Thread for orphaned comments

2005 Apr 11, 5:00pm 171,585 views 117,730 comments

by Patrick ➕follow (60) 💰tip ignore

« First « Previous Comments 45,914 - 45,953 of 117,730 Next » Last » Search these comments

Personal income has NOTHING to do with the rise in RE prices the last few years. If it did, RE prices would have fallen further.

Huh? You think nominal incomes haven't been rising for the last few years?

This is real income so nominal growth is even higher:

This isn't rocket science. IT's true for stocks, bonds and yes even real estate. Yields dropping go hand in had with prices increasing. (No this doesn't mean the opposite never occurs).

Do you really think that back in 1980 when people were expecting double digit yields in stocks, and bonds, that was because middle class incomes were so much lower? Or because of how much they expected incomes to increase?

marcus,

When was the last time interest rates increased for a sustained period? What did housing prices do?

Were there other times of sustained increases in interest rates? What did housing prices do then?

Are you predicting a long term increase in rates and decrease in house prices? In my mind, long term would be greater than 2 year period of interest rate growth and 2 point increase in interest or so? Or are you talking about shorter term fluctuations of 3 months to two years?

Your graph is more about the number of new Walmart jobs, or cities that were able to bring back teachers and cops that had been laid off, than it is about salary increases.

So what? A cop or teacher that is now employed certainly might want to buy a house.

This isn't rocket science. IT's true for stocks, bonds and yes even real estate. Yields dropping go hand in had with prices increasing. (No this doesn't mean the opposite never occurs).

It isn't rocket science. The only explanation is that people don't buy a house for the same reason that they buy a stock or bond. Because, you know, they actually LIVE in a house.

It isn't rocket science. The only explanation is that people don't buy a house for the same reason that they buy a stock or bond. Because, you know, they actually LIVE in a house.

But prices aren't allowed to fall in a way that simply reflects the supply and demand relative to prospective homeowners.

Enter the investor, who is attracted to the yield relative to other investments

who's yield is tied either directly or indirectly to interest rates.

Marcus got this one right. This has nothing to do with the minimal rise in incomes, but with the huge crony support of the government and Fed of the housing market, using backstop guarantees and special investor programs to prop up a market thats shouldn't. Lending standards have eased a bit again, jumbos are back so more qualify to overpay. Pair that with the foreign money trying to find a safe haven in some of the better areas in the US, ZIRP, and you have the perfect storm. It's housing inflation which the Fed calls "subdued" ;)

Marcus got this one right. This has nothing to do with the minimal rise in incomes, but with the huge crony support of the government and Fed of the housing market, using backstop guarantees and special investor programs to prop up a market thats shouldn't. Lending standards have eased a bit again, jumbos are back so more qualify to overpay. Pair that with the foreign money trying to find a safe haven in some of the better areas in the US, ZIRP, and you have the perfect storm. It's housing inflation which the Fed calls "subdued" ;)

blah blah blah Fed blah blah government blah blah blah crony...

Like I said, add a zero and all will be well. That will be my campaign slogan in 2020:

"When the going gets tough, just add a zero! Vote for me and I'll be your number ONE zero!"

Going back to the idea of a 2017 (+-) crash... Though I've seen many things over the years that scream to me, "this isn't sustainable," whenever the SHTF in the past, there always seems to be an element of surprise with respect to the critical event that starts the dominoes tumbling.

Obviously, if we could predict crashes years in advance, we'd probably opt to avoid them. With all the disruption in Europe and the sovereign debt crisis, many were convinced that the Euro was on it's last legs. Yet, rabbits were pulled out of hats to avert a meltdown of the system. Not only didn't it crash, but, for the most part, it held its exchange rate value.

It seems to me that you would have to have an unpredicted event in order to provide the spark. God knows we already have plenty of accelerant to react with the spark. So, kindly pull out your crystal ball.... Assuming you agree that there must be a critical event that no one anticipated to get things going, do you have any guesses on what that might be? Or do you believe that there doesn't have to be an unanticipated critical event, and even despite best efforts, there is nothing that can be done to avoid a meltdown in 2017 (+-)?

