Thread for orphaned comments

2005 Apr 11, 5:00pm 199,205 views 117,730 comments

by Patrick ➕follow (61) 💰tip ignore

« First « Previous Comments 45,937 - 45,976 of 117,730 Next » Last » Search these comments

I'm glad you understand my point.

I don't have hardly any emotion about the degree to which you do not understand my point.

There will be no "Reaganesque figure". Research indicates that immigrant communities which will grow as a total share of electorate reject small government conservatism aka fewer services/safety nets via smaller government. Latino and asian communites want the government to take an active role in realms of health care, entitlements and environment. They primarily vote on fiscal issues and cannot be picked off via wedge issues such as abortion, gun control, etc. In essence, small government conservatism predominantly appeal to white voters and due to demographic trends it will be extremely surprising if such a candidate is elected for president going forward. Also, it is very likely that texas will turn blue in 15 to 20 yrs which will likely to be a final nail in GOP coffin in terms of presidential aspiration if GOP sticks to small govt conservatism formula.

The cost of debt IS inflation plus risk premium

And when long term money can be borrowed for the same as expected inflation, or even less ? What does this do to prices of capital assets.

I'm telling you what history says

No you aren't.

If I show you a significant period when housing was going up when mortgage money was getting dramatically cheaper, you'll say it doesn't count because incomes were going up. Those significant periods of time exist, and it's more than extremely obvious I'm right.

Give it up man.

When was the last time interest rates increased for a sustained period? What did housing prices do?

When was the last time LT interest rates dropped for a sustained period?

What did housing prices do?

In the period you refer to interest rates were rising along with perceived high inflation in everything (not just asset values).

During the protracted period when interest rates were dropping it was not deflationary except during recession, and even then incomes weren't dropping except due to layoffs.

Can you put this all together?

The BLS shows 288,000 more jobs. There are 445,000 unaccounted for? Maybe fell off the employment charts because their unemployment ran out?

And when long term money can be borrowed for the same as expected inflation, or even less ? What does this do to prices of capital assets.

Long term money cannot be borrowed for less than expected inflation. Inflation may turn out to be higher than expectations, but the long term bond market is telling you what the long term inflation expectation is right now.

The yield curve even tells you when the market expects inflation to pick up.

At that rate, they'll have the UE rate down to 4% by the Nov. elections...

Like any other index (eg, CPI)...tell a story...get elected

From Mish:

abor Force Factors

Discouraged workers stop looking for jobs

People retire because they cannot find jobs

People go back to school hoping it will improve their chances of getting a job

People stay in school longer because they cannot find a job

Disability and disability fraud

Were it not for people dropping out of the labor force, the unemployment rate would be well over 9%.

Synopsis

Last month, weather-related effects were taken back and then some. This month we see a return to the divergence between the household survey and the establishment survey. +288,000 vs. -73,000 is massive. So is the decline in labor force of 800,000. That is the only reason the unemployment rate declined. All things considered, this was not a good report.

Read more at http://globaleconomicanalysis.blogspot.com/2014/05/nonfarm-payrolls-288000-unemployment.html#t7iyIhbMixfsZwp2.99

