patrick.net

An Antidote to Corporate Media

1,205,876 comments by 14,328 users - PeopleUnited, WookieMan online now

10 Year Yield Having A 2nd Taper Moment

2015 Jun 9, 7:31am 33,131 views 131 comments

by _ ➕follow (8) 💰tip ignore

« First « Previous Comments 57 - 96 of 131 Next » Last » Search these comments

Remembering that prices are still rising, however.

I hear this back in 2003-2006

've said this before, but I continue to remind you that sales are not always a good substitute for demand.

I couldn't disagree with you more here

Adjusting to population the sales are dreadful but the demand curve for renting is booming

Math, Facts and Data matter, I can't live in a world or believe in something that the data doesn't justify it

In 2014 year 6 of the economic cycle

Even with higher rates, estimates by some were up to 5.7 million and 5.8 million existing home sales, everyone in America had growth

Which I totally understand curving the demand to adjust to population you should be around that level

However....

Only one person said demand curve will be negative year over year in 2014 if cash volumes falls because mortgage demand was weak after the taper spike...

What happened... first time ever in American economic history that existing home sales had a negative year over year print

#In an up cycle this late into the recovery

Even with inventory rising and in year 6 of the economic cycle sales came in at 4.9 million only 800K above the lows of the Great Recession even with 30% cash buyers (though total volume fell for cash buyers)

Number 1 Housing analyst in America Ivy Zelman April 2014

Nick Timiraos â€@NickTimiraos

Zelman existing home sales forecasts: 2014 at 4.8M (vs earlier 5.4M); 2015 at at 4.9M (vs 5.7M); 2016 at 5.0M (vs 5.9M). 2013 was 5.09M.

Nick Timiraos â€@NickTimiraos

Ivy Zelman slashes existing home sales forecast: now -5% for 2014, vs earlier +6% forecast. New home sales forecasts unchanged.(Big miss on her new home sales) estimates were 25% sales growth came in at 1.9% biggest miss on sales ever

More details here

http://loganmohtashami.com/2014/04/11/miss-housing-nirvana-crys-uncle/

For every 1% change in interest rate, purchasing power changes by 10% for the same monthly payment. Since most people qualify for mortgages at the top of their payment affordability (they buy "payments", not "houses"), if rates go up 1%, the house they can buy has to drop by 10% in price to keep the same payment.

If mortgage rates creep back up, it will put a big dent into this so called "housing recovery".

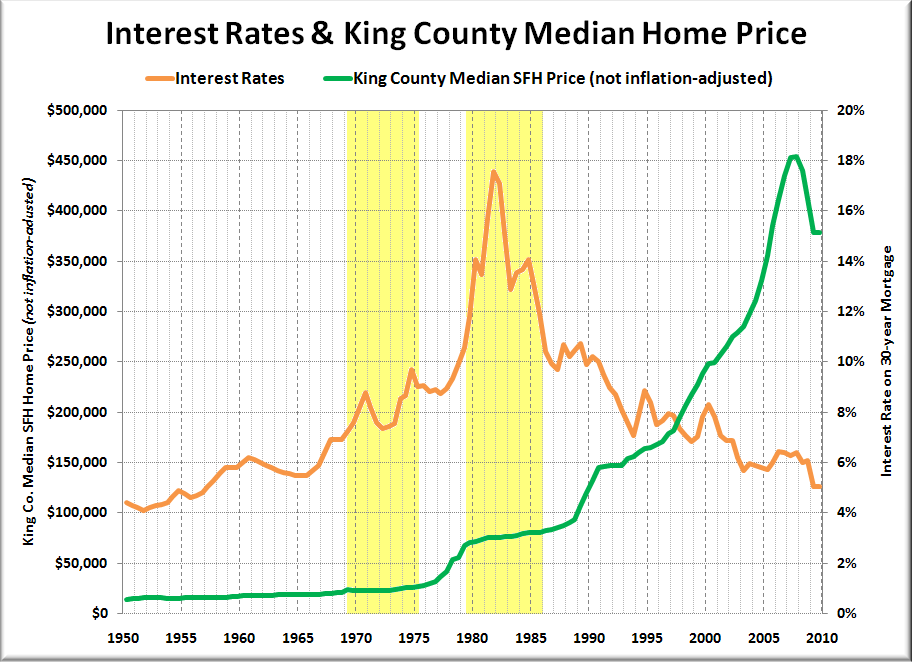

Just remember - as counterintuitive as it is, history says otherwise.

