Thread for orphaned comments

2005 Apr 11, 5:00pm 233,516 views 117,730 comments

by Patrick ➕follow (59) 💰tip ignore

« First « Previous Comments 2,243 - 2,282 of 117,730 Next » Last » Search these comments

Nomo, apparently you are one of those with liberal neurosis (a personality ndisorder). That expains a lot. Thank you Doctor Rossiter.

If a private entity wanted to deal in electronic gold, they could easily accept deposits from people wishing to utilize their service. Likewise, others could make withdrawals. If the market responded positively to this system, it would all come together in the marketplace.

Isn’t this essentially what we have right now? I can buy and sell electronic gold with the stroke of a key.

But you can't pay for your groceries with it. You can't pay your taxes with it. It is not legal tender. Furthermore, Gold carries a 25% tax on it for being classified as a "collectible". It can't function as money until legal tender restrictions are lifted and they stop taxing the crap out of it.

Here is a good read: kitco commentaries Paul Nathan April 15 2010

Just google the above and read, it's called "Why Gold?" Then you'll know !!

Good day.

Nomograph is an ass

Nomo, apparently you are one of those with liberal neurosis (a personality ndisorder). That expains a lot. Thank you Doctor Rossiter.

Lovely answers, just what we've come to expect.

Nomo, apparently you are one of those with liberal neurosis (a personality ndisorder). That expains a lot. Thank you Doctor Rossiter.

I didn’t know you Conservative types were so into the touchy-feely pyschobabble stuff.

Neuroses notwithstanding, don’t you have ANY ideas about how to restore the gold standard? I thought that was your crusade. Didn’t your AM talk radio Messiahs get to the part about actual ideas, or do you only listen to the “I blame Libs for my problems†part?

The Neocon embracing of the gold standard is only a recent development that was started with Glenn Beck. Gold companies deliberately target the neocon audience right now because they are sympathetic to the call for less spending and sound fiscal policy.

There has been a strong sect in economics and the libertarian community that has been calling for a sound monetary and fiscal policy for over 10 straight years and has literally been disgusted with the Neocons that ran the country under George Bush/Alan Greenspan. The Right Wing does a great job at hijacking any legitimate movement in this country and turning it into crap. The Tea Party movement had a slight chance of being legitimate until Fox News and Sarah Palin got a hold of it.

It wasn't long ago that Republican ideologues were making fun of people who bought gold. Now they want in on the party. Unfortunately, they have no clue as to why gold is a good investment today and simply buy because advertisers on Fox News convinced them to. As a result, they will have no clue when to sell and they'll be left holding the bags when its time to sell your gold.

Oak--

Maybe you can answer my main question--why does gold have value? What gives it the "intrinsic" value that others keep talking about?

Oak–

Maybe you can answer my main question–why does gold have value? What gives it the “intrinsic†value that others keep talking about?

Didn't I already give up on trying to convince you of this in another thread?

Gold retains its value because it is rare, easily divisible, stable in supply, and doesn't degrade and cannot be counterfeited. You cannot find another element on planet earth that meets those specific criteria. No other commodity is able to serve as a stable monetary unit of account like Gold for those reasons. Silver used to meet that criteria until we began using it up in industry.

As hellbent as some people are to try to convince you that "gold is worthless and has no value", the market has disagreed with you for thousands of years and will continue to do so until a Gold comet hits planet earth.

Maybe you can answer my main question–why does gold have value? What gives it the “intrinsic†value that others keep talking about?

If you saw a $100 bill and a 1 ounce bullion gold coin on the sidewalk and could only pick up one, which one would you pick up?

Gold retains its value because it is rare, easily divisible, stable in supply, and doesn’t degrade and cannot be counterfeited. You cannot find another element on planet earth that meets those specific criteria.

Well, there are a copule of problems with that as I see it. Meeting those criteria may make it a good currency, but doesn't make it valuable.

And there are several other metals that fit your profile--Rhodium, palladium are metals that come to mind.

I'll ask again--why is it valuable?

Hahaha - you claim not to know. You simply refuse to acknowledge reality. Typical liberal neurosis...a personality disorder - medically documented. Argue all you want, blah, blah, blah, whine, whine whine, but it doesn't change reality. Hahaha.

Let me suggest CESIUM as a store of value!

It's a rare metal with the wonderful quality of becoming liquid at 83F, so even a child can mint coins it's no more difficult than making popsicles, then melt it and return to original form.

(Tune, "Why don't we get drunk..."

with apologies to Jimmy Buffett)

I've got a pound of Cesium,

It's burning gently near.

