Thread for orphaned comments

2005 Apr 11, 5:00pm 197,212 views 117,730 comments

by Patrick ➕follow (61) 💰tip ignore

« First « Previous Comments 2,732 - 2,771 of 117,730 Next » Last » Search these comments

who controls the printing presses, if not The Fed? Keep it simple for me please.

Money is not "printed" by the Fed, it is printed by the Treasury.

The Fed can and does create new money by crediting the Treasury's accounts. When it does this it takes a fresh T-note in exchange. In theory it can sterilize this money creation by selling this Treasury Note, which will take money out of the economy.

The Fed has all kinds of ways of getting liquidity -- money -- into the system, but dollars do not appear out of nowhere, there is always an exchange of assets.

QE is basically monetizing existing debt. Most of the QE was buying illiquid but government-guaranteed assets which juiced the money supply with new money into the system, much of it just parked in treasury issues for the safe yield.

I am far, far from an expert in this area so this is just my general understanding.

ok .. I follow thus far .... so, who tells the treasury to start printing and how much to print?

dollars do not appear out of nowhere, there is always an exchange of assets. ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Of course they do. The T-bills which they get from the Treasury are also freshly printed.

Every time you go to the bank and get a mortgage, that's money created out of nowhere.

who tells the treasury to start printing

that's more a vault cash issue. I assume some % of the required bank reserves -- money the bank has that cannot be lent out -- can move to/from vault cash in the bank and electronic record at the Federal Reserve. When the Fed needs more cash to send to banks, it gets it from the Treasury, and pays just the cost of production, not the face value.

Every time you go to the bank and get a mortgage, that’s money created out of nowhere

Yes and no. Technically the bank is lending out their depositors' money. If the loan goes bust and the underlying asset can't repay the loan, somebody has to take a monetary loss somewhere.

But what did happen of course is that the check the buyer gave to the seller becomes the seller's cash when deposited in a bank and the money supply therefore increases by the amount of the loan.

What the Fed did with QE is just take over a trillion of assets on its books. Since it doesn't really care if it loses money losses it takes will just reduce the amount of money in "earnings" it makes on its operations as the nation's system of central banks. The NY FRB is the most leveraged here but can call on help from other FRBs.

Would you kindly fedex whatever you're smoking? C-S has been FLAT since December. Scroll up and look at the graph if you don't believe me. the $8000 pulled demand into that plateau and loan volume from May is at 1997 lows.

Now, interest rates are going to be the driver more than anything and it wouldn't surprise me to see 3.5/4.5 rates on 15/30 money.

Case-Shiller admitted that their seasonally-adjusted prices have not been accurate due to a failure in their model.

Current house market conditions are exactly what we had back in 2005/2006 when prices stalled and sales volume dropped precipitously. It is a classic standoff between the buyers and sellers. Sellers pull inventory off the market, hoping to come back when the market is stronger. Buyers are waiting out for lower prices. Unfortunately for sellers they are going to lose, again.

The crash of 2007/2008 skewed the seasonally-adjusted computation, because C-S uses 3 years worth of data, and a normally strong season of spring, back in 2008 was weaker than the weakest season of winter.

Accurate or not, prices DO fall (or moderate) every year in winter and DO surge in spring and summer.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Yes, so if nominal prices are flat in the spring (where they should be up, normally), that means that seasonally-adjusted prices should be even lower, not higher like S-P is showing. Because of the last 3 years, where spring had lower prices than winter, S-P formula has switched to adjusting higher instead of adjusting lower.

I stated a fact that isn’t subject to interpretation

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

So, what precisely is the document you used to make a statement "Even the bear rallies during the Great Depression never lasted more than 6 months"?

It makes predictions that homes selling in the 1930s and 1940s for $4000 should be selling today in the $80,000 range after being corrected for inflation.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

And why is this wrong? If you assume an 80% decline in prices, like I previously said, you arrive exactly at the $80,000 figure.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Did you even look at the top of that chart? It sais $INDU, which stands for Dow Industrials. I told you before that the housing market moves a lot slower than the stock market, so a 6 months rally in the stock market, corresponds to a 2 year rally in housing. The rally we had in housing so far, only lasted 9 months (Feb-Nov), and then it stalled.

