Housing Market Sure to Double-Dip: Whitney

2010 Mar 16, 3:31am 23,523 views 90 comments

« First « Previous Comments 13 - 52 of 90 Next » Last » Search these comments

Yes many properties are being bought out with cash. But I think many of these all cash purchases are made by house flippers.

And that is what is left, flippers buying between themself without any real end users, horse trading!

Exactly. Slowly these buyer market for all cash flippers will wane and another tipping point in RE market will be the saturation of these properties ready to be flipped. Throw in the ARM resetting(especially in CA for next 2-3 years), regular mortgage going sour and strategic defaults. Happy days are ahead of California housing market. Cheers!

Yes many properties are being bought out with cash. But I think many of these all cash purchases are made by house flippers.

And that is what is left, flippers buying between themself without any real end users, horse trading!

I am seeing quite a few of these types. Cash offer, splash a new paint, bought for 350K and listed for 520K, waiting for a sucker. You gotta love the realtwhore description on those listings: "NOT A SHORT SALE OR REO, New carpet, New paint..blah..blah..as is sale"

Oh..yeah..if its as-is sale, why the hell would I buy from you, I would rather buy from bank..Happy days are ahead indeed.

The expiration of the $8k credit should not have any impact on higher end houses since, if you can afford that kind of house, you most likely don’t qualify for the credit since your income is too high.

This likely explains why the only houses that are selling in Portland are those at the low end, less than $250K. Sure some folks with big $$ are getting great deals at the high end but very few can pull off the financing. Early on the local realtors were blaming 'folks sitting on the fence' but it seems clear to me that given our unemployment numbers and the fact that prices are still way out of whack with incomes, it's more than just folks sitting on the fence waiting for prices to drop....folks just can't afford those $300K+ homes.

The expiration of the $8k credit should not have any impact on higher end houses since, if you can afford that kind of house, you most likely don’t qualify for the credit since your income is too high.

Another thing to mention about Portland's market though I don't think we are unique in this regard... the $8K credit would assist the 'move-up' buyer though the feeling around Portland is that those that sold aren't moving up but renting or leaving town, did I mention our crappy unemployment numbers?!

I am a landlord for 30 yrs, also real estate investor and mtg broker, I am in 100% forclosure due to govt. policies on lending and banks that dont care. If you think you have seen something with all these forclosures, just wait. Prices will go a lot LOWER as the years go on. No way out,RENT ONLY.

@warblah/sarrodda

A wage increase or increase in borrowing is not required for inflation (or rather hyperinflation) to occur, the Fed says that but it isn't true. Just look at what happened in Argentina or Zimbabwe or Weimar Germany. Inflation and/or hyperinflation can also occur if a central bank screws up its monetary policy, or decides to purposely devalue its currency in order to inflate away debt. Remember, the Fed doesn't even have to print money, only electronically sell/buy a few dozen trillion dollars worth of bonds back and forth between it and the Treasury. Tadaaa inflation!! Yes, that is an extreme example, but I would point out they are already doing essentially that with QE, just on a smaller scale. Also bear in mind that they're throwing lots of money at the GSE's, who are lending out even if the banks aren't right now.

It should be noted that while there have major deflationary forces due to large amounts of debt being defaulted on that the rate of inflation still hasn't gone negative yet. We had a drop in the rate of inflation (disinflation) for a while around the start of 2009, and the drop was to a rate that was still positive, but then it went up again.

"I am a landlord for 30 yrs, also real estate investor and mtg broker, I am in 100% forclosure due to govt. policies on lending and banks that dont care."

No, your in foreclosure because your a speculator who gambled and lost. If I lose all my money in Vegas, Barney Frank is not to blame. Nor is Goldman Sachs. I am to blame.

I'm going with stagflation.

A “correction†in bonds will look like a big spike in interest rates. I doubt that will drive real estate prices much lower since all the transactions I’m watching currently are being made with cash.

Don't think of it as real estate prices being driven lower, you have to think of real estate as a whoopee cushion in the immanent shadow of a big fat ass.

Let's get at the coalface: real estate, which is essentially a discretionary consumer good, must eventually reconcile with the reality of diminishing middle class incomes. It's either that, or the government grubstakes the house buying public forever. THERE ARE NO OTHER ANGLES YOU CAN COME AT THIS FROM.