The sky-blue flame looks lovely,

But it's noise I want to hear.

So darlin' bring some water,

A couple pints'll do.

And why don't we mix up the two?

Why don't we mix up the two?

'Cause Cesium and water,

Really make a wicked brew.

You say I've got a death wish,

But honey, I'm just blue.

So why don't we mix up the two?

---Songs of Cesium #29

Re: OP

over the past half hour I did a little thought experiment...

If I was Ben Bernanke/Tim Geithner (they would probably have to work together on this) and wanted to return America to a sound monetary system (which by the way obviously they do not), here is what I would do:

This first step is not necessary but would make it more fun...

1. Raise interest rates. This "tightening" step would cause the world to believe that we are serious about our sound dollar policy and as a result precious metal prices would drop (for those new to precious metals the dollar and gold have an inverse relationship in general meaning when gold is up the dollar is down and vice versa). As a bonus this would drive housing prices down.

2. After having driven the price of gold down I would take advantage of the secrecy of the FED and use my vast supplies of fiat cash and stealth bank and trading accounts to buy precious metals, starting with futures contracts and then after buying as many of them as I could without pushing the price up too high, I would start buying physical gold where ever I could find it and as much as I could, slowly over time pulling more and more gold into the New Fort Knox. I would roll over the futures contracts in order to suppress the price and not alert the world market that I was pulling off literally tons of gold for the American stockpile (which is of course already the largest in the world if the official story is correct). Then when the time was right I would make one final push to purchase physical gold and let my futures contracts expire demanding delivery. At this point the "world gold market" would probably be exposed as another ponzi scheme where "gold" was traded but there was actually not really much physical gold at all, it was all just paper gold which didn't exist but rather was "traded" to give the illusion of a market.

Anyway to make a long story short I would buy as much gold as I could using my fiat dollars and clean out the gold market. Compared to our national debt or even our military spending this would not take that much money to pull off. It doesn't matter though, I have access to the printing press. When all was said and done I would own all available supplies of gold, America would have a vastly increased majority share of the world's gold and we could initiate the gold standard in earnest.

3. At this point I am torn as to whether or not I would default and screw all foreign investors or just be a nice guy and allow them to benefit from the new gold standard. Most of our debt is actually "owed" not to foreigners but to the Fed and American investors such as pension funds. So it would be Americans that benefited the most by choosing not to default. After deciding (default or honor debt), then and only then would I make known that in fact it was the American Treasury department that had cornered the market on gold.

4. Allow Federal Reserve notes to continue circulating, but also make them redeemable in gold or gold backed trading/debit accounts with an exchange rate based on the ratio of Fiat Federal Reserve notes (theoretically the central bank knows exactly how many dollars are out there right? so this should be easy to do) to actual gold reserves. I don't care to guess what an ounce of gold would be worth but I expect it would be at least a couple thousand dollars. Essentially the Federal Reserve note will become backed by gold. This would force all other nations to devalue/revalue their currency based on the amount of gold in their country's reserves (had we chosen not to default we might have to send some gold overseas to settle our debts. This would help the countries we owed money to, to revalue their currency (which might be good because they would be in a better position to buy American goods if their currency was more valuable).

5. Change the nature of the Federal Reserve from private bank and lender of last resort to National Storehouse. Eliminate fractional reserve banking. Allow the free market to set interest rates based on risk. Encourage and reward savings with actual interest and NO FEAR OF INFLATION.

anyway that was my thought experiment. But before you attack it, as I am sure many will be want to do, please consider that:

-this is by no means a well thought out plan

-it is the only idea anyone on this board has been bold enough to put forward

-Nomograph is an ass

-before you accuse me take a look at yourself

-Cinnamon takes a backseat to no Babka!

Re: OP

over the past half hour I did a little thought experiment…

.......

-this is by no means a well thought out plan

You wasted a half-hour of your life on that?

Gold retains its value because it is rare, easily divisible, stable in supply, and doesn’t degrade and cannot be counterfeited. You cannot find another element on planet earth that meets those specific criteria.

Well, there are a copule of problems with that as I see it. Meeting those criteria may make it a good currency, but doesn’t make it valuable.

And there are several other metals that fit your profile–Rhodium, palladium are metals that come to mind.

I’ll ask again–why is it valuable?

Rhodium, palladium? Maybe you missed that whole "stable in supply" criteria I set forth. Rhodium was in extreme shortage 2 years ago. The industrial catalytic applications of Rhodium and Palladium cause those metals to be heavily used up by industry resulting in an unstable above ground supply. Your money supply would go bonkers if it were tied to these two metals.