The 1980 homebuyer who balked at the 75K house was ass fucked when rates rose to near 18% and nominal prices never dropped in the slightest and in fact rose 25% over the course of the decade.

If anyone thinks this King Co chart is cherrypicking, heres the national chart which shows the same thing.

Math, Facts and Data matter, I can't live in a world or believe in something that the data doesn't justify it

That's the problem. The math, facts, and data don't always support your theories but you are unwilling to reconsider. You distort distort the data in an effort to make it seem to support your thesis rather than letting the data tell the story and finding a thesis that fits.

Like here:

I couldn't disagree with you more here

Adjusting to population the sales are dreadful but the demand curve for renting is booming

You've completely ignored my point that using sales as a substitute for demand may not be correct, but instead repeat that sales are low. Nobody is arguing that sales are strong. The discussion is your INTERPRETATION of that data---not with the data itself. Try to understand that.

You have the weakest demand curve ever from first time home buyers .... With the lowest rate curve on 10's since 1941-1945 ... But you do have the strongest demand curve for renting ... The battle between those who provide math facts and data compared to those with an economic assumption theory

You have the weakest demand curve ever from first time home buyers .... With the lowest rate curve on 10's since 1941-1945 ... But you do have the strongest demand curve for renting ... The battle between those who provide math facts and data compared to those with an economic assumption theory

Do you really not understand the difference between arguing facts and arguing what those facts mean?

And you still believe that rates correlate with demand? Talk about ignoring facts....

My charts speak for themself ... You on another hand never provide

1. Data

2. Information

3. Charts

4. Historical context

To be honest I actually believe you're just talking for sake of having an debate....

It does?? Let's look at the last 25 years (that's as far back as FRED has house prices).

Yes it does. Here is that same Fred data set except it is going back 45 years

http://www.jparsons.net/housingbubble/

He also has the spreadsheet you can download if you want to look at the raw data.

*

See a general trend line of prices versus interest rates, except for the few years after the artificial bubble popped in 2006 and the system needed to reset to the norms?

Noted, that's why the 25 year data set gives us a assumption (i.e. higher rates = lower prices) that does not hold up when you look at the full 50+ year data set

The only way I can reconcile the full 60 year data set is to say that it generally shows nominal prices (a) stay flat or ooze upward in rising rate environments and (b) explode upward in falling rate environments. This would be consistent with the thesis of "sticky" prices and the relentless rise of nominal incomes (again nominal, not inflation adjusted) for the last 50+ years

The only real exception here was the 2006 bubble which we both agree was artificial.

The only real exception here was the 2006 bubble which we both agree was artificial.

Which doesn't get talked about enough inflation adjusted home prices for existing homes aren't back to the bubble in 2006

Only housing crop where inflation adjusted prices are higher than the bubble are for new homes

I hate this affordability index model

assumes every American has 20% down but a DTI of 25%...

However, it shows how 34 years of falling rates and rise of prices.... (Size) of the debt grows ... rate needs to be lower to service the debt and even in this

cycle with rates under 5% since 2011 the real demand curve from main street was to rent not to buy

Very strong demand from Rich though

The issue I have with that data is that he uses "inflation adjusted" data for his graphs.

No he doesn't. The red line is inflation adjusted, but the blue line is nominal. This is what is shown in the 60 year chart too.

Call it Crazy says

I think the last 25 years is a large enough time frame to get a trend.

The last 25 years gives you a picture that blows up in your face if you look at the last 60. Also, the last 25 years does not have a single incidence of a sustained increase of interest rates. Thus why would you use it to come up with a thesis of what happens with a sustained increase of interest rates (rising rates = falling prices), when the only (albeit older) data shows the exact opposite of the rising rates = falling prices concept?

Plus, a big dynamic changed in the 80's with dual income households becoming more popular (which I believe added to the faster rise in prices from the late 80's along with dropping rates). Back in the 60's and 70's the majority were single income households (which is why prices grew slowly with rising rates).

