Let's tell Obama we do NOT want to restore bubble prices

2011 Aug 30, 6:27am 23,509 views 110 comments

« First « Previous Comments 71 - 110 of 110 Search these comments

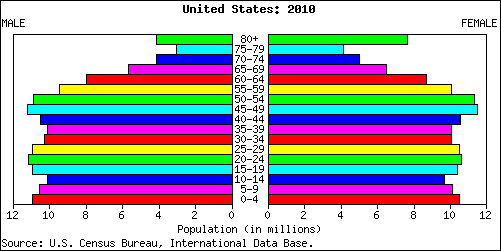

Home prices can't be permitted to reach equalibrium because that would cause that generation to draw more heavily on government resources as they grow older, something the government can't afford. Their 401k's are on life support, so market supports beyond housing can't be removed, lest they loose what's left of their retirment SAVINGS and start cutting back draconianly on their spending. I capitalize savings because everyone complains that the boomers didn't save. Yes, they did, just in investment vehicles they were told were safe but weren't. This image of Boomers not being as American as their forefathers is BS. They're just so much bigger than any generation before themselves, their lives had to be different. And unfortunately, for those of us who are younger than them, our lives will be less and our markets distorted, not because of their actions, but merely that they were all born together in a giant cohort.

To a point I can agree with you but we've already crossed that point. Let's examine something a bit more basic and step back for a moment. As a historical basis when has retirement ever been viable or well defined?

Before the era of FDR people either relied on religions or their families for support. FDR was greatly inspired by Bismark..unemployment insurance, social security, medicare..all these concepts came from him. He created this as a way of pacifying any potential communist revolutions. This is how the age of 65 was established but life expectancy back then was only 45. By the time FDR introduced social security life expectancy was 65..meaning that some of these social safety nets for older people were incentives to live longer rather than a massive social blanket for tens if not hundreads of millions of people.

By any metric the baby boomers received some of the greatest amounts of advancements in the modern era. When tens of millions of people do the same things at the same times of course they would boom. Gerber baby food in the 50's, muscle cars in the 60's, education in the early 70s, real estate in the 80's, 401ks in the 90s. Generations that come later do not have as much wealth and are smaller in size and scope.

For any investment to work you have to be able to sell it/exchange it for something else in value. There's a strong reason why gold, silver and shares in apple do better than investing in 8track players, analog cell phones and old boxes of pac man ceral.

"BUYERS MAKE VALUE", until more powerful entities intervene. Gubmint only stalls equilibrium, because it would damage the powerful.

"BUYERS MAKE VALUE", until more powerful entities intervene. Gubmint only stalls equilibrium, because it would damage the powerful.

"Just because some fool overpaid by half a million dollars doesn't mean the calculator is wrong."

Well, then there are lots of "fools" because another comp sold for $760,000 and yet another sold for $820,000. So we have $760,000, $800,000, and $820,000. I will gladly provide the addressed if you wish...

True story.

@HousingWatcher and Clara,

The purpose of the calculator is not to derive the market value of a house. Market vaule is determined at the bidding war and there are still people out there willing to spend overborrow for 500-800k houses that only rent at $2500. Overpriced or underpriced, the undeniable truth of the free markets is that the real price is the price that was paid. That is, until that changes...

What the calculator does for you is to help you determine if the prices the market is offering you are worth taking. Should you rent or should you buy? If you plug in the numbers it might tell you that you should choose to rent at $2500 until you can buy at $350k; that doesn't mean somebody else isn't going to go buy at $600k. Did they make a good choice? Should you jump in just because they did? I don't think so, but that's up to you.

Market vaule is determined at the bidding war and there are still people out there willing to spend overborrow for 500-800k houses that only rent at $2500

The average cost of ownership of a $800,000 house over 30 years is ~$1700/mo. (Not counting the opportunity cost of the $800,000 principal repayment.)

If history is any guide rents will be $5000 on this house soon enough. PITI is fixed at ~$5700.

Don't make the mistake I did and compare PITI vs rent. The P in PITI is principal repayment, which is not an expense, but a form of savings.

This is how the age of 65 was established but life expectancy back then was only 45. By the time FDR introduced social security life expectancy was 65

Life expectancy at age 20 has risen 10 years since 1930.