The fact that gold is inert (which is why people refer to it as useless) is one of the main reasons it successfully functioned as money. The market has never accepted Rhodium as money and it never will.

The fact that gold is inert (which is why people refer to it as useless) is one of the main reasons it successfully functioned as money.

Not at all. Inert is a good thing--that's why it is used as a contact material in electronics. You are correct about the industrial uses of Rhodium causing it to be more unstable.

Do you understand my question though--scarcity doesn't imply valuable. There has to be demand as well. I still don't see why people believe gold is valuable other than:

1. It is shiny and makes pretty ornaments

2. Historically it was used a currency

What am I missing?

Anything that is scarce and has a use (in this case, monetary use) will have value. You are trying to make this more complicated than it is.

But it's not used as money anymore

Gold is valuable as a store of wealth against fiat currencies. As painful as it may be, break open the ole history books and see what happens when countries go off the metal standard (gold/silver).

Gold has no debt. Fiat currency is debt. Take a bill from your pocket and at the top it clearly states

'federal reserve note' well, let me see can I now pay a note with a note. Only until the ponzi scheme implodes. Can I do the same with gold? No, it has no debt. Can't print it either. Electronic gold, sure you can trade in electronic gold. Would highly recommend you know what your doing and have enough of the real stuff to back up the contract(s) your trading. You do the math.

Yes in all probability gold will become fixed in price as a partial reserve to the world reserve currency which will consist of a basket of currencies, no longer exclusive to the us dollar. I have no current conclusion where this fractional value of an IMF or world currency will be, guestimate between 10 & 30%

Can't be more than 30% not enough bullion on the planet. Other alternative back to serfdom and can kiss the feet of the 'nobleman' who owns the castle because he has the gold.

The days of everything for nothing built on credit are over; they were over when they started it just takes a while for cycles to run their term.

Someone earlier said 'you can't spend it' try this. Go to your local auto dealer and talk to the dealer or general manager (someone who understands money) pick out a 35k vehicle and offer him 29 1oz gold eagles with a current spot price of 1160. Guess who just purchased a depreciable asset with an appreciable asset?

Gold has no debt? Amazing. Therefore fractional reserve lending did not exist in the Golden Days prior to 1971. Obviously my texts are wrong.

Your text's wern't wrong - your understanding of fractional reserve lending is.

Since fractional reserve lending was invented, "printing money" i.e. manufacturing more debt/credit out of thin air has been common practice. Whether you pretend you are backing all that paper with gold or not is at best a quibble. The sum total of gold and/or dollars in circulation in 1970 was FAR FAR less than than the sum total of all the assets and debts that represented our national "wealth".

Backing paper money with gold is the specifically the point. If more paper money is issued than an equal amount of gold reserves available to redeem them - then a crime has been committed. So how is gold a debt ???

Is it any different if a priest molests someones son than if the government steals from someones son ??

Backing paper money with gold is the specifically the point. If more paper money is issued than an equal amount of gold reserves available to redeem them - then a crime has been committed. So how is gold a debt ???

It's a good question. Paper money only accounts for a small fraction of the money supply. Are you proposing to eliminate fractional reserve along with re-adopting the gold standard?? How about bringing back the outhouse? Or horse drawn carraiges?

CNBC also had similar story and comments. The majority of the contruction is upscale Condos priced $100K well above normal salaries of Chinese consumers $3500-7500/year. Lots of money coming from the US to China as well.

Backing paper money with gold is the specifically the point. If more paper money is issued than an equal amount of gold reserves available to redeem them - then a crime has been committed. So how is gold a debt ???

It’s a good question. Paper money only accounts for a small fraction of the money supply. Are you proposing to eliminate fractional reserve along with re-adopting the gold standard?? How about bringing back the outhouse? Or horse drawn carraiges?

You seem to think paper money is a symbol of the progression of society. Paper money is an example of the degradation of society. It has already been tried before and has always failed.

It has monetary use. That’s why central banks have refused to sell it despite the fact that they haven’t used it to back the currencies for 40 years

First off--central banks have been selling gold. I posted a link to an article about Britain which talked about how their central bank had sold off almost all of its gold because they wanted the money "working" for them-ie earning interest.

Second--What do you mean by monetary use? You can't really use it to buy anything, so I don't follow.