Noted. And since this period coincided with very high inflation, its pretty astounding that nominal home prices rose so little. Yet as we know (but don't like to admit) is that rising nominal incomes is a lagging, yet necessary component of inflation (this also shows up in those charts BTW). Thus, the 1980 waiter who passed when the house cost 75K found the house "cheaper" in 1982 when it cost 3% more, and his (or his and her) income rose 8% (or whatever). Granted, he was still getting slaughtered at the grocery store where things were rising more than the 8% income rise, but again, that's what the data shows us.

If the last 25 years can't give you a good indication of the CURRENT housing market, then you're grasping for straws...

The last 25 years gives us a very good indication of what happens in a falling rate environment, but tells us nothing whatsoever happens in a sustained rising rate environment because it has not existed in the last 25 years. Thus, what people on Patnet have consistently done for the last decade is to automatically assume the reverse (i.e. if falling rates = rising prices, then rising rates MUST = falling prices). This argument has intuitive appeal as people DO shop for payment as you said. Still, the data (yes old but the only data on point) tells us the rising rates = falling prices does not happen. Instead, the payment shoppers get sidelined until such time as their nominal incomes rise (hopefully faster than the rise of prices) that they can afford it. This is the only thing that I see that can reconcile the entire 60 year data set.

I get your whole point about 50 - 60 years ago, but what happened back then has very little to do with today's housing market

Yes, but it has everything to do with how people respond to stimuli, and in that regard, human behavior doesn't change over time. In a vacuum, higher rates could and should equal lower prices, but this isn't the case, which is the whole reason I have been vexed by this question and the only way I can reconcile all the data with human behavior. That said, I should note if (a) lenders added a rate premium which had nothing to do with bond rates or inflation or (b) nominal incomes stopped rising, then I would bet you dollars to doughnuts the rising rates = falling prices would ring true. Yet, as long as the US remains the words dominant hegemonic power there is no chance of this happening.Call it Crazy says

Which is why I used the last 25 years a snap shot.

That may be so, but it is also the one that has been bandied about bubble blogs for the better part of a decade - sometimes purposefully as people have intentionally deleted the 1970-1990 data to "prove" what they want to believe that if they wait, prices would fall:

/misc/Median+House+Price+vs.+Nominal+Interest+Rates+%281980-2011%29

You and I are old dogs here and remember and lived the double digit mortgage rates. The majority of the kids here only know about them from history books!

Actually, I was in pre school back then. Thus it baffled me when the few gristled vets I talked to (pre graphs) noted they didn't remember home prices falling in the early 80s since I had no memory of the period and the rising rates = falling prices thesis intuitively made sense. Either way, I am much more interested in accuracy as misinformation on housing has caused real pain to my family, and I wanted to feel very comfortable about the whole interest rate vs. price issue before I would weigh in on the topic. In real life, I like to fuck around as much as the next guy, but its only on this topic where I become the pedantic dickhead I am here.

My charts speak for themself ... You on another hand never provide

1. Data

2. Information

3. Charts

4. Historical contextTo be honest I actually believe you're just talking for sake of having an debate....

You provide so many charts that there's no need for me to provide any more. My disagreement isn't with your data or your charts, it's with your interpretation of that data, like I said. You use sales as a representation of demand. As I told you before, that assumes unlimited supply, which is clearly not the case. You continue to post that demand is inversely correlation with interest rates despite the historical evidence showing this to be untrue. I wouldn't even say I'm arguing--just trying to point out some flaws in your reasoning.

As I told you before, that assumes unlimited supply, which is clearly not the case

2014 Inventory up

--- Rates Up----

Demand negative Year over Year

YoY ... purchase application demand

Higher PITI inflation rates cause the first negative demand curve in an up cycle

Like I said

You never provide any data, charts, or information

You have an economic assumption theory that the data doesn't agree with but in your own mind you believe your right

To that I can't change your thinking nor will I try because men like you never bring

Math, Data, Facts into the equation

Your economic assumption theory's do have

limf(X) =sky

x-a

It's ok...

Last 20 years I have seen people shun away from math, facts, and data and live off of spin .... your sentence structure speech patterns, no different.

That's completely fine everyone has to have their own thing

Mine, simply is

Math, Facts and Data matter, numbers don't lie... people do, however.

