patrick.net

An Antidote to Corporate Media

1,254,877 comments by 14,980 users - mell, Onvacation, Patrick, The_Deplorable online now

« First « Previous Comments 5 - 44 of 44 Search these comments

Patrick, can you limit posters to starting one thread a day? I think that could help with the craziness.

tovarichpeter would self-destruct.

I guess Patrick got busy... or he lost interest. It's just a shame. He had a great idea and he executed it well. I just wish you could still glimpse some of that original idea. Patrick.net isn't special anymore. It's just one of the millions of bitching sites that exist around the internet, where intelligence is scorned and outrageousness, applauded.

It is sad. I (being a then newbie to blogs) have very mixed feeling about the demise of this place, but in some ways, it may be for the best.

The ones I feel worst for? Those posters (and especially the lurkers) who came here for housing info and now feel left behind. CIC is going to go into fits of apoplexy hearing this but I recently checked the email I used to log in here (first time in years), and was stunned to see how many people privately emailed me in supporting the (I-just-want-to-buy-w/o-fear-of-another-crash-and-get-on-with-my-life) viewpoint which once posed the silent majority of this site.

The overall zeitgeist of this largely silent group? Even in the face of all the govt intervention we all saw, they were encouraged by Patrick's insistence why 2009-2012 wasn't a good time, but if they waited as he said, "their time would come". They were encouraged by his relentless confidence that price/rent would work out (via prices coming down in the fortress areas), and his remarks to other renters to keep being patient and they would "win". As Patrick said, you could have "one cookie now, or two cookies later". Apparently that emotion laden stuff really resonated with a lot of folks.

Remember "10 reasons it was a 'terrible' time to buy"? Unrealistic buy/rent metrics aside, when was this alleged 'good' time to buy? If you weren't going to buy 2010-2012, when is this mythic "good" time that the renters were "waiting" on? Put otherwise:

When do the patient renters (but not renters for life) win?

If they were then told to "wait", since waiting implied they were waiting for something...when would they be told to "buy"? They passed on the one cookie, where are the two?

Many too were disillusioned when his viewpoint switched from "wait" to "bottom-schmottom" fuck you I got mine cheap rent forever. That was great for him with his cheap rent & all, but for many, renting for life simply wasn't an option. What of those who told spouses their waiting would be rewarded? What of those who didn't have the cheap rent forever options he had? What was the point of "waiting" if you were going to pass on the bottom and be left with...nothing?

Sadly, he never answered those questions. Eventually, he lost interest in the site and left those "waiters" high and dry. Some were even expecting some sort of apology or explanation of how it all went so horribly wrong. Alas, it now looks like no such closure looks like it will be forthcoming.

FWIW, I personally DO agree somewhat with CIC's viewpoint in that many who put too much reliance in Patrick's words deserved what they got. That said, for whatever reason, the 2004-2009 housing bubble was a unique event in all our lives and rightly or wrongly, Patrick became a safe harbor for the fears, hopes, and beliefs of many many people. Thus, once that burden was (even if unfairly) placed on him, it would be nice if he perhaps did a bit more in terms of closure for those who felt as if they (rightly or wrongly) deserved more of an answer than they got. Alas, it appears that this just isn't going to happen.

Many too were disillusioned when his viewpoint switched from "wait" to "bottom-schmottom" fuck you I got mine cheap rent forever.

I don't ever recall him putting that way exactly... However, as for myself I'm glad I didn't buy in the SF Bay area. I actually put over a million in the bank ( and I work in biotech which doesn't pay very well vs. other tech ) post tax. If I'd bought I wouldn't have done nearly so well or been mobile.

Eventually I did buy a nearly new house out of state for 50K down. I net 650 / month renting it out and might more if the timing looks good. Fortunately I get free property management via a family member otherwise that might not be so sweet.

I'm not married and have no children so this life style is easier for me to swing than it otherwise would be. But I have lots of single friends in the bay area who got creamed in the downturn and lost lots of money after they bit off more than they can chew. Many tried to get me to do the same.

On the other hand... I may want to move back to the bay area for work at some point. Looking at rents there now - yuck! I've got friends there making a bit over 100K who are looking to get out to places like Reno etc., but they aren't in tech.

So Pat did help some people out... Everyone should do their own due diligence. Free advice is free for a reason.

Patrick is closing the forum? Or is this rampant speculation?

Well, I do not blame Patrick for not buying in the 2009-2012 period.

I saw the huge propping up of the market and my thought was how could this possibly go on for long? Well, it did.

Besides, many of the properties available at that time investors bought, fixed up, and sold for a profit. I looked at the original listings and went 'Ewwww'.

