Thread for orphaned comments

2005 Apr 11, 5:00pm 232,777 views 117,730 comments

by Patrick ➕follow (59) 💰tip ignore

« First « Previous Comments 5,416 - 5,455 of 117,730 Next » Last » Search these comments

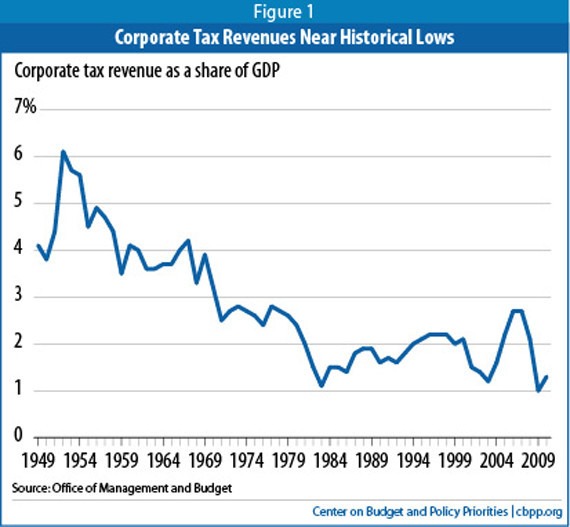

Here’s a graph clearly illustrating exactly who benefits from economic bubbles and how the “trickle down†theory is pure BS. Note that Reagan was sworn in at the 1981 tick (no, I’m not a Dem; both parties are corrupt beyond redemption).

Yeah, but that graph also needs context what's going on there / how that happens. First and foremost, that graph is NOT the free market at work. It is our current corporatist-kleptocratic system doing what it's designed to do: SHORT-CIRCUIT THE FREE MARKET AND PUT THE MONEY INTO THE HANDS OF THE POLITICALLY POWERFUL ELITE.

Yeah, trickle down has not worked, but not for the reasons many authoritarian-lefties (power to the state vs. the individual) argue.

What that graph shows you is the funneling of wealth into financial asset prices, which is part and parcel of the political-banking nexus running the show in the United States.

I wish more lefties could hold hands with Libertarians on this particular issue: we share a common enemy: corporatism and bankers. Lefties think that with the right people in power, the beast can be tamed and turned into the people's servant, so you want all that power to remain in D.C. and at the Fed, so you can confiscate wealth and rights for your own more noble purposes. But the problem is not your objectives -- which I think we'd agree on (Mine are at least, to have the most wealth possible among all citizens, with the highest standard of living possible, with good clean, healthy environment for us all to live, AND for us to all be freely living in consensual liberty.).

The problem is your means. Using guns and threat of incarceration or death to make off with the fruits of others labor and life (without their consent) is fundamentally immoral and wrong. I don't care if it's so the bankers and their legalized $trillion dollar counterfeiting machine (money printing system at the people's expense), or their never having to have a loss when they keep their profits (forced charity for bankers and Wall Street) ------ or if its unionista welfare, or simple handouts for the poor. The means are wrong and are in the end both horribly corrupted to benefit some at the expense of others. American are generally quite charitable, including many of the Tea Partiers you and I rail against. Some may be entirely off base, but I'll not impune their motives are entirely different than yours of mine (yes, I know -- there are some massive differences), it's their means I have a problem with.

There is another way. Return power to individuals and remove it from the state = true power to the people!!

The primary challenge confronting the West is thugocracy. Union air traffic controllers in Spain getting 450k a year, then implode the spainish economy by going on strike. Greek workers bankrupting Greece with "13 months" pay and average bribe of $1500/year for every Greek citizen. States like California and New York run by an alliance of trial lawyers and public sector unions. Teachers getting pad 100k a year for part time jobs (summers and vacays).... about $70/hour. Janitors in New York get 100k/year + pension.. public sector workers have pensions that make them all millionaires. NY teachers can beat up students and they still can't get fired.

Then combined senior transfers and lobbies.

The result is that ALL WESTERN ECONOMIES CAREEN TO BANKRUPTCY FROM TRANSFER PAYMENTS TO SENIORS AND BLOATED PUBLIC UNION WAGES. US is just worse with our huge military budget.