2014 Inventory up

Up isn't the same as unlimited. It's up from low levels and still BELOW what most people believe is equilibrium. That's why prices are rising.

Like I said

You never provide any data, charts, or information

You have an economic assumption theory that the data doesn't agree with but in your own mind you believe your right

To that I can't change your thinking nor will I try because men like you never bring

Math, Data, Facts into the equation

Your economic assumption theory's do have

limf(X) =sky

x-aIt's ok...

Last 20 years I have seen people shun away from math, facts, and data and live off of spin .... your sentence structure speech patterns, no different.

That's completely fine everyone has to have their own thing

Mine, simply is

Math, Facts and Data matter, numbers don't lie... people do, however.

I do provide charts and evidence, when I believe that someone is wrong about data or facts. In this case, you are interpreting the data incorrectly. There's no need for me to post the same data again in order to show you how you are misinterpreting it.

Please tell me specifically which economic assumption of mine is not supported with the data. I'm all ears.

You love to pretend that you're the only one that like data and facts. I can assure you that I am at least as interested in data and facts as you. I just choose to let the data speak before I draw any conclusions. You don't. So, again--please tell me which economic assumption of mine is not supported with the data. I've already told you 2 of you assumptions that are incorrect and not supported with data.

There's no need for me to post the same data again in order to show you how you are misinterpreting it.

I have never seen you post any data ever

Please tell me specifically which economic assumption of mine is not supported with the data. I'm all ears.

That rates don't matter...

I have never seen you post any data ever

You obviously haven't read many of my posts

That rates don't matter...

Now that's funny. On this very thread, another poster has shown you the data. I posted something similar a long time ago. I'll try to find the old post and copy it here too.

I've already told you 2 of you assumptions that are incorrect and not supported with data.

This kind of statement is exactly what I am talking about ... seriously.. there are plenty of housing bear trolls that you will have a better discussion with than me.

All I show is data.. if America was watching our conversations what do you think they would say

The man hiding behind a fake name who presents no data is trying to talk his way with an economic assumption theory

The man who doesn't hide behind a fake name, writes about housing, speaks to economist and gets invited to economic conferences actually presents a very simple

#causation

#correlation

#Representation

factor model

Come one, you really think this game your playing works on people

You had one aggressive move in rates in this cycle and that changed the PITI factor so much that everyone whiffed on their 2014 sales call

The cycle wasn't ready for higher rates and that created the first ever bear market on purchase applications in an up cycle ( year 6) ever recorded since the data was collected

In fact the reason they gave for the excuse for the decline curve shift in demand

"A sharp move in interest rates"

This is from the number #1 Housing analyst in America too

"I think nirvana took a pause," Zelman told CNBC on Wednesday. "During that time home prices were surging and we had very attractive affordability, and a few months after I was on we saw rates surge about 100 plus basis points and we saw a pause.

The consumer was rationally responding to the surge in prices and the backup in rates."

All I show is data.. if America was watching our conversations what do you think they would say

The man hiding behind a fake name who presents no data is trying to talk his way with an economic assumption theory

The man who doesn't hide behind a fake name, writes about housing, speaks to economist and gets invited to economic conferences actually presents a very simple

I'm commenting on the data you already posted. Do you really need me to repost it? Why?

You had one aggressive move in rates in this cycle and that changed the PITI factor so much that everyone whiffed on their 2014 sales call

I thought everyone has whiffed on their sales calls for 3 years running? And it was because prices are too high-isn't that your thesis?

Regardless, if your argument is that spikes in interest rates can have short term effects on demand--I will grant you that is possible. But, looking at historical data over long periods, there is no correlation between rates and demand. Hell, even after the spike you posted above, rates were still very low.

I'm commenting on the data you already posted. Do you really need me to repost it? Why?

This is your tactic,

.....

This is just a guess

You're a female, from Hawaii or the islands and I am going to say you're a baseball fan because you like stats?

How did I do?

See, I come with data first ... and then show the relationship factor

You just come out of no where

Seriously, as a friend, I am telling you, you say things that make no sense what so ever.

