patrick.net

An Antidote to Corporate Media

1,249,735 comments by 14,902 users - Ceffer, FarmersWon online now

« First « Previous Comments 5 - 44 of 109 Next » Last » Search these comments

Ugh Krugman

"But how is that possible? Doesn’t taxing the rich and helping the poor reduce the incentive to make money? Well, yes, but incentives aren’t the only thing that matters for economic growth. Opportunity is also crucial. And extreme inequality deprives many people of the opportunity to fulfill their potential."

Yet no mention of the demise of opportunity at the hand of the well intentioned regulations. We don't need a recital of the now you are supposed tos by overpaid parasites who's only real purpose is to collect a 6 figure salary.

"Think about it. Do talented children in low-income American families have the same chance to make use of their talent — to get the right education, to pursue the right career path — as those born higher up the ladder? Of course not. Moreover, this isn’t just unfair, it’s expensive. Extreme inequality means a waste of human resources."

Yet the spending drain in public education has dumbed down the public as a result of unionized teachers and centralized dumb/arrogant ideas.

But favorite line is "Think about it." Ironical if only he would take his own advise.

"And government programs that reduce inequality can make the nation as a whole richer, by reducing that waste."

Funny it was just a few weeks ago that Krudman endorsed Pikkety's theory about inequality being caused by inflation. Yet a few weeks later he is back to the problem is not enough government control... He seems to practice a sort of mental masturbation totally divorced from reality.

"Doesn’t taxing the rich and helping the poor reduce the incentive to make money"

that's just it though, "making money" is not what is going on here.

Nobody "makes money" other than the Fed, and banks if it's true they can lend money out of thin air and not their capital+deposits.

One of out of three income dollars in this economy is being raked out by the top 5%.

This is why things are so unbalanced here. I'd prefer we tax the rent-seeking directly -- in health, real estate, imports, banking -- before we just blindly go after the rich in general, but the typical GOP defense of wealth (see above!) is what's killing this country, not high taxes.

This is why things are so unbalanced here.

Not true, that is a symptom NOT a cause.

And once again we see the ubiquitous graph that "explains everything"

No, the immense rent flows from the 99% to the 1% is not a symptom, it is the problem.

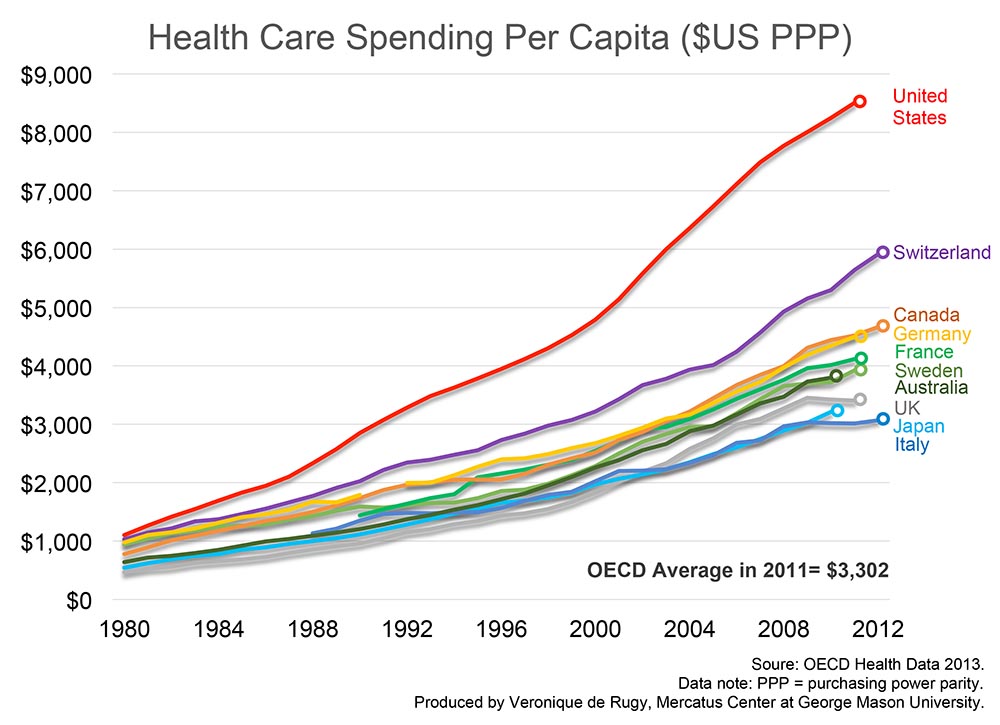

Health care + housing expense / wages

"Symptom" my ass!

