patrick.net

An Antidote to Corporate Media

1,206,229 comments by 14,334 users - ForcedTQ, ohomen171, Onvacation, Robber Baron Elite Scum online now

Let's tell Obama we do NOT want to restore bubble prices

2011 Aug 30, 6:27am 23,529 views 110 comments

« First « Previous Comments 55 - 94 of 110 Next » Last » Search these comments

Housing prices need to be propped to keep interest/your blood flowing to banks.

Stop dreaming of buying a house in Beverly Hills or Lower Manhattan with cost of rental equivalent. There are millions of houses in America where is cheaper to buy then rent.

And more ofen than not, those areas where buying is cheaper are places you likely don't want to live in. Either because it is a dangerous ghetto or there are absolutely no jobs.

And more ofen than not, those areas where buying is cheaper are places you likely don't want to live in. Either because it is a dangerous ghetto or there are absolutely no jobs.

Absolutely disagree. You are looking only around your area. Try to think out of BOX.

I think your calculator's numbers need some updating. I entered the numbers for my house in NJ and it said that the market value is $334,000 and the market rent is $2,300. A comparable house down the street just sold last week for $800,000.

Just because some fool overpaid by half a million dollars doesn't mean the calculator is wrong. The calculator uses pretty simple math, and explains exactly how it arrived at the fair value from the rent.

Of course if the rent estimate is wrong, that's another story, but just change the rent esitmate then.

Bro, the guy is still right. Your calculator is totally unrealistic. Housing will NEVER come back to this low. For example, my neighborhood 2500 SQFT can generate $2500 rent, but it tells me the house only worth $350k. Really!? If thats tue, everyone will jump in and buy it as rental already.

I think your calculator's numbers need some updating. I entered the numbers for my house in NJ and it said that the market value is $334,000 and the market rent is $2,300. A comparable house down the street just sold last week for $800,000.

Just because some fool overpaid by half a million dollars doesn't mean the calculator is wrong. The calculator uses pretty simple math, and explains exactly how it arrived at the fair value from the rent.

Of course if the rent estimate is wrong, that's another story, but just change the rent esitmate then.

$350,000 x 4% is $1166/mo cost-of-money.

I know RE pros don't factor ROI/cap rates like that but I do.

"Someone told me that during the WPA Era, the government gave people jobs all over the country. They didn't pay people salaries but they gave them a job, food, a place to stay, and a few dollars a day. It really built infrastructure throughout the country. It gave people their basic shelter and food needs. It gave people a sense of pride and a sense that they were part of something greater than themselves. And it got the wheels moving again."

That depends as one could argue that was just a sellout to wall st again. Cheap labor for companies more or less with the government being the middle man.

http://en.wikipedia.org/wiki/Bechtel

This company pretty much has made many of the major projects around the globe over the past 80 years.

"Would that really be so difficult to replicate now? Our national infrastructure certainly needs help. And lots of people need a daily purpose and task in their lives and would embrace becoming part of a large movement to get America going again."

In all due respects I don't think so. Think about it this way. If someone really want to work with their hands on a trade they can do so. Simply shoving an book on electrical work to a noobie isn't going to make the project managers that much confident. Let's not also forget what you are saying would cause a massive uproar with the AFLCIO. The other issue is that unlike in the 30's we have a fair amount of regulations that would restrict the same work from being performed. Here's an example

http://en.wikipedia.org/wiki/Lunchtime_atop_a_Skyscraper

We're also more efficient today than back then. Why would we manually dig holes if a massive auger and do it faster? Supposedly there were jobs of digging a hole and then refilling it (teaching people how to dig basically).

If we want to admit to it or not the demand for manual labor keeps shrinking. I can't think of that many products that actually demand someone manually to manufacture it.