And we are talking California. Check out many other areas of the Country, North Carolina, Florida, etc. There are many livable and reasonably priced properties available still.

All the threads and comments are still here, just all in Misc now.

I'm starting to track SF tech companies and have some categories about those, but everything else will just be in misc.

Patrick, nice guy,

But his ten reasons are plain wrong and useless. I debated every point in the past.

The strength of a forum is in it's purpose. I.E. If the main purpose of Pat.net was to advise people on real estate through the big downturn?, then that purpose has passed.

I know that Mises institute has grown a lot in the past years because of people seeking stability in volatile times.

I have seen other forums do well when the purpose of the forum aligned with current trends, mainly cnc, in manufacturing, but faded when the trend faded.

TED does not have the open forums any more, either as it turned in to too much arguing.

Every owner of a business will tell you the purpose of the business is to make money, and they are wrong. The customer does not give a rat's ass if you make a dime. The purpose of the business has to align with the purpose of the customer or it will languish.

Perhaps a survey of what your purpose is for coming to Pat.net?

Those who waited for the great correction were wrong, but for all of the right reasons.

Instead we all got to see a 'tour de force' show of government policy co-opted by the financial sector as those waiting on the sidelines witnessed sound fundamental economics principles overruled by brute force of government on behalf of the financial sector.

I might add that those folks who didn't continue to monitor the situation, had initially decided not to buy and didn't have a back up plan. Maybe even a back up to to the back up and then didn't start to execute those plans - it's their own fault. If they did and that still didn't work then obviously those plans were not so sound. I just kept my day job, invested in the stock market and got lucky. Others might have done better by moving to another locale.

As for this site, I think it's still great. I've learned a lot on here even from people I don't agree with. Maybe even from one or two lunatics.

Thanks for keeping it around Pat!

Apologies for my crappy grammar...

The optimum time to buy real estate turned out to be mid 2012, but not for reasons that make economic sense.

Those who waited for the great correction were wrong, but for all of the right reasons.

Keep waiting... this thing is NOT over, by a long shot.

That said, for whatever reason, the 2004-2009 housing bubble was a unique event in all our lives and rightly or wrongly, Patrick became a safe harbor for the fears, hopes, and beliefs of many many people. Thus, once that burden was (even if unfairly) placed on him, it would be nice if he perhaps did a bit more in terms of closure for those who felt as if they (rightly or wrongly) deserved more of an answer than they got. Alas, it appears that this just isn't going to happen.

Patrick is not wrong. Phase II of the housing collapse may be happening in slow motion, but the housing market is far from a bottom. Housing is barely half way to the eventual bottom that I anticipate. Those who are still waiting to buy are the lucky ones. Those who have bought recently will come to regret it.

I discuss my analysis about real estate in the first link and then about the enveloping debt bubble causing the problems in the second.

The optimum time to buy real estate turned out to be mid 2012, but not for reasons that make economic sense.

For my neck of the woods it was the end of 2010.

Those who have bought recently will come to regret it.

I strongly disagree with this.

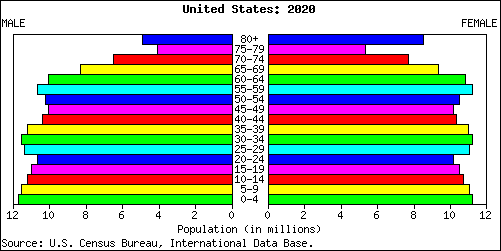

Our demographics are going to put us in a horrible housing pinch starting right around now.

Now that is a "full house"!

Though if gas stays at $2 then that will help people live further out. Every mile of distance from the core adds an exponential (quadratic?) amount of new land, assuming you're not moving into another neighboring housing market like the major conurbanations.

is wages. Wages go up, housing goes up, guaranteed.

This ain't Japan:

Patrick, can you limit posters to starting one thread a day? I think that could help with the craziness.

I suggested this several years ago.

Those who waited for the great correction were wrong, but for all of the right reasons.

Instead we all got to see a 'tour de force' show of government policy co-opted by the financial sector as those waiting on the sidelines witnessed sound fundamental economics principles overruled by brute force of government on behalf of the financial sector.

Great post.

True, 2012 prices were lower then than they are now... However, financing was very difficult for many. Though some of us might be cash titans, many of us depend on financing to make a purchase of this magnitude.

So if widgets sell normally for $25,000, and I say I'm willing to sell them for $10,000... but you don't have $10,000... Is it still a bargain?

To me the bargain is the point at which the price is the lowest and my ability to pay is at the highest. "Low prices" that I can't afford are irrelevant to me.

