patrick.net

An Antidote to Corporate Media

1,204,631 comments by 14,314 users - Al_Sharpton_for_President, RC2006 online now

Deflation Rearing its Ugly Head Around the Globe

2014 Nov 14, 12:55am 48,394 views 155 comments

Comments 1 - 40 of 155 Next » Last » Search these comments

Quick, someone buy moar MBS. house prices are in danger of becoming too cheap!

China is missing the US consumption, i.e. the US current account deficit is half what it was

Beauty is in the eye of the beholder. Deflation is beautiful for renters and savers, but ugly for debtors and the merchants of debt. Corporate and government news reflect bankers' POV, opposing deflation, but actual data disprove the lopsided warnings.

We've had the Fed system for 100 years, and commercial and government "news" mouthpieces intone the purpose is to stabilize prices and promote full employment. Most people like those goals, and don't bother checking the facts. In the 100 years since the Fed started, America has endured a Great Depression, the current Great Recession (beautiful for bankers bailed out by Fed QE/ZIRP), several other severe recessions, and almost continuous war financed by debt, and the currency has lost 97% of its value. During the prior 100 years, America also endured occasional recessions and wars, but the price level remained fairly constant through an entire century in which periods of inflation and deflation offset each other. In both centuries, the economy grew. The difference is, in the Fed era, the growth was captured primarily by the FIRE sector, which benefits from the expectation of inflation.

The difference is, in the Fed era, the growth was captured primarily by the FIRE sector, which benefits from the expectation of inflation.

Yep.

Deflation is the perfect pretext to give more money to rich people.

If they wanted to solve it, they would start sending pile of cash to every citizens. Or the government would run a huge deficit.

Pulling a Zimbabwe is not that hard, you just need to try.

Yeah cheap gas, affordable healthcare and education, and a nicer home. Why would anyone want that? Inflation great, deflation bad. Paying more and getting less great, getting more for your money bad.

Why would anyone want that?

they wouldn't. it's a very a vicious cycle - businesses can't grow enough to meet their debt obligations, banks start to run, worker wages drop, government can't collect enough taxes to fund their promises... rinse and repeat.

Deflation is the perfect pretext to give more money to rich people.

You have that backwards.

Don't expect the Fed to raise interest rates aggressively anytime soon due to the threat of deflation lingering.

Don't expect the Fed to raise interest rates aggressively anytime soon due to the threat of deflation lingering.

That would be the opposite of what to expect?

Don't expect the Fed to raise interest rates aggressively anytime soon due to the threat of deflation lingering.

i would agree. lower rates have the effect of reducing the cost of servicing government debt and therefore the amount of taxes needed - trying to squeeze an already wage-suppressed workforce through higher taxation would be painful.

QE is an asset inflation tool that has certainly blown up equities and home prices, but not wages - as businesses buy stocks and wealthy people invest in real estate. this is why other economies are hesitant to pursue that path - europe has instead gone with austerity. it remains to be seen what china will do.

Don't expect the Fed to raise interest rates aggressively anytime soon due to the threat of deflation lingering.

There is no threat except for the Fed further stagflating things.

Deflation is beautiful for renters and savers

Yeah cheap gas, affordable healthcare and education, and a nicer home. Why would anyone want that? Inflation great, deflation bad. Paying more and getting less great, getting more for your money bad.

It's amazing to me that seemingly intelligent folks are so blind when it comes to the effects of deflation. Prices don't fall in a vacuum. When you're unemployed, I don't think you'll take much solace in the fact that gas prices are 25 cents cheaper. Or that real estate is 20% cheaper. When you have no income, everything looks expensive...

There is no evidence I've seen that real wages grow faster under deflation than inflation.

The falsehood being spread about deflation is that folks will put off buying and wait for prices to go even lower. Just like now folks are buying immediately as opposed to paying 2% more later. Of course that is not happening now, and it won't under deflation. So what is the real reason that the PTB hates deflation?

It's amazing to me that seemingly intelligent folks are so blind when it comes to the effects of deflation. Prices don't fall in a vacuum

Cop out. Prices of electronics fall all the time and yet people make trillions off of them. Cheap health care, housing, and education isn't going to destroy the economy, but rather free up capital (a.k.a. stimulus) for people to buy other goods and services.