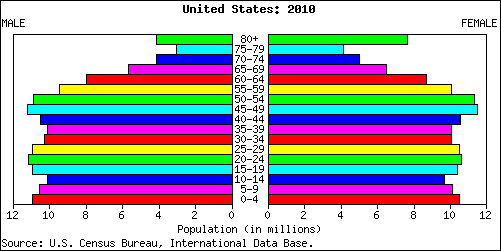

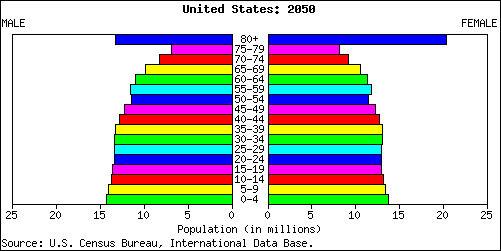

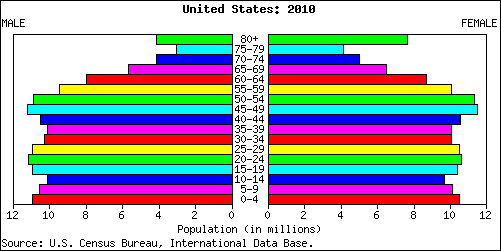

I think a vital issue that is being ignored is the demographics. I once heard the baby boom generation described as the fetal pig lodged in the gut of the snake, and it's an apt metaphor. Whatever our government does it has be work around that big lump. Home prices can't be permitted to reach equalibrium because that would cause that generation to draw more heavily on government resources as they grow older, something the government can't afford. Their 401k's are on life support, so market supports beyond housing can't be removed, lest they loose what's left of their retirment SAVINGS and start cutting back draconianly on their spending. I capitalize savings because everyone complains that the boomers didn't save. Yes, they did, just in investment vehicles they were told were safe but weren't. This image of Boomers not being as American as their forefathers is BS. They're just so much bigger than any generation before themselves, their lives had to be different. And unfortunately, for those of us who are younger than them, our lives will be less and our markets distorted, not because of their actions, but merely that they were all born together in a giant cohort.

"Just because some fool overpaid by half a million dollars doesn't mean the calculator is wrong."

Well, then there are lots of "fools" because another comp sold for $760,000 and yet another sold for $820,000. So we have $760,000, $800,000, and $820,000. I will gladly provide the addressed if you wish...

In this new environment, there is no way banks are going to lend money to buyers to buy a house that is $500,000 overpriced. It will never appraise. NEVER.

I once heard the baby boom generation described as the fetal pig lodged in the gut of the snake

not quite that bad now:

perhaps a better analogy would be a pig through a snake that's constipated:

I capitalize savings because everyone complains that the boomers didn't save. Yes, they did, just in investment vehicles they were told were safe but weren't. This im

One man's savings is another man's debt.

The only thing that matters really is whether or not the US has the productivity to support our consumption going forward.

We kinda do, but we've also offshored so much that I'm not entirely sure any more.

We can certainly feed ourselves -- Ag is only 2% of GDP -- but we have a bad energy deficit and a big trade deficit with China that needs levelling out somehow.

The projected multi-trillion-dollar medicare deficits are a joke. Medical services can't take 30% of GDP, something -- their obscene profit margins -- is going to have to give here.

And more ofen than not, those areas where buying is cheaper are places you likely don't want to live in. Either because it is a dangerous ghetto or there are absolutely no jobs.

Please remind me again why I didnt go work for Cisco back some 20 years ago before they went IPO ???

Ahhh... They were located in East Palo Alto during a Crack epidemic of the early 90s.

Could have been retired 9-10 years later.

As you are aware, we are in the midst (arguably, tail end) of a housing correction (Not downturn)

Good luck with that, many like Waxman, Dobbs and Franks consider the bust in housing due to bad loans and NOT that prices became disconnected from incomes or inflation. Pretty much Franks himself back in 2005 dismissed RE as being overpriced relative to incomes/inflation.

So for them to come 180 degrees and now accept that we are in a correction, not a downturn, would be a miracle. However as we have seen their actions over the past 5 years indicate their mindset hasnt changed nor will it.

The projected multi-trillion-dollar medicare deficits are a joke. Medical services can't take 30% of GDP, something -- their obscene profit margins -- is going to have to give here.

At the current rate, Insurance companies will simple send you overseas for more complex medical needs which is much cheaper.

Housing prices have been rising disproportionately to income since 1990, according to an article I read a couple years ago in the Oklahoman. Houses need to be restored to affordable pricing, especially for the 63% of American households, which, in 2006, had a household income of under $60k. There never should have been a bubble, and those who played with that fire are getting burned.

Housing prices have been rising disproportionately to income since 1990, according to an article I read a couple years ago in the Oklahoman.

Funny stuff.. San Jose Mercury news ran articles dismissing the housing bubble will the typical nonsense reasons. Each one of their reasons over the past years has been proven wrong. Never did they or have to this day measured historical prices over incomes.