FICA has risen from 2% on first $40,000 (2010 dollars) to 12.4% on first $107,000.

http://staff.jccc.net/swilson/businessmath/taxes/fica.htm

http://www.infoplease.com/ipa/A0005140.html

Generations that come later do not have as much wealth and are smaller in size and scope.

Missing in this analysis is productivity per worker. Thanks to computers, cheap oil, automation, etc we're 50% more productive now than 30 years ago.

http://research.stlouisfed.org/fred2/graph/?g=1VI

The baby boom echo is only 10% smaller than the bb, btw.

Counting bodies is misleading. What needs to be counted is economic opportunity. That doesn't necessarily scale with just raw population, otherwise Bangladesh would not be nearly the poorest country on the planet.

Market vaule is determined at the bidding war and there are still people out there willing to spend overborrow for 500-800k houses that only rent at $2500

The average cost of ownership of a $800,000 house over 30 years is ~$1700/mo. (Not counting the opportunity cost of the $800,000 principal repayment.)

If history is any guide rents will be $5000 on this house soon enough. PITI is fixed at ~$5700.

Don't make the mistake I did and compare PITI vs rent. The P in PITI is principal repayment, which is not an expense, but a form of savings.

“Nessuna soluzione . . . nessun problema!„

I didn't run these numbers through the calculator, just commented on the statements others had made based on their use of the calculator.

But I find it hard to believe that the average cost of an 800k house is only $1700 a month. The interest alone doesn't get below that until after 20 years. Are you taking appretiation into account with that statement? If so that's one area where I'd have to disagree based on the direction I see the current market going. At best I see prices in my area 10 years from at or slightly below where they are now.

But I find it hard to believe that the average cost of an 800k house is only $1700 a month.

Yes, I as well just cannot see the numbers here. Moreover, is this economy (and many future projections that in a few years forecast numbers straight downward) and this real estate market, who are this smoke and mirror $5000. a month renters? Please. This thread has become out of control.

IMHO I do not see any of this flying in my lens but I do see there are plenty of people around still on Fantasy Island.

But I find it hard to believe that the average cost of an 800k house is only $1700 a month. The interest alone doesn't get below that until after 20 years.

Don't forget tax savings.

who are this smoke and mirror $5000. a month renters?

I'd imagine they are the same people that are paying $800K.

But I find it hard to believe that the average cost of an 800k house is only $1700 a month

That number included 20% down to avoid PMI. Ah, I see I had my spreadsheet at 15 years. Changing to 30, I get these numbers:

Total Interest of $459,964.84 less $161,907.62 tax credit leaves $298,057.22 net interest cost -- $827.94 per month over 360 months.

Property Tax is $300,000.00 less $105,600.00 or $194,400.00 -- $540.00/mo.

Other expenses ($133/mo insurance, $100/mo extra utilities, $200/mo maintenance setaside) = $433/mo.

Total average monthly expense over first 30 years: $1801.27.

You all must view this it is the BEST link I've seen in all the years I have been following Patrick.net, it is right here. Genius.

http://www.youtube.com/watch?source=patrick.net&v=engKtLw0JTM

who are this smoke and mirror $5000. a month renters?

I said "if history is any guide".

The 1B apartment in West LA I rented 1990-1991 for $700 is now renting for $1500.

The 3B apartment my parents rented in the East Bay for $300/mo in the mid-1970s is now renting for $1500.

That's a general doubling of rents every 20 years.

Now, I don't think we're going to get that inflation like that any more, I think we're stuck in Japan's situation of too much debt to raise interest rates a single basis point, and a fake economy that is not going to see wage inflation at all.

But I could be wrong about that, and the crowd wisdom certainly hasn't digested this possibility yet.

1970s to now? History? Why don't we just talk about brainwashing? because that is what that period of time respresents to me.

Anyone talking about this "history" please view the following

http://www.youtube.com/watch?source=patrick.net&v=engKtLw0JTM

FWIW, I am in the deflationary camp.

But I am not the market.

I was talking about past history.

What people don't understand is that the history of 1970-2009 is the history of debt loading:

http://research.stlouisfed.org/fred2/graph/?g=1VQ

that graph is total US debt per worker.

Um, yeah.

It wouldn't surprise me to see home prices HALF what they are now.

Just give me $10 gas, Clinton tax rates, hell, get rid of the MID (which is on the table), higher FICA and Medicare taxes, massive government spending cuts at the state and Federal level . . .

People think inflation is going to come and raise home prices. I just don't see it -- I see the opposite, inflation coming and obliterating home prices.