Rent-seeking here is off the hook, and corporate america is also getting a free ride compared to the rest of us. Their taxes should be doubled if not tripled.

NO, to quote Krudman "think about it"

What changed that increased the inequality? Your graph does nothing to show the cause.

Are you saying that the tax law changed to create this effect? In that case show me a citation.

The Four Horsemen of our economy are:

1) Housing, and real estate in general

2) Health care

3) Our Trade Deficit

4) The skim of the Financial Services sector

the commonality of these 4 areas is that they are raking TRILLIONS out of the paycheck economy each year, via housing rents, sky-high health costs, $500B/yr trade deficit,

and the 5-10% skim finance and insurance is taking.

All this money is simply collecting at the top:

since the rich do not spend much of their incomes back into the paycheck economy, from where they GET their income in the first place.

The rich don't "make" their money from the mines of Zanzibar or the bottom of the sea, they pull their trillions OUT of the backs of working Americans.

Nope that is not a citation nor does it show cause. IOW that is NOT the cause.

How we got here isn't that mysterious. It's been a long, slow grind:

We used to have 22M mfg and info jobs:

Now we're 8M short, even though our working-age population has risen 40M (50%) since 1980.

NAFTA and "free trade" with China has ripped the guts out of our own wealth-creating economy, making us consumers and not producers.

The only thing keeping the game going is our immense government redistribution:

real per-capita gov't spending

but that's not a "cause" just an bandaid on the sucking chest wounds of our economy.

We are a nation of children being sold down the river by neoliberal trade policy, the dismantling of the mid-20th century protective state -- when we had government willing to intercede on labor's behalf.

We lost that in the Nixon/Ford years, and everything accelerated under Reaganism of the 1980s and the Republican Congress of 1995-2006, 2011-now.

The U.S. net international investment position at the end of the first quarter of 2014 was -$5,539.3 billion (preliminary) as the value of U.S. liabilities exceeded the value of U.S. assets (table 1). At the end of the fourth quarter of 2013, the net position was -$5,383.0 billion (revised). The $156.3 billion decrease in the net position reflected a $108.3 billion decrease in the value of U.S. assets and a $48.0 billion increase in the value of U.S. liabilities.

http://www.bea.gov/newsreleases/international/intinv/intinvnewsrelease.htm

reasoning.Bellingham Bill says

The only thing keeping the game going is our immense government redistribution:

Closer, you have an addiction to graphs, at the expense of deductive reasoning.

Graphs show the trends.

What's been going on is clear enough; we let corporate america take over this place.

http://reclaimdemocracy.org/powell_memo_lewis/

Conservatism has totally taken over the GOP and has made major inroads into the Dems. 99% of Congress is to the right of Bernie Sanders (as is ~80% of the population for that matter).

And our corporate media has bamboozled enough people to set the parameters of our national discussion such that the Clintons and Obama are declared to be the limit of what's passably "Left", vs. the vast tranches of ideological space the right enjoys now, all the way out to the randroids of Paul Ryan and Rand (!) Paul himself.

Leftism hasn't destroyed this country -- it's working well in the nordic states and Germany at least -- but conservatism has.

Free trade, laissez-faire in housing policy, allowing corporations to create our laws

http://www.sourcewatch.org/index.php?title=American_Legislative_Exchange_Council

The real cause in the changes in the US current account were due to Nixon taking us off of the gold standard coupled with Friedman's floating exchange rate with a targeted 3% inflation. (the MMTs are no better that Ks) This coupled with the ability to borrow by selling treasuries meant that spending could exceed taxes.

cause, effect, or symptom, it is what it is, and we're going to need more government not less to beat these corporatocratic fuckers back.

