patrick.net

An Antidote to Corporate Media

1,363,428 comments by 15,736 users - 6DOF, desertguy, FuckTheMainstreamMedia, RC2006, Tenpoundbass online now

Comments 1 - 29 of 58 Next » Last » Search these comments

That's just fucking great (um, maybe non-fucking great as the case may be).

https://research.stlouisfed.org/fred2/series/LFWA24TTJPQ647N

is pretty stunning, actually.

But there's still a lot of underemployment in Japan so I don't see the depopulation problem, really.

Real estate is still sky-high in Tokyo, where all the jobs are.

Japan doesn't have half the elderly support problem we do. Their "ranks of aged" are mostly (90%?) arrived by now, while we're going to rise from 50M medicare beneficiaries to 80M+ by 2030.

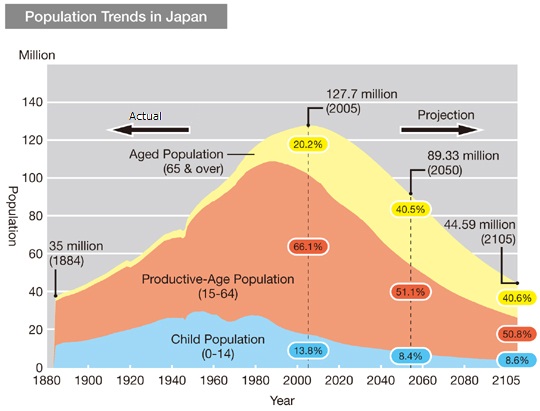

shows the yellow (old people) in this graph isn't going to increase much in absolute terms going forward.

But economically, the fall-off of young does introduce immense deflation. Less demand for teachers, clothing, furniture, cars, etc. It's really quite something; for Japan Inc to survive it must convert this lost domestic demand into exports somehow.

As for their crippling debt, it's also the baby boom's savings. They gave themselves tax cuts and called it savings, 1997-now. Not sure how they're going to square that circle . . .

I'm 80% sure I'm moving back to Japan this decade, so this interests me, LOL.

U.S., which have demonstrated successfully that welcoming people from a variety of nations, who may think differently and have different cultures

That's not exactly true. It's many ppl but assimilated under one culture.

That's the model which has worked because as you said, ppl think differently and bring in new ideas, whether it's in commerce or in education.

Japan doesn't have half the elderly support problem we do. Their "ranks of aged" are mostly (90%?) arrived by now,

As for their crippling debt, it's also the baby boom's savings. They gave themselves tax cuts and called it savings,

There are 2 things I would say about their 'elderly support':

- Inversely the boomers savings are invested in their debts. Pensions holding gov bonds. Which means when they default (through printing or otherwise) these savings will look like smaller, maybe a lot smaller.

- You can also look at it this way: saved money is a claim against the production of the working population: since it is money competing with wages for the produced resources. This implies that whatever happens to the debt and currency, they will in fact be a lot poorer in retirements, and the younger generations will also be a lot poorer as they will be taxed through the nose to support the huge debt and indirectly pay the elderly.

I'm 80% sure I'm moving back to Japan this decade, so this interests me

Personally I would avoid that at all cost. Lots of work, low entertainment, overcrowding (still), general lack of economic opportunities, possible war, radioactive leaks, etc...

Lets take in all the talent and brains from all over the world. I dont care who pays into the retirement system.

Lots of work, low entertainment, overcrowding (still), general lack of economic opportunities, possible war, radioactive leaks

There's a lot of nature available from Tokyo, even more if I were to locate myself more in the interior (or should I say periphery, the most interior point of Honshu is only 90 minutes from the coast).

Satellite internet and good waterfalls to hike to is all I need for entertainment, LOL.

Tokyo is quite "overcrowded", but the periphery is beginning to empty out now, and this will accelerate. Might even be possible to pick up livable real estate for free, that's what a pal did in the 1990s, up in the mountains.

Japan is still the #3 economy and is by far the richest nation on the planet, approaching $3T in NIIP:

There's not going to be a war with China. There might be some hurt feelings, but Japan will get over it.

The situation at Fukushima-I totally sucks, but the leaking will only affect the littoral aquaculture of NE Japan, and I wasn't a big fan of that alleged cuisine to begin with.

The coming 2020 Olympics bring in an interesting new change dynamic. A little shot in the arm for internationalism in Japan, something they could always use.

For sure demographics have a lot to do with it. But the real problem is Abenomics and not allowing the market to clear.

the real problem is Abenomics and not allowing the market to clear.

By "allowing the market to clear", you mean "defaulting on the debt?

That means defaulting on a bunch of pensions: People who will not have an opportunity to make it back.

That means defaulting on a bunch of pensions: People who will not have an opportunity to make it back

Yes, refer to Argentina. Someone posted a thread here the other day about 85% of pension funds will fail in the US.