Our demographics are going to put us in a horrible housing pinch starting right around now.

Bill, you do great analyses. I always enjoy them. In this case though, your overlying assumption is that the economy is improving and will continue to do so. Do the same analysis but factor in a -12% GDP for 2017. See where that takes you. That is where I am coming from. Few people understand how that can happen, much less see that coming.

What do you see causing that?

Simple deflation. As I have reiterated in the past, deflation is a psychological occurrence caused by negative social mood. The causality is endogenously regulated (subconscious) and thus the participants do not even realize they are the cause. In fact they look for exogenous causes to blame like news or current events or social upheavals.

The public's mood, in the aggregate, is what is causing the markets around the world to decline, not vice versa. Bad news, social unrest, and the constant war-mongering of late are results of negative social mood - not causes. As the social mood becomes even more negative and intense, the associated public fear and anger will drive politicians from power, put banks out of business, increase unemployment, start more wars, lower hemlines, foster protests, darken movies, etc.

I picked -12% because that is what it was at the height of the Great Depression. I look for it to be much worse this time, as this is an Elliott Wave peak of greater degree than the Great Depression. Historically, GDP was -18% after WWI, 1920-21, but the Fed was new to the game at that time and so did nothing about it. The economy fixed itself in just a couple of years without "help" from government. When government helps, bad things happen as we learned in the Great Depression and we are learning all over again today.

I don't disagree with this, as I think that reality is actually just agreement. As you say the state constantly pushing war and other things creates a dystopian reality.

But from what i read the cause needs to be more concrete, i.e. when the entitlement SHTF that will be the cause of a real depression as at that point the state will no longer be able to kick the can down the road. In 2030 the last of the boomers will be 65 and that is when the SHTF, that is when the debt service will be at least a double digit percentage of the budget and the rest will get eaten up by entitlements.

deflation is a psychological occurrence caused by negative social mood

that and nobody has any money (or credit) any more.

Obviously*, our consumer economy runs on consumers having spending power.

Consumers enjoy spending power by having DISCRETIONARY income (not just disposable)

Discretionary income = gross income - taxes - all compelled payments

Housing has always put a heavy drag on discretionary income, since we stopped living under trees in lean-tos at least.

shows how Japan has had two major regimes -- the certainly inflationary 1973-93 and the "deflationary" 93-now period.

But the latter is a consequence of the first -- Japan's baby boom turned 25 in 1975 and what followed was 20 years of easy credit expansion, until everyone was loaded up with all the debt they could carry.

When the last yen was borrowed ca 1989, boom, it all collapsed and everyone had to work themselves out of the debt trap they'd gotten stuck in.

shows how Japan overshot on housing specu-investment in the 1980s.

Nobody understands how land valuation serves as both a mainsail for the economy (when consumer credit flows into it) and a sail anchor (when everyone is tapped out from their borrowing binge).

* except to Austrians and other right-wing schools.

Few people understand how that can happen, much less see that coming.

I can see it if DC falls into complete paralysis due to a (D) president (either Hillary or Sanders will do) and a (R) congress that has larger majorities but not the 2/3 required in the Senate to override vetoes.

The Fed doesn't really have the mandate to save the system from itself. Or maybe it does, but that is a regime we haven't really been in.

The 1990, 2001, and 2008 recessions came after pretty big boom-times.

http://research.stlouisfed.org/fred2/graph/?g=XAQ

compares consumer debt leverage (blue) with corporate debt leverage (red)

The story here is easy to see -- corporations got tapped out in the late 80s and late 90s, consumers loaded up debt in the 80s that they backed off on in the 90s, but when corporate debt really overshot in the dotcom recession consumers picked up the ball with a vengeance 2001-2007 as corporations were able to deleverage/default.

Note how leverage has been falling since 2010 though. We're not in an expansionary regime yet.

I've left off government debt since that's what's allowed everyone to deleverage 2010-now.

Kill that factor through gov't borrowing/spending cutbacks and hello depression, yes.

real gov't spending per capita

should that fall to 2000 levels, yeah, things will get ugly here fast

But TBH, I see a 'tax cuts for all!' regime coming this decade. Sanders wants MMT, maybe the GOP will go along with it if they get the flat tax regime they want. Not sure what Clinton wants.

Should the GOP take the presidency, I expect we'll see a replay of Reaganomics -- tax cuts and spending increases, since deficits don't matter when the GOP is proposing the budget.

^ yup, I didn't have Thing 1 of an economics education in 16+ years of public schooling in California (not taking economics in college didn't result in missing anything but still).