Central problem being the muddled middle that isn't going to figure things out until it's too late.

we're going to need more government not less to beat these corporatocratic fuckers back.

Fuck no, dumb ass.

How much has government grown in the past 40yr? go get a graph for that.

We have the BIGGEST centralized government in the history of the world. And it AIN'T WORKIN.

You are getting further away from the truth not closer...

Germany and Canada's government act more for justice and what is right rather than the tyranny of the democracy.

Speaking of health care, make sure to support prop 45 this year in California http://www.consumerwatchdog.org/focusarea/regulating-health-insurance-rates

Health insurance companies already contributed 45M to a campaign against it (Kaiser, Anthem)

Update: better link: http://justifyrates.consumerwatchdogcampaign.org/

"Big government" is working well, or better, for Germany and the nordic states. Canada too.

Very difficult comparison, Police state and privacy wise, Germany is much smaller government. Tax wise it's roughly equal once you add up US federal, state and municipal taxes, maybe it's a little bit more. Compared to the services everybody (rich and poor) gets in return the deal is better though, e.g. super low tuition fees for everybody. I do think it's way too complex though, so I don't want to cheerlead it, just clarify some. The problem is that in the US tax money is immediately diverted to the parasitic sectors (defense, health care, RE, banking, insurance) and most net paying people (wage slaves) never see a dime of it.

diverted to the parasitic sectors (defense, health care, RE, banking, insurance) and most net paying people (wage slaves) never see a dime of it.

. . .

cut DOD ~$500B to Germany's levels -- $238B/yr -- and hundreds of local economies dependent on Uncle Sugar would self-implode, kinda like 1990s LA (after they lost aerospace), but much worse.

So clearly our DOD expense isn't just vanishing into a black hole.

Similarly, health is one of the few dynamic sectors of the economy.

so of course there's lots of redistribution going on there (as gov't pays so much of it). PPACA's 3% tax on investment income, distributed to working class health insurance premium subsidies, is a beautiful thing! Should be 10%, LOL.

So clearly our DOD expense isn't just vanishing into a black hole.

Similarly, health is one of the few dynamic sectors of the economy.

True, but health care is always in demand and I don't think fixing price-fixing for drugs, health insurances, bringing back price discovery and transparency and such would dampen the need for nurses and other workers much, it would definitely cut down on some of the insane profits though. WRT to defense, they can use the money otherwise spent going to war to take care of those who are depending on the sector for the transitional phase. In effect they are not adding much to the economy, because the perpetual war machine feeds on itself and is paid by the taxpayer. Doesn't mean they should give up research and technology in defense.

it would definitely cut down on some of the insane profits though

Sure. But the eurosocialist paradises demonstrate that if you can control profits in health care, the additional consumer surplus is soon used in bidding up housing costs instead.

Same dynamic with Japan I guess.

In effect they are not adding much to the economy, because the perpetual war machine feeds on itself and is paid by the taxpayer

defense is great because it doesn't feel like welfare. Look at me, I'm a big bad warrior defending the nation from all enemies foreign and domestic.

In the scheme of things it'd be much more economical to devote hundreds of billions more to capital improvement projects everywhere they're needed, but that's communism or something.

the important thing is to keep money circulating within what I call the paycheck economy. There's too much parasitical loss out of it, via rents in housing, healthcare, FIRE, and our trade deficit.

This is the tyranny of the democracy at work

This is the tyranny of capitalism at work. Everything's about profiting right now, screw the future. Why do you think we tolerate pollution? Polluting is eating all the food right now.

This is the tyranny of capitalism at work. Everything's about profiting right now, screw the future. Why do you think we tolerate pollution? Polluting is eating all the food right now.

As usual you miss the point...

After his blatant disregard of facts, unwillingness to make cogent arguments, and unreasoning stupidity, I'm downgrading indigenous to status of "schill."

My advice would be to pay no attention to this pawn of the bankers and wealthy elite.

This is the tyranny of the democracy at work

This is the tyranny of capitalism at work. Everything's about profiting right now, screw the future. Why do you think we tolerate pollution? Polluting is eating all the food right now.

What car do you drive Dan? that nice red convertible looks like a high polluting guzzler.