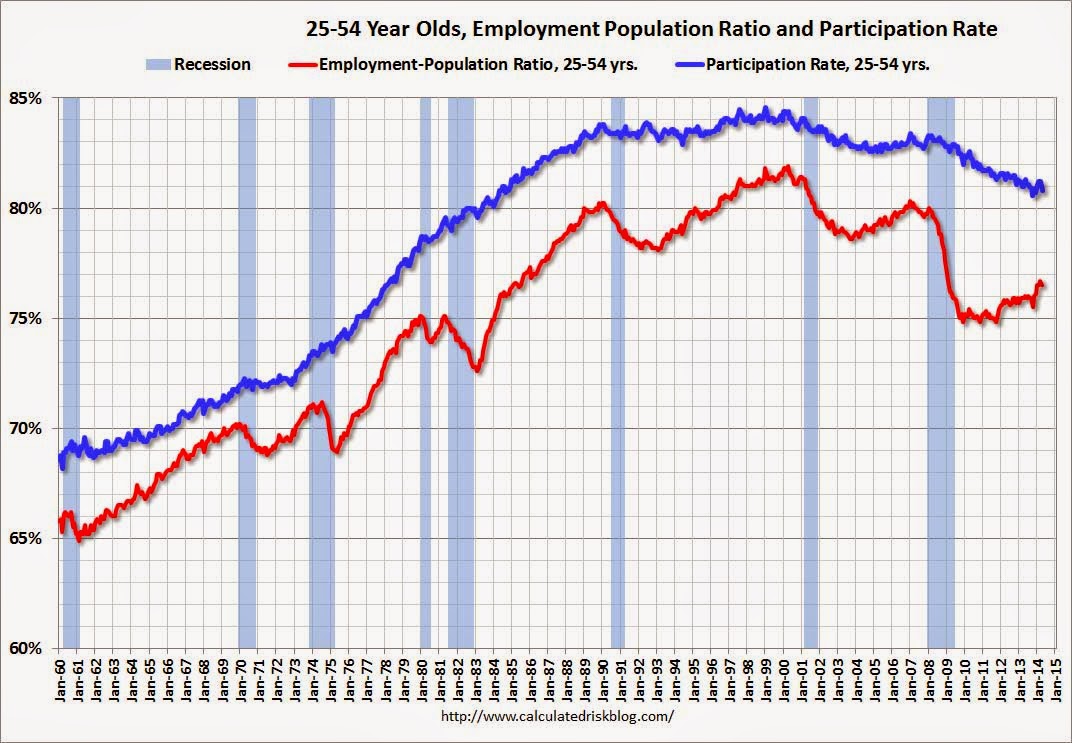

The participation rate for 25-54 is a few percents below its peak.

Where is that graph from? can you zoom it in to the past year?

by month?

So yes, it's a simple computation. But it's not a yes or no calculation.

Yes, it pretty much is. When I did the calculation over an approximately 80 year time period the correlation was positive 0.05 or so. In my mind that is no correlation.

And if you really want to get tricky you can statistically determine whether a correlation exists to a 95% confidence--that is a yes or no answer.

If I show you a significant period when housing was going up when mortgage money was getting dramatically cheaper, you'll say it doesn't count because incomes were going up. Those significant periods of time exist, and it's more than extremely obvious I'm right.

I will do nothing of the sort. The only caveat I'll say is that you have to choose a large enough time period to make for a proper calculation. If you do so, I am very confident that you will find a different answer than you think you will.

Btw, I wonder if Tat thinks there is a correlation between what happened in the stock market from 1982 to 2000, and what happened to LT interest rates.

Of course there is. I've never done it, but I'm quite sure if you did the calculation you'd find that a pretty strong correlation exists between stock returns and interest rates.

Inflation may turn out to be higher than expectations, but the long term bond market is telling you what the long term inflation expectation is right now.

This is debatable. But I can only handle being in one extremely stupid debate at a time. What you say is usually true, but many including I would argue not always. These are unusual times. Can you say QE ?

I used to believe what you say here. But in recent times I have come to see markets as more "rigged" than I used to. Also, markets, including the bond market can get out of whack do to things like, flight to quality, QE, strong international currency imbalances, what currency is the the worlds reserve currency and so forth. So I think your statement is an oversimplification. The bond market is a market, that takes many things in to account (besides inflation).

When I did the calculation over an approximately 80 year time period the correlation was positive 0.05 or so. In my mind that is no correlation.

So we may finally get to an understanding, and lets say you get to feel you're right. I'm pissed that it's so fucking stupid, and that we got to this with such difficulty.

Sometimes there is a very strong negative correlation between RE prices and interest rates. Sometimes there is a very strong positive correlation. It's even pretty simple to explain the conditions for both.

By "sometimes" I mean time frames of multiple decades or more.

You interpret this as no correlation. Since in your view the periods of strong positive correlation cancel out the long periods of negative correlation.

