patrick.net

An Antidote to Corporate Media

1,261,439 comments by 15,062 users - Al_Sharpton_for_President, FarmersWon online now

John Williams of Shadowstats.com Interview: The Next Crash Will Be A Lot Worse!

2013 Jan 28, 7:31am 69,987 views 174 comments

« First « Previous Comments 96 - 135 of 174 Next » Last » Search these comments

HousinBoom is sitting. He is waiting, on the assumption that the collapse is very, very near. And if it does not happen soon, he may be willing to wait it out for a lifetime

Then stop putting words in my mouth. Just because you have no valid argument, you shouldn't twist other people's words. I never said "I am willing to it out for a lifetime"

I said "may" because you seem unwilling or perhaps unable to pick a time upon which you will reconsider your thesis.

Lets try this a different way. Assume its now the year 2063 - the fed is still printing like mad, and the stagnation continues, with no calamity having taken place - at what point in that 50 year time continuum will you have purchased?

Lets try this a different way. Assume its now the year 2063 - the fed is still printing like mad, and the stagnation continues, with no calamity having taken place - at what point in that 50 year time continuum will you have purchased?

This proves my point. Crack for brains think we can print trillions out of thin air for the next 50 years. lol. I'm done. you know what they say, never argue with an idiot, they'll bring you down to their level then beat you with experience.

I'm willing to bet anybody 5 ounces of gold that there will be no economic collapse in the next 2 years. 20 for 5.

"I don't understand economics so I'm scared by arbitrary statistics" is a weird way to live your life.

Crack for brains think we can print trillions out of thin air for the next 50

years.

It is frustrating but Japan has been doing it for 20+ years..........

This proves my point. Crack for brains think we can print trillions out of thin

air for the next 50 years.

Out of curiosity, what have they have been doing for the last 200 years? If they have done it for 200, why can they not do it for another 50?

Crack for brains think we can print trillions out of thin air for the next 50

years.

It is frustrating but Japan has been doing it for 20+ years..........

There is a good possibility that we will be like Japan but we can already see inflationary forces right now in food and other commodities.

It does not look like the Federal Reserve (established December 23, 1913) helped with smoothing out the business cycle; quite the contrary. I also noticed that our economy booms with war.

Are you looking at the same chart as I am? Certainly, the Federal Reserve didn't instantaneously change things, but clearly the business cycle has been smoother after WWII. To what do you attribute that change?

OK--Here is a chart showing US GDP since the early 1800s. You tell me--does it look like there were more boom/bust cycles before 1970 or after 1970?

It does not look like the Federal Reserve (established December 23, 1913) helped with smoothing out the business cycle; quite the contrary. I also noticed that our economy booms with war.

That is graphing business cycles it is not even showing the 2008 crash, HAHA

Yup, that's a possibility. The fact that central banks are trying to hoard as

much gold as possible tells me that they are losing faith in the system. The

system does not have to fail for home prices to fall another 20%+. That is all I

am expecting at best.

I fully expect you see your 20% - however, as has been the case for the last 3 years, I fully expect you see it in the form of nominal stagnation while inflation slowly works its magic and the remaining slack in the system is removed. You have very little upside risk in waiting IMO.

If the crash happens those with property and precious metals will be ok, not

great, ok. Those in paper (401k, stocks, bonds, etc.) are screwed.

If the crash happens all asset prices will get crushed. Cash is king when credit is collapsing.

That is graphing business cycles it is not even showing the 2008 crash, HAHA

Did you look at the x-axis? The chart is a little dated, I'll grant, but it clearly shows underwater was very, very wrong.

If the crash happens those with property and precious metals will be ok, not

great, ok. Those in paper (401k, stocks, bonds, etc.) are screwed.

If the crash happens all asset prices will get crushed. Cash is king when credit is collapsing.

It's going to be a crash but we don't know if it's a deflationary one (stock market collapse) or inflationary (bond market and/or dollar collapse). The job market is the biggest factor for home prices. All I know is that the job market will be in a world of hurt when this occurs. This will not be a soft landing like most bulls are predicting. The longer it doesn't happen, the bigger the bubble and the bigger the collapse will be

Wages are falling so any price increase is not sustainable IMO

http://news.yahoo.com/personal-income-posts-biggest-gain-eight-years-133706758--business.html

That is from early dividend payouts for tax purposes. It will not continue.