People think inflation is going to come and raise home prices. I just don't see it -- I see the opposite, inflation coming and obliterating home prices.

You are not alone.

But I find it hard to believe that the average cost of an 800k house is only $1700 a month

That number included 20% down to avoid PMI. Ah, I see I had my spreadsheet at 15 years. Changing to 30, I get these numbers:

Total Interest of $459,964.84 less $161,907.62 tax credit leaves $298,057.22 net interest cost -- $827.94 per month over 360 months.

Property Tax is $300,000.00 less $105,600.00 or $194,400.00 -- $540.00/mo.

Other expenses ($133/mo insurance, $100/mo extra utilities, $200/mo maintenance setaside) = $433/mo.

Total average monthly expense over first 30 years: $1801.27.

“Nessuna soluzione . . . nessun problema!„

You forgot to factor in that a married couple already receives a standard tax deduction of $11,600 per year.

That's 348,000 over 30 years. Your using 35.2% as the tax rate, so that's $122,496 that a married person already has entitled to them in deductions. That means the interest credit tax benefit of buying a house over taking the standard deduction is only $39,411.62 over the life of the loan.

That brings the monthly cost up over $2100 per month. And it's more than that, really, because inflation will inevitably increase the standard deduction over time whereas the interest costs should remain fixed.

That's actually lower than I thought it'd be, but it also doesn't factor in HOAs, appretiation/depretiation, and the opportunity cost lost to downpayment and forced savings... a lot of which is hard to anticipate anyway.

People think inflation is going to come and raise home prices. I just don't see it -- I see the opposite, inflation coming and obliterating home prices.

I am going to reiterate this, how can the home prices go up if the wages and salaries are in the decline. For those who have jobs,wages are stagnant or are falling due to pay cuts and furloughs. Those who lost jobs can hardly land the with the pay same as last one. Home prices have to keep going down for few more years,at what rate YOY? I don't know,but the faster the better for the country. Inflation cannot touch the home prices in the current economic situation.

He can't possibly be as stupid as the things he's saying, like his bullshit talk about "restoring home prices."

Yes, he IS that stupid. Guess who was the numero dos guy that received the most in campaign contributions from Freddie and Fannie?

A junior senator from Illinois. Barack Hussein Obama

http://www.opensecrets.org/news/2008/09/update-fannie-mae-and-freddie.html

Christopher Dodd was numero uno because he did a lot with getting CRA and other crap out there while leaning on regulators to look the other way when some of them smelled a foul stench coming from CountryWide and other such institutions.

And the NAR (an actual pac) has donated mostly to Republicans (until it melted down).

This is typically a canard. Individuals within an organization do not represent an organization. You can have 1,000 employees donate $250 each to the Democrat and the CEOs donate 100,000 to the Republican--does that make the Dems or the GOP in the pocket of the business?

You'll see that the GSE totals include individuals.

You forgot to factor in that a married couple already receives a standard tax deduction of $11,600 per year.

In high-tax states like California, people buying $800,000 houses will have the full standard deduction covered by the state income tax deduction.

And it's more than that, really, because inflation will inevitably increase the standard deduction over time whereas the interest costs should remain fixed.

Neither here nor there as long as the household is bringing in an upper middle class salary.

That's actually lower than I thought it'd be

yup!

Plugging in 8% interest rates sees the average TCO rise to $2800/mo.

Refiing down to 2.5% would lower the TCO to $1460/mo.

I think we'll see 2.5% rates before 8%.

I deeply regret not buying that $350,000 condo in 2001. Rates were 8%+. That suppressed home values. My housing cost would be under $1000/mo now had I bought.

Bellingham Bob,

The standard deduction increasing is important, as it would decrease the total advantage of buying a house over just taking that deduction over time.

No matter how we do the math I don't imagine myself regretting not buying right now. When it all comes down to it I look at the houses we can afford where we want to live in San Diego and I vomit. In a way that really ends the debate for me. Maybe I'm just not a fan of the 70's style architecture. Maybe I just can't see how anyone would want to live in a 1200 sq ft box with no yard, let alone pay 500 grand for it. But I just can't hop onboard.

If the properties that we do like drop to half the cost, which could happen, we'll buy something. If not we just plan to move in a few years.

For those who have jobs,wages are stagnant or are falling due to pay cuts and furloughs

We can argue about what wages will do in the future, but for people having jobs, wages are NOT decreasing.