Because that chart gives prices in 1940 @ $4000 and prices in 2000 @ $80,000………………..

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Where on that chart do you see the actual formula which was used to compute inflation adjustment?

No, Case-Shiller measures deviation from inflation adjusted mean (or fair-market value). All this is saying is that a house (not a home), was 20% below fair-market in 1940, and 20% above fair-market in 2000. So, why is that so hard to believe? Are you saying that it should be much more than 20% deviation in 2000? If that's true, then, prices should fall even more.

Without lower rates, I just don’t see any potential for housing getting more expensive, outside of Fortress areas, which have their own private economies.

Maybe, but they are not an island. More and more people are looking at the outlying areas, which are becoming much more affordable, and leaving the fortress. I have a friend that just bought in Oakland last month, after living in San Francisco for 15 years. Relative value for money will be a drag on fortress pricing for years.

Also:

Sounds like a strengthening market in the Bay area, doesn't it? Take the 94132 zip code in San Francisco. The median sale price was $720,000 in April, 75% higher than April 2009.

When you look at the details, however, the picture is quite different. A review of this zip code on trulia.com shows that 87 of the 120 listings on June 9 were foreclosures. Although we cannot tell how many of these April sales were foreclosures, MDA DataQuick reported that 30% of all sales in the Bay area were foreclosures and Radar Logic found that 31% of all San Francisco sales in February were foreclosed homes . Clearly, a majority of the sales in this zip code were either foreclosures or short sales and that is also the case for the rest of San Francisco.

With such a high percentage of "distressed sales" in San Francisco, you might be surprised that the median sales price has been rising over the last year. Here is why. As early as July 2009, an important study from zillow.com had reported that 30% of all foreclosure sales nationwide in the previous month were houses in the top third tier of home values in their local market, up from only 16% three years earlier. Foreclosures had steadily moved up from lower priced homes to expensive ones. If you take a look at San Francisco foreclosed properties on realtytrac.com, you will see that this is certainly the case with San Francisco foreclosures. The website is littered with homes that have mortgages of $500,000 and more.

I remember a few years ago when almost everybody believed that forecloses would NEVER be a significant factor in San Francisco real estate. (everybody is high income, there is no sub-prime here, blah, blah, blah....) Well, it's not longer true, and it's just getting started.

Sure thing. Here is one:

http://www.zillow.com/homedetails/3129-Linden-St-Oakland-CA-94608/24740065_zpid/

On sale now for $92K (probably worth as much back in 2000).

Here is the ad for house in Oakland back from 1941 ($4,250):

You are right. Oakland is not a good comparison, because this area went from rural to urban. Let's take a house in Appleton, WI. $6,650 in 1942, sold in 2007 for $93K. The house was built in 1939, so it was brand new back in 1940.

http://www.zillow.com/homedetails/616-S-Locust-St-Appleton-WI-54914/69767697_zpid/

And, if you don't like this one, you will find plenty more examples in Appleton for the same price.

The focus by professional RE crowd is foreclosures,inventory, and its impact on resale pricing but Calif has been driven by move up buyers into new construction higher end housing the past 30 years. The new home construction business in Calif looks dead without move up buyers in volume (think big down payments) or cheap available credit (interest only loans) then most of the traditional new Calif housing market has vanished. Urban sprawl defines Calif and without significant new housing construction what remains is a new market dynamic based on resale homes were half the inventory is distressed so its not bearish or bullish just another change in market dynamics.

It would seem to me that this is a function of housing distress moving up market, for two reasons:

First, the loss per foreclosure is going to be greater. Last year, we were still in tail end of the subprime collapse, where the outstanding balances were lower. The bank that would lose $500K by foreclosing on 3 homes in 2008-2009 may now be looking at losing the same amount in just one foreclosure.

Second, because the foreclosures may be more upscale, the debtors may be more upscale too. When the subprime debtors fell behind, they often just gave up. Now the banks are dealing with more sophisticated deadbeats, who tell more convincing stories about how they will be able to bring their loans current if they have a little more time. And, the banks are probably more inclined to believe these stories (at least for a while), since these new debtors probably do have more options than the subprime debtors.

