patrick.net

An Antidote to Corporate Media

1,267,312 comments by 15,153 users - Ceffer, goofus, Misc, RWSGFY online now

Housing Market Sure to Double-Dip: Whitney

2010 Mar 16, 3:31am 23,471 views 90 comments

Comments 1 - 40 of 90 Next » Last » Search these comments

That's right. Extend and pretend is not going to work indefinitely. There will be another dip.

The market will stabilize now, if not now soon, all these things the goverment is doing will create inflation, everything will go up, if houses don't go up at least they will not fall as deep as without inflation

@jordi_jorda,

There is currently no inflation and there won't be inflation for quite some time. In order to have inflation take hold, you need velocity of money. Right now, velocity is negative and you can see proof of this just by going out to the Fed's website and looking at their graphs! Credit all across the economy is collapsing. Without people and businesses taking on credit, there is no velocity and hence no inflation.

An 8K credit on an 800K house isn't going to cause a massive dip in markets over here in the bay area. On a 300K house, it's a little larger. On a 100K house, it could be quite a bit.

In the end a dip like that won't be massive. Now that at least some of the homes have been flipped to new owners, it won't be a mad rush down. People will likely drop their prices over a few months to match that 8K credit, but it will still take a bit of time before a real double dip happens.

It's likely, but I'm not sure if the government programs will cause it. More likely arms resetting will cause a larger dip.

Whitney has not been that accurate as of late, so lets not get fixiated on any one "expert" and treat them like a modern day prophet.

http://investingcaffeine.com/2009/11/23/meredith-whitney’s-cloudy-crystal-ball/

The expiration of the $8k credit should not have any impact on higher end houses since, if you can afford that kind of house, you most likely don't qualify for the credit since your income is too high.

Yes many properties are being bought out with cash. But I think many of these all cash purchases are made by house flippers. They will be more aware that a cash offer may not be an option for the future buyer of the home they intend to flip. That may be taken into consideration when they make these cash-offers no?

Yes many properties are being bought out with cash. But I think many of these all cash purchases are made by house flippers.

And that is what is left, flippers buying between themself without any real end users, horse trading!

inflation will only work if your wage got inflated too….

add no job recovery to this and there is no inflation in sight.

Let me correct that HousingWatcher posted:

Meredith Whitney's Cloudy Crystal Ball

Although I'd say in her defense, as an investment advisor that spends a lot of time talking to the media, you WILL find contradictory statements at different points in time. Who doesn't change their mind, or make mistakes?

Yes many properties are being bought out with cash. But I think many of these all cash purchases are made by house flippers.

And that is what is left, flippers buying between themself without any real end users, horse trading!

Exactly. Slowly these buyer market for all cash flippers will wane and another tipping point in RE market will be the saturation of these properties ready to be flipped. Throw in the ARM resetting(especially in CA for next 2-3 years), regular mortgage going sour and strategic defaults. Happy days are ahead of California housing market. Cheers!

Yes many properties are being bought out with cash. But I think many of these all cash purchases are made by house flippers.

And that is what is left, flippers buying between themself without any real end users, horse trading!

I am seeing quite a few of these types. Cash offer, splash a new paint, bought for 350K and listed for 520K, waiting for a sucker. You gotta love the realtwhore description on those listings: "NOT A SHORT SALE OR REO, New carpet, New paint..blah..blah..as is sale"

Oh..yeah..if its as-is sale, why the hell would I buy from you, I would rather buy from bank..Happy days are ahead indeed.

The expiration of the $8k credit should not have any impact on higher end houses since, if you can afford that kind of house, you most likely don’t qualify for the credit since your income is too high.

This likely explains why the only houses that are selling in Portland are those at the low end, less than $250K. Sure some folks with big $$ are getting great deals at the high end but very few can pull off the financing. Early on the local realtors were blaming 'folks sitting on the fence' but it seems clear to me that given our unemployment numbers and the fact that prices are still way out of whack with incomes, it's more than just folks sitting on the fence waiting for prices to drop....folks just can't afford those $300K+ homes.

