patrick.net

An Antidote to Corporate Media

1,260,747 comments by 15,055 users - goofus, SharkyP, Tenpoundbass online now

« First « Previous Comments 5 - 30 of 30 Search these comments

Anyway, the SSTF isn't a current issue at all. If I were running things around 2020 I'd start raising the contribution about .2% each year to around 16% of wages, so that Gens X, Y, and Z will be able to decent retirements like the BBers.

If I were running things around 2020 I’d start raising the contribution about .2% each year to around 16% of wages, so that Gens X, Y, and Z will be able to decent retirements like the BBers.

Probably 16% at a min. We don't save adequately. SS is a forced savings. That sounds elitist. But, part of it is that some don't earn enough to save adequately. If it comes off the top, businesses do have to up their pay to make a living wage. Right now, insisting people consistently save is spitting in the wind ... things are tight. Save what?

To be fair, it is a temporary cut.

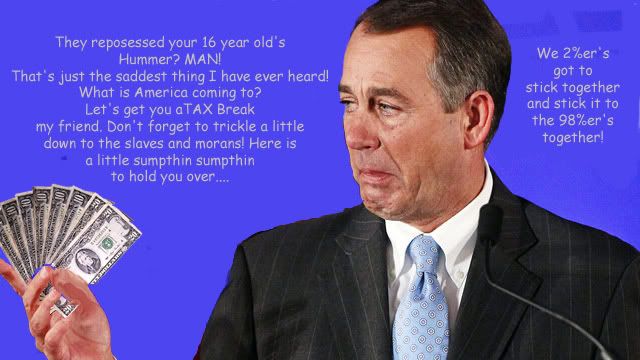

Don’t worry though, next December Republicans will be talking about how we can’t go back to the 6.2% rate because it’ll kill jobs and you don’t want to “raise taxes†during a recession.

These motherfuckers don’t have any plan, other than dismantling the united states of america.

LMAO....love it. However, wouldnt you say the DEMS also use the same tactics to stay in power. I think our politics are so polarized that we cant get many effective bills passed so the easy wins get oversensationalized. I mean, really, who gives a damn about giving a rich man an additional 2%.

If I were running things around 2020 I’d start raising the contribution about .2% each year to around 16% of wages, so that Gens X, Y, and Z will be able to decent retirements like the BBers.

Probably 16% at a min. We don’t save adequately. SS is a forced savings. That sounds elitist. But, part of it is that some don’t earn enough to save adequately. If it comes off the top, businesses do have to up their pay to make a living wage. Right now, insisting people consistently save is spitting in the wind … things are tight. Save what?

You folks are geniuses...I am gonna go make another CIROC martini and smoke another cigar baby!!!

What happened to your interest in increasing your debate skills? Insult is not effective in debate. Why don't you and Shrek try some consistent logic, some facts and some degree of emotional appeal to your audience. Insults might cause some to react or even overact. To the mainstream, we totally dismiss you. No kidding. Maybe you bury some nugget I might even agree with....but we'd never know b/c we scroll right past. I'm still trying to figure out the blogosphere. It's like a mini Glenn Beck, Rush and Ed Schultz try to chime in. Where, oh, where is a voice a reason??? Give me the website link of a higher caliber debate please.

What happened to your interest in increasing your debate skills? Insult is not effective in debate. Why don’t you and Shrek try some consistent logic, some facts and some degree of emotional appeal to your audience. Insults might cause some to react or even overact. To the mainstream, we totally dismiss you. No kidding. Maybe you bury some nugget I might even agree with….but we’d never know b/c we scroll right past. I’m still trying to figure out the blogosphere. It’s like a mini Glenn Beck, Rush and Ed Schultz try to chime in. Where, oh, where is a voice a reason??? Give me the website link of a higher caliber debate please.

Posting malfunction? This is what I authored. I just copied Clarence 13x's post...then unleashed myself. You get the point I'm sure.

To be fair, it is a temporary cut.