The artificially low tax rates, housing bubble, the stock market bubble, debt... are just a side show to gin up the economy to finance the absurd giv't expenditures and keep an economy going shackled with mind numbing regulation from powermad politicians and superior foreign competition (by countries like China that focus on competitiveness while we care more about class envy, stupid regs, transfer payments, bloated unions).

We should not forget that the GOVERNMENT FORCED THE BANKS TO MAKE THE BAD LOANS.. to minority homeowners.. they failed at a spectacular rate, and this lit the fuse. No discussion should miss psychotic regulatory state run by politicians like Barney Frank who demand the banks give them BJ's to stay in business lest regulatory reform destroy them.

Maybe these (real issues) are what the tea party movement is about.

We should not forget that the GOVERNMENT FORCED THE BANKS TO MAKE THE BAD LOANS.. to minority homeowners.. they failed at a spectacular rate, and this lit the fuse.

Thanks for playing.

Tea Party folks are undereducated, ignorant, and driven by fear. Enough said.

Actual corporate tax revenue only amounts to 1.3% of GDP here, other countries are at least DOUBLE that.

http://www.csmonitor.com/Business/Tax-VOX/2011/0209/Corporate-tax-only-a-piece-of-tax-revenue-pie

Clearly US corporations have it easier here than anywhere in the world. One wonders why anyone takes them seriously when they stomp their feet and talk about taking their HQ elsewhere. They get to outsource the labor, and avoid nearly all of the taxes they should theoretically pay. Some will get away with paying NEGATIVE taxes this year due to some accelerated depreciation nonsense passed this year. We give you all the depreciation now, yet you get to use the equipment for it's normal life.

I’ve wondered for a while how manufacturing is being calculated these days. If a manufacturer brings in 90% of the parts for a car from overseas then sells the car for $20,000 is that considered $20,000 in US manufacturing?

Finished goods as it sits on the Balance Sheet, interpreted as actual products made. No distinction is being made if mfg onsite or simply purchased by SCM. Much like a retailer which purchases form a third party. Raw materials and Work in process Inventory, which become finished goods has shrunk and rare on todays Balance Sheets.

What's an SCM? So are you saying that the "manufacturing" numbers include a lot of parts manufactured in other countries then just assembled here? What happens to the numbers if this is all deducted out? Is the US still the "largest manufacturer" in the world? Someone must have the real live numbers, not survey results.

the union thugs in wisconsin are shutting down the state because teachers are furious over making 100k, an annuity pension worth 1,000,000, part time job, full benefits... you can have sex with the students and probably won't get fired (in NYC teachers do not get fired period)... and the state running a huge deficit while hemorrhaging jobs?

I ask... in an environment so fanatically psychotic with braindead leftists... do you think it is possible to hold a reasonable debate over lowering transfers to the unproductive elderly?

No, such reforms are impossible in a union thugocracy.

>>

We should not forget that the GOVERNMENT FORCED THE BANKS TO MAKE THE BAD LOANS.. to minority homeowners.. they failed at a spectacular rate, and this lit the fuse.

Thanks for playing.

>>

Buddy, they called it "Sub-Prime" for a reason... they were lending to people, primarily minorities. The banks were facing constant litigation.. Jesse Jackson had an office on Wall Street extorting the cash cow banks into making dumb loans. A friend of mine worked for a "black owned" firm that was making millions skimming action working with Jackson. Wall Street lives under a PC tyranny and it blew up lending standards. Bush was just as guilty letting it slide hoping to turn minorities into republican homeowners "ownership society". fannie mae... etc... left wing corruption rackets funneling money to community organizers in big cities making loans that would never be paid back as payola.

Buddy, they called it “Sub-Prime†for a reason… they were lending to people, primarily minorities. The banks were facing constant litigation.. Jesse Jackson had an office on Wall Street extorting the cash cow banks into making dumb loans. A friend of mine worked for a “black owned†firm that was making millions skimming action working with Jackson. Wall Street lives under a PC tyranny and it blew up lending standards. Bush was just as guilty letting it slide hoping to turn minorities into republican homeowners “ownership societyâ€. fannie mae… etc… left wing corruption rackets funneling money to community organizers in big cities making loans that would never be paid back as payola.