I also see a problem with public perception. if you consider what some of these same places/parcels went for ten or fifteen years ago, the asking prices/assessments in most parts of the country are still batshit, which means the mentality on both the part of the seller AND buyers is still very much out of whack. Ten years ago, a quarter million bought you a veritable spread in most parts of the country. But it's now etched into the mindset that this is the lower end of housing. Have wages/salaries gone up in stride with that perception? NO! In a normal market, the only buyer willing to overpay by 15% (without the help of Uncle Sam) is the well-heeled architecture nut trying to buy some rare architect designed/built home.

I am a landlord for 30 yrs, also real estate investor and mtg broker, I am in 100% forclosure due to govt. policies on lending and banks that dont care. If you think you have seen something with all these forclosures, just wait. Prices will go a lot LOWER as the years go on. No way out,RENT ONLY.

Sorry to hear about your losses. What happened, exactly? Did you take out HELOCs on your properties?

These days, there are no landlords - only speculators using tenants as placeholders while they wait for their day in the sun.

20% of jumbo loans in CA are in default or foreclosure as of Feb. according to Fed numbers. Most of that spike took place in 2009. Lenders are being very slow to take back properties.

If you're bullish on mid-high end housing at this point you have your head in the sand.

I don't see anything could possibly sustain the housing price at this point. Be wise, don't buy the bubble.

Many think we are following Japan's path. We may be following Argentina's. http://topdocumentaryfilms.com/argentinas-economic-collapse/

I agree. A currency crisis is coming. I think rates will skyrocket to double-digits. I don't believe that they will allow the currency to go to zero. Before then, they will probably have a new currency available. Maybe it's the new global currency they are pushing for? If they let the dollar to go to zero, everyone will be debt free. I doubt they will allow that to happen.

The expiration of the $8k credit should not have any impact on higher end houses since, if you can afford that kind of house, you most likely don’t qualify for the credit since your income is too high.

Everyone's focused on the $8k credit expiration. The larger issue w/ Bay Area homes are the expiration of QE and MBS purchases by the Fed. That will affect financing for housing over FHA/Fannie/Freddie limits.

@warblah/sarrodda

A wage increase or increase in borrowing is not required for inflation (or rather hyperinflation) to occur, the Fed says that but it isn’t true. Just look at what happened in Argentina or Zimbabwe or Weimar Germany. Inflation and/or hyperinflation can also occur if a central bank screws up its monetary policy, or decides to purposely devalue its currency in order to inflate away debt. Remember, the Fed doesn’t even have to print money, only electronically sell/buy a few dozen trillion dollars worth of bonds back and forth between it and the Treasury. Tadaaa inflation!! Yes, that is an extreme example, but I would point out they are already doing essentially that with QE, just on a smaller scale. Also bear in mind that they’re throwing lots of money at the GSE’s, who are lending out even if the banks aren’t right now.

It should be noted that while there have major deflationary forces due to large amounts of debt being defaulted on that the rate of inflation still hasn’t gone negative yet. We had a drop in the rate of inflation (disinflation) for a while around the start of 2009, and the drop was to a rate that was still positive, but then it went up again.

Couple comments here....

The Fed will never hyperinflate because it would mean the death of the Fed. Congress may try and force them to do it but even our idiot politicians know that governments tend to fall during currency crisis.

Second, the stated inflation rates are wrong. During the run-up they were dramatically UNDER-reporting inflation because they weren't correctly factoring in housing costs. Likewise they are currently OVER-reporting inflation for the same reason.

Until all this money actually enters circulation we won't have meaningful inflation. And at the end of the day, the banks don't want to lend and people/companies don't want to borrow. So for the foreseeable future all that printed money will be sitting in bank vaults or on reserve w/ the Fed.

Buy when everyone is selling. Sell when everyone is buying. It always worked for me.

So how are your Enron and Bear Stearns shares doing? I love contrarians, they are useful to have on the other side of my trades.