Don’t worry though, next December Republicans will be talking about how we can’t go back to the 6.2% rate because it’ll kill jobs and you don’t want to “raise taxes†during a recession.

These motherfuckers don’t have any plan, other than dismantling the united states of america.

LMAO….love it. However, wouldnt you say the DEMS also use the same tactics to stay in power. I think our politics are so polarized that we cant get many effective bills passed so the easy wins get oversensationalized. I mean, really, who gives a damn about giving a rich man an additional 2%.

The dems are mostly incompetent, corrupt, and stupid, but I don't think their main goal is to destroy the country. I do believe that is the GOP's goal. They want to turn the US into a loose collection of corporate fiefdoms and theocracies.

Holy crap, I just realized the goverment will fund our kids education IRA of $4,000 in 2011 with the 2% social secuirty tax break. Where did this come from? Is our government that stupid?

I do believe that is the GOP’s goal. They want to turn the US into a loose collection of corporate fiefdoms and theocracies.

I don't know whether I agree that it's their intent. It's just that other priorities (self interest) prevent them from seeing that's where they are taking us.

Where did this come from? Is our government that stupid?

Yes. Yes it is.

Probably 16% at a min. We don’t save adequately. SS is a forced savings.

I'm afraid I''ll have to disagree with you. Social Security isn't forced saving, it just another way to get money so the government can spend more than it takes in every year. There is no massive piggy bank that the government is tossing the "surplus" into, they are using the social security money on everything from military spending to bailing out the banks. The "surplus" is just phantom money the government owes from one account to another. When they need to tap the "surplus" they will have to raise taxes to do it. So your 16% Social Security tax rate will be added to the additional percentage they will need to pay back the Social Security surplus.

Although its a great idea in principal, the money is just going to get flushed with all the other money the government collects. The more things change the more the stay the same. The supposed voter backlash this election year changed nothing.

Yeah, I agree that SS as a 'forced savings' vehicle is terrible.

I would *much* rather have a forced 401k, defaulted to bonds or cash equivalents.

Of course, the program would have to be government run, or else we'd need a constitutional amendment to avoid the mixed interpretation of the commerce clause problem.

Either that, or we could just let people who get to retirement age with no money die in the street.

What kinda morons do we have running the country anyway?

They are called Democrats, and the overwhelming majority of them are total financial incompetents.

The Laffer (â€Laugherâ€) Curve is a joke. The wealthy paid alot more tax in the couple of years after Reagan and the 80s Congress cut taxes

You just contradicted yourself. And, the Laffer Curve, btw, isn’t ‘new’. It was proven in the 1920s and 1960s. JFK was a de-facto supply sider, after all.

Once again, I think you need a refresher on what the word proven means.

Denial of reality as it actually is doesn’t substitute for reasoned refutation. Yet, you do it all the time. Your liberal cultist programmers must be so proud of you.

Pot. Kettle. Black.

The Laffer Curve isn't some magical rule. Most people pointing to it have no idea what was being discussed, which is simply that there is an *optimal* tax rate at which revenue will be maximized -- somewhere between 0 and 100%. At 100% taxation, the economy becomes barter based so no revenue is collected. At 0%, you don't collect any revenue.

Every economy is different, so there is no 'optimal rate'.

The Bush tax cuts are the perfect example of how cutting didn't increase revenue. It was almost two years between the cuts going into effect before federal revenue actually started increasing, and it was entirely because of the credit bubble.

Somehow that got twisted to "lowering taxes increases revenue", which is simply not true.

I think SS has to be viewed more as a program for which a promise is made that the next generation is paying for the current generations SS benefits, regardless of where the country is at that time. Currently we're pulling money from SS, in the future we're going to be short. But it's still just a promise, one which isn't really tied to $'s, but tied to a standard of living at the time of retirement.

So if we hit 5000% inflation, anyone who used bonds could be wiped out. Or if they invested poorly, they get wiped out by an Enron or something. The idea of SS is a promise that isn't written in $'s. It's a promise to give a stipend at retirement which will be a minimal cost covering for you. So regardless of where the economy is, or what is happening, you'll have some basics when you retire.