PS... I meant loanowner, and yes, you are correct to assume that I was referring to leveraged landowners. Loanowner is just less typing :)

But prices aren't allowed to fall in a way that simply reflects the supply and demand relative to prospective homeowners.

Enter the investor, who is attracted to the yield relative to other investments

who's yield is tied either directly or indirectly to interest rates.

Yep. That puts a floor on house prices, not a cap. And the yield also depends strongly on rental prices which are strongly dependent on--guess what--incomes.

I never said interest rates aren't even more highly correlated to inflation. I'm not going to apologize for this not being simple.

If you understand this--then how can you continue to say there is a correlation between house prices and interest rates?

I never said interest rates aren't even more highly correlated to inflation. I'm not going to apologize for this not being simple.

If you understand this--then how can you continue to say there is a correlation between house prices and interest rates?

Because it's complex.

Real estate prices are affected by inflation. But it's also affected by the cost of debt, and income properties (for investment) are affected by the general expectations about return on investment.

This entire argument is silly. The monthly payment for owning a home is in a very real sense the price people pay for a home. And this is STRONGLY affected by interest rates.

The history you want to look at doesn't show this as well as it might because economics is always complex with many variables. In the period you're looking at, the baby boom becoming buyers, and women entering the workforce are probably bigger factors than interest rates or inflation.

Real estate prices are affected by inflation. But it's also affected by the cost of debt, and income properties (for investment) are affected by the general expectations about return on investment.

The cost of debt IS inflation plus risk premium.

It does not change in a vacuum.

Expected future value of money/current value of money = opportunity cost of money = inflation rate.

What's your point? That rich are good at leveraging themselves and doing it while hiding themselves behind corporate veil?

The point is this is not leverage. If SHTF the liabilities will not exceed assets and will not deplete other unrelated wealth.

Because it's complex.

Sure--but whether or not there's a correlation isn't. It's a simple mathemetical calculation.

Real estate prices are affected by inflation. But it's also affected by the cost of debt, and income properties (for investment) are affected by the general expectations about return on investment.

Yep--that's what I've been saying.

This entire argument is silly. The monthly payment for owning a home is in a very real sense the price people pay for a home. And this is STRONGLY affected by interest rates.

Yep, but more weakly than incomes.

The history you want to look at doesn't show this as well as it might because economics is always complex with many variables. In the period you're looking at, the baby boom becoming buyers, and women entering the workforce are probably bigger factors than interest rates or inflation.

I'm glad you understand my point.

The meaningful number is those out of the workforce, it's over 92 million today.

Any way you slice it, employment numbers are not very good.

If you are a koolaid liberal you will say "it could be much worse!" etc.

I went to an HRBlock professional a few times. The ones that are in an office year round. Not the ones that the decor looks like they have a burger value menu, that pop up at surprise locations a for a few months a year. That's when they when to shit.

The thing is with a real tax professional, I mean the ones that really are, and not the ones that learned everything they know from the job training, and it is the software that instructs their every move, and the software is the one that has the final say.

A real accountant, can do more than give you a pop screen that leaves you puzzled and bewildered as to how to comply even if you think you MIGHT not qualify for that deduction. They will instruct you on how to get receipts that you thought you didn't have for things you forgot you bought. Especially when you are like me, and use your debit card/credit card for 99.992124353566% of your purchases.

With the software you can't always communicate that you have deductions, TurboTax this year blitzed right through my taxes, never got to a lot of questions that I was waiting for. I have to refile my taxes, there was just so much that Turbo taxed glazed over. I'm now going to have to go to a professional. Those online things are great if you make less than (X) you don't have any thing to deduct or claim, and you're paid by W2. Ever damn year I use Turbo Tax I swear up and down I'll never do it again. But I always end up waiting to file until the last few days or just hours before the deadline. Then end up using it anyway, as I still don't have a new tax person I trust.

Still every time I use the damn thing after clicking next a thousand times to get your federal tax sent off, and you definitely want to wait until it's verified a 100%. One of the last options is "Great now lets do your Florida State income taxes" Which Florida doesn't have an income tax. I was stupid(aggravated) enough the first time to click, and they charged me another 49 for filing my Florida taxes. Because I kept clicking through, thinking the next page would be the final information for my Federal income tax verification.

