patrick.net

An Antidote to Corporate Media

1,363,640 comments by 15,738 users - MolotovCocktail, ohomen171, PeopleUnited online now

Banned Ted Talk: Tax breaks for the rich increases unemployment

2013 Jul 27, 2:48pm 7,011 views 40 comments

Comments 1 - 40 of 40 Search these comments

Seattle entrepreneur Nick Hanauer

Paris Hilton is more of entrpreneur than Hanaur..

I mean really he hasnt dont much except inherit wealth from his father who created a furniture company. Lucky for him he sold his other business at highly inflated prices.

http://en.wikipedia.org/wiki/Nick_Hanauer

http://en.wikipedia.org/wiki/Pacific_Coast_Feather_Company

Owned by the Hanauer family since 1924, Nick Hanauer (fourth generation) is now chairman and CEO of the company.[

Nick Hanaur is truly a idiot not to understand what

happened when tax cuts were given in early 80s

which allowed higher demand for durable goods

(equipment and technology goods) as companies

were modernizing their operations.. Hello Tech Boom.

As such more people were hired, engineers, sales/marketing,

accounting and manufacturing. Heck in SV alone we

had 3 shifts in manufacturing.. we were a 24/7 day shop.

Is there anything the so called Progressives can point to

where tax hikes had similar impact ... NADA....

This guy is a complete moron. The creation of sustainable jobs is driven by after-tax profit opportunity. Taxing people to create jobs was exemplified by hiring one work gang to dig a ditch and another work gang to fill it back up in the old days; nowadays, the government tax-and-spend is simplified to just handing the tax money to cronies. Perhaps That's what Nick Hanaur wants: more hand out from the government for his nonsense talks. No wonder wealth disparity has been increasing.

Prosperity is driven by the labor of ones capital/stored labor. If you spend all your money on crap it doesn't matter how much your labor earns..It's vital to the middle class that it saves and invests, and it's foolish for government to build policy around fucked up behavior as if people couldn't ever act responsibly with their money on their own.

Agreed.

This speaker is a tard.

I'm surprised TED banned the video as he is as progressive as they are.

The old argument of demand already exists or is it created, which is self evident i.e. was the public clambering for the internet before Al Bore invented it?

He even rolls out the household meme.

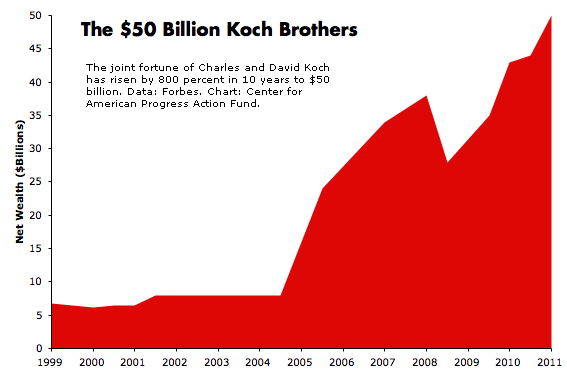

So, maybe conservatives will for once consider, that the "Librul media" is nothing of the sort. If it were, this segment would have run. In fact, PBS and all the "leftist" media outlets, are far more beholden to the Koch Brothers and Big Money, than we think.

It's you who needs to wake the fuck up!

You sure put me in my place, is that all you have to say, are you really that fucking stupid?

Consumer freedom of choice ensures entreprenuers with efficient processes win over cronies. The job creators however are the entreprenuers who can come up with new businesses processes that are more efficient and deliver better value than existing businesses.

The job creators however are the entreprenuers who can come up with new

businesses processes that are more efficient and deliver better value than

existing businesses.

In China.

Consumer freedom of choice ensures entreprenuers with efficient processes win over cronies. The job creators however are the entreprenuers who can come up with new businesses processes that are more efficient and deliver better value than existing businesses.

Say's Law. Yes, yes, we know governement intervention encourages malinvestment and leads to recessions and depressions.

We don't have any modern real world examples of this, of course, because there are no completely free market economies. Personally I would assume lower unemployment in countries of lower government intervention, but that would be using inductive or abductive reasoning instead of deductive logic.