I view this differently. There is no absolute answer to this. But I consider 15 to 30 year time frames significant, and I believe that understanding why there is a positive correlation (when there is), and why there is a negative correlation when there is are both extremely easy.

Furthermore, I acknowledged that a period coming up, when and if inflation kicks in, could be one of the positive correlation times. But given the bizarre mix now, I'm not sure at all. A lot does depend on the bond market.

But I'm very happy if you go away feeling vindicated and that you won the argument.

call it crazy, it's worse than that but you've got the concept right.

captain, I haven't used Turbotax, I have used "Taxcut" for years, lately they call it "HRBlock" but there are numerous questions and explanations I saw in it.

One thing that I liked is you can be in the program and you can download from vanguard or similar all your data, it did actually work so I didn't have to go through 1099's and stuff. I checked it and things went into the correct boxes.

Here's how housing and interest rates have gone over the last 30 years or so, which I believe Marcus referred to. I adjusted the Case-Shiller data to account for inflation. Inflation was done yearly, but it averaged to about 2-3%.

edited to fix chart

Here's how housing and interest rates have gone over the last 30 years or so, which I believe Marcus referred to.

Why inflation adjusted RE prices ? That wasn't my point. In fact interest rates dropping when inflation exists is one of the primary conditions leading to a period when interest rates are very negatively correlated with RE prices (such as the period in your window.

Although the correlation can even be seen there (not including the aberration of 2007 - 2012). Maybe some will want to plot RE prices against Interest rates to see the correlation. But it is obvious.

I'm pissed that it's so fucking stupid, and that we got to this with such difficulty.

OK--I don't think it's stupid at all. IMO, this is an important topic because many people on here assume that as interest rates rise, house prices are going to crater or at least fall in nominal terms. But when you look at what happens historically, this is anything but certain. That's the point I wanted to make.

I chose to adjust for inflation, because RE prices have gone up in every 30 year period you can think of. This is because RE generally goes up with inflation. Adjusting for inflation is a way to remove this fairly well known appreciation effect.

Although the correlation can even be seen there (not including the aberration of 2007 - 2012)

You can't just exclude the part of the data that don't agree with your theory.

So, while interest rates have gone from 10 down to 4%, national housing has been volatile but has gone with inflation give or take. I picked the years, b/c that was where the CS data started. I'd say that over this period, housing has been pretty immune to the large change in interest rates.

If you stop worrying about black swans and this time it's different yada yada, you might expect that housing will continue to follow the 3% inflation + - 10 or 20%.

Why inflation adjusted RE prices ? That wasn't my point.

Although the correlation can even be seen there (not including the aberration of 2007 - 2012). Maybe some will want to plot RE prices against Interest rates to see the correlation. But it is obvious.

Not to continue this well past the point of interest, but looking at the graph, interest rates pretty much fell for 30 years straight. Home prices went up for 5 years, down for ~10 years, then up for 10 years, down for 3-4 years, then flat for 4 years.

How do you conclude there's a correlation there?

many people on here assume that as interest rates rise, house prices are going to crater or at least fall in nominal terms.

This can happen and in fact should, with all else being equal. If interest rates were to rise dramatically for reasons other than inflation expectations, then housing prices would drop. And even if interest rates are going up because of inflation expectations, at some point the fed might repeat what Volker did which would put the kabash on RE appreciation (at that point).

Also, what if inflation and interest rates are going up, but incomes aren't, as they were last time inflation and rates were rising a lot ?

It's really hard to say. But I've had enough experience trading to know that I don't know.

How do you conclude there's a correlation there?

Jeez.

**To see correlation you would plot say interest rates on the horizontal axis and RE prices on the vertical and take time out of it.

I will acknowledge that the 2007 - 2013 data obfuscates it. Am I cherry picking, or is this an extremely anomalous time ? You decide.

But if you did what I said ** using data from 1983 - 2006, you would see a very nice downward pattern and a VERY significant negative correlation.