When you combine the better line of bullshit with the greater loss per occurrence, it makes sense that there will be a greater reluctance to start the foreclosure process.

Here is your answer E-man :

http://www.centralvalleybusinesstimes.com/stories/001/?ID=15473&source=patrick.net

"Foreclosure activity of all kinds dropped across most of California last month, perplexing the experts.

Given the percentage of delinquent home loans in California, “this drop in activity makes no sense,†says Sean O’Toole, president of ForeclosureRadar Inc., of Discovery Bay, a company that tracks the state’s foreclosure activity on a daily basis.

“I would love to say it was due to short sales or loan modifications, but I see little evidence from residential home sales, or HAMP reports to support that theory,†says Mr. O’Toole.

Increasingly it seems that the banks and the regulators that in the past have forced the liquidation of non-performing assets, “are simply waiting and wishing for a return to peak prices reached during the bubble,†says Mr. O’Toole."

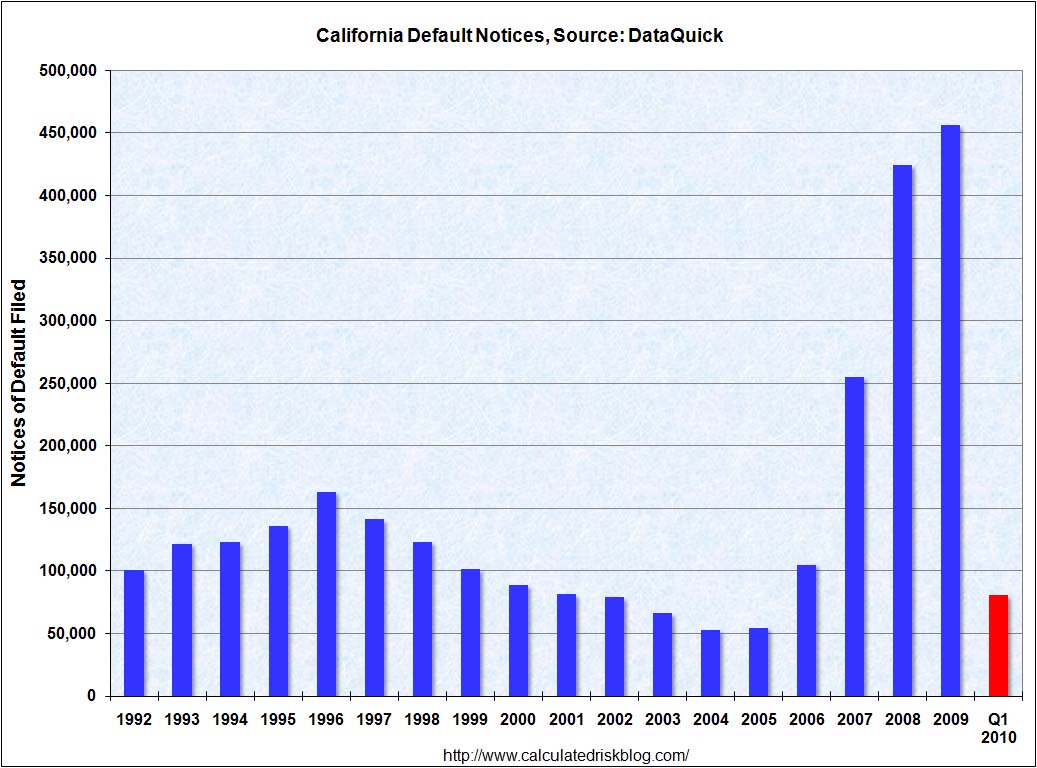

Still trying to beat a dead horse huh. This is not what the people on this board want to hear. Your comments should have been NOD up 43.3%. NTS up 35.8% and foreclosure is way up 141.3%.