The expiration of the $8k credit should not have any impact on higher end houses since, if you can afford that kind of house, you most likely don’t qualify for the credit since your income is too high.

Another thing to mention about Portland's market though I don't think we are unique in this regard... the $8K credit would assist the 'move-up' buyer though the feeling around Portland is that those that sold aren't moving up but renting or leaving town, did I mention our crappy unemployment numbers?!

I am a landlord for 30 yrs, also real estate investor and mtg broker, I am in 100% forclosure due to govt. policies on lending and banks that dont care. If you think you have seen something with all these forclosures, just wait. Prices will go a lot LOWER as the years go on. No way out,RENT ONLY.

@warblah/sarrodda

A wage increase or increase in borrowing is not required for inflation (or rather hyperinflation) to occur, the Fed says that but it isn't true. Just look at what happened in Argentina or Zimbabwe or Weimar Germany. Inflation and/or hyperinflation can also occur if a central bank screws up its monetary policy, or decides to purposely devalue its currency in order to inflate away debt. Remember, the Fed doesn't even have to print money, only electronically sell/buy a few dozen trillion dollars worth of bonds back and forth between it and the Treasury. Tadaaa inflation!! Yes, that is an extreme example, but I would point out they are already doing essentially that with QE, just on a smaller scale. Also bear in mind that they're throwing lots of money at the GSE's, who are lending out even if the banks aren't right now.

It should be noted that while there have major deflationary forces due to large amounts of debt being defaulted on that the rate of inflation still hasn't gone negative yet. We had a drop in the rate of inflation (disinflation) for a while around the start of 2009, and the drop was to a rate that was still positive, but then it went up again.

"I am a landlord for 30 yrs, also real estate investor and mtg broker, I am in 100% forclosure due to govt. policies on lending and banks that dont care."

No, your in foreclosure because your a speculator who gambled and lost. If I lose all my money in Vegas, Barney Frank is not to blame. Nor is Goldman Sachs. I am to blame.

I'm going with stagflation.

A “correction†in bonds will look like a big spike in interest rates. I doubt that will drive real estate prices much lower since all the transactions I’m watching currently are being made with cash.

Don't think of it as real estate prices being driven lower, you have to think of real estate as a whoopee cushion in the immanent shadow of a big fat ass.

Let's get at the coalface: real estate, which is essentially a discretionary consumer good, must eventually reconcile with the reality of diminishing middle class incomes. It's either that, or the government grubstakes the house buying public forever. THERE ARE NO OTHER ANGLES YOU CAN COME AT THIS FROM.

I also see a problem with public perception. if you consider what some of these same places/parcels went for ten or fifteen years ago, the asking prices/assessments in most parts of the country are still batshit, which means the mentality on both the part of the seller AND buyers is still very much out of whack. Ten years ago, a quarter million bought you a veritable spread in most parts of the country. But it's now etched into the mindset that this is the lower end of housing. Have wages/salaries gone up in stride with that perception? NO! In a normal market, the only buyer willing to overpay by 15% (without the help of Uncle Sam) is the well-heeled architecture nut trying to buy some rare architect designed/built home.

I am a landlord for 30 yrs, also real estate investor and mtg broker, I am in 100% forclosure due to govt. policies on lending and banks that dont care. If you think you have seen something with all these forclosures, just wait. Prices will go a lot LOWER as the years go on. No way out,RENT ONLY.

Sorry to hear about your losses. What happened, exactly? Did you take out HELOCs on your properties?

These days, there are no landlords - only speculators using tenants as placeholders while they wait for their day in the sun.

20% of jumbo loans in CA are in default or foreclosure as of Feb. according to Fed numbers. Most of that spike took place in 2009. Lenders are being very slow to take back properties.

If you're bullish on mid-high end housing at this point you have your head in the sand.

I don't see anything could possibly sustain the housing price at this point. Be wise, don't buy the bubble.

Many think we are following Japan's path. We may be following Argentina's. http://topdocumentaryfilms.com/argentinas-economic-collapse/

I agree. A currency crisis is coming. I think rates will skyrocket to double-digits. I don't believe that they will allow the currency to go to zero. Before then, they will probably have a new currency available. Maybe it's the new global currency they are pushing for? If they let the dollar to go to zero, everyone will be debt free. I doubt they will allow that to happen.