After his blatant disregard of facts, unwillingness to make cogent arguments, and unreasoning stupidity, I'm downgrading indigenous to status of "schill."

My advice would be to pay no attention to this pawn of the bankers and wealthy elite.

Projecting, care to point out where I have done that on this thread?

Flat consumption tax is the only fair way to tax the people. Income taxes are completely unfair since you're discriminating against those that make more money.

The "tyranny of democracy" requires that at least 50% of the electorate goes along with the program.

plutocracy -- one dollar one vote -- doesn't even have that low bar to clear, and we got enough of that both here in the US and in Europe over the centuries.

though of course without democratic processes any system will quickly devolve into one bullet one vote, since violence is a more effective lever of power than mere money, wealth, etc.

"Many forms of Government have been tried, and will be tried in this world of sin and woe. No one pretends that democracy is perfect or all-wise. Indeed, it has been said that democracy is the worst form of Government except all those other forms that have been tried from time to time." -- Churchill, speaking as leader of the Opposition, 1947.

Flat consumption tax is the only fair way to tax the people. Income taxes are completely unfair since you're discriminating against those that make more money.

Flat consumption tax is the only fair way to tax the people. Income taxes are completely unfair since you're discriminating against those that make more money.

Taxes are not creating the inequality

Indeed, it has been said that democracy is the worst form of Government except all those other forms that have been tried from time to time." -- Churchill, speaking as leader of the Opposition, 1947.

A Republic is better. Churchill was not all he was cracked up to be...

The speaker in the video that not one of you mutts will watch brought up that very point and said that the Chinese Politburo was better.

reasoning.Bellingham Bill says

The only thing keeping the game going is our immense government redistribution:

Closer, you have an addiction to graphs, at the expense of deductive reasoning.

Deductive reasoning is not a requirement to follow or comment on Patnet. rofl

Flat consumption tax is the only fair way to tax the people. Income taxes are completely unfair since you're discriminating against those that make more money.

All taxes are unfair. Fairness is completely irrelevant. The tax structure has to be designed to create a healthy economy.

Deductive reasoning is not a requirement to follow or comment on Patnet. rofl

It is if you want to separate the wheat from the chaff.

All taxes are unfair. Fairness is completely irrelevant. The tax structure has to be designed to create a healthy economy.

Now that's a central planner talking if I ever heard one. Screw individual rights and let's do what "I" think is best for the greater good.

Now that's a central planner talking if I ever heard one. Screw individual rights and let's do what "I" think is best for the greater good.

Uh, how does setting up a tax structure screw individual rights?

Are you under the impression that rich people have the RIGHT to pay lower taxes than middle class and poor people?

^ yeah, that's my take too.

The question is if they can keep some of the people -- enough to stay in power -- fooled all of the time.

Start with the top 5% as inside-party economic elite, add another 20% as the nomenklatura in media, military, police, they're still 25% away from power in our democratic system.

http://kfmonkey.blogspot.com/2005/10/lunch-discussions-145-crazification.html

says ~27% is the crazification factor here. Shit!

http://en.wikipedia.org/wiki/List_of_countries_by_net_international_investment_position_per_capita

is the scoreboard, and we ain't even on it. $5.5T in the hole the other way, actually.

Uh, how does setting up a tax structure screw individual rights?

Are you under the impression that rich people have the RIGHT to pay lower taxes than middle class and poor people?

I didn't say that setting up a tax structure screws individual rights. Setting up a tax structure that makes higher income people pay more than others is a violation of equal property rights. That's like forcing someone who is rich to pay double the price for a movie ticket.

How are rich people paying less taxes? We have a progressive tax structure that forces them to pay far more. I know for a fact that my effective tax rate is much higher than someone making half my income.

« First « Previous Comments 5 - 44 of 109 Next » Last » Search these comments

http://www.nytimes.com/2014/08/08/opinion/paul-krugman-inequality-is-a-drag.html?hp&action=click&pgtype=Homepage&module=c-column-top-span-region®ion=c-column-top-span-region&WT.nav=c-column-top-span-region&_r=0&gwh=337B58A1D3C9A03D5ED63047B4E8AAD0&gwt=pay&assetType=opinion