It's ok, because you're not an economist, you're not a housing analyst, you don't write about housing and you hide behind a fake name which means it's ok because you don't need to be right

This is all fine, nothing wrong with what you're doing

However, you say things that just aren't realistic

Hint: Narcissism is your enemy not your friend

I myself am only bounded by math, facts and data if I said the things you have said on Patrick I would be laughed at. It's not your fault, this isn't what you do for a living.

However, don't think for a second this mickey mouse stuff works on someone who lives off numbers. :-)

What was the demand curve during the lowest interest rate cycle ever in 10's

Here

Math

Facts

Data

Matter.... you have to know why something happens... that's the only way you get to the truth

Seriously, as a friend, I am telling you, you say things that make no sense what so ever.

However, you say things that just aren't realistic

Instead of continuing to repeat this nonsense, why don't you just have a discussion about the data and interpretations? You always want to distract trying to make it personal, either about me or you. Let's just discuss the data.

So, again, what am I saying that is not realistic? What am I saying that makes no sense.

In case you forgot, here's what I'm saying. If you look at historical data, there is no correlation between interest rates and nominal house prices. This is because incomes are the main driver in house prices, and income is strongly correlated (negatively) with interest rates. That relationship overrides the expected dependency between prices and interest rates. So, what doesn't make sense there?

Instead of continuing to repeat this nonsense, why don't you just have a discussion about the data and interpretations? You always want to distract trying to make it personal, either about me or you. Let's just discuss the data.

Your tactic... it doesn't work with me

If you look at historical data, there is no correlation between interest rates and nominal house prices

Another tactic, change subject, I am talking about demand curve "COME ON" seriously, I have home prices going up for years now...

This tactic you do doesn't work on me...

Miss ... I presume...

My lady, you're dealing with someone who looks at every single data possible every day of his life.. Not just housing but every economic indicator here and over seas

When I post demand curve numbers that means demand curve not prices... Really....come on my lady you know better....

Since inventory levels broke under 6 months that gives pricing power in almost every cycle unless the inventory level shifts above 6 months or you get front loaded with distress sales

We have inventory under 6 months

We have traditional sales rising and distress sales falling

With unemployment claims hovering at a 15 year low there is no recession sign what so ever

My lady I am trying to make the point that I am not the person you should be trying these tactics with... There are plenty of people here that would love to go back and forth on non mathematical statistical trends

Your tactic... it doesn't work with me

lol--you're kidding, right? You do it again on the last post!

Miss ... I presume...

Another tactic, change subject, I am talking about demand curve "COME ON" seriously, I have home prices going up for years now...

OK, let me remind you what we were talking about:

Logan Mohtashami says

Please tell me specifically which economic assumption of mine is not supported with the data. I'm all ears.

That rates don't matter...

Do you remember now?

Yep, but to see if there's a correlation you need to look at a time period when rates are rising to see if prices fall. Not to mention that prices fell significantly during as rates fell in the late 2000s. Doesn't look like a correlation to me.

lol--you're kidding, right? You do it again on the last post!

My lady... seriously... this tactic isn't working...

I am talking about main street America demand curve and how it's been a renting cycle and you're talking only about nominal prices and I just gave you

my thesis on what to do look for on prices and why it's increasing

Distress sales only come in recession my lady

Come on....let it go.... So many more people you can chat with that are better suited for you style of debate

On another level.. in the next recession I don't believe you're going to see a massive correction in prices because of the lack of speculation in this cycle on non capacity owning debt

My lady, still, I got nothing but love for you as always I do enjoy our chats

The past 25 years isn't long enough for you to see a trend??

To see a trend, yes. To attribute causation, clearly not.

You want to cherry pick a small segment where artificial and unreaslistic financiing took place which caused the bubble to pop as your argument?

Of course. I let the data speak for itself.

Of course it doesn't, that would blow up your false narrative that you've spewed through out this thread.

You might as well say pork bellies are correlated to low interest rates or beef prices. Both have risen over the last 25 years too.

In order to show correlation, you must show it holds during both up and down periods.

In case you forgot, here's what I'm saying. If you look at historical data, there is no correlation between interest rates and nominal house prices. This is because incomes are the main driver in house prices, and income is strongly correlated (negatively) with interest rates. That relationship overrides the expected dependency between prices and interest rates. So, what doesn't make sense there?