The expiration of the $8k credit should not have any impact on higher end houses since, if you can afford that kind of house, you most likely don’t qualify for the credit since your income is too high.

Everyone's focused on the $8k credit expiration. The larger issue w/ Bay Area homes are the expiration of QE and MBS purchases by the Fed. That will affect financing for housing over FHA/Fannie/Freddie limits.

@warblah/sarrodda

A wage increase or increase in borrowing is not required for inflation (or rather hyperinflation) to occur, the Fed says that but it isn’t true. Just look at what happened in Argentina or Zimbabwe or Weimar Germany. Inflation and/or hyperinflation can also occur if a central bank screws up its monetary policy, or decides to purposely devalue its currency in order to inflate away debt. Remember, the Fed doesn’t even have to print money, only electronically sell/buy a few dozen trillion dollars worth of bonds back and forth between it and the Treasury. Tadaaa inflation!! Yes, that is an extreme example, but I would point out they are already doing essentially that with QE, just on a smaller scale. Also bear in mind that they’re throwing lots of money at the GSE’s, who are lending out even if the banks aren’t right now.

It should be noted that while there have major deflationary forces due to large amounts of debt being defaulted on that the rate of inflation still hasn’t gone negative yet. We had a drop in the rate of inflation (disinflation) for a while around the start of 2009, and the drop was to a rate that was still positive, but then it went up again.

Couple comments here....

The Fed will never hyperinflate because it would mean the death of the Fed. Congress may try and force them to do it but even our idiot politicians know that governments tend to fall during currency crisis.

Second, the stated inflation rates are wrong. During the run-up they were dramatically UNDER-reporting inflation because they weren't correctly factoring in housing costs. Likewise they are currently OVER-reporting inflation for the same reason.

Until all this money actually enters circulation we won't have meaningful inflation. And at the end of the day, the banks don't want to lend and people/companies don't want to borrow. So for the foreseeable future all that printed money will be sitting in bank vaults or on reserve w/ the Fed.

Buy when everyone is selling. Sell when everyone is buying. It always worked for me.

So how are your Enron and Bear Stearns shares doing? I love contrarians, they are useful to have on the other side of my trades.

@warblah/sarrodda

A wage increase or increase in borrowing is not required for inflation (or rather hyperinflation) to occur, the Fed says that but it isn’t true. Just look at what happened in Argentina or Zimbabwe or Weimar Germany. Inflation and/or hyperinflation can also occur if a central bank screws up its monetary policy, or decides to purposely devalue its currency in order to inflate away debt. Remember, the Fed doesn’t even have to print money, only electronically sell/buy a few dozen trillion dollars worth of bonds back and forth between it and the Treasury. Tadaaa inflation!! Yes, that is an extreme example, but I would point out they are already doing essentially that with QE, just on a smaller scale. Also bear in mind that they’re throwing lots of money at the GSE’s, who are lending out even if the banks aren’t right now.

It should be noted that while there have major deflationary forces due to large amounts of debt being defaulted on that the rate of inflation still hasn’t gone negative yet. We had a drop in the rate of inflation (disinflation) for a while around the start of 2009, and the drop was to a rate that was still positive, but then it went up again.

Couple comments here….

The Fed will never hyperinflate because it would mean the death of the Fed. Congress may try and force them to do it but even our idiot politicians know that governments tend to fall during currency crisis.

Second, the stated inflation rates are wrong. During the run-up they were dramatically UNDER-reporting inflation because they weren’t correctly factoring in housing costs. Likewise they are currently OVER-reporting inflation for the same reason.

Until all this money actually enters circulation we won’t have meaningful inflation. And at the end of the day, the banks don’t want to lend and people/companies don’t want to borrow. So for the foreseeable future all that printed money will be sitting in bank vaults or on reserve w/ the Fed.

100% of fiat currencies fail. It's just a question of when.

Buy when everyone is selling. Sell when everyone is buying. It always worked for me.