If nothing ever got cheaper, we'd still be living in the stone age. Prices of goods should slowly become cheaper over time. People won't stop buying stuff, they'll buy more stuff. 10,000 years of history has shown that.

The falsehood being spread about deflation is that folks will put off buying and wait for prices to go even lower.

Every Black Friday disproves that falsehood.

Cop out. Prices of electronics fall all the time and yet people make trillions off of them.

Deflation is the overall economy is not the same as productivity increases in one sector. There is a huge difference between productivity gains and loss of demand. Both can cause prices to fall, but the effects are drastically different. Trying to imply they are the same is naïve at best and disingenuous at worst.

If nothing ever got cheaper, we'd still be living in the stone age. Prices of goods should slowly become cheaper over time. People won't stop buying stuff, they'll buy more stuff. 10,000 years of history has shown that.

Yes, but cheaper in the only measure that matters--cost/labor hour. Cost/unit of currency is a distraction. Why are you fixated on what a dollar buys? If a dollar only buy 1/10 of what it did 100 years ago, but you made 100X what you did then, you'd agree that you're better off, right?

So what is the real reason that the PTB hates deflation?

Because unemployment rises, leading to more falling prices, leading to more unemployment, etc.

See 1929.

f nominal rates are zero, but deflation is 4% then real interest rates are 4% and the bond market sucks up every available cent of investment capital.

So I invest $1 million in a one year project that returns my $1 million, which means a real return of 4%. And the problem is?

Nope, not if that project is a free market commercial venture that goes tango ultra as demand crashes and its product is worth 60% less than when you bought the firm

In your example, deflation is 4%. But now a product drops 60%.

Assume the product is worth 4% less.

Cash is king as well. Cash is as good as a government bond yielding 4%.

Beauty is in the eye of the beholder. Deflation is beautiful for renters and savers, but ugly for debtors and the merchants of debt.

That's stupid. There are winners and losers. But overall we loose, just because output goes below its potential as a side effect (i.e. unemployment).

The wealthy who have the largest access to fresh money

Just curious--exactly how do the wealthy get the "fresh" money? To what access do you refer? Is there a line you can wait in if you're wealthy? Is there a minimum net worth that you have to have in order to wait in that line?

Yes, but cheaper in the only measure that matters--cost/labor hour. Cost/unit of currency is a distraction. Why are you fixated on what a dollar buys? If a dollar only buy 1/10 of what it did 100 years ago, but you made 100X what you did then, you'd agree that you're better off, right?

Falling cost of goods would fit nicely with the falling wages most people have experienced for the past several years (or more).

As to the deflation triggering job loss fearmongering, Dan is correct. When things get cheaper that drives demand UP, not down. Would you pay $100k for a Hyundai? Of course not but you might buy three for the family if they are cheap enough, and buy three more when the ash trays in those fill up.

Beauty is in the eye of the beholder. Deflation is beautiful for renters and savers, but ugly for debtors and the merchants of debt.

That's stupid. There are winners and losers. But overall we loose, just because output goes below its potential as a side effect (i.e. unemployment).

Ah more fearmongering. Not buying it.

Falling cost of goods would fit nicely with the falling wages most people have experienced for the past several years (or more).

Yes, but it's a distribution problem. Fix the distribution and we're fine (or at least a LOT better)

As to the deflation triggering job loss fearmongering, Dan is correct. When things get cheaper that drives demand UP, not down.

Again--ONLY if prices are falling in a vacuum. Which NEVER happens during widespread deflation. Prices fall, but wages fall faster because unemployment is skyrocketing.

Please provide the data showing that real wages perform better under deflation.

The wealthy who have the largest access to fresh money and the most assets get wealthier across the board and wealth disparity widens greatly as observed since 2008.

Just to add a little not that the Wogster will listen to me, but...

The wealthy invest their money, the vast majority of their assets are invested in income producing investments (not conspicuous consumption, think Warren Buffet). This is the natural order of things. Since these are the people that who are closest to the currency sources these are the ones who get first access to the money. Since the Fed openly targets the stock market as one they want to keep up, wealth effect and all that. It naturally attracts investment. But at the same time the investors stand to lose the most as well.

