patrick.net

An Antidote to Corporate Media

1,364,380 comments by 15,735 users - stereotomy online now

Comments 1 - 17 of 45 Next » Last » Search these comments

It's already true. See Detroit, as example #1.

I would argue certain exurbs all over CA have the same fate.

>severe MERS issues that it would be unsellable

nah, they'll just fix what's screwed up.

>if we have a major financial melt down i think the numbers could be 50-65% of homes that would be unsellable due to lack of funding

that's not a value of $0, that's an illiquid market. Cash buyers would be king, but as long as housing can be rented out for more than the property tax it will have some value.

>financing 100% of the costs of gov with QE. when QE stops, R.E. loans stop

Nah, QE is more about interest rate control than providing liquidity. Though I do think if it is allowed to run out later this year there will be liquidity problems.

All this is not to say that the curent housing price level is safe from further drops. Anyone arguing that doesn't really see the various steamrollers coming right at us.

you get job offer in another state and no one can get a loan financed? you move and have a huse sitting in another city......whats it worth? rent it out...to who. in depressions, the number of rental properties GOES UP and the number of renters goes down because the unemployed/under-employed must move in and co-habitate. you will have 10 families living in one rental.

in an illiquid market, anything that requires credit to sell (and there isnt any credit) will be worth zero....

cash will be king...but that doesnt mean that every property can be rented out.....we have more houses than owners right now....so back to worthless.

QE is 100% about liquidity...permenant open market operations (POMO) are about pushing fake profits thru treasury buy backs to the money center banks....that is the only thing keeping them/system liquid. QE and treasury buying (buy the only buyer...the fed) keeps interest rates (of those treasuries) at zero.....

I think the Fed will be more than happy to directly fund home loans should it come to that.

They already own $760B of agency securities, adding that amount annually would cover most of the market.

Japan's home finance agency is funding 35 year loans (~1% for the first 10 years, ~2% thereafter).

We could do that : )

Then again who knows if Japan's borrowing is sustainable. They may be more f----ed than us.

everytime the fed does a QE, they have to repay/roll that QE with the next one....so double down. QE3 will have to cover the QE1 roll and the QE2 roll and provide addition funds to keep the gov going. throw in RMBS buybacks....again....? japan might have stolen its citizens savings on it way to 200% GDP but we were still buying their hondas and sonys...at least they had that income.

japan had 100 year mortgages...multi generational mortgages.....and all it got them were soshokukei danshi (Ojo-man) ; )

impotent girly-men that work part time jobs and live in the street.

you're describing a situation where there's no renter demand and no buyer demand?

And That's what you see happening when QE comes to an end?

isn't that a bit extreme?

not only ZERO but also negative in some cases. E.g. at least one bank has plowed homes under. So, that cost them money. Lots of people have homes which are worth zero or negative. Same as having an option out of the money. you might just buy that option if you think things will change. Just like an option, time will kill you. houses rot. options time out.

I agree with pkowen. In many areas homes will be worth zero. Not sure what the number is now but was like 20M vacant homes... and they are still building you know. Who wants an old shirt? Who wants an old car? Who wants an old house?

Well, mine's used so I'm throwing it away. There's an empty one up the street with granite countertops we can hide under during the apocolypse.

I think the Fed will be more than happy to directly fund home loans should it come to that.

They already own $760B of agency securities, adding that amount annually would cover most of the market.

Japan’s home finance agency is funding 35 year loans (~1% for the first 10 years, ~2% thereafter).

We could do that : )

Then again who knows if Japan’s borrowing is sustainable. They may be more f—-ed than us.

I think Japan has been screwed for a long time exactly due to that. When an average person spends most of their income on healthcare/housing (and now gasoline) they can't exactly spend a penny elsewhere to grow economy.

I see that everywhere, and I really think that until the government gets out of the mortgage backing of the rich peoples gambling (FN/FR) we won't have much of economic recovery.

how many here (if any) feel that a certain percentage of housing could go to zero?

Some homes that never should have been built in the first place may become nearly valueless. Some tracts in the the far flung deserts of NV and AZ and swamps of FL are already essentially worthless.