I don't want to get into this again. It's been disproved countless times. I'll just give you one actual fact. The default rate on loans made to CRA qualified areas was LESS than those made to non-CRA areas.

Forget the propaganda and do some actual research.

Any discussion of cutting spending that doesn't include military can't be taken seriously.

I don’t want to get into this again. It’s been disproved countless times. I’ll just give you one actual fact. The default rate on loans made to CRA qualified areas was LESS than those made to non-CRA areas.

>>>

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1469092

Sub Prime was about getting minorities mortgages because banks were under the gun. Then, of course, lending standards must be debauched for all.

>Then, of course, lending standards must be debauched for all.

utter non-sequitur.

duxbury001, your thesis doesn't account for the fact that the debt orgy hit all sectors of the lending market, from immigrant strawberry pickers in Central California buying $700,000 houses to major league baseball players borrowing $17M for mansions in Thousand Oaks.

The people running Washington Mutual, Countrywide, Wachovia, and other private corps into the ground didn't need to have a gun pointed at their heads to make their shitty loans, they were making tons of money doing so.

Blaming it on "subprime" minority borrowers is just an attempt to obfuscate the total failure of government to police the mortgage industry, from top to bottom -- appraisers, mortgage brokers, loan underwriters, ratings agencies, Wall Street financial engineers -- the whole thing was entirely crimonogenic thanks to the ideologues and industry players the Republicans put in place to oversee the industry, 2001-2006.

Minority borrowers didn't double the asset value of real estate from $12T in 2000 to $24T at the peak in 2005:

http://research.stlouisfed.org/fred2/series/REABSHNO

that was an economy-wide debt bubble prompted by the tax cuts, lower interest rates, liberalized lending to prime borrowers (no-down, negative-am, stated-income), and defacto deregulation.

To blame it all on the poor people is quite comical actually. This was purely a failure of government.

http://townhall.com/columnists/walterewilliams/2008/01/23/subprime_bailout

this one... pretty much says the story. Banks had "lending affirmative action" foisted upon them and the drop out rate was much like affirmative action drop out rates at colleges.. utterly disastrous.

Aside from CRA, it is true that the Bush Admin (along with the Dem minority in Congress) wanted to see more minorities buy homes 2001-2006.

But this wasn't a primary driver of the bubble. It was contributory, in that moving new people into homes provided more market liquidity on the way up. Plus thanks to the lower lending standards the final bagholders of 2004-2007 were often subprime borrowers rooked into borrowing more than they could afford due to either greed and/or being lied to by the REIC.

When listing the causes of the bubble like above, there's so many that I always leave one out. Eg. I forgot to list the bond insurers like AIG writing checks their balance sheets couldn't cash. . .

I said subprime "lit the fuse" to blow up the market. It began as a "sub prime" crises, then the overall market imploded. Of course if you are compelled to lower standards it has to be open to all. As time went on the sub prime issue fed on the fumes of the housing market and became industry wide and lending standards collapsed.

All banks face harrowing litigation and regulatory threats. Welcome to America.

I said george bush supported these programs to make minorities homeowners. He's just a as complicit. Fannie mae, etc.. democrat rackets. George Bush supported the mortgage interest tax deduction to inflate housing.

As far as policing... after 9/11 FBI was looking for terrorists, not mortgage fraud. Hence banks got away with it. Banks were forced to make crap loans.. so of course they tried to rig the system to get away with it. It wasn't an "ideology"... investment bankers were overwhelmingly democrats at the time.

The underlying problem is the united states, with trillions spend of government employees and transfer payments to the elderly isn't productive anymore... we're broke. Union workers get $70/hour.. unionized teachers (including benefits) probably over $100. Trial lawyers run amok. In this environment the rackets are too powerful and your country is dead. Industry is finished by unions and free trade. All you had left in the 00's was finance and housing (both basically unproductive). So now there are no significant productive growing elements other than software / technology.

one question: where did subprime loans come from? They came from CRA.