@warblah/sarrodda

A wage increase or increase in borrowing is not required for inflation (or rather hyperinflation) to occur, the Fed says that but it isn’t true. Just look at what happened in Argentina or Zimbabwe or Weimar Germany. Inflation and/or hyperinflation can also occur if a central bank screws up its monetary policy, or decides to purposely devalue its currency in order to inflate away debt. Remember, the Fed doesn’t even have to print money, only electronically sell/buy a few dozen trillion dollars worth of bonds back and forth between it and the Treasury. Tadaaa inflation!! Yes, that is an extreme example, but I would point out they are already doing essentially that with QE, just on a smaller scale. Also bear in mind that they’re throwing lots of money at the GSE’s, who are lending out even if the banks aren’t right now.

It should be noted that while there have major deflationary forces due to large amounts of debt being defaulted on that the rate of inflation still hasn’t gone negative yet. We had a drop in the rate of inflation (disinflation) for a while around the start of 2009, and the drop was to a rate that was still positive, but then it went up again.

Couple comments here….

The Fed will never hyperinflate because it would mean the death of the Fed. Congress may try and force them to do it but even our idiot politicians know that governments tend to fall during currency crisis.

Second, the stated inflation rates are wrong. During the run-up they were dramatically UNDER-reporting inflation because they weren’t correctly factoring in housing costs. Likewise they are currently OVER-reporting inflation for the same reason.

Until all this money actually enters circulation we won’t have meaningful inflation. And at the end of the day, the banks don’t want to lend and people/companies don’t want to borrow. So for the foreseeable future all that printed money will be sitting in bank vaults or on reserve w/ the Fed.

100% of fiat currencies fail. It's just a question of when.

Buy when everyone is selling. Sell when everyone is buying. It always worked for me.

100% of fiat currencies fail. It’s just a question of when

Actually, the truth is 100% of non-fiat currencies fail. History has shown this to be true.

100% of fiat currencies fail. It’s just a question of when

Actually, the truth is 100% of non-fiat currencies fail. History has shown this to be true.

Can you give a few examples?

Contrarian doesn't mean buying crap. It generally means you're buying something fundamentally strong, but which has been hit for the wrong reasons. Wamu might have done poorly, but buying citi, wellsfargo, boa after the massive sell off would have been pretty profitable. Wellsfargo in particular!

Contrarian doesn’t mean buying crap. It generally means you’re buying something fundamentally strong, but which has been hit for the wrong reasons. Wamu might have done poorly, but buying citi, wellsfargo, boa after the massive sell off would have been pretty profitable. Wellsfargo in particular!

IMO all the banksters were hit for the RIGHT reasons. We should have had some cleansing bankruptcies and moved on with our lives. However, they snowjobbed the media and the FedGov, who also propagandized you, that putting makeup on these corpses would fix everything. Maybe in some years from now they'll actually be viable banks again not firmly dependent on special facilities & Enron accounting tricks. All this, this is just consequence of limitless blank check backing of Treasury & Fed. Citibank in particular, just should not exist. Megabanks and Too Big To Fail needs to end.

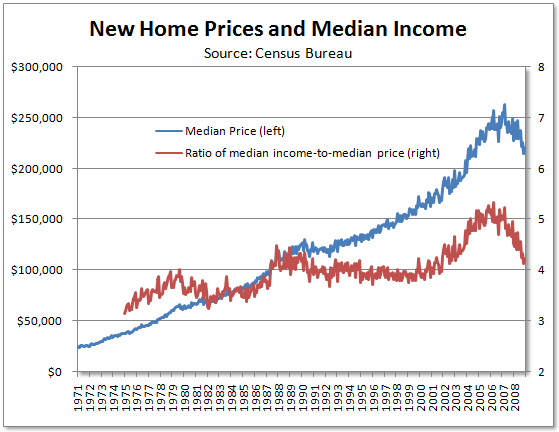

I notice the word "new" in there and that your chart stops at 2006.

Obviously used homes and overhang need to be bulldozed. Or we can

just refer to Case-Shiller which may tell a different story.

Census-based chart of new homes and add a few years is less supportive of sharecropper inevitability:

tatupu70 says

Jimmy says

100% of fiat currencies fail. It’s just a question of when

Actually, the truth is 100% of non-fiat currencies fail. History has shown this to be true.

Can you give a few examples?

Sure I could, but I think it would be easier just to turn it around. Are there any civilized countries not using fiat currency?

tatupu70 says

Jimmy says

100% of fiat currencies fail. It’s just a question of when

Actually, the truth is 100% of non-fiat currencies fail. History has shown this to be true.

Can you give a few examples?