It was coming across Henry George's original treatise on wealth that really opened my eyes.

Here's something from P&P:

Advancing civilization tends to increase the power of human labor to satisfy human desires.

[i.e. since Man is a learning animal, labor gets more skillful at producing goods and services year after year, and capital infrastructure investment continues to multiply the laborer's productive ability in many areas]

We should be able to eliminate poverty. But workers cannot reap these benefits because they are intercepted. Land is necessary to labor. When it has been reduced to private ownership, the increased productivity of labor only increases rent. Thus, all the advantages of progress go to those who own land. Wages do not increase — wages cannot increase. The more labor produces, the more it must pay for the opportunity to make anything at all.

I first really saw this when I moved to Cupertino in 2000 and rents were rising faster than they could update the HTML on their websites.

real (2009 dollars) per-capita housing, health, and education costs per capita (age 15-64).

same data transformed by per-capita (age 15-64) cost divided by hours per week at average wage needed to pay these costs.

This shows one could get by working 10 hrs/week in 1980, now it takes 20 hrs a week to pay housing, health, and education.

Brutal.

Obviously*, our consumer economy runs on consumers having spending power.

If implied in "spending" is also borrowing power Austrians can't see that for good reason... it isn't true. That is the myth being perpetrated by a Keynesian mentality... that borrowing and spending drive the economy. The reality is that production and saving are the paths prosperity. In a world with negative savings rates and armpit deep in debt, you can try to borrow and spend all you want but eventually you will have to produce something. And you won't be able to do that successfully until you free yourself from debt.

I rest my case:

same data transformed by per-capita (age 15-64) cost divided by hours per week at average wage needed to pay these costs.

This shows one could get by working 10 hrs/week in 1980, now it takes 20 hrs a week to pay housing, health, and education.

Brutal.

that borrowing and spending drive the economy

this is still true and obvious if you look at history. We go into the unsustainable zone when the borrowing is funding consumption (and/or stock speculation) and not bona fide goods-producing capital investment -- and the crash will come eventually.

I don't care about Keynesian analysis, just what has happened before and will happen again.

http://en.wikipedia.org/wiki/Business_cycle#Credit.2Fdebt_cycle

Steve Keen is my main man here, so I'm a Keensian not a Keynesian I guess.

So if you want to see what's going to happen down the road, it's best to look at credit leveraging in the economy now.

Part of the main problem we have is all our data is aggregated, it'd be much more helpful to look at the data on a per-quintile basis (to understand how the middle 3 quintiles of the distribution are doing)

Keen goes even further by attempting to model the entire f'in economy at the individual actor level.

http://www.debtdeflation.com/blogs/minsky/

Now, I don't know if he actually knows what he's doing, but I admire the attempt.

As for leveraging, Japan has shown everyone that gov't can go to the moon.

all you need is tax cuts & a printing press, and the will to use it. Austrians need to understand that Weimar/Zimbabwe only happens when the shelves go bare and consumers bid up prices on scarcity. WE ARE NOT IN THAT REGIME NOW (largely thanks to 1.357+ billion China needing our dollars and know-how to continue moving themselves out of medieval-level poverty, plus food security from marvelous productivity gains in factory farming since the 1950s).

Sanders is promoting MMT aka 'hey man let's just print'.

Knowing what I know about housing inflation, I don't think this is the best idea (landlords are all 'yess, come little pretties into my trap'), but it's certainly better less-worse than repeating the 1930s.

production and saving are the paths to prosperity

aka capital concentration, yes. But money in the bank is at the end of the day IRRELEVANT.

What matters is production vs consumption of wealth, and distribution of opportunity, so potential wealth creators become actual wealth creators and not unhappy spectators in the economy.

Wealth at its most elemental is the condition of having no unmet needs and wants. It is also the ability to create the goods and services that provide this utility ("capital").

It is not money, really. Money is just an implementation detail, the markers we trade to determine who gets to take what from the store.

This is no longer the pre-war developmental era. We are living in the Jetson's economy of push-button plenty, we just don't know it, due to the rife rent-seeking from all angles liberating from us our disposable incomes.

Give me $5000 ($800 in 1970 money), and I can live like a King for a year, since I'm no longer on the housing and education treadmill (and my wants are simple -- an interesting non-fiction book or two hours cycling up a scenic road is Good Enough for me). Health insurance is my dominant expense now, but I haven't been hit with a major health expense since 2009, and that was just ~$600 out-of-pocket.

What matters is production vs consumption of wealth, and distribution of opportunity, so potential wealth creators become actual wealth creators and not unhappy spectators in the economy.