It has monetary use. That’s why central banks have refused to sell it despite the fact that they haven’t used it to back the currencies for 40 years

First off–central banks have been selling gold. I posted a link to an article about Britain which talked about how their central bank had sold off almost all of its gold because they wanted the money “working†for them-ie earning interest.

Second–What do you mean by monetary use? You can’t really use it to buy anything, so I don’t follow.

store of value.

Like I said, stop trying to make this so complicated.

Obviously, the market has been buying gold steadily for 8 years now to use as a store of value.. So, if I were you, I'd stop trying to argue.

since britain sold their gold the nominal price of gold has more than quadrupled. How is that “money†working for them?

They made a poor decision--no doubt

You're joking right?? Is debasing and corrupting your own currency a symbol of the progression of society ? Debasing your own currency IS an example of the degradation of society. Debasing one's own currency has been tried before...and unfortunately it always works. The result is monetary and economic disaster.

"There is no subtler or surer means of overturning the existing basis of society than to debase its currency"...OOPS

"Paper money always returns to it's original value - zero"...OOPS

"If Americans ever allow private banks to control the issue of currency, first by inflation, then by deflation, the banks and corporations will deprive the people of their property"...OOPS

"Governments hate gold because it prohibits them from turning a free society into a tyrannical, economic dictatorship"...OOPS

"In a society with a fiat currency, all roads lead first to inflation, then to collapse"...OOPS

"Gold is the money of Kings

Silver is the money of Gentlemen

Barter is the money of peasants

Debt is the money of slaves"...OOPS

Aw shucks, just because things like this happened throughout history does NOT mean they will happen in America - right? History doesn't repeat itself - does it??? These things can't happen here, can they ???

Aw shucks, just because things like this happened throughout history does NOT mean they will happen in America - right? History doesn’t repeat itself - does it??? These things can’t happen here, can they ???

A bunch of quotes does not equal history. Just one man's opinion...

OK, I’ll ask you a question. How did the world operate when we WERE on the gold standard? Low inflation, fiscal responsibility, no currency debasing? I don’t know - thats sounds good to me.

When everyone is on a gold standard, it works.

If the US went back on the gold standard alone, we'd be royally screwed.

And, of course, since the US doesn't really have much gold anymore, it really doesn't seem like going back to a gold standard would make any sense. So we have all of this debt that we have to repay in gold now, but we don't have gold?

Why on earth would anyone intentionally persue such a strategy?

OK, I’ll ask you a question. How did the world operate when we WERE on the gold standard? Low inflation, fiscal responsibility, no currency debasing? I don’t know - thats sounds good to me.

When everyone is on a gold standard, it works.

If the US went back on the gold standard alone, we’d be royally screwed.

And, of course, since the US doesn’t really have much gold anymore, it really doesn’t seem like going back to a gold standard would make any sense. So we have all of this debt that we have to repay in gold now, but we don’t have gold?

Why on earth would anyone intentionally persue such a strategy?

Actually, the US has plenty of gold. And yes, paying our paper debt back in physical gold is a stupid idea. That's why you float it as an independent currency and let the dollar crash on its own.

Carey

Going DOWN! Buy buy buy!!!