Now that sounds a lot better :o)

From the perspective of someone living in NJ, that California real estate looks dirt cheap. If I want to buy a piece of crap 2 bedroom cape house with a rotting roof, tiny bedrooms, a tiny kitchen, a tiny bathroom, all of which, have not been updated since the early 60s, it's going to cost me 250k minimum, 350 to 400k in certain towns.

I'm not sure what a cape house is, but other than that, your description fits this one well, except for the price:

http://www.redfin.com/CA/Los-Altos/26-Pasa-Robles-Ave-94022/home/632537

Extend. Pretend.

I'm not really sure which bearish prediction you're referring too. Homes entering the foreclosure pipeline had to peak some time. That doesn't mean it's peaked in every region, esp. the ones slow to get started, and it doesn't mean prices are about to go up in any sustainable way.

My Ivy Zelman "classic" chart (that I have been carrying around in my wallet for the past three years) says, "Hang on, more fun around the corner".

with only 6 months past in 2010, we get this story: http://www.mercedsunstar.com/2010/06/16/1461382/property-values-in-merced-county.html#storylink=omni_popular

RE is local .... keep your eye on the ball folks.

I would guess he's referring to the ARM reset chart posted back in 2007. By that chart bottom in 2012. It's funny how if you said that in 2007 people thought you were a perma-bear nutjob.

I haven't seen that updated in a while. I kind of wonder with all the special programs and extend & pretend how it looks now too.

No need to foreclose when you can't sell the asset. You have to measure everything with incentives. The banks have a cost to foreclose like $15K or more in legal fees I think. Why do it when you'll just be stuck with the falling asset. Better to leave it in the name of the delinquent and let him/her pay the taxes and maintenance. Bankers aren't stupid. That's why they manage your money.

Its already being covered in another thread: http://patrick.net/?p=403806

I was told more houses are coming onto market in, say, Orinda and prices are getting marginally better than a year ago (e.g. from 800K to 700K). Houses stay on the market for a long time in Lafayette which probably means people expect better prices in the future. But strangely enough in quite comparable Danville houses are sold almost within a week, at least those without HOA.

Now is what it is. Comparing now to YOY is deceiving since a year ago things were total shit.

Comparing 1 year from now to now is the interesting question.

Mortgage rates higher or lower? Will FHA, FRE, and FNM even be around???

Will there be a tiers 5, 6, 7 for the long-term unemployed or will they just be f---ed?

State and local government -- spending more or spending less?

Federal government --- doing better or fallen to the Teabag Insurrection taking their government back?

Peak reset and recast is next year, btw.

Now is what it is. Comparing now to YOY is deceiving since a year ago things were total shit.

Comparing 1 year from now to now is the interesting question.

Mortgage rates higher or lower? Will FHA, FRE, and FNM even be around???

Will there be a tiers 5, 6, 7 for the long-term unemployed or will they just be f—ed?

State and local government — spending more or spending less?

Federal government — doing better or fallen to the Teabag Insurrection taking their government back?

Peak reset and recast is next year, btw.

Thanks for posting the chart. This is the latest info I've seen

It should be a law that people who say inflation should have to specify which they're talking about.

Monetary inflation? Producer price inflation? Wage inflation?

Senate couldn't get the UI extender passed this week, already. 4.8 million people are on tiers 1 through 4.

'conomy isn't going to be able to absorb these people this year, no way. 900,000 already abruptly to be soon pushed off the dole thanks to the continuing Senate fail, with another similar batch arriving every month. Gulf coast becoming a toxic mess at the start of the summer vacation season's not going to help employment, though I guess domestic tourism is something of a zero-sum so that will net out elsewhere.

As I argue here every day, it wouldn't surprise me to see gas go to $10/gallon. Milk at $5. I just fail to see how this price inflation is going to push up wages. In theory and past history, wage earners in pain go to the boss with ultimatums and get raises. That going to happen this decade???

http://research.stlouisfed.org/fred2/series/UNRATE

says otherwise, and that's WITH ZIRP

http://research.stlouisfed.org/fred2/series/FEDFUNDS

and high social spending

http://research.stlouisfed.org/fred2/series/A063RC1

and high overall spending

http://research.stlouisfed.org/fred2/series/AFEXPND

we're about where we were economically in 1982, but that was a Volcker recession, not the balance sheet recession we're in now.