According to the latest figures, deflation is now perched on China’s doorstep.

China is the next Japan. It has been so obvious now for years. But everyone keeps saying, "It's different this time." It's not.

Please provide the data showing that real wages perform better under deflation.

Feel free do do the same with inflation, especially the minimum wage.

Make sure to factor in the increase in prices especially rents, home prices and cost of education to show how much better off most workers are today than they were in say the 1950s

If the grossly overcompensated members of the FIRE industries feel the pinch in deflation so much the better.

Why are you fixated on what a dollar buys? If a dollar only buy 1/10 of what it did 100 years ago, but you made 100X what you did then, you'd agree that you're better off, right?

And if pigs could fly we wouldn't need airplanes.

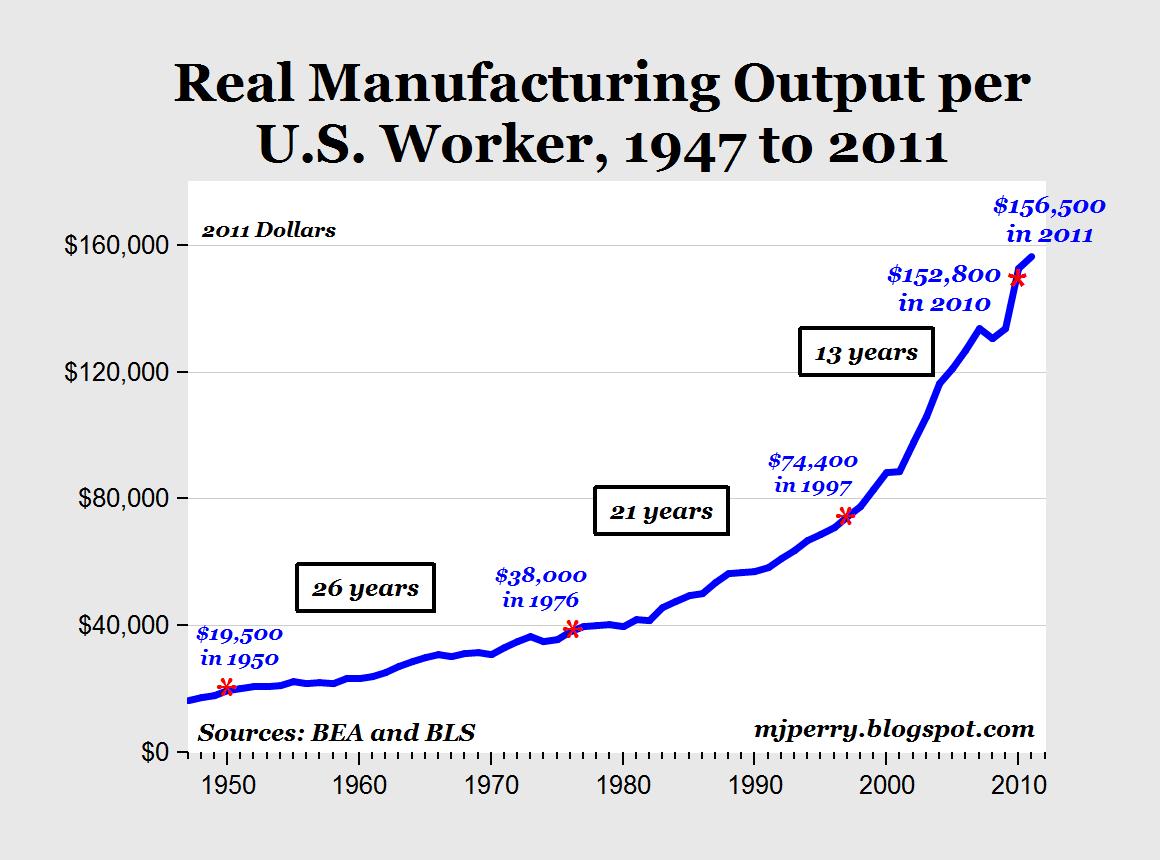

The dollar has lost 96% of its value over the past 100 year. That's a ratio of 1/25. Wages have not kept up despite workers being more productive due to technology. The average worker output today is four time as high as in 1950.