You can also look at it this way: saved money is a claim against the production of the working population: since it is money competing with wages for the produced resources.

Of course, their boomer savings are basically deferred taxation since it's all (~80%) held in JGBs.

Quite a trap they've laid for themselves.

They deleveraged privately and put the load on government instead.

shows they were at peak debt in the late 1990s.

Quite frankly, taxes have to double there probably, tax-to-GDP take is pretty low, almost as low as us, and half that of the eurosocialists running tighter fiscal ships, like Denmark.

the younger generations will also be a lot poorer as they will be taxed through the nose to support the huge debt and indirectly pay the elderly

thing is, every penny the young pay to the seniors will come back to them. The only way pensions are wealth-destroying is if Japan has to import goods to meet them. This is not the case.

Same story for the US to some extent. If our boomers all buy RVs and cruise America burning diesel 24/7, we'll be totally f-ed, but otherwise the trillions going out to them will be redistributionary to a great extent -- more health jobs, more restaurant jobs, more tourist sector jobs.

But mostly more health jobs I'd guess.

Japan's declining population does mean increased food security, the opposite story of what we're facing this century, where our population in 2050 will be 30% higher than now (Japan's will be down ~25%).

I'd guess no need for new infrastructural investment for growth reasons. This is deflationary, killing these jobs, but this century I think we need to move past the quasi-Keysenian concern of jobs for jobs sake, all that pump-priming crap, and just focus on the long term picture and what it takes to get there from here.

We need to see where we want to be in 2050 and plan what needs to be done by 2040, 2030, and 2020. Capitalism is total crap at this long-term planning.

As is democratic government, since the current election cycle is more critical than what's going to happen in 2050.

thing is, every penny the young pay to the seniors will come back to them.

I don't quite agree with that. Yes, you can see it as end demand, and this may mean jobs. But at the end of the day a good chunk of what is produced will go to older folks, which mean the working population will keep a lesser amount than what their parents did.

And the crazy thing is if Japan raises taxes a lot, their sky-high real estate valuations will crash again.

Land in Japan is still hella expensive. Rural parcels with minimal services that get subdivided sell at $1M/acre, since the buildable lot size is so small (100 m2 is common) and nobody bats an eye at paying $50,000 for a lot, since it's only $80/mo in interest burden, thanks to ZIRP.

the real problem is Abenomics

Abenomics is certainly a risky path. The entire debt markets can implode suddenly and with little warning.

But at the end of the day a good chunk of what is produced will go to older folks

production is not a zero-sum game when people are underemployed.

What Japan needs is people getting paid doing productive work. Japan has to limit production of rice since they're in oversupply of that.

http://oryza.com/news/rice-news/japan-my2014-15-rice-production-forecast-decline-766-million-tons

They could make millions more cars than they are.

And what do Japanese seniors consume, anyway? Rice, fish, vegetables, water, air, TV reception.

And health care.

The entire debt markets can implode suddenly and with little warning.

Not in fiat currency regimes. Japan is not dependent on foreigners buying their bonds. They'd prefer they don't, actually.

Abenomics is certainly a risky path. The entire debt markets can implode suddenly and with little warning.

No "can" about it, it will, just like Argentina.

http://finance.yahoo.com/q/bc?s=%5EN225+Basic+Chart&t=5y

Abe is a bad, bad man, LOL

It's abundantly clear that the populations grown during the 19th and 20th centuries are pathologically high.

Even a shrinking industrial state like Japan is still egregiously overcrowded.

Things can only get better with steep declines.

just like Argentina

this is a fundamental non-understanding of macro economics.

Japan essentially won the 20th century with their industrial dominance and weak currency giving them immense competitiveness.

Toyota. Honda. Sony. Yamaha. Toshiba. NEC. I could list world-class industrial powerhouses all day.

What the fuck has Argentina produced in comparison?

Granted, the world is a different place for Japan now than it was in 1980, or 1990 even. China has risen and largely drank their milkshake. As have the ROK chaebols.

Still, if and when they get their nuke fleet back on line Japan will be able to pay its way in the world.

Shows Argentina is walking a much tougher line.

http://research.stlouisfed.org/fred2/series/NYGDPPCAPKDARG

is Argentina's per-capita GDP, roughly 1/10th that of Japan.

http://en.wikipedia.org/wiki/Foreign_trade_of_Argentina#Merchandise_exports_and_imports

shows they have a 18th century economy still, they export food and PMs, import manufactures.

The entire debt markets can implode suddenly and with little warning.

Not in fiat currency regimes. Japan is not dependent on foreigners buying their bonds. They'd prefer they don't, actually.

Well... all the CB can do is buy bonds with printed money. yes they can keep gov bonds low.

But if people don't have confidence that they will be paid back in money as valuable as they put in, they can still sell. If there are no other better investment in Japan, they will look overseas. This is called a capital flight. The Yen could crash. Rates for smaller companies would go through the roof. This can't be helped easily by the central bank.