Sure I could, but I think it would be easier just to turn it around. Are there any civilized countries not using fiat currency?

lol. Does that mean you don't know any? Civilized countries want/need a fiat currency so they can print and make the citizens pay through inflation. So what if civilized countries have fiat currency. My original post stated that 100% of fiat currency fail. What does that have anything to do with your question? It sounds like you are trying to avoid it.

Jimmy--

I just didn't want to list every civilized country on here--it seemed kind of tedious. Unless you have a different definition of failure, I'd say the fact that most countries were on a fixed standard but switched to a fiat currency that is still in use is pretty good proof.

The larger issue w/ Bay Area homes are the expiration of QE and MBS purchases by the Fed.

The end of QE has not gotten much press; I read about it first on this CR thread. Ben has (for now!) landed the helicopters. The last of the MBS purchases are being sterilized by the Treasury Supplemental; supposedly, the Supplemental Bills (56 day terms) will be paid back as the Fed winds down some of its temporary measures from the beginning of the crisis (think TAF, TALF, etc...)

grywlfbg says

Couple comments here….

The Fed will never hyperinflate because it would mean the death of the Fed. Congress may try and force them to do it but even our idiot politicians know that governments tend to fall during currency crisis.

Second, the stated inflation rates are wrong. During the run-up they were dramatically UNDER-reporting inflation because they weren’t correctly factoring in housing costs. Likewise they are currently OVER-reporting inflation for the same reason.

Until all this money actually enters circulation we won’t have meaningful inflation. And at the end of the day, the banks don’t want to lend and people/companies don’t want to borrow. So for the foreseeable future all that printed money will be sitting in bank vaults or on reserve w/ the Fed.

The Fed doesn't have to want to hyperinflate for hyperinflation to occur, AFAIK no central bank has wanted to do that.

I would agree that the current rate of inflation is incorrect, but I don't think its being overreported now, still underreported IMO.

The banks don't have to lend out the money either for inflation/hyperinflation to occur. Even if they continue to sit on the funds for the next few years while the Fed prints eventually our creditors will get nervous and reduce or stop buying our debt on the long or short end or both. They don't have to sell it, just stop buying it and we'll have an hyperinflationary or high inflationary economic crisis.

The Fed doesn’t have to want to hyperinflate for hyperinflation to occur, AFAIK no central bank has wanted to do that.

It's not central banks that cause hyperinflation, it's a governments inability to meet is interest payment obligations or refinance it's debt. If/when hyperinflation happens in the USA, it will be no different. We are nowhere near that point, though certainly doing a slow steady march toward it by not addressing unfunded liabilities.

As for foreign central banks ceasing to stop buying treasuries sufficient to induce hyperinflation, that is extremely unlikely. It would not even do much to inflation here except for imports. It would likely be a positive thing for our economy, since really what they are doing is manipulating their currency to gain trade advantage.

It’s not central banks that cause hyperinflation, it’s a governments inability to meet is interest payment obligations or refinance it’s debt. If/when hyperinflation happens in the USA, it will be no different. We are nowhere near that point, though certainly doing a slow steady march toward it by not addressing unfunded liabilities.

As for foreign central banks ceasing to stop buying treasuries sufficient to induce hyperinflation, that is extremely unlikely. It would not even do much to inflation here except for imports. It would likely be a positive thing for our economy, since really what they are doing is manipulating their currency to gain trade advantage.

Historically debt payments exceeding 5% of GDP has been enough to cause an economic crisis in 2nd and 3rd world countries. The US was always considered a sort of special case, but even then it was thought that the max possible was perhaps 10% or so. We've been well over that since mid 2009. Some sort of inflationary/hyperinflationary crisis is a given at this point, the only question is when.

The gov. needs a constant growth in debt since they're rolling over their current debt with more debt, if they can't get more debt then they can't roll over their old stuff. They will of course resort to more QE when they get to that point, but by that point they'll nearly be the sole buyer of both short and long term US debt. Also the US depends heavily on cheap foreign goods, many if not most things people need are too expensive here. If you try to kill some or most of foreign trade to boost domestic manufacturing with monetary manipulation we'll get hurt far worse since few will be able to afford to buy the goods they produce and the goods will be too expensive to try and sell over seas.