Do the same from say 1950 - 1980, (strongest 1968 - 1980) and you would see a very nice positive correlation.

Maybe the question is, why do people on Patnet expect that we will have high interest rates in the absence of any inflationary pressure?

Do you have such expectations Marcus? I've not read any convincing argument around here.

Even if we were to have mortgage rates increase without any other changes, the net effect would not necessarily be lower prices. Buyers would not want to buy at current prices, because monthly payments would increase. On the flip side, sellers would either not be able to sell at reduced prices (mortgage) or not want to sell at reduced prices. After all, sellers still have their low interest rate loan locked in, and their monthly balance is based on their locked in rate. So, you would have a slow down in sales, but prices might not be so predictable.

But if you did what I said ** using data from 1983 - 2006, you would see a very nice downward pattern and a VERY significant negative correlation.

You'd be wrong. Look again-from 1987 to 1997, there is a very slight positive correlation--rates down, prices down. IMO, the period from 1997 to 2006 is the anomaly.

What I didn't like was the TurboTax just whisked me through, I had a W2 and a 1099. It filed them separately, which I ended up doing the the W2 first. I can't help but think a tax professional, I could have talked to him and discussed the order in which we filed. With the successful war on families and women, I would have liked to explored filing single, head of household, or jointly. My wife never worked, we always filed jointly, and it was always a no brainer.

The IRS hates families and people who are trying to get ahead, there's just new rules, it's not cut and dry anymore. You use one of those software apps, and sure it will present questions but it will never have insight to your scenario, when you don't have any guidance to chose the areas that it presents.

If this was 6 years ago, using any software would have been fine, as the rules were pretty static when Bush was in office. It wasn't a new surprise every tax season, while he lied and said taxes never went up. The only surprises was sending people out even more money they didn't ask for nor need.

I imagine it's like traffic court. You pay the ticket clinic $80 bucks and you never hear a word about that ticket ever again. You go to court your self, and you'll be fined $150.00 court cost.

I'll just pay the tax pros $300 but they'll save you more than you'll pay.

There will be a Reaganesque figure emerging after Obama leaves office in 2016.

God I hope not, Reagan/Bush I presided over more than tripling of the national debt both in real numbers and as a percentage of GDP. Reagan made Bush II and Obama look like misers. Thanks but no thanks to that.

Considering the debt rung up by republican presidents in 20 of the last 34 years, I want to know what small government conservatism formula are we talking about?

There will be a Reaganesque figure emerging after Obama leaves office in 2016.

God I hope not, Reagan/Bush I presided over more than tripling of the national debt both in real numbers and as a percentage of GDP. Reagan made Bush II and Obama look like misers. Thanks but no thanks to that.

Considering the debt rung up by republican presidents in 20 of the last 34 years, I want to know what small government conservatism formula are we talking about?

In only 5 years of presidency, Obama has already run up more national debt than all previous presidents combined. Neither Republican nor Democrat presidents reign in national debt. Government spending and appropriation bills have to originate in the House of Representatives. During Reagan years, Democrats controlled the House, whereas nowadays Republicans do.

My reference to the Reaganesque figure was not so much about Reagan or his policies per se, but the "Morning Again America" social dynamics recovering from the previous "malaise" in the 1970's, which was similar to what we have now.

You'd be wrong

I'm not going to do this anymore. But I'll say it again for anyone who cares or even knows what correlation means.

FACTS: On a horizontal axis put interest rates increasing from right to left.

On a vertical axis put RE price data, with higher prices higher.

Take every one of the data points that occur from 1983 to 2006 and plot them, time is irrelevant on the graph you get, (all the data points come from that time interval - but the graph doesn't tell you when.)

The pattern will not be a perfect descending line. But there will be a very clear tendency for the higher interest rate values to be associated with lower prices, and the lower interest rates to be associated with higher prices.

MY guess would be r = -.6 to -.7

You don't think that 2007 on is anomolous ? What the fuck man. You're arguing for the sake of arguing.

Sure prices being lower wasn't an anomoly, but the actual drop in prices ? That was due to a massive deleveraging financial event. Several reasons that I think we all understand.