Back then we had a better trade balance:

http://research.stlouisfed.org/fred2/series/BOPBCA?cid=125

and gov't spending as percent of GDP was 30% less, and gov't DEBT as percent of GDP was at a post-Depression low of ~30%, compared to 100% now.

I fail to see how anyone can be bullish on the present economy. The political system is beyond dysfunctional, FFS a Christian Dominionist /Tea Party twit is outpolling the majority leader in this election cycle.

Democratic control of the Senate is in doubt. Wouldn't surprise me if they lose it.

I see catastrophe down the road. Well, not right now, I'm now off to Yosemite to catch the sunrise. see yah!

E-man:

As those slides imply Extend & Pretend is not a long term "solution". You should also note that they've been trying Extend & Pretend for almost 2 years at least now.

How much longer do you think they can keep it up? 2 more years? 5 years? A decade? You know Japan tried the same thing and things still haven't recovered after over 20 years right?

Personally I think they've about reached the end of their rope as prices are declining in general once again despite absolutely incredible market support via the GSE's, rule bending, and straight up bail outs. Oh they can continue to slow the losses with more mortgage moratoriums (I personally don't see a bottom until 2015 or 2016), but stopping them is out of the question on either the high, mid, or low range homes.

It doesn't matter what the government tries to do, people can only afford to pay only so much given their wages. Wages are still declining while things are getting more expensive, while services are being cut, and while they're being taxed more. On top of that people in general are _overloaded_ with debt.

Did you know that DTI's of 40% are common these days on so called "prime" loans? This alone guarantees that we'll be seeing higher than normal levels of defaults for years to come.

You gotta be crazy if you think we've seen a bottom in an economic environment like that. We're looking at our own version of the Lost Decade, a low key but looong term Depression is the best we can hope for at this point.

... "denial" ....... "floats your boat" ..... lmao, where is Mikey on this one?!

It should be a law that people who say inflation should have to specify which they’re talking about.

Monetary inflation? Producer price inflation? Wage inflation?

Senate couldn’t get the UI extender passed this week, already. 4.8 million people are on tiers 1 through 4.

Sorry Troy, Buth these same people havent a clue regarding push-pull inflation.

The Truth is out now. The FED colluded with the banks to keep inventory off the market, while they goosed up the bank reserves. Any talk of any kind of a recovery in the house market, is just plain silly, and equivalent to a boxer who has just been KO's, still waving his gloves in the air:

http://truthiscontagious.com/2010/06/16/the-next-housing-crisis-2?source=patrick.net

I personally think it's already a bottom for real estate as well. Prices will always be a mortgage with the same payments (excluding property taxes) as renting, with a 20% down payment or so.

In other words, I agree that low interest rates will cause higher home prices. The only thing that prospective buyers would need to worry about are rent prices.

Cash buyers (or flippers I should say) need to be careful that they are not in the process of flipping when interest rates rise.

They also need to be aware that their potential buyers are all the prospects that they have beat out with their cash offers (or not) on that property. You can be sure as hell that once the properties get relisted after renovation, that there will be negative comments from both buyers and buyer agents.

Interest rates will not rise. Kondratieff winter clearly states:

Rates fall, then they rise again, then they fall much lower:

The FED can no longer lower rates, they ran out of ammunition to prevent K-Winter. But they cannot raise them either.

> Do you realize that people invested in bonds VERY NEARLY lost every penny they had in 2008?

You must be talking about MBS bonds, not the T-bills. People who had T-bills (those are the savers that I am talking about), actually made money. The MBS bond holders should have lost every penny they invested. Instead the FED transferred their losses to the tax-payers, in fact just delaying the inevitable dooms day. You speculators got a great present from the FED in 2009, you got one last chance to get out, lick your wounds, and start all over. But, since you are a greedy SOB that you are, you will not take this chance. You learned nothing in this crash of '08, and you will be paying the piper for a long time to come.

« First « Previous Comments 2,732 - 2,771 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,250,071 comments by 14,908 users - AmericanKulak, Patrick, Tenpoundbass online now