That is from early dividend payouts for tax purposes. It will not continue.

Maybe, maybe not. But to say that incomes are falling is not right.

Maybe, maybe not. But to say that incomes are falling is not right.

That payroll tax just killed any hopes of an increase in wages. lol

Maybe, maybe not. But to say that incomes are falling is not right.

Sorry on that point you are incorrect.

That payroll tax just killed any hopes of an increase in wages. lol

You got that right!

Sorry on that point you are incorrect.

I didn't know your timeframe was a decade. I figured you were referring to present time

54k down to 50K sounds about right for the crisis

I was only linking to show the income drop I did not read his crappy blog :D

I didn't know your timeframe was a decade. I figured you were referring to

present time

Oh yes more long term, short term gains are too volatile. And that is the average which is dragged higher by the high end. A better statisic would be median incomes which are hopelessly low, 26k is the median single wage in the US, DOH!

This will not be a soft landing like most bulls are predicting.

While written today - this could have just have easily been written 3 years ago.

For the last 3 years, despite you continuing to call for a "collapse", it has been the soft landing as each crisis turns into nothingburger after nothingburger. So again, is there any point in the next 0-50 where you decide to re-evaluate your conclusion? Is there any point in the next 0-50 years when you say, "gee, I guess there is not going to be a second collapse after all"?

And if not a date, how bout an event? If the DJIA hits say XYZ then you will change your tune. Or perhaps if unemployment hits ABC then you will reconsider...

BTW - if the answer for you is "I dont know" so be it. It just seems to me that anyone this "certain" of something, despite the some or even any evidence to the contrary, is setting themselves up for a lifetime of disappointment.

For the last 3 years, despite you continuing to call for a "collapse", it has

been the soft landing as each crisis turns into nothingburger after

nothingburger. So again, is there any point in the next 0-50 where you decide to

re-evaluate your conclusion? Is there any point in the next 0-50 years when you

say, "gee, I guess there is not going to be a second collapse after all"?

I guess I would ask why do you believe that 2008 cannot be repeated? What has changed to stop that from happening? Nothing. Do you think that the Fed can bailout everything if everyone decides to sell? When will you get concerned with the Fed balance sheet 5 Trillion, 10 Trillion, 50 Trillion?

I guess I would ask why do you believe that 2008 cannot be repeated?

Because he's a mental midget!

I guess I would ask why do you believe that 2008 cannot be repeated? What has changed to stop that from happening? Nothing. Do you think that the Fed can bailout everything if everyone decides to sell? When will you get concerned with the Fed balance sheet 5 Trillion, 10 Trillion, 50 Trillion?

Lots of reasons why 2008 can't be repeated anytime soon:

Home prices are not overpriced anymore. They are under priced.

Recent home purchases are not leveraged with zero downs. Many were all cash.

Interest rates are a lot lower.

Economy is not sinking anymore, but making a slow come back.

The worst is over, the future is bright.

Home prices are not overpriced anymore.