It might require a 20% tax in 20-40 years, who knows.

As far as the GOP, I think one key problem with the GOP is that they each individually see ways to make themselves richer or help keep their power by making others richer without understanding the true and full repercussions of what they're doing. They're ensuring that they're family is rich and powerful for the longer term but they're undermining everything and eventually going to destroy their families wealth as it's all undermined.

Somehow that got twisted to “lowering taxes increases revenueâ€, which is simply not true

right wing dogma

key problem with the GOP is that they each individually see ways to make themselves richer or help keep their power by making others richer without understanding the true and full repercussions of what they’re doing

They called my generation (boomers) the "me generation," and with good reason. And that selfishness and self involvement has manifested in many ways, across political and socioeconomic groups. Now, as boomers enter their "conservative years" for many that is more or less manifest in a "I've got mine" attitude.

The sad thing is that there is so much propaganda out there from the right, that we can't even have an honest conversation and analysis about tax policy. I fear that only a worse crisis than we have already experienced can lead to change, and it could easily be the wrong change given the current power structure.

The sad thing is that there is so much propaganda out there from the right, that we can’t even have an honest conversation and analysis about tax policy. I fear that only a worse crisis than we have already experienced can lead to change, and it could easily be the wrong change given the current power structure.

There are propoganda problems on the left as well. The "right" only talks about the total % of gross taxes paid by people of varying income levels - if you look at it this way, they say "the top 2% pay 40% of total taxes" (or whatever the number is - I'm quoting from memory). When you look at it this way, it surely looks "unfair". When these are the only numbers or "facts" presented, the "right" will win every time. This is where the "right" whips the left's ass - who wants to promote making a few people pay for EVERYTHING?

I think the better counter-argument is to compare the % of income paid in taxes. For the sake of argument (these numbers are not really what they are - I have no idea what they are...if you know please fill in the blanks for me...), let's say the top 2% are only paying 6% of their income in taxes and those making 50K are paying 10%. This certainly doesn't seem fair to me. I think this is a more reasonable argument for changing the top tax rates - or better yet, throwing out the current swiss-cheese of a tax code. If the "left" or "liberals" or "progressives" (or whatever they want to call themselves) would produce THESE types of numbers people would be more inclined to listen. Instead, the argument is always "these people wouldn't miss paying more" - this doesn't resonate with joe sixpack because HE would certainly miss it. With the screwed up tax system of deductions, different rates for different types of income, etc, it just looks "confiscatory" to talk about raising taxes to some huge percentage - a huge percentage that in reality will never be paid anyway!

I also think it is disingenuous to not include social security/medicrap when talking about effective tax rates - worse when you don't include the "employer" side of the contributions as the "employer" certainly includes this when they figure the total cost of "employing" someone. It is immediately out of whack when the 1st 106k is taxed by SSI/medicrap at a ~13-15% rate - and most people don't make over that amount.

Whoooo Change!!!

Yes we can screw it up better than THEM.

The Democrats, because they aren’t Republicans…

Transparency, has never been more convoluted…

If it weren’t for Republicans it would all be the fault of Chinese.

What’s the Difference between Obama or the Crazy lady running the country?They had to send the Crazy lady to China to kiss their ass, from the wiki leaks, while chief ass kisser stayed home to kiss the Republicans butt.

Yes we can… ya’ll been played!

Power Elite want's to stay in power. Middle class and poor are only there as long as they provide labor to keep up the lifestyle for the elite. Government will probably cut all the programs soon, after all if they can outsource all the jobs overseas why provide benefits for American workers? It's not like they need them.

You also need to figure in the "Bush tax cuts" happen to cut taxes on something that's greatly reduced anyway. I.E.- reducing taxes on severly slashed dividends does not yield a valid comparison to pre-bubble years. If the tax cuts on dividends were repealed, it's not going to bring back tax revenues since dividends aren't at pre-bubble levels. Other aspects fo the tax cuts do more to bring back tax revenue, like reducing or eliminating the per kid tax credit.