In any case okay. You don't get it, and you like to win arguments. That's all I've learned in this debate.

In only 5 years of presidency, Obama has already run up more national debt than all previous presidents combined

The national debt was 11 trillion (all debt from previous presidents) when Obama took office. It is now 16 trillion. Please explain to me how 5 trillion is more than 11 trillion. A mind (even an am radio mind) is a terrible thing to waste.

I'm not going to do this anymore. But I'll say it again for anyone who cares or even knows what correlation means.

http://www.bankrate.com/finance/mortgages/rising-rates-lower-house-prices.aspx

http://www.forbes.com/sites/billconerly/2012/12/18/when-mortgage-rates-rise-will-home-prices-fall/

http://www.calculatedriskblog.com/2013/06/house-prices-and-mortgage-rates.html

... I'll stop there, but you can read the first couple paragraphs of each and they all say: No correlation exists between interest rates and home prices, though would by homebuyers are comforted to think they might be.

Meaning that the author, like Tat, concludes that since interest rates sometimes have a positive correlation to RE price, and other protracted periods they have a negative correlation, that therefore these cancel eachother out, and we can not therefore say there is a correlation. (Actually, like Tat, the authors may not understand this.)

I consider this a legitimate view.

I guess if it helps you, think of me as making a different point, rather than a contradictory one. And that is that over some fairly long periods interest rates have a positive correlation to interest rates. Over other significant periods there is a negative correlation.

I understand why some hold that there is no correlation.

For further understanding of the obvious, you might want to explore the ways in which future income streams are valued by the financial world. They are valued almost entirely as a function of current interest rates. Plug in a higher rate, you get a lower value. This is finance 101.

Real estate price is a multi-variable function, with at least the following input variables:

Expected rental revenue (or owner equivalent rent);

Interest rate (real interest rate discounting future cash flow);

Other costs of carry (taxes, maintenance, insurance, etc.);

Price movement momentum (e.g. mass hysteria);

particular circumstances of the property, buyer and seller.

When all else is equal, the price is of course negatively correlated to interest rate (real interest rate, having accounted for expected inflation). In real life statistics however all else are not usually equal when comparing different time periods. So its a folly to expect scientific A/B test on data that is of historical nature and not repeatable in a lab for proper isolation of variables.

Austrians are actually better mathematicians than the Keynesian idiots who are often failures at pursuing math careers.

Meaning that the author, like Tat, concludes that since interest rates sometimes have a positive correlation to RE price, and other protracted periods they have a negative correlation, that therefore these cancel eachother out, and we can not therefore say there is a correlation.

They don't cancel each other out, they show that there is no correlation. I'm thinking maybe you don't understand what the term means:

correlation /cor·re·la·tion/ (kor″ĕ-la´shun) in statistics, the degree and direction of association of variable phenomena; how well one can be predicted from the other.

The key is the 2nd sentence. How well can one be predicted from the other. As you say, sometimes there is a positive relationship, sometimes negative. No predictive power.

The pattern will not be a perfect descending line. But there will be a very clear tendency for the higher interest rate values to be associated with lower prices, and the lower interest rates to be associated with higher prices.

MY guess would be r = -.6 to -.7

And I'll tell you that you can't do that because inflation will overwhelm your signal. You'd get a much better correlation between time and price.

You should look at price change % vs. interest rate. When I did that, it came out at r = +0.015 or so.

For further understanding of the obvious, you might want to explore the ways in which future income streams are valued by the financial world. They are valued almost entirely as a function of current interest rates. Plug in a higher rate, you get a lower value. This is finance 101.

Why do you keep bringing this up? Houses aren't like stocks and bonds--that's the point here.

Meaning that the author, like Tat, concludes that since interest rates sometimes have a positive correlation to RE price, and other protracted periods they have a negative correlation, that therefore these cancel eachother out, and we can not therefore say there is a correlation. (Actually, like Tat, the authors may not understand this.)