The ugly fact of the matter is that there are no good or even palatable solutions to this mess left. The best we could hope for is an American version of what is going on in Japan, at worst we slowly turn into another shitty 3rd world country.

How about reining in some debt spending, compounding with a weaker dollar which will help exports, helped with a modest recovery plus a little light inflation.

There are answers, there are solutions. This isn't doom and gloom.

Just like when the banks started falling apart, the government did something.

Just like when the housing market started collapsing, the government did something.

It might not have been pretty but it appears to have worked, but there are still a lot of people sitting here scratching their heads saying "I don't get it, why aren't we at 1998 or early prices on houses! It doesn't make sense, the world should have imploded like I calculated with no one doing anything about it.... I'm stumped!"

Historically debt payments exceeding 5% of GDP has been enough to cause an economic crisis in 2nd and 3rd world countries. The US was always considered a sort of special case, but even then it was thought that the max possible was perhaps 10% or so. We’ve been well over that since mid 2009

I'm not following. 2008 was the biggest debt service to GDP.

$451B interest paid / $14.2T GDP = 3.2%

That is nowhere near 10%. Since then interest service has dropped as people rushed to the safety of treasuries because of the riskiness of private debt.

The US sovereign debt is nothing special. It's the "biggest debtor nation" but that's mostly because it's a huge country with huge economy. Many nations have comparable debt/GDP ratios. Japan's debt/GDP is about double ours.

They will of course resort to more QE when they get to that point.

This is one of the biggest misconceptions out there. QE was not undertaken because of sovereign debt issues. Not at all. It was all about private debt, mostly in finance and mortgages, and providing massive liquidity to keep the credit system from freezing up. Had that bubble in private debt not happened, there would be no QE.

It might not have been pretty but it appears to have worked, but there are still a lot of people sitting here scratching their heads saying “I don’t get it, why aren’t we at 1998 or early prices on houses! It doesn’t make sense, the world should have imploded like I calculated with no one doing anything about it…. I’m stumped!â€

Eventually it will come down to trends, it takes time. I dont see implosions, I see on going corrections.

Civilized countries want/need a fiat currency so they can print and make the citizens pay through inflation.

You're forgetting the flip side. If citizens that hold money pay through inflation, then citizens in debt are getting an equal benefit through inflation, as their debt is inflated away. And since money supply and debt are equal, the benefit/taxation to citizens is nil.

How about reining in some debt spending, compounding with a weaker dollar which will help exports, helped with a modest recovery plus a little light inflation.

There are answers, there are solutions. This isn’t doom and gloom.

Just like when the banks started falling apart, the government did something.

Just like when the housing market started collapsing, the government did something.

Doing something isn't the same as doing the right thing. The right thing would've been to allow the housing market and banking system to collapse. Things would've been very bad for years, but I don't believe it would've been the end of everything that some think it would. And it would've allowed regular folks to start over with a clean slate while punishing those who are currently profiting from the mess they started, while allowing home prices to drop to affordable levels without the need for suicide loans and laughably loose lending. As it stand I think we're going to get the worst of both situations, the poor and the middle class will be force to take all the losses and austerity measures to pay for everything while the rich become even richer and corrupt the gov. even further.

It might not have been pretty but it appears to have worked, but there are still a lot of people sitting here scratching their heads saying “I don’t get it, why aren’t we at 1998 or early prices on houses! It doesn’t make sense, the world should have imploded like I calculated with no one doing anything about it…. I’m stumped!â€

But it clearly didn't work. Housing prices only have had a minor jump in prices that is already fading fast while sales have hardly budged. Up something like .8% or so YoY IIRC. And they blew trillions of dollars just to do that. You think that looks like success, or a recovery? I don't. You're just being fooled market manipulation by the government.

I think we'll see a recovery when we get some real job and wage growth and when prices on homes drop to something much more reasonable vs. those wages (say around 3x or less local avg. income).

I’m not following. 2008 was the biggest debt service to GDP.

My mistake I meant deficit but for some reason put debt service. Please attribute to temporary retardedness, very annoying when that happens.

The US sovereign debt is nothing special. It’s the “biggest debtor nation†but that’s mostly because it’s a huge country with huge economy. Many nations have comparable debt/GDP ratios. Japan’s debt/GDP is about double ours.

