should fall into deflation just hand the keys back to the bank, Obama got your back! Most important to remember: never put more than 3,5% down!!!

This guy...

This might be helpful

http://seekingalpha.com/article/1066721-6-scary-charts-on-the-hyperinflationary-cliff

"The Link to Hyperinflation

At this point, it almost doesn't matter what the 'right' thing to do is. There is no right or wrong anymore. The time for the altruistic decisions was years ago before the US chose a path of dependence.

Today, it is almost impossible to cut spending because the population and economy is dependent on it. Worse, as the effects of spending shrink more spending is needed to maintain the status quo.

Today the US government can borrow at ultra low rates - tomorrow, creditors may withdraw and interest rates may skyrocket. If that were to happen the government could choose to print (more) money to pay for social lubrication and keep the population sanguine for a few more months. It is this sort of trapping that can eventually lead to a hyperinflationary cliff.

While many investors have turned to gold (GLD), silver (SLV) and commodities (DBC) as a potential hedge against currency collapse, there are other ways to potentially protect. Nobody really knows what will work until after the fact, but some investors believe that US stocks (SPY) - particularly ones with pricing power - could fare well. Other US investors might want to consider investing in non-US assets such as the iShares MSCI EAFE Index Fund (EFA).

Personally, I'll stick with gold as my insurance policy against currency"

10 or even 20% annual inflation is not "hyperinflation" according to any actual economist. Hyperinflation is characterized by an economy where you literally can't make any long term financial decisions because things are inflating so fast that there's no real value in currency. You won't be able to take on a mortgage because NOBODY WILL LEND MONEY.

Now, if you want to replace the word with "inflation", it's really simple

1.) Determine monthly mortgage payment.

2.) Make a guess as to how many years you will live in the home.

3.) Calculate the total rental price for that period of time, assuming your target inflation percentage (say, 5%).

3b.) Subtract the rent from mortgage and project investment growth over the period (say, 5%)

4.) Calculate the total cost of the mortgage (+taxes) for that period of time.

4b.) Subtract mortgage interest savings, add maintenance costs.

If 4b. is greater than 3b., it's cheaper to buy.

There are dozens of online calculators to make this equation.

However, and this is a big one: There's a world of difference between renting a home and owning, aside from finances. I can choose to remodel a home, and I can use it as collateral for other low interest debt (much lower than any other form of credit you'll ever get). It's hard to put an equivalent financial value on those things.

I can choose to remodel a home, and I can use it as collateral for other low interest debt (much lower than any other form of credit you'll ever get). It's hard to put an equivalent financial value on those things.

So.....buying a house is advantageous because you can undertake enormous spending projects and use it as collateral in order to borrow your way to prosperity?

/facetiousness

So.....buying a house is advantageous because you can undertake enormous spending projects and use it as collateral in order to borrow your way to prosperity?

/facetiousness

It's one advantage, yes.

Being able to use your home as collateral for taking out a loan is a tremendous advantage when you need money for some project. It could be starting a business or paying for an advanced degree. The interest rate you pay on that secured debt is a small fraction of what you pay on the typical unsecured credit lines like credit cards or personal loans.

Just because you don't understand the value of credit doesn't make it a bad idea.

Many people have started businesses using capital borrowed against their homes. It's a perfectly reasonable way to do things.

And, yes, literally "borrowing" your way to prosperity is how virtually everybody who wasn't born into wealth got that way. Every silicon valley tech company borrowed money to get started. Every restaurant chain, every bank, every small business in your community. Very few people have the cash in the bank to start a business. Borrowing with your home as collateral is the single most common method for small business financing, as it's less than half the cost of borrowing against the new business itself (which the bank just treats as unsecured debt).

It could be starting a business or paying for an advanced degree.

I agree with the points made about using house debt do to do these things. They have the potential to greatly benefit the borrower, making the amount paltry in the long run. It is one way of doing it. The number of people that ACTUALLY do that with a HELOC is almost insignificant.

With interest rates what they are now, why not just take out business loans? The qualification requirements are higher than those for a HELOC as are interest rates, but in the end, if the business succeeds the amount borrowed still turns out to be paltry. Borrowing against the house like that does still have some possibility of rendering the loan owner into a renter again. I am just not really seeing a sound logical argument for borrowing lots of money to get a house which you then use to borrow more money to MAYBE become more successful. Lots of people have formed start-ups while renting and securing business loans and/or VC money. I'd rather have to walk away from that stuff than my house if things don't work out. If things DO work out, whatever I borrowed for a business loan or in VC won't be that big of a deal because my business will be making me much more than that.

With interest rates what they are now, why not just take out business loans?

7 years @ 7-10% (SBA loan) vs. 10 years @ 3-4% (HELOC)?

If you have equity in your house, it's MUCH cheaper to use that.

in the end, if the business succeeds the amount borrowed still turns out to be paltry.

Haha, no! The vast majority of businesses fail, and those that succeed frequently struggle to pay back their early loans. There's a whole world of industry between failure and becoming a publicly traded company. The world runs on companies that earn under $1M / year, and to those companies 10% interest is a shit load of money. Many, many companies that are seemingly "successful" wind up failing because they can't repay their debts.

Lots of people have formed start-ups while renting and securing business loans and/or VC money.

Yeah, in the loopy world of silicon valley, sure. In the rest of the world, "VC" isn't even a word that people know. You either borrow the money from your dad or you borrow the money from your house. You can try to borrow the money from the bank, but:

1. They probably won't lend to you.

2. The most they'll lend to you is relatively small.

3. They'll give you what you need, but you'll be paying a minimum of 10%.

Anyway, I'm not suggesting that you buy a house just so that you have the HELOC option, simply that it's an intangible benefit that you'll get if you have equity in your home that you'll never get by renting. A HELOC is the cheapest debt you'll ever be able to get outside of borrowing against your retirement account.

I believe Kevin works for Amazon

Nope.

In any case, software engineer/developer is currenty the most lucrative working class profession in the world.

Not really. It's a great profession, but surgeons, dentists, anesthesiologists, trial lawyers, petroleum engineers, quants, and psychologists all get paid much more on average. Software engineering just looks highly paid on paper because it tends to be concentrated in really expensive areas. There are SWEs in places like ohio and arizona making under $75k. No attending surgeon gets paid that poorly.

Software engineering is probably the best paying job you can get without an advanced degree (or even any degree for that matter) with some regularity. You can certainly make plenty of money in a lot of other professions that don't require an advanced degree (like real estate or banking), but it's a lot harder.

The major downside to being a software engineer is that there are only a handful of places where you can live that will allow you to get paid well and actually enjoy the work that you do. A surgeon or lawyer can go anywhere. I'm limited to big coastal cities (and not all of them, either)

« First « Previous Comments 43 - 61 of 61 Search these comments

How severely would inflation have to rise for it to make sense to burden oneself with a huge mortgage. Many people believe that there is a good chance of hyperinflation in the future. Lets say someone decides to take out a 500,000 dollar mortgage at 5% 30 year fixed right before interest rates start to rise and house prices fall. How much would inflation have to up and over how long a time period for that person to have made a wise choice, compared to renting for ten years after rates go up and prices drop, and buying with cash at a lower price. Not sure how low the price would be though and of course that is a key variable. I am just toying with the idea of housing vs gold. Stash your money in real estate, stash your money in gold? A little bit of both?

#housing