Yep, but to see if there's a correlation you need to look at a time period when rates are rising to see if prices fall. Not to mention that prices fell significantly during as rates fell in the late 2000s. Doesn't look like a correlation to me.

Tatu does have a point with his second comment. When interest rates rose in the late 70's, it was due to inflation. Real Estate is a hedge against inflation. The "real" interest rates were not necessarily high, therefore real estate prices would move up.

If Tatu is stating home prices cannot increase with falling interest rates, that would be wrong, as both, interest and wages determine affordability of a home.

If Tatu is stating home prices cannot increase with falling interest rates, that would be wrong, as both, interest and wages determine affordability of a home.

I think I've been pretty clear with my statements. There is no correlation between interest rates and housing prices.

There is, however, a strong correlation between income and house prices.

If Tatu is stating home prices cannot increase with falling interest rates, that would be wrong, as both, interest and wages determine affordability of a home.

I think I've been pretty clear with my statements. There is no correlation between interest rates and housing prices.

There is, however, a strong correlation between income and house prices.

Question for you. If the 30 year fixed rate mortgage jumped to 12%, with no change in income or inflation, would real estate prices be negatively affected?

Question for you. If the 30 year fixed rate mortgage jumped to 12%, with no change in income or inflation, would real estate prices be negatively affected?

I would expect so. Empirical correlation doesn't worry about hypotheticals though--it's a simple calculation based on historical data.

Speaking of which quoted on USA Today today

"Renting the New American Dream"

In regard to rates and inflation. All we have is pocket inflation and debt has to be serviced at lower rates because the demand curve is just dreadful for most of America in this cycle.

Even with the lowest interest rate curve since 1941-1945 you have the weakest demand from main street America.

But.. and this is the big but.. you have the strongest demand curve ever from wealthy Americans, wall street, foreign buyers, cash buyers, fund buyers, re mod buyers ever seen.

Speculation factor is very little here because there is no way for main street to speculate in big numbers and this is a very good thing for this country. We should proud as Americans to not allow garbage back into the system

Net worth which is highly top end heavy .. really the 1% is getting screwed by the 0.01%

#Globalization

#Technology

#Debt

#Demographics

The good part about America is that we do have a young workforce coming on-line soon and we have 2 solid decades plus of working force that will get better wage inflation that what we saw in this cycle... this is more a 2020-2024 story line

Year 7 of the cycle... 2-4 years left before the next recession .. so the next recovery cycle will look better as prime working age workforce is now growing

There is, however, a strong correlation between income and house prices.

Has not recovered to pre cycle recessions highs (variables in these equation)

New home prices

Nominal way over the pre bubble peak... adjusted to inflation we just past it last month

Existing home prices

This is what happens when you have 30% plus cash buyers in an economic cycle, 20% above historical norms and over 50% of all homes being bought by the reach.

I don't like to use the term bubble for home prices in this cycle, just major disconnection from main street America and this is why the demand curve has been the worst we have ever seen from main street but the strongest demand curve from wall street, rich, Foreign buyers, hedge funds... this even with the lowest rate curve on 10's since 1941-1945

In reality and in lending terms the size of the debt (PITI) inflation model... this is the missing algorithm PITI +DTI +LTI = (HC)

Inventory very key on home prices because the asset itself has capacity to grow in asset value ... like all debt instruments the subsidization factor for housing has been very helpful for growth in nominal price values as well.

So there are legs to grow as long as inventory stays below 6 months and there is a lack of distress sales in the market, both are here to stay this year and even next year as well

The charts above dispute that....

No they don't. I don't know how much more simple I can make this for you.

Now, notice what housing prices did during high the inflation times of the mid/late seventies through 1982. Housing went up. A lot. Then it actually leveled off as interest rates were falling after 1982 before picking up again. Tell me how that is a correlation. Interest rates low--sometimes prices rise, sometimes they fall. Interest rates high, housing prices rise. Where exactly is the correlation there, again??

Strategist says

Here for you buddy starts at 2:21

TOL company was my point but tried to get the builders index there for you

« First « Previous Comments 57 - 96 of 131 Next » Last » Search these comments

http://loganmohtashami.com/2015/06/09/10-year-yield-having-a-2nd-taper-moment/

#housing