They are Bastards with a capitol fuck them!

They are owned by Quicken and not HRBlock. But I shy away from HRBlock and got into using Turbo Tax in the first place, because I felt like those burger joint HRBlocks were worse than the final impression I have of Turbo Tax.

The lady I was seeing at the HRBlock professional office, charged like $300 bucks, but was worth every penny. She died back in about 2006, I was naive enough to think that those HRBurger joints were the same.

Consider this: The jobless rate fell because 733,000 fewer people were considered unemployed. That’s the largest one-month decline since 1949, when unemployment fell by 920,000 when two large national strikes concluded.

Fortunately all the articles I saw today on the topic of 6.3 also included the minus 700,000. If this recession has taught us anything about unemployment it is that one must always consider both sides of that coin.

The Bureau of Labor Statistics reported Friday that the U.S. unemployment rate fell to 6.3% in April, the lowest level since the collapse of Lehman Bros. in September 2008, and the largest one-month drop in the jobless rate in three years.

I told you we are in a recovery.

If we estimate 6 million who signed up will pay, the net result of the "reform" is the existing overpriced industry managed to corral another 2% of the population as additional involuntary customers, while raising prices even higher for everyone, except some people don't see the price because they imagine they're getting a subsidy, which they aren't even getting because they don't get to keep any part of it, 100% and more goes to the industry that wrote the legislation. The mechanism by which the industry increased its revenues, even above prior law, was to change the law so that corporate executives can require everyone to buy whatever the corporate executives are selling, at whatever price the executives decide ("no lifetime caps!"), especially things that they can't sell any other way because no rational person would buy them. (And, recall, those same executives can use the proceeds of those involuntary contracts to finance political campaigns to make everyone buy even more stuff that no rational person would buy if given a free choice in a free market. Whether you call it fascism or lemon socialism or corporatism, the dynamic works the same way.) Meanwhile, the number of uninsured has actually increased since the President took office promising reform, and they face a rigged "market" with even higher prices than ever before. "Thanks, Obamacare."

BTW, good luck when you have an expensive accident and the insurance company says they didn't get your premium check that month, so you're not covered.

"They" are now skeletons in secret death panels mass graves on which the temple of high yield bond funds are built....

Because it's complex.

Sure--but whether or not there's a correlation isn't. It's a simple mathemetical calculation.

Yes. And say a perfect correlation of prices going up when interest rates going down would be a correlation of -1. A slightly less strong correlation would be a correlation of -.999 etc. Even a correlation of -.7 would be (in my book) a very strong correlation. A correlation of - 3, still very much a correlation.

So yes, it's a simple computation. But it's not a yes or no calculation.

In this case not only are you not saying what you mean by "there isn't a correlation," (although I know what that means). It's complicated. Sometimes there is a strong negative correlation, other times a strong positive correlation. Either one of us could probably come up with conditions for there being a positive correlation and conditions for when there is a strong negative correlation (what I have been saying exixts and you and Tatapu say does not).

We also both can come up with significant time intervals of historical data that back up these claims.

IT's not really that interesting an argument, but the underlying dynamics are interesting. It's a fascinating dynamic really. The fact that expectations of inflation can cause (are supposed to cause anyway) interest rates to go up. And high interest rates put a damper on prices. Conversely, a lack of inflation expectations can cause interest rates to go down, which in turn often cause capital assets to go up in price, because cheap borrowed money leverages higher prices.

I'm glad you understand my point.

I don't have hardly any emotion about the degree to which you do not understand my point.

There will be no "Reaganesque figure". Research indicates that immigrant communities which will grow as a total share of electorate reject small government conservatism aka fewer services/safety nets via smaller government. Latino and asian communites want the government to take an active role in realms of health care, entitlements and environment. They primarily vote on fiscal issues and cannot be picked off via wedge issues such as abortion, gun control, etc. In essence, small government conservatism predominantly appeal to white voters and due to demographic trends it will be extremely surprising if such a candidate is elected for president going forward. Also, it is very likely that texas will turn blue in 15 to 20 yrs which will likely to be a final nail in GOP coffin in terms of presidential aspiration if GOP sticks to small govt conservatism formula.

