patrick.net

An Antidote to Corporate Media

1,350,435 comments by 15,721 users - ElYorsh, mell, The_Deplorable online now

Comments 1 - 21 of 21 Search these comments

It may well be herd mentality. We are in historically uncharted territory in terms of the economy, and especially real estate. Combine that with the fact that this is an election year and that there is some likelihood of candidates offering free money for underwater folks, and it doesn't surprise me at all that Bay Area RE inventory has shrunk. Given the super high prices here, a lot of people are VERY underwater on their loans. In the rest of the country, being 20% underwater on your house might mean that you are out $40k. In the SFBA, 20% can easily put you out of $100k, and the chance of getting free money to cover that is probably more than enough toget an owner to hang on for another year.

Is this sustainable? I have no idea. My practical side says, "of course not." My cynical/realistic side says, "dude, this is CA, forget waiting for practical or rational outcomes in this place." There is more demand than supply in the SFBA, and clearly a lot more money than brains. That isn't a recipe for a good life-balance in terms of the cost of living. If you want a life-balance, you can either give it up in competition with hordes of people that don't understand the difference between "living" and "making money", or you can accept some other compromises and leave.

I don't disagree with the premise that herd mentality is a factor, with potential sellers - especially those who are underwater or who want to 'move-up' to a bigger/nicer house - seeing prices go up and holding out in the hope that this will continue.

However, look at these numbers for SFRs in Oakland (all prices):

REOs: 1,164 (per realtytrac.com search, 8/27)

Foreclosed homes for sale: 39 (per Redfin search, 8/27)

So, only 3.3 percent of REOs in Oakland are on the market. This has been going on for months now - I check the numbers every few days.

What other explanation can there be for these not being on the market, except for the banks creating a false scarcity to drive up prices?

Realtytrac also shows 1,232 Preforeclosures and 772 scheduled for auction (again, Oakland SFRs, as of 8/27).

Greg,

I think next summer will be interesting. Looking at the huge drop in NOD filings recently compared to last year, I believe we will likely get more NOD filings after the November election, which translate to more inventory in spring and summer of next year. With a nice price spike this year, I expect a YoY price decline in the 2nd half of next year when comparing to this year. Could that translate to 3% @ 30-yr fixed interest rate?

The recently passed Homeowner Bill of Right, which will take effect in 1/1/2013, will slow down the foreclosure process again. However I'm optimistic that we will see price softness in the 1/2 half of 2013 and into 2014. A second chance to buy in my opinion.

E-man. I agree. I think we will not see any more price gains and probably some moderate declines by this time next year. This works just fine for the banks. There are still a lot of people in underwater properties out there who are making payments on mortgages at 6%. With 10 year treasury at 1.6%, one of those people is easily subsidizing two others who are not making payments. That's why banks are playing this game. Another five years of this and they will be solvent.

APOCALYPSEFUCK is Shostakovich says

Time to force all the banks to foreclose everything in lis pedens immediately and let them fail. Their portfolios can be parted out to healthy credit unions and the executives of the dechartered institutions can go on TV and commit suicide like honorable people.

Why would you admit you're bankrupt when you can still pay yourself a bonus?

Why is the interest rate so low?

Because few are buying or can afford to qualify for a mortgage. Last week it was posted that 80% of mortgage applications were for REFINANCING, not new purchases..... if only 20% of applications are from people who want to buy.... forget the recovery....

Now with standards going back to reality very few qualify for loans and I am not even taking into account those who have gone under they don't even play into the mix. So factor in the horrid job market, losses, uncertainty and that tells me how house prices are headed on a free fall South. There are NO buyers especially for 800K or 500K or even 300K little dumps, IMHO those days are long gone, thankfully.

APOCALYPSEFUCK is Shostakovich says

Time to force all the banks to foreclose everything in lis pedens immediately and let them fail. Their portfolios can be parted out to healthy credit unions and the executives of the dechartered institutions can go on TV and commit suicide like honorable people.