Like Tat says, there is no long term correlation. There is only noise, and random fluctuations that you are trying to assign meaning to. You are failing to see the forest for the trees.

marcus says

I guess if it helps you, think of me as making a different point, rather than a contradictory one. And that is that over some fairly long periods interest rates have a positive correlation to interest rates. Over other significant periods there is a negative correlation.

No one is denying that you can find time periods where there are positive and negative correlations. The price changes in these periods were not driven by the interest rates. They are just noise. If they were driven by interest rates, they would all be correlated in the same direction. We are stating that on the whole, historical data do not in any way back up your claim that an increase in interest rates will cause prices to decline.

For further understanding of the obvious, you might want to explore the ways in which future income streams are valued by the financial world. They are valued almost entirely as a function of current interest rates. Plug in a higher rate, you get a lower value. This is finance 101.

So, a net present value calculation uses a discount rate to discount the value of future cash streams. The expected cash flow is in the numerator and the discount rate is in the denominator. No one is arguing these basic facts. Most are arguing that the discount rate never changes independently from the cash flow. In fact, there are other forces that make the expected future income stream correlated with the discount rate. Things are a little different for a cash investor, where the discount rate is tied to the expected rate of other investments (opportunity cost) and the leveraged buyer, where most of the discount rate is tied to a mortgage cost.

The net effect of all of this over long enough time periods is apparently that there is no significant correlation between mortgage rates and house prices.

Maybe the question is, why do people on Patnet expect that we will have high interest rates in the absence of any inflationary pressure?

So, I ask again, why do you think that we will have high interest rates in the absence of inflationary pressure? I'm using the term interest rates generally to include mortgage rates and expected returns on investments. The inflationary pressure would cause expected cash flow to increase in the future. You keep acting like we need to understand a net present value calculation, but you ignore the relevant questions about how it works.

No one is denying that you can find time periods where there are positive and negative correlations. The price changes in these periods were not driven by the interest rates.

I didn't say they were. What's that saying about correlation and causation ? IF anything (and quite obviously), the positive correlation occurring in the seventies with inflation actually driving interest rates, is something I'm pretty sure even idiots don't deny.

So, I ask again, why do you think that we will have high interest rates in the absence of inflationary pressure?

I didn't say I think we will. And in fact I'm not predicting that.

You keep acting like we need to understand a net present value calculation, but you ignore the relevant questions about how it works.

Because only a total fool would deny this. It affects valuations of income streams and it also affects the monthly payment a family can afford to make.

During a protracted period when inflation was bound to a range of 2 to 4% and yet LT interest rates were dropping further and further, especially the part of the drop that was from say 9% to 5%, in the absence of deflation with steady low inflation, this was extremely highly correlated with rising RE prices, for this period, for incredibly obvious reasons I have described more than once.

The other long period when interest rates were rising (pre 1980), I think you'll find many who say that this correlates with increasing inflation, and since most even define interest rates as having an inflation premium this in no surprise. Need I argue why inflation and rising house prices are correlated over significant periods of time ?

This argument is so stupid.

Some might argue that there is no single trend in interest rates during last 60 years. They wouldn't be wrong. Some will argue it's a random walk.

Another person might say, that the way they look at it, there was 30 year period or so of an up trend, and a clear 30 year period of down trend.

Housing prices were trending up most of the entire time.

SO anyone that wants to argue that there isn't a positive correlation between interest rates and RE prices during the first period, and a negative correlation during the second period, is either a total idiot, or they don't understand what correlation means.

(again - I'm not saying the people who claim no correlation are wrong. They are no more wrong than the people who say there is no single trend in interest rates the past 60 years)

Yes, I've drifted off in to talking about both 30 year periods being understandable, (especially key parts of each period) but that was not my primary argument.

I'm done with this.

Housing prices were trending up most of the entire time.

Housing prices have been trending up for all times. Clearly it's NOT correlated with interest rates. I really don't think you know what correlation means.

« First « Previous Comments 45,937 - 45,976 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,251,310 comments by 14,921 users - mell, Patrick online now