The standard deduction increasing is important, as it would decrease the total advantage of buying a house over just taking that deduction over time.

the standard deduction rises with incomes. As long as the household's state tax payment covers it, the MID is entirely free money.

No matter how we do the math I don't imagine myself regretting not buying right now.

Sure. As long as prices are falling $30,000 a year I'm happy renting.

Maybe I'm just not a fan of the 70's style architecture

LOL. I love old nabes with the big trees.

But I am in no way a buyer in the bay area. Nice place to visit but I wouldn't want to live there. Well, this place maybe:

http://www.redfin.com/CA/Kensington/88-Norwood-Ave-94707/home/1685368

the standard deduction rises with incomes. As long as the household's state tax payment covers it, the MID is entirely free money.

No matter how we do the math I don't imagine myself regretting not buying right now.

Sure. As long as prices are falling $30,000 a year I'm happy renting.

Ah, caught it this time.

The falling prices have helped us feel good about renting for now too. Friends and coworkers tried to point out how well the tax credit was working and how crazy we were. It was a little tougher staying out of it then, but nobody's telling us they told us so anymore.

but for people having jobs, wages are NOT decreasing.

There are still some other shoes that can start dropping here.

Simpson Bowles, the Ryan Plan, the state budget blowing up, interest rates spiking for some reason, $10 gas, the list is pretty long.

but for people having jobs, wages are NOT decreasing.

There are still some other shoes that can start dropping here.

Simpson Bowles, the Ryan Plan, the state budget blowing up, interest rates spiking for some reason, $10 gas, the list is pretty long.

“Nessuna soluzione . . . nessun problema!„

No doubt. That's why I hedged by saying the future is unknown. But I'm tired of bubble saying wages for people working are falling.

We can argue about what wages will do in the future, but for people having jobs, wages are NOT decreasing.

Not entirely true. A lot of my clients complain about being underpaid. What happened for a while is that people who lost jobs, took on lower paying jobs just to make ends meet.

Of course I don't know what they were doing before the bubble. Hard to compare.

I'm not really sure incomes are falling for those with jobs. An employer would be foolish to cut wages of existing workers because that would destroy morale and possibly invite sabatoge as a small minority will seek revenge. An employer would be better off laying off workers or allowing them to retire/ quit, and then re-hiring new workers at a lower wage.

This is how it is typically done. Company A dumps their high paid American workers and then immediately hires low paid H1-Bs. They are not going to tell the American workers that they will now only get the same salary as an H1-B. Even if they ware willing to work for less, they won't give them the option.

"Missing in this analysis is productivity per worker. Thanks to computers, cheap oil, automation, etc we're 50% more productive now than 30 years ago."

True and I agree but

"The baby boom echo is only 10% smaller than the bb, btw."

Not that sure on that though. There is no doubt that we do have smaller family units then in the past (productivity being a major cause but one could argue if one cannot afford a family they simply won't have it).

"Counting bodies is misleading. What needs to be counted is economic opportunity. That doesn't necessarily scale with just raw population, otherwise Bangladesh would not be nearly the poorest country on the planet."

But that is a bit misleading as well. People there were known for having large families but the family units dropped dramatically with higher education (William Easterly's White Man's burden illustrated this). China has more but with a one child policy.

Raw population alone is one thing but economic opportunity pretty much is extending to much of the planet. There are areas that were known for decades of war that have ended..coupled with a oil boom and wealth surged (Angola). Every country wants to be connected (although certainly north korea, iran and Somalia are going to have issues). Raw population and ability to work pretty much showed why china boomed and russia (post ussr) didn't. Historically in an economic downturn countries turn to export markets..of course the trouble with that is it can lead to massive intervention and price wars

Ah yes...they pulled the old 'we didn't make the contributions, our employees did' fraud and you buy it hook, line and sinker?

You guys really have drunk the Obambi Kool-Aide, haven't you?

You're a moron.

Did you actually READ the article? I'll reiterate, since you obviously didn't: When you count directors, officers, and lobbyists, McCain got TEN TIMES AS MUCH in campaign contributions as Obama. TEN TIMES.