Home prices can't be permitted to reach equalibrium because that would cause that generation to draw more heavily on government resources as they grow older, something the government can't afford. Their 401k's are on life support, so market supports beyond housing can't be removed, lest they loose what's left of their retirment SAVINGS and start cutting back draconianly on their spending. I capitalize savings because everyone complains that the boomers didn't save. Yes, they did, just in investment vehicles they were told were safe but weren't. This image of Boomers not being as American as their forefathers is BS. They're just so much bigger than any generation before themselves, their lives had to be different. And unfortunately, for those of us who are younger than them, our lives will be less and our markets distorted, not because of their actions, but merely that they were all born together in a giant cohort.

To a point I can agree with you but we've already crossed that point. Let's examine something a bit more basic and step back for a moment. As a historical basis when has retirement ever been viable or well defined?

Before the era of FDR people either relied on religions or their families for support. FDR was greatly inspired by Bismark..unemployment insurance, social security, medicare..all these concepts came from him. He created this as a way of pacifying any potential communist revolutions. This is how the age of 65 was established but life expectancy back then was only 45. By the time FDR introduced social security life expectancy was 65..meaning that some of these social safety nets for older people were incentives to live longer rather than a massive social blanket for tens if not hundreads of millions of people.

By any metric the baby boomers received some of the greatest amounts of advancements in the modern era. When tens of millions of people do the same things at the same times of course they would boom. Gerber baby food in the 50's, muscle cars in the 60's, education in the early 70s, real estate in the 80's, 401ks in the 90s. Generations that come later do not have as much wealth and are smaller in size and scope.

For any investment to work you have to be able to sell it/exchange it for something else in value. There's a strong reason why gold, silver and shares in apple do better than investing in 8track players, analog cell phones and old boxes of pac man ceral.

"BUYERS MAKE VALUE", until more powerful entities intervene. Gubmint only stalls equilibrium, because it would damage the powerful.

"BUYERS MAKE VALUE", until more powerful entities intervene. Gubmint only stalls equilibrium, because it would damage the powerful.

"Just because some fool overpaid by half a million dollars doesn't mean the calculator is wrong."

Well, then there are lots of "fools" because another comp sold for $760,000 and yet another sold for $820,000. So we have $760,000, $800,000, and $820,000. I will gladly provide the addressed if you wish...

True story.

@HousingWatcher and Clara,

The purpose of the calculator is not to derive the market value of a house. Market vaule is determined at the bidding war and there are still people out there willing to spend overborrow for 500-800k houses that only rent at $2500. Overpriced or underpriced, the undeniable truth of the free markets is that the real price is the price that was paid. That is, until that changes...

What the calculator does for you is to help you determine if the prices the market is offering you are worth taking. Should you rent or should you buy? If you plug in the numbers it might tell you that you should choose to rent at $2500 until you can buy at $350k; that doesn't mean somebody else isn't going to go buy at $600k. Did they make a good choice? Should you jump in just because they did? I don't think so, but that's up to you.

Market vaule is determined at the bidding war and there are still people out there willing to spend overborrow for 500-800k houses that only rent at $2500

The average cost of ownership of a $800,000 house over 30 years is ~$1700/mo. (Not counting the opportunity cost of the $800,000 principal repayment.)

If history is any guide rents will be $5000 on this house soon enough. PITI is fixed at ~$5700.

Don't make the mistake I did and compare PITI vs rent. The P in PITI is principal repayment, which is not an expense, but a form of savings.

This is how the age of 65 was established but life expectancy back then was only 45. By the time FDR introduced social security life expectancy was 65

Life expectancy at age 20 has risen 10 years since 1930.

FICA has risen from 2% on first $40,000 (2010 dollars) to 12.4% on first $107,000.

http://staff.jccc.net/swilson/businessmath/taxes/fica.htm

http://www.infoplease.com/ipa/A0005140.html

Generations that come later do not have as much wealth and are smaller in size and scope.

Missing in this analysis is productivity per worker. Thanks to computers, cheap oil, automation, etc we're 50% more productive now than 30 years ago.

http://research.stlouisfed.org/fred2/graph/?g=1VI

The baby boom echo is only 10% smaller than the bb, btw.

Counting bodies is misleading. What needs to be counted is economic opportunity. That doesn't necessarily scale with just raw population, otherwise Bangladesh would not be nearly the poorest country on the planet.

Market vaule is determined at the bidding war and there are still people out there willing to spend overborrow for 500-800k houses that only rent at $2500

The average cost of ownership of a $800,000 house over 30 years is ~$1700/mo. (Not counting the opportunity cost of the $800,000 principal repayment.)