The cost of debt IS inflation plus risk premium

And when long term money can be borrowed for the same as expected inflation, or even less ? What does this do to prices of capital assets.

I'm telling you what history says

No you aren't.

If I show you a significant period when housing was going up when mortgage money was getting dramatically cheaper, you'll say it doesn't count because incomes were going up. Those significant periods of time exist, and it's more than extremely obvious I'm right.

Give it up man.

When was the last time interest rates increased for a sustained period? What did housing prices do?

When was the last time LT interest rates dropped for a sustained period?

What did housing prices do?

In the period you refer to interest rates were rising along with perceived high inflation in everything (not just asset values).

During the protracted period when interest rates were dropping it was not deflationary except during recession, and even then incomes weren't dropping except due to layoffs.

Can you put this all together?

The BLS shows 288,000 more jobs. There are 445,000 unaccounted for? Maybe fell off the employment charts because their unemployment ran out?

And when long term money can be borrowed for the same as expected inflation, or even less ? What does this do to prices of capital assets.

Long term money cannot be borrowed for less than expected inflation. Inflation may turn out to be higher than expectations, but the long term bond market is telling you what the long term inflation expectation is right now.

The yield curve even tells you when the market expects inflation to pick up.

At that rate, they'll have the UE rate down to 4% by the Nov. elections...

Like any other index (eg, CPI)...tell a story...get elected

From Mish:

abor Force Factors

Discouraged workers stop looking for jobs

People retire because they cannot find jobs

People go back to school hoping it will improve their chances of getting a job

People stay in school longer because they cannot find a job

Disability and disability fraud

Were it not for people dropping out of the labor force, the unemployment rate would be well over 9%.

Synopsis

Last month, weather-related effects were taken back and then some. This month we see a return to the divergence between the household survey and the establishment survey. +288,000 vs. -73,000 is massive. So is the decline in labor force of 800,000. That is the only reason the unemployment rate declined. All things considered, this was not a good report.

Read more at http://globaleconomicanalysis.blogspot.com/2014/05/nonfarm-payrolls-288000-unemployment.html#t7iyIhbMixfsZwp2.99