You're counting EVERYONE who ever got a paycheck, in any way, from Fannie or Freddie. I suppose you think it's relevant whether the fucking janitor at the Fannie Mae office gave 20 bucks to the Obama campaign. Only in your warped right-wing fantasy world would such a thing be considered as him getting money FROM Fannie and Freddie. They don't control what their low-level employees do in their spare time. Yeah, if the president and board of directors of the company are giving money to a candidate, then it's jive to hide behind the fact that they are "employees". Guess what? When you count the actual people who would guide policy at the company in some way, Obama wasn't even CLOSE to being the biggest recipient. But hey, don't let those pesky facts get in the way of your diatribe.

You really drank the Rush Limbaugh Kool-Aid, didn't you?

The Banksters are laughing their asses off at people like you who are so into your little partisan nonsense that you don't even notice they're robbing you blind, and it has nothing to do with whether the R's or the D's are in office.

I think Obama knows about renters being priced out. The problem is there is no easier way to get growth back up unless the current inventory dries up. I am a renter myself and have been frustrated by the high prices, yet sometimes i ask myself.. what is better? Lower home prices vs. More unemployed, including myself? We could have some other bubble, but the housing one beats them all in sheer size.

Lower home prices vs. More unemployed, including myself? We could have some other bubble, but the housing one beats them all in sheer size.

There's no real way to get that party started again. Interest rates are 4%. Lowering them to 2% would only induce a ~10% rise in prices.

The boom (2002-2003) was caused by rates falling from 8% to 5% and tax cuts giving families thousands of dollars more a year to bid up housing.

The bubble (2004-2006) was caused by the abandonment of lending standards (liar loans), the innovation of suicide lending (negative am), and 80/20 "affordability" products that removed any risk to the borrower.

We can't do that again.

House appreciation doesn't create sustainable jobs. Sustainability comes from exportable wealth creation. We can't export homes.

The Banksters are laughing their asses off at people like you who are so into your little partisan nonsense that you don't even notice they're robbing you blind, and it has nothing to do with whether the R's or the D's are in office.

Pwned quite nicely there, gameisrigged. This is exactly what I tell shrek sometimes, that there are many gullible people who focus on stupid things like this, but he insists on his nonsense.

>And the NAR (an actual pac) has donated mostly to Republicans (until it melted down).

Something else I learned on this site.

I think Obama knows about renters being priced out. The problem is there is no easier way to get growth back up unless the current inventory dries up. I am a renter myself and have been frustrated by the high prices, yet sometimes i ask myself.. what is better? Lower home prices vs. More unemployed, including myself? We could have some other bubble, but the housing one beats them all in sheer size.

I don't follow, Java. The "problem" is that inventory needs to "dry up"? How do you reduce inventory? By selling. How do you sell? By offering reasonable prices. High prices would have the exact OPPOSITE effect that you want them to have.

Every dollar of lost value causes, what, $10M of default losses?

That's the jam the system is in.

http://research.stlouisfed.org/fred2/graph/?g=240

$10T of borrowed money and not enough equity to cover it.

House appreciation doesn't create sustainable jobs. Sustainability comes from exportable wealth creation. We can't export homes.

You've got that straight.

And this entire issue of the Resident knowing about renters being priced out of the market? I hate to say that the one's truly ruined IN THE MARKET were the loan debtors on the properties. The renters with no mortgages turned out to be the winners (which was predicted I believe even on Patrick.net at the height of this lunacy about five years ago.)

House appreciation doesn't create sustainable jobs. Sustainability comes from exportable wealth creation. We can't export homes.

That is true...of course the NAR tries to say it does create jobs (thank God for HDTV as you can read actual text now) It says it takes two homes to create one job...sheeshh.

But it would be interesting if we could export homes. I'm surprised that Lennar or some other one wouldn't try to put money into exporting homes..I'm sure it could be done but it is simply a matter of scale.

If you ever want to see an odd assembly line there was this caddy from the late 80s/early 90s

http://en.wikipedia.org/wiki/Cadillac_Allant%C3%A9

And the NAR (an actual pac) has donated mostly to Republicans (until it melted down).

From what I've seen looking at the donation numbers, it's almost a 50/50 split. NAR owns both political parties and play favorites on a case-by-case basis.

« First « Previous Comments 71 - 110 of 110 Search these comments

From a Patrick.net reader:

I agree entirely. There has been absolutely no press coverage or any political statement about how high house prices HURT people and how low prices are better. Let's all write Obama, our congressmen, and housing reporters with this simple message:

Lower food prices are good!

Lower gas prices are good!

Lower house prices are GOOD!

#politics