That's what should happen. But they didn't even do that in Japan, the home of Seppuku. Instead, they had a decade of "zombie banks."

Hey everybody ... remember the "good old days" ? When this used to about communism?

"Somehow it seemed as though the farm had grown richer without making the animals themselves any richer — except, of course, for the pigs and the dogs." - George Orwell, Animal Farm

APOCALYPSEFUCK is Shostakovich says

APOCALYPSEFUCK is Shostakovich says

Time to force all the banks to foreclose everything in lis pedens immediately and let them fail. Their portfolios can be parted out to healthy credit unions and the executives of the dechartered institutions can go on TV and commit suicide like honorable people.

Why would you admit you're bankrupt when you can still pay yourself a bonus?

Exactly. These people should all be jumping from bridges or throwing themselves in front of trains.

In the good old days they jumped off tall buildings. Now the cowards, they grab anything in your wallet and throw you off instead.

Greg,

I think next summer will be interesting. Looking at the huge drop in NOD filings recently compared to last year, I believe we will likely get more NOD filings after the November election, which translate to more inventory in spring and summer of next year. With a nice price spike this year, I expect a YoY price decline in the 2nd half of next year when comparing to this year. Could that translate to 3% @ 30-yr fixed interest rate?

Maybe. I don't believe that this run-up in prices will hold, but they aren't going to start falling until we get a lot more supply.

And I don't believe that NOD's are related to the election.

Greg,

I think next summer will be interesting. Looking at the huge drop in NOD filings recently compared to last year, I believe we will likely get more NOD filings after the November election, which translate to more inventory in spring and summer of next year. With a nice price spike this year, I expect a YoY price decline in the 2nd half of next year when comparing to this year. Could that translate to 3% @ 30-yr fixed interest rate?

Maybe. I don't believe that this run-up in prices will hold, but they aren't going to start falling until we get a lot more supply.

And I don't believe that NOD's are related to the election.

East Bay Real Estate Agent and Blogger

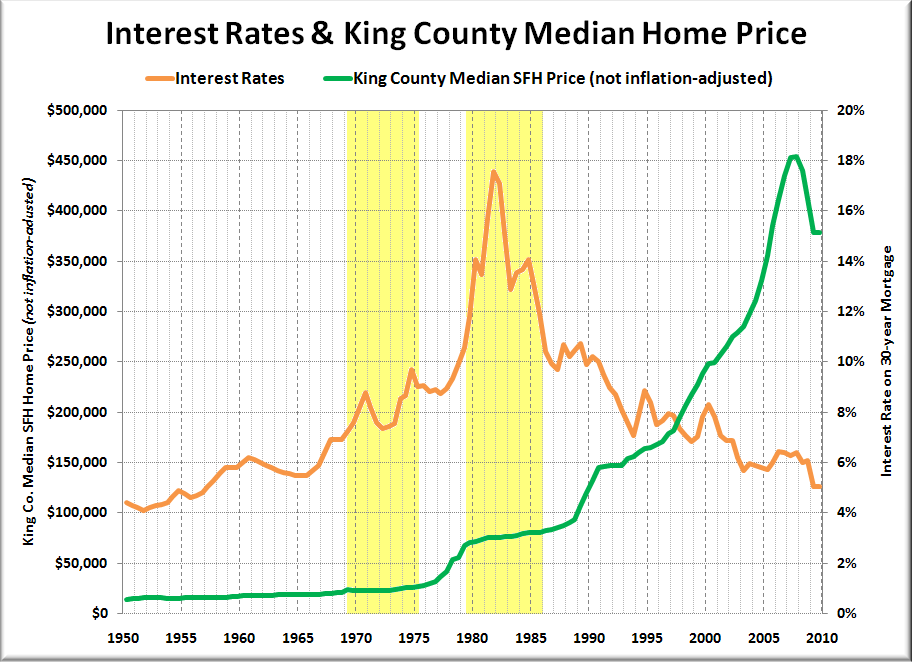

Prices will drop when rates go up. That's no rocket science. But I can guarantee nothing will happen until or short term after election. Long term yes, which is why residential RE is a horrible investment at this point. Because right now there is no such thing as a "buyer season", such thing doesn't really exist there.