100% of fiat currencies fail. It’s just a question of when

Actually, the truth is 100% of non-fiat currencies fail. History has shown this to be true.

100% of fiat currencies fail. It’s just a question of when

Actually, the truth is 100% of non-fiat currencies fail. History has shown this to be true.

Can you give a few examples?

Contrarian doesn't mean buying crap. It generally means you're buying something fundamentally strong, but which has been hit for the wrong reasons. Wamu might have done poorly, but buying citi, wellsfargo, boa after the massive sell off would have been pretty profitable. Wellsfargo in particular!

Contrarian doesn’t mean buying crap. It generally means you’re buying something fundamentally strong, but which has been hit for the wrong reasons. Wamu might have done poorly, but buying citi, wellsfargo, boa after the massive sell off would have been pretty profitable. Wellsfargo in particular!

IMO all the banksters were hit for the RIGHT reasons. We should have had some cleansing bankruptcies and moved on with our lives. However, they snowjobbed the media and the FedGov, who also propagandized you, that putting makeup on these corpses would fix everything. Maybe in some years from now they'll actually be viable banks again not firmly dependent on special facilities & Enron accounting tricks. All this, this is just consequence of limitless blank check backing of Treasury & Fed. Citibank in particular, just should not exist. Megabanks and Too Big To Fail needs to end.

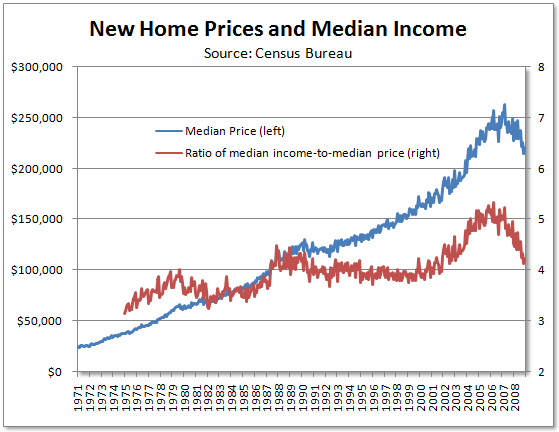

I notice the word "new" in there and that your chart stops at 2006.

Obviously used homes and overhang need to be bulldozed. Or we can

just refer to Case-Shiller which may tell a different story.

Census-based chart of new homes and add a few years is less supportive of sharecropper inevitability:

tatupu70 says

Jimmy says

100% of fiat currencies fail. It’s just a question of when

Actually, the truth is 100% of non-fiat currencies fail. History has shown this to be true.

Can you give a few examples?

Sure I could, but I think it would be easier just to turn it around. Are there any civilized countries not using fiat currency?

tatupu70 says

Jimmy says

100% of fiat currencies fail. It’s just a question of when

Actually, the truth is 100% of non-fiat currencies fail. History has shown this to be true.

Can you give a few examples?

Sure I could, but I think it would be easier just to turn it around. Are there any civilized countries not using fiat currency?

lol. Does that mean you don't know any? Civilized countries want/need a fiat currency so they can print and make the citizens pay through inflation. So what if civilized countries have fiat currency. My original post stated that 100% of fiat currency fail. What does that have anything to do with your question? It sounds like you are trying to avoid it.

Jimmy--

I just didn't want to list every civilized country on here--it seemed kind of tedious. Unless you have a different definition of failure, I'd say the fact that most countries were on a fixed standard but switched to a fiat currency that is still in use is pretty good proof.

The larger issue w/ Bay Area homes are the expiration of QE and MBS purchases by the Fed.

The end of QE has not gotten much press; I read about it first on this CR thread. Ben has (for now!) landed the helicopters. The last of the MBS purchases are being sterilized by the Treasury Supplemental; supposedly, the Supplemental Bills (56 day terms) will be paid back as the Fed winds down some of its temporary measures from the beginning of the crisis (think TAF, TALF, etc...)

Comments 1 - 40 of 90 Next » Last » Search these comments

Meredith Whitney interview with video linked below.

Housing Market Sure to Double-Dip: Whitney (CNBC)

#housing