Its not the size of the economy that matters, its the debt to GDP ratio that matters when it comes to debt service and the ability to take out more debt. Yes, others have had higher or similar ratios (like Japan) for a while now. These countries are however not doing well at all, and the situation in Japan is best referred to as a low level but multi decade depression, which is hardly desirable to say the least. It should be noted that there is no end in sight to Japan's issues, and AFAIK the situation is steadily deteriorating there since they're so dependent on foreign trade which is still in the gutter. It may turn out that all they did was delay their day of reckoning a few decades, we'll have to see.

This is one of the biggest misconceptions out there. QE was not undertaken because of sovereign debt issues. Not at all. It was all about private debt, mostly in finance and mortgages, and providing massive liquidity to keep the credit system from freezing up. Had that bubble in private debt not happened, there would be no QE.

A central bank can choose to implement QE for either reason, it need not be excess private debt deflation that will force the issue. What matters is wether or not the country can sell/finance its debt, if they can't then the choice is either QE, default (QE is really a type of default but you won't hear that spoken of publicly), or implement austerity measures while raising taxes to pay down debt.

This is incorrect. If you have high inflation it becomes impossible to save, you have to spend all your money almost as fast as you get it otherwise you’re screwed

Unless of course you invest in TIPS. Or money market. I guess you can invest after all.

Rich people won’t care since the sheer size of their wealth gives them opportunities that the non-rich wouldn’t have, but the poor and the middle class will just get poorer and poorer since if they can’t save then the only way to increase their wealth is through investments (risky) or improving their wages (which is unlikely to say the least, most can never improve their wages and are essentially stuck in the same “class†for the rest of their lives*).

Wrong again. Inflation hurts the rich more than the poor.

You need a balanced approach to inflationary forces to have a long term stable economy which is what allows people to grow their wealth at a reasonable pace, and we don’t have that and probably won’t for a very long time. Maybe even decades. The ugly truth of the matter is that if you aren’t rich right now the deck is stacked against you and has been for quite some time.

Finally, something you have right. But, it's not for the reasons you outlined.

You’re forgetting the flip side. If citizens that hold money pay through inflation, then citizens in debt are getting an equal benefit through inflation, as their debt is inflated away. And since money supply and debt are equal, the benefit/taxation to citizens is nil.

This is incorrect. If you have high inflation it becomes impossible to save, you have to spend all your money almost as fast as you get it otherwise you're screwed. Assuming of course you have any excess funds to invest/save at all of course. Rich people won't care since the sheer size of their wealth gives them opportunities that the non-rich wouldn't have, but the poor and the middle class will just get poorer and poorer since if they can't save then the only way to increase their wealth is through investments (risky) or improving their wages (which is unlikely to say the least, most can never improve their wages and are essentially stuck in the same "class" for the rest of their lives*).

*http://www.nytimes.com/2006/05/25/business/25scene.html?_r=2

Consider the evidence uncovered by Paul Oyer, a Stanford Business School economist, in his recent paper, "The Making of an Investment Banker: Macroeconomic Shocks, Career Choice and Lifetime Income" (National Bureau of Economic Research Working Paper 12059, February 2006. http://faculty-gsb.stanford.edu/oyer/wp/mba.pdf). Dr. Oyer tracked the careers of Stanford Business School graduates in the classes of 1960 to 1997.

He found that the performance of the stock market in the two years the students were in business school played a major role in whether they took an investment banking job upon graduating and, because such jobs pay extremely well, upon the average salary of the class. That is no surprise. The startling thing about the data was his finding that the relative income differences among classes remained, even as much as 20 years later.

The Stanford class of 1988, for example, entered the job market just after the market crash of 1987. Banks were not hiring, and so average wages for that class were lower than for the class of 1987 or for later classes that came out after the market recovered. Even a decade or more later, the class of 1988 was still earning significantly less. They missed the plum jobs right out of the gate and never recovered.

And as economists have looked at the economy of the last two decades, they have found that Dr. Oyer's findings hold for more than just high-end M.B.A. students on Wall Street. They are also true for college students. A recent study, by the economists Philip Oreopoulos, Till Von Wachter and Andrew Heisz, "The Short- and Long-Term Career Effects of Graduating in a Recession" (National Bureau of Economic Research Working Paper 12159, April 2006. http://www.columbia.edu/~vw2112/papers/nber_draft_1.pdf), finds that the setback in earnings for college students who graduate in a recession stays with them for the next 10 years.