Those who are buying it as a non investment, that's different.

Prices will drop when rates go up. That's no rocket science. But I can guarantee nothing will happen until or short term after election. Long term yes, which is why residential RE is a horrible investment at this point. Because right now there is no such thing as a "buyer season", such thing doesn't really exist there.

Those who are buying it as a non investment, that's different.

If rates rise RIGHT NOW, yes prices will tank. Aside from people being able to afford less house, it may make cash savings accounts more attractive and could diminish demand for houses.

However...

Rates will not be raised until the economy is on solid footing and can support that. If the economy is healthy enough to support rising rates, chances are that people's purchasing power is also increasing and housing prices will also go up at the same time. There are some in here that avidly argue that rising interest rates = rising house prices, which sounds counter-intuitive. Taking a 50,000ft perspective on the economy though, it makes perfect sense. Low interest rates are a SYMPTOM of our economic malaise, not a cause! Rates cannot and will not go up unless the economy vastly improves, or some sort of really drastic measures are taken to do (something) to our ailing economy. Doing that right now would probably cause a depression though, since everything is predicated on conspicuous, credit-driven consumption. We sort of NEED to pull the plug on that, have some sort of collapse and then rebuild from the foundation-up, but we all know that will never happen (willingly anyway).

Rates will not be raised until the economy is on solid footing and can support that. If the economy is healthy enough to support rising rates, chances are that people's purchasing power is also increasing and housing prices will also go up at the same time.

Thank you for putting in your 2 cents. People keep on repeating this fallacy here on Patnet including Patrick himself. Common sense would suggest that's how it should work, but history has proven otherwise.

Wishing won't make it come true although I do wish sometimes. :)

Hey e-man, sorry , I can't tell which position you are taking. Are you arguing that history shows that rising rates = lower prices, or that rising rates = healthier economy = rising house prices?

Obviously, I am not familiar with The History! ;)

People keep on repeating this fallacy here on Patnet including Patrick himself

Agreed. Yet, history shows us a different result:

In 1980, after prices shot up (nominally) to 75K, im sure there were alot of people saying "this is nuts, im gonna wait til interest rates spike and prices TANK". Yet, imagine their horror as interest rates doubled and prices continued to inch up higher and higher.

Its worth nothing BTW that this chart above is in nominal terms. In real terms, yes, as BMW man noted, the guy who waited probably got a better deal because his purchasing power was rising faster than nominal prices.

Still, the problem here is people are thinking nominally as in

"700K for this SHACK??? Wait til interest rates spike and prices tank to 550K!!!".

As the chart notes, paridoxically, what they should be saying is:

"700K for this SHACK??? Wait til interest rates spike and my purchasing power goes up and I get it for cheap at 710K!!!"

We sort of NEED to pull the plug on that, have some sort of collapse and then rebuild from the foundation-up, but we all know that will never happen (willingly anyway).

Well said bmwman, well said.

Its worth nothing BTW that this chart above is in nominal terms. In real terms, yes, as BMW man noted, the guy who waited probably got a better deal because his purchasing power was rising faster than nominal prices.

Still, the problem here is people are thinking nominally as in

"700K for this SHACK??? Wait til interest rates spike and prices tank to 550K!!!".

As the chart notes, paridoxically, what they should be saying is:

"700K for this SHACK??? Wait til interest rates spike and my purchasing power goes up and I get it for cheap at 710K!!!"

Well said. I have nothing to add here other than I get it for cheap at $735k. :)

Loan mods, robo-signing, bulk sales, and other programs have helped reduce supply, but those programs alone don't explain why the difference from a year ago is so dramatic.

Social mood has quietly shifted. It's herd mentality, not economics.

http://bayarearealestatetrends.com/2012/08/27/why-is-housing-inventory-low/

#housing