Banks were forced to make crap loans..

No they weren't. Like I said above, why would they complain about being forced to do something that was making them billions of dollars?

At any rate, subprime alone was a small part of the $24T asset bubble. Subprime didn't force anyone to make suicide loans, and it was suicide lending that pushed prices up 2003-2005 and kept them there in 2006 and half of 2007.

we’re broke.

No we aren't. The top 10% is still doing very well, better than ever, TYVM.

But I agree that the current situation is unsustainable and taxing the shit out of the rich would only be a temporary solution.

If we want a middle-class society again we're going to have to figure out how to get economic opportunity back.

I don't think we can get there from here, actually. The wealthy have successfully captured the debate.

Just look at the bumrush of apologists for wealth in this thread, LOL.

http://www.reuters.com/article/2010/10/04/us-usa-foreclosures-race-idUSTRE6930K520101004

>>

No they weren’t. Like I said above, why would they complain about being forced to do something that was making them billions of dollars?

>>

Banks in the 90's and early 00's were subject to constant litigation and legal threats to make affirmative action loans. Later subprime became industry standard. I am not saying that this CAUSED the problem.. but lit the fuse. CRA introduced lax lending practices to the banking sector.

http://www.sherdog.nets/f54/affirmative-action-lending-blame-mortgage-crisis-848758/

As for the US being broke... no, we are absolutely bankrupt. Our transfer obligations to the elderly / pensions to overpaid gov't workers / other debt... range from 55 trillion to 75 trillion.. which is roughly the value of all US assets.

Rich people already pay for most of the taxes. Nearly every public sector in major states has an annuity value pension of over $1,000,000.. so they are your millionaires and why you are broke.

Banks in the 90’s and early 00’s were subject to constant litigation and legal threats to make affirmative action loans. Later subprime became industry standard. I am not saying that this CAUSED the problem.. but lit the fuse. CRA introduced lax lending practices to the banking sector.

I've heard this argument before at Pat.net, but I've never been able to understand it.

What you're saying is that the government forced a bank to make a handful of loans it didn't want to. And then because they were forced to make a handful of loans against their will, they then decided to go ahead and make thousands more freely on their own? Why exactly would they do that?

Our transfer obligations to the elderly / pensions to overpaid gov’t workers / other debt… range from 55 trillion to 75 trillion.. which is roughly the value of all US assets.

Most of that is simply medicare . . .$36T in unfunded liability over the next 75 years.

That's $480B per year or almost five million $100,000/yr jobs, LOL, just the "unfunded" part of it.

This is an utter joke and given we've got 80 million baby boomers starting to turn 65 this year like I said above we just can't raise taxes to pay for this, we're going to have to work on the sector's profit margins too.

This is not to say that the public sector is not too big now. That we are spending $5.5T on government (ex-SSI) this year is mind-boggling -- that's $50,000 per household.

I think we need to close the $1.6T deficit with $800B in spending cuts and $800B in tax increases, falling on the rich but not exclusively. There was nothing wrong with the Clinton tax brackets, they were adequately funding the government.

Alas, cutting $800b in spending is going to throw 5 to 10 million people out of work. . . there are really no easy answers now, anybody who thinks they have the solution just doesn't understand the problem.

Tea Party folks are undereducated, ignorant, and driven by fear. Enough said.

A well thought out statement if there ever was one. It's nice to know there are people on this site that don't ever make ignorant, generalized statements. LOL

I’ve heard this argument before at Pat.net, but I’ve never been able to understand it.

What you’re saying is that the government forced a bank to make a handful of loans it didn’t want to. And then because they were forced to make a handful of loans against their will, they then decided to go ahead and make thousands more freely on their own? Why exactly would they do that?

>>>

Good question. Circa 1975 banks were rather staid. CRA, fannie, eventually banks became a plaything of the left to extort, harass, shakedown and cajole. The industry morphed over time under huge pressue to loan to minorities. Minorities default at much higher rates, but minority politicians want to extort and shakedown the banks, so banks lowered standards.

http://www.libertynewsonline.com/article_301_29075.php

When the housing market exploded, homes became an appreciating asset to collateralize.. so they lowered standards for all. Lowered standards became industry standard. The reason the housing market took off in the first place and became a boom was lowered standards cajoled by politicians, mortgage deduction, easy money. Regulation limited land use, boosting housing costs (particularly in california). What began as a policy to encourage housing created a housing bubble.