Control of Capital in a free market is not a barrier to entry so using government regulation to limit the power of concentrated capital is counterproductive.

The job creators however are the entreprenuers who can come up with new

businesses processes that are more efficient and deliver better value than

existing businesses.

In China.

Doesn't have to be. The cheaper goods from imports should be enablers of new businesses that use them, all else being equal. The problem we have here is taxation and regulatory uncertainties prevent new businesses from emerging, on top of debt burden that has already taken up the entire benefit of some types of capital investment (such as education)

We don't have any modern real world examples of this, of course, because there are no completely free market economies. Personally I would assume lower unemployment in countries of lower government intervention, but that would be using inductive or abductive reasoning instead of deductive logic.

The lack of completely free market does not prevent individuals making decisions in relatively freer market conditions. It's just like, there is no 100% perfect sex partner, but it doesn't prevent you from acting differently to different members of the gender(s) of your desire. Some will induce you to work harder to win her/his heart, some will make you shut off entirely; many are in between.

Control of Capital in a free market is not a barrier to entry so using government regulation to limit the power of concentrated capital is counterproductive.

Government regulations are not abstractions enforced by God, but by real vulnerable human beings called regulators. They are far more likely to be captured by existing concentrations of capital than a sea of consumers spending their own money are susceptible to such capture.

They are far more likely to be captured by existing concentrations of capital

That's why we have progressive tax rates...to prevent excessive concentrations of capital.

They are far more likely to be captured by existing concentrations of capital

That's why we have progressive tax rates...to prevent excessive concentrations of capital.

Is this a joke? The top bracket cut off line is about $400k. The ones rich enough to buy regulators are making an order of magnitude more than that! and paying effective tax rates much lower than the top bracket. It's like banning/taxing people cooking in kitchens because there have been fires in town due to arsonists.

The ones who can compete and whittle away wealth and power concentrated in the hands of people making $4M+ a year are not the $40k a year workers, but the $200k-1M smaller business operators offering the $40k worker alternative employment opportunities.

Is this a joke? The top bracket cut off line is about $400k. The ones rich enough to buy regulators are making an order of magnitude more than that! and paying effective tax rates much lower than the top bracket. It's like banning/taxing people cooking in kitchens because there have been fires in town due to arsonists.

The ones who can compete and whittle away wealth and power concentrated in the hands of people making $4M+ a year are not the $40k a year workers, but the $200k-1M smaller business operators offering the $40k worker alternative employment opportunities.

Agreed. And this is actually the hardest segment to operate in with regards to taxes, I'd say it even starts around the mid 100Ks to get harder to eek out net capital formation against the tax man and other regulations wasting one's time. This is then being sold to the plebes as "the rich" paying their fair share ;)

Is this a joke? The top bracket cut off line is about $400k. The ones rich

enough to buy regulators are making an order of magnitude more than that! and

paying effective tax rates much lower than the top bracket.

Ok, so we *do not* really have progressive tax rates.

We should.

We should have progressive tax rates on dividend income and capital gains so

the truly super rich who will never suffer in any absolute sense will pay more

while those in the this mid range can begin to accumulate capital and use it to

start businesses and create jobs.

Agree.

Is this a joke? The top bracket cut off line is about $400k. The ones rich

enough to buy regulators are making an order of magnitude more than that! and

paying effective tax rates much lower than the top bracket.

Ok, so we *do not* really have progressive tax rates.

We should.

Tax laws are man-made laws. Lawmakers are susceptible to capture. That's why "progressive tax" almost always penalize the the 2nd-tier 3rd-tier 4th-tier capital owners who are the very people who would otherwise offer alternatives that the masses under a monopolized system do not have. It is a system designed to win votes for the sloganeering orchestrated by the super-rich and raise more taxes so those in control of the government can spend it and entrench their monopoly even further.

Tax laws are man-made laws. Lawmakers are susceptible to capture. That's why

"progressive tax" almost always penalize the the 2nd-tier 3rd-tier 4th-tier

capital owners who are the very people who would otherwise offer alternatives

that the masses under a monopolized system do not have. It is a system designed

to win votes for the sloganeering orchestrated by the super-rich and raise more

taxes so those in control of the government can spend it and entrench their

monopoly even further.