Also when you say they don't depend on foreign buyers, you imply 2 things:

1 - Japanese don't care about losing money by investing in a losing proposition. I don't think that's true.

2 - They will keep a current account surplus. But printing yens encourages debt increase in Japan, and therefore tends to deteriorate the account balance. Plus as retirees numbers increase, they will necessarily dis-save more. We will see Abe tax consumption precisely because it's a way to tax foreign goods indirectly (while giving tax cuts to Japanese companies) and preserve the account balance. But I doubt this will be enough.

Abenomics may just be coming too late to save Japan.

Believe it or not I'd like to build a ~20-unit apartment bldg in Tokyo serving gaijin like me. There's a screaming market demand for low-BS housing for foreigners.

Though Japan does have pretty goofy tenant-protection laws, unlike the US where it's pretty trivial to get the sheriff's services inside a month.

But try as I might, I can't get it to pencil out due to Tokyo's insane land valuations.

http://www.athome.co.jp/ks_14/dtl_6953343999

is a quick search of land, ~30 minutes outside of town, on the outside edge of not-inconvenient location to the city itself.

$770k for 360m2 (~4000'). This is 200% zoning so I could build 430m2 of apartments, at 30m2 each that'd be 14 units.

That's $50,000 per unit just for land value. This is pretty much constant out this far, and the closer you get, the higher it goes.

http://www.athome.co.jp/ks_14/dtl_1069759908

$2.4M for 500M for the same zoning in a bit better location (still 25 minutes out).

500m2 x .6 x 2 = is 600m2 of allowed construction, or 20 units . . . $120,000 per unit of land cost.

http://www.athome.co.jp/ks_14/dtl_1071260008

is totally prime real estate. 800m2 x .6 x 2 = 960m2 of space, or 30 30m2 units.

Price? $470k per unit.

That's Tokyo's real estate gradient.

That's Tokyo's real estate gradient.

Can you build underground? Coffin sized units?

But printing yens encourages debt increase in Japan

and weakens the yen. Once I figured out that Japan would prosper more with the yen at 150 than 50 I realized Japan's not too bad off, really.

Kuroda just needs to keep printing. His job's not done until prices have another zero on them, basically.

This is of course sacrilege, and I don't know how it's going to turn out. But even with their depopulation, Japan still has a lot of people to put to work.

Age 15-24 Japan (blue) vs Germany (red)

http://research.stlouisfed.org/fred2/graph/?g=xpX

About half our young population are junk people totally unprepared for life.

1/4 don't finish high school, half that do don't qualify for a 4 year college.

It behooves Japan to invest more in its youth, and I hope they are doing that now. I do know that the average high school in Japan is streets ahead of the average high school in the US, in terms of educational merit.

this is a fundamental non-understanding of macro economics.

I agree, Argentina had the second largest GDP in the world 100 yr ago. Today it is 26th.

The reason is continual meddling by the state(Juan and Evita Peron fame), the last event I heard about was the president confiscating private pension funds.

You might say they just did not have natural resources, but nether does Japan.

You might say they did not have the culture, but they did 100yr ago, but the government meddling affected their culture the same way as it has here.

Anyway I agree, this is a fundamental non-understanding of macro economics.

Can you build underground? Coffin sized units?

I actually read an article back in the 1990s about maybe underground construction. With today's high-DPI displays, why the hell not. Put up some fake scenery in this:

and it'd probably be superior to some crappy surface unit.

The reason is continual meddling by the state

that and an insane macro policy in the 1980s.

Chicago Boys ran Argentina into the ground in the 1990s

"Record foreign debt interest payments, tax evasion and capital flight resulted in a balance of payments crisis that plagued Argentina with severe stagflation from 1975 to 1990. Attempting to remedy this, economist Domingo Cavallo pegged the peso to the U.S. dollar in 1991 and limited the growth in the money supply. His team then embarked on a path of trade liberalization, deregulation, and privatization. Inflation dropped to single digits and GDP grew by one third in four years;[2] but external economic shocks, as well as a dependency on volatile short-term capital and debt to maintain the overvalued fixed exchange rate, diluted benefits, causing the economy to crumble slowly from 1995 until the collapse in 2001"

Comments 1 - 29 of 58 Next » Last » Search these comments

http://www.bloomberg.com/news/2014-04-15/japan-s-population-shrinks-for-third-year-as-ranks-of-aged-grow.html

The recommended solution: "We have argued for some time that Japan has a lot to learn from Australia and the U.S., which have demonstrated successfully that welcoming people from a variety of nations, who may think differently and have different cultures but are highly talented, strengthens the economy on both the demand and supply sides,†Mizuho Securities Co.’s Chief Market Economist Yasunari Ueno wrote in a report on April 9."

I.E.: New entrants to keep the ponzi going.