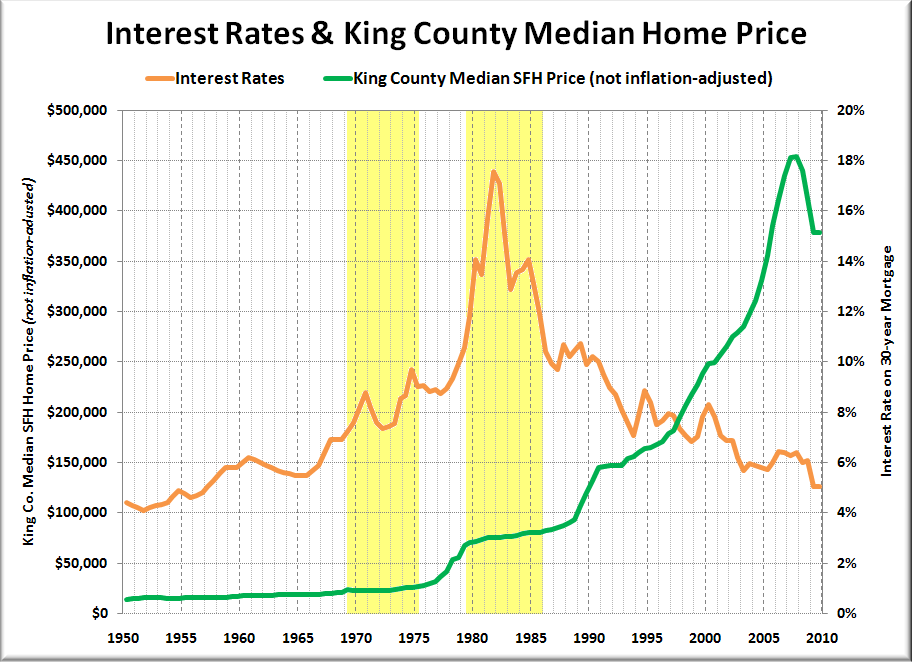

So says those that own, those that rent believe the opposite, some of those that own (me) still believe the opposite. Home prices are being supported by low interest rates. What happens if rates rise?

Lots of reasons why 2008 can't be repeated anytime soon:

You saying it can't be repeated shows your ignorance. Lehman, Bear, Wachovia, WAMU, Countrywide, Merril, have been absorbed by the remaining big 5 banks. They are now much bigger than before the last crisis when Lehman ALONE destroyed the credit markets. You keep smoking that it can't happen again crack pipe.

Home prices are not overpriced anymore.

So says those that own, those that rent believe the opposite, some of those that own (me) still believe the opposite. Home prices are being supported by low interest rates. What happens if rates rise?

If rates rise, that means unemployment will certainly have fallen and incomes will be up. So house prices will probably be rising as well.

If rates rise, that means unemployment will certainly have fallen and incomes

will be up. So house prices will probably be rising as well.

The last housing bubble was caused by what? Artificially low payments with crazy subprime loans. Interest only, pick a pay, you name it. Rising rates do not lead to higher home prices.

For the last 3 years, despite you continuing to call for a "collapse", it has

been the soft landing as each crisis turns into nothingburger after

nothingburger. So again, is there any point in the next 0-50 where you decide to

re-evaluate your conclusion? Is there any point in the next 0-50 years when you

say, "gee, I guess there is not going to be a second collapse after all"?

I guess I would ask why do you believe that 2008 cannot be repeated?

No absolutely, it can be repeated. I continue to look for risk pricing in the bond market, or in the a1/p2. As they both sit there, while we print with wild abandon, I dont think twice about it. If they start to rise, like we saw in 2007 - absolutely I will be changing my tune - and fast.

Yup1 says..."Do you think that the Fed can bailout everything if everyone decides to sell? When will you get concerned with the Fed balance sheet 5 Trillion, 10 Trillion, 50 Trillion?"

Yes. Unequivocably. Again, I am operating on the assumption that they realize how serious this is - and if push comes to shove, they would much rather risk a global conflict with our creditors than they would see rioting, tanks in the streets, and the risk they could be dragged thru the streets, mogadishu style.

And therein lies the risk with changing course. There is so so so much debt out there - if called simultaneously, like we almost had in 2008, some very very very powerful players on the worlds stage will be very very screwed. And everyone knows this. Hence, no one is willing to pull the trigger - instead they wail, and shout, and then readily gobble down more of our debt.

So in that regard, honestly, there is no notational limit that we cannot exceed. Its kinda like the 500 billion dollar bill (zimbabwe dollars) I got as a gift. The guy got it for $4USD on ebay. Mugabe would rather destroy his country's ability to be a member of the worlds stage than risk dying at the hands of his countrymen. When push comes to shove, I am pretty sure which way our PTB will decide too.

Rising rates do not lead to higher home prices.

Of course not. It's not cause and effect. But rates also don't rise and fall randomly. They rise when there is an expectation of inflation and fall when there is an expectation of deflation.

So, if you are saying that rates are rising, that means there is an expectation of inflation, which implies higher incomes and lower unemployment.

Its kinda like the 500 billion dollar bill (zimbabwe dollars) I got as a gift.

The guy got it for $4USD on ebay.

Dude whoever bought that got robbed my buddy got me a 100 Trillion dollar one for 4 bucks, ROFLMFAO!