Ok, so how do we fix this problem?

I'm not trying to "win an argument" here. I really do want problems to be solved.

We should have progressive tax rates on dividend income and capital gains so the truly super rich who will never suffer in any absolute sense will pay more while those in the this mid range can begin to accumulate capital and use it to start businesses and create jobs.

You are assuming that the dividends will always pay out and the stock that back them never loses value. In a dynamic free market you cannot just sit back and watch your investments grow, in fact in 2008 the picture would have changed dramatically but the Fed and the government did not let that happen. A low flat tax on income and capital gains makes most sense. You can exclude lower incomes up to a certain point from both taxes. If the tax percentage is low enough and not progressive there will be enough incentive to work hard and prosper and the middle class & small business wouldn't get crushed. Also capital gains tax is problematic in the sense that it is double taxation as a stock price/dividend usually reflects a forward/future expected income stream which is then taxed again (corp. taxes) when it actually happens after you have been taxed selling your stock for a gain or getting a dividend.

Ok, so how do we fix this problem?

I'm not trying to "win an argument" here. I really do want problems to be solved.

As a start:

- Do not interfere with the markets (bailouts, money printing & first-in-line access)

- Remove any special interest regulations from the tax code

- Prosecute fraud

Do not interfere with the markets (bailouts, money printing & first-in-line access)

I'm perfectly happy to let the markets punish its participants. We'd have much sharper crashes and much sharper recoveries.....in theory. I'm unsure if cumulatively over decades it would reverse wealth disparity. I suspect it will never be tested.

Yeah. Regarding the progressive tax system and the way inflation is fudged here, after getting promoted I found myself first earning net very close to the same amount and when the reversal of the SS tax cuts and the brutal health-care inflation (rates increased by > 20%, of course not counted by the CPI) kicked in this year I started netting significantly less ;)

Ok, so how do we fix this problem?

I'm not trying to "win an argument" here. I really do want problems to be solved.

What is the problem? That some people control more resources than others at any given time? or fixed immutable caste system? The former is just the flip side of the same coin called "upward mobility." The latter is aristocracy.

I'm perfectly happy to let the markets punish its participants. We'd have much sharper crashes and much sharper recoveries.....in theory. I'm unsure if cumulatively over decades it would reverse wealth disparity. I suspect it will never be tested.

"Reverse" is the precise word. The market place is a lot better at "trading places" (reference to the 80's movie) than the government instigated "leveling" can accomplish. Government "leveling" produces a privileged caste.

I'm unsure if cumulatively over decades it would reverse wealth disparity

Over several boom-bust cycles the problem would only magnify.

Real wealth in this country, would use every downturn to snap up even more of the pie. Poorer classes don't have the margin for strategic buys during a downturn, someone with oceans of cash who has less, still does.

Loose the income disparity meme it is a straw man.

There will ALWAYS be income disparity, it does not matter.

What matters is the standard of living. In this country the poor have air conditioning, enough to eat, cell phones, free "education" etc etc, where else in the world does this exist?

I'm unsure if cumulatively over decades it would reverse wealth disparity

Over several boom-bust cycles the problem would only magnify.

Real wealth in this country, would use every downturn to snap up even more of the pie. Poorer classes don't have the margin for strategic buys during a downturn, someone with oceans of cash who has less, still does.

There is nothing to snap up from the poor. And there are constantly acquisitions and mergers, often more so in boom times. The only major distortion is the Fed printing all the money and giving it to crony capitalists/politicians and their lobbying sectors.

What is the problem?

The problem you spelled out in your post. Look at the quote.

You snipped the more in-detail exploration of "the problem":

That some people control more resources than others at any given time? or fixed immutable caste system? The former is just the flip side of the same coin called "upward mobility." The latter is aristocracy.

Real wealth in this country, would use every downturn to snap up even more of the pie. Poorer classes don't have the margin for strategic buys during a downturn, someone with oceans of cash who has less, still does.