Without CRA, fannie, playthings of the left, you would have never had a boom and never had a debauch of lending standards. When the housing market weakened, the first domino to fall was subprime... with vast numbers of minorities who got their loans in the 90's and 00's. So debauched lending helped cause the boom and the bust.

You were bitching earlier about no Republicans posing serious cost cutting ideas, yet the Republican controlled House just submitted $60 billion in cuts to the Democrat controlled Senate.

Yeah, if you scroll up you’ll find I talked about it.

$61 billion in cuts on a $1.6 trillion deficit wont even pay for the Bush tax cut extensions for a single year.

This entire charade is a joke.

>>

As opposed to the democrats? Whose spending philosophy is slam on the gas until we fly off the cliff?

The republicans won't touch entitlements for a few years. They were burned in '86, '96,'00,'08... psychotic leftists will tear them to pieces. You can't cut teachers from 100k to 95k in benefits without commie jihad in wisconsin. You think the country is ready for responsible governance? I don't think so.

So you don’t think there are consequences to CRA, figting redlining, etc? You think that boosting lending to minorities is risk and cost free? You think it doesn’t debauch an industry? Pass the bong.

You completely misrepresent what actually happened. Again--CRA loans defaulted at a rate less than non CRA loans. How do you explain that??

Your theory is interesting, but is completely refuted by the actual facts.

Cuts? I don’t favor any cuts. I think the government needs to monetize the debt and tax rich people again.

As for California, the solution to our problem is to repeal prop. 13.

>>>>

prop 13 is the only reason california hasn't fallen into the ocean. if property taxes go up, cost of ownership increases and housing prices implode.

Cali's economy is already dead, boosting taxes will kill it more.

Got news for you.... global economy.. you can't raise taxes because people can move. They are already fleeing cali's trial lawyer/public union thugocracy (so fast it cause a housing boom in AZ in NV).

Therefore you have to lower costs... bloated public sector pensions, paying elderly social security to watch TV and live an extra two months for 100k in medical bills, paying welfare to minorities and illegals to have kids (future democrats).

You completely misrepresent what actually happened. Again–CRA loans defaulted at a rate less than non CRA loans. How do you explain that??

>>>

You are saying that CRA was a moneymaker for banks? Blacks have triple to default rate so someone is cooking the books or has a biased sample. Banks were losing money with their inner city lending and making up for it in the suburbs. This is common knowledge.

http://johnrlott.tripod.com/op-eds/FoxNewsMortgagesReg091808.html

My argument is that the culture of banking got debauched by the political pressure to make bad loans and the housing boom was let loose.

Who's the Tea Party idol?

The sort of clown who thinks it's perfectly reasonable to espouse voting rights be restricted to property owners only.

My argument is that the culture of banking got debauched by the political pressure to make bad loans and the housing boom was let loose.

Your argument is avoiding the central fact that the bankers and the post-2001 regulators were in on the scam.

Obfuscating it, in fact.

The government de-regulated in 1998-2008, and the eventual catastrophe was entirely predictable.

Unregulated markets always blow themselves up. It is their nature. If someone can safely steal $10M, they will. That's enough to not have to work again in this life.

prop 13 is the only reason california hasn’t fallen into the ocean. if property taxes go up, cost of ownership increases and housing prices implode.

nah, higher taxes would just lower home values. They key thing with Prop 13 is the lost revenue on non-owner occupied housing. Corporations can buy land and then rent it out for all time at a protected tax rate.

Ditching Prop 13 for SFH would have marginal effects compared to the billions of lost revenue on commercial and rental properties.

Got news for you…. global economy.. you can’t raise taxes because people can move.

When you go can I have your house?

Troy said:

"nah, higher taxes would just lower home values."

Which in turn means lower property tax revenue coming to the State. Not to mention higher taxes chasing away even more California businesses to Texas, Arizona and Nevada.