If history is any guide rents will be $5000 on this house soon enough. PITI is fixed at ~$5700.

Don't make the mistake I did and compare PITI vs rent. The P in PITI is principal repayment, which is not an expense, but a form of savings.

“Nessuna soluzione . . . nessun problema!„

I didn't run these numbers through the calculator, just commented on the statements others had made based on their use of the calculator.

But I find it hard to believe that the average cost of an 800k house is only $1700 a month. The interest alone doesn't get below that until after 20 years. Are you taking appretiation into account with that statement? If so that's one area where I'd have to disagree based on the direction I see the current market going. At best I see prices in my area 10 years from at or slightly below where they are now.

But I find it hard to believe that the average cost of an 800k house is only $1700 a month.

Yes, I as well just cannot see the numbers here. Moreover, is this economy (and many future projections that in a few years forecast numbers straight downward) and this real estate market, who are this smoke and mirror $5000. a month renters? Please. This thread has become out of control.

IMHO I do not see any of this flying in my lens but I do see there are plenty of people around still on Fantasy Island.

But I find it hard to believe that the average cost of an 800k house is only $1700 a month. The interest alone doesn't get below that until after 20 years.

Don't forget tax savings.

who are this smoke and mirror $5000. a month renters?

I'd imagine they are the same people that are paying $800K.

But I find it hard to believe that the average cost of an 800k house is only $1700 a month

That number included 20% down to avoid PMI. Ah, I see I had my spreadsheet at 15 years. Changing to 30, I get these numbers:

Total Interest of $459,964.84 less $161,907.62 tax credit leaves $298,057.22 net interest cost -- $827.94 per month over 360 months.

Property Tax is $300,000.00 less $105,600.00 or $194,400.00 -- $540.00/mo.

Other expenses ($133/mo insurance, $100/mo extra utilities, $200/mo maintenance setaside) = $433/mo.

Total average monthly expense over first 30 years: $1801.27.

You all must view this it is the BEST link I've seen in all the years I have been following Patrick.net, it is right here. Genius.

http://www.youtube.com/watch?source=patrick.net&v=engKtLw0JTM

who are this smoke and mirror $5000. a month renters?

I said "if history is any guide".

The 1B apartment in West LA I rented 1990-1991 for $700 is now renting for $1500.

The 3B apartment my parents rented in the East Bay for $300/mo in the mid-1970s is now renting for $1500.

That's a general doubling of rents every 20 years.

Now, I don't think we're going to get that inflation like that any more, I think we're stuck in Japan's situation of too much debt to raise interest rates a single basis point, and a fake economy that is not going to see wage inflation at all.

But I could be wrong about that, and the crowd wisdom certainly hasn't digested this possibility yet.

1970s to now? History? Why don't we just talk about brainwashing? because that is what that period of time respresents to me.

Anyone talking about this "history" please view the following

http://www.youtube.com/watch?source=patrick.net&v=engKtLw0JTM

FWIW, I am in the deflationary camp.

But I am not the market.

I was talking about past history.

What people don't understand is that the history of 1970-2009 is the history of debt loading:

http://research.stlouisfed.org/fred2/graph/?g=1VQ

that graph is total US debt per worker.

Um, yeah.

It wouldn't surprise me to see home prices HALF what they are now.

Just give me $10 gas, Clinton tax rates, hell, get rid of the MID (which is on the table), higher FICA and Medicare taxes, massive government spending cuts at the state and Federal level . . .

People think inflation is going to come and raise home prices. I just don't see it -- I see the opposite, inflation coming and obliterating home prices.

People think inflation is going to come and raise home prices. I just don't see it -- I see the opposite, inflation coming and obliterating home prices.

You are not alone.

But I find it hard to believe that the average cost of an 800k house is only $1700 a month

That number included 20% down to avoid PMI. Ah, I see I had my spreadsheet at 15 years. Changing to 30, I get these numbers:

Total Interest of $459,964.84 less $161,907.62 tax credit leaves $298,057.22 net interest cost -- $827.94 per month over 360 months.

Property Tax is $300,000.00 less $105,600.00 or $194,400.00 -- $540.00/mo.

Other expenses ($133/mo insurance, $100/mo extra utilities, $200/mo maintenance setaside) = $433/mo.

Total average monthly expense over first 30 years: $1801.27.

“Nessuna soluzione . . . nessun problema!„

You forgot to factor in that a married couple already receives a standard tax deduction of $11,600 per year.