However, homes in desirable areas near employment centers will always have value. In other words, if you think that you are going to get a free house on the SF peninsula, you’ve got another thing coming.

I think you misquoted there but anyway - I don't think I'm getting "a free house on the peninsula", and never implied that I would. However, there are some real dumps even on this blessed stretch of land, in parts of San Mateo, Redwood City, even San Carlos and Belmont (not to mention EPA) that you couldn't pay me to live in. I am sure they will never be "zero" but people are still buying dumps for $400k plus.

I basically agree with you, except I would add that it ain't just NV, AZ and FL that have houses that shouldn't have been built. I agree they are the biggest hotspots. ""Exurbs", feh. I haven't driven out to Sac-o-tomatoes in a while but even two-three years ago I saw developments in the middle of nowhere that were clearly not going to make it.

soshokukei danshi (Ojo-man) ; )

Hannah, what's an Ojo-man? What language is that? (I though Americans called soshokukei danshi "herbivores".)

soshokukei danshi (Ojo-man) ; )

Hannah, what’s an Ojo-man? What language is that? (I though Americans called soshokukei danshi “herbivoresâ€.)

japanese slang....herbivores and ojo-man are the same thing....

'A 2007 survey by a major toilet-seat maker found that half of Japanese men sit on the toilet to urinate, while bras designed for men have been selling briskly since they hit the market last November.'

( http://search.japantimes.co.jp/cgi-bin/fl20090510x1.html )

i love japanese culture but i cant say i even begin to understand it......

China will probably surpass our economy in the next 20 years if this continues. These backward thinking fuckwads like Barney Frank really put us up shit creek.

Didn't Japan go through the same kind of housing bubble which eventually crashed for basically the same reasons that ours did (just on a much bigger domestic scale)?

There is a good article on this:

http://timandjulieharris.com/2008/12/29/zero-percent-100-year-mortgages-coming-in-2009100-year-loans-realtor-coaching-and-training-future/

I like the quote from it:

Creative financing wins over most unsophisticated borrowers in the end as they consider only the monthly payments with no regard for longer term considerations. But a few savvy consumers will make better choices. And in most parts of the country, the wiser choice is still building equity through renting. The equity comes from investing and compounding all the additional disposable income you keep from not buying inflated assets!

soshokukei danshi (Ojo-man) ; )

Hannah, what’s an Ojo-man? What language is that? (I though Americans called soshokukei danshi “herbivoresâ€.)

japanese slang….herbivores and ojo-man are the same thing….

‘A 2007 survey by a major toilet-seat maker found that half of Japanese men sit on the toilet to urinate, while bras designed for men have been selling briskly since they hit the market last November.’( http://search.japantimes.co.jp/cgi-bin/fl20090510×1.html )

i love japanese culture but i cant say i even begin to understand it……

And I hear they are making a phone that is tactile like a human face or some crap. So you can feel closer to people when talking to them.

Didn’t Japan go through the same kind of housing bubble which eventually crashed for basically the same reasons that ours did (just on a much bigger domestic scale)?

There is a good article on this:

I can't wait until 2009 comes, and we see if these guys are right about their prediction of 100 year mortgages. Err...ummm...???

Didn’t Japan go through the same kind of housing bubble which eventually crashed for basically the same reasons that ours did (just on a much bigger domestic scale)?

http://en.wikipedia.org/wiki/Japanese_asset_price_bubble

http://en.wikipedia.org/wiki/Japan_deflation#In_Japan

Systemic reasons for deflation in Japan can be said to include:

Tight monetary conditions. The Bank of Japan has kept monetary policy loose only when inflation has been below zero, tightening whenever deflation ends.[20]

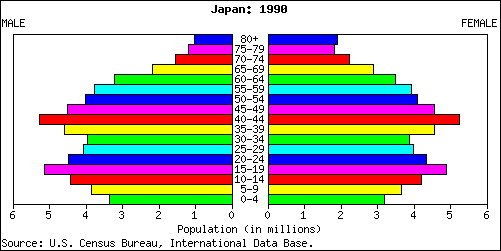

Unfavorable demographics. Japan has an aging population (22.6% over age 65) that is not growing and will soon start a long decline. The Japanese death rate recently exceeded the birth rate.