Is it just a coincidence that the biggest Blue States with the highest taxes and union obligations are the most bankrupt and dysfunctional? (California, Michigan, New Jersey, New York.....)?

How much more empirical evidence do we need that simply raising taxes is not a solution? Where has it worked in recent years?

Is it just a coincidence that the biggest Blue States with the highest taxes and union obligations are the most bankrupt and dysfunctional? (California, Michigan, New Jersey, New York…..)?

And yet... why do these dysfunctional Blue States continue to let it slide that they contribute more in Federal revenues than they receive back? Time for Blue States to stop letting slackers in Red States sit around, they are like Welfare Queens griping while they hypocritically gobble up all they can from the trough. I believe the imbalance is sufficient that if we cut that dead weight we'd be instantly in balance.

Which in turn means lower property tax revenue coming to the State.

Not when properties enjoying original 1978 valuations + 2%/yr are reassessed . . . 32 years of 2% raises have only resulted in ~80% increases in assessed value, about 40% of what inflation has wrought.

Not to mention higher taxes chasing away even more California businesses to Texas, Arizona and Nevada.

um, the beauty of land value taxes is that . . . YOU CAN'T MOVE THE LAND.

Higher taxes on commercial property would come entirely out of rents. This is an iron law of economics, one of the more settled questions. By taxing landlords more we could tax their tenant's income less.

The LVT is a beautiful thing. Waay too sensible to ever be considered any more. The entire field of economics was altered to eliminate its arguments, LOL.

How much more empirical evidence do we need that simply raising taxes is not a solution? Where has it worked in recent years?

Oh, the US 1995-2001, Germany, Sweden, Norway, Denmark . . .

ISTM the higher the taxes, the more sustainable the economy. Funny, that.

Your argument is avoiding the central fact that the bankers and the post-2001 regulators were in on the scam.

Obfuscating it, in fact.

>>>>>>

I agree with you on that.

I do not understand why you insist that free markets implode? Before leftists and george bush II

took the morgage industry as a plaything it was doing fine.

Governement intervention caused the crisis (as it usually does)

1) fannie

2) fha

3) fed easy money

4) subsidies-- mortgage tax deduction

5) cha, lending affirmative action

6) ignoring mortgage corruption

so gov't caused the housing boom and therefore the crash. You wonder why no one banker is going to trial? Madoff is already talking about the gov't being a ponzi scheme (how dare he state the obvious!!!). Bankers will never go on trial because they will put the gov't on trial. Without gov't intervention this would have never happened. the tea partiers are 100% correct, government has no place in housing where it will just be manipulated by corrupt politicians.

Time for Blue States to stop letting slackers in Red States sit around

Right you are, Ken.

California loses ~20% of its Federal tax dollars, Michigan 8%, New Jersey 40%, New York, 20%.

The LVT is a beautiful thing. Waay too sensible to ever be considered any more. The entire field of economics was altered to eliminate its arguments, LOL.

How much more empirical evidence do we need that simply raising taxes is not a solution? Where has it worked in recent years?

Oh, the US 1995-2001, Germany, Sweden, Norway, Denmark . . .

ISTM the higher the taxes, the more sustainable the economy. Funny, that.

>>>>>

Government spending is climbing exponentially for 50 years. You cant raise taxes out of that. You need to cut costs? Personally I think liberals are just psychos and like to raise taxes because it is legalized theft. Then give it to the public union and trial lawyer extortionists (the backbone of the mobster democrats).

so gov’t caused the housing boom and therefore the crash.

Nope. Government FAILURE TO ACT in 2003-2006 caused the housing bubble/crash.

Government policy had some contributory elements to the bubble, but government policy had NOTHING TO DO with suicide lending. CRA and "subprime" had nothing to do with that. Subprime loans tended to be better-underwritten than prime and Alt-A loans.

It was suicide lending -- roping borrowers into 2-5 year loans that they had no hope of being able to fully service -- that was the primary cause of the bubble.

You can tell what the suicide lending was because these forms of loans were banned in the bubble aftermath.