That's 348,000 over 30 years. Your using 35.2% as the tax rate, so that's $122,496 that a married person already has entitled to them in deductions. That means the interest credit tax benefit of buying a house over taking the standard deduction is only $39,411.62 over the life of the loan.

That brings the monthly cost up over $2100 per month. And it's more than that, really, because inflation will inevitably increase the standard deduction over time whereas the interest costs should remain fixed.

That's actually lower than I thought it'd be, but it also doesn't factor in HOAs, appretiation/depretiation, and the opportunity cost lost to downpayment and forced savings... a lot of which is hard to anticipate anyway.

People think inflation is going to come and raise home prices. I just don't see it -- I see the opposite, inflation coming and obliterating home prices.

I am going to reiterate this, how can the home prices go up if the wages and salaries are in the decline. For those who have jobs,wages are stagnant or are falling due to pay cuts and furloughs. Those who lost jobs can hardly land the with the pay same as last one. Home prices have to keep going down for few more years,at what rate YOY? I don't know,but the faster the better for the country. Inflation cannot touch the home prices in the current economic situation.

He can't possibly be as stupid as the things he's saying, like his bullshit talk about "restoring home prices."

Yes, he IS that stupid. Guess who was the numero dos guy that received the most in campaign contributions from Freddie and Fannie?

A junior senator from Illinois. Barack Hussein Obama

http://www.opensecrets.org/news/2008/09/update-fannie-mae-and-freddie.html

Christopher Dodd was numero uno because he did a lot with getting CRA and other crap out there while leaning on regulators to look the other way when some of them smelled a foul stench coming from CountryWide and other such institutions.

And the NAR (an actual pac) has donated mostly to Republicans (until it melted down).

This is typically a canard. Individuals within an organization do not represent an organization. You can have 1,000 employees donate $250 each to the Democrat and the CEOs donate 100,000 to the Republican--does that make the Dems or the GOP in the pocket of the business?

You'll see that the GSE totals include individuals.

You forgot to factor in that a married couple already receives a standard tax deduction of $11,600 per year.

In high-tax states like California, people buying $800,000 houses will have the full standard deduction covered by the state income tax deduction.

And it's more than that, really, because inflation will inevitably increase the standard deduction over time whereas the interest costs should remain fixed.

Neither here nor there as long as the household is bringing in an upper middle class salary.

That's actually lower than I thought it'd be

yup!

Plugging in 8% interest rates sees the average TCO rise to $2800/mo.

Refiing down to 2.5% would lower the TCO to $1460/mo.

I think we'll see 2.5% rates before 8%.

I deeply regret not buying that $350,000 condo in 2001. Rates were 8%+. That suppressed home values. My housing cost would be under $1000/mo now had I bought.

Bellingham Bob,

The standard deduction increasing is important, as it would decrease the total advantage of buying a house over just taking that deduction over time.

No matter how we do the math I don't imagine myself regretting not buying right now. When it all comes down to it I look at the houses we can afford where we want to live in San Diego and I vomit. In a way that really ends the debate for me. Maybe I'm just not a fan of the 70's style architecture. Maybe I just can't see how anyone would want to live in a 1200 sq ft box with no yard, let alone pay 500 grand for it. But I just can't hop onboard.

If the properties that we do like drop to half the cost, which could happen, we'll buy something. If not we just plan to move in a few years.

For those who have jobs,wages are stagnant or are falling due to pay cuts and furloughs

We can argue about what wages will do in the future, but for people having jobs, wages are NOT decreasing.

The standard deduction increasing is important, as it would decrease the total advantage of buying a house over just taking that deduction over time.

the standard deduction rises with incomes. As long as the household's state tax payment covers it, the MID is entirely free money.

No matter how we do the math I don't imagine myself regretting not buying right now.

Sure. As long as prices are falling $30,000 a year I'm happy renting.

Maybe I'm just not a fan of the 70's style architecture

LOL. I love old nabes with the big trees.

But I am in no way a buyer in the bay area. Nice place to visit but I wouldn't want to live there. Well, this place maybe:

http://www.redfin.com/CA/Kensington/88-Norwood-Ave-94707/home/1685368

« First « Previous Comments 55 - 94 of 110 Next » Last » Search these comments

From a Patrick.net reader:

I agree entirely. There has been absolutely no press coverage or any political statement about how high house prices HURT people and how low prices are better. Let's all write Obama, our congressmen, and housing reporters with this simple message:

Lower food prices are good!

Lower gas prices are good!

Lower house prices are GOOD!

#politics