Fallen asset prices. In the case of Japan asset price deflation was a mean reversion or correction back to the price level that prevailed before the asset bubble. There was a rather large price bubble in equities and especially real estate in Japan in the 1980s (peaking in late 1989).

Insolvent companies: Banks lent to companies and individuals that invested in real estate. When real estate values dropped, these loans could not be paid. The banks could try to collect on the collateral (land), but this wouldn't pay off the loan. Banks delayed that decision, hoping asset prices would improve. These delays were allowed by national banking regulators. Some banks made even more loans to these companies that are used to service the debt they already had. This continuing process is known as maintaining an "unrealized loss", and until the assets are completely revalued and/or sold off (and the loss realized), it will continue to be a deflationary force in the economy. Improving bankruptcy law, land transfer law, and tax law have been suggested (by The Economist) as methods to speed this process and thus end the deflation.

Insolvent banks: Banks with a larger percentage of their loans which are "non-performing", that is to say, they are not receiving payments on them, but have not yet written them off, cannot lend more money; they must increase their cash reserves to cover the bad loans.

Fear of insolvent banks: Japanese people are afraid that banks will collapse so they prefer to buy (United States or Japanese) Treasury bonds instead of saving their money in a bank account. This likewise means the money is not available for lending and therefore economic growth. This means that the savings rate depresses consumption, but does not appear in the economy in an efficient form to spur new investment. People also save by owning real estate, further slowing growth, since it inflates land prices.

Imported deflation: Japan imports Chinese and other countries' inexpensive consumable goods (due to lower wages and fast growth in those countries) and inexpensive raw materials, many of which reached all time real price minimums in the early 2000s. Thus, prices of imported products are decreasing. Domestic producers must match these prices in order to remain competitive. This decreases prices for many things in the economy, and thus is deflationary.

When an average person spends most of their income on healthcare/housing (and now gasoline)

Hierarchy of needs. Shelter is pretty high up there, as is health, and substitute goods are pretty minimal, either you have a place to live and your health or you don't.

Gasoline is also important, at least if you want to get to work, but is not quite a dominant expense like shelter is.

Thing is, both health care and gasoline have current production costs. Already-built housing does not, its production cost is a sunk cost from long ago. Housing call fall a lot farther from here if other costs go up.

It's no accident that housing sucks up every last dollar of ours, and it's not really due to government intervention, either (housing payments would still suck up all our money at higher interest rates and lower prices).

Real estate is just a treadmill. The richer we get, the more housing costs when the supply is constrained. This was seen from the Iron Triangle in Richmond to the wonderful sunny properties of Laguna Beach 2003-2007.

If you want affordable real estate, you have to increase the housing supply such that competition for land is reduced enough to remove the demand pressure. The Japanese actually have done a pretty good job of that, density in eg. Tokyo is just insane, but in a good way.

As for the Japanese asset bubble, the Japanese went from stimulating their economy to slamming on the brakes.

Plenty of leveraged gambling was going on and the receding tide just wiped out everyone who had borrowed their way to prosperity.

There was also maximal stress on housing, as the baby boom was aged 35-39 in 1985:

their baby boom echo was entering their teenage years and everyone needed bigger houses. . .

Comments 1 - 17 of 45 Next » Last » Search these comments

how many here (if any) feel that a certain percentage of housing could go to zero? meaning either the home can not be sold for legal(aka MERS) reasons or that when financial markets freeze, there will be no money/credit available to lend so a home would be 'worthless' as a financial product.

i would hazard a guess that at least 20% and maybe closer to 40% of R.E. could have such severe MERS issues that it would be unsellable. if we have a major financial melt down i think the numbers could be 50-65% of homes that would be unsellable due to lack of funding.....

right now the federal government is financing 100% of the costs of gov with QE. when QE stops, R.E. loans stop as 98% of the securitization market is now freddie and fannie.....housing goes to zero.

...remember we bulldozed homes, shot cattle and burned crops in the 30's......but this time is different?

#housing