Hence, no one is willing to pull the trigger - instead they wail, and shout,

and then readily gobble down more of our debt.

So in that regard, honestly, there is no notational limit that we cannot

exceed.

At some point mathematics takes over and the amounts of debt cannot even be serviced, then what? If you are just printing money to make fake reserves you are doing nothing. If that money does not get into the real economy the increased debts will eventually default. I guess you could go with a 0 interest rate, all of that money is fake anyway.

I guess that is the point, do we all not understand at this point that it is all fake. A large group of people being "poor" while an individual person is "rich" when ALL of the credit money ever created is fake is pretty rediculous.

If the population in general ever comes to truely understand the nature of credit money, no one will ever pay back another debt again, EVER!

But rates also don't rise and fall randomly. They rise when there is an

expectation of inflation and fall when there is an expectation of deflation.

That is what they used to mean, I agree. If you think that is what rates mean in todays ZIRP environment I believe you are wrong.

Of course not. It's not cause and effect. But rates also don't rise and fall

randomly. They rise when there is an expectation of inflation and fall when

there is an expectation of deflation.

So, if you are saying that rates are rising, that means there is an

expectation of inflation, which implies higher incomes and lower

unemployment.

Bill Gross from PIMCO said in 2010 that without Uncle Sam backing mortgages rates would climb by 3 to 4 %. I wonder what home prices would be with 7-9% mortgages?

You guys understand that Zimbabwe was never a stable global superpower with reserve currency status right?

Dude whoever bought that got robbed my buddy got me a 100 Trillion dollar one

for 4 bucks, ROFLMFAO!

LOL - I stand corrected it was actually a 500 trillion note. Is yours the one with the 2010 redemption date?

I guess that is the point, do we all not understand at this point that it is all

fake.

Yeah , pretty much. If there was any doubt, the world realizes it is all a big ponzi scheme right now. But like all ponzis, once you recognze its a ponzi and all of you will lose, it behooves you to pawn it off on someone else - in this case the next generation (who will then have their own 2008 minute whereupon [unless someone calls their bluff] they will pawn that ponzi on to the next generation.

A large group of people being "poor" while an individual person is "rich" when

ALL of the credit money ever created is fake is pretty rediculous.

At the end of the day, money is just a representation of resources, (be them natural, political, or otherwise). In 2008, the worlds pool of bullshit was drained, and we were all exposed as swimming naked. Still, we, here in the US were still recognized as being the biggest, strongest, pack of grenades across its chest... So when we said "why dont we re-fill this pool, and lets all pretend it didnt happen" everyone else, recognized how powerless they were they nodded in agreement.

It wont always be this way. Eventually China or someone else will be big enough to call the shots. Im just not so sure that is going to happen while I happen to be on this planet.

Rising rates do not lead to higher home prices.

Real or nominal? In nominal terms, the record is not as clear as you think it is.

I dont have a graph for the US, but I do have tabular data, if you want to confirm it for the whole US. Either way, Im sure the people back in the 80s who decided to wait as interest rates hit 14-15-16 percent, watched in horror as nominal prices continued to slowly lurch upward.

I wonder what home prices would be with 7-9% mortgages?

The market would collapse. Removing govt supporting 90% of all new mortgages underwriting or increasing interest rates or dumping shadow inventory at once will dramatically impact the housing market to the downside. We saw how quickly it dried up once the home buyer credit expired. It needs govt support to survive at all.

Yup! Watch the bond market. It's in the largest bubble in over 200 years and WILL burst because ALL economic bubbles bursts. The sheep won't know what hit them. Bonds have an inverse relationship with rates so you know what that means

Contrarian conjecture aside -- you're right, YUP1.

There will be no middle class income growth in America in the next decade. (Why would there be?)

Home prices are not overpriced anymore.

So says those that own, those that rent believe the opposite, some of those that own (me) still believe the opposite. Home prices are being supported by low interest rates. What happens if rates rise?

If rates rise, that means unemployment will certainly have fallen and incomes will be up. So house prices will probably be rising as well.

« First « Previous Comments 96 - 135 of 174 Next » Last » Search these comments

http://www.youtube.com/embed/seBWlOMt2Tk