These data confirm that people essentially cannot close the wage gap by working their way up the company hierarchy. While they may work their way up, the people who started above them do, too. They don't catch up. The recession graduates who actually do catch up tend to be the ones who forget about rising up the ladder and, instead, jump ship to other employers.

Dr. Oyer himself never bought into the view that young people today are slackers. "Kids today," he said in an interview, "are harder working and more programmed than any kids in history." Although he is a Stanford Business School star, Dr. Oyer said, laughing, "I don't even know if I could get into college if I were competing with kids today."

You need a balanced approach to inflationary forces to have a long term stable economy which is what allows people to grow their wealth at a reasonable pace, and we don't have that and probably won't for a very long time. Maybe even decades. The ugly truth of the matter is that if you aren't rich right now the deck is stacked against you and has been for quite some time.

Edit: this is a timely article too, more recent then the other one: http://www.huffingtonpost.com/2010/03/17/social-immobility-climbin_n_501788.html?ref=patrick.net#title_permalink

Social Immobility: Climbing The Economic Ladder Is Harder In The U.S. Than In Most European Countries

Is America the "land of opportunity"? Not so much.

A new report from the Organization for Economic Co-Operation and Development (OECD) finds that social mobility between generations is dramatically lower in the U.S. than in many other developed countries.

So if you want your children to climb the socioeconomic ladder higher than you did, move to Canada.

The report finds the U.S. ranking well below Denmark, Australia, Norway, Finland, Canada, Sweden, Germany and Spain in terms of how freely citizens move up or down the social ladder. Only in Italy and Great Britain is the intensity of the relationship between individual and parental earnings even greater.

For instance, according to the OECD, 47 percent of the economic advantage that high-earning fathers in the United States have over low-earning fathers is transmitted to their sons, compare to, say, 17 percent in Australia and 19 percent in Canada.

Recent economic events may be increasing social mobility in the U.S. -- but only of the downward variety. Harvard Professor Elizabeth Warren, for example, argues that America's middle class had been eroding for 30 years even before the massive blows caused by the financial crisis. And with unemployment currently at astronomical levels, if there are no jobs for young people leaving school, the result could be long-term underemployment and, effectively, a lost generation.

@tts

The poor have debt. Credit card debt, car debt, school debt. Debt that probably hurts a lot. If inflation destroys that debt, how does that hurt them? They can't save, but they can sure get out of debt fast.

Middleclass home owners - Now inflation is eating away at their mortgages. They can pay off their mortgage way faster.

Rich - If they have money, they have to dump it fast! If they have investments holding mortgages, they have to get rid of those fast, and get assets! If they have homes, those homes go up in value, and nothing else. If they have homes with LOTS of debt, that debt starts getting erased.

If banks collapsed, new ones could take their places easily. Bankers would have a field day! If the market is empty, it's easy to create a new business. If you're competing with wells fargo/citi/boa, it's not that easy. These banks were saved, but not given much. They've been hurt by mortgages, and they'll be hurt more in the future when everything comes off their books. If inflation kicks in, they'll be hurting even more as all their hard earned good mortgages turn less and less profits.

As far as letting everyone fail and start over and "perhaps" it wouldn't have been any worse. Why take that risk? Destroying a world currency, destroying the confidence that lenders give us? Destroying consumer confidence? Why take that risk? Save things, get a black eye for doing it, but it's better than risking everything for a possible "better" solution. I'm sure you're one of those people who criticized these "risk" taker home owners for getting in over their heads, but when it comes to a risk that could hurt the country again, you're all for it, as long as it helps you. I see very little difference between your approach and the home owners who create the mess in the first place.

Unless of course you invest in TIPS. Or money market. I guess you can invest after all.

You're assuming they account for inflation properly, I don't believe they do. Money market has similar issues of manipulation.

Wrong again. Inflation hurts the rich more than the poor.

The rich have the resources to avoid the effects of inflation. At worst they'll loose a few per cent of their assets, but so what? If you've got tens or hundreds of millions of dollars you won't even notice it.

« First « Previous Comments 13 - 52 of 90 Next » Last » Search these comments

Meredith Whitney interview with video linked below.

Housing Market Sure to Double-Dip: Whitney (CNBC)

#housing