http://www.redfin.com/CA/Concord/1130-Carey-Dr-94520/home/1580724

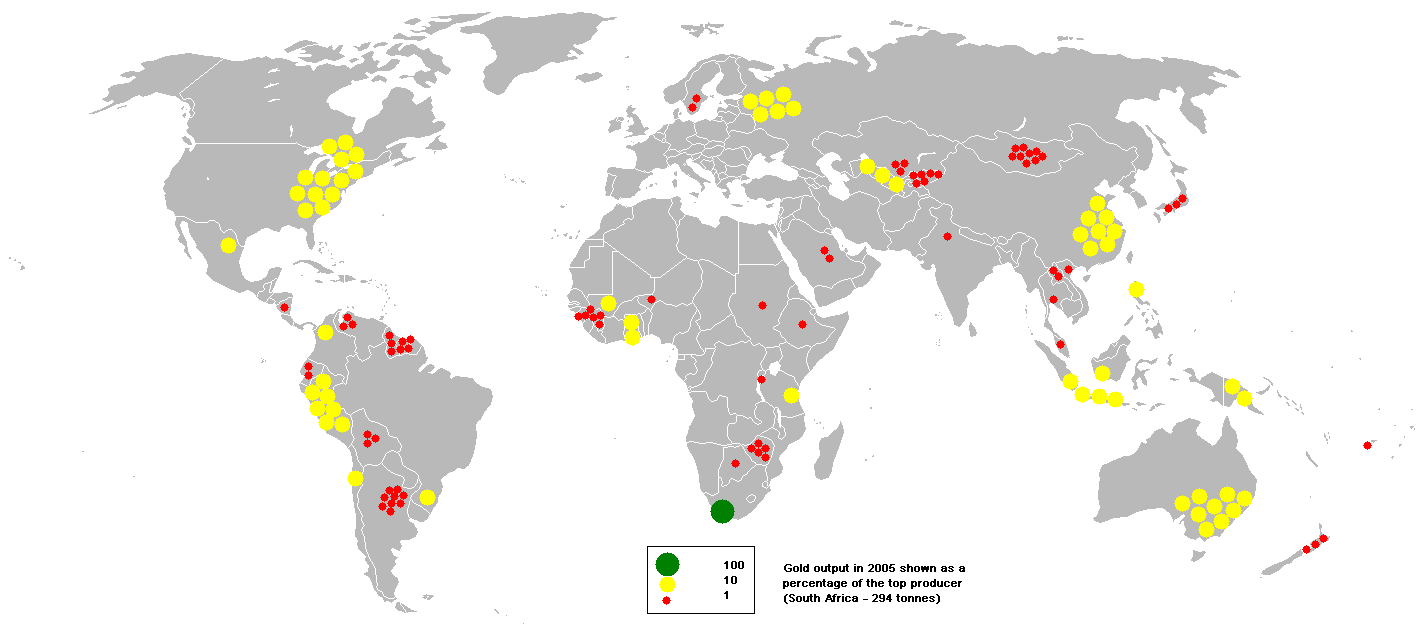

Exactly how much gold do we have Oakman? Last I recall we haven't even done a physical account of the storage in Fort Knox in decades. There's also quite a bit on ZeroHedge about the Gold ETF having pretty much no direct connection to actual physical gold. I have read that the entire world above-ground gold amounts to about 20 cubic meters. Looking at this chart:

We don't seem to have very many highly-productive mines.

1130 Carey is a tear down. I’m surprised they are asking that much.

Last refi was courtesy of World Savings Bank in 2006 (the 2002 refi was for $255k). Already a NOTS on this property so the clock is ticking...

He who has the gold sets the standards. I'm full of priceless gems today.

we looked at a lot of "Needs TLC. Fixer. Diamond in the rough. build sweat equity. " houses... most were tear-downs or in need of a complete gut/remodel

A tear down, really? Is it infested with termites or condemned due to mold? Seriously, unless it's condemned for some environmental reasons I doubt really a "tear down". Our house wasn't touched since 1949 except the roof, which was leaking...it was nowhere near a tear down, nothing that a roof, gutters, paint and flooring didn't fix.

It's funny how when it's a house you buy in the area for too much money it's a light fixer. When it's a house that shows prices are still falling, it's a tear down.

Exactly how much gold do we have Oakman? Last I recall we haven’t even done a physical account of the storage in Fort Knox in decades. There’s also quite a bit on ZeroHedge about the Gold ETF having pretty much no direct connection to actual physical gold. I have read that the entire world above-ground gold amounts to about 20 cubic meters. Looking at this chart:

We don’t seem to have very many highly-productive mines.

I'm assuming it's still in Fort Knox and the Fed isn't lying about it's balance sheet. As far as GLD, GLD does has tons of physical in vault. They just don't have enough to pay out the holders of GLD.

Forgive me for jumping in with all that preceded this. I've only scanned through the comments. My question is "how much of this is mental?" I had that discussion with a sub-vendor of mine earlier today. Everyone wants to believe that things will go up to, but few are willing to put their $$$ where their mouth is. Many RFQ's, few orders. The bottom line is we are all "cautiously optimistic" but no one is willing to make that fist move into the unknown. If suddenly we collectively say "the worst is over, it's save to spend again" then things will stake off, and we will have two - three years of growth, and "recovery" independent of the fundamentals behind said growth. In short believing things will get better is almost as good as things actually getting better.

If suddenly we collectively say “the worst is over, it’s save to spend again†then things will stake off, and we will have two - three years of growth, and “recovery†independent of the fundamentals behind said growth. In short believing things will get better is almost as good as things actually getting better.

This assumes the collective in question is entirely comprised of savers with stable employment/stable and/or growing salaries, all waiting to spring from the sidelines. I don't see that, for the most part. You cannot spend what you don't have, and what the banks aren't lending, and I think the money-for-nothing paradigm is a thing of the past.

« First « Previous Comments 2,243 - 2,282 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,266,926 comments by 15,148 users - WookieMan online now