You have it exactly backwards. The wealthy are far more leveraged than the middle class and the poor. The poor can't even get credit to leverage. The middle class can leverage perhaps 2:1 on equity margin accounts, and 5:1 on real estate. It's the banksters that can leverage 50:1 even 500:1. That's why the government and central bank have to step in to use the equities of and promises from future taxpayments from the middle class and output of the poor to bail out the super-rich. That's how the super-rich stay rich in a fiat-money system: massive leverage without risk to themselves.

Real wealth in this country, would use every downturn to snap up even more of the pie. Poorer classes don't have the margin for strategic buys during a downturn, someone with oceans of cash who has less, still does.

You have it exactly backwards. The wealthy are far more leveraged than the middle class and the poor. The poor can't even get credit to leverage. The middle class can leverage perhaps 2:1 on equity margin accounts, and 5:1 on real estate. It's the banksters that can leverage 50:1 even 500:1. That's why the government and central bank have to step in to use the equities and promises of future taxpayments from the middle class and output of the poor to bail out the super-rich. That's how the super-rich stay rich in a fiat-money system: massive leverage without risk to themselves.

Exactly. In 2008 some very big companies and individual investors would have gone belly-up, but instead of letting it sort out they gave the TBTFs unlimited backstop so that they not only survived but also were the only ones with enough money to snap up all the other failing businesses of relevant size, making them TBTFer.

It's the banksters that can leverage 50:1 even 500:1. That's why the government

and central bank have to step in to use the equities of and promises from future

taxpayments from the middle class and output of the poor to bail out the

super-rich. That's how the super-rich stay rich in a fiat-money system: massive

leverage without risk to themselves.

Agree with you there. +1

But then again, what about massive deflation? That's usually not a good thing. Or at least that's what we're told.

The middle class can leverage perhaps 2:1 on equity margin accounts, and 5:1 on real estate. It's the banksters that can leverage 50:1 even 500:1.

Oh really?

Then how did this happen?

From here:http://sourcewatch.org/index.php/Koch_Brothers

Quite a few non-FIRE Richie Rich types, only got richer during the downturn.

Agree with you there. +1

But then again, what about massive deflation? That's usually not a good thing. Or at least that's what we're told.

Short deflation is not a bad thing: that's how bad debts are written off, and how new businesses can be put together cheaply by buying assets from liquidating old businesses.

Central bank intervention tends to produce stagflation.

Oh really?

Then how did this happen?

Do you not see the massive drop during the market tanking?

The massive growth of Koch brothers' fortune is due to them hitting the jackpot with natural gas and oil in the last few years. It is the booming industry. Koch Industries being a privately held company (not publicly traded stock holding company), some of the accounting values attributed to them can also be fishy.

Do you have problem with some people getting rich producing things that people want?

That's how the super-rich stay rich in a fiat-money system: massive leverage without risk to themselves.

Dare I intuit that you suggest there is some modicum of regulation needed? Hannibal Lector doesn't care how he acquires the ingredients to his "delightful amuse bouche."

The fiat money regulation is what they use to insulate themselves from the statistical tail risk. No fiat money regulation, no bailouts, and the statistical tail risk would take care of getting rid of those reckless gamblers very quickly.

Consumer freedom of choice ensures entreprenuers with efficient processes win over cronies. The job creators however are the entreprenuers who can come up with new businesses processes that are more efficient and deliver better value than existing businesses.

Say's Law. Yes, yes, we know governement intervention encourages malinvestment and leads to recessions and depressions.

We don't have any modern real world examples of this, of course, because there are no completely free market economies. Personally I would assume lower unemployment in countries of lower government intervention, but that would be using inductive or abductive reasoning instead of deductive logic.

Control of Capital in a free market is not a barrier to entry so using government regulation to limit the power of concentrated capital is counterproductive.

Really, you don't have any examples of government causing price distortions leading to malinvestment? Have you seen what all the ridiculous subsidies to the corn farmers have resulted in with this country?

Comments 1 - 40 of 40 Search these comments

Business Insider Article

http://www.N1b_Q1lprAk

http://www.bBx2Y5HhplI