And that's a conservative estimate. Looking at manufacturing it's more like 8 times.

The average yearly income has gone from $800 to $26,364 from 1913 to 2013. If we take into conservative increase in productivity (doubling every 25 years) and take into account the debasement of the currency, then the $800/yr income of 1913 should have changed to $297,248.01 in 2013.

Currency debasement and the resulting rise in the cost of living have done nothing to increase the wealth of the typical American. On the contrary, as Elizabeth Warren has proven discretionary income has decreased during all the years of inflation.

The modern single-earner family trying to keep up an average lifestyle faces a 72 percent drop in discretionary income compared with its one-income counterpart of a generation ago.

The bottom line is that currency debasement is nothing more than stealing from savers, the very people needed to allow other people to get loans for college, houses, and new businesses. Meanwhile, everyone in charge of Social Security is shitting their pants because Americans aren't saving enough to retire.

Well, if savers are getting screwed, then no one will save.

Of course, saving is evil. So don't bother funding your 401Ks and IRAs. Social Security will take care of everything, just as long as the U.S. population keeps doubling every 100 years. Let's just hope that all that talk about peak baby is just bullshit. As long as there are 620 million Americans 100 years from now, this generation will be OK. Of course with such exponential growth in population, it won't be long before humans are covering every each of surface area on the Earth including the oceans, but hey, if Noah can save two of every species on an ark, why should that be a problem.

The really sick thing about currency debasement is that it forces hard-working, honest people who pay their taxes and actually produce wealth for a living to then play zero-sum games with the money they store their wealth in just to avoid losing it. People should be able to put the money they earned someplace where it won't lose purchasing power after taxes and currency debasement.

And people should not have to go into debt in order to buy anything that cost more than a week's wages. They should be allowed to save for big purchases without getting screwed over by the Federal Reserve.

People should be able to put the money they earned someplace where it won't lose purchasing power after taxes and currency debasement.

And people should not have to go into debt in order to buy anything that cost more than a week's wages. They should be allowed to save for big purchases without getting screwed over by the Federal Reserve.

Full ack. If "target inflation" is 2% but even the "highest-yield" savings rate is less than half than that (keep in mind that as a taxpayer you need much more than the inflation rate to break even with savings from net income), then you know savers are getting fucked by the Fed. They are actively discouraging saving with the ongoing debasement theft and the middle-class to wage-slaves (upper-middle class to upper class) bear the brunt of this crime, not the 47% or the wealthy.

And if pigs could fly we wouldn't need airplanes.

The dollar has lost 96% of its value over the past 100 year. That's a ratio of 1/25. Wages have not kept up despite workers being more productive due to technology. The average worker output today is four time as high as in 1950.

First of all, wages HAVE kept up.

.

As you can see, flat median real wages is a somewhat recent phenomena (since Reagan) and it's a distribution problem, not a wealth creation problem. As such, it has very little to do with inflation.

The average yearly income has gone from $800 to $26,364 from 1913 to 2013. If we take into conservative increase in productivity (doubling every 25 years) and take into account the debasement of the currency, then the $800/yr income of 1913 should have changed to $297,248.01 in 2013.

Yep, but that problem has very little do with inflation.

Currency debasement and the resulting rise in the cost of living have done nothing to increase the wealth of the typical American. On the contrary, as Elizabeth Warren has proven discretionary income has decreased during all the years of inflation

Don't confuse correlation with causation.

Well, if savers are getting screwed, then no one will save.

If no one was saving, savings rates wouldn't be next to zero. Rates are driven by supply and demand, despite what the Fed cult will tell you. The fact that rates are zero means plenty of people are saving.

The really sick thing about currency debasement is that it forces hard-working, honest people who pay their taxes and actually produce wealth for a living to then play zero-sum games with the money they store their wealth in just to avoid losing it. People should be able to put the money they earned someplace where it won't lose purchasing power after taxes and currency debasement.