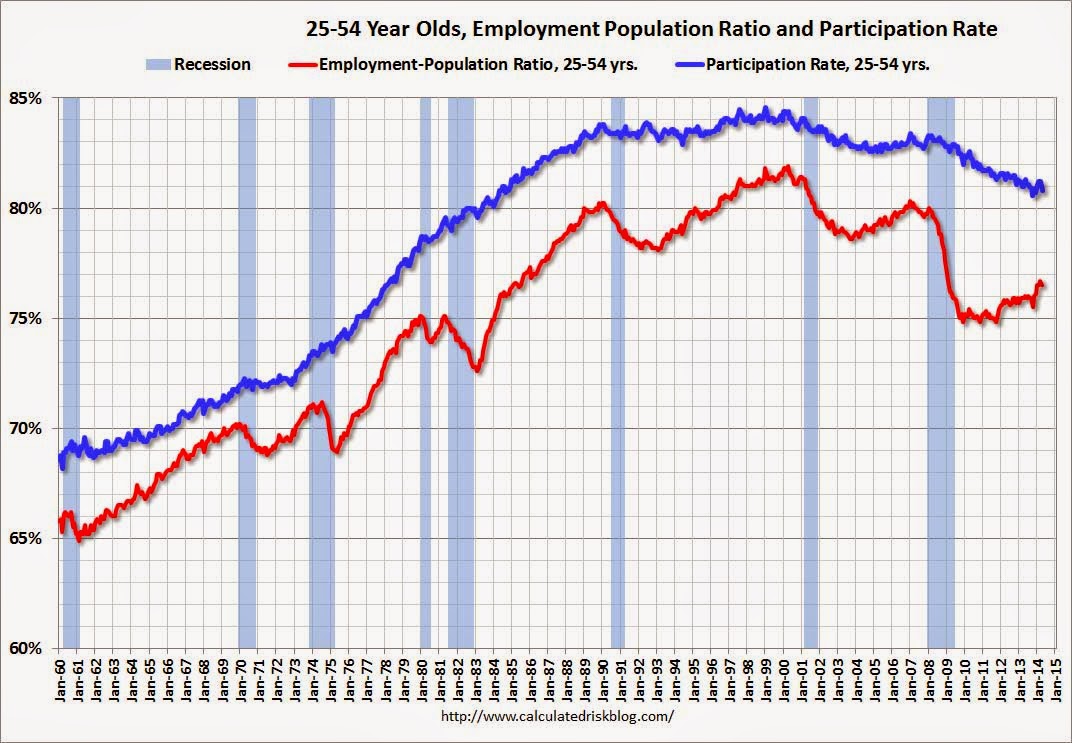

The participation rate for 25-54 is a few percents below its peak.

Where is that graph from? can you zoom it in to the past year?

by month?

So yes, it's a simple computation. But it's not a yes or no calculation.

Yes, it pretty much is. When I did the calculation over an approximately 80 year time period the correlation was positive 0.05 or so. In my mind that is no correlation.

And if you really want to get tricky you can statistically determine whether a correlation exists to a 95% confidence--that is a yes or no answer.

If I show you a significant period when housing was going up when mortgage money was getting dramatically cheaper, you'll say it doesn't count because incomes were going up. Those significant periods of time exist, and it's more than extremely obvious I'm right.

I will do nothing of the sort. The only caveat I'll say is that you have to choose a large enough time period to make for a proper calculation. If you do so, I am very confident that you will find a different answer than you think you will.

Btw, I wonder if Tat thinks there is a correlation between what happened in the stock market from 1982 to 2000, and what happened to LT interest rates.

Of course there is. I've never done it, but I'm quite sure if you did the calculation you'd find that a pretty strong correlation exists between stock returns and interest rates.

Inflation may turn out to be higher than expectations, but the long term bond market is telling you what the long term inflation expectation is right now.

This is debatable. But I can only handle being in one extremely stupid debate at a time. What you say is usually true, but many including I would argue not always. These are unusual times. Can you say QE ?

I used to believe what you say here. But in recent times I have come to see markets as more "rigged" than I used to. Also, markets, including the bond market can get out of whack do to things like, flight to quality, QE, strong international currency imbalances, what currency is the the worlds reserve currency and so forth. So I think your statement is an oversimplification. The bond market is a market, that takes many things in to account (besides inflation).

When I did the calculation over an approximately 80 year time period the correlation was positive 0.05 or so. In my mind that is no correlation.

So we may finally get to an understanding, and lets say you get to feel you're right. I'm pissed that it's so fucking stupid, and that we got to this with such difficulty.

Sometimes there is a very strong negative correlation between RE prices and interest rates. Sometimes there is a very strong positive correlation. It's even pretty simple to explain the conditions for both.

By "sometimes" I mean time frames of multiple decades or more.

You interpret this as no correlation. Since in your view the periods of strong positive correlation cancel out the long periods of negative correlation.

I view this differently. There is no absolute answer to this. But I consider 15 to 30 year time frames significant, and I believe that understanding why there is a positive correlation (when there is), and why there is a negative correlation when there is are both extremely easy.

Furthermore, I acknowledged that a period coming up, when and if inflation kicks in, could be one of the positive correlation times. But given the bizarre mix now, I'm not sure at all. A lot does depend on the bond market.

But I'm very happy if you go away feeling vindicated and that you won the argument.

call it crazy, it's worse than that but you've got the concept right.

captain, I haven't used Turbotax, I have used "Taxcut" for years, lately they call it "HRBlock" but there are numerous questions and explanations I saw in it.

One thing that I liked is you can be in the program and you can download from vanguard or similar all your data, it did actually work so I didn't have to go through 1099's and stuff. I checked it and things went into the correct boxes.

Here's how housing and interest rates have gone over the last 30 years or so, which I believe Marcus referred to. I adjusted the Case-Shiller data to account for inflation. Inflation was done yearly, but it averaged to about 2-3%.

edited to fix chart

« First « Previous Comments 45,914 - 45,953 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,236,935 comments by 14,793 users - Misc online now