Government basically spun the wheel in 2001-2002 and walked away from the table in 2003. The FIRE sector had their fun 2004-2007, raking in their cut of a TWELVE TRILLION dollar bubble.

Your 1-5:

1) fannie

2) fha

3) fed easy money

4) subsidies– mortgage tax deduction

5) cra, lending affirmative action

were "sustainable" interventions, to a great extent at least. GSEs didn't cause the housing bubble of 2002-2004, they only got in the game in 2005 and 2006.

FHA was a total non-entity during the bubble, losing market share to private label mortgage houses with looser rules.

Fed easy money 2001-2004 was an indirect cause, but "easy money" didn't make home prices go past affordability -- rate resets haven't been the problem, it was people paying more than they could afford, and the interest rate is orthogonal to that.

Likewise, the MID raised prices but didn't force borrowers to borrow more than they could pay back.

All this "government intervention" crap is perfectly disproven by the fact that Texas did not suffer a bad housing bubble. The Texas market has TONS of government intervention -- both high property taxes and very strict rules about home equity extraction.

What really turned the bubble into a catastrophe was the feedback that home equity withdrawals were having, 2004-2006. This kept the bubble going much longer and made it twice as big as it should have been.

I think liberals are just psychos and like to raise taxes because it is legalized theft.

I like to raise taxes because I think government should be paid for, and when it IS paid for we get better government because without taxes there is no feedback on the citizens. Having to pay for Iraq as it happened would have educated people to not fall for the warmonger's call again.

I also think taxes should NOT be too "progressive". I think everyone should pay their fair share and I also believe that tax cuts on the poor is just a backdoor subsidy for the rich since every dollar not taxed just ends up in land values and the rents poor people pay.

I would move to Norway, Denmark, Sweden, or Germany in a heartbeat if I could. They've got their act together. The US? Not so much.

Troy - you don't need to move land to move your business. Businesses have been fleeing California for the last several years.

http://jan.ocregister.com/2010/02/24/list-names-100-companies-leaving-california/31805/

As others have pointed out, government costs and spending have exploded. For instance, we spend more now per student then we did 20 years ago in inflation adjusted dollars for education. Yet the quality of our schools are worse today despite spending more money. Is the solution to raise taxes and spend more on education?

It just boggles the mind that so many folks really seem to believe that our State, Local and Federal Government doesn't need to reform and reduce costs. Virtually every country in Europe has implemented austerity programs to scale back their welfare states and the Private sector has cut to the bone.

But we are being told that the US Government is just find and dandy and no cuts need to be made.

FFS - the new GAO report today shows that Medicare Fraud alone is $48 BILLION a year. That is over 4X the combined profits of the top 10 insurance companies. Just imagine what the waste is going to be once Obamacare is fully implemented?

currently your grandkids pay for it with deficit spending. leftists love big government following lenins maxim "the worse the better"

ultimately exponentially exploding gov't costs, entitlements, regulatory state, trial lawyer litigation state will destroy what's left of the private sector. unions rightly view themselves as adversaries to the private sector, whom they despise ("the rich"). So they don't care if their policies are utterly reckless.

as for europe, they aren't corrupt like us. american goverment is 21st in the world corruption wise (and this understates it). include collusive trial lawyer/ union rackets... we are one of the most corrupt country on earth. 4 of the last 5 governors of illinois are in jail. no other western nation can touch the democrats in terms of gangsterism.

So we cant do what canada or denmark do. we are a kleptocracy, so socialism here is just an invitation to more corruption. so the US needs radical laissez faire with an emphasis on catching corruption. Higher taxes will just be squandered on rackets and hoaxes. Hence the tea party argument is correct. Limit government. No gov't in housing.

4 of the last 5 governors of illinois are in jail. no other western nation can touch the democrats in terms of gangsterism.

Actually the only former Governor of Illinois currently in jail is a Republican.

« First « Previous Comments 5,416 - 5,455 of 117,730 Next » Last » Search these comments

patrick.net

An Antidote to Corporate Media

1,266,714 comments by 15,147 users - askmeaboutthesaltporkcure, Maga_Chaos_Monkey, rocketjoe79, Tenpoundbass online now