...The idea of SS is a promise that isn’t written in $’s. It’s a promise to give a stipend at retirement which will be a minimal cost covering for you. So regardless of where the economy is, or what is happening, you’ll have some basics when you retire.

Promise is a good way to put it, but it's not just for retirement. I wish people would recognize that.

I have always considered SS an insurance policy. It is actually titled SSI (Social Security Insurance). SSI replaces some of our lost income in retirement, or disability or to dependants of retiree (spouse) or disabled (minor children).

Well unless we culturally change how we view elders, we're going to keep SSI around or make changes necessary to keep it around. I doubt culturally we're going to change much. We are used to our individual freedoms. When we are young we try and move out fast. When we're old, we try and hang onto our homes for as long as possible. If we cut SSI that burden moves to the children. #1 parents don't want to move in with their children, #2 children don't want their parents moving in with them for the most part.

So I see us keeping that promise in some form. The benefit will be there, how it's done is unknown today, as it's a problem 15-30 years out. Or more.

I never understood the "hanging onto the house" thing. My Dad is doing it right now, despite his heart condition and Mom's creeping into....you know, forgetting things. Why do 2 people at 80+ cling to a 2 story (3 counting garage underneath) house? It's not the one any of the children grew up in. Every time I talk to him it's well we'll think about putting it on the market after I do this and that and paint the place. Just SELL the thing as-is I say. I suppose I'll never understand, except for needing more space for Little Vicente, we were perfectly happy in our prior 900-square foot 2x1 cottage. I wish like heck I could afford to own a house in california and put an inlaw cottage out back for them. Can't due to the screwed up real estate situation here.

…The idea of SS is a promise that isn’t written in $’s. It’s a promise to give a stipend at retirement which will be a minimal cost covering for you. So regardless of where the economy is, or what is happening, you’ll have some basics when you retire.

Promise is a good way to put it, but it’s not just for retirement. I wish people would recognize that.

I have always considered SS an insurance policy. It is actually titled SSI (Social Security Insurance). SSI replaces some of our lost income in retirement, or disability or to dependants of retiree (spouse) or disabled (minor children).

SSI is a subprogram within social security called Supplemental Security Income (SSI). It's basically welfare for poor or disabled seniors that don't have the work history to qualify for regular SS. I remember it being passed sometime in the early 70's. I'm pretty sure SSI is funded under general tax revenues not FICA.

…The idea of SS is a promise that isn’t written in $’s. It’s a promise to give a stipend at retirement which will be a minimal cost covering for you. So regardless of where the economy is, or what is happening, you’ll have some basics when you retire.

Promise is a good way to put it, but it’s not just for retirement. I wish people would recognize that.

I have always considered SS an insurance policy. It is actually titled SSI (Social Security Insurance). SSI replaces some of our lost income in retirement, or disability or to dependants of retiree (spouse) or disabled (minor children).SSI is a subprogram within social security called Supplemental Security Income (SSI). It’s basically welfare for poor or disabled seniors that don’t have the work history to qualify for regular SS. I remember it being passed sometime in the early 70’s. I’m pretty sure SSI is funded under general tax revenues not FICA.

That's correct, and SSI is tiny compared to what FICA is paying for -- ~$55B vs $700B.

However, it's important to know that prior to the 1970s, SSI was paid out of the same funding as FICA. The legislation simply moved to make the main fund more of a retirement program / pension replacement and less of an 'insurance policy'.

Ok, let me get this straight, it is projected that, starting between 2018 to 2020, the program will have to start drawing on the U.S. Treasury Notes accumulated during the surplus years. In the late 2040s or early 2050s, the Treasury securities may be exhausted. Beyond the early 2050s, Social Security will be running a deficit under its current terms.

So congress solution to fix this problem is to CUT the social security tax rate? Am I missing something here? What kinda morons do we have running the country anyway?