Like I've said in the past, I enjoy your analyses. My only (slight) disagreement with your statement is that money in the bank is irrelevant. Even in an inflating economy it is not irrelevant but it is foolish. In a deflating economy it is absolutely necessary.

I think the idea that slight inflation is necessary for progress was an idea born of the 20th century, perpetuated by the banking industry, and co-opted by the Federal Reserve to justify skimming their annual profits from an ignorant population of working class producers. Inflation and deflation are normal cycles that have happened for all of history. Sometimes the booms and busts were extreme but they always leveled themselves rather quickly without state intervention. Today, intervention is the norm and the current boom is so levered that the bust will be catastrophic. Whenever government tries to intervene in the business cycle, greed and avarice dominate the decision process. Nothing good ever happens when the state decides to tell the populace what it should have or want. I am reminded of a quote from Milton Friedman,

"Indeed, a major source of objection to a free economy is precisely

that... it gives people what they want instead of what a particular

group thinks they ought to want. Underlying most arguments against

the free market is a lack of belief in freedom itself."

Whenever government tries to intervene in the business cycle

that's just it, since the postwar management revolution of the 1960s, VisiCalc in the 1970s, 123 & Microsoft Excel in the 1980s, the internet in the 1990s, and touch phones today (j/k), I don't think we face a 'business cycle' any more -- of business over-investing in productive capacity, outrunning demand.

Japan has shown government has a pretty big bazooka to intervene with, and the benefits of such intervention is to eventually (hopefully...) reset the game for the debtor classes, at the expense of the "savers" aka 1%.

" free market is a lack of belief in freedom itself"

I'll believe in the "free market" freedom of minarchists when there's good land free for the taking again.

and my doctor has enough time on his hands to make housecalls for that matter.

this is why I'm a left-libertarian and not a right-libertarian.

http://foldvary.blogspot.com/2012/03/self-destruction-of-libertarian-party.html

I don't think we face a 'business cycle' any more -- of business over-investing in productive capacity, outrunning demand.

From an Austrian, and perhaps more cogently, a Socionomic point of view, it is not over-investment that causes the problems. It is mal-investment. Low or no interest credit will make a business go into debt in an attempt to make a profit in an area of production for which there may not be sufficient demand. Worse, he may not be qualified to produce a product of that nature and thus manufactures an inferior product simply because the funding is available and the risk is minimal. I believe the real estate market is doing this now. Low mortgage rates have created a new bubble in both the residential and commercial areas. When Treasury yields start to rise significantly in the coming months, real estate will again take a big hit, probably bigger that 2006.

Mal-investment tends to be much less a problem when a businessman must put his own capital at risk, or at least meet adequate credit qualifications. Subsidies, tax credits and the like are just stealing from those who produced and saved to provide an unqualified advantage to a privileged group. In keeping with the real estate theme, the reduction of FHA down payments to 3% this year is simply creating another round of sub-prime loans. Apparently no lessons were learned from the last debacle.

When Treasury yields start to rise significantly in the coming months,

this is going to be the Test of Theories heh

says no inflating rates in my lifetime, LOL

the reduction of FHA down payments to 3% this year is simply creating another round of sub-prime loans

not in the slightest. Getting more people out of the maws of the "income property" brigade is a good thing.

FHA losing 200 bps on bad loan principal is neither here nor there in the scheme of things.

Rates going up with the economy going down simply doesn't compute for me now. We'll see!

One of the beauty things about the QE injection is that all that money is still pinging around the system. Until we have off world colonies, printed money has nowhere else to go.

shows the scale of the money pumps (blue). Red is federal spending.

Funny how the GOP successfully mau-maud Bernanke to slow down the QE leading up to the 2012 election.

Funny how the longer we go the lower it goes.

My thesis is that the more debt we make, the lower interest rates have to go.

In Japanese, that's 積み上げより債務、金利は下がらせる

which of course they've been giving us a preview of this dynamic since 1993.

"Manufacturers, which have benefited from the export competitiveness generated by a weaker yen, have been limited in their hiring. The number of jobs in the sector was 10.19 million in November, matching the lowest level since December 2012, when the figure hit a level unseen since 1961"

US has 12M mfg jobs, with a population base almost ~2.5X greater:

I don't get it man, somebody "disliked" my treasury chart above.

They also disliked this post. There's a serial disliker whose goal it is is to dislike anything that doesn't confirm their biases. Even fact-based stuff.

I suspect the disliker doesn't believe in evidence, empirical knowledge, or reality based information.

« First « Previous Comments 5 - 44 of 44 Search these comments

I see Misc and.... no others. What?