And people should not have to go into debt in order to buy anything that cost more than a week's wages. They should be allowed to save for big purchases without getting screwed over by the Federal Reserve.

If there was no inflation, banks would charge you fees to hold your money. There is no free lunch. If you think a world where people keep their money in their mattress is better than what we have now, then we just disagree.

Feel free do do the same with inflation, especially the minimum wage.

Make sure to factor in the increase in prices especially rents, home prices and cost of education to show how much better off most workers are today than they were in say the 1950s

If the grossly overcompensated members of the FIRE industries feel the pinch in deflation so much the better.

I posted a chart of real median wages since 1939. And I'm not saying inflation helps grow real wages--I'm saying it's a distraction.

Deflation doesn't solely affect the FIRE sector--everyone would be affected. Something about cutting of one's nose to spite one's face would seem to be appropriate when discussing deflation.

If "target inflation" is 2% but even the "highest-yield" savings rate is less than half than that (keep in mind that as a taxpayer you need much more than the inflation rate to break even with savings from net income), then you know savers are getting fucked by the Fed.

The Fed doesn't set savings rates. Further, savings rates NEVER keep up with inflation--it's the cost of safety and liquidity.

They are actively discouraging saving with the ongoing debasement theft and the middle-class to wage-slaves (upper-middle class to upper class) bear the brunt of this crime, not the 47% or the wealthy.

Savings rates of near zero seem to indicate that there is plenty of money in savings.

Not that this is the best source, but Wiki describes numerous theories about deflation and its causes from several economists. At least using this source, there seems to be no consensus, and I would have to say that no one really knows.

Some intriguing bits:

"It is agreed that hoarding money, whether in cash or in idle balances, is deflationary in its effects." - Without trust in the financial system, folks will hoard cash. The failure to apply the law to financial crimes and reform Wall Street reinforces this belief, and is deflationary.

"Historically not all episodes of deflation correspond with periods of poor economic growth." E.g., technological progress.

"To slow or halt the deflationary spiral, banks will often withhold collecting on non-performing loans (as in Japan, and most recently America and Spain)." - Perhaps an explantation of folks living for free in defaulted homes.

" (Deflation) causes a transfer of wealth from borrowers and holders of illiquid assets, to the benefit of savers and of holders of liquid assets and currency..."

The average yearly income has gone from $800 to $26,364 from 1913 to 2013. If we take into conservative increase in productivity (doubling every 25 years) and take into account the debasement of the currency, then the $800/yr income of 1913 should have changed to $297,248.01 in 2013.

Yep, but that problem has very little do with inflation.

Isn't it a combination of both creating inflation and then not appropriately distributing it correctly? So you're both right. Then if all this liquidity exists and the banks are flush with cash, savings rates will naturally be low because the demand for money is low. The fed is pumping liquidity into the banks, which is keeping that money in the hands of the rich thereby creating your distribution problem. So the fed is a large part of the cause if the gov't isn't forcing a proportionate amount of wealth redistribution to compensate.

Deflation is caused by a decrease in the money supply.

Inflation is caused by an increase in the money supply.

There is no other definition.

The fed is pumping liquidity into the banks, which is keeping that money in the hands of the rich

I don't follow that---the Fed is buying assets from banks, and injecting money into circulation through bond purchases. How do either of these keep money in the hands of the rich?

The distribution problem is caused by the lack of leverage of labor vs. capital and current tax structure.

Comments 1 - 40 of 155 Next » Last » Search these comments

According to the latest figures, deflation is now perched on China’s doorstep.

In September, China’s consumer price index was up 1.6%, but its producer price index fell 1.8%. The CPI increase was its lowest since 2010.

Economic growth is also receding. It’s hard to pinpoint the exact figures, because Chinese economic data is notoriously sketchy. But in September, demand for electric power, a “bellwether for China economic activity,†fell 8.4% from the prior month, the second straight monthly decline.

“Deflation is the real risk in China,†stated the chief economist at a Hong Kong bank.

http://www.globaldeflationnews.com/deflation-rearing-its-ugly-head-in-subtle-and-not-so-subtle-ways-around-the-globe/